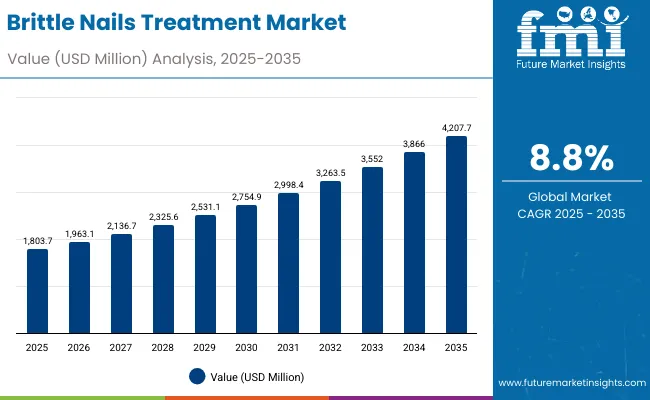

The Brittle Nails Treatment Market is expected to record a valuation of USD 1,803.7 million in 2025 and USD 4,207.7 million in 2035, with an increase of USD 2,404 million, which equals a growth of more than 193% over the decade. The overall expansion represents a CAGR of 8.8% and more than a 2X increase in market size.

Brittle Nails Treatment Market Key Takeaways

| Metric | Value |

|---|---|

| Brittle Nails Treatment Market Estimated Value in (2025E) | USD 1,803.7 million |

| Global Brittle Nails Treatment Forecast Value in (2035F) | USD 4,207.7 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

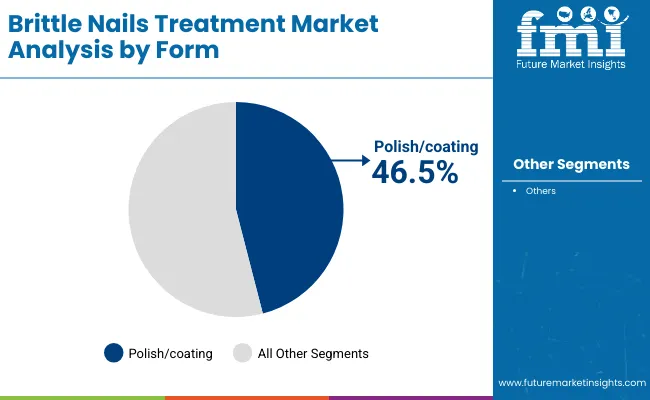

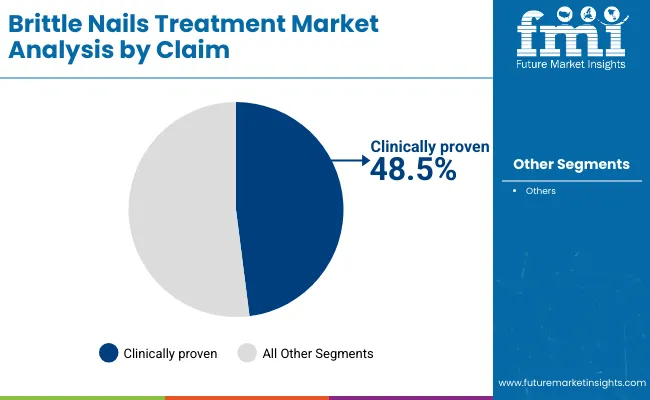

During the first five-year period from 2025 to 2030, the market increases from USD 1,803.7 million to USD 2,754.9 million, adding USD 951.2 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption of brittle nail treatments across women consumers and elderly users, driven by the rising prevalence of nail damage due to aging, nutritional deficiencies, and salon practices. Polish/coating formulations dominate this period as they cater to 46.5% of demand in 2025, meeting consumer needs for easy application and immediate strengthening effects. Clinically proven claims remain a critical driver, accounting for 48.5% of revenues in 2025, reflecting strong reliance on efficacy-backed products.

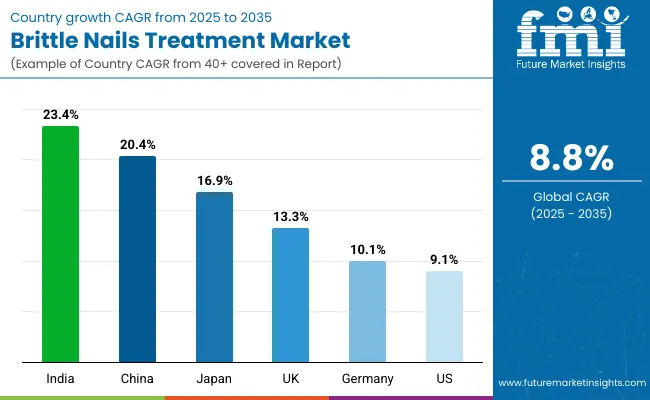

The second half from 2030 to 2035 contributes USD 1,452.8 million, equal to 60% of total growth, as the market jumps from USD 2,754.9 million to USD 4,207.7 million. This acceleration is powered by widespread adoption of serums and cuticle/nail oils as consumers shift to targeted treatments and multi-ingredient therapies. Markets in Asia-Pacific, particularly India (23.4% CAGR) and China (20.4% CAGR), drive double-digit growth, supported by expanding middle-class spending and growing salon penetration. E-commerce platforms expand their reach, enabling premium brands to scale globally with natural/organic and vegan claims. By 2035, the combined demand for oils, serums, and capsules significantly reshapes the form segment, while men and frequent salon users emerge as faster-growing end-user categories.

From 2020 to 2024, the Brittle Nails Treatment Market expanded steadily, reaching over USD 1.7 billion by 2024, driven by early adoption of strengthening polishes and cuticle oils in North America and Europe. During this period, the competitive landscape was dominated by professional nail care brands, with OPI and Sally Hansen holding significant shares. The market was characterized by a reliance on hardware-like products (polishes/coatings), which controlled nearly half of revenues in 2025, while serums and supplements were positioned as secondary or emerging categories. Competitive differentiation relied heavily on brand reputation, visible results, and salon endorsements, while e-commerce remained a developing but under-penetrated channel.

Demand for brittle nails treatment is projected to accelerate to USD 1,803.7 million in 2025, and the revenue mix will gradually shift as oils, serums, and oral supplements gain adoption across global beauty consumers. Traditional leaders like OPI and Essie face rising competition from niche specialty brands such as Dermelect and Nailtiques, which market themselves with clinically proven claims and targeted active ingredients like biotin, keratin, and peptides. Emerging entrants are focusing on natural, vegan, and fragrance-free formulas, catering to a growing segment of health-conscious consumers. The competitive advantage is increasingly shifting from brand heritage alone to a broader ecosystem of efficacy, claim transparency, and channel presence, especially through direct-to-consumer e-commerce and influencer-led marketing.

The Brittle Nails Treatment Market is expanding as consumer awareness of nail health increases, driven by both cosmetic and clinical needs. Advances in formulations with active ingredients such as biotin, keratin, peptides, vitamin E, and plant oils have improved the ability to strengthen nail plates and cuticles, enabling faster recovery from brittleness. The rise of clinically validated products has reinforced consumer trust, particularly in markets like the USA and China where "clinically proven" accounts for nearly half of sales. Women remain the dominant user group, but elderly consumers and frequent salon visitors are contributing to broader adoption.

The expansion of multi-channel retail is another growth catalyst. Pharmacies/drugstores and e-commerce platforms are increasingly central to distribution, providing consumers with easy access to specialized nail health solutions. Demand for vegan and natural/organic claims is growing rapidly, reflecting a wider shift toward clean beauty. Regionally, Asia-Pacific markets such as India and China are recording double-digit CAGR due to rising disposable incomes and a cultural emphasis on beauty and personal care. Segment growth is expected to be led by polish/coating formulations in the near term, but oils and serums are projected to capture larger market shares by 2035 as consumer preference shifts toward customized, nutrient-rich, and long-lasting solutions.

The Brittle Nails Treatment Market is segmented by treatment type, active ingredient, form, channel, claim, end user, and region. Treatment type includes topical strengthening polishes, cuticle/nail oils, oral supplements, and serums, representing the diverse ways consumers approach nail health. Active ingredients such as biotin, keratin, peptides, vitamin E, and plant oils are central to efficacy-driven demand. Form segmentation covers polish/coating, oil drops, capsules, and serums, addressing consumer application preferences across cosmetic and therapeutic needs. Channels include pharmacies/drugstores, e-commerce, mass retail, and salons/professional, highlighting the multi-platform nature of distribution.

Claims such as natural/organic, clinically proven, fragrance-free, and vegan reflect the growing importance of trust, safety, and sustainability. End user segmentation spans women, men, elderly, and frequent salon users, showcasing the market’s wide demographic appeal. Regionally, the market spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with high growth concentrated in Asia-Pacific and steady expansion across the USA and Western Europe.

| Form | Value Share% 2025 |

|---|---|

| Polish/coating | 46.5% |

| Others | 53.5% |

Polish/coating products lead with 46.5% share in 2025, making them the single largest form segment in the brittle nails treatment market. Their dominance stems from convenience, affordability, and the ability to provide immediate cosmetic enhancement alongside strengthening effects. These products are widely available through mass retail, pharmacies, and salons, ensuring accessibility to a broad consumer base. However, the 53.5% share of other forms (serums, oils, and supplements) signals a shifting preference toward specialized and long-term solutions.

Serums and cuticle oils, often enriched with keratin, peptides, and plant oils, are gaining traction in premium and salon-driven channels. Meanwhile, oral supplements are tapping into the nutraceutical trend, offering a holistic approach to nail health. This balance suggests that while polishes remain the backbone of the category, the future of market growth lies in diversified formats that combine efficacy with lifestyle integration.

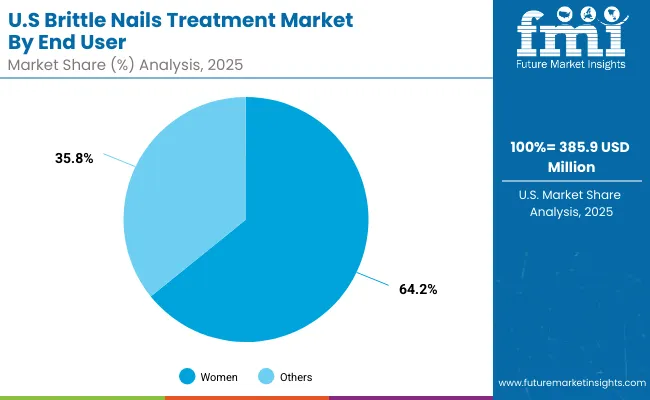

| End User | Value Share% 2025 |

|---|---|

| Women | 62.6% |

| Others | 37.4% |

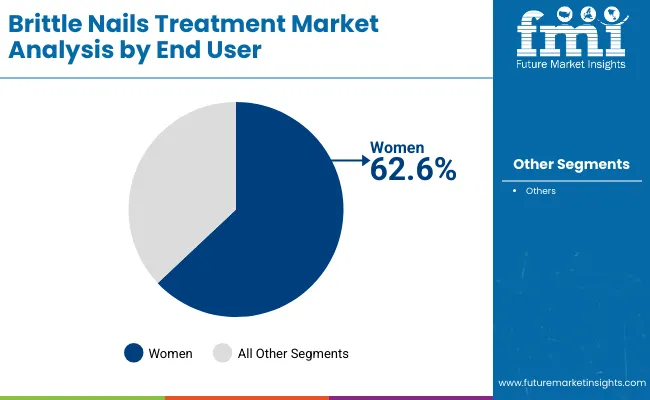

The women’s segment is forecasted to hold 62.6% of the Brittle Nails Treatment Market share in 2025, led by higher awareness of nail aesthetics, broader usage of cosmetics, and the influence of fashion and beauty trends. Women are more likely to integrate nail strengthening polishes, oils, and serums into their daily beauty routines, contributing to sustained demand in both professional salon and at-home care channels.

This dominance is further amplified by targeted marketing campaigns, product innovations featuring natural/organic claims, and the increasing popularity of vegan and fragrance-free formulations. The growing frequency of nail salon visits also adds to recurring demand for strengthening products. While men, elderly, and frequent salon users are rising in importance, women continue to remain the largest and most reliable consumer group, shaping product design, pricing strategies, and retail distribution.

| Claim | Value Share% 2025 |

|---|---|

| Clinically proven | 48.5% |

| Others | 51.5% |

The clinically proven claim segment is projected to account for 48.5% of the Brittle Nails Treatment Market revenue in 2025, establishing itself as the leading claim type. Products backed by clinical validation are highly valued by consumers seeking guaranteed results against nail brittleness, particularly in markets like the USA and China where health-conscious purchasing decisions are dominant. This segment benefits from rising trust in scientifically supported formulations that demonstrate measurable improvements in nail strength and appearance.

Companies are investing heavily in R&D and product trials to gain "clinically tested" labeling, which significantly boosts consumer confidence. The segment’s strength lies in bridging both cosmetic and therapeutic positioning, making it attractive across pharmacies, e-commerce, and professional salons. Given the growing role of efficacy-based marketing, clinically proven products are expected to remain the most influential category in claim-driven consumer purchases.

Rising Nail Damage Linked to Lifestyle and Salon Practices

A major driver for the Brittle Nails Treatment Market is the increasing prevalence of nail damage caused by frequent salon procedures such as gel manicures, acrylic nail extensions, and harsh removers. These practices, while popular for their aesthetic appeal, weaken nail beds and lead to brittleness, cracking, and thinning over time. Women, who account for over 60% of the market, are particularly impacted as regular exposure to UV lamps, chemicals, and solvents escalates the demand for strengthening polishes, oils, and serums. This driver is not just about beauty but about repair and recovery, making treatment products a recurring purchase. The expansion of nail salons worldwide, especially in Asia-Pacific and Western Europe, amplifies this factor, fueling steady growth across both mass-market and premium brands.

Expansion of Targeted Active Ingredient Formulations

Unlike generic nail care products, brittle nail treatments are now being formulated with highly targeted active ingredients such as biotin, keratin, peptides, and plant oils. Biotin-enriched oral supplements, for example, are gaining popularity in North America, while keratin-based coatings are seeing higher demand in Asia. The development of ingredient-specific claims provides differentiation for brands and increases consumer willingness to pay premium prices. This driver reflects a scientific and functional approach, where consumers are not only looking for cosmetic improvement but also for biological repair and reinforcement. The growth of nutraceuticals and dermo-cosmetics overlaps strongly here, pulling new customers into the brittle nails treatment category.

Lack of Standardized Clinical Proof Across Markets

A critical restraint for the Brittle Nails Treatment Market is the lack of standardized, globally recognized clinical testing frameworks. While "clinically proven" claims dominate consumer trust in the USA and China, regulatory interpretations differ across Europe, Japan, and India. Many products marketed as strengthening formulas lack rigorous clinical backing, leading to skepticism and slower adoption among educated consumers. This inconsistency in efficacy claims undermines trust, creating barriers for brands attempting to expand across multiple geographies with uniform positioning.

High Price Sensitivity in Emerging Economies

Although India and China are among the fastest-growing markets with CAGRs above 20%, the adoption of premium brittle nails treatments is still constrained by price sensitivity. Oral supplements, serums, and branded polishes are often perceived as non-essential luxury items rather than healthcare products. Local low-cost alternatives, DIY remedies, and natural oils often replace branded treatments in these markets. This makes it challenging for international players to sustain margins and scale effectively in lower-income consumer segments, despite high demand potential.

Rise of Natural, Vegan, and Clean-Label Nail Treatments

A defining trend in the brittle nails treatment market is the shift toward natural and vegan products, reflecting broader clean beauty movements. Consumers are increasingly concerned about the use of formaldehyde, toluene, and other harsh chemicals in nail care. Brands are responding by formulating plant-oil-based serums, fragrance-free coatings, and supplements with clean-label certifications. This trend is particularly strong among younger consumers and in regions like Europe, where sustainability and ingredient transparency are key purchase drivers. The shift creates room for new entrants to carve niches, while established players must reformulate to maintain trust.

E-commerce and Direct-to-Consumer Platforms Driving Premiumization

Another major trend is the growing role of e-commerce and D2C channels in the distribution of brittle nails treatments. Digital platforms allow niche and premium brands to bypass traditional retail, reaching consumers with targeted marketing campaigns and subscription-based offerings. For example, clinically proven serums and biotin supplements are being sold via recurring D2C models, enabling higher consumer retention. This digital shift also allows brands to leverage influencer marketing, nail art communities, and social media tutorials to showcase efficacy in real time. As a result, premium and specialized products gain traction faster than in traditional retail, reshaping the global revenue mix.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.4% |

| USA | 9.1% |

| India | 23.4% |

| UK | 13.3% |

| Germany | 10.1% |

| Japan | 16.9% |

The Brittle Nails Treatment Market shows distinct regional growth dynamics, with India (23.4% CAGR) and China (20.4% CAGR) leading the expansion through 2035. Rising disposable incomes, greater beauty consciousness among younger demographics, and rapid urbanization are fueling demand for strengthening polishes, serums, and oral supplements in these countries. India’s growth is particularly accelerated by a fast-expanding middle class and the influence of e-commerce platforms that provide access to international and niche brands.

In China, clinically proven treatments dominate as consumers favor efficacy-backed formulations, while premiumization in beauty and personal care further accelerates adoption. Both markets benefit from increasing salon penetration, where frequent nail services are boosting recurring demand for repair and recovery treatments.

Developed markets continue to show steady growth, with Japan at 16.9% CAGR reflecting strong consumer affinity for high-quality and innovative beauty products, and the UK (13.3%) benefiting from trends in vegan and clean-label nail care. Germany (10.1%) maintains growth through its robust pharmacy-driven retail structure, where clinically supported and natural-based treatments are in high demand. The USA market (9.1% CAGR), already large at USD 385.9 million in 2025, expands more moderately, driven by women consumers who account for 64.2% of demand.

While growth rates are lower than emerging Asia, the USA remains central to global revenues, supported by established brands like OPI, Sally Hansen, and Essie, along with a mature distribution network across pharmacies, salons, and online platforms. This mix of high-growth emerging markets and stable developed regions ensures a balanced trajectory for the Brittle Nails Treatment Market.

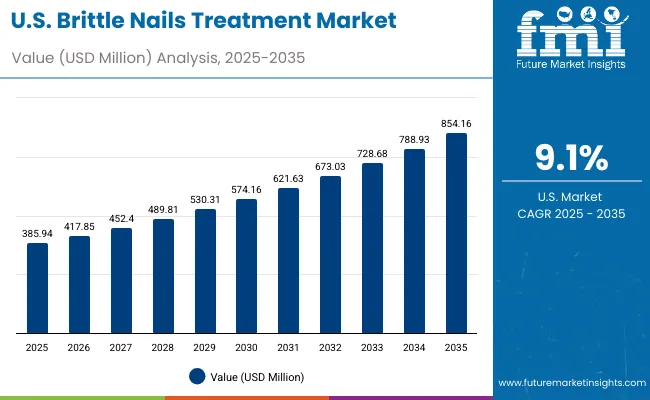

| Year | USA Brittle Nails Treatment Market (USD Million) |

|---|---|

| 2025 | 385.94 |

| 2026 | 417.85 |

| 2027 | 452.40 |

| 2028 | 489.81 |

| 2029 | 530.31 |

| 2030 | 574.16 |

| 2031 | 621.63 |

| 2032 | 673.03 |

| 2033 | 728.68 |

| 2034 | 788.93 |

| 2035 | 854.16 |

The brittle nails treatment market in the United States is projected to grow at a CAGR of 9.1%, supported by increasing consumer spending on nail health and aesthetics. Women remain the dominant segment, accounting for 64.2% of revenues in 2025 (USD 247.9 million), reflecting their high frequency of salon visits and preference for clinically proven products. E-commerce is expanding as a primary channel, complementing established pharmacy and drugstore sales. Rising demand for vegan, fragrance-free, and organic formulations is reshaping product portfolios, while established players like OPI, Sally Hansen, and Essie continue to hold strong brand equity.

The brittle nails treatment market in the United Kingdom is expected to grow at a CAGR of 13.3%, driven by consumer preference for vegan and natural/organic nail care solutions. Frequent salon users, particularly in metropolitan cities, are contributing to recurring demand for strengthening polishes and oils. The retail structure in the UK also supports premiumization, with specialty beauty chains and online platforms promoting niche and clinically supported brands. Additionally, the cultural shift toward sustainability has boosted demand for products marketed as cruelty-free and clean-label.

India is witnessing the fastest growth globally, with the brittle nails treatment market forecast to expand at a CAGR of 23.4% through 2035. The expansion is driven by growing disposable incomes, increased urbanization, and heightened awareness of nail health among younger women. Tier-2 and Tier-3 cities are becoming new growth hubs, supported by the penetration of affordable polishes and biotin-based supplements. E-commerce platforms like Nykaa and Amazon India are fueling rapid access to both international and domestic brands. Public awareness campaigns on beauty and nutrition also support adoption of oral supplements.

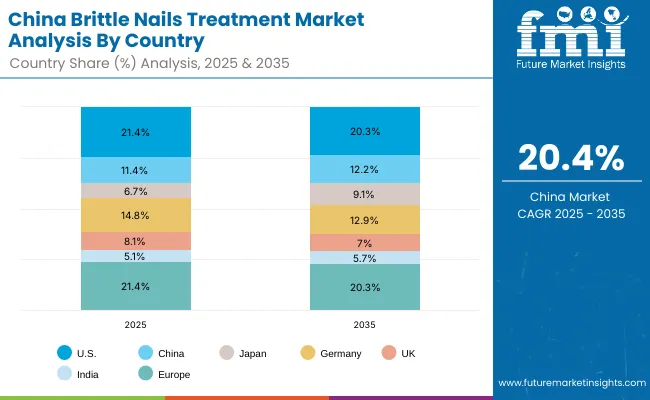

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 11.4% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 8.1% |

| India | 5.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.3% |

| China | 12.2% |

| Japan | 9.1% |

| Germany | 12.9% |

| UK | 7.0% |

| India | 5.7% |

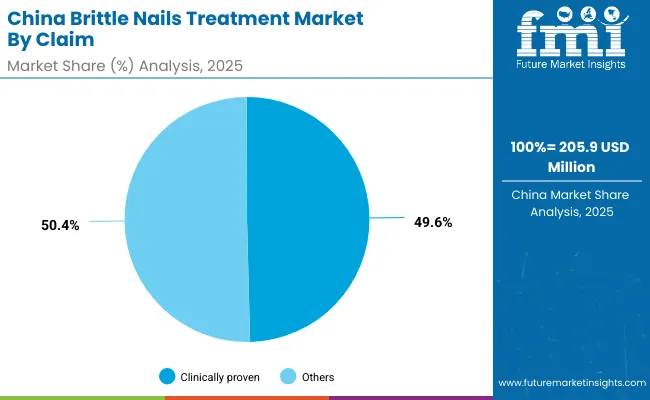

The brittle nails treatment market in China is expected to grow at a CAGR of 20.4%, among the highest globally. This growth is fueled by strong consumer trust in clinically proven formulations, which account for 49.6% of sales in 2025 (USD 102 million). Premiumization in beauty products and higher spending on personal grooming are driving demand across urban centers. Additionally, local brands are innovating with plant-oil-based serums and supplements, offering competitive pricing against international players. E-commerce penetration, livestream shopping, and cross-border sales have further accelerated growth, making China a critical market for global expansion.

| USA by End User | Value Share% 2025 |

|---|---|

| Women | 64.2% |

| Others | 35.8% |

The brittle nails treatment market in the United States is projected at USD 385.9 million in 2025, expanding steadily at a CAGR of 9.1% through 2035. Women contribute 64.2% of revenues (USD 247.9 million), reflecting their higher frequency of salon visits and greater reliance on strengthening polishes and clinically proven treatments. The dominance of women as the primary end users highlights the role of both aesthetic and therapeutic motivations in purchase behavior.

This clear end-user skew reflects the maturity of the USA beauty market, where clinically validated claims and dermatologist-endorsed products enjoy significant consumer trust. Expansion is supported by premium brands leveraging e-commerce and subscription-based direct-to-consumer platforms. As product lines diversify with vegan, fragrance-free, and natural claims, demand is growing not only in urban centers but also in suburban retail chains and online platforms. Professional salons remain important, but digital retail adoption is reshaping consumer access to nail health solutions.

| China by Claim | Value Share% 2025 |

|---|---|

| Clinically proven | 49.6% |

| Others | 50.4% |

The brittle nails treatment market in China is valued at USD 205.9 million in 2025, making it one of the fastest-growing national markets with a CAGR of 20.4% through 2035. Clinically proven treatments dominate with 49.6% share (USD 102 million), reflecting strong consumer preference for efficacy-backed products that guarantee results. Trust in science-driven formulations is particularly high in China, where consumers are increasingly cautious about product authenticity and effectiveness.

The rapid rise of e-commerce platforms, livestream shopping, and cross-border imports is driving accessibility of both international and domestic brands. Local innovators are formulating affordable plant-oil-based serums and supplements to compete with global players. Growing salon penetration, urban middle-class spending, and the integration of wellness positioning in nail treatments further enhance momentum. By 2035, China’s contribution to the global market is expected to increase as the share of clinically validated and premium brands expands beyond Tier-1 cities.

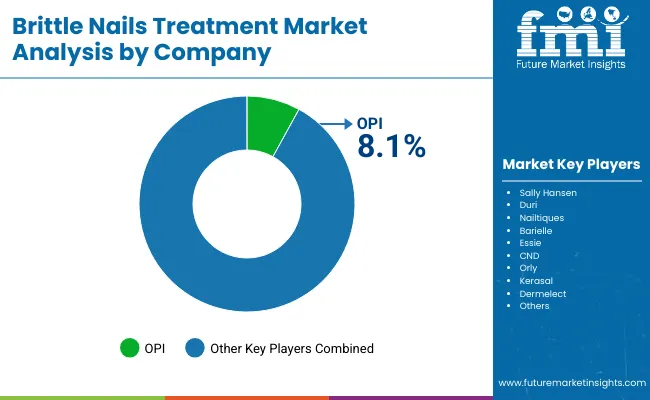

The Brittle Nails Treatment Market is moderately fragmented, with a mix of multinational beauty giants and niche specialty brands. OPI leads globally with an 8.1% share in 2025, supported by its strong salon presence, extensive polish range, and brand equity across premium nail care. Its dominance reflects both heritage and distribution strength across North America and Europe.

Established brands such as Sally Hansen, Essie, Orly, and CND drive adoption through mass retail, pharmacies, and e-commerce, combining affordability with trusted product lines. Specialty-focused brands like Nailtiques, Barielle, Kerasal, and Dermelect differentiate with clinically proven claims, active ingredient-rich serums, and targeted positioning for brittle nail repair and recovery. Their strength lies in addressing therapeutic needs beyond cosmetic enhancement.

The competitive differentiation is shifting toward clean-label innovation, clinical validation, and omnichannel strategies. E-commerce platforms and subscription-based D2C models allow newer entrants to compete with established salon-oriented players. With vegan, fragrance-free, and natural/organic claims gaining traction, competition is increasingly defined by transparency and consumer trust. By 2035, players with integrated ingredient innovation pipelines and strong digital retail footprints are expected to gain an upper hand.

Key Developments in Brittle Nails Treatment Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Treatment Type | Topical strengthening polishes, Cuticle/nail oils, Oral supplements, Serums |

| Active Ingredient | Biotin, Keratin, Peptides, Vitamin E, Plant oils |

| Form | Polish/coating, Oil drops, Capsules, Serum |

| Channel | Pharmacies/drugstores, E-commerce, Mass retail, Salons/professional |

| Claim | Natural/organic, Clinically proven, Fragrance-free, Vegan |

| End User | Women, Men, Elderly, Frequent salon users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, United Kingdom, Germany, France, China, Japan, India, Brazil, South Africa, Canada |

| Key Companies Profiled | OPI, Sally Hansen, Duri, Nailtiques, Barielle, Essie, CND, Orly, Kerasal, Dermelect |

| Additional Attributes | Dollar sales by treatment type and form, adoption trends in clinically proven and natural/organic claims, rising demand for polishes and serums across professional salons, sector-specific growth in women and elderly consumers, supplements revenue segmentation, integration with e-commerce and subscription-based direct-to-consumer models, regional growth led by India and China, and innovations in biotin, keratin, and peptide-based formulations |

The Brittle Nails Treatment Market is estimated to be valued at USD 1,803.7 million in 2025.

The market size for the Brittle Nails Treatment Market is projected to reach USD 4,207.7 million by 2035.

The Brittle Nails Treatment Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Brittle Nails Treatment Market are topical strengthening polishes, cuticle/nail oils, oral supplements, and serums.

In terms of form, the polish/coating segment is projected to command 46.5% share in the Brittle Nails Treatment Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brittleness Tester Market - Growth & Demand 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA