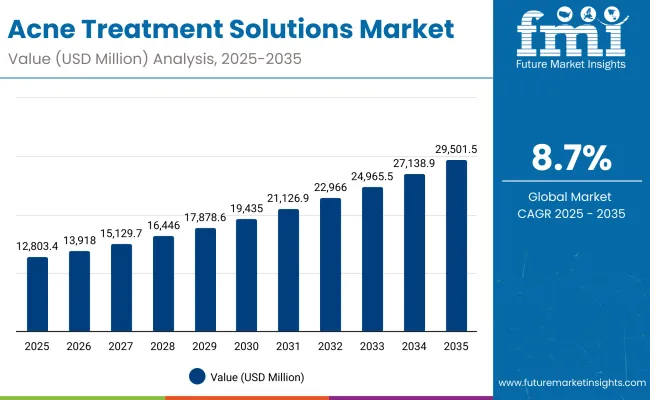

The Acne Treatment Solutions Market is expected to record a valuation of USD 12,803.4 million in 2025 and USD 29,501.5 million in 2035, with an increase of USD 16,698.1 million, which equals a growth of 130% over the decade. The overall expansion represents a CAGR of 8.7% and more than a 2X increase in market size.

Acne Treatment Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Acne Treatment Solutions Market Estimated Value in (2025E) | USD 12,803.4 million |

| Acne Treatment Solutions Market Forecast Value in (2035F) | USD 29,501.5 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 12,803.4 million to USD 19,435.0 million, adding USD 6,631.6 million, which accounts for 40% of the total decade growth. This phase records steady adoption of OTC topicals such as cleansers and gels, driven by consumer preference for accessible and preventive skincare solutions. Benzoyl peroxide and salicylic acid–based products dominate this period due to proven clinical efficacy and broad availability.

The second half from 2030 to 2035 contributes USD 10,066.5 million, equal to 60% of total growth, as the market jumps from USD 19,435.0 million to USD 29,501.5 million. This acceleration is powered by prescription topicals, systemic therapies, and device-based treatments such as LED/blue light gaining wider acceptance. Increased dermatologist-led recommendations, coupled with digital health and tele-dermatology platforms, support this phase. Advanced formulations combining retinoids, niacinamide, and anti-inflammatory blends further expand consumer reach, strengthening growth momentum in premium dermocosmetics.

From 2020 to 2024, the Acne Treatment Solutions Market grew steadily, driven by the expansion of dermocosmetic brands and rising consumer preference for preventative skincare routines. During this period, OTC topical solutions captured the bulk of revenues, with benzoyl peroxide and salicylic acid maintaining dominance as frontline treatments. Prescription products contributed significant growth, supported by dermatologist adoption, while systemic and device-based therapies had limited but rising presence. Service-based dermatology models also began gaining traction through telehealth and online pharmacy platforms.

Demand for Acne Treatment Solutions will expand further to USD 12,803.4 million in 2025, with the revenue mix gradually shifting as e-commerce and digital dermatology platforms enhance accessibility. Traditional skincare leaders face growing competition from digital-first entrants that emphasize personalization, subscription models, and AI-driven skin diagnostics. The competitive advantage is moving from single-ingredient topicals to hybrid portfolios combining actives, data integration, and consumer-focused digital ecosystems.

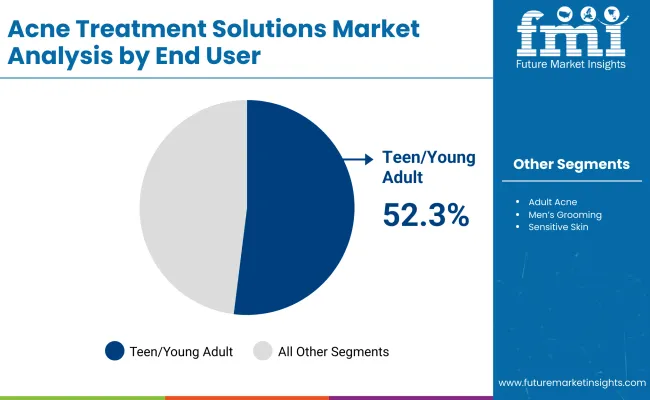

The surge in acne cases among teenagers and young adults is a key growth driver, with this group representing over 50% of end-user demand in 2025. Accessibility of OTC topicals such as gels, cleansers, and spot treatments, combined with social media-driven beauty consciousness, is expanding product adoption. The popularity of fast-acting benzoyl peroxide and salicylic acid products is reinforced by influencers, online tutorials, and brand campaigns, pushing early intervention trends in acne care.

Rapid expansion of tele-dermatology services and e-pharmacy platforms is significantly boosting prescription topical adoption, particularly retinoids and antibiotic formulations. Patients increasingly prefer digital consultations for skin issues, allowing prescriptions to be delivered seamlessly through online pharmacies. This shift improves accessibility in both developed and emerging markets while reducing reliance on in-person visits. Combined with growing dermatologist collaboration with skincare brands, these channels accelerate prescription-based acne care penetration and are reshaping traditional distribution models.

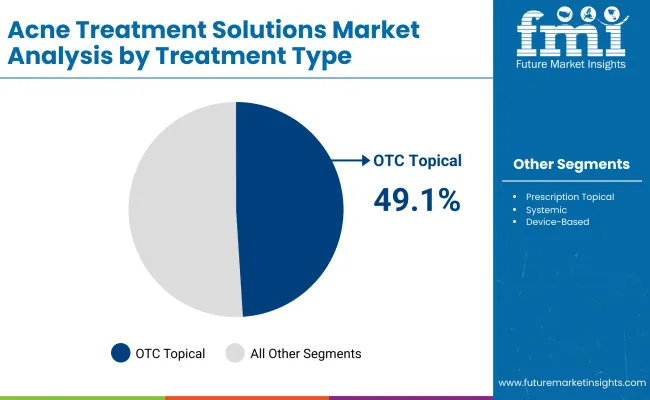

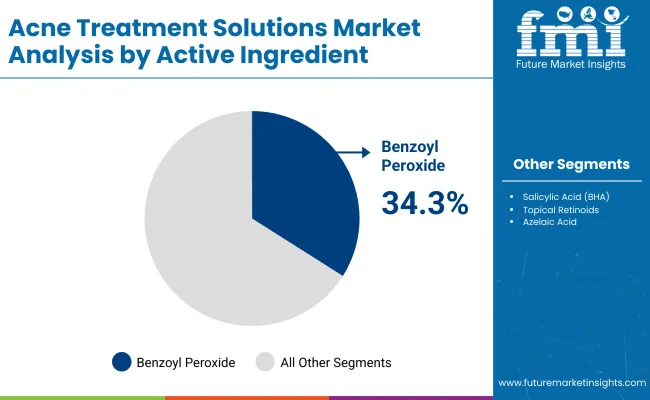

The Acne Treatment Solutions Market is segmented by treatment type, active ingredient, form, channel, end user, and region. Treatment types include OTC topicals (cleansers, gels), prescription topicals (retinoids, antibiotics), systemic therapies (oral antibiotics, isotretinoin), and device-based solutions (LED/blue light). Active ingredients comprise benzoyl peroxide, salicylic acid, topical retinoids, azelaic acid, and niacinamide blends, each addressing specific acne severity levels. By form, the market covers gels/gel-creams, serums, cleansers, spot treatments, and patches. Distribution channels include e-commerce, pharmacies/drugstores, dermatology clinics, and mass retail. End-user categories span teens/young adults, adult acne, men’s grooming, and sensitive skin. Regionally, the scope includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with China and India driving the fastest growth.

| Treatment Type | Value Share% 2025 |

|---|---|

| OTC topical | 49.1% |

| Others | 50.9% |

The OTC topical segment is projected to contribute 49.1% of the Acne Treatment Solutions Market revenue in 2025, maintaining its lead as the dominant treatment category. Growth is driven by consumer preference for easily accessible, non-prescription products such as cleansers, gels, and spot treatments. These products are widely available across retail and online platforms, making them the first line of defense for mild to moderate acne. Their affordability, convenience, and strong brand visibility through dermocosmetic players further reinforce demand. The segment is expected to remain the backbone of acne treatment solutions, supported by continuous innovations in fast-acting actives and combination formulations.

| Active Ingredient | Value Share% 2025 |

|---|---|

| Benzoyl peroxide | 34.3% |

| Others | 65.7% |

The benzoyl peroxide segment is forecasted to hold 34.3% of the market share in 2025, driven by its role as one of the most effective and widely used active ingredients in acne treatment solutions. Known for its antibacterial properties and ability to reduce excess oil, benzoyl peroxide remains a first-line treatment for mild to moderate acne. Its affordability, over-the-counter availability, and inclusion across cleansers, gels, and spot treatments continue to reinforce adoption. The segment’s growth is further supported by clinical validation, brand-backed education campaigns, and integration into combination therapies with retinoids and salicylic acid, ensuring it maintains dominance in acne treatment formulations.

| End User | Value Share% 2025 |

|---|---|

| Teen/young adult | 52.3% |

| Others | 47.7% |

The teen and young adult segment is projected to account for 52.3% of the Acne Treatment Solutions Market revenue in 2025, establishing it as the leading end-user group. This dominance reflects the high prevalence of acne during adolescence, where hormonal fluctuations significantly drive skin concerns. Teens and young adults are also more inclined toward preventive skincare routines, fueled by social media influence and brand marketing campaigns. The growing availability of OTC topicals, spot treatments, and patches tailored to younger skin types, combined with rising awareness around early intervention, ensures this segment remains at the forefront of market demand throughout the forecast period.

Rising prevalence of adult acne

While acne has traditionally been associated with teenagers, rising adult acne casesparticularly among womenare fueling market expansion. Stress, hormonal imbalances, pollution exposure, and lifestyle-related dietary factors are driving demand for long-term acne management solutions. This has led to higher adoption of prescription retinoids, systemic therapies, and dermocosmetic lines marketed specifically for adult skin. Brands are increasingly targeting adults with anti-acne formulations that also address concerns like aging, pigmentation, and dryness, ensuring continued growth beyond the adolescent population.

E-commerce and tele-dermatology integration

The surge in e-commerce platforms and digital health solutions is transforming acne treatment accessibility. Online pharmacies, brand-owned D2C websites, and tele-dermatology apps allow consumers to access both OTC and prescription products seamlessly. Personalized regimens, AI-driven skin analysis, and subscription-based models are driving consumer engagement and repeat purchases. This convenience particularly benefits teens and young adults, who prefer digital channels for skincare. As digital ecosystems expand globally, they are accelerating product penetration and supporting both established players and new entrants.

Antibiotic resistance in acne care

The increasing reliance on topical and oral antibiotics for acne treatment is raising concerns about antibiotic resistance, limiting long-term use. Dermatologists are becoming cautious with prescriptions, especially for systemic therapies like oral antibiotics. Regulatory bodies are also imposing stricter guidelines on antibiotic usage in dermatology. This restraint creates challenges for sustained prescription sales, pushing brands to diversify portfolios with safer alternatives such as retinoids, azelaic acid, and device-based therapies. Addressing antibiotic resistance remains a critical barrier for market growth.

Growing demand for multifunctional formulations

Consumers are increasingly seeking acne treatments that offer multifunctional benefits beyond clearing breakouts. Formulations combining acne-fighting actives like benzoyl peroxide or retinoids with niacinamide, ceramides, or hyaluronic acid are gaining traction, as they target both acne and secondary concerns such as redness, dryness, and post-inflammatory marks. The clean-label and sensitive-skin movement further fuels demand for gentler yet effective blends. This trend is reshaping product development, with leading brands positioning hybrid solutions that balance efficacy with skincare wellness, appealing to a broader consumer base.

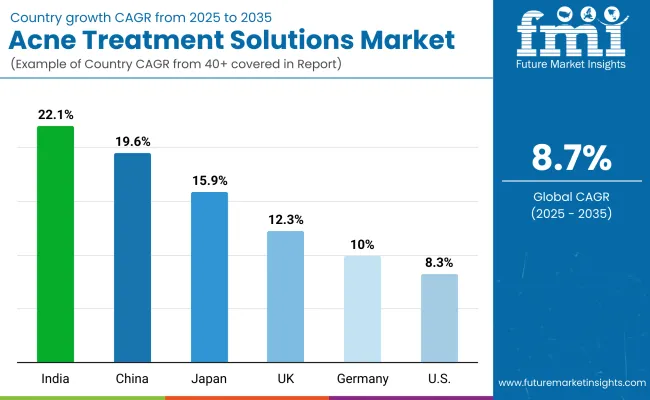

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.6% |

| USA | 8.3% |

| India | 22.1% |

| UK | 12.3% |

| Germany | 10.0% |

| Japan | 15.9% |

The global Acne Treatment Solutions Market shows clear regional disparities in growth, shaped by demographics, healthcare access, and consumer skincare preferences. Asia-Pacific is the fastest-growing region, led by India at 22.1% CAGR and China at 19.6%, fueled by a large youth population, rising disposable incomes, and the popularity of K-beauty and J-beauty-inspired acne care. Digital platforms and affordable dermocosmetic launches further accelerate adoption.

Europe maintains strong performance, with the UK at 12.3% and Germany at 10.0%, supported by premium dermocosmetic brands, dermatologist-backed OTC lines, and rising demand for clean-label solutions. Japan, at 15.9% CAGR, benefits from innovation in mild formulations and multifunctional serums designed for sensitive skin, alongside strong integration of device-based acne therapies. North America, led by the USA at 8.3% CAGR, shows steady growth supported by established dermatology networks, high consumer spend on premium acne regimens, and strong brand loyalty, though the market is more mature compared to Asia-Pacific.

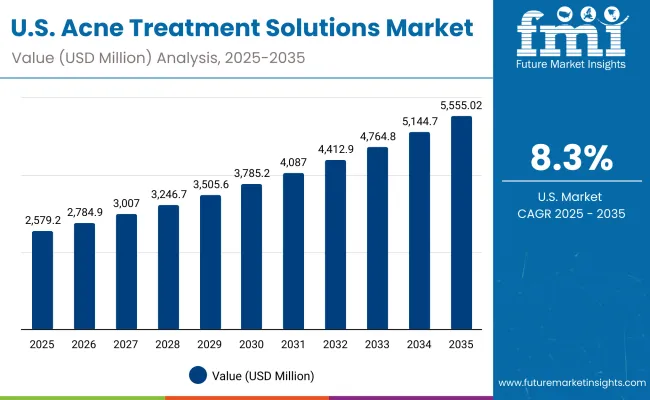

| Year | USA Acne Treatment Solutions Market (USD Million) |

|---|---|

| 2025 | 2,579.26 |

| 2026 | 2,784.93 |

| 2027 | 3,007.00 |

| 2028 | 3,246.77 |

| 2029 | 3,505.67 |

| 2030 | 3,785.21 |

| 2031 | 4,087.04 |

| 2032 | 4,412.94 |

| 2033 | 4,764.83 |

| 2034 | 5,144.77 |

| 2035 | 5,555.02 |

The Acne Treatment Solutions Market in the United States is projected to grow at a CAGR of 8.3%, supported by a strong base of dermatology practices, high consumer awareness, and consistent adoption of dermocosmetic brands. OTC topicals remain the largest contributor, particularly cleansers and gels, while prescription retinoids and antibiotics continue to drive dermatologist-led treatments. Tele-dermatology expansion and e-pharmacy integration are enhancing prescription adherence. Meanwhile, growing acceptance of device-based therapies such as blue light and LED treatments is expanding options for consumers seeking non-invasive solutions.

The Acne Treatment Solutions Market in the United Kingdom is expected to grow at a CAGR of 12.3%, supported by rising demand for dermocosmetic brands and dermatologist-driven prescriptions. OTC topicals, particularly cleansers and gels, remain highly popular, while prescription retinoids and combination therapies are gaining traction through the NHS and private dermatology clinics. Clean-label and sensitive-skin-focused formulations are in strong demand, aligning with consumer preferences for gentler acne care. E-commerce platforms and pharmacy chains are expanding access, while premium brands drive growth through marketing campaigns.

India is witnessing rapid growth in the Acne Treatment Solutions Market, projected to expand at a CAGR of 22.1% through 2035. Rising disposable incomes, increased skincare awareness, and the influence of social media are accelerating adoption across both metro and tier-2 cities. OTC topicals such as benzoyl peroxide and salicylic acid products are widely favored, while prescription retinoids are gaining popularity via dermatologists and telehealth platforms. Growing investments from global brands in affordable, India-specific formulations further fuel market expansion.

The Acne Treatment Solutions Market in China is expected to grow at a CAGR of 19.6%, the highest among leading economies. Growth is fueled by a large youth population, increasing skincare wareness, and rising affordability of dermocosmetic brands. OTC topicals dominate demand, particularly benzoyl peroxide and salicylic acid formulations, while tele-dermatology and e-commerce platforms are driving wider access to prescription treatments. Domestic players are offering competitively priced solutions, while global brands expand premium lines targeted at urban consumers, creating a balanced mix of mass and premium acne solutions.

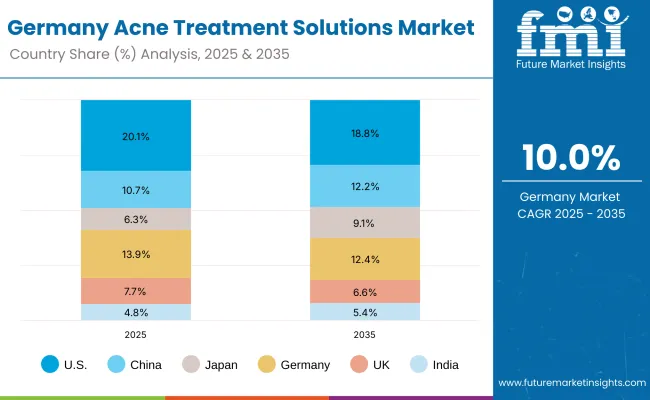

| Country | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.7% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.7% |

| India | 4.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 12.2% |

| Japan | 9.1% |

| Germany | 12.4% |

| UK | 6.6% |

| India | 5.4% |

The Acne Treatment Solutions Market in Germany is projected to grow at a CAGR of 10.0%, supported by the country’s advanced dermatology infrastructure and strong consumer preference for dermocosmetic brands. Pharmacy-driven distribution dominates, with La Roche-Posay, Bioderma, and CeraVe leading sales of OTC topicals. Prescription treatments, especially retinoids and antibiotic combinations, are increasingly prescribed in both private and public clinics. Clean-label and sensitive-skin-focused solutions are gaining ground, reflecting Germany’s regulatory push for safer cosmetic formulations. Growing demand for premium serums and clinic-grade device-based acne treatments further supports long-term market expansion.

| USA by Treatment Type | Value Share% 2025 |

|---|---|

| OTC topical | 51.8% |

| Others | 48.2% |

The Acne Treatment Solutions Market in the United States is projected at USD 2,579 million in 2025, reaching USD 5,555 million by 2035, at a CAGR of 8.3%. OTC topicals such as benzoyl peroxide cleansers and salicylic acid formulations dominate due to strong retail penetration across pharmacies and mass-market outlets. Prescription retinoids and antibiotic topicals remain critical in dermatology practices, especially for moderate to severe acne cases. The rise of clean-label and dermatologist-tested claims is shaping consumer demand, while tele-dermatology and DTC brands are increasing accessibility. Device-based acne treatments like LED therapy are emerging but remain a niche.

| China by End User | Value Share% 2025 |

|---|---|

| Teen/young adult | 54.2% |

| Others | 45.8% |

The Acne Treatment Solutions Market in China is valued at USD 1,376 million in 2025, expanding at a CAGR of 19.6% through 2035, one of the fastest globally. Teen and young adult consumers represent the largest segment at 54.2%, driven by rising urbanization, pollution-linked acne prevalence, and strong K-beauty and C-beauty influence. Affordable OTC topicals such as benzoyl peroxide and niacinamide blends dominate, while prescription retinoids are gaining traction in dermatology clinics. E-commerce platforms and social commerce channels such as Tmall and Douyin amplify accessibility, especially in lower-tier cities. Emerging opportunities lie in device-based LED treatments and clean-label serums, with strong uptake among middle-class youth.

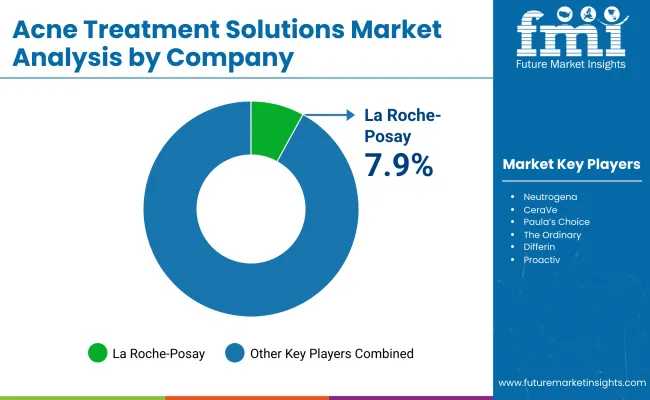

| Company | Global Value Share 2025 |

|---|---|

| La Roche- Posay | 7.9% |

| Others | 92.1% |

The Acne Treatment Solutions Market is moderately fragmented, led by multinational dermatology and skincare brands alongside niche innovators in OTC formulations and device-based therapies. La Roche-Posay, holding 7.9% share, maintains leadership through prescription-grade efficacy in dermocosmetic OTC topicals, bolstered by strong dermatologist endorsements and pharmacy distribution networks. Other key global players such as Neutrogena, CeraVe, Paula’s Choice, and The Ordinary leverage diversified acne portfolios spanning benzoyl peroxide cleansers, salicylic acid serums, and retinoid-based solutions.

Mid-tier specialists including Differin, Proactiv, and Murad focus on targeted acne treatment regimens, subscription-based skincare routines, and premium clean-label claims. Rising challengers like COSRX and Bioderma emphasize K-beauty and gentle formulations, appealing to sensitive skin consumers across Asia and Europe. Competitive differentiation is shifting away from single-ingredient OTC products toward holistic solutions integrating multifunctional actives, microbiome-supporting blends, and device-enhanced regimens. The growing traction of LED/blue light therapies, AI-powered skin diagnostics, and direct-to-consumer platforms is reshaping competitive positioning.

Key Developments in Acne Treatment Solutions Market

| Item | Value |

|---|---|

| Quantitative Units | USD 12,803.4 Million |

| Treatment Type | OTC topical (cleansers, gels), Prescription topical (retinoids, antibiotics), Systemic (oral antibiotics, isotretinoin), Device-based (LED/blue light) |

| Active Ingredient | Benzoyl peroxide, Salicylic acid (BHA), Topical retinoids, Azelaic acid, Niacinamide blends |

| Form | Gel/gel-cream, Serum, Cleanser, Spot treatment, Patch |

| Channel | E-commerce, Pharmacies/drugstores, Dermatology clinics, Mass retail |

| End User | Teen/young adult, Adult acne, Men’s grooming, Sensitive skin |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | La Roche- Posay, Neutrogena, CeraVe, Paula’s Choice, The Ordinary, Differin, Proactiv, Murad, Bioderma, COSRX, |

| Additional Attributes | Dollar sales by treatment type and active ingredient, adoption trends in OTC topicals and prescription retinoids, rising demand for LED/blue light device-based acne therapies, sector-specific growth in dermatology clinics, pharmacies, and e-commerce, software and services integration through AI-powered skin diagnostics and personalized regimens, regional trends influenced by consumer preference for natural/clean-label products, and innovations in formulations such as micro-dosed retinoids, niacinamide blends, and advanced benzoyl peroxide delivery systems. |

The global Acne Treatment Solutions Market is estimated to be valued at USD 12,803.4 million in 2025.

The market size for the Acne Treatment Solutions Market is projected to reach USD 29,501.5 million by 2035.

The Acne Treatment Solutions Market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key treatment types in the Acne Treatment Solutions Market are OTC topicals (cleansers, gels), prescription topicals (retinoids, antibiotics), systemic therapies (oral antibiotics, isotretinoin), and device-based treatments (LED/blue light).

In terms of treatment type, OTC topicals are projected to command 51.8% share in the Acne Treatment Solutions Market in 2025,

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acne Scarring Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-acne Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

Hormonal Acne Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Moderate-to-Severe Acne Treatment Market Trends and Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA