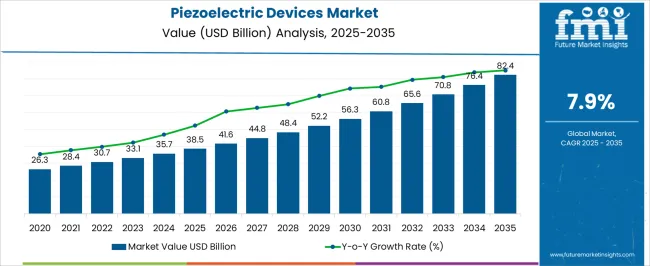

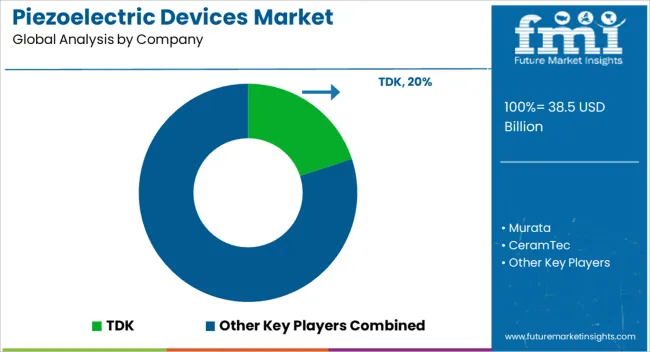

The piezoelectric devices market is estimated to be valued at USD 38.5 billion in 2025 and is projected to reach USD 82.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The industry is positioned in the growth phase, where adoption is expanding across automotive, healthcare, consumer electronics, and industrial automation. Early adoption has been largely driven by applications in sensors, actuators, and ultrasonic devices, where reliability and miniaturization remain critical advantages. From 2025 to 2030, the market is expected to experience accelerated adoption, supported by advancements in energy harvesting and wearable electronics. This period reflects the transition from niche applications to wider integration, particularly in medical imaging and precision manufacturing.

By 2030 onward, broader acceptance in next-generation mobility solutions, including electric vehicles and autonomous systems, will reinforce market penetration, marking the entry into the late growth stage of the adoption lifecycle. Despite strong growth, eventual saturation in mature industries such as consumer electronics may slow adoption rates in the post-2032 period. Emerging opportunities in smart infrastructure and industrial IoT will sustain momentum. The market trajectory suggests that while mass adoption is not yet complete, piezoelectric devices are moving toward a stable and entrenched phase in multiple industries globally.

| Metric | Value |

|---|---|

| Piezoelectric Devices Market Estimated Value in (2025 E) | USD 38.5 billion |

| Piezoelectric Devices Market Forecast Value in (2035 F) | USD 82.4 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The piezoelectric devices market is positioned as a key enabler across several technologies driven parent industries. Within electronic components and sensors, it is estimated at 7.4%, due to its role in transducers, resonators, and actuators. In medical devices and diagnostics, a 5.6% share is observed, primarily through ultrasound imaging and precision surgical tools. For industrial automation and control, a 4.8% presence is calculated, supported by demand for vibration monitoring and micro positioning. The automotive electronics sector accounts for 6.2%, where piezoelectric actuators and sensors enhance efficiency and safety systems. Consumer electronics applications hold 3.9%, driven by buzzers, microphones, and haptic feedback solutions.

Recent industry trends have highlighted the development of advanced piezoelectric ceramics, thin films, and polymers, enabling greater sensitivity and miniaturization. Breakthroughs have included flexible piezoelectric materials for wearable devices, energy harvesting systems for wireless sensors, and lead free formulations to meet regulatory demands. Key players have focused on integrating piezoelectric modules into IoT based platforms, enhancing connectivity and performance. Strategic collaborations with automotive OEMs and medical technology firms have been established to create specialized applications. Furthermore, production strategies are shifting toward scalable thin film deposition and additive manufacturing, improving cost efficiency and enabling wider adoption across industrial and consumer markets.

The market is experiencing steady expansion, driven by the growing demand for precision sensing, actuation, and energy harvesting solutions in industrial, automotive, medical, and consumer electronics sectors. The capability of these devices to convert mechanical stress into electrical energy and vice versa has positioned them as critical components in applications that require high accuracy and reliability.

Advancements in materials science, miniaturization techniques, and manufacturing processes have improved device performance, durability, and integration with modern electronics. Increasing adoption in medical imaging, ultrasonic sensing, and industrial automation is contributing to market growth, while the shift toward smart, connected systems is further accelerating demand.

Regulatory support for energy-efficient technologies and ongoing research into lead-free piezoelectric materials are creating new opportunities With the combination of established demand in traditional sectors and emerging applications in IoT-enabled systems, the market is expected to sustain robust growth, supported by both incremental innovation and strategic investment from key industry players.

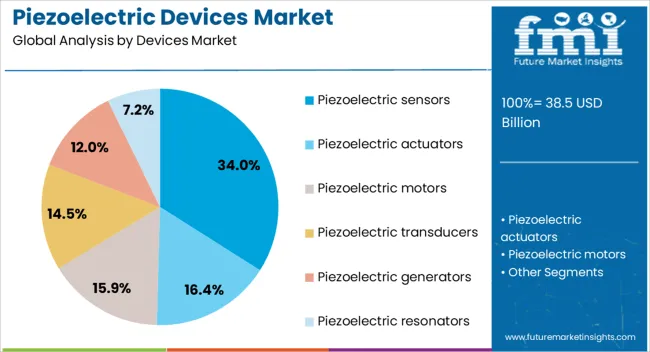

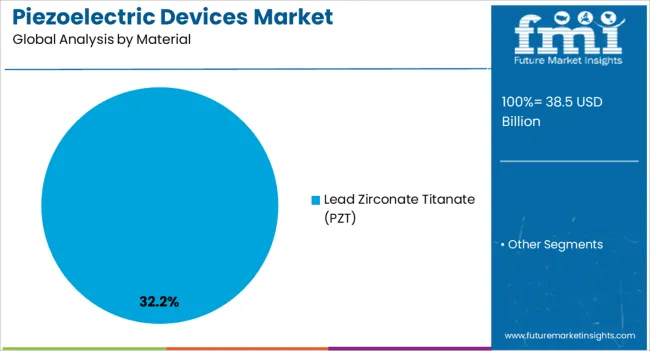

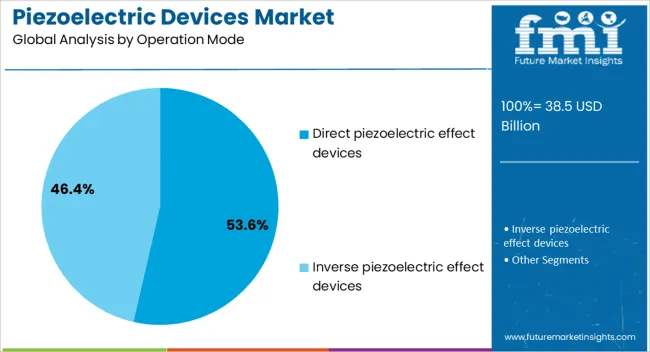

The piezoelectric devices market is segmented by devices market, material, operation mode, application, end use industry, and geographic regions. By devices market, piezoelectric devices market is divided into piezoelectric sensors, piezoelectric actuators, piezoelectric motors, piezoelectric transducers, piezoelectric generators, and piezoelectric resonators. In terms of material, piezoelectric devices market is classified into lead zirconate titanate (PZT). Based on operation mode, piezoelectric devices market is segmented into direct piezoelectric effect devices and inverse piezoelectric effect devices. By application, piezoelectric devices market is segmented into ultrasonic imaging & diagnostics, positioning and navigation, vibration sensing, energy harvesting, inkjet printing, micro-actuation, and sound and pressure sensing. By end use industry, piezoelectric devices market is segmented into consumer electronics, healthcare, automotive, aerospace & defense, industrial & manufacturing, energy & utilities, and telecommunications. Regionally, the piezoelectric devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The piezoelectric sensors segment is projected to hold 34% of the market revenue share in 2025, making it the leading device category. Growth in this segment has been supported by the rising use of high-precision sensors in automotive safety systems, industrial process monitoring, and consumer electronics.

The ability of piezoelectric sensors to deliver accurate measurements under extreme environmental conditions has made them a preferred choice for applications requiring consistent performance and low maintenance. Software integration and digital signal processing advancements have further enhanced their value by enabling real-time analytics and improved system responsiveness.

The miniaturization of sensor components has also expanded their use in portable and wearable devices, supporting growth in healthcare and personal monitoring applications With industries increasingly prioritizing predictive maintenance and quality control, piezoelectric sensors are expected to maintain their leadership due to their proven reliability, scalability, and adaptability in a wide range of operational environments.

The lead zirconate titanate (PZT) material segment is expected to account for 32.20% of the market revenue share in 2025, positioning it as the leading material type. PZT’s dominance has been attributed to its superior piezoelectric properties, which enable high sensitivity and efficiency in both sensing and actuation applications.

The material’s stability across a broad range of temperatures and its adaptability to various device architectures have reinforced its adoption in demanding industrial, medical, and defense applications. PZT’s compatibility with high-frequency operations has also made it a preferred material for ultrasonic imaging and non-destructive testing systems.

Ongoing innovations in PZT-based formulations are further enhancing performance while addressing environmental regulations related to lead content As industries continue to seek materials that balance performance, durability, and cost-effectiveness, PZT remains the benchmark for high-performance piezoelectric devices, ensuring its sustained leadership in the market.

The direct piezoelectric effect devices segment is anticipated to command 53.60% of the market revenue share in 2025, making it the leading operation mode. The segment’s leadership has been driven by the wide application of direct effect devices in energy harvesting, pressure sensing, and vibration monitoring systems. Their ability to generate electrical energy directly from mechanical stress has made them indispensable in self-powered sensor systems, particularly in remote or inaccessible environments.

The increasing focus on sustainable and maintenance-free devices has further boosted adoption. Advances in material engineering have improved energy conversion efficiency and device miniaturization, expanding their integration into portable electronics, industrial machinery, and environmental monitoring systems.

Additionally, the compatibility of direct effect devices with wireless communication modules enables real-time data transmission without external power sources, aligning with the growing trend toward autonomous sensing solutions These advantages have firmly established direct piezoelectric effect devices as a preferred choice across multiple industries.

The market has gained momentum as industries integrate these components for sensing, actuation, and energy harvesting applications. Piezoelectric materials convert mechanical energy into electrical signals and vice versa, enabling their use in diverse fields including healthcare, automotive, consumer electronics, and industrial automation. Increasing demand for compact, efficient, and high-performance electronic devices has been a central factor driving adoption. Technological advancements in piezoelectric materials, such as lead-free ceramics and thin-film applications, have further strengthened the market outlook. Strong interest from both medical diagnostics and precision manufacturing sectors has reinforced the perception of piezoelectric devices as critical enablers of innovation.

A prominent dynamic has been the use of piezoelectric devices in the medical field. Ultrasonic imaging systems, surgical instruments, and diagnostic sensors have increasingly incorporated piezoelectric transducers to deliver precision and reliability. These devices provide non-invasive imaging capabilities, high sensitivity, and compact form factors, making them indispensable in modern healthcare. Applications have extended beyond diagnostics to include drug delivery systems and therapeutic ultrasound devices. With the global emphasis on early disease detection and minimally invasive procedures, the medical sector has continued to present strong demand for piezoelectric technologies. This growing medical integration has been a decisive force shaping the market.

Piezoelectric devices have been deployed extensively across industrial automation and automotive applications. They are utilized in vibration sensors, fuel injectors, pressure monitors, and condition monitoring systems, supporting precision and efficiency in manufacturing and mobility sectors. Automotive manufacturers have integrated piezoelectric injectors in engines to enhance fuel efficiency and reduce emissions. In industrial environments, piezoelectric sensors have been used to monitor equipment health, minimizing downtime through predictive maintenance. This expansion across high-value industrial and automotive applications has increased the scope of the market and highlighted the versatility of piezoelectric technology across critical operational systems.

The consumer electronics sector has emerged as another influential area for piezoelectric device integration. Piezoelectric buzzers, actuators, and sensors have been embedded in smartphones, wearable devices, and IoT-enabled products to deliver compact and energy-efficient functionalities. Demand for haptic feedback systems in devices and gaming equipment has further reinforced growth. As the proliferation of connected devices has accelerated, piezoelectric components have been identified as essential in enhancing user experience and device reliability. Their ability to combine miniaturization with durability has made them highly suitable for the rapidly evolving electronics landscape, thereby boosting market demand across consumer applications.

While the market has advanced with innovations in lead-free piezoelectric materials and thin-film technologies, challenges remain in achieving broader adoption. Issues related to temperature stability, material brittleness, and high production costs have hindered wider use in certain industries. Environmental concerns regarding the use of lead-based ceramics have accelerated the push for eco-friendly alternatives, which are still under development. Moreover, limitations in scaling production for thin-film piezoelectric devices have slowed commercialization in large-volume electronics. These constraints have shaped the competitive landscape, where research and development have been directed toward overcoming such technical and material barriers.

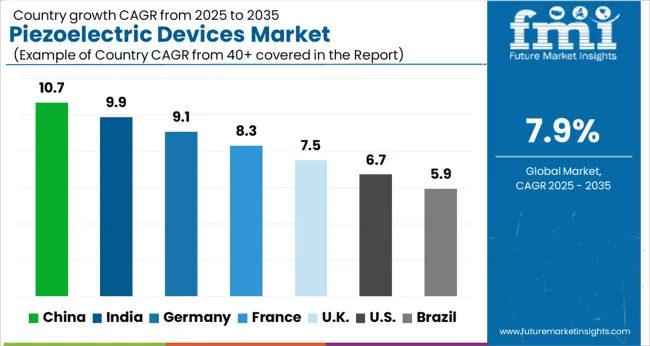

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

China maintained the strongest expansion in the piezoelectric devices market with a forecast growth rate of 10.7%, driven by increasing deployment across consumer electronics, automotive components, and industrial applications. India followed with 9.9%, where growing adoption in medical ultrasound equipment and telecommunication devices contributed to steady development. Germany secured 9.1% due to higher integration of advanced sensors and actuators across automotive and aerospace industries. The United Kingdom recorded 7.5%, supported by its focus on research activities in energy harvesting technologies. The United States registered 6.7%, where advancements in defense and healthcare instrumentation sustained consistent market activity. Together, these countries represent a diversified landscape of adoption, manufacturing, and technology integration that influences the global trajectory of piezoelectric devices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expanding with a CAGR of 10.7%, underpinned by large-scale adoption in electronics, automotive, and industrial applications. The country benefits from a strong domestic supply chain that ensures consistent availability of materials and components for local manufacturers. Government-backed research initiatives are enabling advanced product development, while global firms are partnering with Chinese companies to expand production. Growing consumer interest in smart products such as wearables and mobile devices is accelerating the deployment of piezoelectric components. Local companies are emphasizing performance improvements and cost competitiveness to strengthen their global position. This trend is allowing China to evolve as a dominant force in shaping worldwide production, especially in consumer electronics, healthcare technologies, and industrial automation.

India is recording a CAGR of 9.9% in the market, fueled by rising adoption across healthcare, consumer electronics, and industrial automation. Outsourcing of manufacturing to India has enabled cost-efficient production of components, allowing the country to gain greater presence in global supply chains. The medical sector is particularly influential, with ultrasound devices and diagnostic tools using piezoelectric elements at large scale. Growing industrial automation and robotics adoption is also generating opportunities for demand expansion. Domestic manufacturers are investing in partnerships with foreign firms to access advanced technologies, while government programs supporting electronics production further strengthen growth prospects. This combination of healthcare demand, consumer electronics expansion, and supportive policies is positioning India as an increasingly important hub for piezoelectric device development.

Germany is achieving a CAGR of 9.1% in the market, supported by its tradition of advanced engineering and high-quality manufacturing. The country has positioned itself as a hub for precision technologies, with industrial automation and automotive sectors driving substantial adoption. German manufacturers are focusing on integrating piezoelectric sensors into control systems to enhance efficiency, while research institutions are exploring advanced ceramics and polymers to boost reliability. The strong emphasis on export-oriented growth ensures that German innovations are influencing global supply chains. A mature research ecosystem combining universities and private firms is further advancing materials science in this domain. With its focus on precision, reliability, and durability, Germany continues to be a leader in shaping high-performance piezoelectric solutions for global markets.

The United Kingdom is witnessing a CAGR of 7.5% in the market, primarily influenced by demand in aerospace, defense, and medical technologies. Specialized applications requiring reliability and performance are central to adoption. Healthcare advancements are increasing reliance on piezoelectric technology for diagnostics and surgical tools, while defense projects are applying these components in mission-critical systems. Local manufacturers are developing niche solutions where high precision is essential, supported by government-backed innovation funding. Collaboration with European research networks is enhancing technical expertise and driving breakthroughs in materials science. As the market shifts toward specialized applications, the UK is carving out a distinctive role in high-value segments of the piezoelectric devices industry.

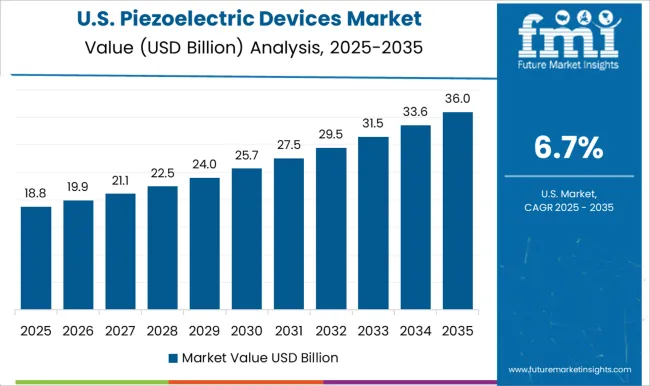

The United States is progressing at a CAGR of 6.7% in the market, characterized by its focus on advanced applications in healthcare, aerospace, and defense. Strong investment in research has led to the development of specialized composites and materials that improve efficiency and durability. The healthcare sector is a major contributor, with piezoelectric devices used in imaging, monitoring, and therapeutic technologies. Aerospace firms are also applying these components to improve flight systems and operational reliability. Robotics and industrial automation continue to offer new opportunities for adoption across diverse industries. With robust innovation ecosystems, university research, and funding channels, the United States is maintaining a leadership role in advancing global standards for piezoelectric technologies.

The market is shaped by a wide network of global manufacturers specializing in materials, sensors, actuators, and transducers that leverage piezoelectric properties for energy conversion and precision applications. TDK and Murata have maintained strong leadership by integrating piezoelectric materials into multilayer components, resonators, and consumer electronic solutions, benefitting from advanced ceramic technology. CeramTec has focused on high-performance ceramics tailored to medical devices, industrial systems, and defense equipment, making it a major European contributor. CTS Corporation has enhanced its presence with precision-engineered piezoelectric components that support automotive, industrial, and communication technologies, emphasizing reliability and design scalability.

PI (Physik Instrumente) has established dominance in nanopositioning and motion control systems, where piezo actuators are critical to achieving ultra-precise movements across optics, photonics, and semiconductor industries. APC International has positioned itself as a key supplier of custom piezoelectric ceramics and assemblies, supporting both research institutions and industrial-scale applications. Alongside these leaders, other listed players contribute to market diversity, offering specialized products across ultrasound imaging, vibration control, and energy harvesting. The competitive environment demonstrates a blend of diversified multinational corporations and specialized niche firms, all driven by material innovation, miniaturization, and integration into next-generation electronic and medical systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.5 Billion |

| Devices Market | Piezoelectric sensors, Piezoelectric actuators, Piezoelectric motors, Piezoelectric transducers, Piezoelectric generators, and Piezoelectric resonators |

| Material | Lead Zirconate Titanate (PZT) |

| Operation Mode | Direct piezoelectric effect devices and Inverse piezoelectric effect devices |

| Application | Ultrasonic imaging & diagnostics, Positioning and navigation, Vibration sensing, Energy harvesting, Inkjet printing, Micro-actuation, and Sound and pressure sensing |

| End Use Industry | Consumer electronics, Healthcare, Automotive, Aerospace & defense, Industrial & manufacturing, Energy & utilities, and Telecommunications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TDK, Murata, CeramTec, CTS Corporation, PI (Physik Instrumente), APC International, and (Other listed players) |

| Additional Attributes | Dollar sales by device type and application, demand dynamics across medical, automotive, and industrial sectors, regional trends in piezoelectric technology adoption, innovation in sensitivity, miniaturization, and energy harvesting, environmental impact of material sourcing and disposal, and emerging use cases in wearable electronics, ultrasound imaging, and precision actuators. |

The global piezoelectric devices market is estimated to be valued at USD 38.5 billion in 2025.

The market size for the piezoelectric devices market is projected to reach USD 82.4 billion by 2035.

The piezoelectric devices market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in piezoelectric devices market are piezoelectric sensors, piezoelectric actuators, piezoelectric motors, piezoelectric transducers, piezoelectric generators and piezoelectric resonators.

In terms of material, lead zirconate titanate (pzt) segment to command 32.2% share in the piezoelectric devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Piezoelectric Materials Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Sensors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Accelerometer Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Ceramics Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Breaking Down Market Share in Piezoelectric Sensors Manufacturing

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

C-Arms Devices Market Analysis – Trends & Forecast 2024-2034

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA