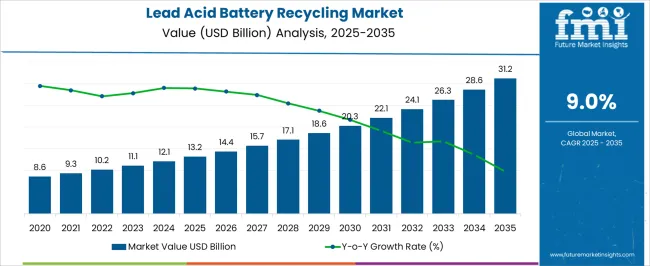

The global lead acid battery recycling market is projected at USD 13.2 billion in 2025 and is anticipated to reach USD 31.2 billion by 2035, growing at a CAGR of 9.0% over the forecast period. An analysis of the growth rate volatility index reveals the stability and fluctuations in market expansion across the decade. In the early phase, from USD 8.6 billion to USD 12.1 billion, the market experiences moderate volatility as collection infrastructure, regulatory compliance, and technological upgrades in recycling processes gradually scale up.

Year-on-year growth remains consistent, reflecting steady demand driven by rising electric vehicle penetration, automotive battery replacements, and industrial applications. The mid-phase, spanning USD 13.2 billion to USD 20.3 billion, exhibits slightly higher volatility due to fluctuations in raw material prices, changing environmental regulations, and variable regional adoption rates of recycling technologies. In the later years, from USD 22.1 billion to USD 31.2 billion, the volatility index stabilizes as the market matures, benefiting from optimized recycling processes, increased automation, and improved recovery efficiency of lead and ancillary materials.

Overall, the growth rate volatility analysis highlights that while early-stage expansion encounters moderate fluctuations, long-term trends indicate stable and sustainable growth, driven by regulatory support, technological innovations, and the rising global demand for recycled lead. This understanding helps stakeholders anticipate market dynamics, optimize investment strategies, and manage operational risks while capturing opportunities in the evolving lead acid battery recycling sector through 2035.

| Metric | Value |

|---|---|

| Lead Acid Battery Recycling Market Estimated Value in (2025 E) | USD 13.2 billion |

| Lead Acid Battery Recycling Market Forecast Value in (2035 F) | USD 31.2 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The lead acid battery recycling market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the automotive battery market, which accounts for about 40% share, as the widespread use of lead acid batteries in vehicles creates a continuous stream of spent batteries requiring recycling to recover lead and other valuable materials. The industrial and stationary energy storage sector contributes around 25%, driven by the deployment of lead acid batteries in backup power systems, UPS units, and telecom infrastructure, which generates significant end-of-life battery volumes. The environmental services and waste management market holds close to 15% influence, supported by regulatory mandates, extended producer responsibility programs, and compliance requirements that ensure proper collection, treatment, and recycling of hazardous battery components.

The smelting and metal recovery industry adds nearly 12%, as recovered lead and polypropylene from recycled batteries are reintegrated into industrial supply chains, reducing dependence on virgin raw materials and lowering production costs. The renewable energy and microgrid storage market contributes nearly 8%, as lead acid batteries continue to be used in off-grid solar, rural electrification, and hybrid storage applications, ultimately feeding into the recycling ecosystem at end-of-life. The distribution of market influence shows that automotive and industrial battery applications form the backbone of this market, while waste management, metal recovery, and renewable energy sectors continue to reinforce its commercial and environmental significance. This interconnected ecosystem demonstrates that the lead acid battery recycling market is sustained by multiple industries, ensuring steady demand, regulatory compliance, and consistent year-on-year growth.

The lead acid battery recycling market is witnessing steady expansion driven by regulatory mandates, rising battery consumption, and the economic viability of lead recovery. Growing environmental awareness, coupled with strict policies on hazardous waste management, has intensified the adoption of closed-loop recycling systems for lead acid batteries. This market benefits from the mature infrastructure available for collection and processing, making lead acid batteries one of the most recycled products globally.

Moreover, the demand for secondary lead, driven by its cost competitiveness compared to primary lead, continues to fuel market activity. The recycling process ensures a sustainable supply of lead, reducing dependency on mining while supporting circular economy goals.

Technological advancements in refining and safety standards have further optimized recovery efficiency and environmental compliance. With continuous growth in automotive, industrial, and energy storage sectors, the lead acid battery recycling market is expected to maintain positive momentum, bolstered by supportive legislation and the critical need for resource conservation in heavy metal industries.

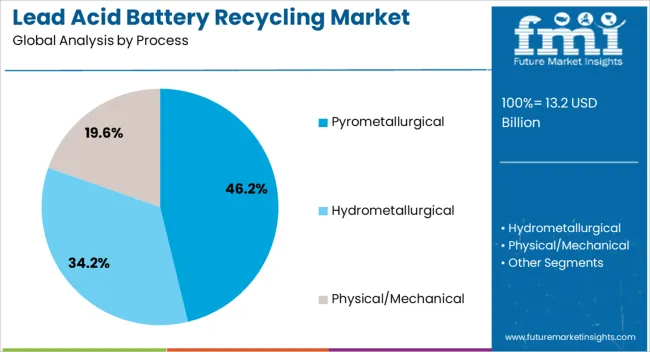

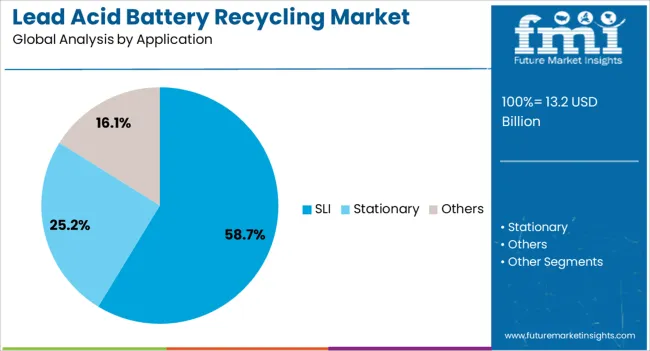

The lead acid battery recycling market is segmented by process, application, and geographic regions. By process, lead acid battery recycling market is divided into Pyrometallurgical, Hydrometallurgical, and Physical/Mechanical. In terms of application, lead acid battery recycling market is classified into SLI, Stationary, and Others. Regionally, the lead acid battery recycling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pyrometallurgical process accounts for approximately 46.2% of the lead acid battery recycling market, maintaining a dominant share due to its long-standing operational history and high lead recovery rate. This segment relies on thermal treatment methods to extract lead from spent batteries, enabling the separation of metallic components with efficiency. Its resilience in high-throughput operations has made it the preferred method for large-scale recyclers dealing with automotive and industrial battery waste.

Despite concerns about emissions and energy use, investments in pollution control technologies have enabled compliance with environmental norms. The process remains particularly attractive in regions with established metallurgical industries and infrastructure.

Moreover, the ability to process various battery types and compatibility with existing smelting facilities further sustains its utilization. Although emerging hydrometallurgical alternatives offer cleaner processes, pyrometallurgical recycling continues to be favored for its proven performance, scalability, and integration into global secondary lead supply chains.

The SLI (Starting, Lighting, and Ignition) application holds the largest share in the lead acid battery recycling market at approximately 58.7%, reflecting the high volume of these batteries in circulation. Widely used in automotive applications, SLI batteries generate substantial end-of-life waste, driving consistent demand for recycling solutions. The structured collection systems for automotive batteries, combined with regulatory incentives, have facilitated high recycling rates in this segment.

Additionally, automotive manufacturers and aftermarket players are actively involved in battery take-back programs, reinforcing a steady input stream for recyclers. The recycled lead derived from SLI batteries is often reintegrated into new battery production, enhancing resource efficiency and reducing raw material costs.

Technological compatibility, high recovery yields, and policy alignment have all contributed to the SLI segment’s dominant position. As global vehicle ownership continues to rise, particularly in emerging markets, the SLI segment is expected to retain its leadership role in application-based recycling within the lead acid battery industry.

The lead acid battery recycling market is shaped by the growing demand for automotive and industrial batteries, technological advancements in recycling processes, government regulations, and the expansion of commercial and industrial recycling networks. Rising battery volumes from vehicles and backup systems are creating a steady supply of recyclable materials. Improved recycling technologies enhance recovery efficiency, cost-effectiveness, and environmental compliance.

Policy incentives and regulatory enforcement are encouraging proper disposal and structured collection. Organized logistics and recycling networks ensure operational scalability and traceability. Together, these factors are driving sustained market growth, increasing adoption of responsible recycling practices, and reinforcing the market’s role in resource recovery and environmental protection globally.

The market is witnessing growth due to rising use of lead acid batteries in automotive, electric, and industrial applications. Lead-acid batteries remain prevalent in vehicles, backup power systems, and renewable energy storage, creating a steady stream of end-of-life batteries for recycling. Automotive fleet expansion and growing demand for backup and off-grid power solutions are fueling collection volumes. Recycling these batteries reduces environmental hazards and recovers valuable materials, ensuring resource efficiency. Increasing awareness of environmental compliance and corporate responsibility is encouraging battery manufacturers, service centers, and consumers to participate in recycling programs, supporting steady market growth.

Recycling technologies for lead acid batteries are evolving to improve recovery efficiency and reduce environmental impact. Techniques such as pyrometallurgical, hydrometallurgical, and mechanical processing are used to extract lead, plastics, and acid safely. Innovations in smelting, separation, and neutralization are enhancing material yield and operational safety. Companies are investing in automated sorting and processing systems to handle higher volumes and maintain compliance with environmental standards. Improved recycling methods reduce emissions, waste, and energy consumption, making operations more cost-effective. The advancement of recycling technologies is increasing adoption among battery recyclers and encouraging investment in capacity expansion globally.

Regulatory frameworks and policy initiatives are driving the lead acid battery recycling market. Governments across North America, Europe, and Asia-Pacific are implementing extended producer responsibility (EPR) policies, mandatory recycling targets, and environmental compliance standards. Financial incentives, subsidies, and public-private partnerships support collection and processing infrastructure. Regulatory enforcement reduces improper disposal and promotes safe handling of lead-containing waste. Compliance with local and international standards is motivating battery manufacturers, recyclers, and distributors to adopt formal recycling processes. Policy support, combined with monitoring and reporting requirements, is enhancing collection efficiency and creating a structured and reliable recycling ecosystem.

The market is expanding through organized collection, logistics, and recycling networks catering to industrial and commercial battery users. Fleet operators, industrial facilities, and renewable energy providers are participating in structured battery return programs. Specialized logistics companies ensure the safe transport of spent batteries to certified recycling plants.

Collaboration between OEMs, battery distributors, and recyclers is improving efficiency and traceability in the recycling supply chain. Increasing urbanization and industrial activity are contributing to higher volumes of end-of-life batteries, creating a consistent feedstock for recyclers. These organized networks support operational scalability, enhance recycling rates, and mitigate environmental and regulatory risks associated with lead disposal.

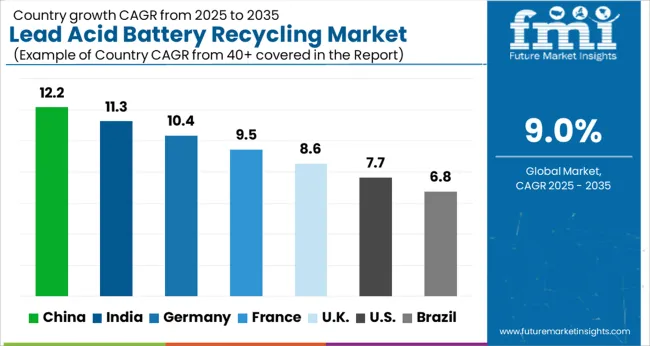

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

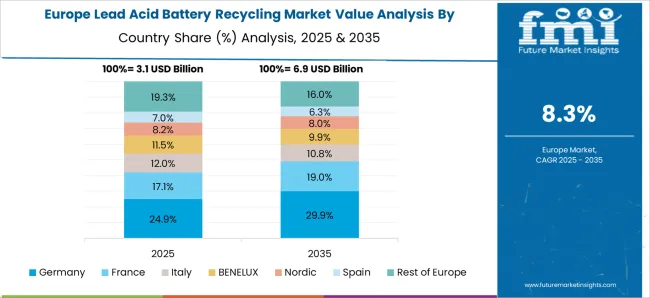

The global lead acid battery recycling market is projected to grow at a CAGR of 9.0% from 2025 to 2035. China leads with 12.2%, followed by India at 11.3%, Germany at 10.4%, the UK at 8.6%, and the USA at 7.7%. Growth is driven by increasing automotive and industrial battery usage, stringent environmental regulations, and rising awareness of resource recovery. BRICS countries, particularly China and India, are scaling collection networks, smelting facilities, and secondary lead production to meet recycling demand. OECD nations such as Germany, the UK, and the USA focus on advanced processing technologies, compliance with international standards, and circular economy initiatives to enhance efficiency and sustainability. The analysis spans over 40+ countries, with the leading markets detailed below.

The lead acid battery recycling market in China is projected to grow at a CAGR of 12.2% from 2025 to 2035, supported by rapid adoption of automotive, industrial, and energy storage applications. Increasing electric vehicle (EV) production, coupled with rising demand for backup power solutions, drives the need for efficient recycling infrastructure. Domestic recyclers are investing in advanced smelting, separation, and purification technologies to recover lead, plastic, and acid with minimal environmental impact. Government regulations promoting circular economy practices, waste management standards, and environmental compliance further encourage market expansion. Rising awareness of sustainable battery disposal and resource recovery strengthens growth prospects.

The lead acid battery recycling market in India is expected to grow at a CAGR of 11.3% from 2025 to 2035, fueled by growing automotive, industrial, and power backup applications. Widespread use of two-wheelers, commercial vehicles, and stationary batteries generates a significant volume of spent batteries, driving recycling needs. Recyclers are investing in efficient recovery processes for lead, polypropylene, and acid to meet environmental standards. Government initiatives supporting proper battery disposal, extended producer responsibility (EPR) policies, and incentives for recycling infrastructure accelerate adoption. Increased awareness of environmental safety and regulatory compliance among industries ensures sustainable growth in the recycling sector.

The lead acid battery recycling market in Germany is projected to grow at a CAGR of 10.4% from 2025 to 2035, driven by stringent environmental regulations and high adoption of automotive and industrial batteries. Advanced recycling facilities leverage smelting, hydrometallurgical, and mechanical recovery processes to maximize lead and polymer extraction. Regulatory frameworks such as the Battery Act ensure proper collection, recycling, and disposal, encouraging compliance from manufacturers and consumers. Industrial, renewable energy storage, and transportation sectors contribute to growing battery volumes. Increasing focus on circular economy principles and sustainable resource management further boosts market potential.

The lead acid battery recycling market in the UK is expected to grow at a CAGR of 8.6% from 2025 to 2035, driven by rising automotive and industrial battery usage. Recyclers are adopting advanced smelting and acid neutralization technologies to efficiently recover lead, polypropylene, and electrolyte materials. Government regulations on battery collection, disposal, and environmental compliance enhance market adoption. The growth of renewable energy storage systems and increasing battery volumes from commercial and residential sectors further support demand. Collaboration between manufacturers, recyclers, and regulatory authorities ensures effective recovery and promotes a circular economy in battery management.

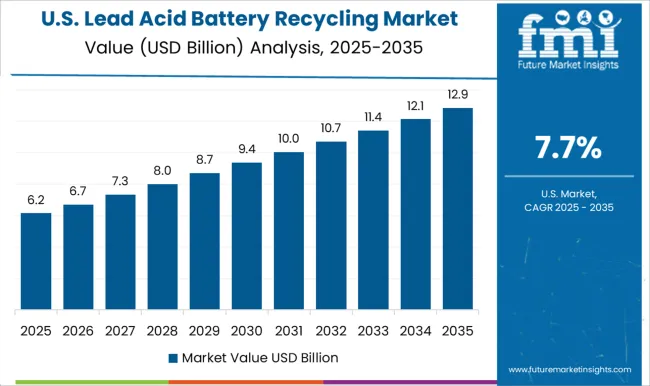

The lead acid battery recycling market in the USA is projected to grow at a CAGR of 7.7% from 2025 to 2035, supported by high volumes of automotive, industrial, and stationary batteries. Established recycling networks implement smelting, mechanical, and hydrometallurgical recovery processes to extract lead, plastic, and acid efficiently. Regulatory frameworks by the Environmental Protection Agency (EPA) ensure proper collection, recycling, and disposal, driving compliance across manufacturers and consumers. Rising EV and backup power adoption, combined with increased awareness of sustainable recycling practices, encourages investment in advanced recycling infrastructure. Growth in battery volumes from industrial and commercial sectors further strengthens market expansion.

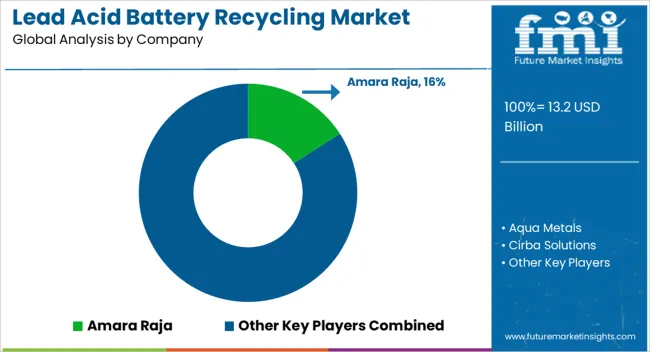

Competition in the lead acid battery recycling market is shaped by processing efficiency, regulatory compliance, and material recovery rates. Amara Raja, Aqua Metals, Cirba Solutions, Clarios, East Penn Manufacturing Company, EnerSys, Exide Technologies, Glencore, GME Recycling, Gravita India, RecycLiCo Battery Materials, Umicore, and Yuasa Battery lead by offering comprehensive recycling solutions, including collection, smelting, refining, and reintroduction of recovered lead into battery production. Product differentiation is achieved through proprietary recovery technologies, high lead purity outputs, closed-loop recycling processes, and environmentally responsible disposal methods, ensuring compliance with international safety and environmental standards.

Mid-tier and regional players focus on small-scale collection and processing, offering cost-efficient services that align with local regulations and provide quick turnaround capabilities, particularly in emerging markets where informal recycling is prevalent. Strategies employed by leading companies emphasize advanced recovery technologies, automated sorting, and process optimization to maximize material yield and minimize environmental impact. Digital tracking of battery flows, process monitoring, and quality assurance protocols are leveraged as key differentiators to enhance operational efficiency and ensure sustainable output.

Differentiation is further strengthened through partnerships with automotive OEMs, battery manufacturers, and collection networks, ensuring consistent feedstock supply and secure handling. Companies strive to strike a balance between high recovery efficiency, operational safety, cost-effectiveness, and environmental compliance, thereby supporting circular economy objectives while maintaining profitability. The market reflects strong competition based on technological expertise, process scalability, and environmental stewardship, where global and regional players maintain leadership by providing efficient, reliable, and compliant recycling solutions.

Continuous improvements in smelting technologies, secondary lead processing, and regulatory adherence support long-term growth, while customer-focused services, logistical efficiency, and high-purity recovery reinforce market positioning. The lead acid battery recycling market demonstrates a dynamic landscape driven by resource efficiency, regulatory frameworks, and sustainable material management.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.2 Billion |

| Process | Pyrometallurgical, Hydrometallurgical, and Physical/Mechanical |

| Application | SLI, Stationary, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amara Raja, Aqua Metals, Cirba Solutions, Clarios, East Penn Manufacturing Company, EnerSys, Exide Technologies, Glencore, GME Recycling, Gravita India, RecycLiCo Battery Materials, Umicore, and Yuasa Battery |

| Additional Attributes | Dollar sales, share, recycling capacity, regional adoption, collection and processing methods, competitor landscape, pricing trends, regulatory compliance, recovered material demand, end-use industry applications, technology efficiency, environmental impact management. |

The global lead acid battery recycling market is estimated to be valued at USD 13.2 billion in 2025.

The market size for the lead acid battery recycling market is projected to reach USD 31.2 billion by 2035.

The lead acid battery recycling market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in lead acid battery recycling market are pyrometallurgical, hydrometallurgical and physical/mechanical.

In terms of application, sli segment to command 58.7% share in the lead acid battery recycling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Lead Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA