The global KNN lead-free piezoelectric ceramics market, valued at USD 418.1 million in 2025, is projected to grow significantly and reach USD 1,909.0 million by 2035, expanding at a strong CAGR of 16.4%. This translates to an absolute increase of USD 1,490.9 million and overall growth of nearly 4.6 times during the forecast period. The expansion is primarily driven by the rising global emphasis on environmentally compliant materials, with potassium sodium niobate (KNN) ceramics emerging as a viable alternative to conventional lead zirconate titanate (PZT). Stricter regulatory frameworks around hazardous materials, especially in developed markets such as the European Union, North America, and Japan, have accelerated the adoption of lead-free piezoelectric solutions, reshaping industry priorities in sensor technologies, actuators, and medical devices.

A major growth catalyst lies in the increasing utilization of KNN ceramics in biocompatible sensor technologies. Their ability to function in implantable devices, ultrasound equipment, and other medical diagnostics makes them highly attractive for the expanding healthcare sector. With the medical industry seeking non-toxic, high-performance materials for human-compatible applications, demand for lead-free alternatives is rising steadily. At the same time, industrial automation and advanced electronics manufacturing are opening opportunities for piezoelectric ceramics in precision control systems, robotics, and consumer devices. KNN ceramics are being leveraged in sustainable electronics manufacturing, where regulatory pressures and consumer demand converge to favor non-toxic components in consumer goods, sensors, and energy-harvesting devices.

The adoption of KNN ceramics will be shaped by early-stage applications in high-value medical and specialty electronics sectors, where their eco-friendly profile outweighs cost considerations. However, during this phase, manufacturers will face challenges in bridging the performance gap with traditional lead-based ceramics, particularly regarding piezoelectric coefficients and thermal stability. Production costs also remain relatively high due to complex synthesis and sintering processes, which may limit large-scale adoption. Despite these hurdles, rising investments in research and development are expected to improve performance parameters and reduce cost barriers, preparing the KNN lead-free piezoelectric ceramics market for broader penetration in the following years.

The KNN lead-free piezoelectric ceramics market is expected to enter a phase of accelerated mass adoption. With advancements in processing technologies, improved scalability, and enhanced material stability, KNN ceramics will find wider usage in mainstream electronics, automotive sensors, and industrial monitoring equipment. Asia-Pacific, led by China, South Korea, and Japan, will emerge as a key production hub due to strong government-backed initiatives supporting green electronics and significant investments in piezoelectric material R&D. Europe and North America will continue to be early adopters, driven by strict environmental directives and robust demand from medical and industrial applications.

Between 2025 and 2030, the KNN lead-free piezoelectric ceramics market is projected to expand from USD 418.1 million to USD 893.4 million, resulting in a value increase of USD 475.3 million, which represents 31.9% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for RoHS-compliant piezoelectric materials in electronics manufacturing, product innovation in composition optimization and sintering technologies, as well as expanding integration with medical device applications and environmental monitoring systems. Companies are establishing competitive positions through investment in advanced ceramic processing technologies, crystallographic engineering capabilities, and strategic partnerships with medical device manufacturers and automotive sensor suppliers.

From 2030 to 2035, the KNN lead-free piezoelectric ceramics market is forecast to grow from USD 893.4 million to USD 1,909.0 million, adding another USD 1,015.6 million, which constitutes 68.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized KNN formulations, including doped compositions with enhanced piezoelectric coefficients and temperature stability tailored for demanding industrial applications, strategic collaborations between materials scientists and device manufacturers, and an enhanced focus on achieving performance parity with lead-based alternatives while maintaining environmental compliance. The growing emphasis on sustainable electronics manufacturing and biocompatible implantable devices will drive demand for advanced, high-performance KNN lead-free piezoelectric ceramic solutions across diverse application sectors.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 418.1 million |

| Market Forecast Value (2035) | USD 1,909.0 million |

| Forecast CAGR (2025-2035) | 16.4% |

The KNN lead-free piezoelectric ceramics market grows by enabling electronics manufacturers and medical device producers to achieve regulatory compliance with environmental restrictions while maintaining acceptable electromechanical performance in sensor and actuator applications. Device manufacturers face mounting pressure to eliminate hazardous substances from product designs, with KNN (potassium sodium niobate) ceramics providing viable lead-free alternatives achieving 60-80% of the piezoelectric performance of traditional PZT materials, making these environmentally compliant ceramics essential for sustainable electronics development. The biomedical industry's need for non-toxic implantable materials creates demand for lead-free piezoelectric solutions that can function safely within the human body without lead leaching risks associated with conventional piezoceramics.

Government initiatives promoting hazardous substance elimination through RoHS, REACH, and medical device regulations drive adoption in consumer electronics, automotive sensors, and medical implant applications, where material composition compliance has direct impact on market access and regulatory approval. The global shift toward sustainable manufacturing practices and circular economy principles accelerates KNN ceramic demand as companies seek alternatives to lead-based piezoelectrics that create disposal challenges and environmental contamination risks. However, performance limitations including lower piezoelectric coefficients and reduced temperature stability compared to PZT ceramics may limit adoption rates among applications requiring maximum electromechanical coupling and extreme operating conditions.

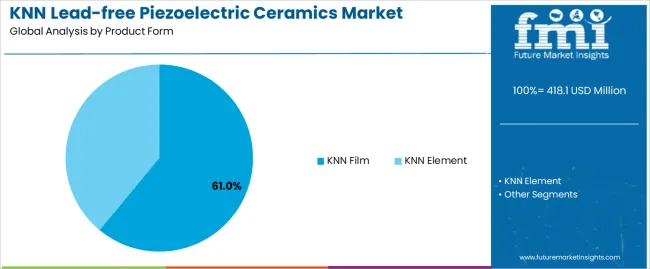

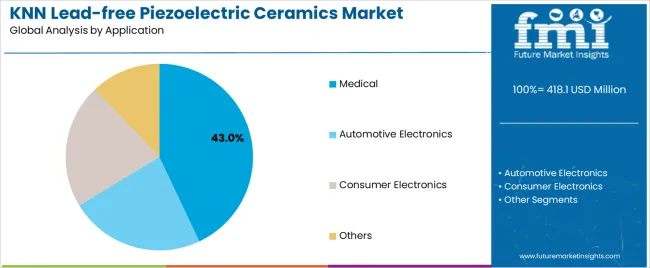

The KNN lead-free piezoelectric ceramics market is segmented by product form, application, and region. By product form, the KNN lead-free piezoelectric ceramics market is divided into KNN film and KNN element. Based on application, the KNN lead-free piezoelectric ceramics market is categorized into medical, automotive electronics, consumer electronics, and others. Regionally, the KNN lead-free piezoelectric ceramics market is divided into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

The KNN film segment represents the dominant force in the KNN lead-free piezoelectric ceramics market, capturing approximately 61.0% of total market share in 2025. This advanced category encompasses thin-film formulations featuring sputtered KNN layers (38.0%), sol-gel-derived films (16.0%), and pulsed laser-deposited coatings (7.0%), delivering comprehensive piezoelectric functionality with miniaturization capabilities suitable for microelectromechanical systems (MEMS) and flexible electronics applications. The KNN film segment's market leadership stems from its exceptional compatibility with semiconductor processing technologies, superior integration with silicon substrates enabling monolithic sensor fabrication, and growing demand for miniaturized piezoelectric devices in wearable medical monitors and automotive pressure sensors.

The KNN element segment maintains a substantial 39.0% market share, serving applications requiring bulk ceramic components through sintered pellets (22.0%), thick-film pastes (11.0%), and composite structures (6.0%). This segment addresses industrial actuators, ultrasonic transducers, and high-power applications where three-dimensional ceramic structures provide necessary displacement and force generation capabilities.

Key advantages driving the KNN film segment include:

Medical applications dominate the KNN lead-free piezoelectric ceramics market with approximately 43.0% market share in 2025, reflecting the critical importance of biocompatible, non-toxic materials in implantable devices and diagnostic equipment. The medical segment's market leadership is reinforced by widespread adoption across ultrasound transducers (18.0%), implantable sensors (14.0%), and therapeutic ultrasound systems (11.0%), which require lead-free compositions for patient safety and regulatory compliance with medical device directives prohibiting hazardous substances in body-contact applications.

The automotive electronics segment represents 28.0% market share through specialized applications including pressure sensors (12.0%), fuel injection systems (9.0%), and knock sensors (7.0%). Consumer electronics accounts for 19.0% market share featuring applications in smartphone haptics (8.0%), printer heads (6.0%), and micro-speakers (5.0%). The others segment holds 10.0% market share encompassing industrial sensing and energy harvesting applications.

Key market dynamics supporting application preferences include:

The KNN lead-free piezoelectric ceramics market is driven by three concrete demand factors tied to regulatory compliance and technological advancement. First, environmental regulations, including the EU RoHS Directive, China RoHS, and similar legislation globally, mandate lead elimination from electronics manufacturing, with compliance deadlines creating urgent demand for validated lead-free alternatives that achieve acceptable piezoelectric performance across sensor and actuator applications. Second, medical device biocompatibility requirements drive KNN adoption for implantable sensors and therapeutic devices, with regulatory agencies increasingly scrutinizing lead content in body-contact applications and tissue-penetrating instruments where lead leaching poses patient safety risks. Third, sustainability commitments by multinational electronics manufacturers accelerate material substitution efforts, with corporate environmental policies targeting hazardous substance elimination creating sustained demand for environmentally compliant piezoelectric materials throughout global supply chains.

Market restraints include performance limitations where KNN ceramics typically achieve only 60-80% of the piezoelectric coefficient (d33) values of optimized PZT compositions, creating application constraints for high-performance actuators and energy harvesting devices requiring maximum electromechanical coupling efficiency. Manufacturing complexity and higher production costs resulting from precise composition control requirements, specialized sintering atmospheres, and lower processing yields compared to mature PZT manufacturing technologies pose adoption barriers for cost-sensitive applications. Temperature stability challenges where KNN ceramics exhibit more pronounced property degradation near their polymorphic phase transition temperatures create reliability concerns for automotive and industrial applications experiencing wide operating temperature ranges.

Key trends indicate accelerated adoption in Asia-Pacific manufacturing centers, particularly China and Japan, where electronics production concentration combines with stringent environmental regulations creating massive demand for RoHS-compliant piezoelectric materials. Advancements in technology are trending toward compositional doping strategies using lithium, tantalum, and antimony additions to enhance piezoelectric coefficients, texturing techniques that achieve grain-oriented microstructures for improved properties, and multilayer architectures that enable higher voltage generation, all of which are enabling next-generation product development. However, the KNN lead-free piezoelectric ceramics market thesis could face disruption if alternative lead-free systems such as bismuth sodium titanate (BNT) or barium titanate achieve superior performance characteristics, or if advances in lead-containing piezoceramics with complete lead encapsulation eliminate environmental concerns while maintaining performance advantages.

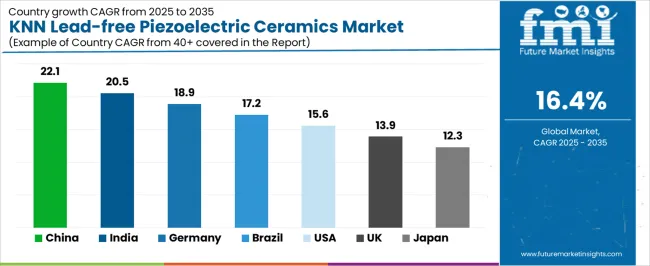

| Country | CAGR (2025-2035) |

|---|---|

| China | 22.1% |

| India | 20.5% |

| Germany | 18.9% |

| Brazil | 17.2% |

| USA | 15.6% |

| UK | 13.9% |

| Japan | 12.3% |

The KNN lead-free piezoelectric ceramics market is gaining momentum worldwide, with China taking the lead thanks to aggressive electronics manufacturing expansion and environmental compliance enforcement programs. Close behind, India benefits from growing medical device manufacturing capabilities and electronics production incentives, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where automotive sensor innovation and stringent environmental standards strengthen its role in European advanced materials supply chains. Brazil demonstrates robust growth through expanding medical device production and industrial automation, signaling continued investment in lead-free piezoelectric technologies. Meanwhile, the USA stands out for its medical device innovation leadership and defense electronics applications, while the UK and Japan continue to record consistent progress driven by research excellence and precision manufacturing capabilities. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the KNN lead-free piezoelectric ceramics market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the KNN Lead-free Piezoelectric Ceramics Market with a CAGR of 22.1% through 2035. The country's leadership position stems from comprehensive electronics manufacturing dominance, intensive environmental regulation enforcement, and aggressive materials innovation programs driving adoption of lead-free piezoelectric technologies. Growth is concentrated in major manufacturing regions, including Guangdong, Jiangsu, Zhejiang, and Shandong, where consumer electronics producers, automotive sensor manufacturers, and medical device companies are implementing KNN ceramic solutions for regulatory compliance and export market access. Distribution channels through materials suppliers, electronic component distributors, and direct relationships with major electronics manufacturers expand deployment across diverse application sectors. The country's Made in China 2025 initiative provides policy support for advanced materials development, including research funding for lead-free piezoelectric compositions and manufacturing technology advancement.

Key market factors:

In major industrial regions including Karnataka, Maharashtra, Tamil Nadu, and Gujarat, the adoption of KNN lead-free piezoelectric ceramics is accelerating across emerging medical device manufacturing facilities, automotive component production units, and consumer electronics assembly operations, driven by government manufacturing incentives and environmental awareness programs. The KNN lead-free piezoelectric ceramics market demonstrates strong growth momentum with a CAGR of 20.5% through 2035, linked to comprehensive electronics manufacturing expansion and increasing focus on sustainable materials adoption. Indian manufacturers are implementing lead-free piezoelectric technologies and quality assurance systems to improve export competitiveness while meeting international environmental standards for electronics and medical device markets. The country's Production Linked Incentive schemes for electronics and medical device manufacturing create sustained demand for compliant materials, while increasing emphasis on Make in India programs drives domestic materials development capabilities.

Germany's advanced materials sector demonstrates sophisticated implementation of KNN lead-free piezoelectric technologies, with documented case studies showing successful integration in automotive pressure sensors and industrial automation systems achieving reliable performance. The country's automotive and industrial equipment infrastructure in major regions, including Baden-Württemberg, Bavaria, North Rhine-Westphalia, and Hesse, showcases integration of environmentally compliant piezoelectric materials with existing sensor manufacturing systems, leveraging expertise in precision ceramics and materials characterization. German manufacturers emphasize technical validation and long-term reliability testing, creating demand for high-quality KNN ceramics that meet stringent automotive qualification requirements and industrial performance standards. The KNN lead-free piezoelectric ceramics market is expected to maintain strong growth through a focus on research excellence and application engineering, with a CAGR of 18.9% projected through 2035.

Key development areas:

Brazil's expanding industrial sector demonstrates growing implementation of KNN lead-free piezoelectric technologies, with increasing focus on medical device manufacturing and automotive component localization supporting market growth. The country shows solid potential with a CAGR of 17.2% through 2035, driven by healthcare infrastructure investment and automotive industry development across major regions, including São Paulo, Minas Gerais, Rio de Janeiro, and Rio Grande do Sul. Brazilian manufacturers are adopting lead-free piezoelectric materials for compliance with emerging environmental regulations and export market requirements, particularly in medical ultrasound equipment and automotive sensor applications. Technology deployment channels through materials distributors, technical service providers, and manufacturing equipment suppliers expand coverage across diverse application sectors.

Leading market segments:

The USA market leads in advanced KNN piezoelectric research based on integration with MEMS technologies and biomedical device innovation supporting next-generation applications. The country shows solid potential with a CAGR of 15.6% through 2035, driven by medical device innovation and defense electronics applications across major regions, including Massachusetts, California, Minnesota, and Texas. American researchers and manufacturers are developing advanced KNN compositions with enhanced piezoelectric coefficients and improved temperature stability, particularly for implantable medical sensors requiring biocompatibility and miniaturized ultrasound imaging arrays. Technology deployment channels through medical device companies, defense contractors, and industrial sensor manufacturers expand coverage across high-value application sectors.

Leading market segments:

The UK's KNN lead-free piezoelectric ceramics market demonstrates focused research and development activities centered on materials optimization and advanced characterization, with documented contributions to understanding structure-property relationships in modified KNN compositions. The country maintains steady growth momentum with a CAGR of 13.9% through 2035, driven by academic research excellence and specialized manufacturing capabilities in precision ceramics and electronic materials. Major research centers, including universities in Northern England, Southeast England, and Scotland, showcase advanced materials development where academic-industry collaboration programs advance composition optimization and processing technology refinement.

Key market characteristics:

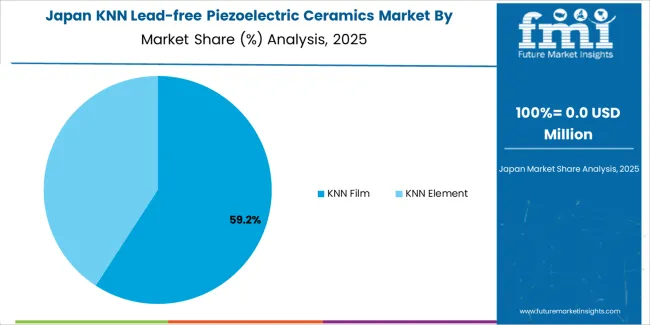

Japan's KNN lead-free piezoelectric ceramics market demonstrates sophisticated implementation focused on high-precision manufacturing and comprehensive materials characterization, with documented leadership in thin-film deposition technologies and composition optimization strategies. The country maintains steady growth momentum with a CAGR of 12.3% through 2035, driven by electronics industry requirements for environmental compliance and researchers' emphasis on achieving performance parity with lead-based alternatives through advanced materials engineering. Major manufacturing and research regions, including Kanto, Kansai, Chubu, and Kyushu, showcase advanced ceramic processing capabilities where manufacturers achieve exceptional compositional uniformity and microstructural control enabling superior device performance.

Key market characteristics:

The KNN lead-free piezoelectric ceramics market in Europe is projected to grow from USD 79.5 million in 2025 to USD 362.8 million by 2035, registering a CAGR of 16.4% over the forecast period. Germany is expected to maintain its leadership position with a 33.2% market share in 2025, declining slightly to 32.6% by 2035, supported by its advanced automotive sensor infrastructure and major materials research centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia regions.

The United Kingdom follows with a 21.4% share in 2025, projected to reach 21.8% by 2035, driven by comprehensive materials research programs and medical device innovation initiatives. France holds a 17.6% share in 2025, expected to rise to 17.9% by 2035 through automotive electronics development and industrial sensor applications. Italy commands a 10.8% share in both 2025 and 2035, backed by precision ceramics manufacturing and medical device production. Spain accounts for 7.2% in 2025, rising to 7.4% by 2035 on electronics manufacturing expansion. The Netherlands maintains 4.6% in 2025, reaching 4.8% by 2035 on MEMS development activities. The Rest of Europe region is anticipated to hold 5.2% in 2025, expanding to 5.7% by 2035, attributed to increasing research activities in Nordic countries and emerging materials development programs in Eastern European research institutions.

The Japanese KNN lead-free piezoelectric ceramics market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of materials science research with precision manufacturing capabilities across electronics production facilities, medical device companies, and advanced materials research institutions. Japan's emphasis on environmental compliance and technical excellence drives demand for high-performance KNN ceramics that approach lead-based piezoelectric properties through advanced composition optimization and processing technologies. The KNN lead-free piezoelectric ceramics market benefits from strong partnerships between university research groups and industrial manufacturers including major electronics companies, creating comprehensive innovation ecosystems that prioritize fundamental understanding and property optimization. Research and manufacturing centers in Tokyo, Osaka, Nagoya, and other major technology hubs showcase advanced KNN implementations where materials achieve 70-80% of PZT performance through lithium and antimony doping strategies and grain texturing techniques.

The South Korean KNN lead-free piezoelectric ceramics market is characterized by intensive research collaboration, with academic institutions and industrial research centers maintaining significant activities through comprehensive materials development programs and application engineering initiatives. The KNN lead-free piezoelectric ceramics market demonstrates increasing emphasis on achieving performance parity with lead-based alternatives, as Korean researchers advance composition optimization strategies that enhance piezoelectric coefficients and temperature stability through systematic dopant studies and processing parameter optimization. Research institutions are expanding capabilities through strategic international collaboration, offering specialized expertise including advanced characterization methodologies and computational materials design approaches supporting accelerated development. The competitive landscape shows increasing integration between materials research activities and electronics manufacturing applications, creating innovation pathways that translate fundamental discoveries into commercial products for consumer electronics and automotive sensor applications.

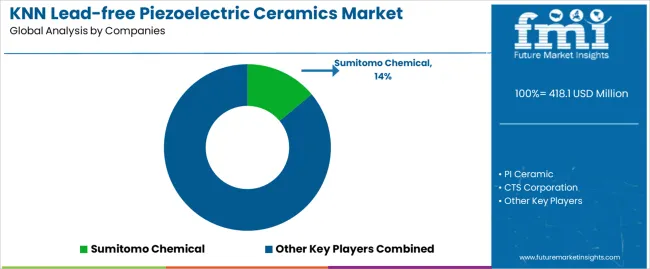

The KNN lead-free piezoelectric ceramics market features approximately 15-20 meaningful players with moderate to high fragmentation, where the top three companies control roughly 35-40% of global market share through established materials expertise and proven manufacturing capabilities serving electronics and medical device industries. Competition centers on piezoelectric performance optimization, manufacturing yield consistency, and application engineering support rather than volume production capabilities. Sumitomo Chemical leads with approximately 14.0% market share through its comprehensive advanced materials portfolio and strong presence in electronics manufacturing supply chains.

Market leaders include Sumitomo Chemical, PI Ceramic, and CTS Corporation, which maintain competitive advantages through extensive materials research capabilities, proven track records in piezoelectric ceramics manufacturing, and deep expertise in composition optimization and processing technology, creating performance and reliability advantages with demanding customers in medical device and automotive sectors. These companies leverage research and development capabilities in crystallographic engineering and phase diagram optimization along with ongoing technical support relationships with device manufacturers to defend market positions while expanding into emerging applications including flexible electronics and biomedical implants.

Challengers and product specialists focus on specific application niches or regional markets, offering differentiated capabilities in thin-film deposition technologies, custom composition development, and application-specific engineering services. The competitive landscape includes emerging materials companies developing novel dopant strategies and processing innovations that enhance KNN piezoelectric properties toward performance parity with conventional lead-based ceramics.

Regional players and specialized ceramic manufacturers create competitive pressure through localized production capabilities and rapid prototyping services, particularly in high-growth markets including China and India, where proximity to electronics manufacturing clusters provides advantages in technical service delivery and design iteration cycles. Market dynamics favor companies that combine proven materials performance with comprehensive application engineering support addressing complete device integration from material selection through manufacturing process optimization, enabling electronics and medical device companies to successfully transition from lead-based to environmentally compliant piezoelectric materials while maintaining acceptable performance standards.

knn lead-free piezoelectric ceramics represent environmentally compliant materials that enable device manufacturers to achieve regulatory compliance while delivering 60-80% of the piezoelectric performance of traditional PZT ceramics, providing biocompatible alternatives with acceptable electromechanical coupling and zero lead content in demanding medical and electronics applications. With the KNN lead-free piezoelectric ceramics market projected to grow from USD 418.1 million in 2025 to USD 1,909.0 million by 2035 at a 16.4% CAGR, these sustainable piezoelectric materials offer compelling advantages - environmental compliance, biocompatibility, and hazard elimination - making them essential for medical applications (43.0% market share), automotive electronics (28.0% share), and device manufacturing operations seeking alternatives to lead-based piezoceramics that create regulatory challenges and environmental concerns.

| Item | Value |

|---|---|

| Quantitative Units | USD 418.1 million |

| Product Form | knn Film, KNN Element |

| Application | Medical, Automotive Electronics, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Sumitomo Chemical, PI Ceramic, CTS Corporation |

| Additional Attributes | Dollar sales by product form and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with advanced ceramics manufacturers and materials research institutions, composition development and processing technology specifications, integration with medical device manufacturing and electronics assembly systems, innovations in dopant strategies and microstructural engineering, and development of specialized formulations with enhanced piezoelectric properties and temperature stability capabilities. |

The global KNN lead-free piezoelectric ceramics market is estimated to be valued at USD 418.1 million in 2025.

The market size for the KNN lead-free piezoelectric ceramics market is projected to reach USD 1,909.0 million by 2035.

The KNN lead-free piezoelectric ceramics market is expected to grow at a 16.4% CAGR between 2025 and 2035.

The key product types in KNN lead-free piezoelectric ceramics market are KNN film and KNN element.

In terms of application, medical segment to command 43.0% share in the KNN lead-free piezoelectric ceramics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Bio-ceramics and Hydroxyapatite Market 2025-2035

Pottery Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Advanced Ceramics Market Analysis - Size, Share & Forecast 2025 to 2035

Electronic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Monolithic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Industrial Ceramics Market Growth – Trends & Forecast 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Ceramics Market Size and Share Forecast Outlook 2025 to 2035

High-Temperature Ceramics Market Growth - Trends & Forecast 2025 to 2035

Zirconia-Based Dental Ceramics Market Trends - Growth & Forecast 2024 to 2034

Piezoelectric Devices Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Materials Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Sensors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Accelerometer Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Piezoelectric Sensors Manufacturing

Piezoelectric Ceramics Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA