The wearable sensor market is expanding rapidly, driven by advancements in miniaturization, connectivity, and sensor fusion technologies that enable real-time health, fitness, and activity monitoring. The proliferation of smart devices and the integration of IoT ecosystems have accelerated adoption across consumer, healthcare, and industrial verticals.

Rising awareness of preventive healthcare and the growing demand for remote patient monitoring solutions have further strengthened market momentum. The current scenario reflects widespread utilization in wristwear, footwear, and bodywear applications, supported by innovations in biosensing and motion tracking.

Future growth is expected to be reinforced by increasing application diversity, including smart textiles and AR/VR-enabled devices. With continuous progress in data accuracy, power efficiency, and design optimization, the wearable sensor market is positioned for sustained expansion across multiple end-use domains globally.

| Metric | Value |

|---|---|

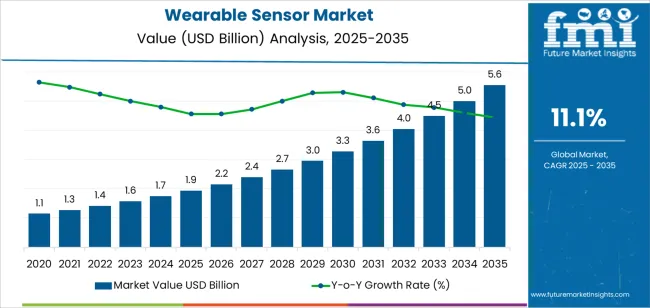

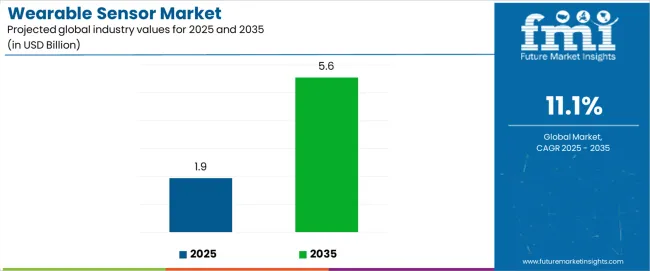

| Wearable Sensor Market Estimated Value in (2025 E) | USD 1.9 billion |

| Wearable Sensor Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 11.1% |

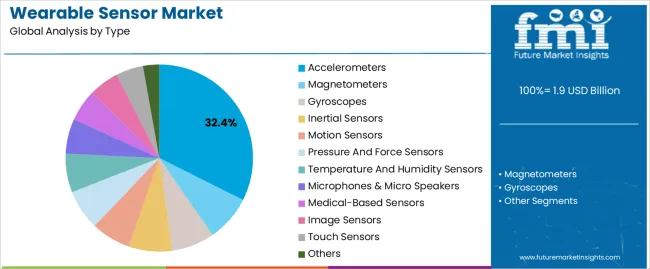

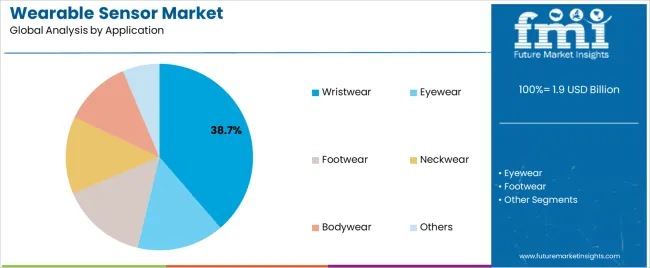

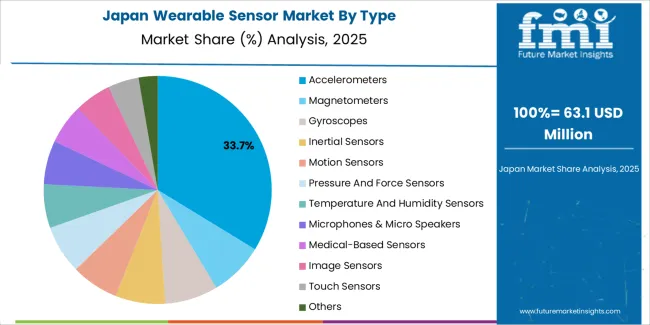

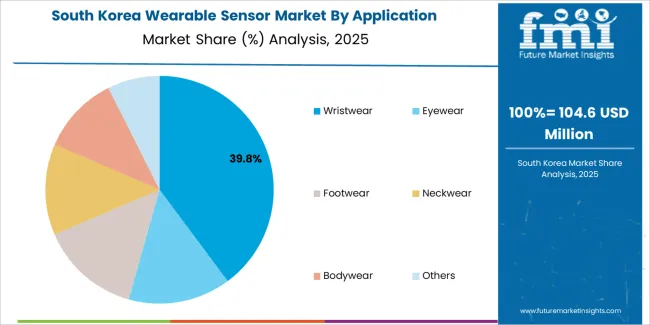

The market is segmented by Type, Application, and Vertical and region. By Type, the market is divided into Accelerometers, Magnetometers, Gyroscopes, Inertial Sensors, Motion Sensors, Pressure And Force Sensors, Temperature And Humidity Sensors, Microphones & Micro Speakers, Medical-Based Sensors, Image Sensors, Touch Sensors, and Others. In terms of Application, the market is classified into Wristwear, Eyewear, Footwear, Neckwear, Bodywear, and Others. Based on Vertical, the market is segmented into Consumer, Healthcare, Industrial, and Other Verticals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The accelerometers segment leads the type category in the wearable sensor market, holding approximately 32.4% share. Its dominance is driven by its critical role in motion detection, orientation tracking, and activity recognition across various wearable devices.

Accelerometers are integral to smartwatches, fitness bands, and medical monitoring systems, enabling continuous user movement analysis and gesture control. Their compact size, low power consumption, and integration compatibility with microcontrollers have facilitated widespread deployment.

Growth in this segment is supported by ongoing product innovation in multi-axis and MEMS-based accelerometers that deliver enhanced precision. The increasing emphasis on user experience and data-driven health insights continues to sustain demand, positioning accelerometers as a foundational component within the wearable sensor ecosystem..

The wristwear segment dominates the application category, accounting for approximately 38.7% share of the wearable sensor market. This leadership is attributed to the strong consumer base for fitness trackers, smartwatches, and health monitoring bands.

The segment benefits from high device penetration, continuous product innovation, and increasing functionality integration such as heart rate monitoring, oxygen saturation measurement, and sleep tracking. Enhanced Bluetooth and cloud connectivity have expanded application scope, allowing seamless data transfer and real-time analytics.

The convenience of wrist-based devices for everyday use and their aesthetic appeal have further fueled adoption. With major technology brands investing heavily in next-generation wearables, the wristwear segment is expected to maintain its leading share in the foreseeable future..

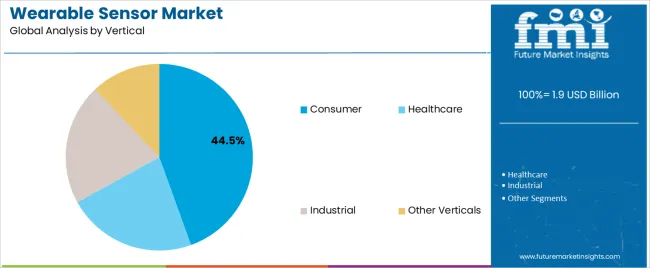

The consumer segment leads the vertical category, holding approximately 44.5% share of the wearable sensor market. This dominance is driven by the widespread adoption of fitness and lifestyle wearables among health-conscious individuals seeking real-time activity tracking.

The segment benefits from the integration of multi-sensor systems that measure diverse parameters such as motion, temperature, and biometrics, enhancing user engagement and personalization. Expanding disposable incomes and growing demand for connected wellness ecosystems have reinforced market penetration.

Additionally, increasing collaborations between technology firms and fitness platforms are accelerating product innovation. With wearable technology becoming a mainstream component of consumer electronics, the consumer segment is projected to sustain its market leadership over the forecast period..

Wearable Sensor Companies Expand Product Offerings Beyond Basic Fitness Tracking

The functions of wearable sensor products are becoming more complex, beyond simple fitness tracking. By making this tactical change, they can reach a larger market of health-conscious customers looking for more comprehensive well-being insights.

These firms strive to distinguish their goods and target higher-value market niches by integrating wearable technology sensors that track vital indications, including blood oxygen levels, ECG readings, and sleep patterns. By diversifying their offerings, they position themselves as suppliers of critical health management solutions and reduce the risk associated with depending just on the fitness tracking sector.

For instance, in July 2025, Biostrap USA launched the new wearable Biostrap Kairos gadget, which measures stress resilience and provides insights into heart rate variability (HRV). Biostrap provides data visualization of the autonomic nervous system, which is supplemented by the unique Vital Science software for measuring the sympathetic and parasympathetic branches via a wrist-worn device.

Integration with Voice Assistants and AI Presents Opportunities in the Market

The increasing ubiquity of voice assistants and artificial intelligence (AI) presents a potential opportunity for wearable sensor manufacturers. This entails combining AI capabilities for natural language processing with wearables that include voice-activated functionalities.

Sensor-based wearables can improve user experiences by enabling hands-free engagement and intelligent help. Possibilities include developing wearables that blend perfectly with well-known voice assistant systems, encouraging user interaction, and presenting goods as state-of-the-art in the quickly changing field of AI-powered personal assistants.

Recognizing this potential, in October 2025, Wearable Devices Ltd., a technology growth company specializing in artificial intelligence (AI) powered touchless sensing wearables, announced the integration of a new gesture and voice-controlled interface for its Mudra Band for Apple Watch and AirTouch technology, which takes advantage of Apple's AI-based digital assistant, Siri.

Demand Non-intrusive Health Monitoring Solutions Creates Growth Prospects in the Market

To meet customer demand for non-intrusive health monitoring solutions, wearable sensor companies are investing in the creation of smart clothes and textile-based sensors. These businesses are developing cutting-edge items that easily fit into people' daily lives by directly integrating sensors into clothing.

This tactical move toward smart textiles creates additional revenue sources and broadens the addressable market beyond conventional wearables, providing substantial market potential. The wearable sensor industry can benefit from the confluence of fashion and technology by forming relationships with fashion labels and textile producers. This allows them to create compelling offers that appeal to consumers who value style.

| Attribute | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Segment | Accelerometers (Type) |

|---|---|

| Value CAGR (2025 to 2035) | 21.0% |

Based on type, the accelerometers segment is projected to rise at a 21.0% CAGR through 2035.

| Segment | Wristwear (Application) |

|---|---|

| Value CAGR (2025 to 2035) | 20.8% |

Based on application, the wristwear segment is anticipated to expand at a 20.8% CAGR through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 21.6% |

| United Kingdom | 22.7% |

| China | 21.5% |

| Japan | 22.1% |

| South Korea | 22.2% |

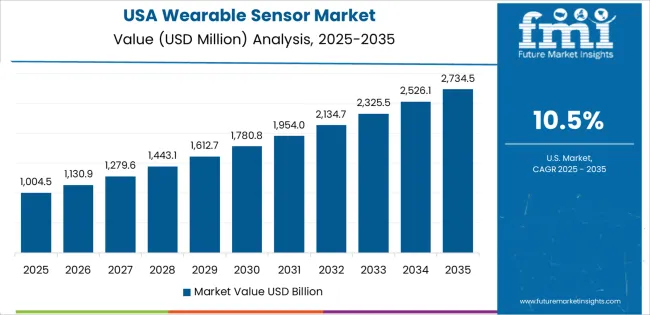

The demand for wearable sensors in the United States is predicted to surge at a 21.6% CAGR through 2035.

The sales of wearable sensors in the United Kingdom are expected to rise at a 22.7% CAGR through 2035.

The wearable sensor market growth in China is estimated at a 21.5% CAGR through 2035.

The demand for wearable sensors in China is anticipated to amplify at a 22.1% CAGR through 2035.

The sales of wearable sensors in South Korea are projected to surge at a 22.2% CAGR through 2035.

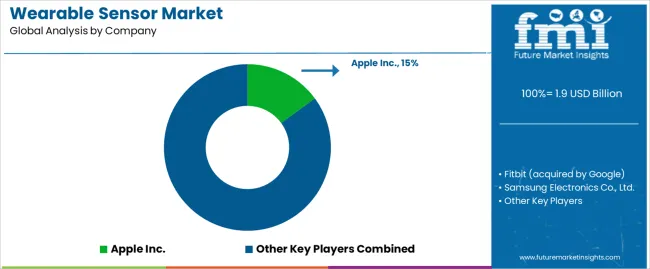

The competitive environment of the wearable sensor market is highlighted by strong competition among prominent competitors vying for market domination and a substantial portion of rising customer demand.

Leading companies like Apple, Samsung, and Fitbit are always racing to develop and improve their product ranges. These organizations rely on their strong brand awareness, broad ecosystems, and effective marketing techniques to sustain a competitive advantage.

Recent Developments

The global wearable sensor market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the wearable sensor market is projected to reach USD 5.6 billion by 2035.

The wearable sensor market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in wearable sensor market are accelerometers, magnetometers, gyroscopes, inertial sensors, motion sensors, pressure and force sensors, temperature and humidity sensors, microphones & micro speakers, medical-based sensors, image sensors, touch sensors and others.

In terms of application, wristwear segment to command 38.7% share in the wearable sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Sensors Market

Wearable Sensors For Animal Health Management Market

Wearable Fall Detector Market Size and Share Forecast Outlook 2025 to 2035

Wearable Industrial Exoskeleton Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA