The industrial energy management system market is experiencing robust growth driven by increasing energy costs, stringent sustainability regulations, and the rising need for operational efficiency across manufacturing and heavy industries. The current market landscape is defined by accelerated digital transformation, integration of IoT and AI-based analytics, and heightened awareness of carbon footprint reduction. Companies are adopting advanced systems to monitor, control, and optimize energy use across industrial processes.

The future outlook remains promising as industries transition toward smart manufacturing and sustainable production models. Government incentives for energy conservation and carbon neutrality are further accelerating adoption.

Growth rationale is rooted in the ability of energy management systems to deliver real-time insights, reduce operational costs, and enhance compliance with global efficiency standards Continuous innovation in software platforms, cloud connectivity, and predictive analytics is expected to reinforce market expansion and strengthen the strategic importance of energy management systems within industrial operations worldwide.

| Metric | Value |

|---|---|

| Industrial Energy Management System Market Estimated Value in (2025 E) | USD 37.2 billion |

| Industrial Energy Management System Market Forecast Value in (2035 F) | USD 82.6 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

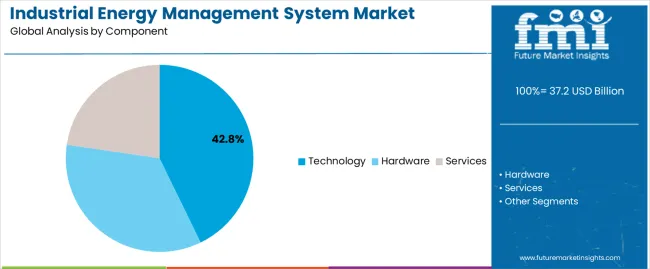

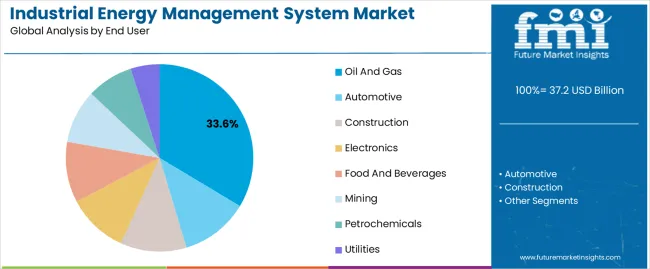

The market is segmented by Component and End User and region. By Component, the market is divided into Technology, Hardware, and Services. In terms of End User, the market is classified into Oil And Gas, Automotive, Construction, Electronics, Food And Beverages, Mining, Petrochemicals, and Utilities. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The technology segment, accounting for 42.8% of the component category, has emerged as the leading segment due to its critical role in enabling data-driven decision-making and operational optimization. Adoption has been driven by the integration of smart sensors, advanced analytics, and automation platforms that collectively improve energy visibility and performance efficiency.

The segment’s leadership is supported by continuous innovation in digital technologies such as cloud computing, AI, and IoT-based solutions. These advancements have enabled real-time monitoring, predictive maintenance, and demand response capabilities across industrial facilities.

The scalability and interoperability of modern energy management technologies have further strengthened market penetration As industries focus on achieving energy efficiency targets and sustainability goals, the technology segment is expected to maintain its dominance through continuous upgrades and the growing adoption of intelligent, connected systems.

The oil and gas segment, representing 33.6% of the end-user category, has remained dominant due to its intensive energy consumption and operational complexity. The sector’s leadership is reinforced by the need for precise monitoring and optimization of energy resources across exploration, production, and refining operations.

Adoption of advanced energy management systems has enabled real-time tracking of energy usage, reduction of wastage, and improvement in process reliability. Stringent environmental regulations and the global transition toward cleaner energy have further encouraged oil and gas companies to implement efficient energy control systems.

Investments in digital infrastructure and automation technologies have enhanced transparency and energy accountability across large-scale facilities As the industry continues to prioritize carbon reduction and operational efficiency, the oil and gas segment is expected to sustain its market share and drive significant demand for advanced industrial energy management solutions.

Operational cost control is essential to maintaining profitability and competitiveness in the corporate environment. Energy costs account for an important share of an industry's operating costs.

The industrial energy management system (IEMS) provides a systematic approach to cost reduction by optimizing energy use, detecting energy inefficiencies, and implementing policies to reduce waste. IEMS helps enterprises find operational and energy savings potential using data analytics, predictive modeling, and real-time monitoring.

The adoption of industrial energy management system is a strategic investment in long-term cost management because reducing energy expenses increases profitability, improves financial performance, and gives businesses a competitive edge.

| Attributes | Details |

|---|---|

| Industrial Energy Management System Market Value for 2020 | USD 25,462.40 million |

| Historical Market Value for 2025 | USD 32,219.20 million |

| CAGR from 2020 to 2025 | 6.1% |

One of the main obstacles to the adoption of industrial energy management systems is the high initial expenditure needed for execution. Due to financial limitations or concerns about the investment's return, businesses are hesitant to commit resources to acquiring and implementing energy management systems.

Enterprises put energy management activities on hold due to the significant initial expenditures associated with modifications to infrastructure, software, hardware, and consulting services. The perceived financial risk linked to the initial investment prevents the widespread adoption of industrial energy management systems despite the long-term savings on energy costs.

The preceding section offers the segmented industrial energy management system market analysis. In-depth studies suggests that the hardware segment prevails in the component category and the construction sector stands out in the end user category.

| Top End User | Construction Sector |

|---|---|

| Market Share (2025) | 21.20% |

The construction sector's increasing focus on green building practices and environmental responsibility aligns with integrating energy-efficient technologies. Large amounts of energy are consumed during construction projects, which makes reliable energy management systems essential for maximizing use.

The industrial energy management systems are a wise investment since increases in construction efficiency directly result in cost savings. Construction firms are compelled to implement advanced energy management techniques due to sustainability objectives and regulatory requirements.

| Top Component | Hardware |

|---|---|

| Market Share (2025) | 39.20% |

Due to their durability and dependability, hardware components are essential for continuous energy management activities. Hardware purchases guarantee energy management programs' long-term viability and scalability, resulting in financial savings and increased operational effectiveness.

The hardware components provide the physical infrastructure necessary for monitoring and controlling industrial energy management systems. Hardware serves as the framework for data collection, allowing for real-time observations of patterns in energy use.

The following tables, which emphasize the most prominent economies in Australia, China, the United States, Germany, and Japan, demonstrate the demand for industrial energy management systems. A thorough examination indicates Australia delivers substantial industrial energy management system market opportunities.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Australia | 11.8% |

| China | 8.8% |

| United States | 5.1% |

| Germany | 3.7% |

| Japan | 3% |

Australia is experiencing a trend toward integrating renewable energy sources into industrial energy management systems due to its abundance of renewable energy supplies.

Government programs that support energy efficiency and reduce emissions stimulate the adoption of industrial energy management systems in Australia. Australia has many industrial sites in remote areas, emphasizing the significance of sophisticated monitoring and control systems in energy management.

China is leading the way in industrial energy management solution innovation due to the growing use of IoT and AI technology. Due to China's industrial energy management system market size, large-scale energy management system adoption offers abundant opportunities.

Chinese enterprises are supported by rising labor costs and environmental laws to adopt industrial energy management systems to comply with rules and save money.

Renewable energy sources are integrated into industrial energy management systems due to the decentralization of energy production in the United States. In the United States, technological innovations like data analytics and cloud computing are improving the functionality of industrial energy management systems.

Industries are investing in energy management systems to optimize energy usage and reduce environmental consequences due to the United States shale gas boom.

In Germany's manufacturing facilities, the adoption of smart energy management technologies is emphasized by Industry 4.0 principles. Germany is experiencing increased expenditures on energy-efficient technologies and management systems due to its shift away from fossil fuels and nuclear power.

Germany's demand for industrial energy management systems is compelled by its dedication to renewable energy sources and strict environmental laws.

Modern energy management systems can increase efficiency and dependability in Japan's aged industrial infrastructure. Due to its limited domestic energy supplies, Japan strongly emphasizes energy security, which motivates investments in effective energy management technology.

Japan's industrial energy management market is experiencing a rise in the adoption of innovative techniques, including demand response systems and virtual power plants.

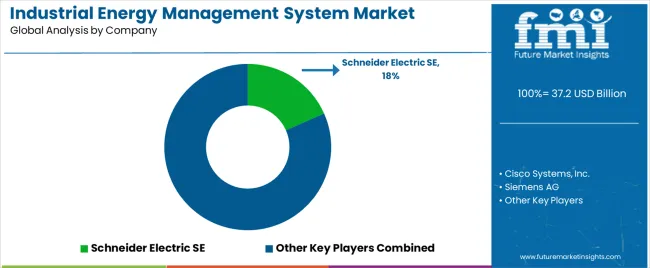

Key industrial energy management system providers strive to gain market share and influence by dependable and innovative. Prominent industrial energy management system providers are well-represented, using their wealth of knowledge and technological know-how to influence the direction of the industry.

Eaton Corporation Plc, EnerNOC, Inc., and ASEA Brown Boveri (ABB) Ltd are the main industrial energy management system vendors influencing the competitive dynamics. The industrial energy management system (IEMS) industry encounters more competition due to their services and solutions for various industrial needs.

Notable industrial energy management system manufacturers include Honeywell International, Inc., Rockwell Automation, and EFT (Energy Inc.), providing cutting-edge energy optimization and management methods. With their combined experience, Hatch Ltd. and Azbil Corporation enhance the IEMS market with advanced collaborations and solutions.

The market is made more dynamic by the engagement of emerging industrial energy management system suppliers like Shanghai Baosight Software Co., Ltd., which encourages innovation and pushes boundaries.

The industrial energy management system solution market is positioned for ongoing expansion and development as long as these sector leaders keep coming up with new ideas and working together. The global industrial sectors' pursuit of efficiency, sustainability, and technical advancements has created a dynamic competitive landscape.

Latest Advancements

| Company | Details |

|---|---|

| Schneider Electric | Work on Schneider Electric's new smart factory in Dunavesce, Hungary got underway in March 2025. 500 workers are scheduled to work at the 25,000-square-meter new location, which will cost EUR 40 million to build. This new smart factory will boost capacity to meet growing demand as Europe enhances its energy independence and expedites its energy transition. |

| AutoGrid | One of the leading electricity companies in India, Tata Electricity, and AutoGrid announced a new, conventional cooperation in February 2025 to roll out a demand response program for all of their residential, commercial, and industrial customers. This innovative approach is going to promote India's sustainable energy development while helping to satisfy peak demand. |

| Siemens Energy | A new version of Syntax's SAP Digital Manufacturing Cloud (DMC) infrastructure was developed and deployed for over 80 production sites globally in December 2025 because of a partnership between Siemens Energy and the well-known multi-cloud provider for mission-critical applications. Syntax was contracted to manage SAP DMC subscription contracts for five test factories in Mexico, Germany, and the Germany. These sites present Siemens Energy's diverse requirements, while Syntax gathers vital operation data for analysis, process modeling and execution, and resource coordination. |

| IBM | IBM introduced the upcoming version of its LinuxONE server in September 2025. This platform, which is based on Kubernetes and Linux and is favorably scalable, accommodates thousands of workloads inside the footprint of a single strategy. With IBM LinuxONE Emperor 4, customers could run workloads at higher densities and capacities by turning on unused cores without increasing their energy consumption and related greenhouse gas emissions. |

The global industrial energy management system market is estimated to be valued at USD 37.2 billion in 2025.

The market size for the industrial energy management system market is projected to reach USD 82.6 billion by 2035.

The industrial energy management system market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in industrial energy management system market are technology, energy platform, distributed control system (dcs), meter data management (mdm), peak load control system (plcs), programmable logic controls (plc), energy analytics, supervisory control and data acquisition (scada), energy management information system (emis), hardware, communication network hardware, industrial hardware, services, consulting, system integrators and maintenance and support services.

In terms of end user, oil and gas segment to command 33.6% share in the industrial energy management system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Monitoring Market

Industrial Skid System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Industrial Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Industrial Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

Crowd Management System Market

Asset Management System Market

Dealer Management System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA