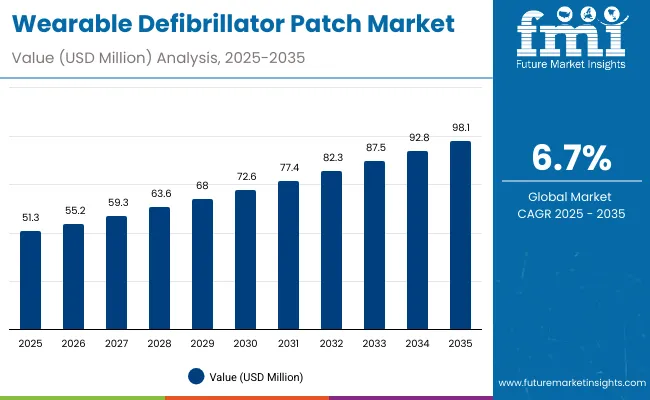

The global wearable defibrillator patch market is projected to grow from USD 51.3 million in 2025 to approximately USD 98.1 million by 2035, recording an absolute increase of USD 46.8 million over the forecast period. This translates into a total growth of 91.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.7% between 2025 and 2035.

Wearable Defibrillator Patch Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 51.3 million |

| Forecast Value in (2035F) | USD 98.1 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The overall market size is expected to grow by nearly 1.9X during the same period, supported by increasing demand for advanced cardiac monitoring technologies, growing prevalence of cardiovascular diseases, and rising adoption of wearable medical devices across the global healthcare and patient care sectors.

Between 2025 and 2030, the wearable defibrillator patch market is projected to expand from USD 51.3 million to USD 72.6 million, resulting in a value increase of USD 21.3 million, which represents 45.5% of the total forecast growth for the decade. This phase of development will be shaped by increasing cardiovascular disease prevalence, rising demand for remote patient monitoring solutions, and growing utilization in post-cardiac event care applications. Medical device manufacturers and cardiac care specialists are expanding their wearable technology capabilities to address the growing preference for continuous cardiac monitoring features in defibrillator patch systems.

From 2030 to 2035, the market is forecast to grow from USD 72.6 million to USD 98.1 million, adding another USD 25.5 million, which constitutes 54.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced cardiac monitoring technologies, the integration of AI-powered arrhythmia detection systems for premium wearable defibrillator products, and the development of enhanced connectivity features for specialized applications. The growing emphasis on preventive cardiac care and patient outcome optimization will drive demand for intelligent defibrillator patches with enhanced monitoring capabilities and improved therapeutic effectiveness.

Between 2020 and 2024, the wearable defibrillator patch market experienced steady growth, driven by increasing cardiovascular disease awareness and growing recognition of wearable cardiac monitoring systems' superior patient care capabilities across hospital and home care applications. The market developed as healthcare providers recognized the potential for wearable defibrillator technology to enhance patient outcomes while meeting modern healthcare requirements for continuous monitoring and emergency intervention. Technological advancement in patch design and cardiac detection algorithms began emphasizing the critical importance of maintaining therapeutic readiness while extending patient mobility and improving quality of life effectiveness.

The wearable defibrillator patch market represents a rapidly emerging medical technology opportunity at the intersection of cardiac care, wearable devices, and emergency intervention, with the market projected to expand from USD 51.3 million in 2025 to USD 98.1 million by 2035 at a steady 6.7% CAGR-a 1.9X growth driven by accelerating cardiovascular disease prevalence, healthcare provider demand for continuous monitoring solutions, and the integration of advanced cardiac detection technology into portable emergency care devices.

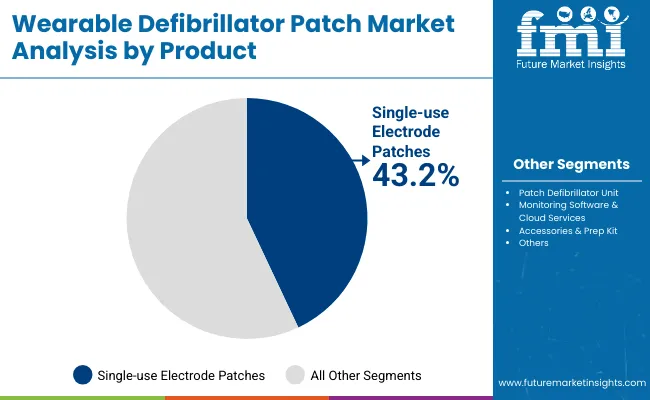

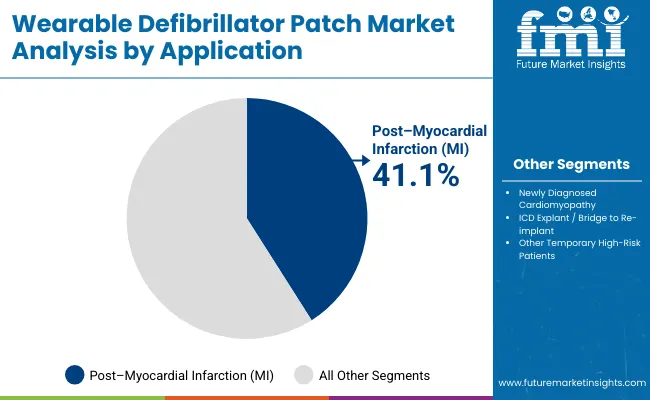

This convergence opportunity leverages the growing need for cardiac protection, the desire for patient mobility during recovery, and advances in wearable medical technology to create products that offer life-saving intervention capabilities in a comfortable, continuously wearable format. Single-use electrode patches lead with 43.2% market share due to their reliability and ease of use, while post-myocardial infarction applications dominate demand as healthcare providers increasingly focus on preventing sudden cardiac death in high-risk patients. Geographic growth is strongest in developed markets where advanced cardiac care infrastructure and healthcare spending support adoption of premium wearable medical devices.

Pathway A - Single-use Electrode Patch Technology Leadership

The dominant product technology offers superior reliability, consistent electrical contact, and simplified patient management essential for life-critical applications. Companies developing advanced single-use electrode systems with enhanced adhesion, improved signal quality, and extended wear duration will capture the leading technology segment. Expected revenue pool: USD 35-45 million.

Pathway B - Post-Myocardial Infarction Care Applications

The largest application segment benefits from growing focus on preventing sudden cardiac death and improving post-cardiac event patient outcomes. Providers developing comprehensive post-MI monitoring solutions with integrated emergency intervention, physician connectivity, and patient education features will dominate this primary market. Opportunity: USD 40-55 million.

Pathway C - Advanced Arrhythmia Detection and AI Integration

Next-generation products require sophisticated cardiac rhythm analysis capable of distinguishing life-threatening arrhythmias from benign irregularities with minimal false positives. Companies investing in advanced AI algorithms, machine learning capabilities, and clinical validation will create competitive differentiation and premium positioning. Revenue uplift: USD 15-25 million.

Pathway D - Enhanced Patient Comfort and Wearability

Modern patients require devices that support normal daily activities while providing continuous protection. Developing products with improved adhesive systems, waterproof designs, and ergonomic form factors addresses growing patient compliance demands while reducing discontinuation rates. Expected upside: USD 10-18 million.

Pathway E - Integrated Healthcare System Connectivity

Advanced products require seamless integration with electronic health records, physician monitoring systems, and emergency response networks. Systems offering comprehensive connectivity options, real-time data transmission, and automated emergency alerts create enhanced value propositions for healthcare providers. USD 12-20 million.

Pathway F - Extended Battery Life and Reliability Features

Patients require confidence in device performance during extended wear periods, especially during sleep and physical activity. Companies developing advanced power management, battery technology, and device reliability features will capture premium positioning opportunities. Pool: USD 8-15 million.

Pathway G - Pediatric and Specialized Patient Applications

Children and patients with unique anatomical or medical requirements represent growing opportunities for specialized device variants. Developing tailored solutions for pediatric care, elderly patients, and specific cardiac conditions expands beyond standard adult applications. Expected revenue: USD 6-12 million.

Pathway H - Home Care and Remote Monitoring Integration

Healthcare cost reduction drives demand for solutions that enable safe patient discharge and home-based recovery monitoring. Companies developing comprehensive home care packages with caregiver training, remote physician oversight, and emergency coordination will capture emerging market opportunities. Pool: USD 8-14 million.

Market expansion is being supported by the increasing global prevalence of cardiovascular diseases and the corresponding shift toward wearable cardiac monitoring technologies that can provide superior patient protection while meeting healthcare requirements for continuous monitoring and emergency intervention capabilities. Modern healthcare providers and cardiac specialists are increasingly focused on incorporating wearable defibrillator patches to enhance patient outcomes while satisfying demands for advanced cardiac care technologies and portable life-saving devices. Wearable defibrillator patches' proven ability to deliver superior patient mobility, continuous protection, and emergency intervention capabilities makes them essential devices for high-risk cardiac patients and post-procedure monitoring applications.

The growing emphasis on preventive cardiac care and patient-centered treatment approaches is driving demand for high-quality wearable defibrillator patch products that can support distinctive patient experiences and comprehensive cardiac protection across post-myocardial infarction, high-risk patient, and transitional care categories. Healthcare provider preference for devices that combine continuous monitoring excellence with emergency intervention capabilities is creating opportunities for innovative wearable implementations in both hospital discharge and long-term care applications. The rising influence of remote patient monitoring and connected healthcare ecosystems is also contributing to increased adoption of premium wearable defibrillator patch products that can provide authentic healthcare integration characteristics.

The market is segmented by product and application. The demand for products is divided into single-use electrode patches, patch defibrillator unit, monitoring software & cloud services, accessories & prep kit, and others. Based on application, the market is categorized into post-myocardial infarction (MI), newly diagnosed cardiomyopathy, ICD explant/bridge to re-implant, and other temporary high-risk patients.

The single-use electrode patches segment is projected to account for 43.2% of the wearable defibrillator patch market in 2025, reaffirming its position as the leading product category. Medical device manufacturers and cardiac care providers increasingly utilize single-use electrode patch technology for their superior reliability, consistent electrical contact, and ease of patient management in life-critical wearable defibrillator applications across diverse healthcare settings. Single-use electrode technology's standardized design and proven performance directly address the clinical requirements for consistent cardiac monitoring and reliable emergency intervention in wearable defibrillator operations.

This product segment forms the foundation of modern wearable cardiac protection applications, as it represents the technology with the greatest reliability potential and established compatibility across multiple patient care systems. Manufacturer investments in electrode optimization and adhesive enhancement continue to strengthen adoption among medical device producers. With healthcare providers prioritizing patient safety and device reliability, single-use electrode patch systems align with both clinical effectiveness objectives and patient comfort requirements, making them the central component of comprehensive wearable defibrillator strategies.

Post-myocardial infarction (MI) applications are projected to represent the largest share of wearable defibrillator patch demand in 2025 at 41.1%, underscoring their critical role as the primary application for cardiac protection devices in post-cardiac event patient care and hospital discharge protocols. Healthcare providers and cardiologists prefer wearable defibrillator systems for their exceptional patient protection capabilities, continuous monitoring features, and ability to maintain therapeutic readiness while supporting patient mobility requirements during post-MI recovery periods. Positioned as essential devices for high-risk cardiac patient management, wearable defibrillator patches offer both life-saving intervention and quality of life enhancement advantages.

The segment is supported by continuous growth in post-cardiac event care protocols and the growing availability of advanced wearable cardiac technologies that enable enhanced patient outcomes and risk reduction at the post-hospital discharge level. Additionally, healthcare systems are investing in preventive cardiac care technologies to support patient safety improvement and healthcare cost optimization. As cardiovascular disease management continues to evolve and providers seek superior patient protection solutions, post-myocardial infarction applications will continue to dominate the application landscape while supporting technology advancement and patient care optimization strategies.

The wearable defibrillator patch market is advancing steadily due to increasing cardiovascular disease prevalence and growing demand for continuous cardiac monitoring solutions that emphasize superior patient protection across hospital discharge and high-risk patient management applications. However, the market faces challenges, including high device costs compared to traditional monitoring alternatives, technical complexity in arrhythmia detection algorithms, and competition from implantable cardiac devices. Innovation in battery life extension and patient comfort enhancement continues to influence market development and expansion patterns.

Expansion of Post-Cardiac Event Care Protocols

The growing adoption of wearable defibrillator patches in comprehensive post-myocardial infarction care and transitional cardiac monitoring applications is enabling healthcare providers to develop protocols that provide distinctive patient protection capabilities while commanding premium positioning and enhanced patient outcome characteristics. Advanced care protocols provide superior safety while allowing more sophisticated cardiac risk management across various patient categories and treatment segments. Healthcare systems are increasingly recognizing the competitive advantages of wearable cardiac protection positioning for comprehensive patient care development and cardiac specialty market penetration.

Integration of Advanced Arrhythmia Detection and AI Analytics

Modern wearable defibrillator patch suppliers are incorporating advanced cardiac rhythm analysis algorithms, machine learning systems, and predictive analytics technologies to enhance detection accuracy, improve patient outcomes, and meet healthcare provider demands for intelligent and reliable cardiac monitoring solutions. These programs improve device performance while enabling new applications, including personalized cardiac care and predictive intervention systems. Advanced AI integration also allows suppliers to support premium market positioning and clinical excellence leadership beyond traditional cardiac monitoring products.

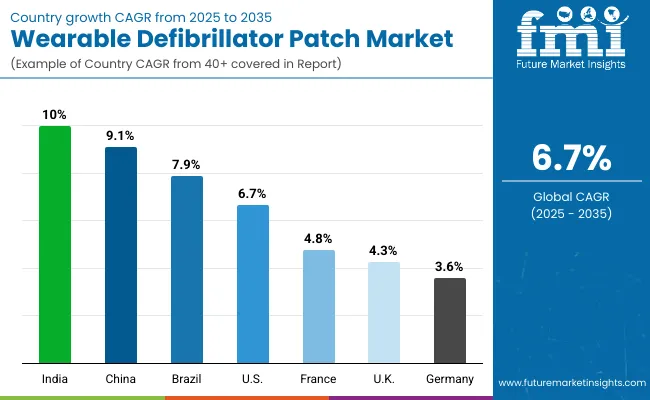

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 10.0% |

| China | 9.1% |

| Brazil | 7.9% |

| USA | 6.7% |

| France | 4.8% |

| UK | 4.3% |

| Germany | 3.6% |

The wearable defibrillator patch market is experiencing robust growth globally, with India leading at a 10.0% CAGR through 2035, driven by expanding healthcare infrastructure, rising cardiovascular disease awareness, and increasing adoption of advanced cardiac monitoring technologies. China follows at 9.1%, supported by growing healthcare investments, expanding middle-class access to premium medical devices, and rising focus on preventive cardiac care. Brazil shows growth at 7.9%, emphasizing healthcare system modernization and expanding cardiac care capabilities. The USA demonstrates 6.7% growth, prioritizing advanced cardiac care innovation and comprehensive patient monitoring solutions. France records 4.8%, focusing on healthcare technology integration and patient outcome optimization. Europe exhibits 4.3% growth, supported by established cardiac care infrastructure and advanced medical device adoption. The UK demonstrates 4.3% growth, emphasizing clinical excellence and patient safety priorities. Germany shows 3.6% growth, focusing on precision medical technology and high-quality cardiac care solutions.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from wearable defibrillator patches in India is projected to exhibit exceptional growth with a CAGR of 10.0% through 2035, driven by expanding healthcare infrastructure and rising awareness of cardiovascular disease prevention across major urban and developing healthcare centers. The country's growing medical device market and increasing adoption of advanced cardiac monitoring technologies are creating substantial demand for wearable defibrillator solutions in both private and public healthcare applications. Major medical device manufacturers and cardiac care companies are establishing comprehensive distribution and clinical support capabilities to serve both domestic healthcare needs and regional export markets.

Revenue from wearable defibrillator patches in China is expanding at a CAGR of 9.1%, supported by growing healthcare investments, increasing middle-class access to premium medical technologies, and expanding cardiac care infrastructure with advanced monitoring capabilities. The country's developing healthcare ecosystem and expanding medical device manufacturing sector are driving demand for sophisticated wearable cardiac protection products across both urban healthcare facilities and emerging regional medical centers. International medical device companies and domestic healthcare manufacturers are establishing comprehensive production and clinical support capabilities to address growing market demand for advanced cardiac monitoring solutions.

Revenue from wearable defibrillator patches in Brazil is projected to grow at a CAGR of 7.9% through 2035, driven by healthcare system modernization initiatives, expanding cardiac care capabilities, and growing focus on preventive medicine requiring advanced patient monitoring solutions. Brazil's developing healthcare infrastructure and increasing emphasis on cardiac disease prevention are creating substantial demand for both standard and premium wearable defibrillator patch varieties. Leading medical device companies and cardiac care specialists are establishing comprehensive clinical strategies to serve both Brazilian markets and growing regional healthcare demand.

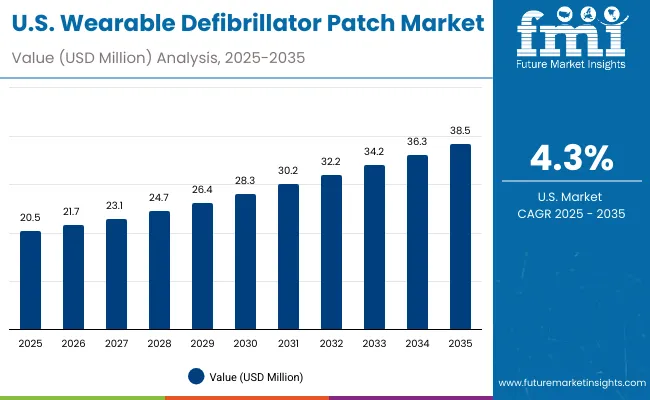

Revenue from wearable defibrillator patches in the United States is projected to grow at a CAGR of 6.7% through 2035, supported by the country's advanced cardiac care sector, innovation leadership capabilities, and established market for premium patient monitoring solutions. American healthcare providers and medical device manufacturers prioritize clinical excellence, patient safety, and technological advancement, making wearable defibrillator patches essential devices for both hospital discharge protocols and long-term cardiac care management. The country's comprehensive healthcare ecosystem and clinical adoption patterns support continued market development.

Revenue from wearable defibrillator patches in France is projected to grow at a CAGR of 4.8% through 2035, supported by the country's healthcare technology integration initiatives, advanced cardiac care development sector, and established expertise in premium medical device applications. French healthcare providers' focus on clinical excellence, patient outcome optimization, and technological innovation creates steady demand for intelligent cardiac monitoring products. The country's attention to healthcare quality and patient safety drives consistent adoption across both traditional hospital and emerging home care applications.

Revenue from wearable defibrillator patches in the United Kingdom is projected to grow at a CAGR of 4.3% through 2035, supported by the country's clinical excellence priorities, advanced healthcare development sector, and established focus on patient safety and cardiac care innovation. British healthcare providers' emphasis on evidence-based medicine, clinical outcomes, and patient-centered care creates steady demand for advanced cardiac monitoring products. The country's attention to healthcare quality and clinical effectiveness drives consistent adoption across both NHS and private healthcare applications.

Revenue from wearable defibrillator patches in Germany is projected to grow at a CAGR of 3.6% through 2035, supported by the country's precision medical technology sector, advanced engineering capabilities, and established reputation for producing superior medical devices while working to enhance cardiac monitoring precision and develop high-quality wearable technologies. Germany's medical device industry continues to benefit from its reputation for engineering excellence while focusing on clinical innovation and manufacturing precision.

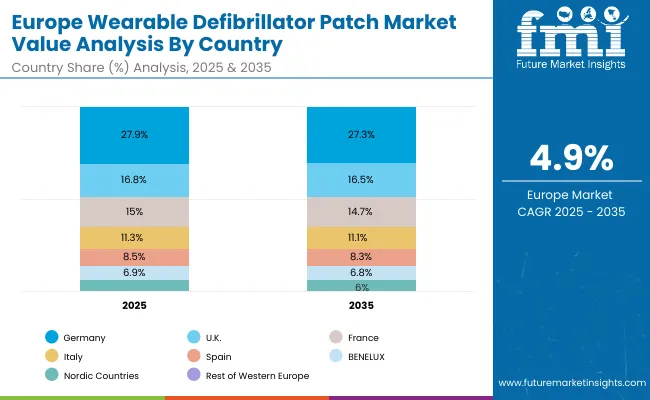

The wearable defibrillator patch market in Europe is projected to grow at a CAGR of 4.9% from 2025 to 2035. Germany is expected to maintain its leadership position with a 27.9% market share in 2025, declining slightly to 27.3% by 2035, supported by its precision medical technology sector, advanced healthcare infrastructure, and clinical capabilities serving regional and international markets.

The United Kingdom follows with a 16.8% share in 2025, projected to reach 16.5% by 2035, driven by priorities in advanced cardiac care, clinical excellence, and evidence-based patient monitoring. France holds a 15.0% share in 2025, expected to maintain 14.7% by 2035, supported by healthcare technology integration and medical device adoption, though facing challenges from competition and regulatory dynamics.

Italy accounts for 11.3% in 2025, projected to ease to 11.1% by 2035, while Spain contributes 8.5% in 2025, declining slightly to 8.3% by 2035. The Nordic Countries represent 6.9% in 2025, shifting marginally to 6.8% in 2035, while BENELUX holds 6.0% by 2035. The Rest of Western Europe region is expected to account for 7.6% in 2025, moderating to 6.0% by 2035, reflecting mixed growth dynamics across smaller and mature markets.

The wearable defibrillator patch market in Japan is projected to grow steadily from 2025 to 2035, supported by advanced healthcare infrastructure, a strong cardiac care ecosystem, and adoption of digital monitoring technologies.

Single-use electrode patches are expected to maintain their leadership position with a 44.0% market share in 2025, projected to remain dominant at 43.8% by 2035, reflecting recurring demand in patient management and replacement cycles. Patch defibrillator units follow with 25.0% in 2025, expected to sustain 24.7% by 2035, supported by robust adoption across hospitals and outpatient settings.

Monitoring software & cloud services hold 22.0% in 2025, forecasted to increase marginally to 22.5% by 2035, leveraging Japan’s digital health and AI-enabled monitoring capabilities. Accessories & prep kits account for 9.0% in 2025, expected to moderate slightly to 9.0% by 2035, reflecting stable but limited growth in consumables.

The wearable defibrillator patch market in South Korea is projected to expand through 2035, driven by rapid adoption of telehealth, strong hospital integration, and increasing reliance on home-based cardiac monitoring.

Home care is expected to maintain its leadership with a 40.0% market share in 2025, projected at 40.2% by 2035, supported by consumer-driven healthcare adoption and favorable government policies for remote cardiac management. Hospitals follow closely with 36.0% in 2025, projected to sustain 35.8% by 2035, reflecting South Korea’s strong tertiary care network and technology integration in clinical practice.

Cardiology & electrophysiology clinics account for 24.0% in 2025, expected to remain steady at 24.0% by 2035, supported by specialized expertise and niche demand from referred patients requiring advanced cardiac monitoring.

The wearable defibrillator patch market is characterized by competition among established medical device companies, specialized cardiac monitoring manufacturers, and integrated healthcare technology suppliers. Companies are investing in advanced cardiac rhythm detection technologies, patient comfort optimization systems, application-specific product development, and comprehensive clinical support capabilities to deliver consistent, high-performance, and reliable wearable defibrillator products. Innovation in detection accuracy enhancement, battery life extension, and customized patient care compatibility is central to strengthening market position and healthcare provider satisfaction.

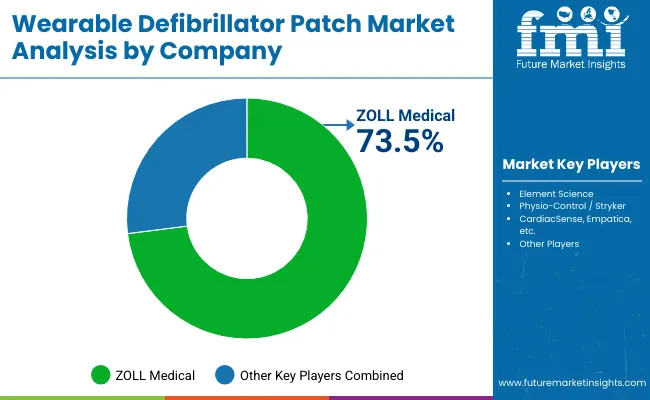

ZOLL Medical leads the market with a dominant 73.5% share, focusing on comprehensive cardiac care solutions and advanced emergency medical technologies, offering premium wearable defibrillator patch products with emphasis on clinical excellence and life-saving intervention capabilities. Other key players provide specialized cardiac monitoring and emergency response capabilities with focus on innovation and clinical support. Physio-Control/Stryker delivers integrated emergency medical solutions with emphasis on healthcare system integration and operational excellence. Cardiac Science specializes in cardiac monitoring technologies with focus on detection accuracy and clinical reliability. Empatica focuses on wearable health monitoring with emphasis on advanced sensor technology and patient experience optimization.

Key Players in the Wearable Defibrillator Patch Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 51.3 million |

| Product | Single-use Electrode Patches, Patch Defibrillator Unit, Monitoring Software & Cloud Services, Accessories & Prep Kit, Others |

| Application | Post-Myocardial Infarction (MI), Newly Diagnosed Cardiomyopathy, ICD Explant/Bridge to Re-implant, Other Temporary High-Risk Patients |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ZOLL Medical, Physio-Control/Stryker, Cardiac Science, Empatica |

| Additional Attributes | Dollar sales by product and application, regional demand trends, competitive landscape, technological advancements in cardiac monitoring, healthcare integration initiatives, patient outcome optimization programs, and clinical excellence enhancement strategies |

The global wearable defibrillator patch market is valued at USD 51.3 million in 2025.

The size for the wearable defibrillator patch market is projected to reach USD 98.1 million by 2035.

The wearable defibrillator patch market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product segments in the wearable defibrillator patch market are single-use electrode patches, patch defibrillator unit, monitoring software & cloud services, accessories & prep kit, and others.

In terms of application, post-myocardial infarction (MI) segment is set to command 41.1% share in the wearable defibrillator patch market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA