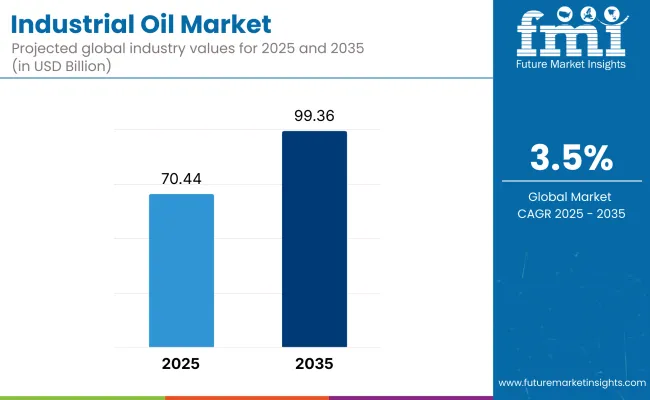

The industrial oil market is valued at USD 70.44 billion in 2025 and is expected to reach USD 99.36 billion by 2035, advancing at a 3.5 % CAGR throughout the forecast period.

Within the industrial oil market, the United States remains the most lucrative country in 2025 thanks to its diverse manufacturing base, robust automotive output, and stringent EPA lubricant-performance mandates. Meanwhile, India is poised to be the fastest-growing national market from 2025 to 2035 as rapid industrialization and “Make-in-India” capex propel demand for high-performance hydraulic and process oils.

Across factories and power plants, decarbonization targets and predictive-maintenance strategies are reshaping the industrial oil market. Operators are migrating from mineral grades to long-drain synthetics that reduce lubricant consumption by up to 25 %, while bio-based blends gain traction where VOC and biodegradability rules tighten.

Volatile crude prices restrain adoption in cost-sensitive sectors, spurring suppliers to launch re-refined base-oil loops and subscription-based condition-monitoring services. Key trends steering the industrial oil market include AI-enabled oil-health sensors, ISO 4406-plus filtration upgrades, and additive packages tuned for electric-drive gearboxes in renewable-energy assets.

Looking ahead, the industrial oil market is set to pivot toward closed-loop lubrication ecosystems. By 2030, cloud analytics will use vibration and thermal inputs to auto-adjust additive top-ups, extending drain intervals to 15,000 operating hours in heavy-duty hydraulics.

Bio-based esters sourced from algae and waste-seed oils are expected to triple their share, helped by carbon-credit incentives in the EU and North America. Vendors that bundle carbon-footprint dashboards, on-site micro-re-refining skids, and circular-economy service agreements are forecast to capture outsized share through 2035.

Mineral oils still dominate volumes, but tightening emission norms and ESG mandates are pushing end users toward bio-based industrial oils derived from soybean, rapeseed, and waste-cooking-oil feedstocks.

These grades offer superior biodegradability and lower toxicity, winning procurement tenders in food-processing, hydropower, and forestry equipment. Synthetic PAO and ester blends retain performance leadership in extreme-temperature gearboxes, yet face price sensitivity outside OECD markets. Suppliers are scaling enzymatic trans-esterification plants and drop-in additive systems to accelerate bio-based penetration.

| Oil Type | CAGR (2025 to 2035) |

|---|---|

| Bio-based Industrial Oils | 5.2% |

Wind-turbine gearboxes, solar-tracker drives, and grid-scale battery installations are emerging as high-growth niches, demanding fluids with long oxidative life and low pour points. As global installed wind capacity doubles by 2030, demand for synthetic gear and hydraulic oils that withstand 18-month service intervals is set to surge. Traditional manufacturing and automotive plants will remain volume anchors, but their growth trails the renewable-energy sector as governments channel stimulus toward green infrastructure.

| End-Use Segmen | CAGR (2025 to 2035) |

|---|---|

| Renewable-Energy Assets | 5.7 % |

These high-growth niches-bio-based formulations and renewable-energy deployments-signal where innovators should target R&D, additive chemistry, and circular-service models to maximise share in the industrial oil market through 2035.

This report is based on the consensus of the survey of various stakeholders in the industrial oil market, which includes manufacturers, suppliers, distributors, retailers, microparticle, and end-user segments from various industries. The intention was to gain insights on the evolving challenges and opportunities shaping the sector.

Respondents cited the growing influence of sustainability and environmental regulations on product formulations and sourcing strategies. The general consensus among industry leaders was that we require more bio-based and alternative synthetic oils that can enable us to reduce our environmental footprint without sacrificing performance.

Rapid industrialization, particularly in emerging economies, is driving the demand for industrial oil, the survey also stated. Stakeholders identified growing applications in energy generation, heavy machinery, and automotive manufacturing as driving growth. However, they cited supply chain disruptions and crude oil price volatility as concerns that impact production and pricing strategies.

Interviews with experts elucidate technological advancements in refining processes and additive formulations that prolong oil life and efficiency. In manufacturing and power generation, innovations in lubrication technology, combined with digital monitoring systems, are driving operational efficiency, participants said. Regulatory compliance and the transition to greener alternatives were also identified as important long-term industry sustainability drivers.

Respondents indicated they were confident about the future of the market despite adversity with citing strategic research and development investments. Companies are emphasizing the expansion of production capacity and the development of tailored solutions to address the needs of different industries. The findings in the survey demonstrate a general high commitment towards innovation, sustainability, and flexibility in the evolving industrial oil market.

| Countries/Regions | Key Regulations & Policies |

|---|---|

| United States | Environmental Protection Agency (EPA) regulations on lubricant disposal, Renewable Fuel Standard (RFS), and ASTM standards for industrial oils. |

| European Union | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, Euro 7 emission standards, and circular economy policies for industrial lubricants. |

| China | "Made in China 2025" policies promoting advanced lubricant technologies, National Environmental Protection Standards, and restrictions on high-emission oils. |

| India | Bureau of Indian Standards (BIS) for lubricant quality, Petroleum & Explosives Safety Organization (PESO) guidelines, and focus on biodegradable lubricants. |

| Japan | Japan Industrial Standards (JIS) for lubricants, Ministry of Economy, Trade and Industry (METI) directives on energy-efficient industrial oils. |

| Brazil | National Agency of Petroleum, Natural Gas, and Biofuels (ANP) guidelines on industrial oil composition and environmental impact. |

| Gulf Cooperation Council (GCC) | GCC Standardization Organization (GSO) regulations on lubricant specifications and environmental compliance for industrial applications. |

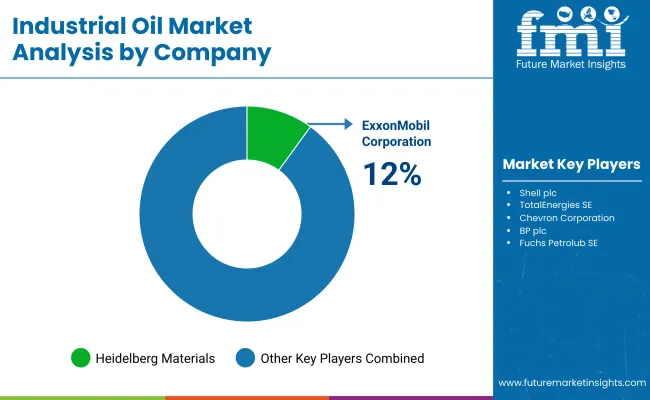

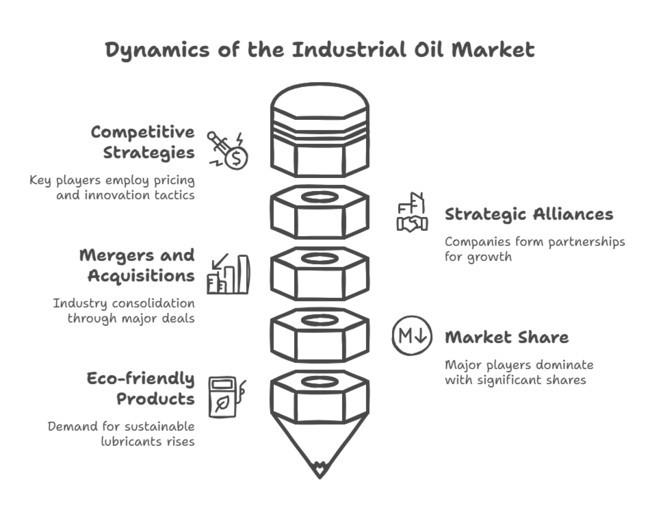

The industrial oil market is characterized by both aggressive pricing strategies from key players and innovations that are transforming the sector, as well as strategic partnerships and global expansion to keep up with demand. Price competition is still a significant consideration, with a proliferation of manufacturers in certain areas.

Attributing this, segment players are progressively differentiating themselves by investing in R&D collaborations to develop high performing, energy-saving and sustainable industrial oils. The demand for eco-friendly lubricants has resulted in bio-based and synthetic lubricants that meet stringent regulatory requirements, and consumers are also promoting such sustainable alternatives in India and worldwide.

Leading global players are pursuing strategic alliances with raw material providers, end users and research institutes to promote growth. They can also prepare to venture into developing sectors through partnerships. Companies are also strategizing around mergers and acquisitions to expand their industry reach, optimize the supply chain and enhance production.

As a result, manufacturers have begun providing predictive maintenance and even more advanced predictive services based on oil condition using digitalization and smart monitoring solutions embedded in their oil with the applications industrial oil. These include longer contracts with key players in the automotive, energy and manufacturing sectors, ensuring they remain relevant and profitable.

Indian Oil Corporation (IOC) has shown solid performance, achieving a 43% market share in India's petroleum products sector in the fiscal year 2025. This dominance is due to its extensive refining capacity, fuel retail network, and strategic expansions.

However, in the global industrial oil market, its share is significantly smaller compared to major international players like ExxonMobil and Shell. The rise comes due to its strategic initiatives like the addition of nearly 1,800 outlets through its expanding petrol pump network, a 14 per cent growth in volume sales of fuel and a highest-ever pipeline expansion for the fiscal, 2025 to 2035 period.

Though we do not have concrete segment share data for other industrial oil players, it can be reasonably noted that firms such as IOC are adopting diversified measures in order to increase their segment share. It is expected that as the sector continues to evolve, more of the competition will follow with similar approaches to protect industry share and gain a larger stake.

In 2024 and early 2025, mergers and acquisitions in the industrial oil sector increased. In October, ExxonMobil announced a deal to acquire Pioneer Natural Resources for USD 59.5 billion in an all-stock transaction to bolster its shale oil assets.

A few days later, Chevron announced it would take over Hess Corporation in a USD 53 billion all-stock deal (total enterprise value of USD 60 billion), improving its exploration and production arms. Occidental Petroleum took a page from the consolidation playbook too, acquiring Permian oil and gas producer Crown Rock for about USD 12 billion, including debt, bolstering its position in the lucrative Permian Basin.

In March 2025, Honeywell International Inc. acquired Sundyne LLC for USD 2.2 billion to bolster its Energy and Sustainability (ESS) business. Sundyne, based in Arvada, Colorado, makes high-engineered pumps and compressors that serve petrochemical, liquefied-natural-gas (LNG) and renewable fuel sector. This acquisition aligns with Honeywell's effort to expand its energy security solutions and comes on the heels of several such portfolio transformation deals.

Market Share Analysis

ExxonMobil Corporation

Shell plc

TotalEnergies SE

Chevron Corporation

BP plc (Castrol Industrial)

Fuchs Petrolub SE

Idemitsu Kosan Co., Ltd.

SK Lubricants

Sinopec Corp

Phillips 66 (Phillips 66 Lubricants)

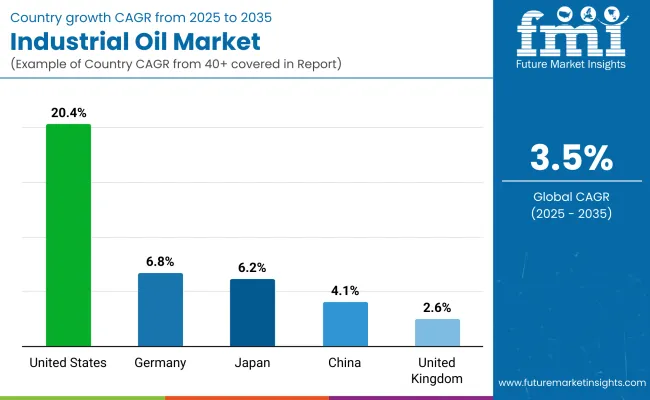

The USA industry for industrial oil continued to be robust, as demand from manufacturing, automotive and energy sectors grew. The United States holds a 20.4% industry share, driven by strong industrial demand and sustainability initiatives. The country experienced considerable consolidation, and the major oil companies were building out their infrastructure through mergers and acquisitions.

Sustainability regulations drove industrial oils towards biodegradable options, as governments have mandated the reduction of carbon emissions and pollutants. Lower Import Dependency through Investment in Domestic Oil Production and Refining Tech new domestic oil production and refining tech investments, which sustained the supply chain and reduced dependency on import. The USA industrial oil industry is expected to grow at a steady pace in the forthcoming years, due to the integration of industrial automation and sustainability initiatives.

The industrial oil landscape in the UK was reshaped as renewable energy investments surged and environmental regulations. The United Kingdom's industrial oil industry is growing at a 2.6% CAGR, driven by sustainability efforts and advanced manufacturing. The demand for traditional industrial oils remained healthy, but we saw a clear shift to more sustainable and synthetic solutions.

British companies in automotive, aerospace and heavy machinery centre on high-performance lubricants and hydraulic fluids to improve efficiency and achieve EU and domestic environmental standards. The restructuring of supply chains due to Brexit-related trade adjustments caused companies to look for new partners in and outside Europe.

Digitalization also permeated the industrial sector, where AI-enabled maintenance solutions had augmented the efficiency of sectors like manufacturing. The government policies to reach net-zero emissions make the industry move towards low-carbon, sustainable products. Thus, the future of UK industrial oil lies within gradual shifts in sustainability and technological advancements.

France's industrial oil industry has been shaped by the country's strong push toward sustainability and technological innovation. Tighter government regulations and EU-wide policies mandating carbon neutrality spurred industries to use biodegradable and low-emission industrial oil. The automotive and aerospace industries, major players in the industry, sought to improve fuel efficiency and reduce environmental impact through investment in high-performance lubricants.

Manufacturing industries in France also focused on energy-efficient production processes, which spurred the demand for specialty industrial oils that reduce machine wear and tear and waste. Moreover, the focus on research and development in France led to innovations in oil formulations, including synthetic and bio-based options.

The French industrial oil industry is likely to gradually change towards greener alternatives, coupled with steady demand in conventional sectors owing to strong government push for sustainable industrial solutions and on-going technological advancements.

Given its solid manufacturing, automotive, and engineering sectors, was good for Germany's industrial oil industry and holds a 6.8% industry share, driven by strong industrial demand and sustainability initiatives. Plus, the focus on industrial processes is paying off for the country as industrial machine using high-end lubricants and hydraulic fluids that are improving productivity and longevity have seen increased demand.

In the face of the German government’s policies of energy efficiency and emission reduction, industries adopted synthetic and biodegradable oils, also in the light of wider EU goals. Maintained a mixed growth trend in the automotive and industrial sectors due to high disposable income and strong investments into the predictive maintenance and industrial automation that optimize oil consumption and help reduce the downtime in manufacturing plants.

Geopolitical factors from the global supply chain forced companies to diversify the sourcing strategies, bringing stability to the industrial oil sector. In the field of technology, Germany remains at the forefront of engineering and industrial progress, and also acts in the area of oil as one of the most developed industries which is predicted to grow in a more innovative and eco-friendly way.

Companies continued to seek efficiency and sustainability, and demand for both high-quality lubricants and specialized industrial oils remained stable. Biodegradable and synthetic industrial oils gradually replaced traditional options due to Italy's regulatory environment, which was compatible with the directive of the EU regarding emission reduction and promotion of alternatives that are friendly to the environment.

Expansion of the renewable energy sector in the country has also driven a transition towards sustainable solutions in the means of production. Italian firms worked to modernize their manufacturing using automation and machine-digital monitoring and optimizing their oil and their site to save running costs.

The industrial oil industry in the country is anticipated to grow in a steady manner, facilitated by advancements in technology, meeting regulatory standards of compliance, and the continued movement towards sustainability in industrial scopes.

The industrial oil demand in South Korea was supported primarily by the country advanced manufacturing sector which encompasses the automotive, shipbuilding, and electronics industries. With a high emphasis on innovation, the country witnessed high demand for industrial oils that improves efficiency and decreases maintenance cost, thus driving growth for the segment.

Government action emphasizing sustainability and carbon neutrality encouraged companies to use greener lubricants and hydraulic fluids. Smart manufacturing technologies, e.g. IoT-based monitoring and AI-driven predictive maintenance, were essential to optimize industrial oil use.

South Korea also increased its refining and processing capabilities, lessening its reliance on imports and ensuring a stable supply chain. The high-tech industrial landscape of the country will drive continued evolution of the industrial oil industry around sustainability, automation, and advanced formulations.

The Japanese industrial oil industry is behind precision engineering and high-tech industries. The top automotive and robotics industries in the country needed specialized lubricants and hydraulic fluids that enable superior performance in adverse conditions. The Japan holds a 6.2% industry share, driven by strong industrial demand and sustainability initiatives.

Japan’s focus on reducing industrial emissions has contributed to increased investment in synthetic and biodegradable industrial oils. Petroleum production is more automated now than at any time in history, aided by AI, which makes it entirely possible to avoid wasting anything, even oil. In response to government regulatory favouritism towards sustainable industry practices, developer's oil formulations transitioned towards lower-emission energy solutions.

Japan’s Industrial Oil Industry may not be the biggest in the world, but it is among the most sustainable, owing to technological adoption, regulatory compliance, and the growing need for high-quality and sustainable industrial solutions.

China has the largest industrial oil industry in the world, driven by accelerating industrialization, strong infrastructure, and a growing manufacturing sector. The China industrial oil industry is growing at a 4.1% CAGR, driven by sustainability efforts and advanced manufacturing. The demand for industrial oils in the country also grew, along with major investments in high-performance lubricants used in machines, automotive and heavy industries.

Increase in adoption of synthetic & bio-based industrial oils due to stricter government regulations on emissions & sustainability. Beijing also redoubled efforts to strengthen domestic refining capacity, to ensure supply chain stability. And the emergence of smart manufacturing and automation further optimized oil per industry. China’s industrial oil industry is anticipated to experience steady growth alongside continuing industrial expansion and regulatory reforms, with increased focus on efficiency and sustainability.

The Australian and New Zealand industrial oil industry was largely influenced by mining, agriculture, and transportation. Industrial oils demand was stable, with a focus on sustainability and regulatory compliance. Stricter emission policies and a waste management framework introduced by the Australian government means that industries now prefer eco-friendly lubricants which holds a 0.5% industry share.

New Zealand’s industrial sector has not been left behind, adopting sustainable alternatives and reinforcing its commitment to environmental preservation. By that time, automation was set to take off in either mining or agriculture, optimizing oil usage further in both areas and thus improving efficiency and lowering costs.

As Australia and New Zealand's industrial oil industry gets built up with infrastructure and sustainable options, the country is projected to embrace innovation and environmental friendliness when it comes to oil solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth due to COVID-19 impact and supply chain disruptions in early 2020. Recovery started in 2022 with increased industrial activity. | Stronger growth expected due to rising automation, renewable energy expansion, and bio-based oil adoption. |

| Recovery in manufacturing, increasing demand from automotive and power sectors, rising synthetic oil use. | Sustainability trends, bio-based oil innovations, stricter regulations on emissions, and continued industrial expansion. |

| Industrial engine oils dominated due to high demand in automotive and machinery sectors. | Process oils and bio-based oils expected to see higher demand as industries shift to eco-friendly solutions. |

| Mineral and synthetic oils were widely used due to cost-effectiveness. | Bio-based oils expected to grow rapidly with sustainability initiatives. |

| Automotive and manufacturing led the industry, while power generation saw steady growth. | Power generation, construction, and renewable energy sectors expected to drive demand. |

| Asia-Pacific dominated due to industrialization, while North America and Europe saw steady demand. | Asia-Pacific remains dominant in the overall industrial oil sector, but Europe and North America are experiencing faster adoption rates of bio-based oils relative to their existing industry sizes. |

| Stricter regulations on emissions encouraged cleaner industrial oils but adoption was slow. | Governments worldwide enforcing stringent environmental policies, accelerating bio-based oil use. |

| Growth in synthetic oils and expansion of the electric vehicle sector. | Bio-based oil innovations, industrial automation, and increased adoption in renewable energy sectors. |

Global macroeconomic factors such as GDP growth, trade policy, supply chain disruptions, energy transition policy lead to an inextricable linkage between the industrial oil market. The industrial oils are consumed are also closely related to industrial production and infrastructure construction, especially in the developing countries like India, China, and southeast Asia. A surge in industrial lubricants and process oil consumption can be attributed to rising manufacturing in these economies as they expand further.

This segment is also affected by the ongoing energy transition. To this end, governments around the world are encouraging the use of renewable energy and sustainable industrial practices, pushing companies to develop bio-based and synthetic alternatives. Yet industrial oils are still the most demanded by some heavy machinery, automotive and power plant types.

Moreover, changing geopolitical circumstances and trade policies disrupt oil supplies, resulting in price fluctuations. Brent crude oil prices have a direct impact on the industrial oil production costs. Inflationary pressures, along with currency fluctuations, determine procurement strategies for industrial firms, and this in turn impacts the overall industry growth.

However, the industrial oil segment is expected to experience steady growth through the implementation of technological advancements, industrial automation, and major global infrastructure projects..

The transition from petrochemical-based to bio-based or other sustainable oils is one of the major contributors of growth in the industrial oil industry. As governments and industries demand reduced carbon emissions and environmentally friendly alternatives, businesses that invest in renewable and biodegradable lubricants will create a competitive advantage. This trend is especially notable in regions with stringent environmental regulations, like Europe and North America.

The Asia-Pacific region is projected to have the highest growth rate during the forecast period, due to the rapid industrialization in China, India, and Southeast Asia. A high demand for industrial oils exists as a result of rising manufacturing action, infrastructure growth, and a booming automotive sector.

In this case, companies targeting the local industrys need to explore setting up local production plants and distribution partnerships to cut down on costs and enhance supply chain efficiencies. Industries like aerospace, power generation and precision machining need specialized lubricants capable of operating in extreme conditions.

Industrial oil manufacturers must research and develop sustainable and high-performance lubricants to remain competitive. Increased industry position and regulatory compliance will be derived from investment in environmentally conscious formulations, and gaining industry certifications. Expanding their regional reach in fast-growing regions such as Asia-Pacific is another area where companies need to invest.

Building more local production, logistics, and after-sales services is essential to achieve industry share. In areas where sustainability is more concerned, it would be all about advertising bio-based alternatives and customer education for the benefits.

Digital transformation trend means that manufacturers can research and produce smart lubrication solutions linked to IoT platforms. Add conditioning monitoring and predictive maintenance services to industrial oils (new business model, new applications, new revenues, higher loyalty).

Finally, companies must expand their product portfolios to address the changing demands of industrial applications." Businesses can capitalize on future industrial trends and improve profitability by concentrating on higher margin segments including synthetic oils, process oils, and specialty lubricants.

Mineral, Synthetic and Semi-Synthetic, Bio-based

Process Oil, Hydraulic Oils, Industry Engine Oils, Gear Oils, Metal Working Fluids, Turbine and Circulating Oils, Refrigerating Oils, Compressor Oils

Crude Oil, Soybean, Rapeseed, Sunflower, Palm, Others

Energy Generation, Oil & Gas, Manufacturing, Automotive, Heavy Engineering Equipment

North America, Latin America, Europe, East Asia, SAPeI (South Asia Pacific excl. India), The Middle East & Africa, India

Industrial oil is widely used in manufacturing, automotive, energy, mining, and heavy machinery sectors for lubrication, cooling, and operational efficiency.

Growing industrialization, increasing automation, demand for high-performance lubricants, and sustainability trends are key factors driving growth.

Companies are focusing on bio-based and environmentally friendly lubricants, reducing carbon footprints, and enhancing recycling and re-refining technologies.

Asia-Pacific, particularly China and India, is seeing rapid growth due to expanding manufacturing and infrastructure development. North America and Europe are also advancing in synthetic and bio-based oils.

Major companies include ExxonMobil, Shell, TotalEnergies, Chevron, BP (Castrol), Fuchs Petrolub, Idemitsu Kosan, SK Lubricants, Sinopec, and Phillips 66.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Oil Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Oil Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Oil Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Source, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Oil Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Source, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Oil Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Oil Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Oil Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Oil Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Oil Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Oil Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Oil Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Oil Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Oil Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Oil Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by End-Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Oil Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA