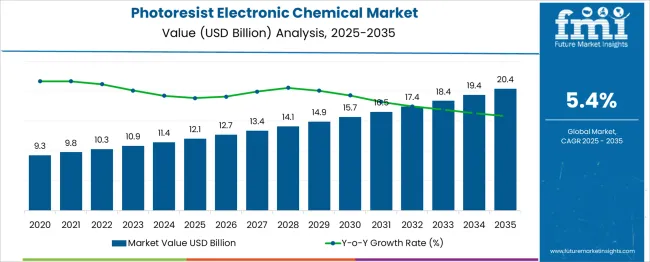

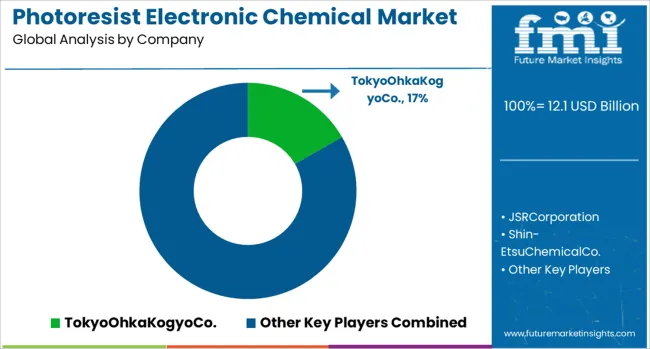

The Photoresist Electronic Chemical Market is estimated to be valued at USD 12.1 billion in 2025 and is projected to reach USD 20.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. This growth is supported by a steady CAGR of 5.4%, driven by increasing demand for advanced semiconductor manufacturing, electronics miniaturization, and the rise of 5G, IoT, and AI technologies. In the first five-year phase (2025–2030), the market is expected to expand from USD 12.1 billion to USD 16.0 billion, adding USD 3.9 billion, which accounts for 47% of the total incremental growth, driven by robust demand in semiconductor fabs and high-tech manufacturing. The second phase (2030–2035) contributes USD 4.4 billion, representing 53% of incremental growth, reflecting continued demand as the electronics industry continues to scale up and adopts newer technologies.

Annual increments will rise from USD 0.7 billion in the early years to USD 1 billion by 2035, reflecting stronger growth driven by advancements in semiconductor technologies, high-performance chips, and innovations in photoresist materials. Manufacturers focusing on next-gen photoresists, cost-efficient solutions, and expanding applications in emerging sectors will capture the largest share of this USD 8.3 billion opportunity.

| Metric | Value |

|---|---|

| Photoresist Electronic Chemical Market Estimated Value in (2025 E) | USD 12.1 billion |

| Photoresist Electronic Chemical Market Forecast Value in (2035 F) | USD 20.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Photoresist Electronic Chemical market is witnessing steady expansion, largely influenced by rapid advancements in semiconductor fabrication and the miniaturization of electronic components. Increasing investments in EUV lithography and advanced packaging technologies are accelerating the demand for high-quality photoresist materials that can meet stringent resolution and sensitivity requirements.

The growth of consumer electronics, electric vehicles, and high-performance computing is fueling the need for precise patterning and complex circuit integration, further boosting market traction. Strong demand from foundries and integrated device manufacturers (IDMs) is being supported by significant R&D efforts and capacity expansions in leading semiconductor hubs across Asia Pacific and North America.

Moreover, government initiatives to localize semiconductor manufacturing and reduce dependency on global supply chains are enhancing demand for domestically produced photoresist chemicals. Over the forecast period, the market is expected to benefit from innovations in resist formulations that improve etch resistance, process throughput, and compatibility with next-generation wafer technologies, reinforcing its critical role in advanced electronics production.

The photoresist electronic chemical market is segmented by type, substrate, application, end use, and geographic regions. By type, the photoresist electronic chemical market is divided into Positive and Negative. In terms of substrate of the photoresist electronic chemical market, it is classified into Silicon, Glass, Metal, and other substrates. Based on the application of the photoresist, the electronic chemical market is segmented into Semiconductor Manufacturing, Printed Circuit Boards (PCBs), LCD Displays, Micro-Electro-Mechanical Systems (MEMS), and Other applications.

By end use of the photoresist, the electronic chemical market is segmented into the Semiconductor Industry, Electronics Industry, Display Industry, MEMS Industry, and Other Industries. Regionally, the photoresist electronic chemical industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

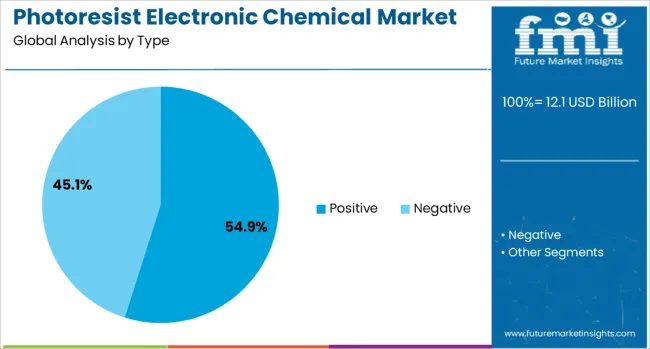

The positive type segment is projected to account for 54.9% of the total revenue share in the Photoresist Electronic Chemical market in 2025, establishing it as the leading segment by type. This dominance is being driven by the superior resolution, line-edge precision, and controllable exposure properties offered by positive photoresists in high-density circuit fabrication. These resists are widely utilized in submicron and nanometer-scale processes, where accurate pattern transfer is crucial.

Their compatibility with complex lithographic techniques and high etch resistance has enhanced their preference in critical layer patterning in semiconductor manufacturing. Continued investment in leading-edge technology nodes and the demand for highly integrated chips have reinforced the reliance on positive photoresist materials.

Their predictable development behavior, improved sensitivity to light sources such as KrF and ArF, and lower defect rates are enabling optimized yield outcomes in wafer processing. As lithography continues to evolve toward extreme ultraviolet platforms, the use of positive photoresists is expected to sustain its leadership due to their adaptability to advanced exposure systems.

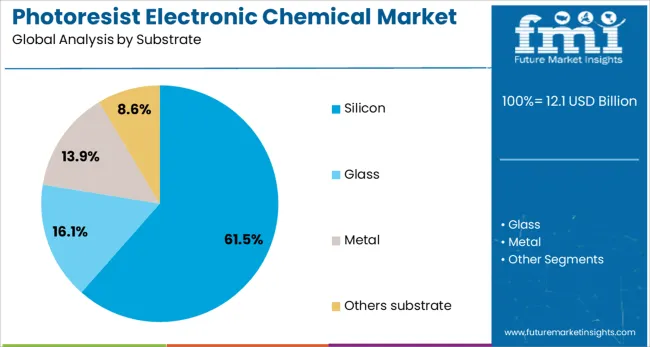

The silicon substrate segment is expected to capture 61.5% of the total revenue share in the Photoresist Electronic Chemical market in 2025, representing the most dominant substrate category. The strong position of silicon is being maintained due to its established role as the foundational material for semiconductor device fabrication. Its electrical conductivity, thermal properties, and cost-efficiency have made it the substrate of choice for integrated circuits and memory components across a wide range of electronic applications.

The compatibility of silicon with advanced etching and doping techniques has enabled its continued dominance even as device geometries shrink. Growing investments in front-end semiconductor production and wafer-level packaging are further increasing the reliance on silicon-based substrates.

Furthermore, the substrate’s mechanical stability under high-temperature processing and its well-documented performance in complex layer stacking have strengthened its adoption in cutting-edge chip design. As the demand for high-speed, energy-efficient chips increases, the silicon segment is expected to remain central to process innovation in electronic chemical applications.

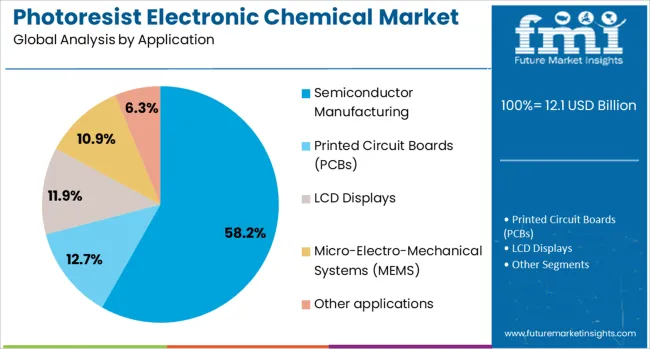

The semiconductor manufacturing segment is anticipated to account for 58.2% of the overall revenue share in the Photoresist Electronic Chemical market in 2025, emerging as the largest application area. This dominance is being driven by the accelerated scaling of semiconductor devices and the demand for precise photolithographic processes in chip production. As manufacturers transition to smaller nodes, the need for high-performance photoresist materials capable of delivering fine resolution and pattern fidelity has become critical.

Semiconductor manufacturing processes require consistent film thickness, uniform exposure, and minimal defectivity, all of which are being addressed by advanced photoresist formulations. The rapid growth in applications such as 5G infrastructure, autonomous systems, and artificial intelligence is further intensifying the requirement for complex chip architectures, thereby increasing the consumption of photoresist chemicals.

Investments in new fabrication plants and technology nodes by leading foundries are reinforcing demand for robust, high-purity photoresist solutions. As the industry pushes toward higher density and multifunctional integration, this application segment is expected to remain the primary driver of growth in the market.

The photoresist electronic chemical market is growing, driven by the increasing demand for precision chemicals in semiconductor manufacturing. Opportunities are emerging in the expanding electronics and semiconductor industries, while trends toward greener, bio-based photoresists are gaining momentum. However, high production costs and complex processes remain significant challenges. By 2025, overcoming these barriers will be crucial for sustaining the growth and accessibility of photoresist chemicals in semiconductor manufacturing.

The photoresist electronic chemical market is expanding due to the increasing demand for advanced semiconductor manufacturing processes. As electronics become more compact and powerful, the need for precision chemicals like photoresists is growing. These chemicals are essential in photolithography, a critical process in the production of integrated circuits. The rise of 5G, AI, and consumer electronics continues to drive demand for advanced semiconductor technologies. By 2025, the market is expected to see consistent growth, driven by technological advancements in semiconductor devices.

Opportunities in the photoresist electronic chemical market are growing with the expansion of the global electronics and semiconductor industries. As the demand for smaller, more efficient electronic devices increases, the need for high-performance photoresists continues to rise. Emerging technologies like flexible electronics and advanced displays also present significant opportunities. By 2025, the market will likely benefit from these growth sectors, with photoresist chemicals playing a crucial role in the production of next-generation semiconductor devices and displays.

Emerging trends in the photoresist electronic chemical market show a growing shift toward green chemistry and bio-based photoresists. With increasing environmental concerns, manufacturers are developing more sustainable alternatives to traditional photoresist chemicals, which are often toxic and harmful. Bio-based and environmentally friendly photoresists are gaining traction in semiconductor manufacturing as a means of reducing hazardous waste and improving eco-compliance. By 2025, these sustainable trends are expected to play a larger role in shaping the market's future.

Despite the market’s growth, challenges such as the high cost of production and complex manufacturing processes persist. The production of high-quality photoresist chemicals involves advanced and costly methods, which can limit the adoption of these chemicals in cost-sensitive markets. Additionally, the complex formulation process, requiring precise control over chemical properties, adds to the production costs. By 2025, addressing these barriers through cost-efficient and scalable manufacturing processes will be essential for sustaining market growth.

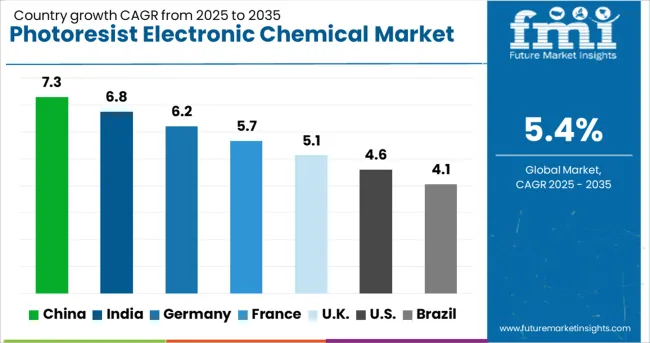

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global photoresist electronic chemical market is projected to grow at a 5.4% CAGR from 2025 to 2035. China leads with a growth rate of 7.3%, followed by India at 6.8%, and France at 5.7%. The United Kingdom records a growth rate of 5.1%, while the United States shows the slowest growth at 4.6%. These differences in growth rates are driven by factors such as increasing demand for semiconductors, advancements in electronics manufacturing, and innovations in photoresist technology. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, growing electronics sectors, and rising demand for advanced electronics, while more mature markets like the USA and the UK experience steady growth driven by established semiconductor industries and technological advancements. This report includes insights on 40+ countries; the top markets are shown here for reference.

The photoresist electronic chemical market in China is growing at a robust pace, with a projected CAGR of 7.3%. China’s rapid expansion in the semiconductor and electronics industries is a key driver of market growth. As the country continues to invest in advanced semiconductor manufacturing technologies and the development of integrated circuits (ICs), the demand for high-quality photoresist chemicals is increasing. China’s focus on becoming self-sufficient in semiconductor production, along with growing consumer electronics demand, further fuels the market. Additionally, government initiatives and investments in technology innovation are supporting the growth of the photoresist electronic chemical market.

The photoresist electronic chemical market in India is projected to grow at a CAGR of 6.8%. India’s expanding electronics and semiconductor sectors, along with the country’s increasing focus on manufacturing advanced technology components, are driving demand for photoresist chemicals. The government’s initiatives to boost the local semiconductor manufacturing industry, combined with the growing demand for electronic devices, are expected to contribute significantly to the market’s growth. Furthermore, India’s expanding information technology sector and the rise of digital technologies are fueling the need for high-quality electronic chemicals, including photoresists, to support electronic manufacturing.

The photoresist electronic chemical market in France is projected to grow at a CAGR of 5.7%. France’s well-established electronics and semiconductor industries, along with its focus on technology innovation, continue to drive demand for photoresist chemicals. The increasing demand for consumer electronics, along with growing investment in semiconductor production and manufacturing processes, is contributing to market growth. Additionally, France’s commitment to sustainability and technological development in advanced manufacturing processes supports the adoption of high-performance photoresist chemicals in the country’s electronics sector.

The photoresist electronic chemical market in the United Kingdom is projected to grow at a CAGR of 5.1%. The UK continues to invest in its semiconductor and electronics industries, driving steady demand for photoresist chemicals. As the demand for advanced semiconductor components rises in the country’s technology and manufacturing sectors, the need for high-quality photoresist materials increases. Additionally, the UK’s focus on innovation in microelectronics and the growing trend of automation and digitalization in manufacturing processes contribute to the market’s steady growth.

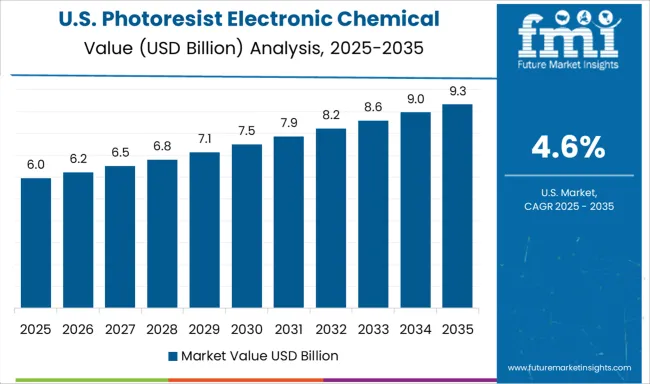

The photoresist electronic chemical market in the United States is expected to grow at a CAGR of 4.6%. Despite being a mature market, the USA remains a key player in the global semiconductor and electronics industries, driving steady demand for photoresist chemicals. The ongoing advancements in semiconductor technologies and the increasing adoption of next-generation electronics and integrated circuits contribute to market growth. Additionally, the demand for innovative electronic products and high-quality materials for precision manufacturing ensures the continued adoption of photoresist chemicals, despite slower growth compared to emerging markets.

Industry leaders are strategically positioning themselves through innovation, localization, sustainability, and geopolitically astute maneuvers. Established giants like Merck, JSR Corporation, Shin-Etsu Chemical, Tokyo Ohka Kogyo, and Fujifilm maintain their dominance by investing heavily in R&D to develop cutting-edge photoresist materials, including next-gen EUV-compatible formulations and advanced packaging resists. They also reinforce global reach by expanding manufacturing facilities across regions to serve major semiconductor clusters and mitigate supply chain risks. Complementing these efforts are strategies by regional players. In China, Hubei Dinglong is rapidly closing the gaps in the domestic supply of KrF and ArF photoresists, leveraging tailored resin technologies and localized production to gain orders from key wafer manufacturers, aligning with national goals to reduce reliance on imports. At the same time, broader geopolitical strategies underlie market developments in Europe and North America, where policies like the U.S. CHIPS Act and the EU’s similar initiatives are driving local production and R&D investments in photoresists to achieve technological sovereignty.

Sustainability has emerged as a growing strategic priority. Leading manufacturers are incorporating water-based and bio-based resist chemistries to minimize environmental impact and navigate increasingly stringent regulations. Meanwhile, industry-wide efforts toward supply chain diversification are inspiring firms to establish production capacities closer to key markets, enhancing agility and resilience in the face of global disruptions. Moreover, some players are refining their offerings to meet specialized demands, whether for advanced lithography nodes used in AI, IoT, and 5G, or tailored solutions for flexible, wearable, and display electronics, by expanding product portfolios to include both positive and negative resists optimized for high purity, performance, and niche applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.1 Billion |

| Type | Positive and Negative |

| Substrate | Silicon, Glass, Metal, and Others substrate |

| Application | Semiconductor Manufacturing, Printed Circuit Boards (PCBs), LCD Displays, Micro-Electro-Mechanical Systems (MEMS), and Other applications |

| End Use | Semiconductor Industry, Electronics Industry, Display Industry, MEMS Industry, and Other Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TokyoOhkaKogyoCo., JSRCorporation, Shin-EtsuChemicalCo., DuPont, MerckKGaA, SumitomoChemicalCo., FujifilmCorporation, MicroChemCorporation, AllresistGmbH, and Avantor |

| Additional Attributes | Dollar sales by chemical type and application, demand dynamics across semiconductor, photolithography, and electronics sectors, regional trends in photoresist chemical adoption, innovation in advanced materials and photonic technology, impact of regulatory standards on safety and environmental concerns, and emerging use cases in 5G technology and integrated circuit manufacturing. |

The global photoresist electronic chemical market is estimated to be valued at USD 12.1 billion in 2025.

The market size for the photoresist electronic chemical market is projected to reach USD 20.4 billion by 2035.

The photoresist electronic chemical market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in photoresist electronic chemical market are positive and negative.

In terms of substrate, silicon segment to command 61.5% share in the photoresist electronic chemical market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photoresist Chemical Market Forecast and Outlook 2025 to 2035

Electronic Materials and Chemicals Market Analysis by Product, Application, End Uses, and Region through 2035

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA