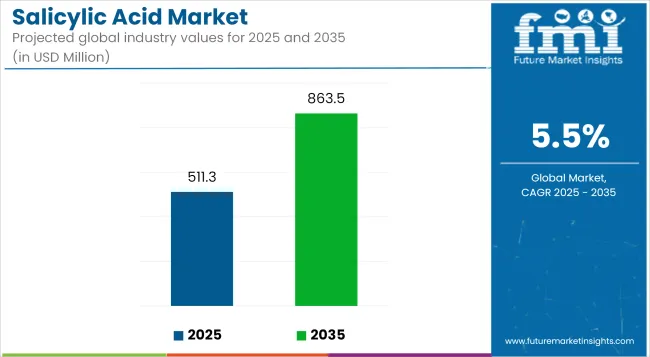

The salicylic acid market, valued at USD 511.34 million in 2025, is poised to reach approximately USD 863.45 million by 2035, reflecting sustained growth at a CAGR of 5.5%. The compound's broad-spectrum utility in skincare, personal care, and pharmaceutical preparations has underpinned steady demand, especially across regulated markets in North America and Europe. Its adoption in high-volume dermatological and anti-inflammatory products has positioned it as a cornerstone active ingredient across topical OTC and prescription treatments.

Growth in the salicylic acid industry is being propelled by a rising prevalence of acne-related disorders, increasing personal grooming trends, and consistent industrial-scale utilization in preservatives and pain-relieving medications. However, regulatory constraints associated with overuse concentrations, particularly in cosmetics and pediatric products, have imposed reformulation pressures on downstream players.

Demand for gentler, sustained-release formats has intensified. Key players have expanded their portfolios to meet demand for low-irritant or naturally derived derivatives. Additionally, technical trends toward plant-based synthesis and green chemistry alternatives have emerged, reflecting the shift toward sustainable sourcing and cleaner labels.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 511.34 million |

| Projected Industry Value (2035F) | USD 863.45 million |

| Value-based CAGR (2025 to 2035) | 5.5% |

Over half the market is expected to be consolidated within pharmaceutical-grade applications, dominated by formulations targeting acne, callus, and anti-inflammatory concerns. This trend is projected to persist into 2035, supported by a continuing rise in dermatological consultations and increased accessibility of advanced skincare.

Industrial use-particularly in food preservatives and analgesic manufacturing-will remain critical, though competitive substitution by bio-based acids may moderate its share in select geographies. Future demand is likely to remain product- and application-specific, especially as formulators prioritize safety, efficacy, and regulatory alignment.

With under 8.5% market share in 2025, botanical salicylates are poised to challenge synthetic salicylic acid’s value chain dominance. Sourced from wintergreen oil, willow bark, and other phenolic plant extracts, these derivatives are increasingly leveraged in premium natural cosmetics, particularly in Europe and Japan.

The European Commission’s ban on certain synthetic preservatives under Annex III of the EU Cosmetics Regulation (EC) No. 1223/2009 has intensified demand for naturally derived beta hydroxy acids, placing pressure on synthetic suppliers to pivot or differentiate. Brands like Typology (France) and Waphyto (Japan) have launched willow bark-based formulations that offer exfoliating efficacy with lower irritation potential, catering to sensitive skin demographics.

Despite challenges in achieving consistent bioactive concentration during extraction, recent advancements in fermentation-derived salicin production-such as those seen in biosynthesis models from companies like Givaudan Active Beauty-are expected to bridge performance gaps.

Growth in this segment will hinge on regulatory certification (e.g., COSMOS, ECOCERT), brand positioning, and extract standardization. With formulators shifting toward full-spectrum bioactives, the segment may see double-digit growth in high-income markets post-2028. However, production scalability, higher cost-per-kilo, and supply chain variability remain key constraints to broader industrial use.

Holding just over 6.1% share in 2025, salicylic acid’s use in food preservatives is expected to decline steadily in South and East Asia due to regulatory tightening and consumer-driven reformulation. In countries like China and Indonesia, historically lax enforcement of food-grade preservative thresholds has permitted salicylic acid's use in pickled vegetables and sauces.

However, the Chinese National Health Commission (NHC) reclassified salicylic acid in 2023 as “non-approved” under GB2760-2022 for many categories, aligning more closely with international standards such as the Codex Alimentarius.

This shift has led to a surge in R&D for alternative antimicrobial agents, including fermentate blends, lactic acid derivatives, and rosemary extracts, particularly among local condiment giants like Haitian and ABC Kecap. Concurrently, multinationals including Tate & Lyle and Corbion are scaling up food-safe bioacid production, positioning themselves as viable substitutes.

The transition is further catalyzed by ASEAN’s harmonization initiatives and rising demand for “preservative-free” claims across export-oriented food categories. Although salicylic acid remains legal in niche applications (e.g., low-moisture seasoning blends), its removal from mainstream food use is increasingly a certainty in Asia’s reformulating markets.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for the global Salicylic Acid market. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.7% |

| H2 (2024 to 2034) | 6.8% |

| H1 (2025 to 2035) | 6.9% |

| H2 (2025 to 2035) | 7.0% |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 6.7%, followed by a higher growth rate of 6.8% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase to 6.9% in the first half and remain considerably high at 7.0% in the second half. In the first half (H1) the sector witnessed an increase of 5 BPS while in the second half (H2), the business witnessed a decrease of 10 BPS.

Innovation in Functional Foods with Added Health Benefits Augmenting the Global Market

The development of functional foods has attracted considerable attention as consumers increasingly seek external options that provide more than basic nutrition. The above foods are crafty: to improve health beyond the usual nutrients, commonly used ingredients are minerals, vitamins, and several bioactive compounds.

Salicylic acid has emerged as a highly valuable component, accepted not only in cosmetics but also in acne treatment, together with health benefits accepted by experts and food producers.

This trend is reflected in the changing diet options, which prefer functional foodstuffs for a greater wellness benefit similar to immune system support, improved cardiovascular fitness, and reduced inflammation. However, the consumer should continue to be cautious about the origin and quality of such an ingredient, as these benefits are attractive.

Willow bark is characterized by its salicylic acid concentration, which is a naturally occurring anti-inflammatory chemical. In recent years, researchers and manufacturers have started looking at the usage of this chemical in sports nutrition, particularly in the context of inflammation-related illnesses including arthritis, heart disease, and other metabolic disorders.

Add salicylic acid to your diet, along with polyphenols, omega-3 fatty acids, and other antioxidants, to boost anti-inflammatory effects and overall health benefits. Tea and juice are familiar with their natural anti-inflammatory and stress-relieving properties; however, more research is needed to fully assess their effects.

Increasing Popularity of Over-The-Counter (OTC) Acne Treatment Products Boosting the Salicylic Acid Market Growth

A global trend toward more customized skincare and medical care is reflected in the rise of over-the-counter acne treatments, especially those that contain salicylic acid. Acne is a skin disorder that impacts individuals of all age groups, although it is most common in teens. Over-the-counter drugs, particularly those containing salicylic acid, are becoming more popular due to an increasing need for affordable, effective acne treatments.

Unlike other options like benzoyl peroxide, salicylic acid is more effective and gentler and produces less harm to the skin when used for acne treatment. The majority of individuals opt for over-the-counter products that contain salicylic acid, as they are more expensive than prescription versions and involve more complex chemicals or procedures.

Furthermore, the belief in non-invasive treatments for the skin and face has helped enhance its appeal in acne treatment. Conventional treatments with oral antibiotics or topical retinoids often cause massive side effects and sometimes require extending the duration before noticing improvements.

Growth of Salicylic Acid-Based Food Preservation Solutions Boosts the Market

The development of food preservation solutions based on salicylic acid has been spurred by the growing customer desire for safe and natural methods to ensure food safety and extend shelf life. This presents a significant opportunity in the food industry.

Salicylic acid, an organic compound with proven antibacterial and anti-inflammatory properties, is widely used in health and cosmetics. However, its efficacy as a food preservative is becoming increasingly apparent, coinciding with a global trend toward sustainable and clean-label food production.

Salicylic acid is an effective preservative as it inhibits the growth of bacteria, molds, and yeasts that cause food spoilage. Salicylic acid therefore disrupts the cellular activities of the microorganisms while preserving food products fresh with quality.

This applies greatly in the categories of baked products, dairy products, sauce, and ready-to-eat food products. Where microbial growth leads to spoilage and subsequent wasting. With the global food waste crisis at its critical levels, salicylic acid-based solutions could play a very crucial role in reducing losses along the supply chain, from production to consumption.

However, the formulation and marketing of salicylic acid-based food preservation formulations need to overcome some challenges. Some important steps in that direction include regulatory approval and safety testing to ensure salicylic acid can be used in food applications in a way that does not endanger consumers' health.

Tier 1 companies in Salicylic Acid, account for a significant share of the global market. BASF SE, Merck KgaA, and Thermo Fisher Scientific, these companies account for a major share of the global market and are at the forefront of innovation.

They are constantly driving innovation in salicylic acid applications and emphasizing residue-free solutions to fulfill rising customer demand for healthier and more trustworthy alternatives. Their enormous global presence, as well as their ability to propel advancements in product quality and sustainability, maintain their position as industry leaders.

Tier 2 Companies are the regional players focused on specialized products and adjust their offers to local consumer tastes, assuring competitiveness and adaptability within their territories. These companies frequently bridge the gap between global leaders and regional leaders.

Tier 3 Companies are smaller players who are usually limited to the local or regional areas. They tend to service localized areas and do not possess the same level of research & development as bigger companies but are nonetheless helpful in satisfying local needs. These companies are smaller in size but remain strong in their target industries which produce salicylic acids tailored to the specific needs of niche producers.

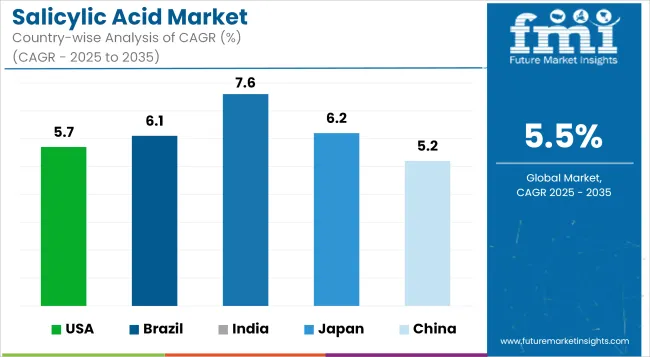

The following table shows the estimated growth rates of the top three territories. China and Japan are set to exhibit high consumption, recording CAGRs of 5.2% and 6.2%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| The USA | 5.7% |

| Brazil | 6.1% |

| India | 7.6% |

| Japan | 6.2% |

| China | 5.2% |

The growing usage of salicylic acid in dermatological and medicinal applications contributes to the market's rapid growth in the USA. Salicylic acid-based treatments are becoming more and more essential as skin disorders like psoriasis and acne become more prevalent.

Dermatologists and pharmaceutical industries increasingly rely on this chemical for its keratolytic, anti-inflammatory, and exfoliating capabilities, making it a critical element in topical therapies.

Furthermore, the usage of salicylic acid in commonly accessible items like cleansers, medicated pads, and ointments has increased owing to the pharmaceutical industry's emphasis on over-the-counter (OTC) medications.

Salicylic acid is also becoming more and more well-liked in analgesic formulations because of its ability to effectively reduce inflammation and relieve pain, making it a useful substance in the medical field.

Not only have new drug formulations enabled the pharmaceutical drugs sector development, but companies have embraced new technologies and have moved towards eco-friendly and sustainable production and alternative methods that ensure clean the environment, and allow a safer and more efficient production.

China is one of the leading countries globally in the salicylic acid market, relying on cost-effective manufacturing methods and its dominance in the production of raw materials to create a competitive advantage.

As one of the world leaders in phenol, which is one of the basic raw materials used to synthesize salicylic acid, China therefore has an integrated supply base that provides for continuous availability besides the low cost of manufacture.

Owing to this benefit, Chinese manufacturers are in a position to offer salicylic acid at affordable prices, making the country a leading supplier in international markets.

In addition, China boasts of a strong industrial framework and government support for the chemicals manufacturing industry, which helped to establish large-scale capacity production facilities that can effectively serve both domestic and export markets.

The country's focus on increasing production capacity and adopting highly advanced technologies has also significantly enhanced product quality, giving Chinese salicylic acid the ability to meet the strictest international specifications.

The competition landscape of the Salicylic Acid market is intense. BASF SE, Thermo Fisher Scientific, and Merck KgaA are some of the major market players and contribute significantly in terms of research & development investment and emphasizing the development of sustainability and availability of salicylic acid formulations to meet the requirements of the pharmaceutical, and cosmetics industry.

To expand their sales, producers are implementing numerous strategies including strategic and vertical acquisitions. Strategic collaborations between cosmetics, food preservatives, pharmaceutical producers, and technology manufacturers are becoming more widespread and promoting high-product innovation in salicylic acid solutions. Furthermore, sustainability trends and growing regulatory constraints are motivating players to develop and distinguish their products while fostering a culture of continual innovation.

For instance:

As per Form, the industry has been categorized into Powder and Liquid.

As per End-Use Application, the industry has been categorized into Pharmaceutical, Skin Care, Hair Care, Food Preservatives, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

The global industry is estimated at a value of USD 511.34 million in 2025.

Sales increased at 6.5% CAGR between 2020 and 2024.

Some of the leaders in this industry include Thermo Fisher Scientific Inc., BASF SE, Seqens International, Alta Laboratories, Merck KgaA, Alfa Aesar, Midas Pharma GmbH, Novocap, Simco Chemicals, Shanghai Sunwise Chemical Co., Ltd., and Cayman Chemical, among others.

The North American territory is projected to hold a revenue share of 24.6% over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA