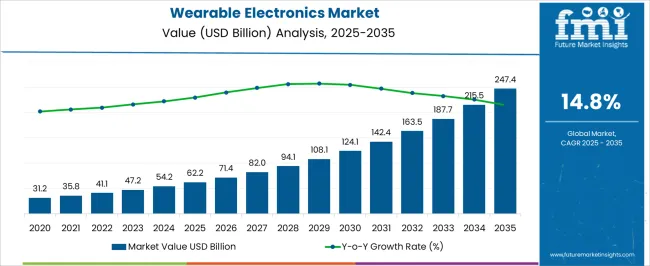

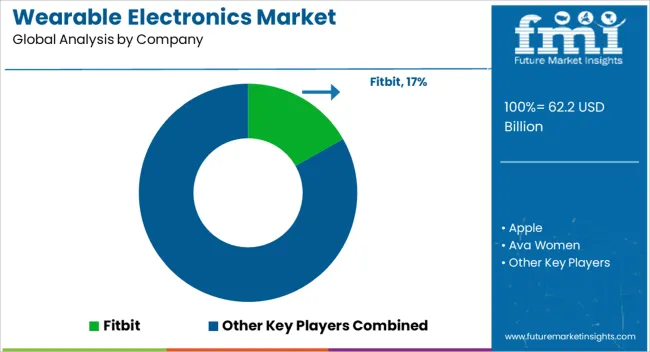

The Wearable Electronics Market is estimated to be valued at USD 62.2 billion in 2025 and is projected to reach USD 247.4 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| Wearable Electronics Market Estimated Value in (2025 E) | USD 62.2 billion |

| Wearable Electronics Market Forecast Value in (2035 F) | USD 247.4 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The wearable electronics market is experiencing rapid expansion, supported by rising consumer demand for connected devices that provide real-time monitoring, communication, and lifestyle enhancement. Growth is being accelerated by continuous innovations in sensors, low-power processors, and advanced communication technologies that enable seamless connectivity with smartphones, tablets, and cloud platforms. Increasing health awareness, coupled with the shift toward preventive healthcare, is driving adoption of wearables for fitness tracking, chronic disease monitoring, and wellness applications.

Significant investments from technology companies in smart textiles, miniaturized components, and energy-efficient designs are enabling broader integration of wearables into everyday life. Regulatory encouragement for digital health solutions and insurance incentives for health monitoring devices are further shaping demand.

Expanding use cases across healthcare, sports, military, and enterprise environments are reinforcing the market’s future outlook As consumer preferences evolve toward multifunctional and fashion-integrated electronics, the wearable electronics market is positioned for strong long-term growth, with ecosystem players focusing on innovation, personalization, and interoperability to meet global demand.

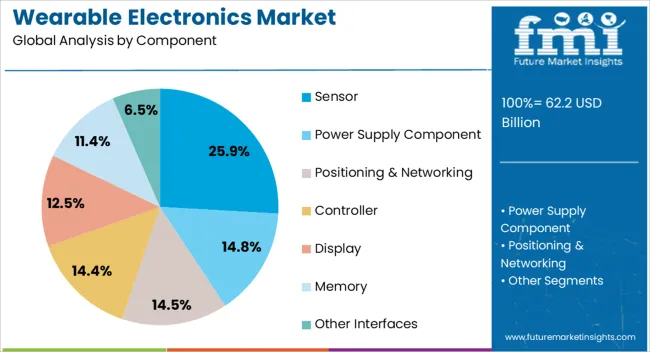

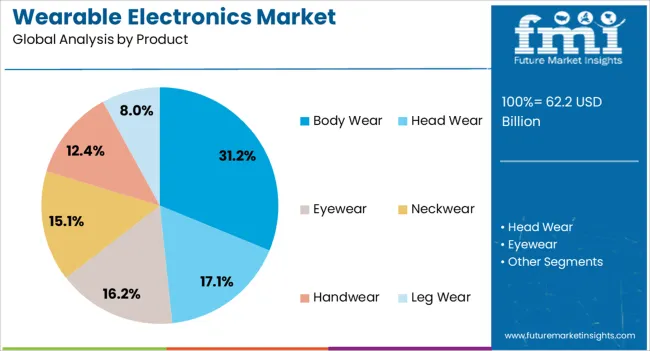

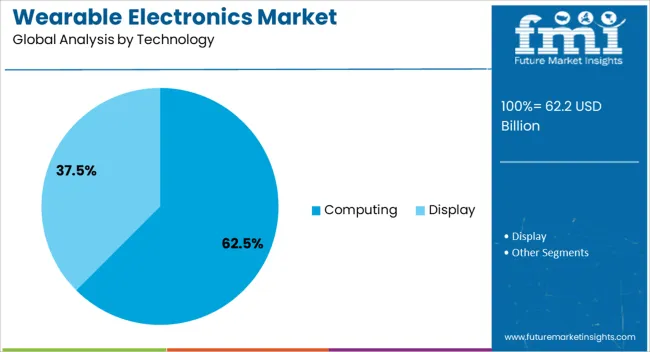

The wearable electronics market is segmented by component, product, technology, application, and geographic regions. By component, wearable electronics market is divided into Sensor, Power Supply Component, Positioning & Networking, Controller, Display, Memory, and Other Interfaces. In terms of product, wearable electronics market is classified into Body Wear, Head Wear, Eyewear, Neckwear, Handwear, and Leg Wear. Based on technology, wearable electronics market is segmented into Computing and Display. By application, wearable electronics market is segmented into Consumer Electronics, Healthcare & Medical, Automotive & Transportation, Military & Defense, and Other Industries. Regionally, the wearable electronics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sensor segment is projected to capture 25.9% of the wearable electronics market revenue share in 2025, making it the leading component category. Its dominance is being supported by the critical role sensors play in enabling core functionalities such as motion detection, biometric tracking, and environmental monitoring.

Advances in micro-electro-mechanical systems and miniaturization technologies have allowed sensors to deliver high accuracy while maintaining low power consumption, which is vital for battery-dependent wearables. Growing consumer demand for devices that provide precise health insights, including heart rate, oxygen saturation, and sleep patterns, is fueling the adoption of advanced sensor modules.

The segment’s leadership is further reinforced by increasing integration of multi-sensor platforms within single devices, allowing simultaneous tracking of multiple metrics The expansion of wearable applications into medical-grade monitoring, sports performance optimization, and industrial safety is expected to continue driving demand for innovative sensor solutions, positioning the segment as the backbone of wearable functionality in the coming years.

The body wear product segment is anticipated to account for 31.2% of the wearable electronics market revenue share in 2025, positioning it as the leading product category. This growth is being driven by widespread adoption of smart clothing, fitness trackers, and health monitoring devices that are designed for continuous contact with the body. Consumer preference for lightweight, comfortable, and aesthetically appealing devices that can be seamlessly integrated into daily routines is supporting strong demand for body wear products.

Technological advances in flexible electronics, smart fabrics, and energy-efficient batteries are enabling new product designs that combine fashion with advanced functionality. The segment’s dominance is also supported by the growing popularity of devices for fitness and wellness monitoring, where consistent body contact ensures accurate data capture.

Expanding applications in clinical settings, workplace safety, and military operations are further boosting adoption With personalization, style, and functionality converging, body wear products are expected to remain the largest contributor to the wearable electronics market.

The computing technology segment is expected to hold 62.5% of the wearable electronics market revenue share in 2025, making it the leading technology category. This dominance is being reinforced by the growing need for embedded processing capabilities that allow wearables to function as standalone smart devices.

Advanced processors and microcontrollers are enabling devices to run sophisticated algorithms for health analytics, motion tracking, and artificial intelligence-based applications directly on the device, reducing reliance on external systems. The segment’s growth is being fueled by increasing demand for real-time data processing, faster connectivity, and extended battery performance in consumer and enterprise wearables.

Continuous improvements in chip design and energy efficiency are supporting the expansion of multifunctional applications, from medical diagnostics to augmented reality As wearables become more integral to digital ecosystems, computing technology will continue to play a pivotal role in enabling interoperability, personalization, and advanced data-driven features, ensuring its sustained leadership in the market.

One of the primary drivers of this market is the proliferation of health and fitness trackers. Companies like Fitbit, Garmin, and Apple are continuously innovating to provide more accurate health metrics, such as heart rate monitoring, sleep tracking, and stress management features. The integration of advanced sensors and artificial intelligence (AI) to deliver personalized health insights is becoming a significant selling point.

Smartwatches are another dominant segment within the wearable electronics market. Apple Watch continues to lead, with competitors like Samsung, Huawei, and Fossil expanding their market shares. These devices are evolving beyond simple notifications and fitness tracking to offer more comprehensive health monitoring, such as electrocardiogram (ECG) capabilities and blood oxygen level measurements. The versatility and convenience of smartwatches are driving their adoption among consumers looking for multifunctional devices.

The market is also witnessing growth in smart clothing and wearables. Smart clothing, embedded with sensors to monitor physiological parameters, is gaining traction in sports and healthcare sectors. Meanwhile, wearables, which include wireless earbuds with smart features like voice assistance and health monitoring, are rapidly gaining popularity. Companies like Bose, Sony, and Apple are at the forefront of this trend, enhancing user experiences with high-quality audio and intelligent features.

Regionally, North America holds the largest market share, driven by high consumer spending and technological advancements. However, the Asia-Pacific region is expected to witness the fastest growth, fueled by increasing urbanization, rising disposable incomes, and a growing tech-savvy population.

Despite the promising growth trajectory, the wearable electronics market faces several critical restraints that could hinder its expansion. One of the primary challenges is the high cost of advanced wearable devices. Premium products like smartwatches and smart clothing often come with a steep price tag, limiting their accessibility to a broader consumer base, particularly in price-sensitive markets.

Battery life and energy consumption are significant technical constraints. Many wearable devices require frequent recharging, which can inconvenience users and reduce the overall user experience. Manufacturers are continually working on improving battery efficiency, but this remains a critical area needing substantial advancements.

Data privacy and security concerns also pose significant challenges. Wearable devices collect a vast amount of personal and health data, raising issues around data breaches and unauthorized access. Ensuring robust security measures and gaining consumer trust are imperative for market growth.

Another restraint is the limited interoperability between different wearable devices and other tech ecosystems. Consumers often face difficulties integrating wearables from different brands, leading to fragmented user experiences and reduced functionality.

The industry also faces regulatory hurdles, particularly for health-related wearables that require compliance with stringent medical device regulations. These regulatory barriers can slow down the introduction of innovative products and increase development costs.

Health and Wellness Integration

The integration of health and wellness features in wearable electronics is a dominant market trend. Devices like smartwatches and fitness trackers now offer advanced health monitoring capabilities, including heart rate variability, blood oxygen levels, and ECG readings.

Companies such as Apple and Fitbit are leading this trend, providing users with comprehensive health insights and personalized recommendations. The COVID-19 pandemic has further accelerated this trend as consumers become more health-conscious and seek devices that can monitor their well-being in real time.

Enhanced Connectivity and IoT Integration

Enhanced connectivity and integration with the Internet of Things (IoT) are reshaping the wearable electronics market. Wearables are increasingly designed to seamlessly connect with other smart devices, creating a cohesive and interconnected ecosystem.

This trend is evident in smart home applications, where wearables can control home automation systems, and in workplace settings, where they enable efficient communication and productivity. The development of 5G technology is expected to boost this connectivity further, offering faster data transfer and more reliable connections.

AI and Machine Learning Advancements

Artificial intelligence (AI) and machine learning (ML) advancements are significantly impacting the wearable electronics market. These technologies enable wearables to provide more personalized and adaptive user experiences. For instance, AI-driven analytics can offer users tailored fitness programs, predictive health alerts, and enhanced user interaction.

Companies like Google and Samsung are investing heavily in AI and ML to enhance the functionality and user experience of their wearable products. This trend is expected to drive innovation and create new opportunities in the market.

Investors can capitalize on the growing demand for health and wellness wearables. With increasing consumer focus on health monitoring and preventive care, companies like Fitbit, Apple, and Garmin are continuously innovating in this space. Investing in firms developing advanced health sensors, AI-driven health analytics, and remote monitoring technologies offers substantial growth potential.

Emerging markets present significant opportunities due to rising disposable incomes and increasing tech adoption. Additionally, the expansion of IoT integration in wearables, supported by 5G technology, promises enhanced connectivity and functionality. Strategic investments in companies focusing on IoT-enabled wearables and those targeting these burgeoning markets can yield high returns.

India is emerging as a significant player in the wearable electronics market, bolstered by its youthful population and increasing smartphone penetration. With rising health awareness and fitness consciousness among consumers, there is a growing demand for affordable and multifunctional wearables.

Companies like Noise, boAt, and Fire-Boltt are gaining traction by offering budget-friendly yet feature-rich products tailored to local preferences. The Indian market also benefits from an expanding e-commerce ecosystem, making it easier for consumers to access the latest wearable technologies.

Government initiatives promoting digital health and fitness further stimulate market growth. As urbanization and disposable incomes continue to rise, India is poised to become a major market for wearable electronics.

China is experiencing rapid growth in the wearable electronics market, driven by its large population, rising disposable incomes, and increasing urbanization. The country's tech giants, such as Xiaomi, Huawei, and Oppo, are major players, offering affordable and feature-rich wearables that cater to a broad consumer base.

The Chinese market is characterized by a high level of competition, which drives continuous innovation and price competitiveness. Additionally, China's advanced manufacturing capabilities and supply chain efficiency support large-scale production and quick market adaptation.

The government's focus on digital health and smart city initiatives further propels the adoption of wearable technologies, making China a key growth region in the global wearable electronics market.

The United States remains at the forefront of the wearable electronics market, driven by its robust technological infrastructure and high consumer adoption rates. Companies like Apple, Fitbit, and Garmin dominate the market, continuously pushing the envelope with innovative features and advanced health monitoring capabilities.

The USA market benefits from a strong emphasis on health and wellness, with consumers increasingly seeking devices that offer comprehensive health insights. Additionally, significant investments in research and development, coupled with a tech-savvy population, ensure a steady demand for the latest wearable technologies. The integration of AI and IoT in wearables further enhances the market potential, positioning the USA as a leader in wearable electronics innovation.

Sensors are the top component in the wearable electronics market because they are crucial for health and fitness monitoring, which drives consumer demand. Devices like smartwatches and fitness trackers rely on sensors to provide accurate data on heart rate, sleep patterns, physical activity, and blood oxygen levels.

These insights enhance user experience and engagement by offering personalized health recommendations. Additionally, sensors enable advanced features like gesture and motion detection, which improve device interactivity and functionality. As consumers prioritize health and wellness, the innovation and integration of sensors remain pivotal in sustaining the growth of the wearable electronics market.

Display technology is a top component in the wearable electronics market due to its crucial role in providing users with real-time information and interactive experiences. Displays enable visual feedback, data visualization, and user interface interaction, enhancing the functionality and appeal of wearable devices for consumers.

Manufacturers and major companies should focus on developing affordable, feature-rich wearables to cater to diverse markets, particularly in emerging economies. Investing in localized marketing strategies and forming strategic partnerships with regional tech firms can enhance market penetration.

Additionally, prioritizing advancements in battery life, data security, and interoperability will address consumer concerns and drive global adoption. Emphasizing health and wellness features can further attract a broad consumer base.

Industry Updates

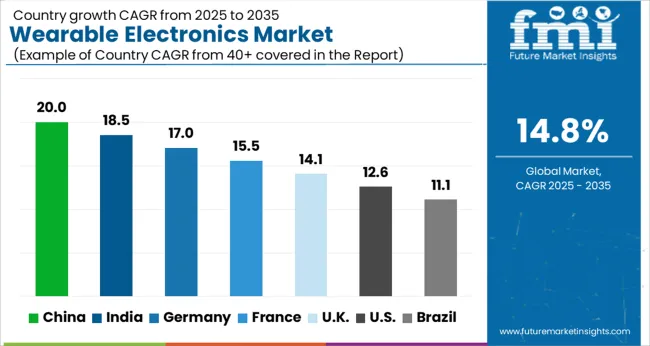

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

| USA | 12.6% |

| Brazil | 11.1% |

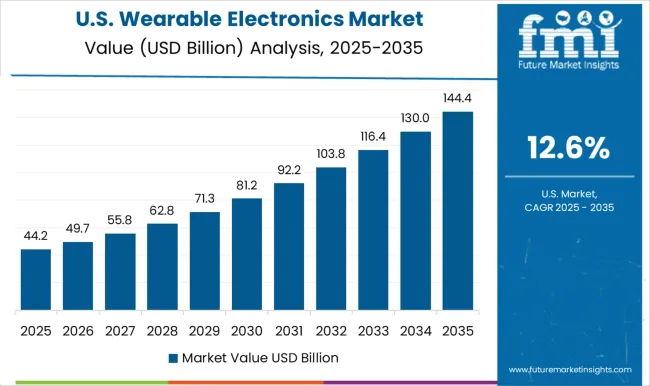

The Wearable Electronics Market is expected to register a CAGR of 14.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.0%, followed by India at 18.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.1%, yet still underscores a broadly positive trajectory for the global Wearable Electronics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.0%. The USA Wearable Electronics Market is estimated to be valued at USD 22.2 billion in 2025 and is anticipated to reach a valuation of USD 72.6 billion by 2035. Sales are projected to rise at a CAGR of 12.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.2 billion and USD 1.7 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 62.2 Billion |

| Component | Sensor, Power Supply Component, Positioning & Networking, Controller, Display, Memory, and Other Interfaces |

| Product | Body Wear, Head Wear, Eyewear, Neckwear, Handwear, and Leg Wear |

| Technology | Computing and Display |

| Application | Consumer Electronics, Healthcare & Medical, Automotive & Transportation, Military & Defense, and Other Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fitbit, Apple, Ava Women, Garmin, WHOOP, Vuzix, Dexcom, Huawei, Samsung, and GOQii |

The global wearable electronics market is estimated to be valued at USD 62.2 billion in 2025.

The market size for the wearable electronics market is projected to reach USD 247.4 billion by 2035.

The wearable electronics market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in wearable electronics market are sensor, power supply component, positioning & networking, controller, display, memory and other interfaces.

In terms of product, body wear segment to command 31.2% share in the wearable electronics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Fall Detector Market Size and Share Forecast Outlook 2025 to 2035

Wearable Industrial Exoskeleton Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Wearable Beauty Market Size, Growth, and Forecast for 2025 to 2035

Wearable Medical Robots Market - Trends & Forecast 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Blood Pressure Monitor Market Trends and Forecast 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Wearable Fitness Technology Market Insights - Trends & Forecast 2025 to 2035

Wearable Computing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA