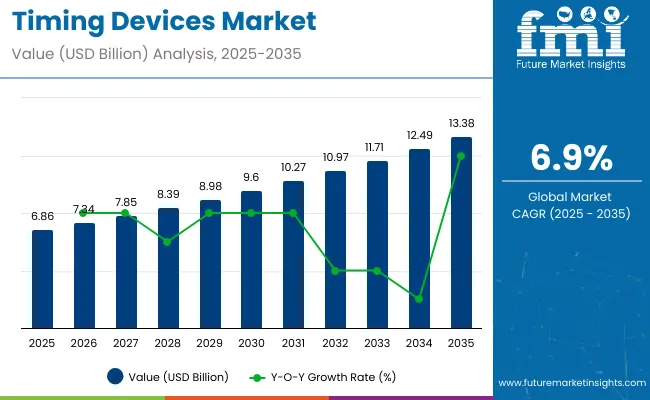

The timing devices market is estimated to be worth USD 6.86 billion in 2025 and is anticipated to reach USD 13.38 billion by 2035, expanding at a compound annual growth rate (CAGR) of 6.9% during the forecast period. The rising demand for precision timing applications across various sectors, including telecommunications, automotive, healthcare, and industrial automation, is the primary factor driving this market’s growth.

As industries worldwide continue to adopt increasingly complex systems requiring precise synchronization, the need for advanced timing solutions has grown significantly.

One of the key factors contributing to the market’s expansion is the increasing integration of timing devices in next-generation technologies. Timing devices are crucial components in the development of 5G networks, autonomous vehicles, and IoT systems, where high accuracy is paramount.

The demand for synchronization and precise timekeeping in these advanced technologies has driven the adoption of atomic clocks, GPS receivers, and real-time clocks in various applications, propelling the market forward. Additionally, timing devices are crucial in space research, military operations, and the energy sector, where precise time synchronization is essential for mission-critical operations.

Recent developments in the market have seen a surge in innovation, with companies focusing on the miniaturization of timing devices and integrating these devices with wireless communication networks. This advancement aims to enhance the precision and efficiency of timing solutions while also reducing energy consumption. As a result, modern timing devices are becoming increasingly cost-effective and versatile, making them a more attractive choice for a broader range of industries.

On September 19, 2024, Seiko Epson Corporation announced its acquisition of Fiery, LLC, a leading provider of digital front end (DFE) servers and workflow solutions for the print industry, from Siris Capital Group affiliates. This acquisition, subject to regulatory approvals, will strengthen Epson’s digital printing capabilities.

Fiery’s products, known for enhancing printing productivity, align with Epson’s strategic vision to drive growth in commercial and industrial printing. Epson President Yasunori Ogawa expressed confidence that this partnership will accelerate the digital transformation of the printing market, enhancing customer success and creating new opportunities in the evolving printing landscape.

Timing devices, including quartz crystals, oscillators, and atomic clocks, are critical components in telecommunications, consumer electronics, automotive systems, and aerospace applications. These devices are regulated to ensure performance reliability, electromagnetic compatibility, material safety, and compliance with international trade and technology control laws.

Electromagnetic Compatibility (EMC) Regulations

Timing devices must meet EMC standards to ensure they do not emit or are not affected by electromagnetic interference. In the European Union, devices must comply with the Electromagnetic Compatibility Directive (2014/30/EU). In the United States, the Federal Communications Commission (FCC Part 15) governs unintentional radiators, including timing circuits used in electronic products.

Material Safety and Environmental Compliance

Timing devices must adhere to environmental regulations regarding hazardous substances. The Restriction of Hazardous Substances (RoHS) Directive in the EU limits the use of materials such as lead, mercury, and cadmium in electronic components. Additionally, the REACH Regulation ensures safe handling of chemical substances in components and materials used in timing devices.

Export Control and Technology Licensing

High-precision timing devices, especially atomic clocks and those used in aerospace or defense, are often subject to export control regulations. In the United States, the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) control the export of certain sensitive timing technologies. Similar restrictions apply in Japan, the EU, and other jurisdictions under their dual-use technology control frameworks.

Quality and Performance Standards

Timing devices must meet international standards for frequency accuracy and reliability. Standards such as IEC 60444 for quartz crystal units and IEEE 1139 for atomic clocks ensure uniform performance benchmarks. Compliance with these standards is often required in telecommunications, automotive, and aerospace certifications to guarantee synchronization and timing precision.

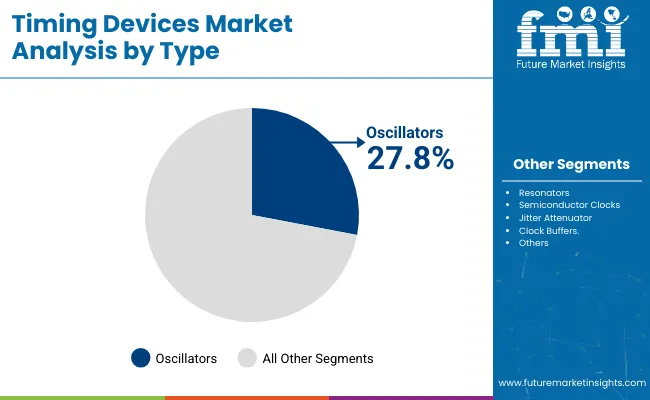

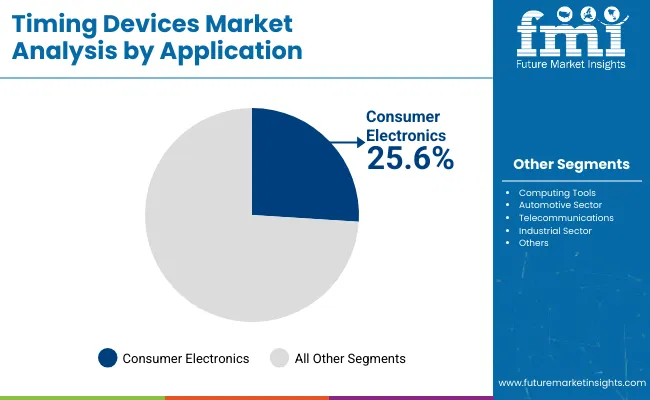

The timing devices market is poised for steady growth as demand for precision timing solutions increases across various industries, including consumer electronics, automotive, and telecommunications. Oscillators lead the product segment due to their reliability and versatility. In contrast, the consumer electronics segment remains a dominant end-user, driven by the continuous innovation in smart devices and wearables.

Oscillators are expected to hold a significant 27.8% market share in 2025, driven by their crucial role in providing stable frequencies for electronic devices. These components are essential in a wide range of applications, including communications, automotive electronics, medical devices, and consumer electronics.

Manufacturers such as Qorvo, Inc., NXP Semiconductors, and STMicroelectronics continue to innovate in oscillator technology, offering highly accurate, low-power solutions that meet the increasing demand for precision in modern electronics. As the world moves toward more connected and automated systems, oscillators will continue to be a key component for maintaining synchronization and reliability in electronic systems.

The growing need for wireless communication, GPS systems, and high-performance computing will further bolster oscillator demand. With their widespread applications in mobile phones, wearables, and IoT devices, oscillators are expected to maintain their position as the dominant product in the timing devices market.

The consumer electronics segment is projected to capture 25.6% of the timing devices market by 2025, driven by the growing demand for accurate timing in devices such as smartphones, smartwatches, and other wearable technologies.

Consumer electronics companies, driven by advancements in IoT, 5G connectivity, and the growing demand for energy-efficient devices, are investing heavily in precision timing technologies to improve performance and user experience. Leading companies such as Apple, Samsung, and Sony are focusing on integrating high-performance timing devices, including oscillators and resonators, into their products to ensure accurate synchronization and enhance functionality.

As the consumer electronics market continues to grow at a rapid pace, the demand for robust, low-power timing solutions is expected to rise, driving further growth in this segment. Additionally, innovations in next-generation wearable technology and connected devices will continue to drive the need for accurate timing devices, solidifying the consumer electronics segment as a key driver of the timing devices market.

The shifting industry is exemplified by the rapid adoption of AI-equipped time-monitoring network solutions, super-intelligent watches, and the installation of highly accurate synchronizing software tools. Customers attach greater priority to business prestige, fashion, and intelligent features, while suppliers prioritize precision, reliability, and the simplicity of implementing industrial applications in their processes.

Dealers, on the one hand, stress the importance of pricing strategies, brand diversity, and demand forecasting obligations, and manufacturers, on the other hand, allocate funds to R&D for innovation and cost-cutting processes. The orientation towards eco-friendly raw materials and digital transformation remains the backbone of the industry, with innovations such as biometric authentication, quantum timekeeping, and blockchain-based timestamping technologies gaining increasing traction.

The anticipated increase in the use of GPS-enabled and AI-powered timekeeping devices aims to enhance precision and efficiency across various sectors, driven by the need for highly synchronized systems.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| SiTime Corporation | Approximately USD 50 |

| Microchip Technology Inc. | Approximately USD 75 |

| TXC Corporation | Approximately USD 40 |

| Abracon LLC | Approximately USD 60 |

Strategic partnerships and technological advancements have brought significant growth in the industry during 2024 and early 2025. The collaboration between SiTime Corporation and an automaker to supply MEMS-based timing solutions for ADAS underscores the growing convergence of precise timing in vehicle safety features.

Again, Microchip Technology Inc. is developing telecommunication infrastructure through accurate timing, as demonstrated by its recent contract to enhance cloud service, which highlights the effective use of precise timing in increasing network reliability. Providing crystal oscillators for wearable technology is the driving force behind TXC Corporation's partnership to enhance performance in consumer electronics, fueled by the demand for improved performance in these devices.

Emphasizing the importance of precise performance in operational efficiency is also the partnership formed by Abracon LLC to integrate timing solutions into industrial automation. The innovations reflect that the strong and growing timing devices have indeed contributed to allowing innovations in several fields.

Risks involved in the industry are present in the supply chain, such as the lack of microchips and key parts necessary for production, which can sometimes lead to unwanted consequences, for instance, deterring production and thus increasing costs. Always on the lookout for quality suppliers, exploring additional sourcing avenues is a prime aspect that companies should concentrate on to ensure continued manufacturing and distribution.

The strict regulations surrounding battery usage, electronic waste disposal, and environmental sustainability have a negative effect on the industry. The sector is required to address this issue by utilizing environmentally friendly materials, producing energy-efficient products, and adhering to international standards. Packaging that incorporates biodegradable and recyclable components will be the two key factors that dominate the competitive edge in the industry.

Despite the challenging global situation and companies' efforts to mitigate cyber threats, the industry's level of concern about adopting IoT and cloud connections is increasing. The risks of hacking, data breaches, and unauthorized third-party access pose a threat to the privacy of users and the integrity of the system.

Adopting cutting-edge security protocols, implementing continuous software upgrades, and utilizing encrypted communication channels are some of the measures that businesses should consider to establish trust with consumers.

The financial risks manufacturers face stem from the fluctuations in raw materials, such as metals and electronic components. Furthermore, ongoing geopolitical tensions and trade embargoes could be a contributing factor to supply chain interruptions. However, using different suppliers for raw materials, establishing local production units, and implementing forthcoming strategic pricing policies are some of the actions that can be taken to overcome the problem and keep the business prospering.

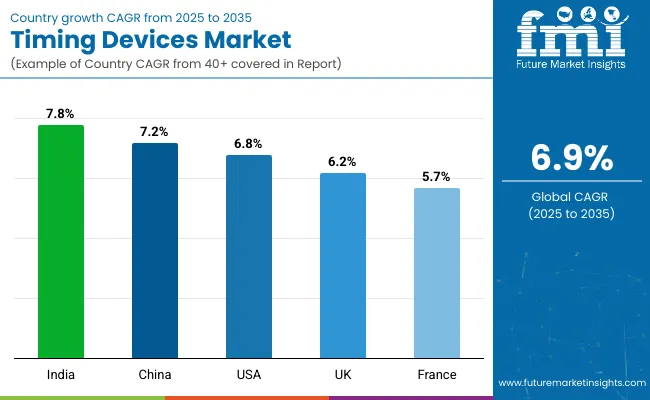

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| France | 5.7% |

| UK | 6.2% |

| China | 7.2% |

| India | 7.8% |

The United States is among the leading players in the industry due to its strong presence in the defense, aerospace, and 5G technology sectors. The rapid rollout of 5G networks requires ultra-high precision timing solutions to synchronize the networks, placing a significant demand on high-performance oscillators and atomic clocks. The strong defense sector is dependent on cutting-edge timing solutions for GPS-reliant military missions, secure communications, and missile guidance systems.

Financial industries, especially those involved in high-frequency trading, rely on nanosecond-scale precision, thereby fueling the need for precision timing instruments even further. Government efforts towards improving satellite-based navigation and cybersecurity further increase the industry's strength, and industry leaders like Microchip Technology and SiTime Corporation are still at the forefront of developing precision timing devices.

FMI is of the opinion that the USA industry is slated to grow at 6.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| 5G Rollout | The rollout of 5G networks across the country needs high-precision timing solutions to ensure seamless transfer of data. |

| Defense Sector | Military missions require GPS-based navigation and reliable communication backed by atomic clocks. |

| Financial Market | High-precision timekeeping is essential for high-frequency trading, enabling the rapid execution of trades. |

| Space & Navigation | NASA and industry dictate the need for strong timing solutions in satellite navigation. |

| IoT & Automation | Smart infrastructure and autonomous vehicle initiatives drive the need for the right synchronization solutions. |

The UK is also experiencing high growth in the industry, driven by the exponential rise in 5G, industrial automation, and advancements in space technology. The telecommunications industry requires accurate timing for a stable 5G network, whereas the nation's focus on Industrial IoT (IIoT) and smart manufacturing necessitates a demand for synchronized automated systems.

The UK's participation in satellite navigation projects, such as those led by the UK Space Agency, requires high-precision clocks and frequency control equipment. The London financial industry, a global hub for high-frequency trading, relies on high-accuracy time coordination to ensure smooth transactions.

FMI is of the opinion that the UK industry is slated to grow at 6.2% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| 5G Network Installation | The installation of 5G technology requires high-precision timing to ensure stability within the network. |

| Industrial IoT | Smart manufacturing and automation are based on synchronized timing systems. |

| Space & Navigation | Atomic clocks are essential for satellite missions, enabling accurate navigation and location. |

| Financial Sector | The trading centers in London depend on precise timekeeping for algorithmic trading. |

| National Security | Secure communications and cybersecurity programs need strong timing solutions. |

India's industry is expanding at a high velocity, fueled by the ubiquitous rollout of 5G, smart city development, and growing defense modernization programs. The deployment of 5G networks requires precision in time solutions to ensure smooth connectivity. Smart city initiatives supported by the government have IoT-based real-time monitoring networks that need suitable time synchronization.

The defense department supports satellite-based navigation networks, such as NavIC, using advanced atomic clocks and frequency control devices. Fintech businesses that rely on speedy digital transactions also require accurate time-stamping tools. With record foreign investment and government-sponsored manufacturing plans under the "Make in India" initiative, India is well-positioned to become the world's leading destination for timepieces.

FMI is of the opinion that the Indian industry is slated to grow at 7.8% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| 5G Rollout | The mass-scale rollout of 5G throughout the country enhances the demand for high-accuracy timing solutions. |

| Smart Cities | Real-time IoT-based monitoring requires precise synchronization. |

| Defense Sector | NavIC satellite navigation system relies on high-performance atomic clocks. |

| Fintech & Digital Payments | The introduction of electronic transactions necessitates precise time-stamping solutions. |

| Manufacturing & R&D | Government policies promote the indigenous manufacturing of high-precision timing devices. |

Technological development and infrastructure expansion at a rapid pace in China is driving the growth of the industry. The country's dominance in 5G and telecommunication is fueling the need for high-accuracy timing solutions. The trend of smart cities and intelligent transportation systems is on the rise, and synchronized networks are needed to enhance efficiency.

The defense and aerospace industries utilize atomic clocks to ensure secure navigation and military applications. China's involvement in space exploration and satellite-based navigation systems also increases the demand for high-performance timing equipment. The nation's financial sector, particularly in high-frequency trading, also relies on accurate time synchronization.

FMI is of the opinion that the Chinese industry is slated to grow at 7.2% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| 5G & Telecom Growth | Reliable telecommunications require high-precision timing equipment. |

| Smart Cities & IoT | The Internet of Things (IoT) requires accurate time synchronization in urban environments. |

| Aerospace & Defense | Military uses and navigation systems require highly developed atomic clocks. |

| Space Exploration | Chinese satellite programs require good timing to position correctly. |

| Financial Market | The stock industry relies on accurate time-stamping for algorithmic trading. |

France is emerging as a significant industry player through its robust aerospace industry, 5G infrastructure deployment, and focus on industrial automation. The nation's leadership in aerospace and space exploration requires state-of-the-art timing solutions for safe navigation and communications systems.

The deployment of 5G networks and industry digitalization requires excellent time synchronization. The nation's financial industries, such as high-frequency trading operations, also depend on nanosecond accuracy. With rising research and development spending, France is poised to increase its share in the global marketplace for Time Devices.

FMI is of the opinion that the French industry is slated to grow at 5.7% CAGR during the study period.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Aerospace & Aviation | Airborne systems need to have high-accuracy timing solutions to operate safely. |

| 5G Deployment | Deployment of the 5G network increases the need for communication synchronization. |

| Industrial Automation | Smart manufacturing utilizes accuracy in timekeeping. |

| Space Programs | Satellite navigation systems need atomic clocks. |

| Financial Services | High-frequency trading relies on synchronized time. |

The industryis on a fast track for growth as it has been making use of advances in miniaturization, low power consumption, and high-precision timing solutions for applications in telecommunications, IoT, aerospace, and industrial automation. End users are becoming increasingly demanding in terms of high-stability oscillators, atomic clocks, and MEMS-based timing solutions, driven by the adoption of 5G technology, AI-driven systems, and edge computing.

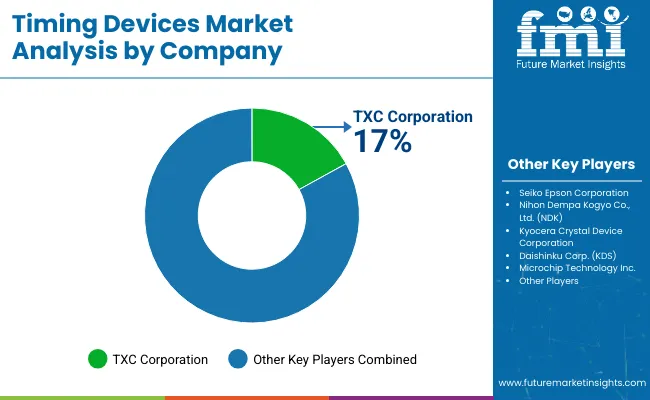

The leading players in the industry are Seiko Epson Corporation, Microchip Technology Inc., and SiTime Corporation, which have made significant investments in R&D and offer a superior range of products specifically related to MEMS oscillators, real-time clocks (RTC), and temperature-compensated crystal oscillators (TCXO). Nihon Dempa Kogyo (NDK) and Rakon Limited offer specialized solutions in areas such as aerospace, industrial automation, and high-frequency telecommunications.

Emerging competition from cheaper, cost-effective quartz oscillators and real-time clocks (RTCs) is driving large-scale manufacturing in countries such as China and Taiwan. The future-shaping innovations have included many more, especially low-power consumption and ultra-precision timing devices, to cater to next-gen connectivity, autonomous systems, and smart grids.

Strategic space includes time synchronization with AI, increased demand for Timing solutions in robust 5G infrastructure, and consolidation with mergers and acquisitions. This highly competitive and rapidly evolving industry favors timing solutions related to ultra-low jitter oscillators, ruggedized timing solutions, and application-specific timing modules.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.86 billion |

| Projected Market Size (2035) | USD 13.38 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Oscillators, Resonators, Semiconductor Clocks, Jitter Attenuator, Clock Buffers |

| Applications Analyzed (Segment 2) | Computing Tools, Consumer Electronics, Automotive Sector, Telecommunications, Industrial Sector |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA) |

| Countries Covered | US, UK, China, Japan, India, South Korea, France, Italy, Germany |

| Key Players influencing the Timing Devices Market | Seiko Epson Corporation, Nihon Dempa Kogyo Co., Ltd. (NDK), TXC Corporation, Kyocera Crystal Device Corporation, Daishinku Corp. (KDS), Microchip Technology Inc., Rakon Limited, Hosonic Electronic Co., Ltd., SiTime Corporation, Siward Crystal Technology Co., Ltd. |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, application demand shifts, consumer electronics growth, regional demand trends, competitor dollar sales & market share |

By type, the segment is categorized into Oscillators, Resonators, Semiconductor Clocks, Jitter Attenuator, and Clock Buffers.

By application, the segment is classified into Computing Tools, Consumer Electronics, Automotive Sector, Telecommunications, and Industrial Sector.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The industry is estimated to generate USD 6.86 billion in 2025.

The market is projected to reach USD 13.38 billion by 2035, growing at a CAGR of 6.9%.

Key manufacturers include Seiko Epson Corporation, IQD Frequency Products Ltd., Nihon Dempa Kogyo Co. Ltd., TXC Corporation, Microchip Technology, Inc., Texas Instruments, Infineon Technologies AG, Kyocera Corporation, Murata Manufacturing Co. Ltd., and Rakon Limited.

Asia-Pacific, particularly Japan and China, due to strong demand in consumer electronics, telecommunications, and automotive sectors.

Quartz-based timing devices dominate due to their high precision, reliability, and widespread use in consumer electronics and industrial applications.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Type, 2017 to 2032

Table 5: Global Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 7: North America Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 11: North America Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 17: Latin America Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 19: Europe Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Type, 2017 to 2032

Table 23: Europe Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 25: Asia Pacific Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Asia Pacific Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 28: Asia Pacific Market Volume (Units) Forecast by Type, 2017 to 2032

Table 29: Asia Pacific Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 31: Middle East and Africa Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 32: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: Middle East and Africa Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 34: Middle East and Africa Market Volume (Units) Forecast by Type, 2017 to 2032

Table 35: Middle East and Africa Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 36: Middle East and Africa Market Volume (Units) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y to Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 11: Global Market Y to Y Growth (%) Projections by Type, 2022 to 2032

Figure 12: Global Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 15: Global Market Y to Y Growth (%) Projections by Application, 2022 to 2032

Figure 16: Global Market Attractiveness by Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Application, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ million) by Type, 2022 to 2032

Figure 20: North America Market Value (US$ million) by Application, 2022 to 2032

Figure 21: North America Market Value (US$ million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y to Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 29: North America Market Y to Y Growth (%) Projections by Type, 2022 to 2032

Figure 30: North America Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 33: North America Market Y to Y Growth (%) Projections by Application, 2022 to 2032

Figure 34: North America Market Attractiveness by Type, 2022 to 2032

Figure 35: North America Market Attractiveness by Application, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ million) by Type, 2022 to 2032

Figure 38: Latin America Market Value (US$ million) by Application, 2022 to 2032

Figure 39: Latin America Market Value (US$ million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y to Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 47: Latin America Market Y to Y Growth (%) Projections by Type, 2022 to 2032

Figure 48: Latin America Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: Latin America Market Y to Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ million) by Type, 2022 to 2032

Figure 56: Europe Market Value (US$ million) by Application, 2022 to 2032

Figure 57: Europe Market Value (US$ million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y to Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 65: Europe Market Y to Y Growth (%) Projections by Type, 2022 to 2032

Figure 66: Europe Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 69: Europe Market Y to Y Growth (%) Projections by Application, 2022 to 2032

Figure 70: Europe Market Attractiveness by Type, 2022 to 2032

Figure 71: Europe Market Attractiveness by Application, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: Asia Pacific Market Value (US$ million) by Type, 2022 to 2032

Figure 74: Asia Pacific Market Value (US$ million) by Application, 2022 to 2032

Figure 75: Asia Pacific Market Value (US$ million) by Country, 2022 to 2032

Figure 76: Asia Pacific Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: Asia Pacific Market Y to Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: Asia Pacific Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 81: Asia Pacific Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 83: Asia Pacific Market Y to Y Growth (%) Projections by Type, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: Asia Pacific Market Y to Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: Asia Pacific Market Attractiveness by Type, 2022 to 2032

Figure 89: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 90: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 91: Middle East and Africa Market Value (US$ million) by Type, 2022 to 2032

Figure 92: Middle East and Africa Market Value (US$ million) by Application, 2022 to 2032

Figure 93: Middle East and Africa Market Value (US$ million) by Country, 2022 to 2032

Figure 94: Middle East and Africa Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 95: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: Middle East and Africa Market Y to Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: Middle East and Africa Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 99: Middle East and Africa Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 100: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 101: Middle East and Africa Market Y to Y Growth (%) Projections by Type, 2022 to 2032

Figure 102: Middle East and Africa Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 103: Middle East and Africa Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 104: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 105: Middle East and Africa Market Y to Y Growth (%) Projections by Application, 2022 to 2032

Figure 106: Middle East and Africa Market Attractiveness by Type, 2022 to 2032

Figure 107: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 108: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Timing Gear Market Size and Share Forecast Outlook 2025 to 2035

Automotive Timing Chain & Belt Market Growth - Trends & Forecast 2025 to 2035

Automotive Timing Belt Market

Automotive Timing Chain Market

Variable Valve Timing Market Size and Share Forecast Outlook 2025 to 2035

Frequency Control and Timing Device Market Size and Share Forecast Outlook 2025 to 2035

Assured PNT (Positioning, Navigation, and Timing) Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA