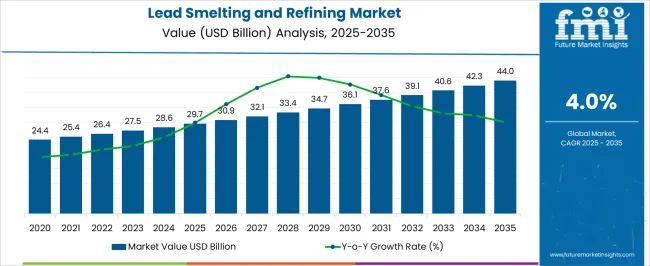

The lead smelting and refining market was valued at USD 29.7 billion in 2025 and is projected to reach USD 44 billion by 2035, reflecting a CAGR of 4%. The absolute dollar opportunity over this period highlights a significant rise of USD 14.3 billion, underscoring the continued demand for refined lead in battery production, construction materials, and industrial applications. This opportunity suggests that while growth is moderate compared to other metals, the steady upward trajectory indicates reliability in demand, driven largely by energy storage and automotive industries.

The expansion also reflects the market’s resilience, as lead maintains its relevance in both traditional and emerging industrial domains despite increasing competition from alternative materials. The lead smelting and refining market was valued at USD 29.7 billion in 2025 and is projected to reach USD 44 billion by 2035, representing an absolute dollar opportunity of USD 14.3 billion. Year-on-year increases indicate consistent expansion, as the market responds gradually to stable consumption patterns. The opportunity is being reinforced by industries that rely on lead-acid batteries, radiation shielding, and various alloys, where refined lead continues to be irreplaceable. The modest CAGR of 4% may appear conservative, but it signals a market characterized by long-term stability rather than volatility.

The absolute dollar growth indicates that companies with efficient smelting and refining operations are well-positioned to capture value, especially in regions where recycling and regulated supply chains dominate.

| Metric | Value |

|---|---|

| Lead Smelting and Refining Market Estimated Value in (2025 E) | USD 29.7 billion |

| Lead Smelting and Refining Market Forecast Value in (2035 F) | USD 44.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The lead smelting and refining market has been positioned as a vital segment within several extensive parent industries, each reflecting measurable influence and adoption. Within the non-ferrous metals market, lead smelting and refining accounts for approximately 6.8%, as lead continues to be a critical material for multiple industrial applications. In the base metals market, its share is estimated at 5.9%, driven by the role of refined lead in manufacturing, construction, and automotive components.

The battery materials market records a penetration of nearly 8.7%, as refined lead serves as the backbone of lead-acid batteries, which dominate energy storage for automotive, backup power, and industrial uses. Within the metal recycling market, lead smelting and refining contribute around 7.4%, reflecting its importance in secondary lead production, reducing reliance on primary ore extraction, and ensuring material efficiency. In the metallurgical equipment and processing market, the share is about 4.6%, given the dependency on advanced smelting technologies and refining systems to enhance efficiency and reduce impurities in processed lead.

These industries indicate that the lead smelting and refining market accounts for approximately 33.4% of the parent markets, underscoring its strategic significance in industrial supply chains. Its adoption has been strongly influenced by the demand for reliable energy storage, durable construction materials, and cost-efficient recycling solutions, positioning it as an indispensable element in global manufacturing and energy infrastructure. The market has been shaping competitive approaches in its parent industries, reinforcing the relevance of lead processing in enabling operational stability and material security across diverse applications.

The lead smelting and refining market is witnessing steady expansion, driven by increasing demand for refined lead in battery manufacturing, industrial applications, and specialized alloys. The market’s current growth trajectory is supported by technological advancements in furnace design, process optimization, and environmental compliance systems, which have improved operational efficiency and reduced emission levels.

Strong demand from the automotive and energy storage sectors is fueling the requirement for refined lead, particularly in regions with expanding manufacturing capabilities. Recycling initiatives and secondary lead production have further strengthened market supply stability, reducing dependence on primary extraction and contributing to cost efficiency.

Additionally, regulatory measures encouraging sustainable processing methods are pushing refiners to adopt cleaner and more efficient smelting techniques. With growing infrastructure development and industrialization in emerging economies, coupled with steady consumption in mature markets, the lead smelting and refining sector is positioned for consistent long-term growth, supported by a balanced mix of primary and secondary production sources.

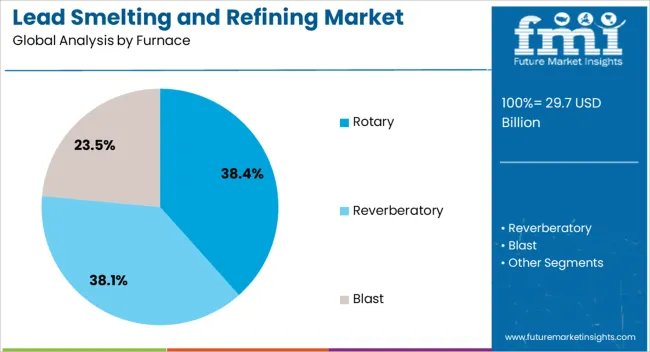

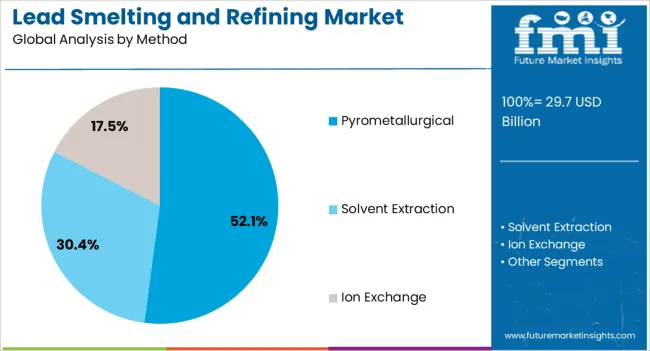

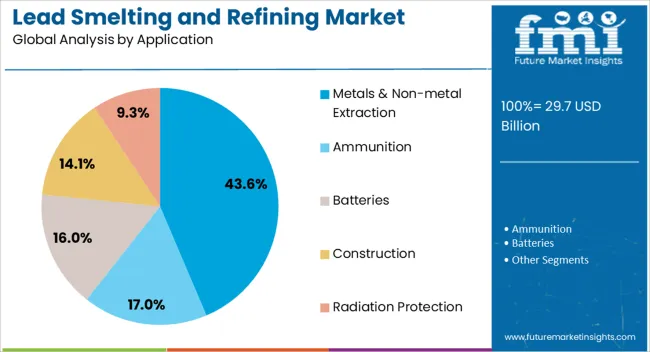

The lead smelting and refining market is segmented by furnace, method, application, and geographic regions. By furnace, lead smelting and refining market is divided into Rotary, Reverberatory, and Blast. In terms of method, lead smelting and refining market is classified into Pyrometallurgical, Solvent Extraction, and Ion Exchange. Based on application, lead smelting and refining market is segmented into Metals & Non-metal Extraction, Ammunition, Batteries, Construction, and Radiation Protection. Regionally, the lead smelting and refining industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotary furnace segment dominates the furnace category in the lead smelting and refining market, holding approximately 38.4% share. This dominance is attributed to the rotary furnace’s versatility in processing both primary and secondary lead sources with high recovery efficiency. Its adaptability to handle varying feed compositions, including battery scrap and lead-bearing residues, has strengthened its position among refiners seeking operational flexibility.

The segment’s growth is reinforced by its relatively lower capital investment requirements and ability to process materials with minimal pre-treatment. Furthermore, the rotary furnace’s compatibility with modern pollution control technologies has enhanced compliance with stringent environmental regulations.

Its widespread adoption across both large-scale and small-to-medium-sized refining facilities underscores its operational reliability and cost-effectiveness. With ongoing technological enhancements aimed at improving energy efficiency and throughput, the rotary furnace segment is expected to maintain its leadership in the furnace category throughout the forecast period.

The pyrometallurgical segment leads the method category, accounting for approximately 52.1% of the lead smelting and refining market. This method’s dominance is largely due to its established technological maturity, ability to handle high-volume processing, and suitability for both primary ores and recycled materials.

Pyrometallurgical processes are favored for their faster throughput, scalability, and cost-efficiency, making them a preferred choice for industrial-scale operations. The segment’s growth has been supported by advancements in furnace designs, fuel optimization, and integrated emission control systems that address environmental concerns while maintaining process efficiency.

Additionally, the method’s compatibility with various furnace types, including blast and rotary furnaces, offers refiners flexibility in plant configurations. With sustained demand for refined lead in batteries, alloys, and chemical compounds, the pyrometallurgical segment is expected to retain its leading position, reinforced by continued process innovations and the ability to integrate with recycling operations for secondary lead production.

The metals and non-metal extraction segment dominates the application category, representing approximately 43.6% share of the lead smelting and refining market. This leadership is driven by the essential role of lead in metallurgical operations, where it is used in producing alloys, shielding materials, and chemical compounds. The segment’s growth is supported by expanding demand for refined lead in industries such as construction, electronics, and protective equipment manufacturing.

Its application extends beyond traditional uses, with increased utilization in specialized industrial processes that require lead’s density and corrosion resistance. Additionally, the recovery of associated by-products during lead refining, such as silver and other valuable metals, enhances the economic viability of operations.

Regulatory compliance regarding material handling and environmental performance has also driven technological adoption within this segment. With global demand for high-purity lead and related materials projected to rise, metals and non-metal extraction is expected to remain the dominant application area in the coming years.

The lead smelting and refining market has been influenced by rising demand from battery manufacturing, construction, and industrial applications. Adoption has been driven by increasing consumption of lead-acid batteries in automotive, backup power, and grid storage segments. Opportunities are emerging in recycling initiatives, refined production methods, and secondary smelting capacities. Trends are being observed in efficient recovery technologies, expanding secondary lead processing, and integration with circular economy models, while challenges persist in environmental compliance, energy intensity, and raw material availability. The market outlook remains favorable with consistent industrial and energy-related demand.

The automotive three way catalytic converter market is witnessing robust demand as stringent emission standards are enforced across North America, Europe, and Asia-Pacific. Increasing production of passenger cars and light commercial vehicles is fueling the requirement for efficient exhaust treatment systems to limit harmful pollutants such as carbon monoxide, nitrogen oxides, and hydrocarbons. Original equipment manufacturers are integrating advanced catalytic converters to meet regulatory compliance and enhance engine performance. Furthermore, the growth of fuel-efficient vehicles, hybrid models, and retrofitting initiatives in older vehicles is expanding the market. Rising consumer awareness regarding air quality and emission control contributes to increased adoption. Regional variations in automotive manufacturing, vehicle lifecycle patterns, and government policies influence demand significantly. Manufacturers are being compelled to balance cost-efficiency with high conversion efficiency and durability, making product innovation and quality a critical focus. The growing automotive production and emission compliance needs collectively drive sustained market expansion.

Opportunities in the lead smelting and refining market have been largely defined by the growing emphasis on recycling, secondary smelting, and efficient recovery of lead from used batteries and scrap materials. Producers have been observed focusing on secondary smelting facilities to reduce dependence on primary ores and ensure a steady supply of refined lead. In opinion, this shift represents a practical opportunity, as recycling not only reduces costs but also ensures long-term availability of critical resources. Expansion of regional collection networks, investment in high-yield refining methods, and collaboration between recyclers and manufacturers are opening new avenues for growth. Developing economies with rising automotive and power storage demand present strong opportunities for expansion of secondary smelting operations. Overall, opportunities are being shaped by the strategic focus on recycling, resource recovery, and expansion of refining capacity to support the growing consumption of lead across industries.

The lead smelting and refining market has been shaped by trends in efficient recovery technologies, secondary processing growth, and refined product quality improvements. Producers have been increasingly adopting processes that maximize recovery rates while maintaining energy efficiency and product consistency. In opinion, trends in secondary smelting are gaining momentum as industries recognize the importance of recycled lead in meeting growing global demand. Regional markets are witnessing investments in refining plants with advanced recovery methods to improve yield and reduce operational inefficiencies. Another observed trend is the growing role of lead refining in supporting industrial-grade applications such as cable sheathing, ammunition, and specialized alloys. Overall, these trends reflect an industry shift toward optimized recovery, efficient utilization of resources, and the balancing of primary and secondary production to meet market requirements.

The lead smelting and refining market has faced persistent challenges related to environmental compliance, high energy consumption, and constrained raw material access. Smelting operations are subject to stringent regulations regarding emissions, waste management, and worker safety, which have increased operational costs and limited flexibility for producers. In opinion, the reliance on primary lead ores is creating supply-side pressures as ore quality varies by region and mining conditions remain volatile. Energy intensity of smelting processes also adds to cost pressures, especially in markets with fluctuating energy tariffs. Integration of secondary smelting has helped offset some challenges but has not fully mitigated supply chain constraints. Furthermore, global competition among producers and compliance with international trade standards make scaling more complex. Overcoming these barriers requires careful investment in compliance systems, efficient energy usage, and expanded secondary lead recovery to stabilize long-term growth.

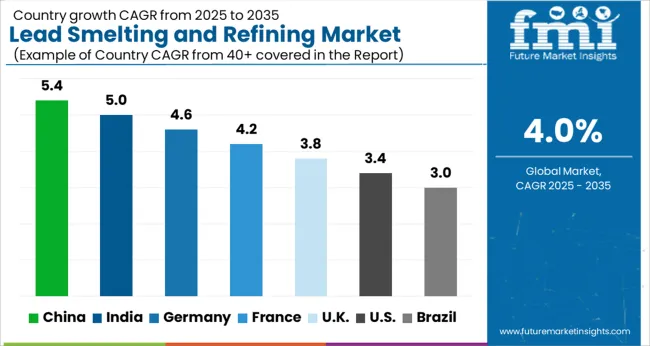

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global lead smelting and refining market is projected to grow at a CAGR of 4% from 2025 to 2035. China leads with 5.4% growth, followed by India at 5%, and Germany at 4.6%. The United Kingdom records 3.8%, while the United States shows 3.4% growth. Expansion is influenced by rising demand for lead in battery production, construction, and radiation shielding applications. Emerging markets like China and India show higher growth rates due to increasing automotive production, expanding industrial demand, and government-led initiatives supporting metals processing, while developed markets focus on refining efficiency, recycling activities, and maintaining consistent supply chains for downstream industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

The lead smelting and refining market in China is growing at a CAGR of 5.4%, supported by high demand from the automotive, construction, and electronics sectors. China remains the largest global consumer of refined lead, with significant reliance on it for battery production in electric vehicles, energy storage, and industrial applications. Growth is reinforced by large-scale smelting capacities, government-backed infrastructure projects, and expanding recycling activities aimed at meeting domestic demand. The market benefits from China’s strong manufacturing ecosystem and global export position, which enables large volumes of refined lead to enter international markets while ensuring consistent domestic supply.

The lead smelting and refining market in India is advancing at a CAGR of 5%, fueled by strong demand for batteries, electronics, and construction materials. Lead is widely utilized in automotive applications, particularly for conventional and electric vehicle batteries. Market growth is reinforced by increasing recycling initiatives, rising imports of lead concentrates, and the expansion of secondary smelting capacities. India’s demand is also supported by government policies that encourage clean energy storage solutions and industrial development, ensuring lead remains a key component in power storage systems and various manufacturing processes.

The lead smelting and refining market in Germany is projected to grow at a CAGR of 4.6%, driven by high demand from the automotive sector, renewable energy storage, and the chemical industry. Germany’s refined lead market is heavily influenced by its strong automotive production base, where lead-acid batteries remain critical. Growth is reinforced by the country’s recycling initiatives, which aim to reduce dependence on imported concentrates, and the integration of advanced refining technologies that improve efficiency. The presence of major smelting facilities and environmental regulations also shapes the market landscape, with a focus on maintaining supply while meeting stringent environmental standards.

The lead smelting and refining market in the United Kingdom is expanding at a CAGR of 3.8%, supported by demand from construction, automotive, and energy storage industries. UK refiners and recyclers focus on maintaining consistent supply for domestic consumption while reducing reliance on imports. Growth is reinforced by recycling activities, particularly in the secondary lead sector, which supplies batteries for automotive and backup power applications. Market expansion is also influenced by government guidelines supporting energy efficiency and environmental compliance, which shape refining operations and recycling practices across the country.

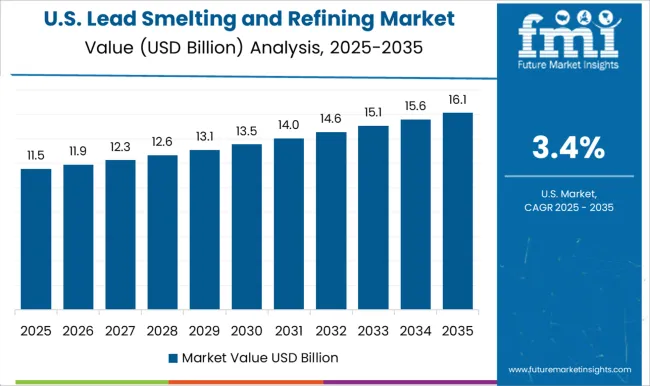

The lead smelting and refining market in the United States is growing at a CAGR of 3.4%, driven by steady demand from the automotive, defense, and construction sectors. The USA market relies heavily on secondary smelting for refined lead supply, with recycling playing a central role in meeting domestic demand for batteries and industrial applications. Growth is reinforced by increasing defense-related demand for radiation shielding materials and consistent consumption in backup power systems. Market expansion is also supported by innovation in recycling methods and regulatory frameworks aimed at ensuring supply chain stability and minimizing environmental impacts.

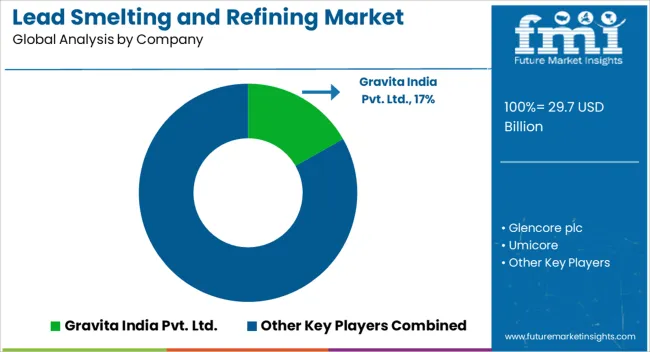

The lead smelting and refining market is being defined by a combination of global mining corporations, recycling leaders, and regional smelters focused on both primary and secondary production. Glencore plc, Umicore, and Boliden Group are being positioned as global leaders through large-scale integrated operations, regulatory compliance, and advanced refining technologies. Their strategy is being executed with emphasis on efficiency, environmental compliance, and diversified supply chains that secure consistent raw material availability. Hindustan Zinc Limited, Yuguang Gold Lead, and Tasnee are being recognized for regional dominance, offering large-scale smelting capacity and cost advantages.

Gravita India, Ecobat Technologies, and Recylex are being directed toward secondary lead recycling, capitalizing on the growing demand for sustainable battery-grade lead. Doe Run Resources, Dansuk Industrial, Asia Recycling Resources, and Teck are being noted for their specialized refining processes, reliable distribution networks, and niche expertise. Competition is being defined by refining efficiency, purity levels, and regulatory alignment, while market leadership is being reinforced through long-term contracts, strong global distribution, and proven supply reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.7 Billion |

| Furnace | Rotary, Reverberatory, and Blast |

| Method | Pyrometallurgical, Solvent Extraction, and Ion Exchange |

| Application | Metals & Non-metal Extraction, Ammunition, Batteries, Construction, and Radiation Protection |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gravita India Pvt. Ltd., Glencore plc, Umicore, Hindustan Zinc Limited (HZL), Yuguang Gold Lead Co. Ltd, Ecobat Technologies, Recylex S.A, Dansuk Industrial Co., Ltd., Asia Recycling Resources Pte Ltd, Doe Run Resources Corporation, Boliden Group, and Tasnee, Teck |

| Additional Attributes | Dollar sales by process type (primary and secondary smelting) and product (refined lead, alloys) are key metrics. Trends include rising demand from battery manufacturing, growth in recycled lead refining, and stricter environmental regulations. Regional adoption, recycling infrastructure, and industrial applications are driving market growth. |

The global lead smelting and refining market is estimated to be valued at USD 29.7 billion in 2025.

The market size for the lead smelting and refining market is projected to reach USD 44.0 billion by 2035.

The lead smelting and refining market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in lead smelting and refining market are rotary, reverberatory and blast.

In terms of method, pyrometallurgical segment to command 52.1% share in the lead smelting and refining market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Lead Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA