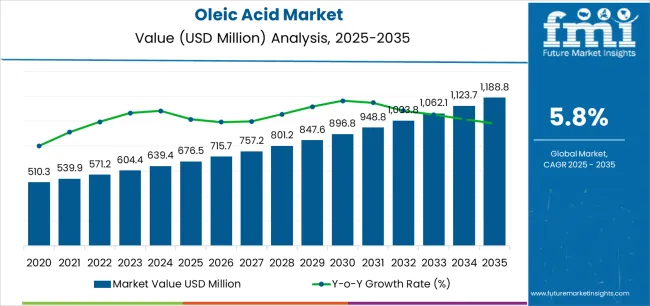

The oleic acid industry stands at the threshold of a decade-long expansion trajectory that promises to reshape food formulation technology, pharmaceutical excipient applications, and oleochemical manufacturing solutions. The market's journey from USD 676.5 million in 2025 to USD 1,188.8 million by 2035 represents substantial growth, demonstrating the accelerating adoption of plant-based oleic acid formulations and high-oleic oilseed technology across food processing, pharmaceutical manufacturing, and cosmetics sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 676.5 million to approximately USD 908.7 million, adding USD 232.2 million in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of food-grade oleic acid systems, driven by increasing clean-label food demand and the growing need for pharmaceutical excipient manufacturing worldwide. Advanced extraction technologies and GMP-compliant production systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness sustained growth from USD 908.7 million to USD 1,188.8 million, representing an addition of USD 282.9 million or 55% of the decade's expansion. This period will be defined by mass market penetration of high-oleic formulations, integration with comprehensive bio-based manufacturing platforms, and seamless compatibility with advanced drug delivery systems and natural cosmetics infrastructure. The market trajectory signals fundamental shifts in how manufacturers approach oleochemical sourcing optimization and product formulation management, with participants positioned to benefit from sustained demand across multiple grade categories and application segments.

The food and beverage sector also plays an influential role in shaping market dynamics. Oleic acid serves as a key component in food additives, emulsifiers, flavor carriers, and stabilizers used in processed foods, baked goods, confectionery, and emulsified products. The increasing global consumption of packaged and convenience foods is boosting demand for oleic acid-derived additives that support product consistency, shelf stability, and sensory quality. As food manufacturers shift toward healthier oils with favorable fatty acid profiles, oleic acid-rich ingredients are becoming more widely incorporated into food processing.

Industrial applications further enhance market momentum. In the lubricants and metalworking industries, oleic acid serves as a key raw material for producing esters, surfactants, plasticizers, and corrosion inhibitors. Its natural lubricity, water resistance, and anti-corrosion properties make it valuable in machinery maintenance, hydraulic systems, and metal treatment processes. Rising industrial expansion and the shift toward bio-based chemicals are encouraging broader adoption of oleic acid in technical applications.

The Oleic Acid market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its formulation optimization phase, expanding from USD 676.5 million to USD 908.7 million with steady annual increments averaging 5.8% growth. This period showcases the transition from conventional oleic acid grades to high-oleic oilseed derivatives with enhanced purity characteristics and integrated quality control systems becoming mainstream features.

The 2025-2030 phase adds USD 232.2 million to market value, representing 45% of total decade expansion. Market maturation factors include standardization of GMP manufacturing protocols, declining production costs for pharmaceutical-grade formulations, and increasing food industry awareness of clean-label benefits reaching 98-99% purity specifications in emulsifier applications. Competitive landscape evolution during this period features established oleochemical companies like Wilmar International and BASF expanding their food and pharma portfolios while specialty manufacturers focus on high-oleic seed development and bio-based excipient capabilities.

Future Market Insights, globally acknowledged for insights in polymers and industrial coatings research, states that from 2030 to 2035, market dynamics shift toward advanced application integration and global pharmaceutical expansion, with growth continuing from USD 908.7 million to USD 1,188.8 million, adding USD 282.9 million or 55% of total expansion. This phase transition centers on specialty pharmaceutical-grade systems, integration with advanced drug delivery networks, and deployment across diverse cosmetics formulation scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic oleic acid production to comprehensive formulation optimization systems and integration with sustainable sourcing platforms.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 676.5 million |

| Market Forecast (2035) | USD 1,188.8 million |

| Growth Rate | 5.8% CAGR |

| Leading Source | Plant-based Source Type |

| Primary Application | Food & Beverages Segment |

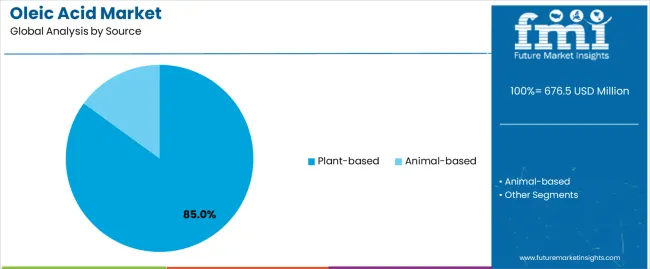

The market demonstrates strong fundamentals with plant-based oleic acid systems capturing a dominant share through sustainable sourcing and high-oleic oilseed optimization capabilities. Food & beverages applications drive primary demand, supported by increasing clean-label formulation requirements and pharmaceutical excipient technology. Geographic expansion remains concentrated in Asia-Pacific markets with established palm and sunflower oil infrastructure, while developed economies show accelerating adoption rates driven by bio-based product preferences and natural cosmetics growth.

Market expansion rests on three fundamental shifts driving adoption across food, pharmaceutical, and cosmetics sectors. Clean-label food formulation trends create compelling operational advantages through plant-based oleic acid that provides natural emulsification and stabilization without synthetic additives, enabling food manufacturers to meet consumer preferences while maintaining product quality and extending shelf life. Pharmaceutical excipient demand accelerates as drug manufacturers worldwide seek high-purity oleic acid systems that complement oral and injectable formulations, enabling effective drug solubilization and bioavailability enhancement that align with regulatory standards and patient safety requirements.

Natural cosmetics expansion drives adoption from personal care companies requiring effective emollient solutions that minimize synthetic ingredients while maintaining skin conditioning performance during product development and formulation operations. However, growth faces headwinds from raw material price volatility that varies across oilseed suppliers regarding crop yields and seasonal availability, which may limit profitability in cost-sensitive manufacturing environments. Competition from alternative fatty acids also persists regarding linoleic and stearic acid substitution that may reduce oleic acid consumption in price-focused applications.

The oleic acid market represents a diversified yet critical oleochemical opportunity driven by expanding global clean-label food production, pharmaceutical manufacturing sophistication, and natural cosmetics formulation requirements for superior functional effectiveness. As manufacturers worldwide seek to achieve natural ingredient positioning, enhanced drug delivery performance, and sustainable sourcing credentials, oleic acid is evolving from a basic fatty acid commodity to a sophisticated functional ingredient that ensures product differentiation and regulatory compliance.

The convergence of consumer health awareness, pharmaceutical innovation acceleration, and the naturalization of cosmetics creates sustained demand drivers across multiple end-use segments. The market's growth trajectory, from USD 676.5 million in 2025 to USD 1,188.8 million by 2035, at a 5.8% CAGR, reflects fundamental shifts in food formulation requirements and pharmaceutical excipient optimization.

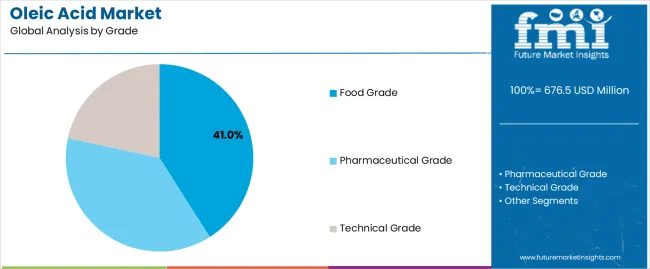

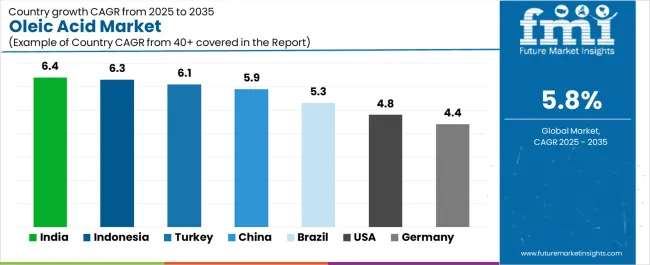

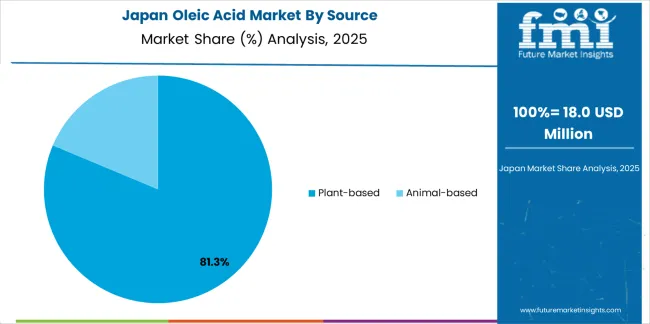

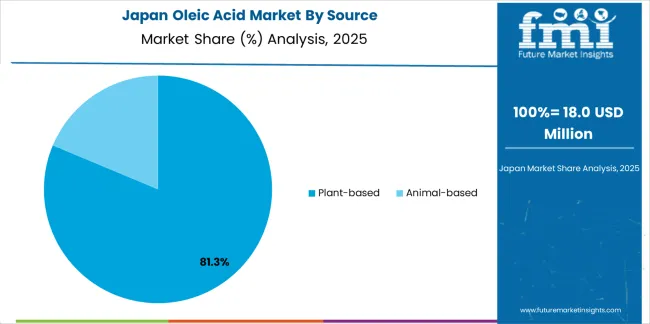

Geographic expansion opportunities are particularly pronounced in Asia-Pacific markets, where India (6.4% CAGR) and Indonesia (6.3% CAGR) lead through aggressive high-oleic oilseed programs and food processing infrastructure development. The dominance of plant-based sources (85.0% market share) and food & beverages applications (41.0% share) provides clear strategic focus areas, while emerging pharmaceutical and cosmetics applications open new revenue streams across diverse manufacturing markets.

Strengthening the dominant plant-based segment (85.0% market share) through enhanced high-oleic seed varieties, superior extraction technologies, and sustainable sourcing certifications. This pathway focuses on optimizing oleic acid content to 98-99% purity grades and developing non-GMO formulations for clean-label applications. Market leadership consolidation through agricultural partnerships, traceability systems, and organic certification enables premium positioning while expanding penetration across food and pharma applications. Expected revenue pool: USD 85-125 million

Rapid growth across India (6.4% CAGR) and Indonesia (6.3% CAGR) creates expansion opportunities through local oilseed cultivation and palm-based oleochemical integration. Localization strategies reduce import dependency, enable faster quality assurance, and position companies advantageously for regional procurement programs while accessing growing domestic markets requiring food-grade and pharmaceutical-grade oleic acid. Expected revenue pool: USD 75-110 million

Expansion within the dominant food & beverages segment (41.0% market share) through specialized formulations addressing clean-label requirements and natural emulsification needs. This pathway encompasses spray-drying technologies, kosher and halal certifications, and compatibility with diverse food processing systems, enabling integration with advanced processing technologies and shelf-life extension systems. Expected revenue pool: USD 65-95 million

Strategic expansion into pharmaceutical applications (37.0% market share) requires GMP-compliant manufacturing and specialized formulations addressing oral and injectable drug delivery. This pathway addresses solubilization enhancement, bioavailability optimization, and controlled-release systems, creating opportunities for long-term supply agreements and co-development partnerships with pharmaceutical companies. Expected revenue pool: USD 60-90 million

Development of specialized oleic acid for cosmetics & personal care (12.0% share) addressing natural emollient requirements and skin penetration enhancement. This pathway encompasses skin conditioning applications, hair care formulations, and natural soap bases. Technology differentiation through organic certifications and safety assessments enables diversified revenue streams while expanding addressable market opportunities in premium personal care segments. Expected revenue pool: USD 45-70 million

Integration into technical-grade applications including bio-based lubricants, textile processing, and coatings formulations. This pathway encompasses metalworking fluids, textile auxiliaries, and alkyd resin production. Market positioning through cost-competitive technical grades and consistent supply reliability creates opportunities for industrial partnerships replacing petroleum-based alternatives. Expected revenue pool: USD 35-55 million

Development of ultra-high-purity pharmaceutical-grade oleic acid (29.0% of grade segment) addressing stringent regulatory compliance and advanced drug delivery requirements. This pathway encompasses injectable-grade specifications, USP/EP compliance, and comprehensive impurity profiling, enabling access to high-value pharmaceutical partnerships and specialty excipient markets. Expected revenue pool: USD 30-50 million

Primary Classification: The market segments by Source into Plant-based and Animal-based categories, representing the evolution from conventional animal fats to sustainable plant-derived oleic acid for comprehensive application optimization.

Secondary Classification: Grade segmentation divides the market into Food Grade, Pharmaceutical Grade, and Technical Grade, reflecting distinct requirements for purity specifications, regulatory compliance, and application suitability.

Tertiary Classification: End-Use segmentation covers Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Industrial, and Others sectors, demonstrating diverse demand drivers across manufacturing applications.

Quaternary Classification: Application segmentation by functional role includes Emulsifiers/Stabilizers, Solvents/Carriers, Lubricity/Plasticizers, Surfactants/Soaps, and Others, reflecting specific performance requirements.

Regional Classification: Geographic distribution spans Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa, with Asia-Pacific markets leading adoption while developed economies show steady growth patterns driven by clean-label trends and pharmaceutical innovation.

Market Position: Plant-based oleic acid systems command the leading position in the Oleic Acid market with approximately 85% market share through sustainable sourcing features, including high-oleic oilseed cultivation, non-GMO availability, and environmental positioning that enable food and pharmaceutical manufacturers to achieve clean-label credentials across diverse application environments.

Value Drivers: The segment benefits from consumer preference for plant-derived ingredients that provide natural positioning, allergen avoidance, and sustainability alignment without compromising functional performance. Advanced oilseed breeding features enable consistent oleic acid content, improved extraction yields, and integration with organic certification systems, where ingredient transparency and environmental responsibility represent critical procurement requirements.

Competitive Advantages: Plant-based oleic acid systems differentiate through proven sustainability credentials, consistent supply availability, and integration with high-oleic sunflower and safflower programs that enhance market stability while maintaining functional performance suitable for food, pharmaceutical, and cosmetics applications.

Key market characteristics:

Animal-based oleic acid systems hold approximately 15.0% market share in the Oleic Acid market due to their specific functional characteristics and established applications in technical and industrial segments. These systems appeal to manufacturers requiring tallow-derived oleic acid with particular fatty acid profiles for specialized industrial applications.

Market Context: Food & beverages end-use dominates the Oleic Acid market with approximately 41.0% market share driven by clean-label reformulation and natural ingredient adoption that requires effective emulsification, stabilization, and product quality enhancement supporting consumer health preferences.

Appeal Factors: Food manufacturers prioritize supplier reliability, quality consistency, and technical support that enable integrated ingredient development programs across product categories. The segment benefits from regulatory pressure and consumer demand for natural ingredients that emphasize transparency and minimal processing.

Growth Drivers: Packaged food growth creates sustained demand for natural emulsifiers, while clean-label regulations mandate adoption of plant-based oleic acid for synthetic additive replacement and ingredient simplification.

Market Challenges: Price sensitivity and commodity pricing volatility may limit profitability during periods of oilseed supply fluctuations or competitive pressure from alternative emulsifiers.

End-use dynamics include:

Pharmaceuticals end-use captures approximately 37.0% market share through drug excipient applications, solubilization systems, and bioavailability enhancement requiring pharmaceutical-grade purity and comprehensive regulatory documentation for oral and injectable drug formulations.

Cosmetics & Personal Care end-use accounts for approximately 12.0% market share, encompassing skin conditioning, hair care, and natural soap applications where oleic acid provides emollient properties and penetration enhancement for active ingredient delivery in premium personal care formulations.

Growth Accelerators: Clean-label food formulation trends drive primary adoption as plant-based oleic acid provides natural emulsification capabilities that enable food manufacturers to eliminate synthetic additives without compromising product stability, supporting consumer health preferences and regulatory compliance that require transparent ingredient declarations. Pharmaceutical innovation accelerates market expansion as drug manufacturers seek high-purity oleic acid systems that enhance bioavailability and enable advanced drug delivery platforms, particularly for lipophilic active ingredients requiring effective solubilization for oral and injectable formulations. Natural cosmetics growth creates sustained demand as personal care companies worldwide adopt plant-based emollients that complement clean beauty positioning, enabling effective skin conditioning and active ingredient penetration that align with consumer preferences for sustainable and natural personal care solutions.

Growth Inhibitors: Oilseed price volatility creates profitability challenges due to seasonal crop yields and agricultural commodity market fluctuations affecting raw material costs, particularly impacting manufacturers in regions dependent on imported high-oleic oilseeds or lacking domestic cultivation infrastructure. Competition from alternative fatty acids persists as linoleic acid, stearic acid, and synthetic emulsifiers offer cost advantages in price-sensitive applications, potentially limiting oleic acid adoption in commodity-grade food and industrial segments where functional performance requirements permit ingredient substitution. Technical limitations exist regarding oxidative stability and rancidity susceptibility that may reduce effectiveness in high-temperature applications or extended storage conditions, affecting performance in certain food processing and industrial coating applications where thermal or oxidative stress challenges fatty acid stability.

Market Evolution Patterns: Adoption accelerates in premium food, pharmaceutical, and cosmetics sectors where clean-label positioning and natural ingredient preferences justify higher oleic acid costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by rising middle-class consumption and packaged food growth. Technology development focuses on high-oleic oilseed breeding programs, sustainable palm oil alternatives, and bio-based production methods that reduce environmental footprint and enable carbon-neutral positioning for environmentally-conscious manufacturers. The market could face disruption if alternative emulsification technologies or synthetic biology-derived fatty acids significantly challenge conventional oleic acid's cost-performance advantages in high-volume food applications, though current consumer preference for natural plant-derived ingredients provides substantial competitive protection.

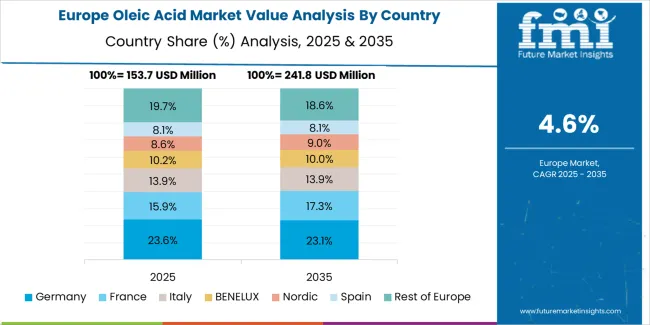

The Oleic Acid market demonstrates varied regional dynamics with Growth Leaders including India (6.4% CAGR) and Indonesia (6.3% CAGR) driving expansion through high-oleic oilseed cultivation and food processing infrastructure development. Steady Performers encompass Turkey (6.1% CAGR), China (5.9% CAGR), and Brazil (5.3% CAGR), benefiting from established oleochemical industries and growing pharmaceutical sectors. Mature Markets feature the United States (4.8% CAGR) and Germany (4.4% CAGR), where premium food applications and pharmaceutical excipient sophistication support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| India | 6.4% |

| Indonesia | 6.3% |

| Turkey | 6.1% |

| China | 5.9% |

| Brazil | 5.3% |

| United States | 4.8% |

| Germany | 4.4% |

Regional synthesis reveals Asia-Pacific markets leading adoption through oilseed cultivation expansion and food processing infrastructure development, while developed economies maintain steady growth supported by pharmaceutical innovation and clean-label food reformulation. Middle Eastern markets show accelerating expansion driven by cosmetics manufacturing and halal-certified ingredient demand.

India establishes market leadership with 6.4% CAGR through aggressive high-oleic oilseed expansion and F&B and pharma capacity additions, integrating advanced oleic acid production as standard capability in food processing plants and pharmaceutical manufacturing facilities. The country's growth reflects government initiatives promoting oilseed self-sufficiency under agricultural development programs and rising pharmaceutical manufacturing under "Pharma Vision 2020" that mandate advanced excipient production capabilities. Expansion concentrates in major industrial centers, including Mumbai, Ahmedabad, and Hyderabad, where food processing facilities and pharmaceutical plants showcase integrated oleic acid consumption that appeals to domestic and export-oriented manufacturers seeking cost-effective production advantages and regulatory compliance capabilities.

Indian oleochemical manufacturers are developing localized production facilities that combine competitive agricultural resources with improving purification technology, including sunflower-based high-oleic cultivation that leverages domestic oilseed availability for sustainable manufacturing.

Strategic Market Indicators:

In Jakarta, Surabaya, and Medan, oleochemical production facilities and food processing plants are implementing advanced oleic acid extraction systems as standard capability for palm oil derivatives and food ingredient manufacturing, driven by increasing government support for downstream processing and export of food/pharma grades that emphasize value addition and supply chain integration. The market achieves 6.3% CAGR, supported by substantial palm-based oleochemical investments that leverage Indonesia's position as leading palm oil producer for sustainable oleic acid manufacturing while expanding pharmaceutical-grade capacity through technology partnerships. Indonesian manufacturers are adopting advanced fractionation and purification systems that provide superior oleic acid yields from palm fatty acid distillate, particularly appealing in cost-competitive food applications where reliable supply and consistent quality represent critical procurement factors.

Market expansion benefits from comprehensive palm oil supply chain integration and government initiatives promoting oleochemical sector development that enable scaled production of food-grade and pharmaceutical-grade oleic acid for domestic consumption and export markets. Technology adoption follows patterns established in oleochemical manufacturing, where process efficiency and quality consistency drive competitive positioning and market access.

Market Intelligence Brief:

Turkey's market expansion demonstrates 6.1% CAGR through fast-growing cosmetics/skin care and food ingredients markets that increasingly incorporate plant-based oleic acid for natural formulations and clean-label positioning. The country leverages strategic positioning between European and Middle Eastern markets and growing domestic consumer sophistication to attract cosmetics manufacturing investments and food processing capacity requiring natural ingredient supply. Industrial centers, including Istanbul, Izmir, and Bursa, showcase expanding installations where oleic acid systems integrate with personal care formulations and food processing operations to optimize product performance and consumer appeal.

Turkish manufacturers prioritize natural and halal-certified oleic acid solutions that balance functional performance with religious and cultural considerations important to domestic and regional export markets, while growing middle-class consumption creates sustained demand for premium food and cosmetics applications.

Strategic Market Considerations:

China's market maintains 5.9% CAGR through scale in food processing and excipient manufacturing and oleochemicals integration that incorporates advanced oleic acid production for pharmaceutical and food applications. The country benefits from massive food processing infrastructure and growing pharmaceutical manufacturing that create multi-segment consumption patterns. Shanghai, Guangzhou, and Shandong regions showcase established installations where oleic acid systems provide functional performance across food emulsification, pharmaceutical solubilization, and industrial applications.

Market dynamics emphasize cost-competitive production through integrated palm and soybean oil processing that delivers reliable performance while accommodating high-volume manufacturing requirements typical of Chinese industrial applications, though premium pharmaceutical and cosmetics segments show increasing adoption of high-purity grades.

Performance Metrics:

Brazil's market demonstrates 5.3% CAGR through packaged foods growth and bio-based lubricants adoption emphasizing natural ingredient sourcing and sustainable industrial chemical alternatives. The country benefits from extensive oilseed cultivation infrastructure and growing food processing sophistication that create diverse oleic acid consumption patterns. São Paulo and Paraná regions showcase installations where oleic acid systems deliver functional performance across food, industrial, and emerging pharmaceutical applications.

Brazilian manufacturers prioritize locally-sourced oleic acid from soybean and sunflower cultivation that provides supply security and supports sustainability positioning for export-oriented food brands, while bio-based industrial applications gain traction through environmental awareness and renewable resource utilization.

Market Intelligence Brief:

The USA market demonstrates 4.8% CAGR through shift to high-oleic formulations in snacks and industrial uses and advanced drug delivery applications emphasizing functional performance and innovation leadership in pharmaceutical and food sectors. American food manufacturers prioritize high-oleic sunflower and safflower derivatives delivering enhanced oxidative stability through proven formulation track records and technical support capabilities. Technology deployment channels include major food ingredient distributors, pharmaceutical excipient suppliers, and oleochemical manufacturers that support sophisticated application requirements.

Manufacturing platform integration capabilities with established food processing systems and pharmaceutical formulations expand market appeal across diverse applications seeking performance reliability and regulatory compliance benefits, while specialty pharmaceutical-grade serves advanced drug delivery segments demanding ultra-high purity specifications.

Market Intelligence Brief:

Germany demonstrates steady 4.4% CAGR through clean-label foods, pharma excipients, and technical applications that incorporate advanced oleic acid for premium formulations in food, pharmaceutical, and industrial sectors. The country leverages engineering expertise in chemical purification and pharmaceutical manufacturing to maintain quality leadership in specialty oleic acid applications. Industrial centers, including Hamburg, Frankfurt, and Bavaria, showcase premium installations where oleic acid systems integrate with pharmaceutical excipient formulations and clean-label food products to optimize regulatory compliance and functional performance.

German pharmaceutical and food companies prioritize EU regulatory compliance and sustainability credentials in oleic acid sourcing, creating demand for certified organic and non-GMO grades with comprehensive documentation supporting pharmaceutical and food safety requirements.

Market Intelligence Brief:

Western Europe accounts for the largest regional demand for oleic acid in Europe, led by Germany (about 22% of European consumption) on the back of food-grade and pharmaceutical excipient uses plus technical lubricants, followed by France (about 15%) with balanced demand across dairy/fats reformulation and cosmetics. The United Kingdom (about 13%) reflects clean-label foods and premium personal care; Italy (about 12%) combines food processing and pharma excipients, while Spain (about 10%) emphasizes snacks/frying oils and industrial uses. The Nordics (about 9% combined, led by Sweden and Denmark) skew toward natural cosmetics and bio-lubricants; Benelux (about 8%) benefits from chemicals logistics and contract manufacturing. The remaining approximately 11% is spread across Central & Eastern Europe (notably Poland, Czechia, and Hungary) where packaged foods growth and regional pharma production are steadily lifting oleic acid consumption through expanding manufacturing facilities.

In Japan, the Oleic Acid market prioritizes plant-based sources, which capture the dominant share of pharmaceutical and cosmetics applications due to their advanced features, including high-purity specifications and seamless integration with premium formulation requirements. Japanese pharmaceutical and cosmetics manufacturers emphasize quality excellence, regulatory compliance, and consumer safety standards, creating demand for pharmaceutical-grade and cosmetics-grade oleic acid that provides consistent performance and comprehensive quality documentation based on application requirements and regulatory frameworks. Food-grade oleic acid maintains secondary position primarily in specialty food applications and natural ingredient formulations where clean-label positioning meets consumer health preferences.

Market Characteristics:

In South Korea, the market structure favors international oleochemical companies, including Wilmar International, BASF, and Kao Corporation, which maintain dominant positions through comprehensive product portfolios and established pharmaceutical and food industry networks supporting excipient manufacturing and food ingredient applications. These providers offer integrated solutions combining pharmaceutical-grade and food-grade oleic acid with technical application support and regulatory documentation services that appeal to Korean pharmaceutical manufacturers and food processors seeking reliable ingredient supply partnerships. Local chemical distributors and specialty suppliers capture moderate market share by providing localized service capabilities and competitive pricing for technical-grade applications, while domestic manufacturers focus on cost-effective solutions tailored to regional food processing and industrial requirements.

Channel Insights:

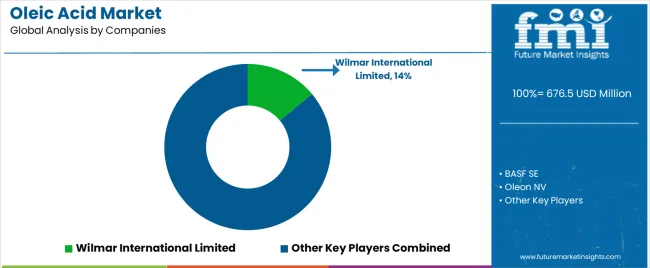

The Oleic Acid market operates with moderate concentration, featuring approximately 20-25 participants, where leading companies control roughly 40-45% of the global market share through established food and pharmaceutical industry relationships and comprehensive oleochemical portfolios. Competition emphasizes purity specifications, regulatory compliance capabilities, and sustainable sourcing credentials rather than price-based rivalry alone.

Market Leaders encompass Wilmar International Limited (14.0% market share), BASF SE, and Oleon NV, which maintain competitive advantages through extensive oleochemical production expertise, global oilseed sourcing networks, and comprehensive quality assurance capabilities that create customer loyalty and support premium positioning. These companies leverage decades of fatty acid technology experience and ongoing purification investments to develop pharmaceutical-grade and food-grade oleic acid with optimized purity specifications and regulatory documentation. BASF introduced new oleic-acid-derived formulations for bio-based lubricants and food-contact additives in 2024, while Oleon commissioned upgrades to pharmaceutical-grade fatty acid lines to support EU and North American demand in 2024.

Technology Innovators include Emery Oleochemicals and Kuala Lumpur Kepong Berhad (KLK Oleo), which compete through specialized purification technology focus and sustainable palm oil integration that appeals to manufacturers seeking certified sustainable sourcing and comprehensive traceability. KLK Oleo announced 2025 capacity enhancements for GMP-compliant oleic acid and esters at select EU facilities, demonstrating competitive differentiation through pharmaceutical-grade manufacturing excellence.

Regional Specialists feature companies like Adani Wilmar Ltd., Croda International Plc, Eastman Chemical Company, and Kao Corporation, which focus on specific geographic markets and specialized applications, including pharmaceutical excipients and cosmetics-grade formulations. Market dynamics favor participants that combine reliable oilseed sourcing with advanced purification capabilities, including pharmaceutical-grade production and organic certification that optimize quality consistency and regulatory compliance. Competitive pressure intensifies as traditional oleochemical producers expand pharmaceutical-grade capacity while specialty chemical companies challenge established players through innovative bio-based production methods and high-oleic oilseed integration targeting premium food and pharmaceutical segments in developed markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 676.5 million |

| Source | Plant-based, Animal-based |

| Grade | Food Grade, Pharmaceutical Grade, Technical Grade |

| End Use | Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Industrial, Others |

| Application | Emulsifiers/Stabilizers, Solvents/Carriers, Lubricity/Plasticizers, Surfactants/Soaps, Others |

| Regions Covered | Asia-Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | India, China, Indonesia, Turkey, Brazil, United States, Germany, and 25+ additional countries |

| Key Companies Profiled | Wilmar International Limited, BASF SE, Oleon NV, Emery Oleochemicals, Kuala Lumpur Kepong Berhad, Cargill Incorporated, Croda International Plc, Eastman Chemical Company |

| Additional Attributes | Dollar sales by source, grade, end-use, and application categories, regional adoption trends across Asia-Pacific, Europe, and North America, competitive landscape with oleochemical manufacturers and specialty chemical producers, food and pharmaceutical industry preferences for clean-label positioning and excipient functionality, integration with high-oleic oilseed programs and sustainable palm oil sourcing, innovations in pharmaceutical-grade purification and bio-based production methods, and development of specialized formulations with enhanced purity specifications and comprehensive regulatory documentation capabilities. |

The global oleic acid market is estimated to be valued at USD 676.5 million in 2025.

The market size for the oleic acid market is projected to reach USD 1,188.8 million by 2035.

The oleic acid market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in oleic acid market are plant-based and animal-based.

In terms of grade, food grade segment to command 41.0% share in the oleic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linoleic Acid (LA) Market Size and Share Forecast Outlook 2025 to 2035

Conjugated Linoleic Acid Market

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Key Companies & Market Share in the High Oleic Soybean Sector

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA