Electronic equipment repair service market now starts to surge ahead at a high speed both on the side of consumers as well as the side of the business community due to cheaper, sustainable ways for their devices. The major market drivers include growing concerns regarding electronic waste, increasing adoption of refurbished devices, and surging demand for extended warranties.

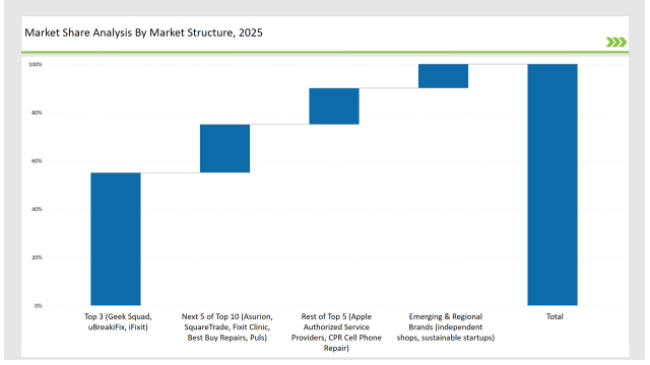

The industry will see transformations with innovative diagnostics, AI-driven troubleshooting, and the emergence of independent repair networks. Strong brand recognition, extensive service networks, and high consumer trust are some of the factors that lead to the dominance of the market by leading service providers such as Geek Squad, uBreakiFix, and iFixit, which collectively hold 55% of the market share.

30% regional repair shops and independent service providers, while emerging online repair platforms and eco-friendly refurbishment services take the remaining 15%.

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Geek Squad, uBreakiFix, iFixit) | 55% |

| Rest of Top 5 (Apple Authorized Service Providers, CPR Cell Phone Repair) | 15% |

| Next 5 of Top 10 (Asurion, SquareTrade, Fixit Clinic, Best Buy Repairs, Puls) | 20% |

| Emerging & Regional Brands (independent shops, sustainable startups) | 10% |

The electronic equipment repair service market in 2025 is moderately concentrated, with the top players accounting for 55% of the total market share. Leading service providers such as UBreakiFix, Geek Squad, and iFixit dominate the segment, while independent repair shops and specialized refurbishing services add competitive diversity.

This market structure reflects strong brand influence while allowing space for regional expertise and emerging repair technologies.

The electronic equipment repair service market operates through multiple channels. 50 percent of the total is taken by authorized repair center and retail service networks as customers are comfortable with the manufacturer-managed repair and in-store consultations.

The e-commerce-based repair platforms also account for 30 percent, led by the mail-in repair services, subscription warranty plans, and DIY repair kits. 15 percent consists of independent shops and local technicians as they tend to be cheap for the out-of-warranty devices. 5 percent consists of corporate service contracts targeted at more professional equipment maintenance and IT support.

The electronic equipment repair market is segmented into smartphones, laptops & computers, home appliances, and gaming consoles. Smartphone repairs take the lead with 45% of the market, as cracked screens, battery replacement, and software issues are some of the common problems. Laptops and computers account for 30% as hardware upgrades, software troubleshooting, and motherboard repairs are the primary reasons.

Home appliance repairs take 15% of the pie, which includes refrigerators, washing machines, and televisions. Gaming console repairs take up 10%, which can be due to overheating software malfunctions or faulty controllers.

2024 so far has been a growth year for an electronic equipment repair service market driven by innovation and sustainability and finally, customer-oriented models. Some of the prominent players include:

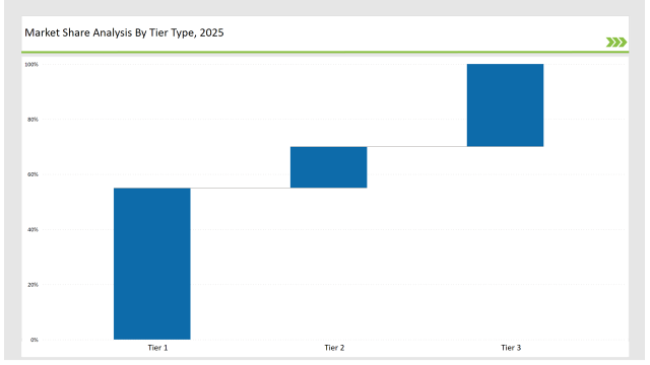

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Geek Squad, uBreakiFix, iFixit |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Apple Authorized Service Providers, CPR Cell Phone Repair |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, independent repair startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Geek Squad | AI-powered diagnostics & same-day repairs |

| uBreakiFix | Manufacturer-backed repair partnerships |

| iFixit | DIY repair kits & right-to-repair advocacy |

| Apple Authorized Service Providers | Expansion of certified technician networks |

| CPR Cell Phone Repair | Nationwide franchise growth for local service accessibility |

| Emerging Brands | On-demand, mobile repair & eco-friendly refurbishment |

The electronic equipment repair service market is ready to be driven to sustainable growth, as the increasing adoption of sustainability initiatives, advances in AI diagnostics, and rising consumer demand for cost-effective repair solutions come together. It shall be the best way to grow with right-to-repair laws in play.

Manufacturers and repair service providers shall strive for accessibility and affordability. It would be AI-driven troubleshooting, mobile repair units, and circular economy-based refurbishment programs that the industry shall spearhead in the future. Thus, digital convenience, regulatory compliance, and eco-friendly repair practices shall make up the overall fabric of evolution for the market of electronic devices.

Leading players such as Geek Squad, uBreakiFix, and iFixit collectively hold around 55% of the market.

Regional and independent repair providers contribute approximately 30% of the market by offering cost-effective, local repair solutions.

Startups focusing on mobile repair, eco-friendly refurbishment, and subscription-based repair services hold about 10% of the market.

Private labels from insurance providers and extended warranty service platforms hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA