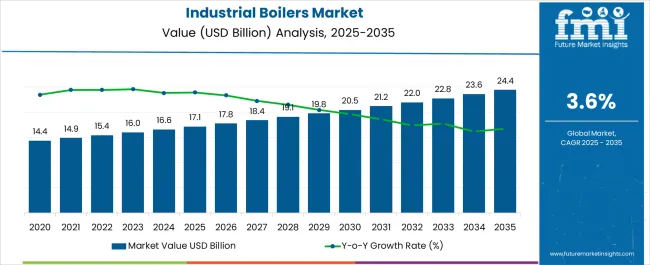

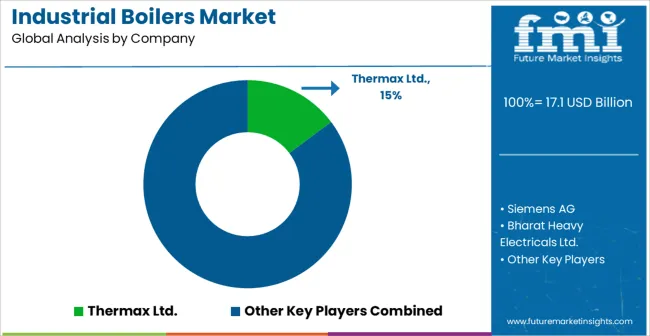

The Industrial Boilers Market is estimated to be valued at USD 17.1 billion in 2025 and is projected to reach USD 24.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Boilers Market Estimated Value in (2025 E) | USD 17.1 billion |

| Industrial Boilers Market Forecast Value in (2035 F) | USD 24.4 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The Industrial Boilers market is experiencing steady growth, driven by increasing industrialization and rising energy demand across manufacturing, chemical, and power generation sectors. The adoption of advanced boiler technologies is being fueled by the need to improve energy efficiency, reduce emissions, and comply with environmental regulations. Industrial boilers are increasingly being integrated with smart monitoring systems, enabling real-time performance tracking, predictive maintenance, and operational optimization.

Growth is further supported by the shift towards cleaner fuels and sustainable energy solutions, which has intensified the demand for high-efficiency condensing boilers. Investments in infrastructure development, particularly in emerging economies, are contributing to increased deployment of boilers across multiple industries. Technological advancements in materials, control systems, and heat recovery mechanisms are enhancing operational efficiency and extending equipment lifespan.

The market is also being shaped by government policies promoting energy conservation and carbon reduction As industries continue to prioritize cost-effective and environmentally responsible energy solutions, the Industrial Boilers market is positioned for sustained growth, with opportunities emerging from modernization and capacity expansion initiatives worldwide.

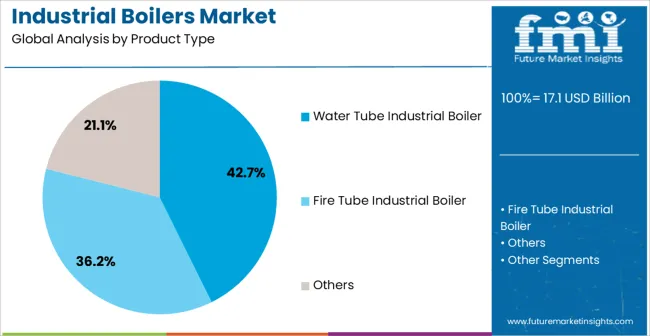

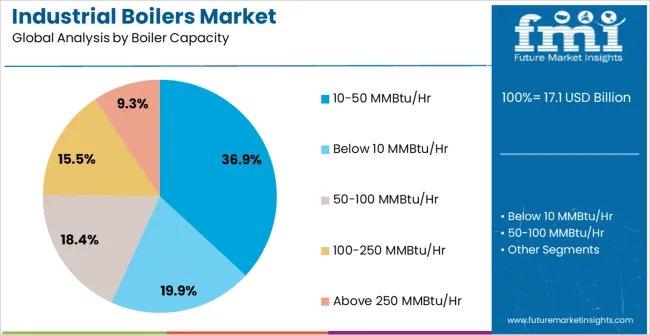

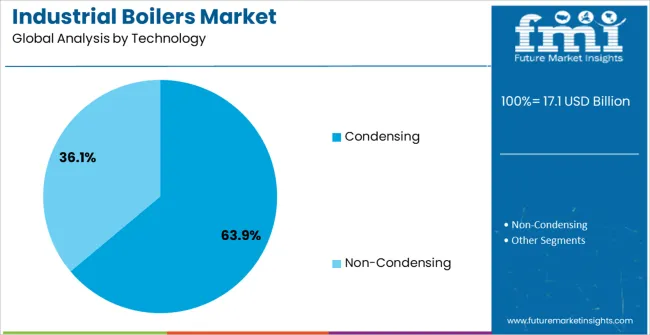

The industrial boilers market is segmented by product type, boiler capacity, technology, fuel type, end user, and geographic regions. By product type, industrial boilers market is divided into Water Tube Industrial Boiler, Fire Tube Industrial Boiler, and Others. In terms of boiler capacity, industrial boilers market is classified into 10-50 MMBtu/Hr, Below 10 MMBtu/Hr, 50-100 MMBtu/Hr, 100-250 MMBtu/Hr, and Above 250 MMBtu/Hr. Based on technology, industrial boilers market is segmented into Condensing and Non-Condensing. By fuel type, industrial boilers market is segmented into Natural Gas, Coal, Oil, and Others. By end user, industrial boilers market is segmented into Chemical Industry, Refinery Industry, Food Industry, Paper Industry, Primary Metals Industry, and Others. Regionally, the industrial boilers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water tube industrial boiler segment is projected to hold 42.7% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by its ability to handle high-pressure and high-capacity steam generation efficiently, making it suitable for large-scale industrial applications. Water tube boilers provide rapid response to load changes, high thermal efficiency, and superior safety characteristics, which have reinforced preference among manufacturers and end users.

Their design allows for easier maintenance and flexibility in fuel usage, supporting diverse operational requirements. Adoption is further supported by their compatibility with advanced technologies such as condensing systems and automation for performance optimization.

Rising demand from sectors such as power generation, chemicals, and refineries has strengthened the market position of water tube boilers As industrial processes increasingly require reliable and high-efficiency steam generation, the water tube boiler segment is expected to maintain its leadership, supported by advancements in materials, design, and energy recovery solutions.

The 10-50 MMBtu/Hr boiler capacity segment is anticipated to account for 36.9% of the market revenue in 2025, making it the leading capacity category. This growth is being driven by the demand for mid-range industrial boilers capable of meeting energy needs for medium to large manufacturing operations without incurring excessive capital expenditure.

Boilers in this capacity range provide a balance between operational efficiency, fuel utilization, and flexibility, which has increased adoption across industries such as food processing, chemicals, and paper manufacturing. The segment benefits from standardization in design, ease of integration with existing plant infrastructure, and compatibility with advanced control and monitoring technologies.

Increased focus on energy efficiency, regulatory compliance, and reduced emissions has further reinforced the segment’s leadership As industries modernize and expand production capabilities, boilers within the 10-50 MMBtu/Hr range are expected to remain highly preferred, providing reliable steam generation while optimizing operational and environmental performance.

The condensing technology segment is projected to hold 63.9% of the market revenue in 2025, establishing it as the leading technology category. Growth in this segment is being driven by its superior energy efficiency and ability to recover latent heat from flue gases, reducing fuel consumption and operational costs. Condensing boilers provide lower emissions compared to conventional systems, which has increased adoption in industries seeking to comply with stringent environmental regulations and carbon reduction targets.

The technology enables integration with smart monitoring and automation systems, allowing real-time performance optimization and predictive maintenance. Rising industrial energy costs and increased focus on sustainability have further strengthened demand for condensing boilers.

Their ability to achieve high thermal efficiency while supporting varying load conditions makes them suitable for diverse industrial processes As industries continue to emphasize energy conservation and cost reduction, the condensing technology segment is expected to maintain its leading position, supported by technological innovation, regulatory compliance, and operational efficiency benefits.

With the strict regulations supporting the reductions of emission of harmful gases, the demand for industrial boilers is expected to rise. The regulations such as the one set by European law that stated emissions limit values (ELVs) for reducing levels of harmful gases such as nitrogen oxides (NOX), sulphur dioxide (SO2), and others from all combustion plant, greatly influence the industrial boilers market.

With increasing emphasis given to low degree of harmful gas emissions, the key players in the industrial boilers market are focusing on upgrading and enhancing their portfolios to ensure abidance to the same. For example, Cochran, an industrial boilers market player, switched from using oil to LNG for space heating at its Scotland site for facilitating developments of a R&D center. With this the company could not just reduce CO2 emissions but also gain economic efficiency with cost savings.

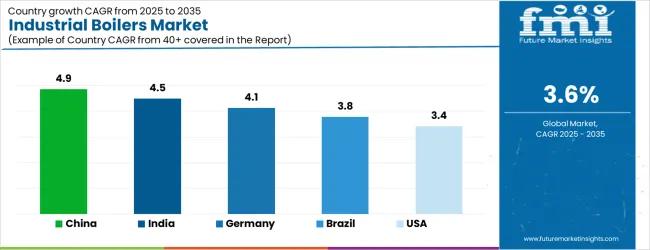

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

The Industrial Boilers Market is expected to register a CAGR of 3.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.9%, followed by India at 4.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.7%, yet still underscores a broadly positive trajectory for the global Industrial Boilers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.1%. The USA Industrial Boilers Market is estimated to be valued at USD 6.2 billion in 2025 and is anticipated to reach a valuation of USD 6.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 821.2 million and USD 543.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.1 Billion |

| Product Type | Water Tube Industrial Boiler, Fire Tube Industrial Boiler, and Others |

| Boiler Capacity | 10-50 MMBtu/Hr, Below 10 MMBtu/Hr, 50-100 MMBtu/Hr, 100-250 MMBtu/Hr, and Above 250 MMBtu/Hr |

| Technology | Condensing and Non-Condensing |

| Fuel Type | Natural Gas, Coal, Oil, and Others |

| End User | Chemical Industry, Refinery Industry, Food Industry, Paper Industry, Primary Metals Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermax Ltd., Siemens AG, Bharat Heavy Electricals Ltd., Forbes Marshall, Mitsubishi Heavy Industries Ltd., Harbin Oil Corporation, Cheema Boilers Limited, IHI Corporation, AC Boilers, Dongfang Oil Corporation Ltd., Cleaver-Brooks., and Babcock and Wilcox |

The global industrial boilers market is estimated to be valued at USD 17.1 billion in 2025.

The market size for the industrial boilers market is projected to reach USD 24.4 billion by 2035.

The industrial boilers market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in industrial boilers market are water tube industrial boiler, fire tube industrial boiler and others.

In terms of boiler capacity, 10-50 mmbtu/hr segment to command 36.9% share in the industrial boilers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA