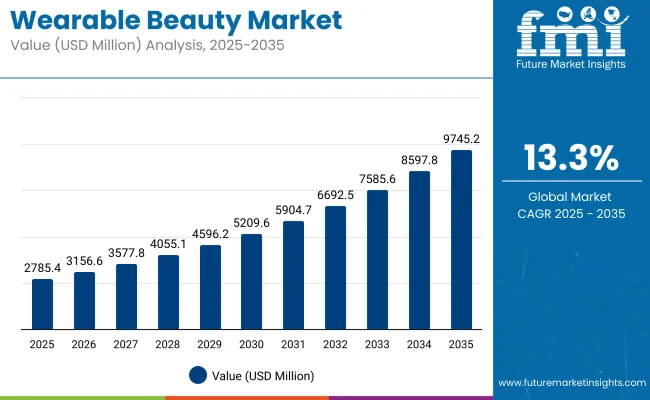

The wearable beauty market is expected to record a valuation of USD 2,785.4 million in 2025 and USD 9,745.2 million in 2035, with an increase of USD 5,334.5 million, which equals a growth of 211% over the decade. The overall expansion represents a CAGR of 13.3% and more than a 3X increase in market size.

Wearable Beauty Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 2,785.4 million |

| Forecast Value in (2035F) | USD 9,745.2 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,785.4 million to approximately USD 5,209.6 million, adding USD 1,834.5 million, which accounts for 34.4% of the total decade growth. This phase records steady adoption of LED masks, micro current devices, and hydration sensors, driven by the demand for personalized skincare, anti-aging benefits, and at-home dermatological-grade experiences. LED light therapy masks dominate this period, capturing over 38% share in the USA, with strong traction in China and Europe.

The second half from 2030 to 2035 contributes a larger share of USD 3,500 million, equal to 65.6% of total growth, as the market jumps from USD 5,209.6 million to USD 9,745.3million. This acceleration is powered by mass deployment of AI-integrated skin analysis, cloud-synced hydration tracking, and app-based light therapy regimens.

Light-based technologies (Red, Blue, NIR LEDs) secure over 52.7% share in China, while global consumers increasingly shift toward full-face, multi-modal devices offering both diagnostics and treatment. Emerging premium players and cloud-linked subscription services begin to boost the recurring value of software-backed platforms, gradually increasing the software and smart connectivity share in total revenue contribution.

From 2020 to 2024, the wearable beauty market grew from USD 1,430 million to USD 2,140 million, driven by hardware-centric adoption of LED masks, microcurrent devices, and sonic cleansers. During this period, the competitive landscape was dominated by beauty device manufacturers, who controlled nearly 85% of total revenue, with leaders such as L’Oréal Group, MTG Co., Ltd. (ReFa), and Foreo focusing on premium facial technology for anti-aging and skin rejuvenation.

Competitive differentiation relied on device quality, skincare efficacy, and consumer design, while software and companion apps were typically bundled as secondary features rather than core revenue drivers. Subscription-based skincare services and analytics platforms had minimal traction, contributing less than 8% of the total market value.

Demand for wearable beauty devices is forecast to reach USD 2,785.4 million in 2025, and the revenue mix will begin shifting as software and services expand to over 18% share. Traditional hardware leaders face rising competition from digital-first entrants offering AI-powered skin diagnostics, app-linked hydration sensors, and cloud-synced treatment routines.

Established manufacturers are pivoting toward hybrid models that integrate real-time feedback, remote dermatologist connectivity, and usage analytics to maintain brand relevance. New entrants specializing in connected skincare ecosystems, AR-based mirror interfaces, and subscription-based beauty routines are capturing share, particularly among Gen Z and tech-native consumers. The competitive edge is moving away from standalone device innovation toward ecosystem integration, data intelligence, and recurring engagement models.

The wearable beauty market is being propelled by the medicalization of beauty and the increasing consumer preference for quantifiable skincare outcomes. Unlike traditional cosmetic products that rely on subjective perception, wearable beauty devices enable objective tracking of skin parameters such as hydration, elasticity, melanin levels, and temperature. This shift is resonating particularly in regions where dermatological literacy is increasing, and consumers are becoming more aligned with clinical-grade, measurable beauty standards.

Wearable beauty technology is also filling the gap between cosmetic dermatology and daily self-care by providing users with professional-grade insights without the need for clinic visits. This fusion of dermatology and beauty is being actively monetized by brands developing diagnostic-led beauty ecosystems with longitudinal skin tracking, making these devices part of preventive skincare strategies rather than just aesthetic enhancement.

In parallel, the growth of closed-loop ecosystems across the beauty tech landscape is reshaping consumer engagement. Several beauty-tech brands are building proprietary ecosystems where the wearable device is just one component of a broader diagnostic and product delivery platform. These systems are designed to lock in users by combining personalized diagnostics, digital coaching, device usage analytics, and subscription-based cosmetic refills based on real-time feedback.

As a result, brands are increasingly focusing on customer lifetime value and ecosystem stickiness rather than one-time device sales. This evolution is reinforcing recurring revenue models and increasing investor interest, which in turn is fueling R&D budgets and rapid innovation. In this context, market expansion is being driven not just by product innovation, but by the strategic redesign of how skincare is delivered, measured, and monetized.

The Wearable Beauty Market is segmented by product type, sensor & technology, Application, end user, and distribution channel. Product types include LED light therapy masks, microcurrent facial devices, sonic cleansing devices & massagers, and hair growth helmets or bands (laser or LED-based), each addressing distinct skincare and haircare needs through home-use, non-invasive innovations.

Sensor and technology segmentation encompasses hydration sensors and skin moisture trackers, UV sensors, and light-based technologies such as red, blue, and near-infrared (NIR) LEDs, which enable real-time diagnostics and adaptive skincare responses. Applications span anti-aging and wrinkle reduction, skin tightening and firming, and acne treatment through blue light or pH-based technologies, supporting a broad demographic from teens to aging populations.

End users are classified into general consumers, professional users such as dermatologists and spa practitioners, and pharmacy or drug store buyers, reflecting a mix of personal care, clinical integration, and OTC accessibility. Distribution channels include both e-commerce platforms and offline retail stores, with online channels offering convenience and algorithmic personalization, while physical outlets provide credibility, experiential trials, and impulse engagement through pharmacies, clinics, and specialty beauty stores.

Regionally, North America and East Asia are dominant markets driven by early tech adoption and skincare-conscious populations, while Europe follows closely with growing demand across premium beauty segments. Meanwhile, South Asia & Pacific and parts of Latin America are emerging as high-potential regions due to increased access to affordable devices and mobile-based beauty solutions.

| By Product Type | Value Share% 2025 |

|---|---|

| LED Light Therapy Masks | 28.5% |

| Others | 71.5% |

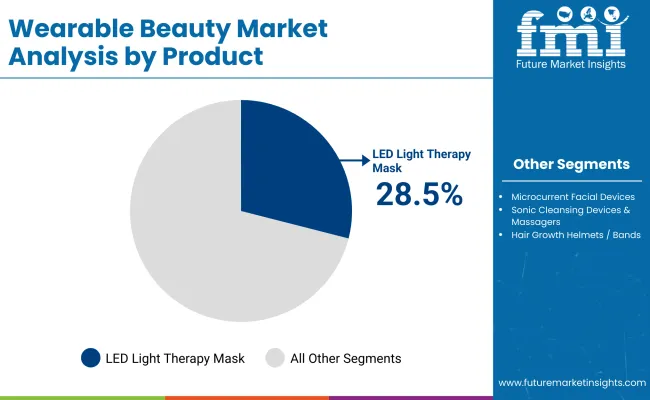

In the wearable beauty market, LED light therapy masks are estimated to command the highest product type share at 28.5% in 2025. This strong uptake is being driven by the growing acceptance of multi-spectrum light technologies in at-home skincare, particularly among consumers targeting visible skin rejuvenation and inflammation reduction.

The segment has gained prominence due to its perceived alignment with clinical dermatology protocols and its non-invasive nature. Compared to sonic cleansing devices or microcurrent facial tools, LED masks are being increasingly perceived as offering more holistic anti-aging benefits through red, blue, and near-infrared wavelengths that penetrate varying skin depths.

The convenience of hands-free application and the ability to incorporate treatment into daily routines has positioned these devices as a preferred choice, especially among time-constrained urban users. Moreover, the integration of features such as smart timers, app connectivity, and dermatologist-approved wavelength settings has enhanced product credibility, prompting wider uptake through both direct-to-consumer platforms and premium beauty retail channels.

While the “Others” category remains fragmented across diverse formats like microcurrent facial devices and hair regrowth bands, the market’s preference is increasingly being concentrated toward LED masks due to their perceived multi-functional efficacy and lower need for user technique proficiency.

| By Sensor & Technology | Value Share% 2025 |

|---|---|

| Light-Based Technologies (Red, Blue, NIR LEDs) | 59.2% |

| Others | 40.8% |

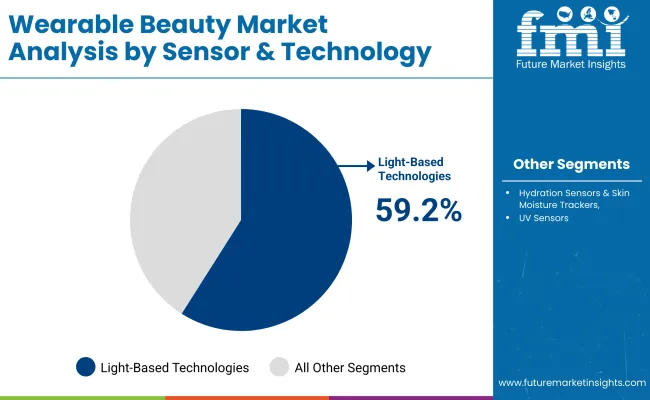

Light-based technologies, including red, blue, and near-infrared (NIR) LEDs, are projected to account for a dominant 59.2% share of the global wearable beauty market by sensor and technology in 2025. The popularity of these solutions is being reinforced by their ability to target multiple skin concerns simultaneouslysuch as acne, fine lines, inflammation, and dullnesswithout requiring invasive treatment or consumables.

These devices are increasingly seen as an accessible extension of in-office dermatology protocols, with many brands offering tailored wavelengths for specific issues. Their growing application in both facial and scalp devices further enhances their functional appeal across gender and age demographics.

The consumer preference for sensor-driven yet non-mechanical solutions is also contributing to the rise of light-based technologies. Compared to vibration-based or thermal sensors, LED-based modules offer a longer product lifecycle and deliver visible results with minimal physical interaction, which aligns with hygiene-conscious and touch-free skincare trends.

Additionally, improved energy efficiency, lower heat output, and programmable settings make these technologies well-suited for wearable formats. The “Others” segment, while sizable at 40.8%, includes electrostimulation, biosensors, and micro-needling integrations that often require more specialized usage or post-care protocols, limiting their adoption in mainstream personal care routines.

| By Application | Value Share% 2025 |

|---|---|

| Anti-Aging and Wrinkle Reduction | 37.3% |

| Others | 62.7% |

Anti-aging and wrinkle reduction applications are anticipated to capture 37.3% of the wearable beauty devices market in 2025, marking them as the most commercially significant application segment. This prominence reflects strong consumer demand for visible, non-invasive rejuvenation solutions as part of preventive and corrective skincare routines.

The integration of LED, EMS (electrical muscle stimulation), and microcurrent technologies in wearables has allowed for enhanced collagen stimulation and improved skin elasticity, making these devices highly desirable across both younger and aging consumer bases seeking to delay or reverse age-related changes.

Despite the wide array of multifunctional beauty devices in the market, anti-aging features continue to be prioritized during product development, marketing, and consumer decision-making. The remaining 62.7% share is distributed among acne treatment, pigmentation correction, hydration, skin tightening, and other emerging applications. However, many of these functionalities are often bundled into devices primarily marketed for anti-aging.

Integration with Dermatologist-Approved Diagnostic Ecosystems

Dermatology-grade validation has increasingly influenced the credibility of wearable beauty devices since 2023. Companies are now collaborating with clinical dermatology labs and certified skin clinics to offer users professional-grade diagnostics through mobile apps paired with smart sensors. These integrations are boosting consumer trust in the effectiveness of wearable skincare devices, especially those that use microcurrent, red-light therapy, and hydration-level detection.

Many brands have been observed offering tele-dermatology consultations synced with their beauty wearables, enabling customers to receive AI-supported regimens tailored to real-time skin diagnostics. This clinical alignment is reducing skepticism around high-tech beauty gadgets and has opened pathways for inclusion in dermatology treatment plans. The market's credibility boost through medical integration is thus serving as a significant growth lever, particularly among middle-aged consumers and those with chronic skin conditions like rosacea or hyperpigmentation.

Growing Affinity for Data-Centric Skin Health Optimization

Between 2023 and 2025, consumers have increasingly treated skin health as a data-driven pursuit rather than a cosmetic goal. Smart sensors embedded in wearable devices now provide granular feedback on factors like moisture retention, skin temperature, UV exposure, and pH balance. This biofeedback loop is particularly valued by consumers who are tech-savvy and motivated to track their progress with quantified insights.

The surge in beauty-focused apps that gamify skincare habits or generate daily skin health scores based on wearable inputs has turned skincare into an interactive, personalized journey. Rather than depending solely on product marketing, consumers are making decisions based on real-time results from their own skin data. This behavioral shift is influencing both demand and engagement, as consumers are now investing in wearables that offer longitudinal insights into how lifestyle, environment, and products are affecting their skin condition.

Limited Battery Life and Usability Constraints in Daily Routines

One of the critical hurdles for mass adoption of wearable beauty tech has been usability friction, particularly stemming from power limitations and wearability discomfort. Devices such as LED therapy masks, ultrasonic toning wearables, or hydration patches often require multiple charging sessions per week, which can disrupt daily skincare routines. In urban regions where consumers already juggle multiple smart devices, the friction caused by needing to charge another accessory has been resulting in declining usage post initial excitement.

Additionally, for certain product categories like microcurrent facial tools or jawline-enhancing wearables, long wear durations or restrictive designs reduce comfort, especially for multitasking users. Between 2023 and 2025, consumer reviews and product return data reflect dissatisfaction with devices that require extensive setup, cannot withstand water exposure, or do not seamlessly integrate into morning and evening routines. This challenge continues to impact product stickiness and long-term retention.

Hybridization of Beauty Wearables with Wellness and Mental Health Functions

A notable trend between 2023 and 2025 has been the convergence of beauty wearables with wellness and emotional health monitoring. Devices traditionally focused on skin appearance are now being hybridized to track stress levels via galvanic skin response, temperature fluctuations, and cortisol-detection patches. Wearable beauty masks, for instance, have started incorporating blue-light therapy and aromatherapy modules aimed at both cosmetic results and stress reduction.

This hybrid positioning appeals strongly to millennial and Gen Z demographics seeking holistic well-being alongside aesthetic enhancement. The intersection of beauty and mindfulness has been prominently marketed in Asia-Pacific and Western Europe, where consumer inclination toward de-stressing rituals overlaps with beauty regimens. Wearables that offer guided meditation while running LED treatments or facial toning routines have especially gained traction. The emotional wellness angle is thus emerging as a dual-purpose differentiator in a market that previously focused solely on physical appearance.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 15.6% |

| USA | 12.6% |

| India | 9.8% |

| UK | 11.1% |

| Germany | 11.8% |

| Japan | 9.8% |

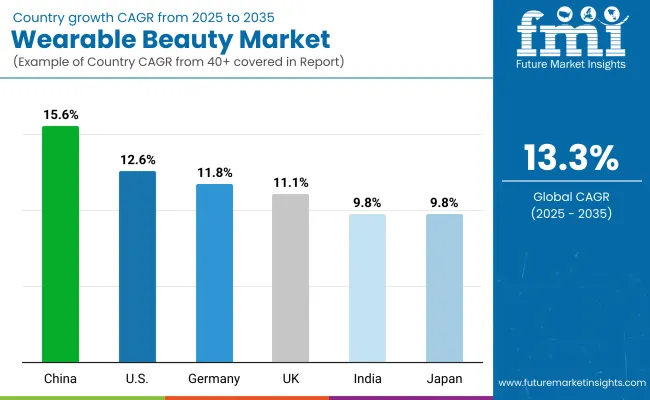

China is expected to record the fastest growth in the wearable beauty devices market with a CAGR of 15.6% from 2025 to 2035, driven by strong tech-beauty convergence, rising consumer affluence, and early adoption of at-home skincare innovations. The USA follows with a CAGR of 12.6%, supported by high spending on premium beauty tech, increased DTC access, and personalization demands. India’s projected CAGR of 9.8% reflects rising urban middle-class consumption, influencer-driven demand, and product affordability improvements.

In Europe, the UK (11.1%) and Germany (11.8%) are witnessing growth fueled by aging demographics and consumer interest in non-invasive anti-aging solutions. Japan, with a slower yet stable CAGR of 9.8%, continues to support innovation, although its mature market presents growth limitations. Asia-Pacific markets, especially China and India, are being increasingly prioritized for strategic expansion and early product launches.

| Year | USA Wearable Beauty Market (USD Million) |

|---|---|

| 2025 | 787.96 |

| 2026 | 875.66 |

| 2027 | 973.12 |

| 2028 | 1081.42 |

| 2029 | 1201.79 |

| 2030 | 1335.54 |

| 2031 | 1484.19 |

| 2032 | 1649.38 |

| 2033 | 1832.96 |

| 2034 | 2036.97 |

| 2035 | 2263.68 |

The USA wearable beauty market is projected to grow steadily from USD 787.96 million in 2025 to USD 2,263.68 million by 2035, expanding at a CAGR of approximately 10.9%. Growth accelerates notably after 2028, as consumer appetite for AI-enabled skincare tools, personalized regimens, and device-app integration intensifies. The market nearly triples over the decade, underscoring a strong consumer shift toward tech-powered beauty solutions.

The growth of the USA wearable beauty market is being strongly driven by the rising consumer preference for personalized, tech-integrated skincare solutions that offer measurable results at home. Between 2025 and 2035, demand is being propelled by AI-powered skin analysis, real-time hydration and UV sensors, and the integration of wearables with mobile apps for tracking and customizing beauty routines.

Consumers are increasingly seeking data-driven, preventative skincare that aligns with wellness goals, prompting both startups and established beauty-tech companies to launch innovative, multifunctional devices. This convergence of beauty and health tech is reshaping product expectations and driving sustained adoption.

The wearable beauty market in the United Kingdom is projected to grow at a CAGR of 11.1% from 2025 to 2035. Growth is being supported by rising demand for tech-driven skincare tools, particularly those offering personalization and app connectivity. Consumers are shifting toward minimalist and wellness-integrated beauty routines, boosting interest in LED therapy and microcurrent devices.

Local expansion is being reinforced through strong retail and e-commerce partnerships.The competitive landscape is being shaped by the entry of wellness-centric brands that bridge cosmetic benefits with mental relaxation, signaling an evolution in beauty tech consumption preferences.

India is witnessing rapid growth in the Wearable Beauty Market, which is forecast to expand at a CAGR of 9.8% through 2035. Growing interest in tech-enabled skincare solutions among Gen Z and millennial consumers has created momentum for mass-market and mid-range wearable beauty devices. A sharp rise in direct-to-consumer sales, especially through influencer-driven platforms and mobile-first e-commerce, has further broadened access. Startups are launching affordable smart masks and LED-based wearables targeting hydration, acne, and anti-aging concerns.

Meanwhile, dermatology clinics and beauty salons are beginning to incorporate diagnostic sensors for personalized skin profiling. In parallel, device manufacturers are forming local partnerships to tailor offerings to Indian skin types and conditions, further boosting regional relevance.

China is witnessing strong momentum in the Wearable Beauty Market, which is forecast to grow at a CAGR of 15.6% through 2035, the fastest among major economies. The rapid digitalization of personal care routines, combined with rising disposable income and tech adoption among young urban consumers, has positioned China as a core growth engine for smart skincare tools.

Domestic brands are aggressively scaling up production of AI-integrated facial devices, skin hydration trackers, and smart massagers targeting home-use beauty regimens. Integration of these devices into TCM-inspired (Traditional Chinese Medicine) wellness offerings is gaining traction, enhancing both cultural relevance and appeal. Retailers are bundling beauty tech with skincare subscriptions via popular social commerce platforms like Douyin and Xiaohongshu, driving repeat sales and market stickiness.

| Countries | 2025 Share (%) |

|---|---|

| USA | 31.2% |

| China | 31.2% |

| Japan | 12.4% |

| Germany | 10.1% |

| UK | 9.3% |

| India | 6.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 28.1% |

| China | 25.1% |

| Japan | 9.7% |

| Germany | 8.5% |

| UK | 8.0% |

| India | 9.3% |

Germany’s share in the global Wearable Beauty Market is projected to decline from 10.1% in 2025 to 8.5% by 2035, reflecting a relative slowdown compared to emerging markets. Despite this share dip, Germany continues to remain a mature and innovation-driven hub for beauty technology, supported by its strong dermatological research base and consumer focus on high-quality, skin-safe devices.

Demand is primarily concentrated in premium segments such as smart anti-aging tools, UV exposure monitors, and clinically validated skin analyzers. However, high device costs and slower adoption rates among older demographics are limiting volume expansion. While wellness-conscious consumers are actively experimenting with connected beauty wearables, the market is being cautiously reshaped through gradual integration with certified dermatological regimens and regulated retail channels.

| China By Sensor & Technology | Value Share% 2025 |

|---|---|

| Light-Based Technologies (Red, Blue, NIR LEDs) | 52.7% |

| Others | 47.3% |

The Wearable Beauty Market in China is projected to hold a 28.1% global share by 2035, up from 31.2% in 2025. Light-based technologies such as red, blue, and near-infrared (NIR) LEDs account for 52.7% of the sensor & technology value share in 2025, signaling their centrality in device functionality. This dominance reflects Chinese consumers’ preference for multifunctional skincare wearables that enable at-home phototherapy, acne treatment, and wrinkle reduction.

Light-emitting sensor modules offer non-invasive, reusable, and cost-efficient options, making them ideal for daily-use beauty routines. Their integration into compact, smartphone-linked devices aligns with rising digital wellness adoption, especially among young urban consumers. Meanwhile, the 47.3% share for other sensor technologies reflects the increasing experimentation with hydration, pH, and motion tracking in niche applications.

China’s R&D ecosystem is fueling local innovations in skin tone calibration and real-time biomarker detection, which are expected to expand the capabilities of light-based modules further. Global brands are also customizing wearable photonics for the Chinese market, focusing on portability, efficacy, and localized skin condition mapping.

| USA By Product Type | Value Share% 2025 |

|---|---|

| LED Light Therapy Masks | 38.2% |

| Others | 61.8% |

The Wearable Beauty Market in the USA is projected to be valued at USD 789.9 million in 2025, with LED light therapy masks accounting for 38.2% of the product type value share. This product category dominates due to its proven efficacy in skin rejuvenation, acne treatment, and wrinkle reduction. The prominence of LED masks is supported by increasing consumer trust in light-based therapies endorsed by dermatologists and wellness professionals.

Their hands-free usage and compatibility with home routines make them a preferred solution for aging skin and photo-damage correction, particularly among Gen X and millennial consumers. Customizable intensity settings and targeted wavelength modules enhance the appeal among tech-savvy users demanding personalized skincare.

Meanwhile, the remaining 61.8% share is occupied by diverse formats such as microcurrent facial wearables, hydration sensors, and thermal massagers. However, none of these currently rival LED masks in perceived clinical efficacy or consumer brand recall. The USA market is also benefiting from strategic collaborations between beauty brands and tech firms to develop AI-integrated LED platforms.

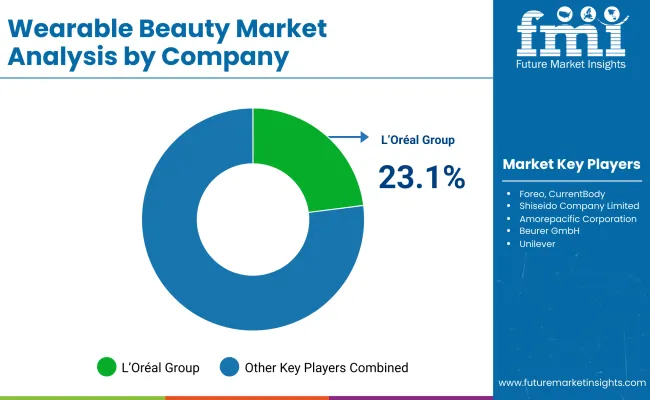

The competitive landscape of the global Wearable Beauty Market in 2025 is significantly concentrated, with L’Oréal Group projected to command a dominant 23.1% share of total value. This leadership position has been secured through early investments in skin sensor-based wearables, strong patent ownership, and consistent consumer engagement through dermatological research-backed product development.

L’Oréal’s strategic collaborations with biotech and digital wellness platforms have further cemented its first-mover advantage, allowing integration of personalized skin diagnostics into consumer beauty routines. The company’s focus on developing scalable, data-enabled skincare tools has ensured rapid global acceptance.

Despite this dominance, the remaining 76.9% of the market is occupied by a fragmented set of companies including device manufacturers, skincare brands venturing into tech, and wellness-focused startups. These players are experimenting with hydration monitors, LED-based masks, and microcurrent tools, aiming to carve out niches by targeting specific consumer groups such as men’s grooming or aging care. However, their scalability and clinical validation remain limiting factors when compared to L’Oréal’s dermatological credentials and global retail footprint.

Key Developments in Wearable Beauty Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,785.4 Million |

| Product Type | LED Light Therapy Masks, Microcurrent Facial Devices, Sonic Cleansing Devices & Massagers, Hair Growth Helmets / Bands (Laser or LED-Based) |

| Sensor & Technology | Hydration Sensors & Skin Moisture Trackers, UV Sensors, Light-Based Technologies (Red, Blue, NIR LEDs) |

| Application | Anti-Aging and Wrinkle Reduction, Skin Tightening and Firming, Acne Treatment (Blue Light or pH-related) |

| End User | General Consumers, Professional Use (Dermatology & Spas), Pharmacy/Drug Stores |

| Distribution Channel | E-commerce, Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, South Africa |

| Key Companies Profiled | L’Oréal Group, MTG Co., Ltd. (ReFa brand), Foreo, CurrentBody, Shiseido Company, Limited, Amorepacific Corporation, Procter & Gamble (Olay, Neutrogena), Beurer GmbH, Unilever, Lancer Skincare |

| Additional Attributes | Dollar sales by product type and application, adoption trends in at-home skin health monitoring and personalized beauty care, rising demand for sensor-integrated wearable devices, category-specific growth in skincare, anti-aging, and wellness segments, revenue segmentation for hardware, software, and app-based services, integration with AI-driven diagnostics, IoT, and real-time analytics, regional trends shaped by consumer tech adoption and wellness digitization, and innovations in biosensors, nanomaterials, and wireless skin-interfacing technologies. |

The global Wearable Beauty Market is estimated to be valued at USD 2,785.4 million in 2025.

The market size for the Wearable Beauty Market is projected to reach USD 9,745.2 million by 2035.

The Wearable Beauty Market is expected to grow at a CAGR of 13.3% between 2025 and 2035.

The key product types in the Wearable Beauty Market are hydration sensors, LED light therapy masks, microcurrent devices, and others.

In terms of product type, LED light therapy masks are expected to command a 28.5% share in the USA Wearable Beauty Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Fall Detector Market Size and Share Forecast Outlook 2025 to 2035

Wearable Industrial Exoskeleton Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Wearable Medical Robots Market - Trends & Forecast 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Blood Pressure Monitor Market Trends and Forecast 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Wearable Fitness Technology Market Insights - Trends & Forecast 2025 to 2035

Wearable Computing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA