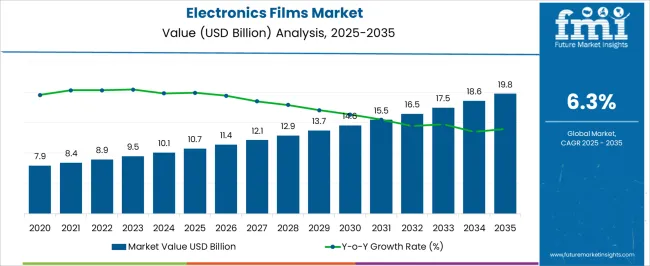

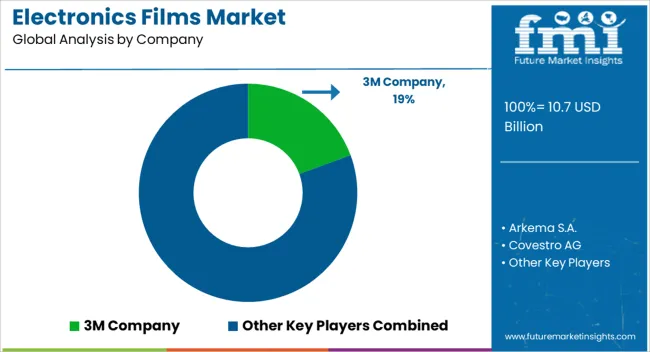

The electronics films market is projected to reach USD 10.7 billion in 2025 and anticipated to expand to USD 19.8 billion by 2035, registering a CAGR of 6.3%, expanding an absolute growth opportunity of USD 9.1 billion. During the initial 5-year block from 2025 to 2029, the market is expected to increase from USD 10.7 billion to approximately USD 12.1 billion, driven primarily by growing demand for flexible displays, touchscreens, and protective films in consumer electronics.

Mid-decade, from 2030 to 2034, the market is projected to grow from USD 12.9 billion to around USD 17.5 billion, fueled by the rising adoption of high-performance films in automotive, industrial, and renewable energy applications.

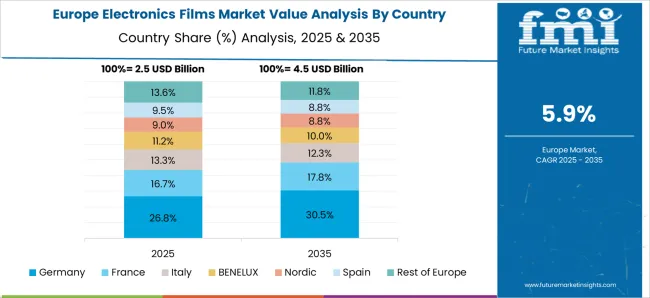

End-of-decade growth, culminating in 2035 at USD 19.8 billion, will be supported by enhanced demand in smart devices, OLED and LCD panels, and packaging for electronic components requiring thermal and electrical insulation. Factors such as miniaturization of devices, rising consumer electronics penetration in emerging markets, and expansion in wearable technology are expected to sustain demand. Regional growth is projected to be strongest in Asia Pacific due to electronics manufacturing hubs, while North America and Europe will witness steady expansion driven by innovation in automotive electronics, industrial sensors, and energy-efficient applications.

The 5-year block segmentation highlights the market’s gradual but steady acceleration across multiple industries, with increasing integration of electronics films into next-generation devices and industrial systems creating a diversified demand landscape.

| Metric | Value |

|---|---|

| Electronics Films Market Estimated Value in (2025 E) | USD 10.7 billion |

| Electronics Films Market Forecast Value in (2035 F) | USD 19.8 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The electronics films market is strongly influenced by five interrelated parent markets that collectively shape adoption, product performance, and application versatility. The consumer electronics market holds the largest share at 35%, as films are extensively used in touchscreens, flexible displays, OLED and LCD panels, and protective layers for smartphones, tablets, and laptops, ensuring durability and enhanced user experience. The automotive electronics market contributes 25%, where electronics films are applied in sensors, infotainment systems, battery insulation, and flexible circuit substrates, supporting the shift toward electric vehicles and advanced driver-assistance systems. The industrial electronics market accounts for 15%, driven by applications in sensors, automation equipment, and control panels that rely on high-performance insulating and protective films.

The renewable energy market represents 12%, with films used in photovoltaic panels, battery packs, and energy storage systems to improve efficiency, reduce heat, and ensure electrical insulation. The electrical equipment and components market adds 13%, where films enhance the performance of capacitors, transformers, and electronic modules in power distribution and industrial systems. Consumer electronics and automotive applications make up 60% of overall demand, emphasizing that personal devices and mobility solutions remain the primary growth drivers for electronics films, while industrial, renewable, and electrical sectors provide diversified avenues for expansion.

The electronics films market is experiencing strong growth due to the rising demand for advanced materials in consumer electronics, automotive electronics, and industrial devices. The market is being driven by the increasing adoption of lightweight, flexible, and high-performance films that enable enhanced device functionality, energy efficiency, and durability. Technological advancements in deposition and coating techniques are improving material properties such as thermal stability, conductivity, and optical clarity, supporting their integration into a wide range of applications.

Growth in the display and semiconductor sectors is further fueling market expansion as manufacturers prioritize innovation and precision in device fabrication. Regulatory focus on energy efficiency, product safety, and environmental compliance is influencing material selection and process optimization.

The increasing prevalence of flexible electronics, foldable displays, and high-resolution screens is creating new growth opportunities for polymer-based and advanced film technologies. With ongoing investment in research and development, along with rising consumer and industrial demand, the electronics films market is poised for sustained expansion over the coming years.

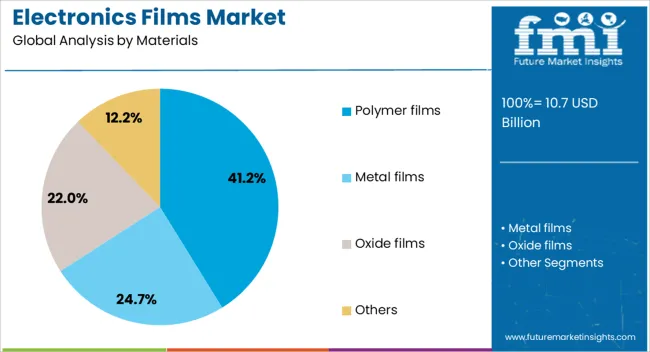

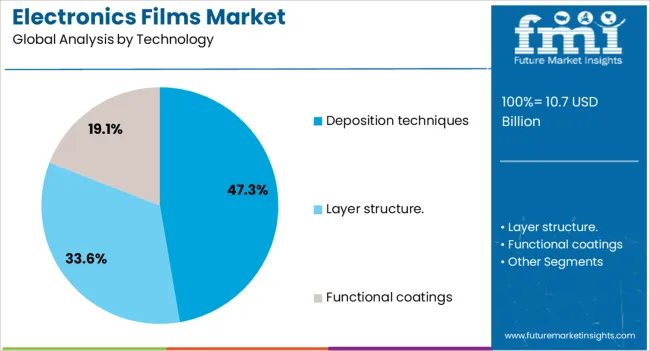

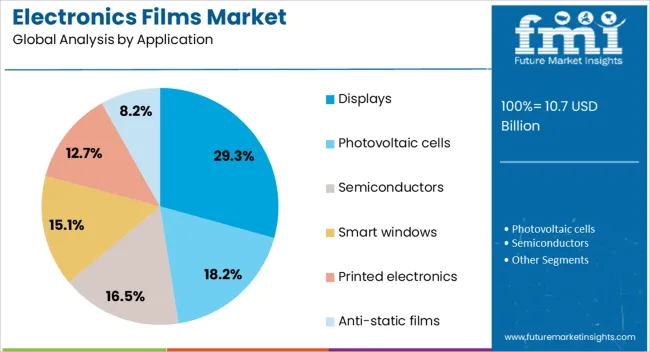

The electronics films market is segmented by materials, technology, application, and geographic regions. By materials, electronics films market is divided into polymer films, metal films, oxide films, and others. In terms of technology, electronics films market is classified into deposition techniques, layer structure, and functional coatings. Based on application, electronics films market is segmented into displays, photovoltaic cells, semiconductors, smart windows, printed electronics, and anti-static films. Regionally, the electronics films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polymer films materials segment is projected to hold 41.2% of the electronics films market revenue share in 2025, making it the leading material type. Its dominance is driven by superior flexibility, lightweight characteristics, and excellent chemical and thermal resistance, which make it suitable for a wide variety of electronic applications. Polymer films are being increasingly adopted in flexible circuits, printed electronics, and protective coatings for displays due to their high optical clarity and mechanical strength.

The segment benefits from ongoing material innovations, including improved dielectric properties and enhanced adhesion, which allow for more reliable integration into complex electronic systems. Manufacturers prefer polymer films for their cost-effectiveness, ease of processing, and compatibility with emerging deposition techniques.

The ability to tailor material properties through chemical modification or multi-layer construction is further reinforcing its market leadership. Increasing demand for polymer films in high-performance and miniaturized devices is expected to sustain the segment’s growth in the near term.

The deposition techniques technology segment is anticipated to account for 47.3% of the electronics films market revenue share in 2025, establishing itself as the leading technology category. Its prominence is being driven by the requirement for precise and uniform thin-film coatings, which enhance device performance, durability, and functional efficiency.

Techniques such as chemical vapor deposition and physical vapor deposition allow for controlled layering, high uniformity, and integration of functional materials, supporting applications in displays, semiconductors, and flexible electronics. The adoption of advanced deposition technologies is being reinforced by increasing demand for miniaturized components, higher resolution displays, and flexible device architectures.

These methods provide manufacturers with the flexibility to customize film properties, optimize production efficiency, and reduce material waste, making them highly attractive for large-scale industrial use. Continuous innovation in deposition processes, including low-temperature and scalable methods, is expected to further drive adoption and maintain the segment’s leading position.

The displays application segment is projected to hold 29.3% of the electronics films market revenue share in 2025, positioning it as the dominant application area. Its growth is being driven by the rapid expansion of consumer electronics, including smartphones, tablets, televisions, and wearable devices, where high-performance films enhance screen brightness, color accuracy, and durability. The segment benefits from the adoption of polymer films and advanced deposition techniques, which enable thin, flexible, and high-clarity display panels.

Increasing investments in high-resolution and flexible display technologies are further accelerating demand. The ability of electronics films to provide consistent optical and mechanical performance in challenging environments has made them indispensable for modern display manufacturing.

Rising consumer expectations for better visual quality, energy efficiency, and long-lasting device performance are reinforcing the growth of this segment. As manufacturers continue to innovate and incorporate new film technologies into next-generation display solutions, the segment is expected to maintain its leadership in market revenue share.

Electronics films are witnessing strong growth across consumer electronics, automotive, industrial, and renewable energy applications. Consumer devices and automotive systems dominate demand, while industrial automation and energy solutions provide diversified expansion opportunities. High-performance materials, protective coatings, and functional enhancements further strengthen market adoption. Regional manufacturing hubs in Asia and innovation-driven markets in Europe and North America continue to shape global growth trajectories, emphasizing both large-scale production and specialized application development. The market is expected to see steady CAGR growth, driven by expanding device penetration, EV adoption, and the integration of films into next-generation electronic and energy systems.

The consumer electronics market remains the largest driver for electronics films, accounting for the majority of global demand. Films are essential in smartphones, tablets, laptops, and wearable devices, providing protection, flexibility, and enhanced display performance. Flexible OLED and LCD panels rely on ultra-thin films for durability, transparency, and scratch resistance, while touch-sensitive interfaces use specialized films to improve responsiveness. Rising disposable incomes and demand for premium devices are fueling adoption, particularly in Asia Pacific, where electronics manufacturing hubs supply global markets. Consumer preferences for sleek designs and high-performance displays push manufacturers to invest in high-quality films, creating opportunities for new entrants and niche suppliers targeting specialized protective, functional, and decorative film applications.

Electronics films are increasingly utilized in automotive applications, driven by electric vehicles, infotainment systems, and safety sensors. Films serve as insulating layers for batteries, wiring, and circuit boards, ensuring performance reliability under high temperatures and mechanical stress. Flexible films are used in display panels, touch interfaces, and HUDs (head-up displays), enabling modern vehicle interiors with advanced infotainment and driver-assistance functionalities. Automotive OEMs prioritize lightweight, durable, and high-performance films to reduce energy consumption and meet regulatory standards. Growing investments in electric mobility and smart vehicle technologies, particularly in North America, Europe, and China, are creating strong demand for films that combine electrical insulation, thermal stability, and structural resilience for both interior and under-the-hood applications.

Industrial electronics and renewable energy sectors are emerging as significant adopters of electronics films. In industrial automation, films are applied in sensors, control panels, and protective covers to enhance equipment reliability and operational safety. Photovoltaic panels, battery storage systems, and energy conversion devices utilize films to improve efficiency, provide electrical insulation, and reduce heat-related degradation. Manufacturing plants in Asia, Europe, and North America are increasingly integrating high-performance films into process equipment to reduce downtime and extend service life. Demand is further reinforced by energy storage adoption, smart meters, and power electronics requiring precise film properties for insulation, optical clarity, and mechanical durability, expanding the addressable market beyond conventional consumer and automotive segments.

The performance of electronics films is enhanced through tailored material selection, coatings, and functional additives. Anti-reflective, scratch-resistant, and heat-stable films are gaining prominence in displays, automotive panels, and industrial equipment. Films with high dielectric strength, thermal conductivity, or moisture resistance are essential in batteries, capacitors, and flexible circuits. Suppliers focus on producing films with consistent thickness, transparency, and mechanical resilience to meet diverse application needs. Co-extrusion, lamination, and surface treatments allow multifunctional performance, expanding usability across electronics, automotive, and energy sectors. These developments drive differentiation among suppliers, with technical support, customization, and compliance with industrial standards serving as critical competitive levers.

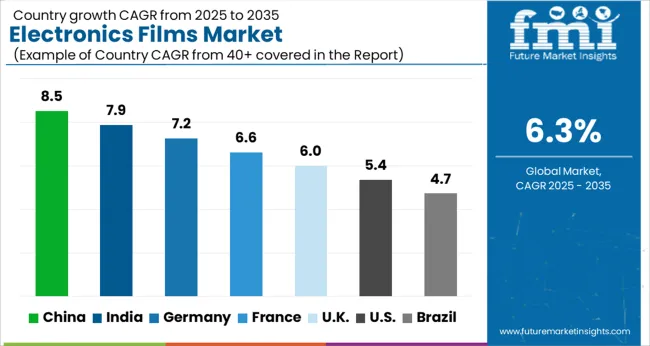

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| U.K. | 6.0% |

| U.S. | 5.4% |

| Brazil | 4.7% |

The global electronics film market is projected to grow at a CAGR of 6.3% from 2025 to 2035. China leads with 8.5%, followed by India at 7.9%, Germany at 7.2%, France at 6.6%, the U.K. at 6.0%, the U.S. at 5.4%, and Brazil at 4.7%. Growth is driven by increasing demand for high-performance films in displays, touchscreens, flexible electronics, solar panels, and electronic components. BRICS countries, particularly China and India, are leading large-scale manufacturing and export initiatives, while OECD nations focus on premium films, R&D, and material innovation. Production capacity, supply chain integration, and technological advancements remain key growth levers across all regions.

China’s electronics film market is projected to grow at a CAGR of 8.5% from 2025 to 2035, driven by strong domestic production of PET, PI, and specialty films for displays, solar panels, and flexible electronics. Manufacturers such as Toray, SKC, and DuPont are expanding production and introducing innovative films with improved thermal, optical, and electrical properties. Government initiatives to promote high-tech manufacturing and R&D investments enhance competitiveness. Supply chain integration and regional production hubs support both domestic demand and exports.

India’s electronics film market is expected to grow at a CAGR of 7.9% from 2025 to 2035, fueled by rising electronics manufacturing, solar panel installations, and adoption of advanced films in industrial applications. Companies are focusing on local production under initiatives like “Make in India,” improving affordability and supply chain efficiency. Tier-2 and tier-3 cities are emerging as high-growth regions for industrial and consumer electronics applications.

Germany’s electronics film market is projected to grow at a CAGR of 7.2% from 2025 to 2035, supported by demand for high-quality, energy-efficient films in automotive, display, and industrial electronics. Manufacturers focus on premium films with advanced thermal, optical, and dielectric properties. R&D in material innovation and regulatory compliance remains central to competitiveness.

The electronics film market in France is expected to grow at a CAGR of 6.6% from 2025 to 2035, led by demand in displays, flexible electronics, and renewable energy applications. Manufacturers are adopting advanced coating and lamination technologies to meet performance requirements.

The U.K. electronics film market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by industrial electronics, touchscreens, and emerging flexible devices. Companies focus on high-performance films with durability and thermal stability.

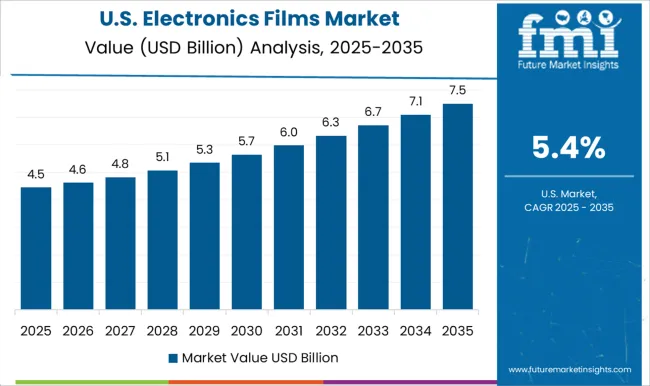

The U.S. market is projected to grow at a CAGR of 5.4% from 2025 to 2035, fueled by demand in consumer electronics, displays, and flexible circuits. Leading manufacturers invest in R&D for advanced polymer films with enhanced optical, dielectric, and thermal performance.

The electronics film market is highly competitive, driven by increasing demand for high-performance films used in displays, touchscreens, flexible electronics, solar panels, and electronic components. Market rivalry is shaped by film type (PET, PI, PEN, and specialty films), thickness, thermal and electrical properties, optical clarity, and cost. Companies differentiate through advanced materials, precision coating, enhanced durability, and customization to meet specific electronic applications and regulatory standards.

Key players such as DuPont, Toray Industries, SKC Group, Mitsubishi Polyester Film, UBE Industries, Kaneka Corporation, 3M, Honeywell, Covestro, and Jindal Poly Films dominate the market by offering technologically advanced, reliable, and versatile electronics films. Strategic partnerships with device manufacturers, display producers, and component suppliers are leveraged to expand market presence. Regional and emerging manufacturers compete by providing cost-effective, flexible, and application-specific films. The market is moderately consolidated, with leading companies focusing on innovation, quality control, regulatory compliance, and long-term technical support to strengthen market share and meet growing demand for electronics films across multiple high-tech sectors.

| Items | Values |

|---|---|

| Quantitative Units | USD 10.7 billion |

| Materials | Polymer films, Metal films, Oxide films, and Others |

| Technology | Deposition techniques, Layer structure., and Functional coatings |

| Application | Displays, Photovoltaic cells, Semiconductors, Smart windows, Printed electronics, and Anti-static films |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Arkema S.A., Covestro AG, DuPont de Nemours, Inc., Eastman Chemical Company, Evonik Industries AG, and LG Chem Ltd. |

| Additional Attributes | Dollar sales, share, CAGR, country-wise demand, segment growth (smartphones, wearables, smart home devices), emerging technologies, supply chain trends, competitor strategies, and end-use adoption patterns. |

The global electronics films market is estimated to be valued at USD 10.7 billion in 2025.

The market size for the electronics films market is projected to reach USD 19.8 billion by 2035.

The electronics films market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in electronics films market are polymer films, metal films, oxide films and others.

In terms of technology, deposition techniques segment to command 47.3% share in the electronics films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronics Cleaning Solvents Market - Growth & Demand 2025 to 2035

Electronics Accessories Market Report – Trends & Forecast 2015-2025

2D Electronics Market

HIFI Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Analysis – Growth & Forecast 2024-2034

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Defense Electronics Obsolescence Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Graphene Electronics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA