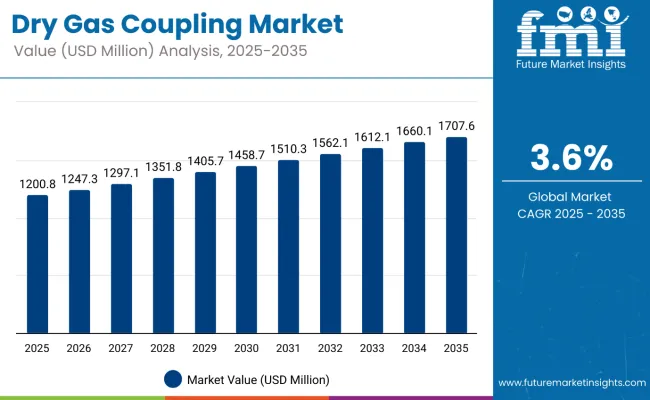

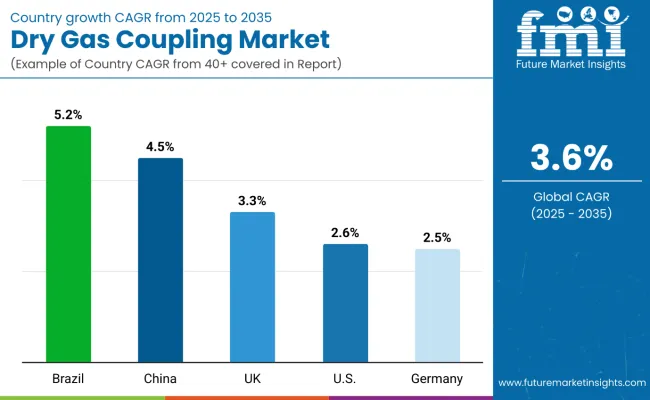

The global dry gas coupling market is expected to grow from USD 1,200.8 million in 2025 to approximately USD 1,707.6 million by 2035, registering an absolute increase of USD 506.8 million, or 42.2% over the forecast period. This growth reflects a 1.42X expansion in market size, with a compound annual growth rate (CAGR) of 3.6% between 2025 and 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,200.8 million |

| Industry Size (2035F) | USD 1,707.6 million |

| CAGR (2025 to 2035) | 3.6% |

From 2025 to 2030, the market is projected to expand from USD 1,200.8 million to USD 1,458.7 million, resulting in a value addition of USD 257.9 million. This phase is anticipated to be supported by stronger mandates for zero-leakage fluid transfer systems, particularly in sectors such as oil & gas, specialty chemicals, and compressed gas distribution. Increased adoption of quick-connect couplings in hazardous gas handling environments will continue to drive installation across Europe, North America, and the Middle East.

During the 2030 to 2035 phase, the market is forecast to grow from USD 1,458.7 million to USD 1,707.6 million, reflecting an increase of USD 248.9 million. This growth will likely be influenced by the expansion of LNG infrastructure, digital tracking integration into coupling systems, and rising demand for high-integrity transfer systems in hydrogen and biofuel distribution. Key players are expected to focus on smart coupling technologies with integrated sensors, predictive maintenance capability, and faster actuation cycles, enabling safe and efficient handling in extreme operational zones.

Between 2020 and 2025, the global dry gas coupling market expanded from USD 1,013.7 million to USD 1,200.8 million, reflecting a total increase of USD 187.1 million, or 18.5%. This growth corresponds to a compound annual growth rate (CAGR) of approximately 3.4% during the period.

Market expansion during this timeframe was driven by a steady rise in cross-industry demand for safe, spill-free, and quick-disconnect solutions across fuel handling, chemical transfer, and industrial gas operations. The oil and gas sector witnessed moderate but sustained investments in midstream infrastructure, including tankers, transfer skids, and loading arms, particularly in North America and the Middle East, where safety regulations became more stringent.

Industrial adoption was further supported by upgrades to existing fluid handling equipment in aging facilities, where conventional threaded or camlock couplings were increasingly replaced by dry disconnect systems. In the chemical sector, retrofitting of dry break couplings in ISO tank containers, IBCs, and gas cylinder filling lines was a notable trend, especially in Western Europe and China.

By 2024, the market had stabilized and was positioned for sustained growth, aided by standardization initiatives and growing awareness of occupational safety in high-pressure gas environments. Several manufacturers introduced new products during this period with improved locking mechanisms, faster flow rates, and enhanced material compatibility (e.g., Hastelloy, stainless steel, PTFE seals) to cater to demanding chemical and fuel applications. These developments contributed to a solid foundation for the accelerated adoption expected in the coming decade.

The global dry gas coupling market is experiencing steady growth due to intensifying focus on safety, environmental protection, and operational efficiency in high-risk fluid and gas transfer operations. Industries handling volatile gases, hazardous chemicals, and pressurized systems are progressively shifting toward coupling solutions that eliminate spillage, minimize downtime, and reduce operator exposure during loading and unloading activities.

Stringent regulatory frameworks established by organizations such as OSHA, ADR, and API are compelling operators to upgrade to certified dry disconnect systems across terminals, refineries, and chemical plants. The need to ensure zero leakage during disconnection is becoming a compliance norm, especially in Europe and North America. This regulatory enforcement is pushing infrastructure operators to adopt standardized and field-proven coupling systems.

Another contributing factor is the increasing investment in modular fueling infrastructure, cryogenic gas storage, and renewable gas supply chains, particularly for LNG, hydrogen, and bio-LPG. These emerging fuel types require precision-engineered couplings that can handle extreme pressures, rapid temperature changes, and high-purity requirements without compromising seal integrity or safety.

Growing cross-border trade of liquefied gases, chemical intermediates, and specialty fluids is also creating demand for dry gas couplings that support fast turnaround times and global interoperability. Companies are actively seeking NATO STANAG-compliant, ISO-certified couplings that work across fleets and terminals without compatibility issues, reinforcing global market momentum.

The expansion of urban refueling stations, fleet depots, and decentralized energy hubs is further boosting demand for lightweight, compact, and user-friendly dry gas couplings. Manufacturers are responding with aluminum and composite-bodied variants, which support ergonomic handling while maintaining chemical resistance and burst strength.

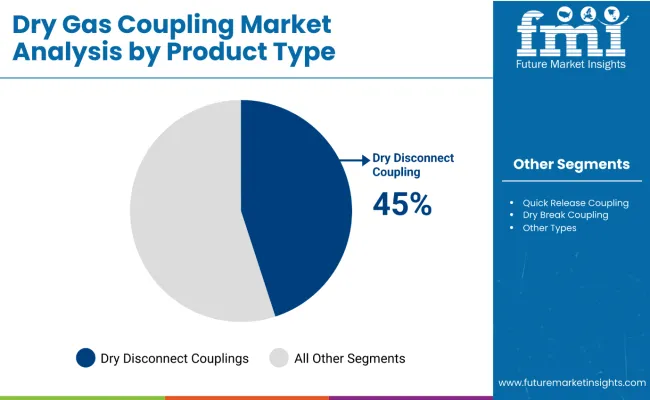

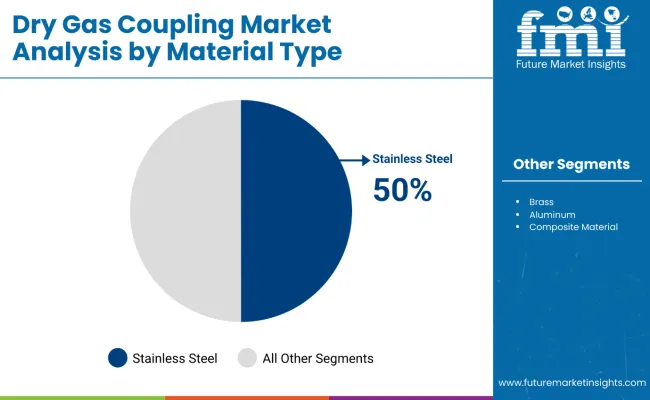

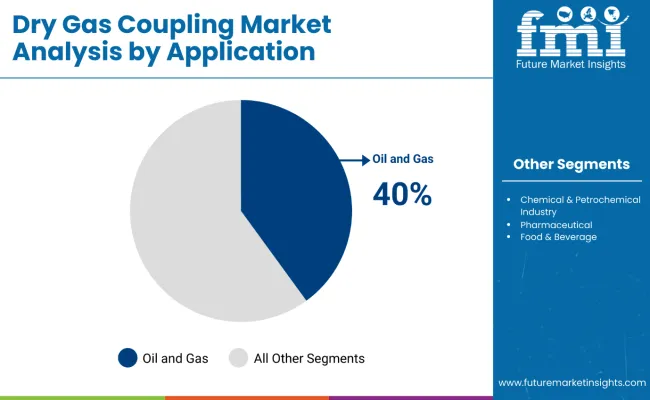

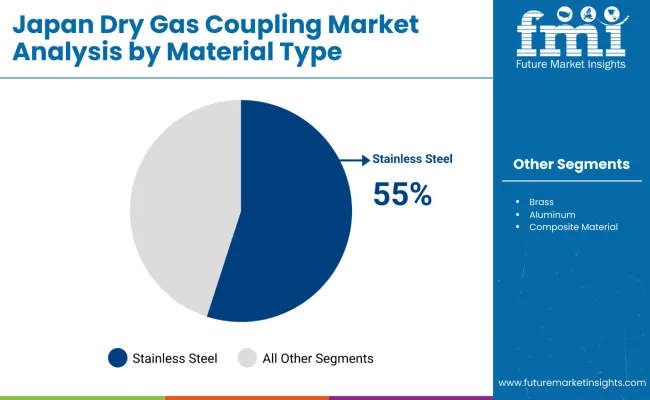

The dry gas coupling market is segmented by product type into dry disconnect couplings, quick release couplings, dry break couplings, and other variants. Dry disconnect couplings lead the segment due to their superior safety and leak prevention during fluid transfer operations. By material type, stainless steel dominates, driven by its durability and resistance to corrosion in harsh environments. Other materials such as brass, aluminum, and composites are selected based on cost, weight, and chemical compatibility.

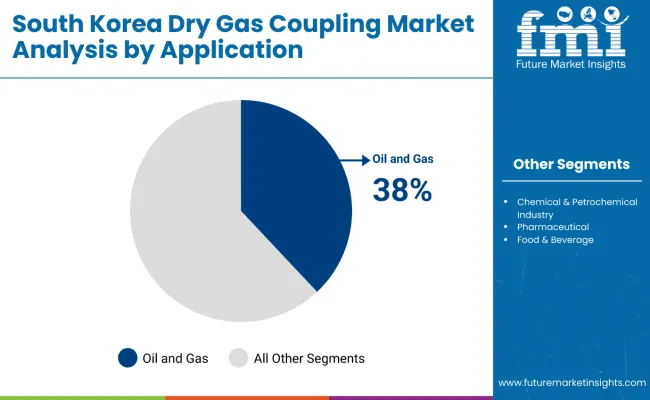

The application segmentation includes oil and gas, chemical and petrochemical, pharmaceuticals, food and beverage, water and wastewater management, and other industrial uses. Oil and gas applications remain the key driver, supported by increasing safety regulations and demand for efficient loading/unloading systems. The market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, each reflecting varying levels of adoption based on industrial safety practices and infrastructure modernization.

Dry disconnect couplings are projected to hold a 45% share in 2025, maintaining their position as the leading product category throughout the forecast period. These couplings are widely adopted in critical fluid transfer operations where quick, safe disconnection is required without spillage. Their use is prominent across refineries, tank farms, offshore rigs, and hazardous chemical plants.

The coupling’s ability to conform to ISO and NATO standards makes it suitable for military-grade and industrial applications. Growing compliance with safety regulations related to toxic, flammable, or high-value fluids is accelerating the replacement of traditional quick couplings with dry disconnect variants. Additionally, investments in LNG bunkering and bulk chemical transport infrastructure are creating long-term demand in Asia-Pacific and the Middle East.

Stainless steel couplings are anticipated to represent 50% of the market in 2025 due to their superior corrosion resistance and high tensile strength. These characteristics are essential for use in oil and gas terminals, chemical processing units, and offshore marine operations. Stainless steel's resistance to heat and chemical degradation ensures coupling longevity, especially in acid, solvent, or pressurized gas applications.

While alternative materials such as aluminum and composites are gaining traction for cost and weight advantages, they are typically chosen for less aggressive environments. The rising installation of stainless-steel couplings in loading arms and cryogenic systems has been observed across LNG terminals in Europe and North America. This material is also being preferred in emerging hydrogen refueling infrastructure projects where leak integrity and pressure ratings are mission-critical.

The oil and gas sector is expected to contribute 40% to total dry gas coupling demand in 2025 and continue as the largest end-use industry over the next decade. Couplings are routinely installed in pipeline distribution networks, refinery tank unloading, fuel depot transfer systems, and floating production storage offloading (FPSO) units. Expansion in downstream capacity, including petrochemical complexes and fuel export terminals in the Middle East and Asia, is a key factor supporting volume growth.

In addition to greenfield projects, periodic inspection and replacement of couplings at brownfield sites are contributing to sustained aftermarket demand. Increasing deployment of vapor recovery systems and emergency shutoff protocols has further pushed oil companies to adopt certified coupling solutions. The sector also benefits from specialized coupling designs capable of handling high-viscosity and high-pressure fluids, strengthening the product’s utility in diverse crude and gas streams.

Standardization and Regulatory Push is Driving Retrofitting ActivitiesThe adoption of dry gas couplings is being accelerated by stringent safety and environmental regulations enforced across chemical, petrochemical, and energy sectors. Compliance with global standards such as ISO 29292, NATO STANAG 3756, and API RP1004 has prompted widespread retrofitting of loading arms and hose systems.

Terminals and transporters are phasing out threaded or camlock fittings in favor of dry disconnect couplings that prevent leakage and ensure spill-free disconnection. This shift is especially prominent in Europe and North America, where regulatory audits and certification mandates have tightened considerably. Industrial operators are also adopting uniform quick-connect formats across fleets to streamline maintenance and meet international safety benchmarks.

Hydrogen, LNG, and Biofuel Infrastructure Driving New Installations

The rapid expansion of gaseous and cryogenic fuel ecosystems particularly for hydrogen, LNG, and bio-LPG is opening up new growth avenues for the dry gas coupling market. These applications demand extremely safe, contamination-resistant, and fast-operating couplings for mobile and fixed installations. Specialized variants designed for ultra-low temperature and high-purity service are gaining traction in hydrogen refueling stations, LNG bunkering terminals, and modular biogas setups. Couplings with integrated safety interlocks, grounding features, and color-coded interfaces are being preferred for their ability to eliminate human error and support automation-driven operations.

Portability and Ergonomics Enhance Operator Adoption

A growing emphasis on operator safety and ease of handling has led to the development of lightweight couplings with ergonomic grip designs and rapid locking mechanisms. In manual loading environments such as fuel tankers and railcar transfers, coupling tools are often handled in tight spaces and under time constraints. Manufacturers are responding with quick-connect mechanisms that offer one-handed operation, visual locking indicators, and reduced insertion force. Aluminum and composite-bodied couplings are emerging as a viable alternative to stainless steel in many mid-pressure applications, offering substantial weight reduction without sacrificing durability.

Digital Monitoring and Predictive Maintenance Emerging as Trends

The integration of sensors and telemetry into coupling systems is enabling real-time tracking of temperature, flow rate, and coupling status. This capability is becoming valuable in process plants and storage facilities that rely on predictive maintenance and automated safety systems. Smart couplings embedded with RFID, pressure sensors, or tamper detection are under evaluation in select markets. These innovations are poised to gain wider adoption as digitalization continues to reshape fluid handling infrastructure in oil & gas, chemical logistics, and specialty gas distribution.

| Countries | 2025 Share |

|---|---|

| Germany | 22% |

| Italy | 12% |

| France | 17% |

| UK | 15% |

| Spain | 8% |

| BENELUX | 10% |

| Rest of Europe | 16% |

| Countries | 2035 Share |

|---|---|

| Germany | 23% |

| Italy | 12% |

| France | 16% |

| UK | 15% |

| Spain | 7% |

| BENELUX | 9% |

| Rest of Europe | 18% |

The Europe dry gas coupling market is expected to increase from USD 360.8 million in 2025 to USD 458.7 million by 2035, reflecting a CAGR of 2.4%. Germany will remain the largest contributor, growing from 22% to 23% of the regional market by 2035 due to its advanced chemical, gas, and energy infrastructure. France and the UK will maintain steady contributions, supported by regulatory safety upgrades and LNG terminal retrofits.

Italy and BENELUX are set to witness marginal share growth owing to robust OEM exports and biogas investments. Spain’s share is expected to contract slightly as other countries accelerate faster. The region’s collective growth will be driven by emission control mandates and standardized coupling technologies across hazardous environments.

Brazil is poised to record the fastest growth in the dry gas coupling market between 2025 and 2035, supported by large-scale LNG infrastructure development and gasification projects across coastal and interior regions. The country is actively expanding its natural gas grid through public-private partnerships, increasing the need for secure, leak-proof gas transfer solutions.

Dry gas couplings are being adopted at new terminals, processing units, and refueling stations to reduce emissions and comply with safety mandates. Their quick-connect functionality and minimal spillage attributes are gaining traction among local operators and multinational contractors operating in Brazil’s upstream and midstream gas sector.

The dry gas coupling market in China is set to witness steady growth, led by massive investments in petrochemical plants and LNG import terminals. Local demand is further driven by the expansion of gas-based power generation and clean fuel transition in industrial clusters. Manufacturers in China are upgrading safety devices at transfer stations, storage tanks, and distribution trucks. The replacement of conventional couplings with dry disconnect variants is gaining momentum, especially in refineries and ship-to-shore transfer systems.

The UK market for dry gas couplings is projected to expand moderately over the forecast period, reflecting growing adoption in hydrogen blending projects, LNG bunkering operations, and offshore energy systems. As the nation transitions to cleaner fuel infrastructure, dry gas couplings are being integrated into refueling stations, transport trailers, and storage depots for enhanced safety and minimal leak risk. Government initiatives around decarbonizing heating and mobility are encouraging the use of gas-handling components that meet ATEX, PED, and ISO standards.

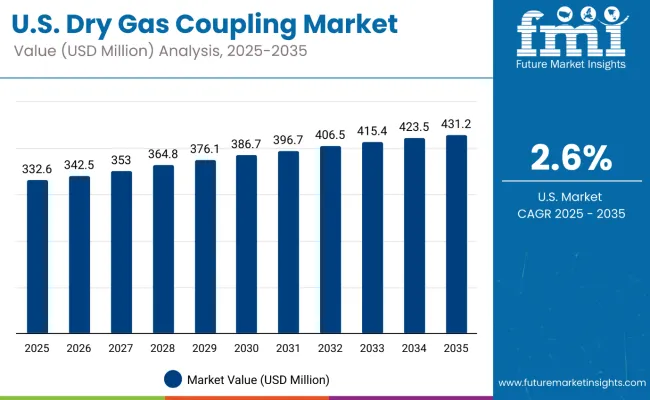

The USA dry gas coupling market is forecast to grow steadily, supported by rising midstream infrastructure spending and modernization of gas transfer equipment in processing and storage sites. Emphasis on fugitive emission control in shale basins and compliance with OSHA and EPA regulations are encouraging the use of dry disconnect couplings. Adoption is rising across LNG liquefaction plants, gas delivery systems, and chemical tanker fleets.

Germany’s dry gas coupling market is anticipated to witness marginal growth due to the country’s matured gas infrastructure, though modernization of existing terminals and chemical parks continues to support steady demand. German manufacturers are innovating coupling designs focused on zero-leak technology, ergonomic operation, and compatibility with legacy systems. Growing usage in specialty gas handling within pharmaceutical, defense, and research sectors is further shaping demand trends.

In Japan, the dry gas coupling market is expected to be driven by sustained demand from chemical processing plants and LNG distribution infrastructure. Stainless steel remains the most preferred material, accounting for 55% of the 2025 market share, due to its corrosion resistance, pressure durability, and compatibility with hazardous gases.

Precision-focused industries in Japan favor stainless steel variants to ensure leak-proof transfer across automated gas delivery systems. Brass and aluminum couplings are also witnessing incremental usage in less corrosive or regulated environments, while composite materials are gradually gaining traction in lightweight industrial setups.

The South Korean dry gas coupling market is heavily shaped by industrial application trends, with the oil & gas sector holding a 38% share in 2025. This is followed by the chemical and petrochemical industry at 24%, both of which require safe, fast-disconnect solutions to prevent gas leaks during pressurized transfer. Demand is also emerging from the pharmaceutical sector and food & beverage industry, where clean-room compliance and zero-spillage operation are critical. Coupling adoption is increasing in wastewater and industrial fluid transport, aided by government focus on hazardous material handling.

Competition in the dry gas coupling market is being shaped by technological differentiation and strategic capacity expansions. Industry players are introducing couplings with enhanced sealing mechanisms, improved pressure ratings, and compatibility with automated fueling systems to address evolving safety and operational standards in industrial and transportation applications. Simultaneously, investments in regional manufacturing and distribution networks are enabling faster delivery and localized support for critical infrastructure projects.

| Item | Value |

|---|---|

| Quantitative Units | Volume (Units), Value (USD Million), CAGR (2025 to 2035), Y-o-Y Growth (%) |

| By Product Type | Dry Disconnect Couplings, Quick Release Couplings, Dry Break Couplings, Other Types |

| By Material Type | Stainless Steel, Brass, Aluminum, Composite Materials |

| By Application | Oil and Gas, Chemical & Petrochemical Industry, Pharmaceuticals, Food & Beverage, Water & Wastewater Management, Other Industrial Application |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Canada, Mexico, Brazil, Germany, France, UK, Italy, Spain, BENELUX, Russia, Poland, China, Japan, South Korea, India, Turkiye, South Africa, GCC Countries |

The global dry gas coupling market is projected to reach approximately USD 1.7 billion by 2035, up from USD 1.2 billion in 2025.

Dry disconnect couplings are anticipated to lead the market owing to their enhanced safety features and applicability across critical gas transfer operations.

Stainless steel is expected to remain the dominant material due to its corrosion resistance and pressure-handling capabilities, especially in oil & gas and chemical sectors.

Oil and gas remains the largest end-use segment, driven by stringent safety standards and the need for leak-proof operations in pressurized environments.

The market is witnessing increased adoption of composite material couplings for lightweight and cost-sensitive applications, along with rising use in pharmaceutical and food-grade installations due to strict hygiene requirements.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA