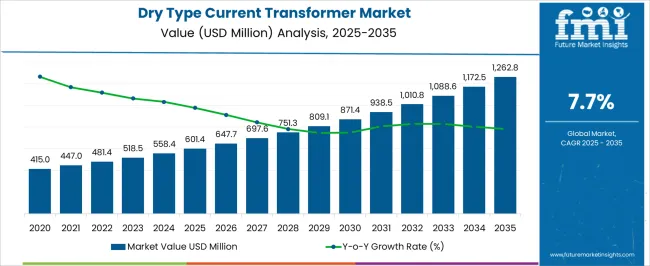

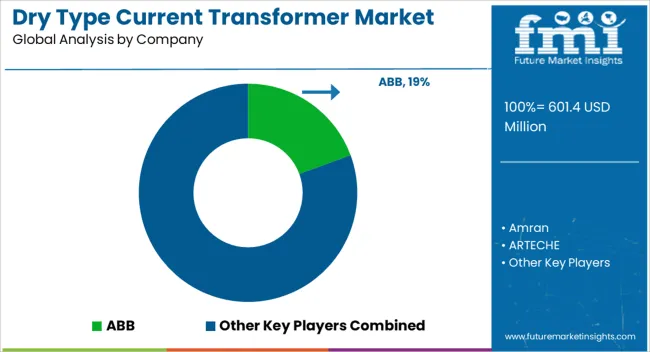

The dry type current transformer market is estimated to be valued at USD 601.4 million in 2025 and is projected to reach USD 1262.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

The dry type current transformer market is projected to witness significant growth, rising from USD 601.4 million in 2025 to USD 1,262.8 million by 2035, representing a compound annual growth rate (CAGR) of 7.7%. Yearly progression is expected to follow a steady trajectory, reaching USD 697.6 million by 2027 and surpassing USD 871.4 million by 2030. Demand is being driven by increasing deployment in electrical distribution networks, industrial plants, and commercial infrastructures, where reliability, accuracy, and maintenance efficiency are being prioritized.

Market expansion is also being influenced by growing replacement of oil-immersed transformers with dry type units due to safety considerations and operational advantages. Over the decade, the dry type current transformer market is being shaped by evolving electrical network standards and heightened emphasis on equipment performance. Adoption in smart grids, substation modernization, and energy monitoring projects is being accelerated, supporting steady revenue accumulation.

Competitive differentiation is being achieved through enhanced insulation materials, compact design, and improved thermal management, which are being recognized as value drivers. By 2035, the market is expected to consolidate its position as a critical component of power distribution systems, reflecting broad-based industrial and commercial integration and consistent market traction.

| Metric | Value |

|---|---|

| Dry Type Current Transformer Market Estimated Value in (2025 E) | USD 601.4 million |

| Dry Type Current Transformer Market Forecast Value in (2035 F) | USD 1262.8 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The dry type current transformer market is estimated to hold a notable proportion within its parent markets, accounting for approximately 20-22% of the current transformer market, around 8-9% of the electrical transformers market, close to 6-7% of the power distribution equipment market, about 5-6% of the medium voltage equipment market, and roughly 3-4% of the electrical substation equipment market.

Collectively, the cumulative share across these parent segments is observed in the range of 42-48%, reflecting a significant presence of dry type current transformers across power distribution and medium voltage applications. The market has been influenced by the increasing adoption of safe, compact, and low-maintenance transformers for industrial, commercial, and utility applications, where reliability, thermal performance, and operational efficiency are highly prioritized. Procurement is often guided by factors such as compliance with electrical standards, durability under load variations, and ease of integration with existing switchgear and monitoring systems.

Market participants have focused on high-quality insulation, reduced energy losses, and enhanced safety features to maintain performance and operational stability across critical infrastructure. As a result, the dry type current transformer market has not only captured a substantial share within the current transformer and electrical transformer segments but has also influenced power distribution, medium voltage, and substation equipment markets, underscoring its strategic role in strengthening electrical network efficiency and reliability.

The dry type current transformer market is experiencing consistent expansion driven by the growing demand for efficient and safe power monitoring solutions in industrial, commercial, and utility applications. Increasing investments in modernizing electrical infrastructure, along with the transition toward smart grids, are enhancing the adoption of dry type transformers due to their safety, low maintenance, and eco friendly characteristics.

Their suitability for indoor use, absence of oil-based insulation, and resistance to fire hazards make them a preferred choice in urban and densely populated areas. Technological advancements in insulation materials and compact design have further strengthened their role in advanced metering and protection systems.

The market outlook remains strong as utilities and industries continue to focus on reliability, operational safety, and environmental compliance in electrical systems.

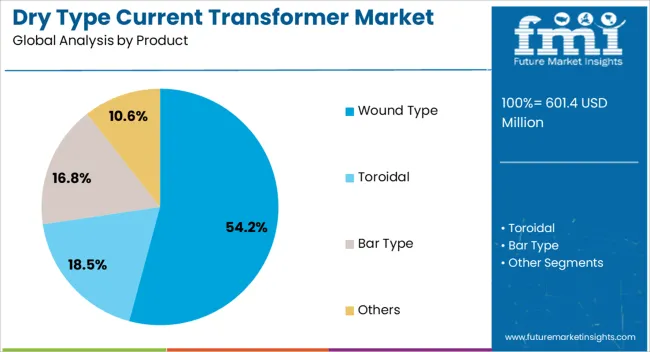

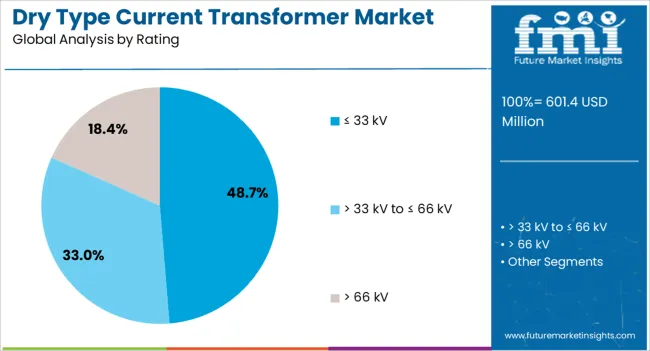

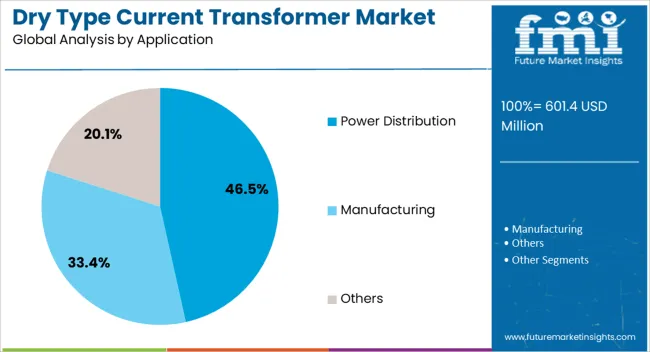

The dry type current transformer market is segmented by product, rating, application, and geographic regions. By product, dry type current transformer market is divided into wound type, toroidal, bar type, and others. In terms of rating, dry type current transformer market is classified into ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV. Based on application, dry type current transformer market is segmented into power distribution, manufacturing, and others. Regionally, the dry type current transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wound type segment is projected to hold 54.2% of the total market revenue by 2025 within the product category, making it the leading segment. Its dominance is attributed to superior accuracy, robust construction, and suitability for a wide range of load conditions.

Wound type transformers are preferred for applications that require high precision in current measurement and protection. Their adaptability in both metering and protection functions and their capability to perform efficiently in diverse environmental conditions have further driven their adoption.

These attributes have reinforced the segment’s leadership position in the product category.

The ≤ 33 kV rating segment is expected to account for 48.7% of market revenue by 2025 within the rating category. This rating is commonly adopted in medium voltage networks, which are widely used in commercial, industrial, and utility distribution systems.

The compatibility of dry type transformers with this voltage range and their ability to provide reliable performance in both indoor and outdoor installations have supported their dominance.

Increasing grid modernization projects and expansion of medium voltage networks in emerging economies are further accelerating demand in this segment.

The power distribution segment is forecasted to represent 46.5% of total market revenue by 2025 under the application category. This is driven by the need for accurate metering and protection in distribution networks, where operational efficiency and reliability are critical.

The integration of dry type transformers in smart distribution systems enhances monitoring capabilities, reduces downtime, and improves energy efficiency.

Growing investments in upgrading urban and rural distribution infrastructure are supporting the sustained demand for this application segment.

The dry type current transformer market is driven by growing demand for safe, reliable, and maintenance-free current measurement in power distribution, industrial, and commercial applications. Opportunities arise from integration with renewable energy systems and industrial automation, while trends emphasize compact, modular, and air-insulated transformer designs. Challenges persist due to high initial costs, regulatory compliance, and the need for skilled installation. Despite these constraints, dry type CTs are increasingly deployed to enhance grid reliability, ensure operational safety, and monitor current flow accurately, supporting steady market growth worldwide.

The demand for dry type current transformers (CTs) has been increasingly influenced by their adoption in power distribution networks, industrial facilities, and commercial buildings. The non-oil design ensures enhanced safety, minimal maintenance, and reduced fire risk, which is critical in urban and industrial installations. Utilities and enterprises are deploying dry type CTs to monitor current flow, protect equipment, and improve grid reliability. This demand is further supported by the rising focus on smart grids and real-time monitoring systems, where accurate current measurement is essential for fault detection and load management. Adoption is particularly strong in regions with strict safety regulations, highlighting the role of dry type CTs in modern electrical infrastructure.

Opportunities in the dry type current transformer market are being driven by integration with renewable energy systems, industrial automation, and microgrid installations. Solar, wind, and distributed energy projects require reliable current measurement to ensure system stability and performance monitoring. Industrial sectors, including manufacturing, chemicals, and steel production, are increasingly deploying dry type CTs for load control, energy management, and protective relaying. Manufacturers are focusing on producing compact, high-accuracy, and modular designs to meet sector-specific needs. As industrial and renewable energy adoption grows, dry type CTs are being positioned as essential components for safe, efficient, and reliable electrical networks, providing a pathway for market expansion.

A prominent trend in the dry type current transformer market is the focus on compact, maintenance-free, and environmentally safe designs. Air-insulated CTs with epoxy resin encapsulation are increasingly preferred over traditional oil-filled transformers due to reduced leakage risk, minimal maintenance requirements, and simplified installation. Advanced insulation techniques, lightweight construction, and standardized modular components are being adopted to improve efficiency, reduce footprint, and enhance operational safety. This trend is further reinforced by demand in commercial complexes, industrial plants, and utility substations where space and safety considerations are critical. These developments are encouraging manufacturers to refine design specifications while ensuring compliance with international electrical standards.

The dry type current transformer market faces challenges stemming from higher initial investment compared to conventional oil-filled CTs. The capital expenditure for high-accuracy, resin-encapsulated units can be significant, limiting adoption among cost-sensitive customers. Compliance with stringent safety and electrical standards, such as IEC, ANSI, and IEEE, adds complexity to manufacturing and installation processes. Furthermore, operators require skilled personnel to handle installation, calibration, and testing to ensure accuracy and reliability. Manufacturers are attempting to mitigate these barriers through modular designs, financing models, and training programs. Despite these measures, cost considerations and regulatory adherence continue to influence purchasing decisions across industrial and utility segments.

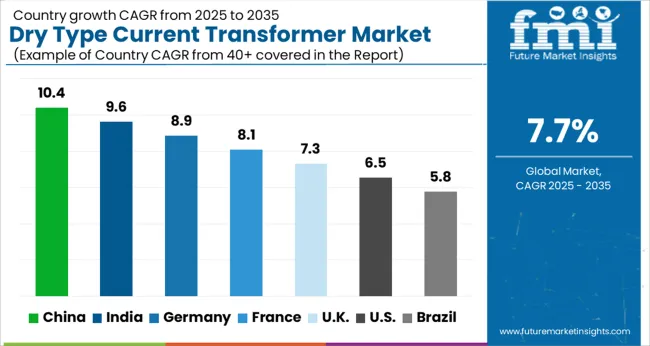

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The global dry type current transformer market is projected to grow at a CAGR of 7.7% from 2025 to 2035. China leads with a growth rate of 10.4%, followed by India at 9.6%, and Germany at 8.9%. The United Kingdom records a growth rate of 7.3%, while the United States shows the slowest growth at 6.5%. Market expansion is driven by rising electricity demand, increased investments in smart grids, and the growing need for safe and efficient energy distribution. Emerging markets such as China and India benefit from expanding industrial infrastructure and modernization of power transmission systems, while mature markets like the USA, UK, and Germany focus on grid reliability, energy efficiency, and integration of advanced monitoring solutions. This report covers insights on 40+ countries; top markets are highlighted here.

The dry type current transformer market in China is projected to grow at a CAGR of 10.4%. Rising industrialization, urban expansion, and the modernization of power distribution networks drive strong demand. Utilities and private power providers increasingly adopt dry type transformers for safety, low maintenance, and efficient load management. Investments in renewable energy integration and smart grid implementation further boost adoption. Local manufacturers and international suppliers provide a wide range of high-voltage, medium-voltage, and compact transformer solutions suitable for industrial, commercial, and residential applications. The emphasis on minimizing energy losses, enhancing reliability, and adhering to stricter safety standards strengthens market growth. Continuous infrastructure development, increasing electricity consumption, and regulatory compliance contribute to China’s leadership in the global dry type current transformer market.

The dry type current transformer market in India is projected to grow at a CAGR of 9.6%. Rapid industrial expansion, increasing urban electrification, and modernization of the electrical grid are primary growth drivers. Utilities are adopting dry type transformers for their compact design, low maintenance, and safety in high-density environments. Government programs supporting renewable energy, energy efficiency, and reliable power distribution boost market demand. Manufacturers focus on producing medium- and low-voltage transformers with advanced insulation and monitoring features. Infrastructure projects, smart city initiatives, and the rising need for grid stability enhance adoption. The market in India is strengthened by increasing investments in industrial, commercial, and residential energy solutions.

The dry type current transformer market in Germany is projected to grow at a CAGR of 8.9%. The country’s industrial and energy sectors rely on dry type transformers for safe and efficient power distribution. Adoption is supported by regulations emphasizing safety, energy efficiency, and reliability in high-voltage networks. Manufacturers provide high-quality, durable, and compact transformers with advanced monitoring and diagnostic capabilities. Integration with smart grids and predictive maintenance systems enhances market penetration. Industrial automation, renewable energy integration, and modernization of power infrastructure drive consistent growth. Germany’s mature energy market focuses on reducing downtime, minimizing energy losses, and ensuring grid stability, supporting steady demand for dry type current transformers.

The dry type current transformer market in the United Kingdom is projected to grow at a CAGR of 7.3%. Demand is fueled by industrial electrification, commercial power distribution, and renewable energy integration. Utilities and private enterprises increasingly adopt dry type transformers for compact design, reliability, and minimal maintenance. Manufacturers focus on providing advanced solutions with monitoring, diagnostic, and energy efficiency features. Government policies promoting grid modernization, safety standards, and energy efficiency further boost market penetration. The UK market benefits from steady adoption in commercial, industrial, and residential sectors, with investments in energy infrastructure and smart distribution systems supporting consistent growth over the forecast period.

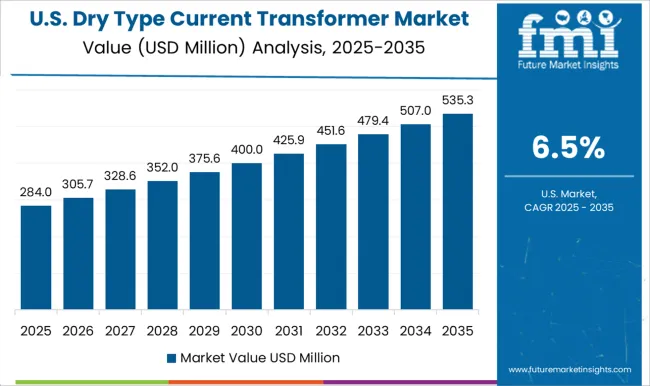

The dry type current transformer market in the United States is projected to grow at a CAGR of 6.5%. Market growth is driven by industrial facilities, commercial complexes, and energy distribution networks seeking reliable, safe, and low-maintenance transformers. Utilities adopt dry type transformers to improve efficiency, safety, and load management. Manufacturers provide compact, high-voltage, and medium-voltage solutions integrated with monitoring systems for predictive maintenance. Investment in renewable energy, smart grids, and infrastructure modernization supports market expansion. The mature USA market focuses on grid stability, energy optimization, and adherence to safety regulations, ensuring steady demand for dry type current transformers across industrial, commercial, and residential applications.

The dry type current transformer market is dominated by global electrical equipment manufacturers and regional specialists providing reliable, safe, and efficient solutions for power distribution and measurement. Companies such as ABB, Siemens Energy, and General Electric lead the market by offering advanced dry type transformers designed for high-voltage applications, industrial substations, and commercial buildings. Marketing materials emphasize insulation quality, maintenance-free operation, and compliance with international safety standards.

Hitachi Energy and ARTECHE differentiate through compact designs, energy efficiency, and precision in current measurement, appealing to utilities and industrial customers. Amran and Automatic Electric focus on versatility, providing transformers suitable for retrofitting existing systems and integration with modern digital monitoring platforms.

Brochures often highlight reliability, operational longevity, and reduced risk of fire or leakage, positioning these products as essential components in high-performance electrical networks. Regional and niche players including Dalian Huayi Electric Power Electric Appliances, Guangdong Sihui Instrument Transformer Works, Instrument Transformers, Macroplast, Peak Demand, TWB, and Wenzhou Unisun Electric compete on cost-effectiveness, customization, and quick delivery for local markets.

Marketing materials stress adherence to IEC and ANSI standards, precision in load monitoring, and ability to operate in harsh environmental conditions. Product brochures highlight robust epoxy resin insulation, low noise emission, and compact footprint for limited-space installations. Competition is driven by reliability, insulation technology, measurement accuracy, and service support. Companies are increasingly emphasizing modularity, integration with smart grid systems, and digital monitoring compatibility, ensuring dry type current transformers remain critical for safe, efficient, and modern electrical power management.

| Item | Value |

|---|---|

| Quantitative Units | USD 601.4 million |

| Product | Wound Type, Toroidal, Bar Type, and Others |

| Rating | ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV |

| Application | Power Distribution, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Amran, ARTECHE, Automatic Electric, Dalian Huayi Electric Power Electric Appliances, General Electric, Guangdong Sihui Instrument Transformer Works, Hitachi Energy, Instrument Transformers, Macroplast, Peak Demand, Siemens Energy, TWB, and Wenzhou Unisun Electric |

| Additional Attributes | Dollar sales by transformer type (indoor, outdoor) and rating (low, medium, high voltage) are key metrics. Trends include rising demand for safe, maintenance-free transformers, growth in power distribution networks, and adoption in renewable energy integration. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global dry type current transformer market is estimated to be valued at USD 601.4 million in 2025.

The market size for the dry type current transformer market is projected to reach USD 1,262.8 million by 2035.

The dry type current transformer market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in dry type current transformer market are wound type, toroidal, bar type and others.

In terms of rating, ≤ 33 kv segment to command 48.7% share in the dry type current transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Dry Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA