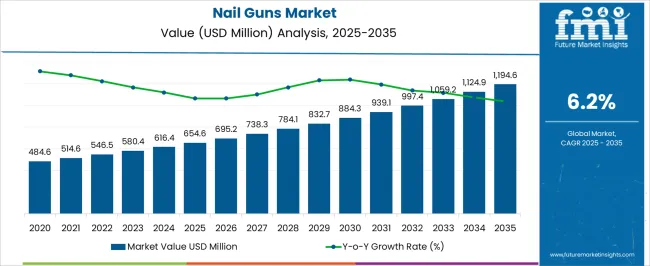

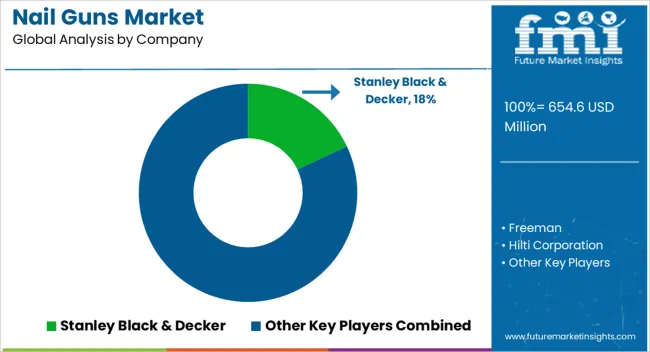

The nail guns market, valued at USD 654.6 million in 2025 and projected to reach USD 1,194.6 million by 2035 at a CAGR of 6.2%, demonstrates a clear movement along the market maturity curve. In the early phase, nail guns experienced adoption driven by professional contractors and industrial users who valued efficiency and reduced manual labor.

The adoption lifecycle shows that by the mid-2020s, penetration was established in commercial construction and woodworking, with steady replacement demand sustaining incremental gains. The trajectory from USD 654.6 million in 2025 to USD 884.3 million in 2030 indicates progression through the growth stage, where increasing awareness, ergonomic designs, and cordless technology innovations drive acceptance among small contractors and residential users.

The market moves toward early maturity after 2030 as usage becomes standardized, evident in the rise to USD 1,059.2 million by 2033. However, differentiation through battery innovations, safety mechanisms, and multi-material compatibility prevents stagnation. By 2035, reaching USD 1,194.6 million, the market is expected to be in late growth and approaching maturity, with penetration high in developed economies but still expanding in emerging regions. The lifecycle suggests sustained but competitive growth, where innovation and regional adoption patterns define long-term market positioning.

| Metric | Value |

|---|---|

| Nail Guns Market Estimated Value in (2025 E) | USD 654.6 million |

| Nail Guns Market Forecast Value in (2035 F) | USD 1194.6 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The nail guns market represents a significant segment within the global power tools and construction equipment industry, emphasizing speed, precision, and productivity in fastening applications. Within the broader power tools sector, it accounts for about 5.4%, driven by demand from residential, commercial, and infrastructure projects. In the woodworking and carpentry equipment segment, it holds nearly 4.7%, reflecting its vital role in framing, roofing, and furniture manufacturing.

Across the professional construction tools market, the share is 4.1%, supporting large-scale adoption for efficiency and labor cost reduction. Within the home improvement and DIY tools category, it represents 3.6%, highlighting use among hobbyists and small-scale users. In the pneumatic and battery-powered fastening tools market, it secures 3.3%, emphasizing the transition from manual hammering to automated and cordless solutions. Recent developments in this market have focused on cordless technology, ergonomics, and multi-surface compatibility. Innovations include lithium-ion powered nail guns, brushless motors for durability, and depth-adjustment features for precision fastening. Key players are collaborating with battery technology providers and construction firms to enhance product performance and safety.

Adoption of compact, lightweight designs, quick-reload systems, and vibration reduction mechanisms is gaining traction to improve user comfort and reduce fatigue. The integration of smart sensors for jam detection, safety locks, and IoT-enabled monitoring is being explored to enhance reliability.

The market is experiencing robust growth fueled by the rising demand for efficient fastening solutions across construction, woodworking, and industrial manufacturing sectors. Increasing infrastructure development activities worldwide, coupled with the need for enhanced productivity and safety on job sites, are driving the adoption of advanced nail gun technologies.

The future outlook is shaped by innovations in ergonomics, battery efficiency, and automation that improve operator convenience and reduce fatigue. Additionally, growing preference for cordless and pneumatic tools that offer portability and consistent power is influencing market expansion.

The demand is further supported by urbanization trends, rising renovation projects, and a shift toward mechanized fastening methods to replace manual nailing. As construction standards become more stringent and contractors seek tools that enhance speed without compromising quality, the Nail Guns market is poised for sustained growth with opportunities for product differentiation and technological upgrades.

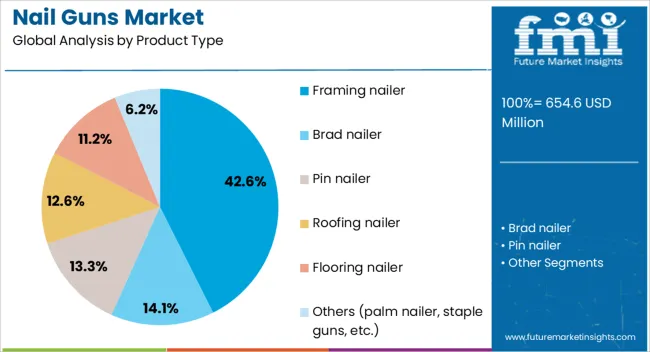

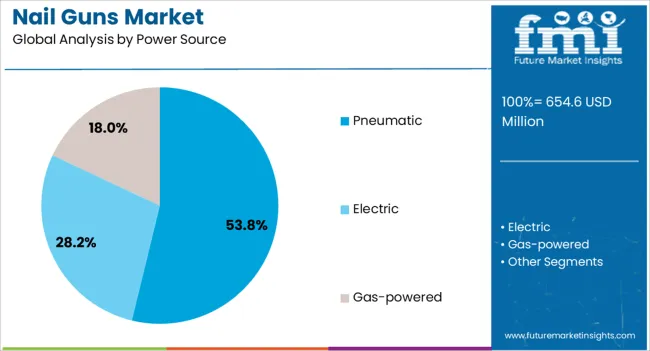

The nail guns market is segmented by product type, power source, operation, end-use, distribution channel, and geographic regions. By product type, nail guns market is divided into Framing nailer, Brad nailer, Pin nailer, Roofing nailer, Flooring nailer, and Others (palm nailer, staple guns, etc.). In terms of power source, nail guns market is classified into Pneumatic, Electric, and Gas-powered.

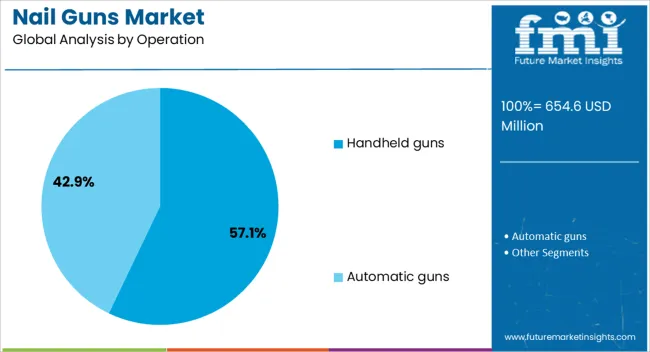

Based on operation, nail guns market is segmented into Handheld guns and Automatic guns. By end-use, nail guns market is segmented into Construction & infrastructure, Furniture & home improvement, Automotive, Packaging, and Others (upholstery, etc.). By distribution channel, nail guns market is segmented into Offline and Online. Regionally, the nail guns industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The framing nailer segment is estimated to hold 42.6% of the market revenue share in 2025, emerging as the leading product type. This prominence is being attributed to its widespread application in heavy-duty construction projects where large timber and framing components require robust fastening. Framing nailers offer superior power and precision that support structural integrity and speed on site.

Their adaptability to various nail sizes and fasteners enhances versatility, making them a preferred choice among professional contractors and builders. The segment growth has also been reinforced by the increasing construction of residential and commercial buildings that demand reliable framing tools.

Ergonomic advancements and compatibility with both pneumatic and battery-powered systems have expanded their use in diverse job environments. Furthermore, framing nailers’ ability to reduce manual labor and improve safety compliance has accelerated their adoption, positioning the segment as a cornerstone of the Nail Guns market.

Pneumatic nail guns are anticipated to command 53.8% of the power source segment’s revenue share in 2025, making them the dominant choice in the market. Their leading position is attributed to the consistent and high power output delivered by compressed air, which allows for rapid firing and penetration in demanding construction tasks. Pneumatic systems are favored in professional environments for their reliability, durability, and capacity to handle heavy-duty applications.

The widespread availability of air compressors on construction sites supports the continued preference for pneumatic tools. Despite the rising popularity of cordless alternatives, pneumatic nail guns maintain their edge due to lower upfront costs and well-established maintenance protocols.

The segment’s growth is also supported by advancements in lightweight design and improved hose management systems that enhance operator mobility and reduce fatigue The proven performance of pneumatic nail guns in high-volume and intensive projects secures their leading status within the power source category.

The handheld guns segment is projected to hold 57.1% of the market revenue share in 2025, reflecting its dominance in terms of operational design. This prevalence is attributed to the demand for portable, easy-to-use fastening solutions that facilitate flexibility and speed across a variety of job sites. Handheld nail guns enable precise targeting, quick maneuverability, and reduced operator strain, making them highly suitable for both professional and DIY applications.

Their ergonomic design and compatibility with various power sources, including pneumatic and battery-powered systems, have expanded their adoption. The growth of this segment has been driven by the increasing number of small to medium construction and remodeling projects where compact and lightweight tools offer practical advantages.

Furthermore, handheld nail guns support enhanced safety through trigger and depth control features, aligning with evolving workplace safety standards. The operational convenience and adaptability of handheld guns secure their leading role in the Nail Guns market.

The market has been influenced by developments in construction, woodworking, and furniture production. Nail guns, also called nailers, have replaced manual hammering methods in many industries due to their efficiency, precision, and labor-saving capabilities. Their adoption has been supported by the rise of large-scale building projects, modular housing, and demand for lightweight furniture manufacturing. Technological advances, including cordless and pneumatic systems, have broadened applications while improving safety and performance. As industries focus on time efficiency and precision fastening, nail guns have secured their role as essential tools across both professional and residential applications.

The construction industry has remained the dominant end-user of nail guns, driven by the need for faster and more accurate fastening methods in large projects. With increased building activities in residential and commercial sectors, demand for efficient tools has expanded. Nail guns enable faster completion of flooring, roofing, framing, and decking tasks compared to manual methods. Contractors increasingly prefer pneumatic and gas-powered nailers for heavy-duty use, while battery-powered options gain popularity in smaller projects. The emphasis on improving productivity, reducing labor costs, and enhancing project turnaround times continues to support the growing use of nail guns in global construction markets.

The furniture and woodworking sectors have adopted nail guns extensively due to their ability to improve assembly speed and ensure precise fastening. Manufacturers rely on brad nailers and finish nailers for delicate woodwork, cabinetry, and upholstery, where aesthetics and structural stability are critical. Rising consumer demand for ready-to-assemble and modular furniture has further strengthened the role of nail guns in production lines. Smaller workshops and DIY enthusiasts have also shown interest in electric and cordless models that combine convenience with professional-grade performance. This rising adoption in both large-scale manufacturing and personal woodworking projects has broadened market opportunities significantly.

Innovation in nail gun technology has played a central role in shaping market growth. Cordless nailers equipped with lithium-ion batteries provide mobility and eliminate the need for compressors or gas cartridges. Pneumatic models are being improved with lightweight designs, enhanced safety features, and reduced recoil to ensure operator comfort. Smart tools with adjustable depth control, jam-clearing mechanisms, and noise reduction technologies are increasingly available. Such advancements make nail guns more versatile and accessible to different user segments. Continuous improvements in energy efficiency, ergonomics, and durability are expected to maintain steady demand across professional contractors and DIY users.

Despite strong adoption, safety concerns and operational risks remain significant challenges in the market. Improper handling or malfunctioning tools can cause injuries, which have necessitated stricter safety regulations and user training requirements. Manufacturers have been incorporating safety mechanisms such as sequential firing modes, trigger locks, and contact safety tips to reduce accidental discharge. Noise levels and vibration exposure also pose ergonomic challenges for long-term users. The cost barriers for advanced cordless models may limit accessibility in developing regions. Addressing these safety and affordability issues will be crucial for ensuring wider market penetration and consistent industry growth.

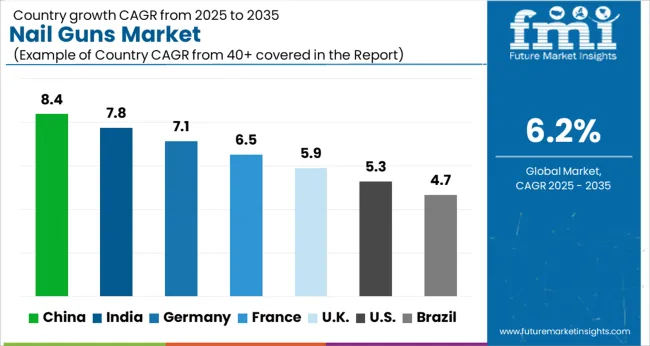

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

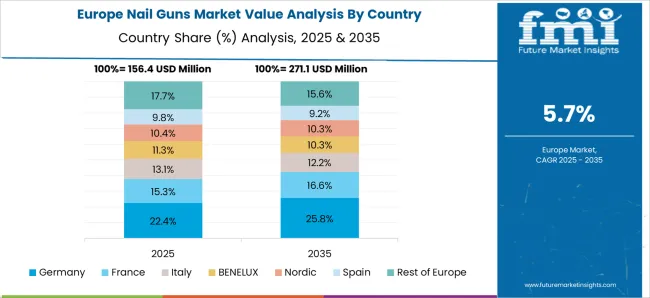

The market is expected to grow at a CAGR of 6.2% from 2025 to 2035, influenced by expanding construction activities, woodworking applications, and the demand for efficient fastening tools. India registered 7.8, supported by rapid residential and commercial construction growth. Germany accounted for 7.1, where high adoption in precision carpentry and industrial projects was noted. China dominated at 8.4, reflecting large-scale infrastructure development and strong manufacturing capacity. The United Kingdom recorded 5.9, driven by steady demand in renovation projects, while the United States stood at 5.3, reflecting adoption in housing and do-it-yourself applications. Each of these markets illustrates a different approach to scaling nail gun usage, driven by local construction dynamics and technological adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to advance at a CAGR of 8.4%, supported by rising construction activity, furniture manufacturing, and rapid adoption of mechanized tools in small and medium enterprises. Domestic companies focus on cost effective pneumatic and cordless variants to capture both professional and DIY segments. Government emphasis on infrastructure growth has played a crucial role in stimulating demand. The exports of Chinese produced nail guns remain significant, as competitive pricing and wide product ranges make local brands strong competitors in international markets.

The market in India is expected to grow steadily with a CAGR of 7.8%, supported by strong demand from furniture workshops, construction contractors, and small-scale manufacturing units. Adoption has been reinforced by the shift from manual nailing methods to mechanized tools for efficiency and safety. Domestic manufacturers increasingly collaborate with international brands to bring affordable cordless models to market, while imports also supplement growing demand. Expansion of real estate and interior design sectors is expected to remain a strong driver of long-term consumption.

Germany is forecast to expand at a CAGR of 7.1%, supported by robust growth in prefabricated housing, carpentry, and renovation projects. Consumers show a preference for high quality cordless models with advanced safety features, creating opportunities for premium international brands. Domestic distributors emphasize after sales service and product durability, which plays a crucial role in buyer decisions. Imports from China and other Asian markets remain essential, though European manufacturers continue to focus on specialized nail gun models for professional carpenters and contractors.

The United Kingdom market is projected to record a CAGR of 5.9%, driven by demand from the construction sector, DIY users, and interior refurbishment projects. Domestic retailers continue to focus on supplying cordless and battery operated models to cater to a growing preference for mobility and convenience. Imports primarily from China and Germany supply a large portion of market requirements. Demand is also supported by an increase in smaller renovation projects, where lightweight and compact nail guns are preferred for efficient use.

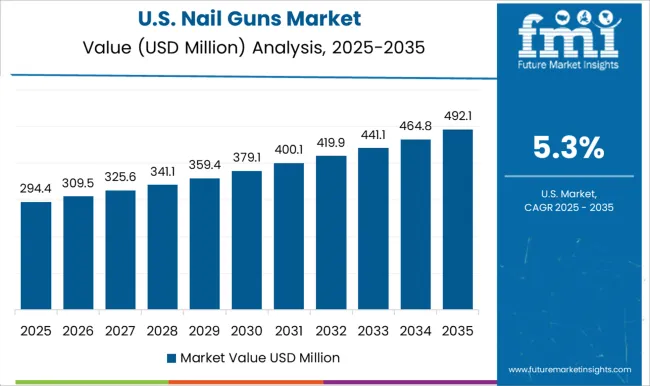

The United States is anticipated to grow at a CAGR of 5.3%, supported by steady demand from the residential housing sector, remodeling projects, and commercial carpentry. Domestic producers emphasize innovation in battery technology, ergonomic design, and safety enhancements, giving them a strong foothold in premium segments. Imports from Asia complement local production, particularly in pneumatic nail guns used in industrial settings. The presence of leading brands ensures continuous product development, while DIY adoption continues to support retail channel growth.

The market is characterized by strong competition among multinational tool manufacturers and specialized pneumatic and cordless equipment providers. Stanley Black & Decker, Hilti Corporation, Hitachi, Makita, Milwaukee, Robert Bosch, and Ryobi dominate the global landscape with expansive product portfolios, advanced cordless technologies, and extensive retail networks. These companies leverage brand recognition, global distribution, and continuous innovation to maintain their competitive edge. Paslode, Senco, Freeman, Metabo, Max Corporation, and Ridgid strengthen the market with a focus on pneumatic nailers, framing nailers, and finish nailers that serve both professional contractors and DIY users. Their strategies emphasize cost efficiency, durable construction, and user-friendly designs to target different customer segments.

Many players are investing in lithium-ion powered nail guns and ergonomic designs to reduce operator fatigue and improve productivity. The competitive environment is influenced by a shift toward cordless solutions, sustainability in battery technology, and increased demand from the construction and woodworking industries. Companies that combine innovation in fastening systems with affordability and after-sales support are positioned to strengthen their market presence.

| Item | Value |

|---|---|

| Quantitative Units | USD 654.6 Million |

| Product Type | Framing nailer, Brad nailer, Pin nailer, Roofing nailer, Flooring nailer, and Others (palm nailer, staple guns, etc.) |

| Power Source | Pneumatic, Electric, and Gas-powered |

| Operation | Handheld guns and Automatic guns |

| End-use | Construction & infrastructure, Furniture & home improvement, Automotive, Packaging, and Others (upholstery, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker, Freeman, Hilti Corporation, Hitachi, Makita, Max Corporation, Metabo, Milwaukee, Paslode, Ridgid, Robert Bosch, Ryobi, and Senco |

| Additional Attributes | Dollar sales by nail gun type and application, demand dynamics across construction, woodworking, and furniture manufacturing sectors, regional trends in professional tool adoption, innovation in power efficiency, ergonomics, and safety features, environmental impact of material use and energy consumption, and emerging use cases in modular construction, precision carpentry, and automated assembly processes. |

The global nail guns market is estimated to be valued at USD 654.6 million in 2025.

The market size for the nail guns market is projected to reach USD 1,194.6 million by 2035.

The nail guns market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in nail guns market are framing nailer, brad nailer, pin nailer, roofing nailer, flooring nailer and others (palm nailer, staple guns, etc.).

In terms of power source, pneumatic segment to command 53.8% share in the nail guns market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nail Polish Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Nail Strengtheners Market

Snail Market Size and Share Forecast Outlook 2025 to 2035

Global Snail Mucin Market Size and Share Forecast Outlook 2025 to 2035

Snail Mucin Skincare Market Growth – Trends & Forecast 2024-2034

Snail Beauty Products Market

Custom Nail Polish Market Growth – Size, Demand & Forecast 2024-2034

Brittle Nails Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Electric Baby Nail Trimmer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic High Speed Nail Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Welding Guns Market Growth - Trends & Forecast 2025 to 2035

Dispensing Guns Market Size and Share Forecast Outlook 2025 to 2035

Perforating Guns Market Size and Share Forecast Outlook 2025 to 2035

Powder Coating Guns Market

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA