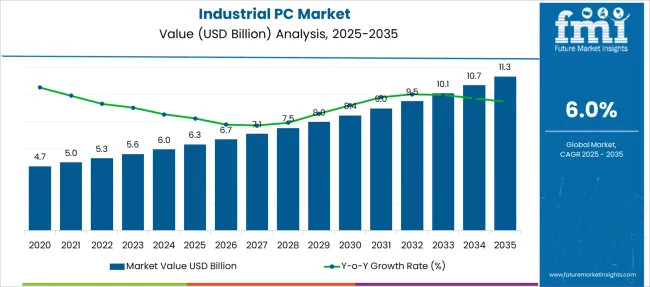

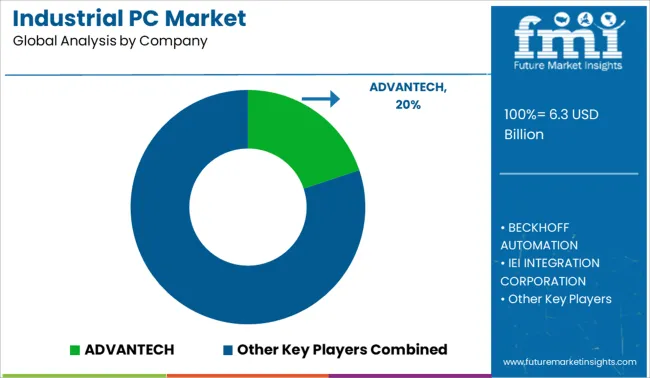

The Industrial PC Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Industrial PC Market Estimated Value in (2025 E) | USD 6.3 billion |

| Industrial PC Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The industrial PC market is expanding rapidly, driven by the increasing adoption of automation and digitization across various industries. Industrial PCs are becoming critical components for process control, monitoring, and data acquisition in manufacturing and industrial environments.

Advances in hardware reliability and ruggedness have enabled industrial PCs to operate effectively in harsh and demanding conditions. The push toward Industry 4.0 and smart factories has accelerated demand for integrated computing solutions that support real-time analytics and system connectivity.

Growth in process industries, such as chemicals, oil and gas, and food processing, is creating a steady need for industrial PCs to improve operational efficiency and ensure continuous production. Additionally, sales channels have shifted toward direct engagement models to provide customized solutions and enhanced customer support. The market is expected to continue growing as digital transformation initiatives deepen across industrial sectors. Segmental growth is anticipated to be led by Panel IPCs, Direct Sales channels, and Process Industries as the primary end-users.

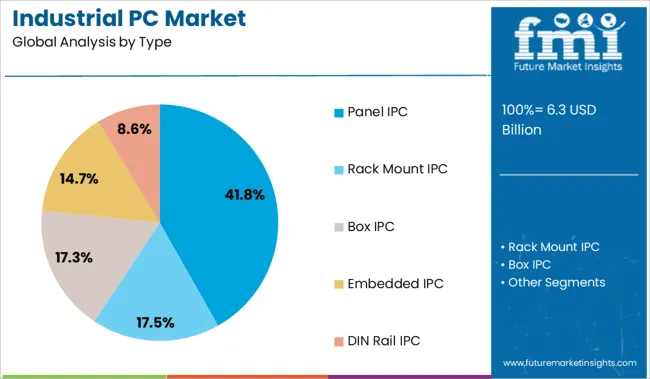

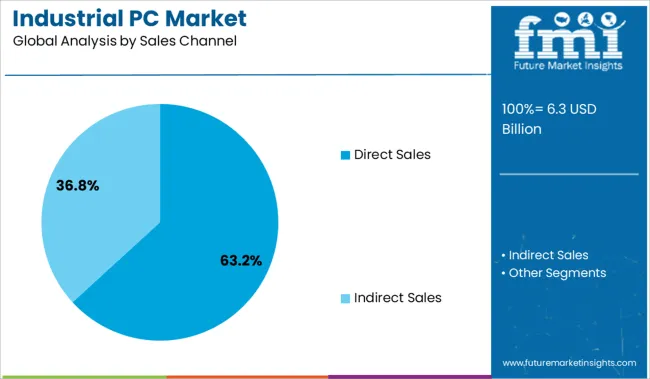

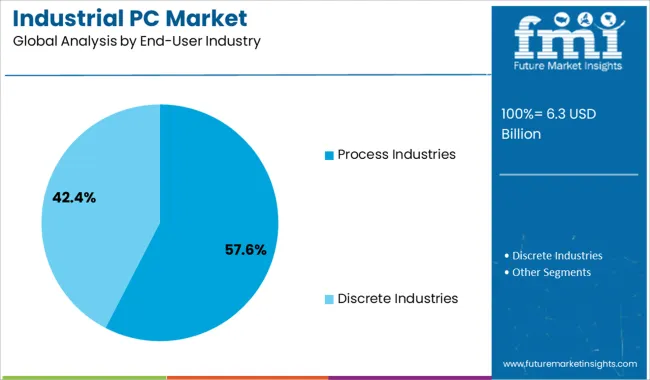

The market is segmented by Type, Sales Channel, and End-User Industry and region. By Type, the market is divided into Panel IPC, Rack Mount IPC, Box IPC, Embedded IPC, and DIN Rail IPC. In terms of Sales Channel, the market is classified into Direct Sales and Indirect Sales. Based on End-User Industry, the market is segmented into Process Industries and Discrete Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Panel IPC segment is projected to contribute 41.8% of the industrial PC market revenue in 2025, holding the largest share among product types. Panel IPCs are favored for their integrated touchscreen interfaces that enable intuitive operator control and real-time monitoring.

Their compact design and ease of installation have made them suitable for factory floors and control rooms alike. The demand for operator-friendly interfaces in automated processes has driven the adoption of panel IPCs, particularly in environments requiring frequent user interaction.

Additionally, improvements in display technology and processing power have enhanced their performance, supporting complex applications in process automation. The segment’s growth is further supported by the increasing need for ruggedized PCs capable of withstanding industrial hazards such as dust, vibration, and temperature fluctuations.

The Direct Sales segment is expected to account for 63.2% of the industrial PC market revenue in 2025, maintaining its position as the leading sales channel. Direct sales models have been favored because they enable manufacturers to offer customized solutions tailored to specific industrial requirements.

Through direct engagement, companies can provide technical support, system integration, and after-sales service more effectively. Industrial clients often prefer this approach for complex purchasing decisions that require close collaboration and specification alignment.

The direct sales channel also allows for better pricing control and customer relationship management. With increasing industrial automation projects and the demand for integrated computing solutions, direct sales channels are expected to retain their dominance in the market.

The Process Industries segment is projected to hold 57.6% of the industrial PC market revenue in 2025, establishing itself as the primary end-user category. Process industries including chemicals, pharmaceuticals, food and beverage, and oil and gas require robust computing solutions for continuous monitoring and control of production processes.

Industrial PCs in this sector play a vital role in ensuring operational efficiency, safety, and compliance with regulatory standards. The complexity and scale of process manufacturing have led to increased investments in automation and real-time data analytics, driving demand for industrial PCs.

Additionally, process industries prioritize reliability and uptime, making rugged and high-performance PCs essential. As these industries continue to modernize and adopt digital solutions, the process industries segment is expected to sustain its leadership in industrial PC consumption.

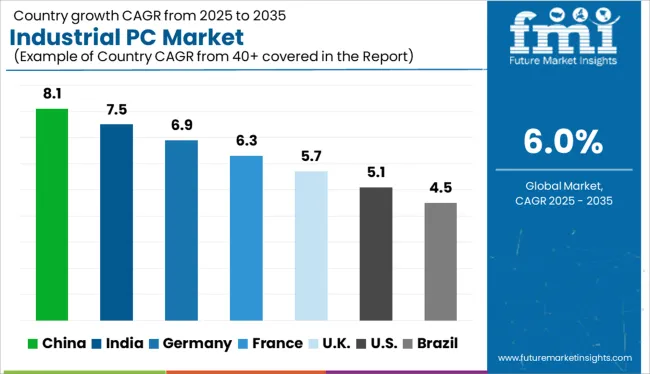

The global demand for industrial PCs is projected to rise at a robust CAGR of 6% during the forecast period from 2025 to 2035, totaling over USD 11.3 Billion by 2035. Growth in the industrial PC market is driven by increasing penetration of digitalization, the rise of Industry 4.0, rapid adoption of automation and IoT across manufacturing industries, the growing need for improving overall productivity, and rising awareness about resource optimization in manufacturing firms. and technological advancements in industrial PCs.

Industrial PCs are mostly used for process control and data acquisition applications. They help manufacturing plants be more productive and efficient by planning, controlling, and monitoring operations in real time. They can also be used as remote terminal units (RTIs) and supervisory control and data acquisition (SCADA) systems.

The rising adoption of automation and several other advanced technologies such as artificial intelligence, robotics, and the Internet of Things across industries to increase productivity and reduce human intervention is a major factor providing impetus to the growth of the industrial PC market. The majority of manufacturing industries today use industrial PCs for data acquisition and process control applications. Products like Advantech industrial pcs are gaining wider popularity as they allow manufacturing industries to significantly increase efficiency and productivity.

Similarly, increasing investments in renewable energy projects worldwide are expected to boost industrial PC sales during the forecast period. Industrial PCs help power plants to collect and analyze data and use it to control manufacturing processes. A lot of businesses are gradually setting up industrial mini pcs to meet the growing need for smart manufacturing solutions.

In addition to this, the rapid growth of the global panel industrial PC market and the growing popularity of industrial 3D printing across developed and developing regions will further boost the demand for industrial PCs in the coming years.

What Factors are Restraining the Growth of the Industrial PC Market?

Despite positive growth projections, there are certain obstacles that are limiting the growth of the industrial PC market. Some of the major factors restraining the growth of the industrial PC market include the high cost of advanced industrial PCs and poor penetration of automation across various emerging economies.

Booming Manufacturing Sector and Presence of Leading Players Driving Industrial PC Market Growth in China

As per FMI, the industrial PC market in China is expected to grow at the highest CAGR during the forecast period, owing to the rapid penetration of automation across manufacturing industries, favorable government support, the growing popularity of advanced products like Advantech industrial PC, and large base of leading industrial PC manufacturers.

Over the years, a rapid economic boom and increasing government spending have ignited the growth of manufacturing industries across China. According to the World Economic Forum, China accounted for 28.4% of global manufacturing output in 2020. As these manufacturing industries are increasingly embracing modern technologies for improving their productivity and minimizing human intervention, demand for industrial PCs across the country will grow at a significant pace during the forthcoming years.

Similarly, the rapid expansion of the fanless industrial PC market will create opportunities for industrial PC manufacturers across the country in the future.

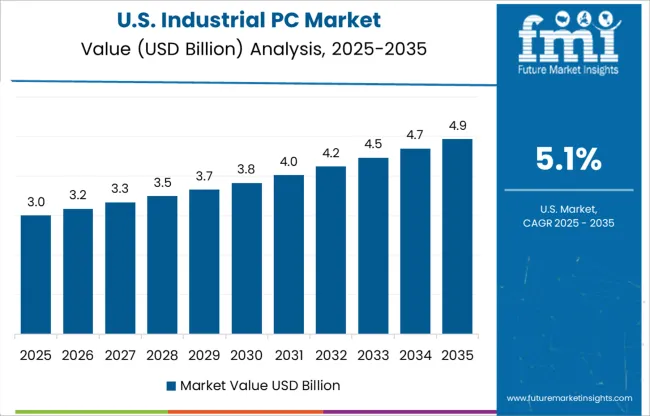

Rising Penetration of Automation and Other Advanced Technologies Like IoT Creating Space for Industrial PC Market Growth in the USA

With the rising adoption of advanced technologies such as the Internet of Things (IoT) and augmented reality (AR), the booming manufacturing sector, and the availability of advanced products, the USA industrial PC market is poised to exhibit robust growth during the forecast period.

Similarly, increasing government initiatives to encourage the adoption of automation and the booming workstation market will further expand the industrial PC market size in the country during the forthcoming period.

Leading industrial PC manufacturers like Advantech Solutions and IEI Integration Corporation are continuously focusing on developing advanced products that can effectively meet end-user demands. Besides this, they are adopting growth strategies such as partnerships, acquisitions, new product launches, collaborations, etc. to gain a competitive edge in the global industrial PC market. For instance,

FMI’s latest study provides a complete packaged solution for the global industrial PC market. It provides compelling insights into the market-shaping factors including growth drivers, restraints, emerging opportunities, consumer demands, etc. The reports use both primary and secondary research methodologies to identify new opportunities for the development of the industrial PC market. It provides details about emerging industrial PC market trends and leading industrial PC manufacturers. Besides underscoring the impact of digitalization on the global industrial PC market size, FMI examines how the rising pentation of industrial automation will boost the demand for industrial PCs globally. The Industrial PC Market analysis includes:

| Attribute | Details |

|---|---|

| Projected Market Size (2035) | USD 9.4 Billion |

| Estimated Growth Rate (2025 to 2035) | 6% |

| Forecast Period | 2025 to 2035 |

| Historic Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Report Coverage | Market forecast, company share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, market dynamics and challenges, and strategic growth initiatives |

| Key Segments Covered | Type, Sales Channel, End-Use Industry, Region |

| Key regions covered | North America (USA, Canada, Rest of North America); Latin America (Brazil, Argentina, Mexico, Rest of Latin America); Western Europe (Germany, United Kingdom, France, Rest of Western Europe); Eastern Europe (Russia, Spain, Rest of Eastern Europe); South Asia Pacific (China, India, Japan, Malaysia, Thailand, Indonesia, South Korea, Rest of South Asia &Pacific); Middle East & Africa (GCC Countries, Turkey, Israel, Rest of the Middle East and Africa(MEA)); Rest of the World Oceania (Africa, South America) |

| End-Use Industry | Process Industries; Discrete Industries |

| Key companies profiled | Advantech Solutions, Beckhoff Automation, Siemens, IEI Integration Corporation, B&R Automation, Kontron S&T, Avalue Technology, DFI, Nexcom International, American Port well Technology, and others. |

| Customization & pricing | Available upon request |

The global industrial PC market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the industrial PC market is projected to reach USD 11.3 billion by 2035.

The industrial PC market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in industrial PC market are panel ipc, rack mount ipc, box ipc, embedded ipc and din rail ipc.

In terms of sales channel, direct sales segment to command 63.2% share in the industrial PC market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA