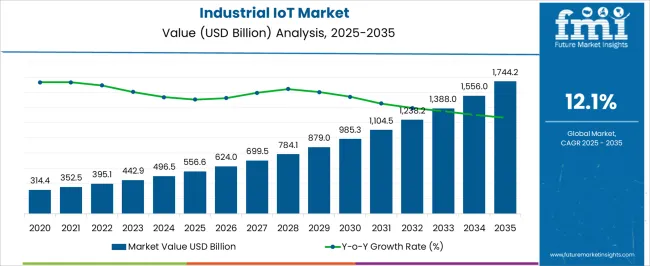

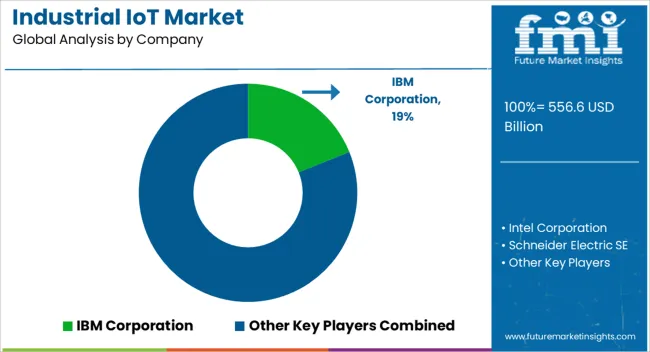

The Industrial IoT Market is estimated to be valued at USD 556.6 billion in 2025 and is projected to reach USD 1744.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

| Metric | Value |

|---|---|

| Industrial IoT Market Estimated Value in (2025 E) | USD 556.6 billion |

| Industrial IoT Market Forecast Value in (2035 F) | USD 1744.2 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The industrial IoT market is expanding rapidly as industries increasingly adopt connected technologies to optimize operations, enhance productivity, and enable predictive maintenance. Rising demand for automation, coupled with advancements in sensors, connectivity, and cloud platforms, has accelerated integration across manufacturing, logistics, energy, and aviation.

Governments and enterprises are investing heavily in smart infrastructure, digital twins, and edge computing, further supporting the widespread deployment of IoT solutions. The shift toward Industry 4.0 practices and the emphasis on data driven decision making are propelling growth, while cybersecurity and interoperability challenges are being addressed through ongoing technological upgrades.

The outlook remains highly favorable as enterprises across industrial verticals continue to prioritize digital transformation, cost efficiency, and sustainable operations.

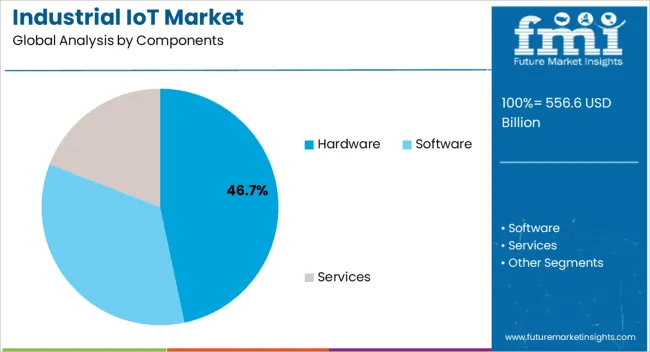

The hardware segment is projected to contribute 46.70% of total market revenue by 2025 within the component category, positioning it as the leading segment. This dominance is being driven by the increasing deployment of sensors, RFID tags, gateways, and edge devices that form the foundation of industrial IoT systems.

Hardware is critical for enabling real time data acquisition, connectivity, and communication across diverse industrial environments. Growing investment in smart factories, automation equipment, and industrial robotics has further strengthened demand for advanced hardware solutions.

Additionally, innovations in miniaturization, energy efficiency, and ruggedized devices have supported their integration into complex and harsh operating conditions. These factors collectively ensure the continued leadership of the hardware segment in the industrial IoT ecosystem.

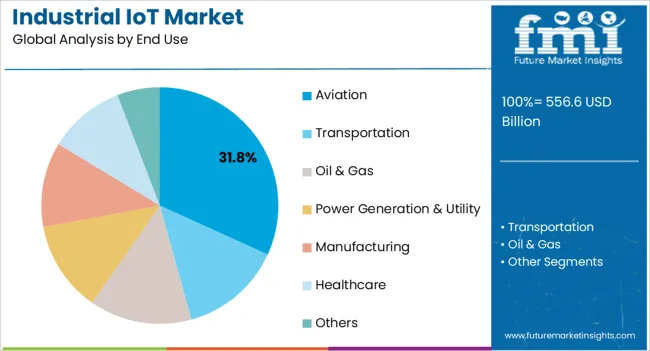

The aviation segment is expected to account for 31.80% of total revenue by 2025 within the end use category, making it the most prominent segment. This growth is being driven by increasing reliance on IoT solutions to improve operational efficiency, enhance safety, and reduce maintenance costs.

Aircraft health monitoring systems, predictive analytics for engine performance, and smart airport solutions are being widely adopted to streamline aviation operations. Real time connectivity has enabled better decision making, reduced downtime, and improved passenger experience.

The integration of IoT in aviation is also supported by regulatory emphasis on safety compliance and the need for data driven operational excellence. With its ability to deliver measurable cost savings and performance improvements, the aviation segment continues to lead industrial IoT adoption across end use categories.

The global industrial IoT industry size expanded at a striking CAGR of 10.0% from 2020 to 2025. In 2020, the global market size stood at USD 273,286.8 million. In the following years, the market witnessed monumental growth, accounting for USD 400,845.6 million in 2025.

Industrial IoT captures enormous volumes of data from connected systems, equipment, and gadgets. By analyzing this data, businesses gain insightful knowledge that is used to improve performance, spot trends, and find abnormalities. Businesses use these insights to make better decisions, run more efficiently, and discover new business prospects. The industrial IoT sector has grown significantly as a result of the development of key technologies including cloud computing, big data analytics, artificial intelligence (AI), and machine learning (ML). These technologies offer the tools and infrastructure required to manage and evaluate the copious amounts of data produced by IIoT devices. To derive actionable insights, and ultimately bolster industrial IoT demand and sales.

The adoption of AI and IoT technologies in the manufacturing industry has accelerated since the start of Industry 4.0. Production process optimization, early warnings, quality control, and machine failure prediction are all possible with AI and IoT-integrated systems.

Manufacturers may separate themselves from their competitors by acquiring precise data and developing unique AI applications, enhancing the demand for Industrial IoT. Since the market has grown in size, leading industry players have been able to provide their end users with considerably better industrial IoT features.

These data transmission components may not be built into machinery in older industrial units, necessitating their external installation. Some legacy equipment may also require modifications to retrofit these components, resulting in additional costs, and hampering the sales of Industrial IoT. One of the significant limitations to the growth of the global market is the ease with which alternative substitutes are available. In addition, the Internet of Things in developing countries may be viewed as one of the critical industrial IoT industry problems facing global agile IoT vendors.

Over the last five years, AI and IoT technologies have swiftly penetrated the medical sector. Medical wearables have begun to include AI and Internet of Things (IoT) technology, resulting in a more connected hospital ecosystem. According to the industrial IoT sales forecast, the Internet of Things (IoT) is predicted to enter mainstream industry use after years of expectation.

The interconnectedness of equipment throughout an industrial manufacturing complex creates security weaknesses, which could lead to operations being compromised. This is because it is impossible to tell where the data is coming from or going from a security standpoint. As a result, the most significant cybersecurity challenge for smart manufacturing on the factory floor is data visibility. For that reason, efficient demand for Industrial IoT should be met.

The global market is divided into three categories based on components, end-use, and region. Despite obstacles, the global IoT industry is predicted to develop at a reasonable rate from 2025 to 2035.

The global market is divided into three categories based on the components: services, software, and hardware. Hardware has the dominant market share and is expected to record a CAGR of 12.3% over the forecast period. In 2025, the hardware segment by components accounted for 53.6% shares in the global market. The backbone of the industrial IoT is networking technology, particularly wireless technology. By linking several machines and sensor nodes to the Internet, these technologies enable machine-to-machine communication. These technologies also allow for the collection of large volumes of data to improve decision-making.

The global market is divided into three categories based on the end-use: Aviation, transportation, oil & gas, power generation & utility, manufacturing, healthcare, and others. Manufacturing holds the dominant share in the market with a CAGR of 11.1% during the forecast period. In 2025, the manufacturing segment by end-use captured 34.6% shares in the global market. Manufacturing companies are rapidly adopting digital manufacturing technologies, and the Internet of Things (IIoT) plays a critical role in these cutting-edge technologies. The market is expected to develop significantly in the near future, owing to the strategic partnerships and alliances that stakeholders are forming. As well as the growing demand for Industrial IoT to provide flexibility, operational efficacy, and regulatory compliance.

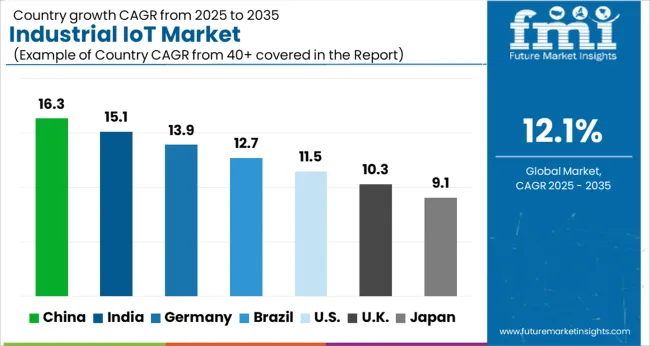

Due to the existence of well-established economies in this region, the North American region is predicted to hold the dominant share of USD 556.6 billion in the global market. This allows them to invest much in research and development. The growing acceptance of various smart connected devices and rapid digitalization throughout the IoT industry's verticals, and advancements in technological sectors have boosted the IoT industry's growing demand in the North American region. In 2025, North America captured 27.4% shares in the global market. The United States garnered 16.3% shares in the global market.

The United Kingdom has the second-prominent market size of USD 142.7 billion in the market. In 2025, the United Kingdom captured 13.2% shares in the global market. Owing to the rapid developments of IOTs in these regions, the European and Asia Pacific regions are expected to see significant growth. The region's growing population, rising research and development investments, and international and domestic IT businesses increased focus on the growth of big data analytics and cloud-based services may boost the market's growth.

| Country | CAGR Share in Global Market (2025) |

|---|---|

| United States | 16.3% |

| United Kingdom | 13.2% |

| China | 12.8% |

| Japan | 7.3% |

| India | 14.3% |

The competitive landscape of the IoT industry provides details on the total economic profit of vendors and companies. The sales and revenues generated in this industry, the IoT share of the worldwide market, the business organization overview, the launch of new products, and the opportunities of the market.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Components, End Use, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global industrial IoT market is estimated to be valued at USD 556.6 billion in 2025.

The market size for the industrial IoT market is projected to reach USD 1,744.2 billion by 2035.

The industrial IoT market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in industrial IoT market are hardware, software and services.

In terms of end use, aviation segment to command 31.8% share in the industrial IoT market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA