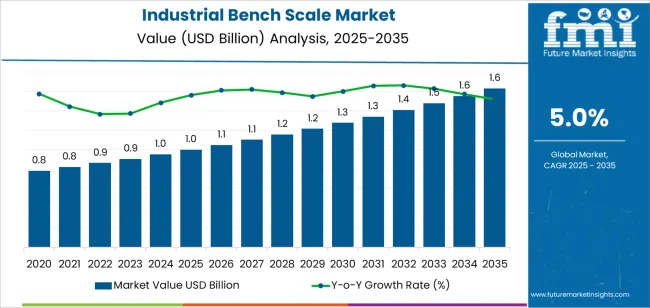

The industrial bench scale market is valued at USD 1.0 billion in 2025 and is forecasted to reach USD 1.7 billion by 2035, advancing at a CAGR of 5.0%. Market growth is driven by increasing demand for precision weighing in manufacturing, logistics, and quality assurance operations. Expanding industrial automation, the rise of smart weighing systems, and the integration of digital connectivity in production environments are strengthening the adoption of bench scales for efficient process control and compliance monitoring.

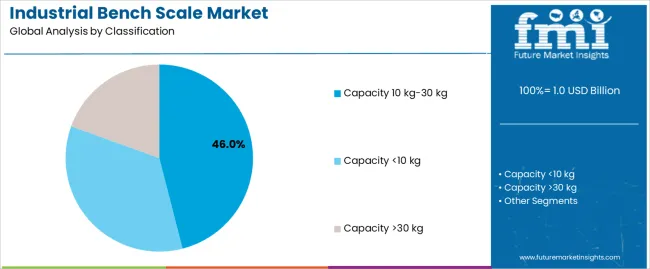

Bench scales with a capacity range of 10 kg–30 kg represent the leading segment due to their versatility in medium-load applications across food processing, pharmaceuticals, and component assembly industries. These scales offer accuracy, durability, and ease of calibration, making them suitable for both production lines and laboratory use. Developments in stainless steel platforms, load cell technology, and data interface compatibility continue to enhance measurement precision and operational reliability.

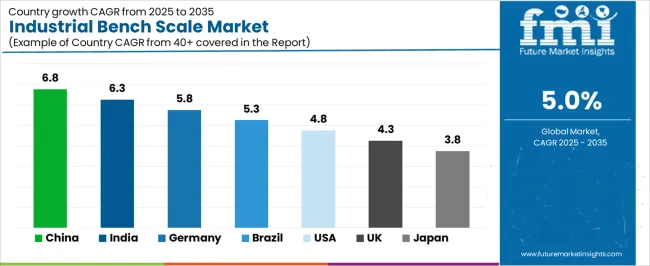

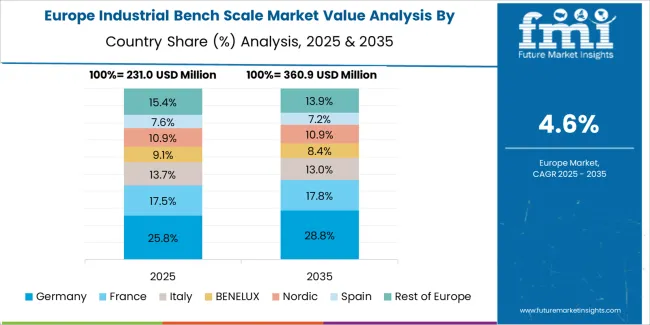

Asia Pacific leads global market growth, supported by industrial expansion in China, India, and Southeast Asia. Europe and North America maintain consistent demand through modernization of manufacturing facilities and adherence to stringent quality standards. Key market participants include Mettler-Toledo, Ohaus, A&D, Minebea Intec, BAYKON, Zhejiang Bawang Weighing Apparatus, and Nuweigh Pty Ltd., focusing on precision engineering, digital integration, and rugged industrial design.

The market’s acceleration and deceleration pattern reflects a controlled yet sustained expansion driven by industrial automation and precision measurement requirements. From 2025 to 2029, the market will enter an acceleration phase as manufacturing, logistics, and food processing sectors increase investments in digital weighing systems integrated with data tracking and calibration software. Rising focus on quality control and regulatory compliance will strengthen adoption during this phase.

Between 2030 and 2035, growth will shift into a mild deceleration phase as adoption in developed markets stabilizes and price competition among suppliers intensifies. Replacement demand and technological upgrades will become the primary growth drivers, particularly for advanced models featuring connectivity and automated calibration functions. Despite the moderation, stable procurement across production, packaging, and laboratory applications will maintain consistent market performance. The overall acceleration–deceleration pattern indicates a mature, reliability-focused industry characterized by incremental innovation, process integration, and steady demand from precision-oriented manufacturing environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.0 billion |

| Market Forecast Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025-2035) | 5.0% |

The industrial bench scale market is expanding as demand rises for precision weighing and measurement solutions in manufacturing, food processing, logistics, laboratories, and quality control operations. Bench scales offer compact footprint and high accuracy, making them suitable for tasks such as batching, sorting, inventory verification, and statistical process control. Growth in factory automation and digital integration fuels adoption of connected bench scales with features like data output interfaces and traceability support.

Innovation in materials, design and electronics enhances durability and measurement integrity for bench scales, encouraging adoption across diverse industries and applications. Strict regulations for product quality, safety and hygiene in sectors such as pharmaceuticals and food further increase demand for reliable bench-scale systems. E-commerce and packaging growth also contribute to demand, due to requirements for consistent, fast weigh-in processes in order fulfillment. Challenges include pricing pressures, competition from cheaper alternatives, and the need for calibration services to ensure long-term reliability. Market maturity in advanced economies contrasts with growth potential in emerging regions where industrial infrastructure is developing.

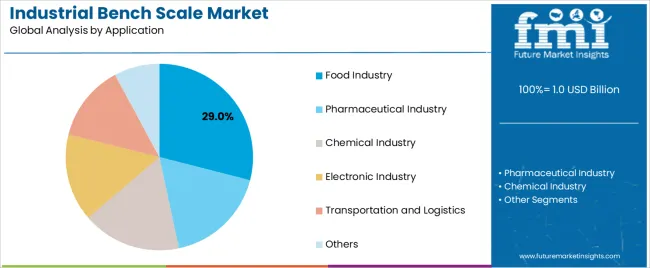

The industrial bench scale market is segmented by classification and application. By classification, the market is divided into capacity <10 kg, capacity 10 kg–30 kg, and capacity >30 kg. Based on application, it is categorized into food industry, pharmaceutical industry, chemical industry, electronic industry, transportation and logistics, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

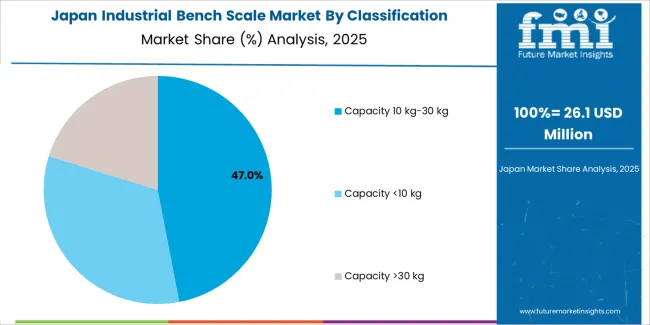

The capacity 10 kg–30 kg segment holds the leading position in the industrial bench scale market, representing an estimated 46.0% of total market share in 2025. This capacity range is widely used across mid-scale industrial operations due to its balance between weighing precision and load handling capacity. Bench scales in this category are preferred in production environments requiring high accuracy for packaging, portioning, and formulation tasks.

Their dominance is reinforced by extensive use in the food, pharmaceutical, and chemical sectors where controlled material measurement and compliance with quality standards are critical. These scales often feature stainless steel platforms, digital interfaces, and connectivity options for data integration into production systems. The capacity <10 kg segment, estimated at 32.0%, serves laboratory and small-component weighing applications, while the capacity >30 kg segment, representing 22.0%, caters to heavy-duty industrial and logistics operations.

Key factors supporting the 10 kg–30 kg segment include:

The food industry segment accounts for approximately 29.0% of the industrial bench scale market in 2025. This dominance reflects the extensive use of bench scales in food production, processing, and packaging applications where precise weight measurement is essential for portion control, labeling accuracy, and regulatory compliance. The demand is reinforced by strict hygiene requirements and the increasing adoption of stainless steel and waterproof models designed for washdown environments.

The pharmaceutical industry segment follows, representing an estimated 24.0% of the market, driven by stringent validation and calibration standards for ingredient measurement. The chemical industry and electronic industry segments collectively account for around 27.0%, supported by applications in formulation, batching, and material inspection. The transportation and logistics segment contributes approximately 12.0%, while the others category, covering educational and research uses, holds the remaining 8.0%.

Primary dynamics driving demand from the food industry segment include:

Demand for precision measurement, automation integration, and broad industrial usage support market expansion.

The Industrial Bench Scale Market grows as manufacturing, logistics, food processing, and chemical industries increasingly require accurate small-to-mid range weighing for quality control, batching, and inventory tasks. Industry 4.0 and automation adoption elevate demand for digital, network-enabled bench scales that interface with MES/ERP systems. Regulations on traceability and standardised measurement practices across global supply chains reinforce uptake. Suppliers’ development of rugged, multifunctional bench scales with modular capacity tiers (<10 kg, 10–30 kg, >30 kg) expands appeal for diverse settings from labs to factory shop-floors.

Price sensitivity, market saturation, and calibration/maintenance requirements limit widespread growth.

Higher-end electronic bench scales with advanced features such as connectivity, compliance certification, or legal-for-trade status command significant cost premiums, restricting adoption by smaller enterprises. Some mature markets already have entrenched suppliers and product penetration, reducing room for growth. Periodic calibration, maintenance, and adherence to metrology standards add recurring operational costs. In lower-income or rural regions, limited infrastructure and awareness hinder investment in high-precision bench weighing equipment.

Digital connectivity, regional growth in Asia-Pacific, and segment diversification define market direction.

Bench scale manufacturers increasingly embed IoT/IIoT features for remote monitoring, data logging, and integration with industrial automation platforms. Asia-Pacific emerges as a major growth region due to expanding industrialisation, rising middle-class manufacturing, and import-substitution policies. The product range is diversifying from basic bench-top devices to hybrid offerings combining weighing, counting, and quality-control modules, targeting pharmaceutical, R&D, and food-safety applications.

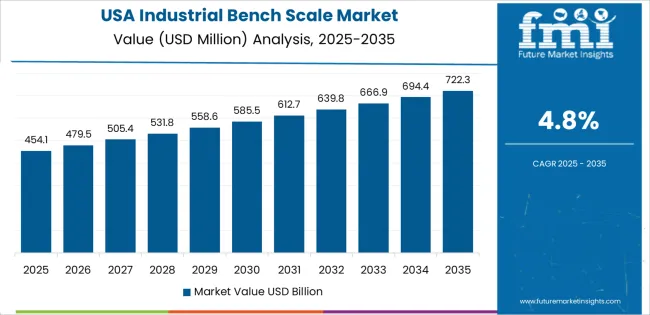

The global industrial bench scale market is expanding steadily through 2035, supported by automation in manufacturing, quality control optimization, and precision requirements across logistics and production facilities. China leads with a 6.8% CAGR, followed by India at 6.3%, reflecting strong industrialization and technological adoption. Germany grows at 5.8%, driven by innovation in sensor integration and digital weighing systems. Brazil records 5.3%, supported by industrial expansion and calibration standardization. The United States posts 4.8%, driven by R&D in process automation and IoT connectivity, while the United Kingdom (4.3%) and Japan (3.8%) maintain steady growth through precision engineering and advanced production systems.

| Country | CAGR (%) |

|---|---|

| China | 6.8 |

| India | 6.3 |

| Germany | 5.8 |

| Brazil | 5.3 |

| USA | 4.8 |

| UK | 4.3 |

| Japan | 3.8 |

China’s market grows at 6.8% CAGR, supported by rapid industrial automation, manufacturing expansion, and export-oriented production. Domestic manufacturers are integrating load cell sensors and smart calibration modules into bench scales for improved accuracy and process efficiency. Government initiatives under Made in China 2025 promote digital weighing systems and smart factory integration. Adoption in electronics, automotive, and logistics industries continues to rise with the focus on standardized quality management. Growing exports of low-cost yet durable weighing systems contribute significantly to the market’s global share.

Key Market Factors:

India’s market grows at 6.3% CAGR, driven by industrialization, modernization of production processes, and the growing focus on precision measurement. Local manufacturers are producing affordable, high-accuracy bench scales suitable for food processing, logistics, and engineering sectors. The Make in India initiative supports domestic scale manufacturing and electronic component integration. Expanding pharmaceutical and chemical industries contribute to demand for high-precision weighing systems. The adoption of digital calibration standards and government accreditation under Legal Metrology Act ensure quality consistency and compliance in industrial measurement.

Market Development Factors:

Germany’s market grows at 5.8% CAGR, supported by innovation in precision engineering, process automation, and material handling optimization. Manufacturers are developing digital bench scales with advanced load cells and real-time data connectivity for Industry 4.0 applications. Integration with enterprise resource planning (ERP) systems enhances traceability and production efficiency. Strong adherence to OIML and DIN standards ensures measurement reliability and accuracy. Increasing adoption in automotive, chemicals, and high-value manufacturing supports steady market expansion. Germany’s leadership in industrial R&D reinforces its role as a hub for precision measurement technology.

Key Market Characteristics:

Brazil’s market grows at 5.3% CAGR, driven by industrial process improvement, logistics optimization, and expansion in food and beverage manufacturing. Local producers are offering durable bench scales designed for humid and heavy-duty environments. Standardization efforts under INMETRO promote accuracy and certification compliance. Growing investment in warehouse automation and agribusiness drives adoption of digital weighing equipment. Partnerships with international suppliers are improving technological quality and distribution networks. As Brazil’s manufacturing and export base expands, the demand for robust, high-capacity bench scales continues to increase.

Market Development Factors:

The United States grows at 4.8% CAGR, supported by industrial automation, high-precision instrumentation, and R&D in sensor technology. Manufacturers are integrating IoT and wireless communication in bench scales for enhanced data transfer and real-time monitoring. Applications across pharmaceuticals, aerospace, and manufacturing require consistent measurement accuracy and compliance with NIST standards. Federal investment in automation and smart factory systems under the Advanced Manufacturing Initiative supports technological upgrades. The replacement of legacy mechanical scales with digital, programmable models maintains long-term market growth.

Key Market Factors:

The United Kingdom’s market grows at 4.3% CAGR, supported by industrial modernization, ecofriendly goals, and digital integration. British manufacturers are introducing energy-efficient and network-ready weighing systems for manufacturing and logistics applications. Compliance with Weights and Measures Act and EU CE certification ensures product quality and accuracy. Investment in automation across packaging, warehousing, and pharmaceutical industries is driving demand for high-performance digital scales. Collaboration with European precision equipment suppliers enhances innovation in smart calibration and data management.

Market Development Factors:

Japan’s market grows at 3.8% CAGR, reflecting a mature industrial ecosystem focused on precision and efficiency. Domestic manufacturers are emphasizing miniaturized, high-accuracy weighing systems compatible with robotic assembly lines. Integration of digital sensors and AI-assisted calibration ensures consistent performance in complex production environments. R&D under the Society 5.0 initiative supports smart factory automation and real-time monitoring systems. Adoption in electronics, precision machinery, and laboratory applications continues to drive steady market growth. Japan’s commitment to manufacturing excellence and product reliability ensures sustained market competitiveness.

Key Market Characteristics:

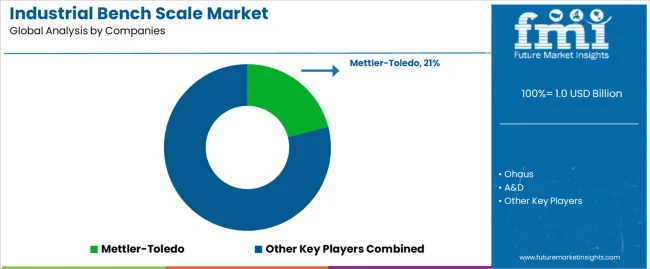

The industrial bench scale market is moderately consolidated, with around fifteen key global and regional manufacturers serving manufacturing, logistics, laboratory, and food processing sectors. Mettler-Toledo leads the market with an estimated 21.0% global share, supported by its broad product range, precision measurement technology, and extensive global service network. The company’s leadership is reinforced by continuous investment in digital calibration, industrial automation integration, and compliance with international metrology standards.

Ohaus, A&D, and Minebea Intec follow as major competitors, focusing on high-accuracy weighing platforms and user-centric designs that integrate seamlessly with industrial control systems. Their competitive advantage lies in reliability, ease of calibration, and durable construction suited for harsh operational environments. BAYKON, Rice Lake Weighing Systems/Ishida, and CAS Corporation maintain strong mid-tier positions, providing competitively priced solutions and regional service support across Asia, North America, and Europe.

Emerging manufacturers such as Zhejiang Bawang Weighing Apparatus, Guangdong Senssun Weighing Apparatus Group, and T-Scale contribute to cost-efficient production and expanding availability in Asia-Pacific markets. Kern & Sohn, Gram Group, and Soehnle Industrial Solutions emphasize precision, compact design, and compliance with industrial quality standards in European markets. Competition centers on measurement accuracy, durability, and digital connectivity. Market growth is supported by increasing automation in industrial processes, the adoption of IoT-enabled weighing systems, and demand for robust bench scales that combine precision, data integration, and long service life in production and quality control environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Capacity <10 kg, Capacity 10 kg–30 kg, Capacity >30 kg |

| Application | Food Industry, Pharmaceutical Industry, Chemical Industry, Electronic Industry, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Mettler-Toledo, Ohaus, A&D, Minebea Intec, BAYKON, Zhejiang Bawang Weighing Apparatus, Nuweigh Pty Ltd., Guangdong Senssun Weighing Apparatus Group, Rice Lake Weighing Systems/Ishida, CAS Corporation, T-Scale, Kern & Sohn, Gram Group, Soehnle Industrial Solutions, Essae-Teraoka Limited, PCE Instruments |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of industrial weighing equipment manufacturers; advancements in digital precision weighing technologies; integration with automation systems for logistics, manufacturing, and quality control applications. |

The global industrial bench scale market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the industrial bench scale market is projected to reach USD 1.6 billion by 2035.

The industrial bench scale market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in industrial bench scale market are capacity 10 kg-30 kg, capacity <10 kg and capacity >30 kg.

In terms of application, food industry segment to command 29.0% share in the industrial bench scale market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA