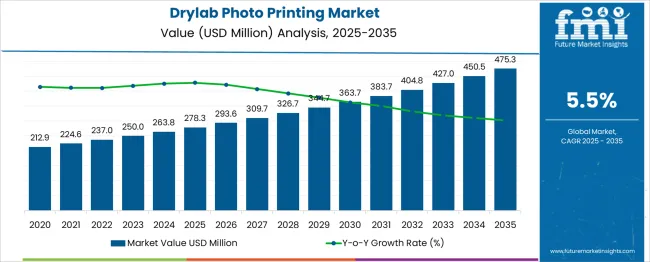

The Drylab Photo Printing Market is estimated to be valued at USD 278.3 million in 2025 and is projected to reach USD 475.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. A peak-to-trough analysis over this forecast period reveals a consistent upward trend without visible contraction years, implying demand resilience across both consumer and commercial verticals. While year-on-year growth moderates over time in percentage terms, the absolute annual gains increase steadily, reflecting underlying market consolidation and maturing purchasing patterns among volume users.

Between 2025 and 2030, the market grows by USD 85.4 million, while the second half adds USD 111.6 million, indicating momentum strengthens in the latter part of the period. The slope of the growth curve flattens slightly between 2026 and 2028, suggesting this segment enters a stabilization phase before scaling further due to increasing demand for short-run photo production, especially from retail kiosks, event photo providers, and high-throughput labs.

The absence of any trough across the forecast years points to structural demand anchored in instant dry chemical-free print formats, minimal maintenance cycles, and compact form factors. As digital photo volumes continue to expand but shift toward high-value print requests, drylab systems are expected to remain positioned as cost-efficient solutions in both on-site and remote deployment models.

| Metric | Value |

|---|---|

| Drylab Photo Printing Market Estimated Value in (2025 E) | USD 278.3 million |

| Drylab Photo Printing Market Forecast Value in (2035 F) | USD 475.3 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The market derives about 35% of its share from consumer-focused photo printing and personalization services, where users seek high-quality prints for albums, calendars, and decor. Event-based photography, including on-site printing for weddings and corporate functions, contributes approximately 25% due to immediate delivery needs and quality expectations. Professional photography studios account for roughly 20%, as drylab printers offer consistent output with minimal processing time.

Around 15% of the market is tied to commercial photo labs and imaging retailers transitioning from wet labs to more compact and cost-effective drylab setups. The remaining 5% is captured through niche photo merchandise products such as mugs, magnets, and keychains requiring reliable, small-batch printing systems. The market is advancing as professional studios and retail photo labs shift toward chemical-free printing systems.

Around 60% of new installations now feature inkjet-based drylab units with high-resolution output and compact modular designs. Demand for on-site, instant printing at events and commercial venues has grown by over 40%, particularly in regions with rising digital photography engagement. Approximately 35% of equipment now supports wireless and mobile printing, enhancing workflow efficiency for both consumers and operators. Asia Pacific leads in deployment volume, while North America shows strong adoption in boutique and experiential photo services. Energy-efficient and low-maintenance systems are driving preference.

The current market landscape is being shaped by the adoption of compact, efficient, and environmentally friendly printing technologies, as highlighted in industry publications, investor presentations, and press releases from key technology companies.

The shift from traditional wet lab processes to dry lab systems has been driven by their lower operational costs, reduced environmental impact, and superior print quality. Future growth is expected to be propelled by innovations in printing materials, the rising popularity of photo merchandise, and the growing need for instant printing services in retail and event settings.

Corporate announcements indicate that advancements in connectivity and automation are enhancing the user experience, further supporting adoption. Sustainability initiatives and the flexibility of drylab systems to meet diverse customer requirements continue to provide new opportunities, fostering robust growth in established and emerging markets alike.

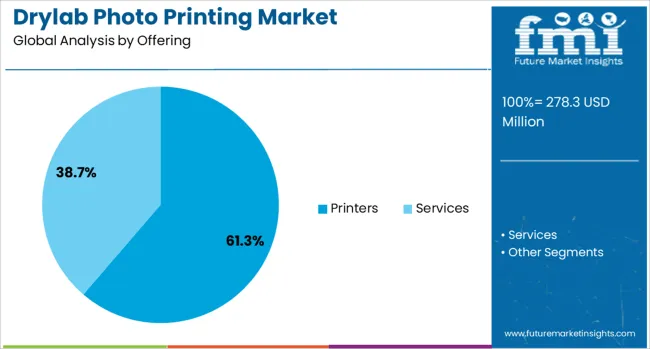

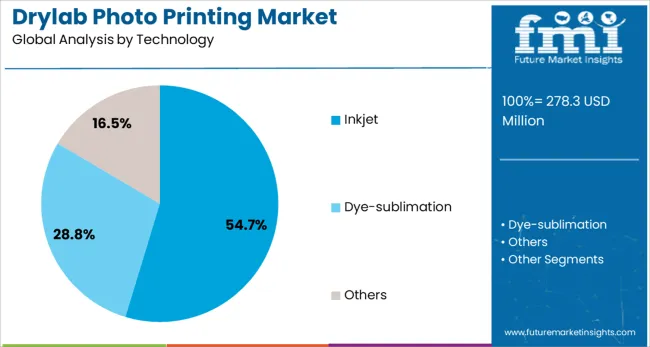

The drylab photo printing market is segmented by offering, technology, connectivity, print size, print finish, end-use industry, and geographic regions. The drylab photo printing market is divided into Printers and Services. In terms of technology, the drylab photo printing market is classified into Inkjet, Dye-sublimation, and Others.

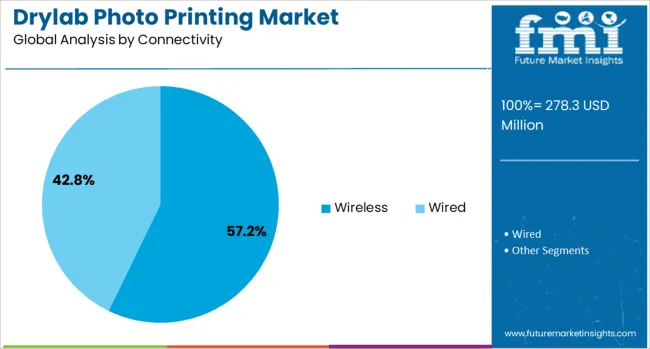

Based on connectivity, the drylab photo printing market is segmented into Wireless and Wired. By print size, the drylab photo printing market is segmented into standard-size prints and large-format prints. By print finish, the drylab photo printing market is segmented into Glossy, Matte, Luster, and Others. The end-use industry of the drylab photo printing market is segmented into Commercial and Residential. Regionally, the drylab photo printing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The printers offering segment is anticipated to hold 61.3% of the Drylab Photo Printing market revenue share in 2025, establishing itself as the leading segment. This dominance has been attributed to the indispensable role of printers as the core hardware enabling drylab operations, as detailed in technical product documentation and corporate disclosures.

Printers have been preferred due to their ability to deliver high-speed, superior-quality prints with low maintenance requirements, meeting the needs of professional photographers and commercial printing businesses. Product announcements have underscored how these devices have evolved to support higher resolution, faster turnaround times, and lower per-print costs, making them highly attractive to cost-sensitive and quality-conscious customers alike.

The segment’s prominence has also been reinforced by the availability of printers in various configurations that cater to diverse volumes and formats, ensuring their suitability for a wide range of applications. These factors combined have secured the printers segment’s leadership in the market.

The inkjet technology segment is projected to account for 54.7% of the Drylab Photo Printing market revenue share in 2025, affirming its position as the dominant technology. Its growth has been driven by superior color reproduction, fine detail rendering, and reduced energy consumption compared to alternative methods, as highlighted in technical specifications and technology briefings.

Inkjet technology has been widely adopted due to its flexibility in handling a broad range of paper types and finishes while maintaining high print quality at lower operational costs. Corporate updates and product launches have emphasized continuous innovation in ink formulations and printhead designs, which have further enhanced reliability and reduced downtime.

The preference for inkjet systems has also been supported by their environmental benefits, including minimal chemical usage and reduced waste generation. These advantages have collectively reinforced the leadership of the inkjet technology segment in the drylab photo printing landscape.

The wireless connectivity segment is forecasted to command 57.2% of the drylab photo printing market revenue share in 2025, securing its role as the leading connectivity option. Growth in this segment has been supported by increasing customer expectations for convenience, flexibility, and seamless integration with mobile and cloud platforms, as reflected in technology news and corporate communications.

Wireless-enabled systems have been preferred because they facilitate easy setup, enable remote monitoring, and allow multiple devices to connect without extensive cabling, addressing the needs of modern, space-constrained environments. Press releases and product presentations have highlighted how wireless connectivity enhances user experience by supporting real-time data transfer, enabling faster service delivery, and reducing installation complexity.

The segment’s dominance has also been underpinned by its alignment with the broader digital transformation trends in retail and event-based photo services. Collectively, these drivers have solidified wireless connectivity as the preferred choice for drylab photo printing systems.

Drylab photo printing systems have gained traction among professional studios and event-based printing services. By 2025, compact modular printers had captured a notable share of the photo output industry due to their speed, footprint efficiency, and lower per-print cost. Retail mini-labs, photo kiosks, and mobile event printers contributed the highest unit sales. Hybrid dye-sub and pigment ink platforms gained preference across regions where long-life, waterproof finishes are prioritized.

A shift toward on-site and on-demand photo delivery has supported drylab adoption across weddings, conferences, and official ID centers. Print stations offering 4×6 and 6×8 sizes saw deployment increases of 21% across Asia Pacific and Middle East wedding markets. Fast warm-up time and no-chemical processing allowed for deployment in high-traffic environments, including malls, airports, and tourist zones. Modular dual-tray configurations raised capacity by 28% per hour compared to conventional wet labs.

While drylabs eliminate chemical waste and offer simplified workflows, the higher cost of dye ribbons and specialty media has affected profitability for high-volume operators. Average per-print costs remained 11% above those of chemical labs in low-throughput settings. Printhead wear and ribbon calibration mismatches triggered 7% more maintenance tickets among entry-level models. Limited support for non-standard paper sizes and rigid output speeds hindered applications in signage or large-format photo merchandising.

Retail chains, including pharmacy chains and electronics outlets, integrated drylab kiosks into <1 m² floor spaces, boosting photo service availability by 31% in urban areas. Touchscreen interfaces with QR scan-to-print options were added to 43% of newly deployed kiosks, streamlining photo selection from mobile devices. On-site printing during tourist events, school functions, and sports meets has opened new use cases. High-durability photo IDs, badges, and certificates have also been targeted with dual-finish support, including matte and gloss lamination.

Workflow automation has been embedded in 36% of drylab systems deployed since 2023. Features such as auto-cropping, face detection, and background smoothing reduced human error during batch processing. Bluetooth and Wi-Fi-enabled models increased by 24%, especially in mobile print vans and pop-up studios. Cloud-controlled print queues and remote diagnostics have also been implemented in 19% of active systems, improving uptime and reducing technician interventions. Energy-efficient heater plates and recyclable cartridges were introduced in over 17% of new-generation machines, aligning with retailer mandates to reduce waste per unit sold.

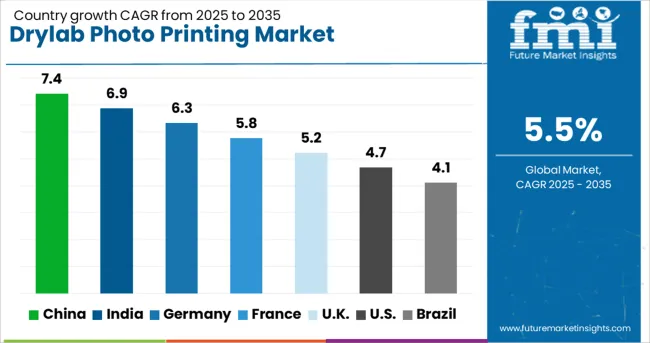

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global drylab photo printing market is expected to grow at a CAGR of 5.5% from 2025 to 2035. China leads at 7.4%, outperforming the global average by 1.9%, driven by demand for high-speed lab-quality prints in commercial photo studios and event printing services. India follows at 6.9%, supported by a rising base of mid-sized print labs and photo retail chains. Germany (OECD) records 6.3%, 0.8% above the global rate, backed by legacy imaging companies transitioning to drylab formats. The United Kingdom (OECD) posts 5.2%, slightly under the benchmark due to slower replacement cycles. The United States (OECD) trails at 4.7%, 0.8% below average, impacted by digital substitution and limited retail photo expansion. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 7.4% of the global drylab photo printing market in 2025. The market has been driven by rising output demand from commercial photo studios, retail kiosk chains, and ID photo centers. Equipment imports from Japanese and Korean manufacturers have increased, focusing on A4/A5 hybrid models with dye-sublimation and inkjet compatibility. Product upgrades have been steered by demand for compact, high-speed printers across Tier 1 and Tier 2 cities.

India held 6.9% of the drylab photo printing market in 2025. Growth has been linked to the proliferation of regional passport and government ID centers requiring high-throughput machines. Fast-developing Tier 3 towns have adopted drylab printers through low-cost leasing models, expanding vendor opportunities for mid-range dye-based photo printers. Resellers have bundled printing software with localized language settings and template libraries.

Germany accounted for 6.3% of the global market in 2025. The demand landscape has been shaped by commercial labs and professional wedding studios adopting hybrid-format drylab machines. OEMs have optimized thermal dye-sublimation platforms to accommodate matte and luster finishes in smaller batch runs. Product adoption has increased in suburban retail kiosks due to high image durability and low maintenance.

The United Kingdom captured 5.2% of the global drylab photo printing market in 2025. Market traction has emerged from pharmacy chains, convenience stores, and supermarket kiosks investing in compact machines for walk-in photo printing. Flexible form factor printers with Wi-Fi and USB-C connectivity have replaced older mini-lab systems. End-user preference for same-hour passport and event photo prints has increased system throughput requirements.

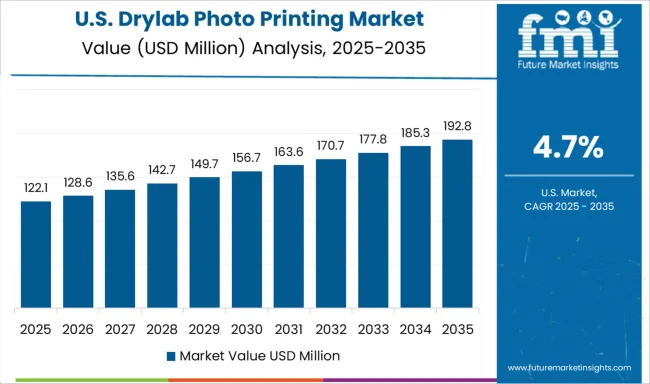

The United States held 4.7% of the global drylab photo printing market in 2025. Declining adoption of wet lab mini-labs has driven demand for drylab alternatives in school photography services, studio back offices, and photobooth vendors. Lightweight machines with roll-fed media have replaced bulky setups in suburban locations. Manufacturers have integrated auto-correction firmware and instant connectivity into low-noise systems preferred by small business operators.

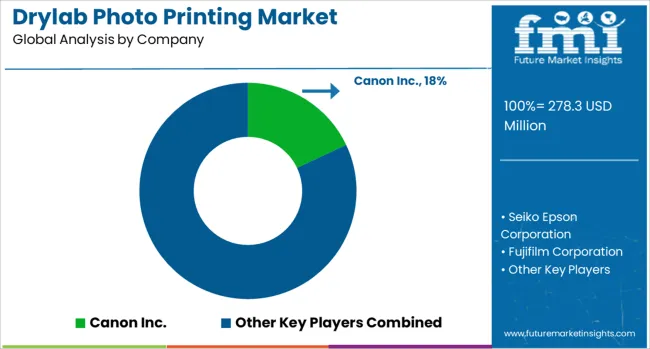

The drylab photo printing market is led by companies with strong imaging and print hardware portfolios, targeting commercial labs, retail kiosks, and professional studios. Canon Inc. supports drylab printing through its DreamLabo systems, offering high-resolution output with dye-based inks designed for long-life photo prints. Seiko Epson Corporation provides SureLab series printers that use advanced inkjet technology for fast, lab-quality results, widely adopted by independent photo labs and retail operators.

Fujifilm Corporation integrates drylab systems within its Frontier lineup, enabling compact, scalable photo production using pigment-based inks and specialized paper. Epson provides new drylab services such as the SureLab series, which aids multiple media sizes and finishes. Its MicroPiezo inkjet tools offers high-resolution pictures with the help of durable inks for professional-grade printing activities.

Moreover, Epson has joined hands with photo labs and retail stores across various countries across the globe. Companies such as Mitsubishi Electric and DNP Photo Imaging supply most powerful and efficient drylab printers to its customers. The DS series of DNP Photo Imaging possess extensive rights for distributing products and the company favors event photo printing owing to portability and maintenance facilities.

Drylab technology, leveraging inkjet, dye-sublimation, or thermal-transfer processes, has transformed photo printing by enabling high-resolution, fast-turnaround prints without chemical processing. It is favored in professional studios, retail kiosks, and event venues for its consistent print quality and flexibility across formats like photo books, canvases, and personalized gifts.

Sustainability is central, with biodegradable inks, recyclable media, and energy-efficient printers increasingly demanded by eco-conscious consumers. Wireless and mobile-enabled kiosks now dominate consumer access, while integration with automated workflow software and smart apps enhances convenience and customization. Despite these strengths, the market faces hurdles such as high upfront and consumable costs, competition from digital-only platforms, and limited adoption in emerging regions due to infrastructure and awareness gaps.

| Item | Value |

|---|---|

| Quantitative Units | USD 278.3 Million |

| Offering | Printers and Services |

| Technology | Inkjet, Dye-sublimation, and Others |

| Connectivity | Wireless and Wired |

| Print Size | Standard size prints and Large format prints |

| Print Finish | Glossy, Matte, Luster, and Others |

| End-use Industry | Commercial and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Canon Inc., Seiko Epson Corporation, Fujifilm Corporation, Dai Nippon Printing Co. Ltd., Kodak Alaris Inc., Noritsu Precision Co. Ltd., and Hiti Digital, Inc. |

| Additional Attributes | Dollar sales by technology (dye sublimation, inkjet, digital minilab) and application (retail kiosks, studios, events), demand driven by instant printing and compact systems, led by Asia-Pacific with North America catching up, innovation in wireless and eco-friendly formats. |

The global drylab photo printing market is estimated to be valued at USD 278.3 million in 2025.

The market size for the drylab photo printing market is projected to reach USD 475.3 million by 2035.

The drylab photo printing market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in drylab photo printing market are printers and services.

In terms of technology, inkjet segment to command 54.7% share in the drylab photo printing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photovoltaic Silane Coupling Agent Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Chemical Market Forecast and Outlook 2025 to 2035

Photomask Inspection Market Forecast and Outlook 2025 to 2035

Photostability Chamber Market Size and Share Forecast Outlook 2025 to 2035

Photo-Label Verifiers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Photographic Paper Market Size and Share Forecast Outlook 2025 to 2035

Photosensitive Alignment Film Market Size and Share Forecast Outlook 2025 to 2035

Photomultiplier Tube Accessories Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Grade High Purity Crystalline Silicon Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Photographic Film Processing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Photoresist and Photoresist Ancillaries Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Photoluminescent Paints Market Size and Share Forecast Outlook 2025 to 2035

Photovoltaic Mounting System Market Analysis - Size, Share, and Forecast 2025 to 2035

Photosensitive Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Electronic Chemical Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA