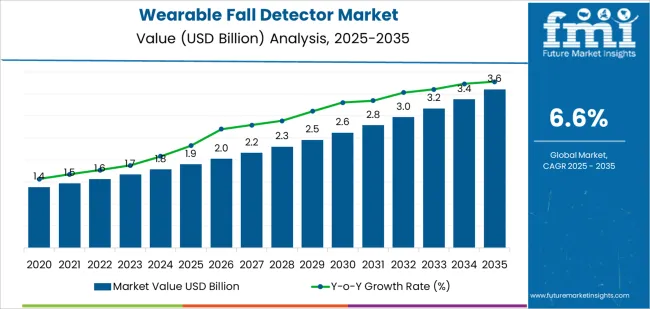

The global wearable fall detector market is valued at USD 1.9 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a CAGR of 6.6%. A peak-through analysis reveals that the market experiences strong growth in the first half of the forecast period (2025-2030), driven by increasing adoption of wearable fall detection systems among elderly individuals, healthcare providers, and fitness-conscious consumers. The demand surge is supported by advancements in sensor technology, real-time alerts, and improved device comfort and accuracy. This period represents a peak in adoption as more regions implement regulations and standards for elderly care and safety, and insurance companies incentivize the use of fall detection devices.

However, after 2030, the market enters a trough period. While growth continues, it slows as the majority of early adopters are already equipped with fall detection systems, and market expansion becomes increasingly driven by replacement cycles and technology upgrades rather than initial adoption. New product innovations, such as integrated health monitoring capabilities and longer battery life, sustain demand during this phase. After the trough, the market rebounds from 2033-2035 as ongoing innovation, including artificial intelligence (AI) and machine learning-driven detection improvements, drives new interest and product differentiation, ensuring continued growth through the end of the forecast period.

Between 2025 and 2030, the Wearable Fall Detector Market expands from USD 1.9 billion to USD 2.7 billion, with annual growth driven by increased adoption of wearable health-tech devices in elderly care, home health monitoring, and hospital settings. The first breakpoint occurs around 2027 to 2028, when the market sees a significant acceleration in annual growth, with increases moving from approximately USD 0.1 billion to USD 0.2 billion per year. This shift is driven by higher healthcare adoption rates, improvements in sensor technologies (e.g., fall detection, real-time alerts), and the integration of wearables with health management platforms, leading to stronger demand in both consumer and healthcare segments.

From 2030 to 2035, the market continues to rise from USD 2.7 billion to USD 3.7 billion, adding USD 1.0 billion. The second breakpoint appears around 2032 to 2033, as the market accelerates further due to the broader integration of fall detection wearables with telemedicine systems, emergency response frameworks, and health insurance programs. Annual growth expands to USD 0.3 billion, driven by increased consumer awareness, affordability of wearable devices, and adoption by healthcare systems globally. By 2035, the combination of technological innovation and market maturity results in a sustained growth trajectory.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.9 billion |

| Market Forecast Value (2035) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The wearable fall detector market is expanding as aging populations and home-based care models increase demand for personal monitoring solutions that ensure safety without restricting mobility. These devices incorporate accelerometers, gyroscopes, and machine learning algorithms to detect falls automatically and alert caregivers or emergency services. Wearable fall detectors offer continuous monitoring in assisted-living facilities, private homes, and hospitals, supporting prevention of serious injury, reducing time to treatment, and optimizing resource allocation in care settings. Manufacturers refine sensor accuracy, battery life, and communication modules (such as LTE/5G and Bluetooth) to enable reliable alerts in real world conditions. With greater acceptance of telehealth and remote monitoring, these devices help support independent living and lower-risk transitions from inpatient care to home environments.

Adoption is also supported by integration with broader digital-health platforms, where wearable fall detectors connect to care management systems, mobile apps, and caregiver dashboards. These integrations enhance adherence tracking, trend analysis, and intervention workflows for at risk patients. Developers focus on form factor design such as smartwatches, pendants, and belt clips to ensure user comfort and ease of use, which encourages adoption among older adults. Although privacy concerns, false alarm rates, and reimbursement frameworks remain challenges, ongoing improvements in algorithm reliability and device connectivity reinforce steady growth in the wearable fall detector market across global senior care ecosystems.

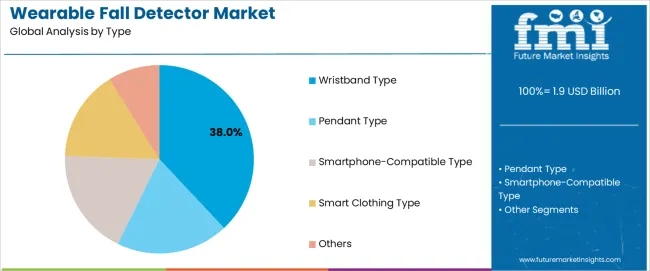

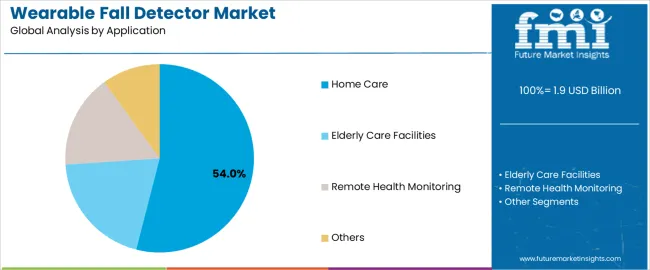

The wearable fall detector market is segmented by type, application, and region. By type, the market is divided into wristband type, pendant type, smartphone-compatible type, smart clothing type, and others. Based on application, it is categorized into home care, elderly care facilities, remote health monitoring, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments reflect the varying needs for fall detection in personal, clinical, and remote healthcare settings.

The wristband type segment accounts for approximately 38.0% of the global wearable fall detector market in 2025, making it the leading type category. This position is driven by the ease of use and familiarity of wrist-worn devices, which provide users with a discreet, comfortable, and practical means of fall detection. Wristband devices are typically lightweight, adjustable, and designed to be worn throughout daily activities, making them ideal for elderly individuals or patients with mobility issues who are at risk of falls.

Manufacturers equip wristband detectors with features like vibration alerts, GPS tracking, and real-time fall detection algorithms that notify caregivers or emergency services in case of an incident. Adoption is strong in home care and elderly care facilities, where continuous monitoring of individuals in their daily environment is essential. The wristband type maintains its lead because it is user-friendly, offers greater comfort compared to pendant types, and supports a range of monitoring applications suited for both independent living and institutional care environments.

The home care segment represents about 54.0% of the total wearable fall detector market in 2025, making it the dominant application category. This position is linked to the growing number of elderly individuals and patients who prefer to receive care at home rather than in institutional settings. Wearable fall detectors play a crucial role in providing peace of mind for caregivers and families by offering real-time alerts, which help mitigate risks associated with falls in independent living scenarios.

These devices are especially valuable for elderly individuals who live alone or in semi-independent conditions, where immediate assistance may not be available. The segment is driven by the increasing adoption of telehealth, remote monitoring, and personal health devices that contribute to aging in place. Adoption is particularly strong in North America, Europe, and East Asia, where the aging population is substantial and the demand for in-home healthcare solutions is rising. Home care retains its leading position because it allows families to monitor loved ones safely, offering a sense of security for both patients and caregivers through continuous fall detection and emergency response capabilities.

The wearable fall detector market is growing as aging populations, increasing prevalence of chronic conditions and longer independent living periods drive demand for personal safety technologies. Wearables equipped with accelerometers, gyroscopes, and fall-detection algorithms enable real-time alerts to caregivers or emergency services when a fall occurs. Growth is supported by advances in sensor miniaturisation, connectivity and integration with health monitoring ecosystems. Adoption is limited by cost sensitivity, user comfort and battery life constraints. Manufacturers are developing smarter bracelets, pendants, wristbands and clip-on devices that prioritise accuracy, ease of use and seamless connectivity.

Demand is driven by the rapidly growing number of older adults living independently and the corresponding rise in falls-related healthcare costs and injury enforcement. Care providers, assisted living facilities and families look for solutions that enable immediate response to falls and improve safety in non clinical settings. Wearables offer discreet, continuous monitoring without the stigma or installation of wall mounted systems. As care models shift from hospital to home and remote settings, the appeal of portable fall detectors that link to mobile networks and alert services continues to increase.

Adoption is limited by several practical issues. Price remains a barrier in budget conscious senior care homes or among self pay older adults. User comfort is a concern some wearables may be bulky or intrusive, reducing consistent use. Battery life constraints and false alarm rates (for example during non fall high motion events) can undermine trust and willingness to adopt. Data privacy and connectivity reliability also affect confidence in continuous monitoring systems. These factors slow wider penetration, particularly in emerging markets or among first time users.

Key trends include integration of multi sensor fusion (accelerometer + gyroscope + ambient sensors) and artificial intelligence algorithms to improve detection accuracy and reduce false positives. Connectivity enhancements such as LTE/5G enabled straps and GPS fallback expand use beyond fixed home environments. Wearables are increasingly combined with other health monitoring features (heart rate, SpO₂, activity tracking) to improve value. The market is also diversifying into form factors suited for active seniors clip ons, smart watches and fitness bracelets with design focus on aesthetics and everyday wear. Regionally, growth is strong in Asia Pacific given rapid demographic ageing and expanding home care infrastructure.

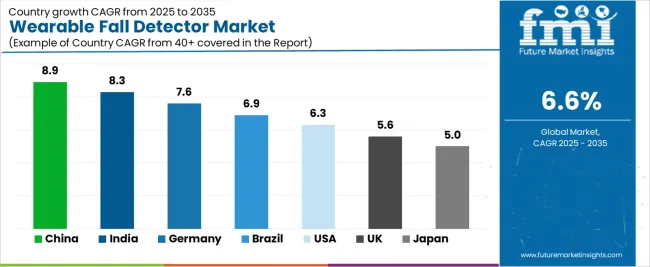

| Country | CAGR (%) |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| Brazil | 6.9% |

| USA | 6.3% |

| UK | 5.6% |

| Japan | 5.0% |

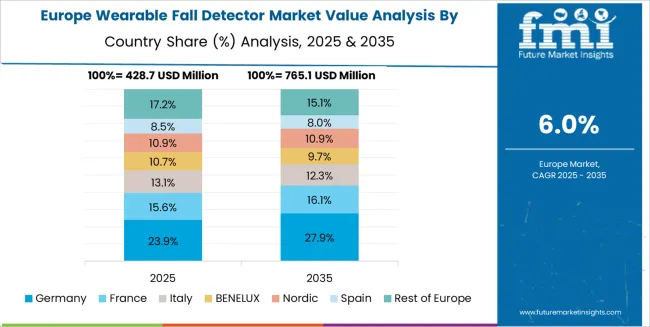

The Wearable Fall Detector Market is growing significantly worldwide, with China leading at an 8.9% CAGR through 2035, driven by advancements in wearable healthcare technologies, increased focus on elderly care, and the growing adoption of fall detection systems in both healthcare and home settings. India follows at 8.3%, supported by rising healthcare access, increasing elderly population, and growing demand for affordable safety solutions. Germany records 7.6%, reflecting high healthcare standards, strong medical device adoption, and increasing interest in autonomous health monitoring systems.

Brazil grows at 6.9%, benefiting from improvements in elderly care infrastructure and expanding wearable device adoption. The USA, at 6.3%, remains a mature market focused on innovative, multi-functional wearables and integration with remote health monitoring systems, while the UK (5.6%) and Japan (5.0%) emphasize advanced sensor technology and real-time fall detection solutions for improving senior citizen safety.

China is projected to grow at a CAGR of 8.9% through 2035 in the wearable fall detector market. Increasing healthcare awareness, an aging population, and government initiatives supporting elder care fuel demand for wearable safety devices. Manufacturers focus on providing compact, user-friendly fall detection technology, particularly for elderly individuals. Hospitals and home care agencies adopt wearable fall detectors to monitor patients’ health remotely. The market is further supported by integration with telemedicine services, enabling real-time alerts for caregivers and family members. Expansion of rehabilitation programs and elderly care facilities also contribute to the growing need for these devices.

India is expected to grow at a CAGR of 8.3% through 2035 in the wearable fall detector market. The country’s rapidly aging population and increasing awareness of elder care needs drive demand for wearable fall detectors. Manufacturers focus on developing affordable, reliable devices suited to both urban and rural markets. Healthcare providers, including hospitals and nursing homes, integrate fall detection systems into their patient care programs to ensure timely intervention. Government initiatives aimed at improving elderly healthcare infrastructure further contribute to the market’s expansion. The increasing availability of home-based care services also accelerates adoption.

Germany is projected to grow at a CAGR of 7.6% through 2035 in the wearable fall detector market. Strict regulatory standards for medical devices and safety enhance demand for certified fall detection solutions. German manufacturers provide wearable devices that comply with EU safety guidelines, ensuring reliability and accuracy. Healthcare providers, including hospitals and senior care homes, adopt fall detectors as part of patient safety programs. Additionally, the market benefits from increasing technological advancements, such as fall detection integrated with other health-monitoring systems. Expansion of elderly care services also contributes to greater market penetration.

Brazil is anticipated to grow at a CAGR of 6.9% through 2035 in the wearable fall detector market. Government programs aimed at improving elderly healthcare infrastructure and services support the adoption of wearable fall detection devices. Local manufacturers focus on developing affordable, durable devices that meet the needs of elderly populations, especially in rural areas. Healthcare institutions, including public hospitals and private clinics, increasingly implement fall detection systems in patient care protocols. The market is further influenced by growing health insurance coverage and reimbursement policies for wearable health-monitoring devices.

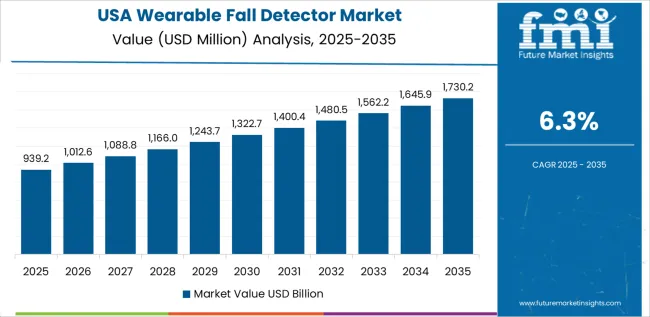

USA is growing at a CAGR of 6.3% through 2035 in the wearable fall detector market. The rising elderly population, along with increasing awareness of fall-related injuries, fuels demand for wearable safety devices in healthcare settings. Elder care services, including nursing homes and home care agencies, incorporate fall detection into their monitoring systems to improve patient outcomes. Manufacturers focus on providing advanced devices with integrated GPS tracking, real-time alerts, and long-lasting battery life. The market also benefits from technological advancements in wearables that combine fall detection with health-monitoring features for comprehensive care.

UK is growing at a CAGR of 5.6% through 2035 in the wearable fall detector market. Technological innovations in wearable devices, such as improved sensors and real-time data processing, drive market adoption. The aging population in the UK and increasing demand for home healthcare services support the use of fall detection devices in both residential and healthcare settings. Wearable fall detectors are integrated with health-monitoring apps and emergency response systems for enhanced safety. The market also benefits from government-supported initiatives focusing on elderly care and technology-enabled healthcare services.

Japan is projected to grow at a CAGR of 5% through 2035 in the wearable fall detector market. Japan’s rapidly aging population and the increasing focus on home care services drive the demand for wearable fall detection devices. Manufacturers are developing lightweight, discreet, and comfortable devices that cater to elderly individuals living independently or with minimal assistance. Japan’s healthcare system, known for its high standards, encourages the adoption of advanced monitoring devices in elder care programs. The market also benefits from government initiatives promoting the safety of older adults in home care environments.

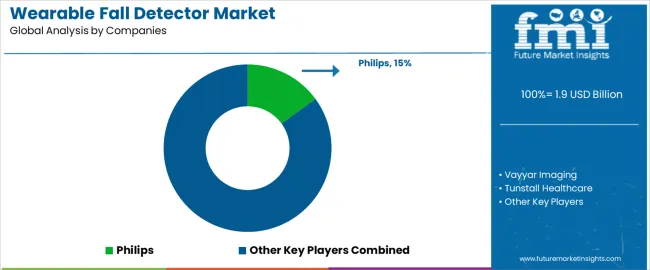

The global wearable fall detector market is highly competitive, driven by a mix of established tech giants, healthcare providers, and specialized medical device companies offering solutions for elderly care, patient monitoring, and emergency response. Philips, Vayyar Imaging, and Tunstall Healthcare hold strong positions by combining advanced fall detection sensors with integrated health-monitoring platforms for at-risk individuals, often linked to real-time alert systems and emergency services. ADT Inc., Bay Alarm Medical, and Medical Guardian strengthen their market presence with wearable devices that not only detect falls but also offer emergency communication capabilities, catering to senior care and independent-living markets. MobileHelp and LifeFone contribute to the growing adoption of wearable health tech with easy-to-use, reliable devices that support both fall detection and health monitoring in a single solution.

Tech companies like Apple Inc., Samsung Electronics, Huawei Technologies, Fitbit, Garmin, and GreatCall are also significant players, incorporating fall detection features into their smartwatches and fitness trackers. These companies enhance their wearables with additional health features such as heart-rate monitoring, sleep tracking, and fitness metrics, which appeal to both health-conscious consumers and the elderly population. VitalTech further broadens market offerings with healthcare-centric wearables that integrate fall detection with telehealth and care coordination platforms. Competition is influenced by device accuracy, battery life, integration with emergency services, and ease of use. Strategic differentiation depends on added functionalities, real-time alerting, and integration with digital health ecosystems. As aging populations grow globally, companies that offer comprehensive, user-friendly solutions with seamless emergency response systems are positioned to gain long-term market dominance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Wristband Type, Pendant Type, Smartphone-Compatible Type, Smart Clothing Type, Others |

| Application | Home Care, Elderly Care Facilities, Remote Health Monitoring, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Philips, Vayyar Imaging, Tunstall Healthcare, ADT Inc., Bay Alarm Medical, Medical Guardian, MobileHelp, LifeFone, Apple Inc., Samsung Electronics, Huawei Technologies, Fitbit, Garmin, GreatCall, VitalTech |

| Additional Attributes | Market share by type and application, wearable technology adoption trends, integration with emergency services and health monitoring systems, sensor accuracy improvements, growth of remote healthcare, consumer demand for comfort and ease of use, battery life improvements, regulatory environment across regions. |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global wearable fall detector market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the wearable fall detector market is projected to reach USD 3.6 billion by 2035.

The wearable fall detector market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in wearable fall detector market are wristband type, pendant type, smartphone-compatible type, smart clothing type and others.

In terms of application, home care segment to command 54.0% share in the wearable fall detector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Industrial Exoskeleton Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Wearable Beauty Market Size, Growth, and Forecast for 2025 to 2035

Wearable Medical Robots Market - Trends & Forecast 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Blood Pressure Monitor Market Trends and Forecast 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Wearable Fitness Technology Market Insights - Trends & Forecast 2025 to 2035

Wearable Computing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA