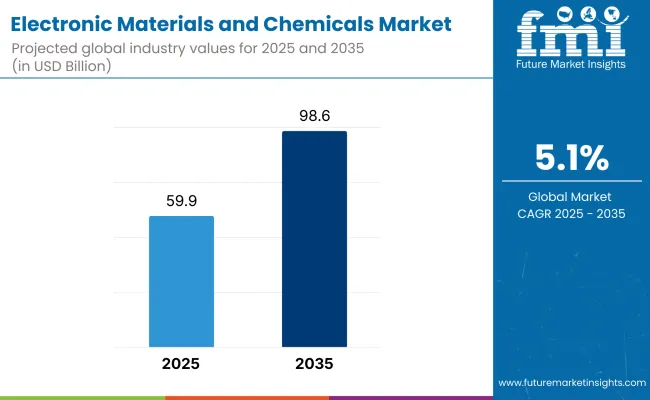

The global electronic materials and chemicals market is estimated at USD 59.9 billion in 2025. By 2035, it is expected to reach approximately USD 98.6 billion. This expansion will occur at a CAGR of 5.1% between 2025 and 2035. The growth is primarily being driven by increasing demand for advanced semiconductors, flat panel displays, and photovoltaic devices.

Demand has been fueled by the widespread deployment of AI data centers and 5G infrastructure. In the Q1 2025 earnings call, Seifi Ghasemi, Chairman and CEO of Air Products, stated that “record investments are being made in high-purity process chemicals to meet unprecedented demand from global chipmakers,” with strong demand reported across the USA, Taiwan, and South Korea. New fabrication plants by Intel (Ohio, 2025) and TSMC (Japan, 2025) have led to increased procurement of CMP slurries, photoresists, and ultra-high purity wet chemicals.

Solar energy investments have further accelerated consumption. In a February 2025 investor update published by Shin-Etsu Chemical Co., the company confirmed a scale-up in production of high-purity polysilicon and fluorine-based etchants for solar cell manufacturers in India and China. This has been attributed to national energy policies promoting solar module localization.

Flat-panel display manufacturing has also intensified its use of electronic chemicals. According to LG Chem’s 2025 materials division outlook, shipments of alignment layers and fluorinated polyimide films for OLEDs rose by 11% year-on-year. The increase has coincided with expanded OLED production in South Korea, led by Samsung Display’s Gen 10.5 line.

Purity regulations outlined by the International Technology Roadmap for Semiconductors (ITRS, 2025 edition) have created new quality control benchmarks. In response, Honeywell Electronic Materials disclosed in its August 2024 whitepaper the development of solvent purification systems achieving impurity thresholds below 1 part per billion-vital for logic node scaling below 3nm.

Volatility in raw material pricing-especially for hydrogen peroxide, isopropyl alcohol, and hydrochloric acid-has led to efforts at localized sourcing. A 2024 joint venture by BASF and Tokyo Ohka Kogyo in Penang, Malaysia, now produces photoresists domestically to reduce over-reliance on Japanese exports, as confirmed in their December 2024 press release.

The electronic materials and chemicals market is dominated by liquid electronic chemicals as they play a vital role in semiconductor fabrication processes, printed circuit board manufacturing, and display technologies. These are wet chemicals, solvents, and photoresists necessary for processing methods such as photolithography, etching, and cleaning during the production of a microelectronic device.

The fast-growing semiconductor industry powered by artificial intelligence, 5G technology and electric cars is propelling demand for high-purity liquid chemicals. The growing need for wet chemicals and ultra-pure solvents is further boosted by government and semiconductor companies heavily investing in chip fabrication facilities. Moreover, the industry is undergoing a shift toward greener and less toxic formulations which are projected to shape the future of the liquid electronic chemicals market.

The electronic materials section of gases and various electronic compounds is expected to have substantial growth for this gasses segment owing to the growing requirement for electronic materials sections such as argon gas, nitrogen gas, fluorine gas, and hydrogen gas. These gases are crucial for semiconductor manufacturing processes such as etching, doping, and plasma-enhanced chemical vapor deposition (PECVD).

As the semiconductor industry moves to ever smaller, more efficient nodes like sub-7nm technology, the need for ultra-pure gases to ensure accuracy and precision in chip manufacturing has become exponentially more important. In addition, an increasing amount of OLED and flexible display panels being produced is also driving up demand for process gases in the electronics sector. The specialty gases market should continue to grow as technology continues to evolve and the demand for high-performance semiconductors increases.

The largest market share of revenues in the electronic materials and chemicals industry is held by silicon wafers, driven by market growth in semiconductor manufacturing for consumer electronics, automotive applications, and data centers. Silicon wafers, used to make ICs, memory chips, and microprocessors, are the backbone of modern electronic devices.

A global chip shortage and push by governments in the USA, China and Europe to become self-sufficient in semiconductors are fueling heavy investments in silicon wafer production. Other Growth Drivers: Also, any advancements in wafer technologies, such as larger wafer sizes, improved fabrication techniques are creating more growth opportunities in this segment.

Demand for printed circuit board (PCBs) has the PCB laminates industry growing strong owing to the increasing usage of smartphones, wearables, medical devices, and industrial automation systems. These laminates (thermosetting and thermoplastic types), as epoxy, polyimide, PTFE, etc., offer structure and electric insulation for electronic components.

The proliferation of 5G network systems, electric cars, and smart home devices have helped to boost the PCB laminates market. When conducting modern electronics, manufacturers focus on materials that can resist a much higher heat level, have stronger signal integrity, and allow for miniaturization. And there has also been a growing focus on sustainable electronics, which is generating interest in green PCB materials with lower levels of toxic substances and driving the development of innovative materials in this segment.

During the period from 2020 to 2024, the electronic materials and chemicals industry showed a good growth as the semiconductor technology was booming. This expanded the demand for consumer electronics, which then led to a high-flying growth in the electric vehicle (EV) and renewable energy industries.

The growth of 5G networks, artificial intelligence (AI), and Internet of Things (IoT) solutions drove demand for high-purity chemicals and materials involved in the manufacturing of chips, printed circuit boards (PCBs), and displays.

Stringent environmental regulations and sustainability objectives also compelled manufacturers to introduce environmentally friendly chemicals and seek out alternative processing approaches. But the market struggled with supply chain disruptions occasioned by the COVID-19 pandemic, shortage of semiconductors, and geopolitical tensions over raw materials availability.

Forward to 2025 to 2035, the market for electronic chemicals and materials will transform under the impact of miniaturization of electronic components, AI-powered smart manufacturing, and the advent of quantum computing. The evolution of next-generation semiconductors (e.g., gallium nitride (GaN) and silicon carbide (SiC)), flexible electronics, and innovative energy storage technologies will unlock new growth prospects.

In addition, sustainable manufacturing processes, such as low-carbon chemical processing, circular economy-based models, and renewable resource-based materials, will determine the future of the industry. Greater adoption of blockchain and digital twins in supply chains will strengthen material traceability and process efficiency.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory Landscape: Environmental regulations pushed for reduced hazardous chemicals in semiconductor and display manufacturing, but adoption was gradual. Circular economy discussions began, but large-scale implementation was limited. | Sustainability-driven policies mandate the use of low-carbon, recyclable, and bio-based electronic chemicals. Circular economy is increasingly being adopted in semiconductor and display manufacturing. |

| Semiconductor Industry Trends: 5nm and 3nm semiconductor production became more popular, with ultra-high purity chemicals required for extreme ultraviolet (EUV) lithography. Chip design with AI increased momentum. | Sub-3nm semiconductor growth accelerates high-purity electronic chemicals demand. Neuromorphic and quantum chip manufacturing requires sophisticated materials for improved performance and thermal management. |

| Display & PCB Technologies: OLED and microLED displays saw broader adoption, with flexible and foldable displays gaining market acceptance. PCB manufacturing relied on traditional materials with incremental upgrades. | Next-generation conductive polymers and ultra-thin insulators are needed for holographic and transparent display, roll-to-roll printed electronics, and graphene-based PCBs. |

| Energy Storage & EV Market Impact: Lithium-ion battery advancements were focused on increasing energy density and charging efficiency. Silicon anode research was of increasing interest but demonstrated limited commercial relevance. | Solid-state and sodium-ion battery development stimulate innovation in the development of novel electrolyte formulas, self-repairing battery materials, and fire-proofed coatings. |

| Advanced Materials Innovation: Quantum dots and 2D materials research was underway but commercialization was still in the nascent stages. Spintronics had promise but did not have widespread applications. | Quantum dots, spintronic materials, and 2D materials are picking up momentum in next-generation computing and ultra-fast data processing. Material choice is impacted by growth in biodegradable electronics. |

| Sustainability & Circular Economy: Green chemistry initiatives gained initial traction, but carbon neutrality efforts in chip manufacturing were limited. Recycling of electronic materials was in pilot stages. | Green chemistry with strong focus, carbon-neutral chip manufacturing, and closed-loop recycling systems for semiconductor and electronic materials. |

Critical Electronic Chemicals and Sourcing Risks in the Industry

Producers are concerned about the growing volatility in the electronic materials and chemicals market due to supply chain disruptions, both from geopolitical tensions and technological advancements. More than 80 percent of rare earth elements (REEs) including neodymium and yttrium come from China, posing risks in an age of trade restrictions. A global helium shortage has led to semiconductor etching, and restrictions on hydrogen fluoride (HF) between Japan and South Korea affected the supply of high-purity chemicals. Funds like the USA CHIPS Act (USD 52 Billion) and EU semiconductor funds (€43B) are pushing for domestic chip manufacturing, resulting in an uptick in demand for localized suppliers.

Advanced nodes (≤3nm) require a major portion of chips manufacturing chemicals, such as semiconductor chemicals, photoresists, CMP slurries, ultra-high-purity gases (NF₃, CF₄, NH₃), etc. Diversifying supply chains is critical. Taiwan, South Korea and Japan provide alternative sources of key chemicals. Australia and Canada are also ramping up rare earth production to become less dependent on China. Firms such as Intel and TSMC are locking up their own chemical supplies via upstream investments.

Proximity production continues to grow. New high-purity chemical plants in Arizona (USA), Germany, and Japan complement semiconductor fab expansions. Critical materials such as TEOS, BCl₃, and HF are stockpiled to avoid shortages. To stay competitive in fast-changing electronics market, suppliers need to obtain long-term contracts, invest in alternative sourcing and form joint ventures to stabilize supply chains and remain competitive.

| Innovation Area | Insights |

|---|---|

| High-K & Low-K Dielectrics | New insulating and conductive materials replacing traditional options to support higher transistor density in advanced semiconductor nodes. |

| Hybrid Organic-Inorganic Materials | Growth in perovskite-based semiconductors and flexible electronics, requiring novel encapsulants, conductive inks, and adhesion promoters. |

| Extreme Thermal & Conductive Solutions | Increasing demand for high-performance TIMs (Thermal Interface Materials) and ultra-low resistance interconnects in AI chips and 3D-stacked devices. |

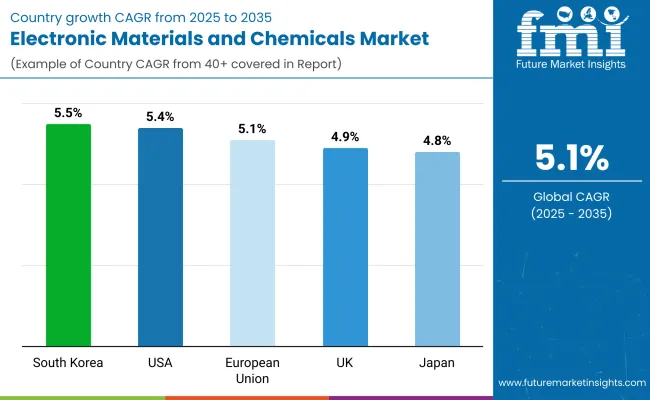

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.9% |

| European Union | 5.1% |

| Japan | 4.8% |

| South Korea | 5.5% |

The USA electronic chemical and material business is experiencing sustained growth, buoyed by fast-paced semiconductor chip production, consumer electronics technology development, and the growing electric vehicle (EV) space. Pressure by the USA administration to increase local production of semiconductors, especially through the CHIPS Act, has been driving noteworthy investment in the high-purity chemicals, etching chemicals, and deposition chemicals involved in producing chips.

Besides, the demand for 5G technology, AI computing, and next-gen data centers is also increasing and, therefore, the demand for photoresists, specialty gases, and sophisticated dielectric material is also demanded. Electronic grade solvents and specialty chemicals are also on a rise because of the expanding PCB market and trends in displays, OLEDs, and quantum computers. Besides, the move towards environment-friendly and lead-free materials is influencing market dynamics according to regulations on sustainability. Country CAGR (2025 to 2035)

Growth Factors in USA

| Key Factors | Details |

|---|---|

| Rising Semiconductor Manufacturing | Increased investments in domestic chip production under the CHIPS Act. |

| Strong R&D Ecosystem | Presence of major tech firms driving innovation in electronic materials. |

| High Demand for Advanced Electronics | Growth in 5G, IoT, and AI-driven technologies. |

| Government Support | Federal incentives to reduce dependence on foreign semiconductor supply chains. |

The UK chemical and electronic material market is expanding at a medium rate. This is because of investment in green electronics, high-performance computing, and semiconductor research. The demand for etchants, doping chemicals, and deposition chemicals is being encouraged by the government's focus on domestic chip fabrication and PCB fabrication.

The UK's focus on 5G infrastructure development, electric vehicle (EV) battery materials, and printed electronics is also fueling market growth. Moreover, clean energy initiatives are driving demand for high-purity silicon wafers, dielectric materials, and conductive polymers for solar panels and energy storage systems.

Quantum computing, photonics, and flexible electronics are some of the areas where research and development are in progress, the market is poised for gradual growth, particularly for green and recyclable materials.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| Focus on Sustainable Electronics | Emphasis on eco-friendly electronic materials and recycling initiatives. |

| Growth in Printed Electronics | Expansion of flexible and printable electronic materials. |

| Investment in Quantum Computing | Government-backed programs for quantum technology research. |

| Semiconductor Research | Collaborations between universities and the private sector. |

The EU market for electronic materials and chemicals is growing as a result of the increased demand for semiconductors, printed circuit boards, and renewable energy electronics. Germany, France, and the Netherlands are at the forefront of chip manufacturing, OLED displays, and advanced sensor technologies.

The European Chips Act is driving investment in fab facilities, litho chemicals, and ultra-high-purity gases. In addition, the EU drive for green production and lead-free electronics is also stimulating innovation in bio-based polymers, non-toxic etchants, and recyclable semiconductors. The automotive sector in the region, with a fervent focus on EVs and autonomous vehicles, is in itself one of the major drivers for high-performance coatings, conductive inks, and encapsulants utilized in electronic control units (ECUs) and battery management systems (BMS).

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| EU Chips Act Implementation | Aiming to boost semiconductor self-sufficiency. |

| Focus on Green Manufacturing | Stringent regulations promoting sustainable electronic chemicals. |

| Rising Demand for EV Electronics | Growth in electronic materials for electric vehicles. |

| Strong Research Institutions | High investment in nanoelectronics and advanced materials. |

Japan's chemicals and electronic materials industry is driven by the country's leadership in high-tech manufacturing, semiconductors, and display technologies. Japan is a dominant player in photoresists, IC fabrication chemicals, and high-purity specialty gases owing to the existence of big electronics majors and advanced research on next-generation materials.

Small-size electronic equipment and IoT products are increasingly being used. The demand for dielectric materials, conductive paste, and encapsulants is growing. Furthermore, Japan is also developing energy-saving and eco-friendly electronics. Because of this, technology is coming in recyclable PCB material, transparent conducting films, and high-performance flexible substrates.more investments in quantum computing, photonic chips, and wearable electronics will fuel the demand for specialty semiconductors and chemical etchants.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| High-Tech Materials Innovation | Japan leads in specialty chemicals for semiconductors. |

| Strong Consumer Electronics Industry | Demand from companies like Sony, Panasonic, and Toshiba. |

| Government Investment in Semiconductors | Collaboration with Taiwan for chip manufacturing. |

| Advanced Display Technology | Growth in OLED, microLED, and quantum dot materials. |

South Korea's electronics chemicals and materials business is expanding very rapidly, driven by its dominance in semiconductors, OLED displays, and lithium-ion batteries. Companies like Samsung, SK Hynix, and LG are leading the consumption of photoresists, high-purity etch chemistries, and advanced packaging materials.

With government incentives for the stimulation of local production of chips and 5G-smart devices, ultra-high-purity gases, silicon wafers, and conductive adhesives are in growing demand. Demand is also fueled by the nation's dominance in flexible and foldable displays through to transparent conductive films and encapsulants. South Korea's EV battery sector is also seeing robust investments with high demand for electrolyte additives, dielectric coatings, and separator films.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Semiconductor Industry Growth | Home to Samsung and SK Hynix, leading chip manufacturers. |

| Heavy Investment in Display Technology | Dominance in OLED and flexible display production. |

| Government Support for Materials Sector | Policies to reduce reliance on Japanese chemical imports. |

| Emerging AI & IoT Demand | Need for high-performance materials in AI-driven devices. |

The market for electronic materials and chemicals is a very competitive market driven by the fast growth of semiconductors, printed circuit boards (PCBs), displays, and electronic components. These materials and chemicals have significant applications in manufacturing, etching, doping, and cleaning electronic devices.

Due to this, they are a significant contributor to industries such as consumer electronics, automotive electronics, telecommunications, and industrial automation. Key players in this industry focus on high-purity materials, green technology, and nanotechnology advancements, as well as expanding their supply chain and R&D base to meet the growing demand for miniaturization, higher performance, and energy efficiency.

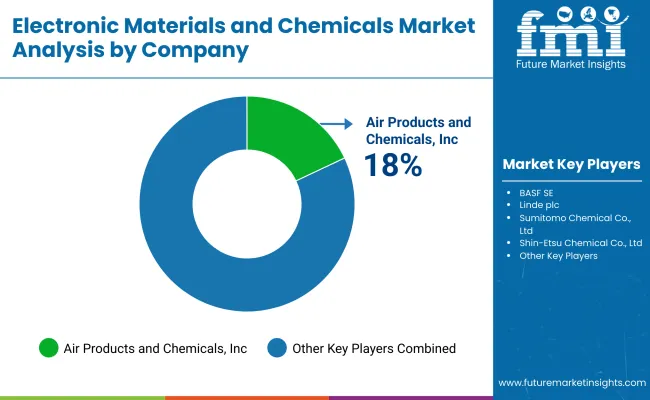

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Air Products and Chemicals, Inc. | 18-22% |

| BASF SE | 15-18% |

| Linde plc | 12-15% |

| Sumitomo Chemical Co., Ltd. | 9-11% |

| Shin-Etsu Chemical Co., Ltd. | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Air Products and Chemicals, Inc. | Manufactures high-purity specialty gases and chemical solutions for semiconductors, displays, and microelectronics with an emphasis on advanced etching and deposition materials. |

| BASF SE | Designs electronic-grade solvents, photoresists, and chip fabrication coatings, as well as PCB manufacturing coatings, focusing on sustainability and chemical efficiency. |

| Linde plc | Expert in high-purity process gases, etchants, and dopants for semiconductor and flat-panel display production, with capabilities in advanced materials for nanotechnology. |

| Sumitomo Chemical Co., Ltd. | Offers photoresists, CMP slurries, and OLED materials for high-performance electronic devices and displays with significant presence in Asian markets. |

| Shin-Etsu Chemical Co., Ltd. | Produces silicon wafers, dielectric materials, and high-performance semiconductor and circuit board adhesives, with an emphasis on miniaturization and high-precision uses. |

Key Company Insights

Air Products and Chemicals, Inc.

Being a world-class supplier in the area of high-purity specialty gases and electronic-grade chemicals meant for semiconductors, flat-panel displays, and microelectronics is what makes Air Products and Chemicals, Inc., one global consultant. The company's etching and deposition materials are necessary in chip fabrication and advanced semiconductor nodes.

Air Products invests significantly in research where the concentration is on next-generation materials that are more efficient for manufacturing sustainability. The company is positioned well by its global distribution and advanced gas technologies.

BASF SE

BASF SE is a development company in high-performing chemicals used in electronics, including solvents, photoresists, coatings, and conductive materials. The firm is committed to resource efficiency and sustainability, producing low-impact, high-purity materials that enable next-generation chip production. Successful collaboration with semiconductor manufacturers and the accent on innovative electronic material could enhance BASF's established status worldwide.

Linde plc

Linde plc is specialist in high-purity process gases, etchants, and dopants needing for semiconductor manufacture. Linde is also very critical in the supply of materials for extreme ultraviolet (EUV) lithography for future transistor productions. Processes are optimized by Linde for optimal yields, low defect rates, and low environmental footprint in manufacturing electronic materials.

Sumitomo Chemical Co., Ltd.

Sumitomo Chemical Co., Ltd. is a leading player in the Asian market for electronics materials with photoresists, chemical mechanical planarization (CMP) slurries, and OLED materials. It is focused on high-resolution patterning such as that done on semiconductor chips and displays in line with this trend of developing smaller and more powerful electronic components that the industry is pushing for. Sumitomo's interests in financing R&D of the next-generation materials such as quantum dot displays and flexible electronics help keep Sumitomo on top of the market.

Shin-Etsu Chemical Co., Ltd.

Shin-Etsu Chemical Co., Ltd. is a giant supplier of silicon wafers, dielectric material, and semiconductor adhesives and printed board-level semiconductor-use adhesives. Miniaturization and high-precision materials forming high-performance lifetimes of electronic components are the focal point of its businesses. In doing so, Shin-Etsu is leading-edge in the development of state-of-the-art wafer technologies and is paramount in HPC and 5G electronics.

Other Key Players (25-30% Combined)

By product, the segmentation is as liquid, gaseous, and solid.

By application, the segmentation is as silicon wafers, PCB laminates, specialty gases, wet chemicals and solvents, photoresist, and others.

By end uses, the segmentation is as semiconductors and integrated circuits, printed circuit boards and flat panel displays.

By region, the segmentation is as North America, Latin America, Europe, Asia Pacific, and The Middle East & Africa.

The electronic materials and chemical sales will be worth USD 59.9 billion in 2025.

The sales are predicted to reach a value of USD 98.6 billion by 2035.

Some of the key companies manufacturing electronic materials and chemicals include Air Products & Chemicals Inc., Bayer AG, Albemarle Corporation, Ashland Global Specialty Chemicals Inc., and others.

The USA is a prominent hub for electronic materials and chemicals manufacturers.

Liquid electronic chemicals is likely to dominate the market by product type.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End Uses, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End Uses, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End Uses, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Uses, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End Uses, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End Uses, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End Uses, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End Uses, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End Uses, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End Uses, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End Uses, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Uses, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End Uses, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Electronic Skin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA