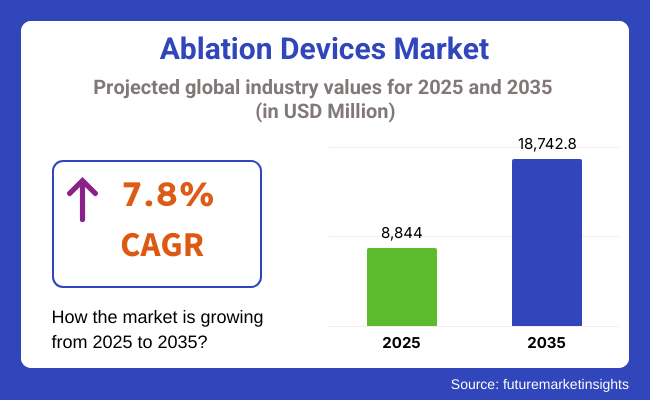

The global Ablation Devices Market was valued at USD 6,424.7million in 2020 and is projected to reach USD 8,844.0 million by 2025. From 2025 to 2035, the market is forecast to expand at a robust CAGR of 7.8%, ultimately surpassing USD 18,742.8 million by 2035. Market growth is being driven by rising chronic disease prevalence especially cardiovascular conditions, cancer, and pain disorders and the increasing shift toward minimally invasive interventions.

Ablation’s precision and efficacy in treating atrial fibrillation, tumor removal, and pain management are enhancing patient outcomes and reducing hospital stays. Innovation in technologies such as pulsed‑field ablation (PFA), microwave, cryoablation, and laser are expanding applications. Integration with robotics and real‑time imaging is further enhancing procedural accuracy.

As healthcare systems prioritize cost-effective, outpatient-based therapies, adoption is being reinforced. Additionally, investment in oncology and cardiac care infrastructure particularly in East Asia and Middle Eastern markets is expanding access.

Market leaders include Medtronic, Boston Scientific, Abbott, Johnson & Johnson, Stryker, and Pulse Biosciences. These companies are accelerating innovation via new catheter technologies, strategic acquisitions, and clinical partnerships. Johnson & Johnson MedTech, announced the USA Food & Drug Administration (FDA) approval of the VARIPULSE™ Platform for the treatment of drug refractory paroxysmal Atrial Fibrillation (AFib). The VARIPULSE™ Platform is designed to enable AFib treatment with a single device that combines PFA therapy and advanced cardiac mapping.

“With this approval, we are excited to bring the VARIPULSE™ Platform to electrophysiologists and patients in the USA, where AFib impacts nearly eight million people,” said Jasmina Brooks, President, Electrophysiology, Johnson & Johnson MedTech. Boston Scientific Corporation announced it has received USA FDA approval for the FARAPULSE™ Pulsed Field Ablation (PFA) System and is indicated for the isolation of pulmonary veins in the treatment of drug-refractory, recurrent, symptomatic atrial fibrillation (AF).

"The approval of the FARAPULSE PFA System marks an important milestone for the millions of people living with paroxysmal AF and is an incredible opportunity to bring the first PFA system designed and built solely for this type of ablation therapy to physicians in the USA," stated Nick Spadea-Anello, President, Electrophysiology, Boston Scientific Manufacturers are also enhancing their portfolios with robotic navigation, imaging integration, and lesion mapping technologies. Focus on targeted therapeutic options, physician education, and streamlined workflows is enhancing penetration across hospitals and ambulatory surgical centers.

North America leads the ablation devices market. The region’s advanced infrastructure, high incidence of atrial fibrillation and tumor cases, and widespread use of PFA technology have reinforced growth. Abundant clinical evidence and physician training in nsPFA, coupled with FDA breakthrough designations, have further accelerated adoption.

Europe is witnessing steady market expansion. The region’s adoption of nanosecond PFA technologies has been driven by successful post-market surveillance and registry data. Public health initiatives promoting early arrhythmia diagnosis and minimal hospital stays have increased demand in cardio centers and oncology departments.

The global ablation devices market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation. The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 8.8%, followed by a slightly lower growth rate of 8.4% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.8% (2024 to 2034) |

| H2 | 8.4% (2024 to 2034) |

| H1 | 7.8% (2025 to 2035) |

| H2 | 7.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.8% in the first half and remain relatively lower at 7.5% in the second half. In the first half (H1) the industry witnessed a decrease of 100 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

In 2025, radiofrequency (RF) ablation is expected to dominate the global ablation devices market, capturing 41.4% of total revenue. The segment’s leadership has been attributed to its proven clinical efficacy, minimally invasive nature, and broad applicability across multiple indications such as cardiac arrhythmias, chronic pain, and oncology.

RF ablation systems have been widely adopted due to their real-time thermal monitoring, controlled energy delivery, and cost-effectiveness compared to alternative modalities like laser or cryoablation. Consistent procedural outcomes, coupled with minimal post-operative complications and reduced hospital stays, have further reinforced its market penetration.

Continued advancements in electrode design, feedback control systems, and integration with image-guided platforms have enhanced procedural safety and precision. Moreover, RF ablation’s compatibility with both outpatient and ambulatory settings has been pivotal in reducing healthcare burden and enabling high-volume usage. The growing preference for minimally invasive therapies and expanded regulatory approvals are expected to sustain the segment’s dominance over the forecast period.

Cancer treatment applications to account for 25.0% of the global ablation devices market revenue in 2025, emerging as a leading segment. The surge in cancer incidence globally, particularly liver, lung, prostate, and renal cancers, has increased demand for localized, tissue-sparing interventions. Thermal ablation methods-particularly RF and microwave-have been adopted as adjunct or alternative therapies to surgery, especially in non-resectable tumors or patients unfit for invasive procedures.

The integration of ablation with real-time imaging modalities such as CT, MRI, and ultrasound has significantly improved tumor targeting and minimized healthy tissue damage. Reimbursement support and growing clinical endorsement for percutaneous ablation in early-stage oncology cases have further bolstered its adoption.

Additionally, advancements in probe design, temperature control, and computer-assisted planning tools have optimized treatment efficacy and repeatability. These factors, along with increasing investments in interventional oncology and rising patient preference for minimally invasive therapies, are expected to maintain this segment’s strong position in the years ahead.

Rising Incidence of Chronic Diseases, Including Cancer and Cardiovascular Conditions is driving the Ablation Devices Market Growth

The increasing prevalence of chronic diseases, including cancer, cardiovascular conditions, and chronic pain, is a significant driver of the ablation devices market. As global populations age and the burden of non-communicable diseases grows, the demand for advanced treatment solutions such as ablation technologies continues to rise. For instance, radiofrequency and microwave ablation have emerged as preferred treatment methods for solid tumors in the liver, kidney, and lungs due to their effectiveness in targeting specific tissues with minimal invasiveness.

In cardiology, catheter ablation is widely used to treat arrhythmias like atrial fibrillation, offering improved patient outcomes and fewer complications compared to traditional surgical methods. The rising awareness about early diagnosis and minimally invasive procedures further supports market growth, as patients increasingly opt for advanced treatments to improve their quality of life.

Continuous Advancements in Technology is driving Revenue Growth for Ablation Devices

The continuous technological advancements in the ablation devices market enhance the precision, safety, and efficiency of treatments. The treatment delivery landscape is being revolutionized by new technologies like robotic-assisted ablation systems, AI-driven procedural planning, and integration of real-time imaging. Robotic systems, for instance, allow for unprecedented precision, especially in complex cases involving cardiac or neurological ablations.

High-intensity focused ultrasound (HIFU) and Cryoablation are offering the world non-invasive treatments that help to take care of patients suffering from certain types of diseases, such as cancer and uterine fibroids. Those advances also significantly increase clinical results while adding a broader dimension of use in the application field for ablation devices. Artificial intelligence integration for diagnostic purposes, optimization of a procedure, lowers human error: highly accurate physician intervention, means personal treatment.

Shift Towards Minimally Invasive Treatments

Minimally invasive Procedures are transforming the landscape by providing effective treatment options with minimal disturbance to the other associated organs. These procedures use small incisions, advanced imaging techniques and specialized devices, catheters and probes to target the affected areas precisely. Unlike traditional open surgeries, which often involve large incisions, significant trauma and lengthy recovery times, minimally invasive techniques allow patients to heal faster, experience less pain and face fewer risks like infections and blood loss. Minimally invasive options have become attractive to patients and doctors alike, given the convenience and ease of procedures. Ablation therapies such as radiofrequency, microwave, laser, and ultrasound ablation have shown immense advancement across the spectrum.

They are perfect in eliminating lesions accurately while preserving healthy tissue with minimal invasion or no invasion at all. Examples of such conditions include cancers, arrhythmias, chronic pain, and many others, where sparing the adjacent normal tissue is most desirable. This appeals to healthcare providers beyond patient outcomes. The treatments reduce hospital stay, decrease the rate of complications, and therefore contribute to cost savings while enhancing overall patient satisfaction. In addition, they resonate with the greater trend toward outpatient and ambulatory care, allowing more patients to be treated in a hospital without losing the quality of care. Growing demand for ablation technologies emphasizes their role in modern, patient-centered healthcare.

High Costs and Accessibility Challenges Limiting Global Adoption of Ablation Technologies

Perhaps, what is among the crucial constraints is how expensive most ablation technologies appear to be when purchased, therefore failing to cut costs in some many low-and-middle-income economies worldwide. Also quite expensive for some will be installation expenses, where people have to arrange for relevant structural infrastructure or, more directly the human professional support to maintain this.

There are numerous cases of out-of-pocket high costs, mostly due to poor adequate insurance coverage and reimbursement policies, that patients undergo. This reduces the uptake of ablation treatment mainly for non-life-threatening conditions. Moreover, specialized training and expertise are also required to be successful in handling these devices and this adds yet another layer of cost and complexity.

It is a severe limiting factor in underserved rural areas, which have fewer advanced medical technologies in the first place. The wide-scale adoption of these ablation technologies globally requires resolution of the cost and accessibility issues.

The global ablation devices industry recorded a CAGR of 5.6% during the historical period between 2020 and 2024. The growth of ablation devices industry was positive as it reached a value of USD 8,184.4 million in 2024 from USD 6,424.7million in 2020.

The ablation devices market has undergone dramatic changes over the last few decades, evolving from a niche field to an indispensable aspect of medical care. It was earlier led by simple technologies, like classic radiofrequency and cryotherapy devices that were used solely for pain treatment and cardiac arrhythmias.

Demand for minimally invasive treatments gained momentum in the late 1990s and early 2000s because of technological progress and growing recognition of patient-centered healthcare solutions. But during this period, ablation devices were highly priced, lack of widespread know-how, and fewer access to new healthcare technologies, which restricted widespread adoption in several regions.

A significant growth in market size has been noticed over the last few years on account of ablation devices related to a steadily increasing incidence of chronic diseases, technological advancement, and the necessity for minimal invasiveness. Advanced energy modalities such as microwave and HIFU have greatly increased the scope of applications for ablation technologies.

Today, these devices range from oncology and cardiology to gynecology and pain management, so there are fewer conditions left untreatable. Real-time imaging, robotics, and AI have further perfected the accuracy and efficiency of ablation procedures, further propelling the use of the treatment by both healthcare providers and patients.

Looking ahead, the ablation devices market has many trends in store for sustained growth. By 2035, the market will experience significant development in AI-driven procedural planning, automated systems, and integration with telemedicine platforms. These advances will make procedures more accessible and efficient, enabling healthcare providers to perform complex procedures with greater accuracy and fewer complications.

With rising adoption of outpatient care and preferences for minimally invasive treatments, demand for ablation technologies is also bound to continue. This trend is supplemented by the emerging focus on personalized medicine and targeted therapies, thus propelling specialized ablation devices designed for particular patient needs.

Tier 1 companies are the industry leaders with 60.0% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries. The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Medtronic plc, Abbott Laboratories, Boston Scientific Corporation

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 30.0% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Ethicon Inc., Boston Scientific Corporation, AngioDynamics Inc., Olympus corporation., Japan Lifeline Co.

Compared to Tiers 1 and 2, Tier 3 companies offer outsourced testing services, but with smaller revenue and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

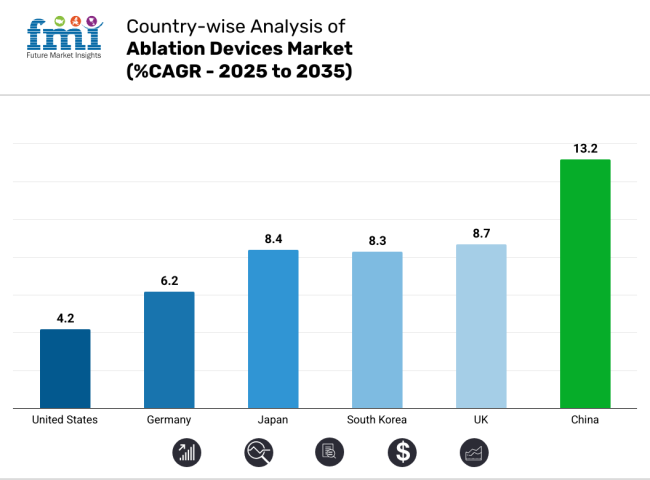

The market analysis for ablation devices in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 84.5%. By 2035, China is expected to experience a CAGR of 13.2% in the Asia-Pacific region.

Germany's ablation devices market is fueled by its robust health infrastructure, the high prevalence of chronic diseases, and the great emphasis on innovation in the field of medicine. Being one of the prime health care destinations in Europe, Germany houses advanced medical facilities and a well-trained workforce, thereby making it the ideal destination to adopt state-of-the-art ablation technologies. Some key drivers of ablation devices relate to the increasingly prevalent incidence of cardiovascular diseases, especially arrhythmia, where catheter ablation is the emerging treatment choice, and Germany is an aging society with a population at a high risk of cancers and other chronic diseases.

Another driving factor behind this is the strong tradition of medical research and innovation in Germany. The country's leading universities and research institutions are actively engaged with medical device manufacturers to advance ablation technologies, including robotic-assisted systems and real-time imaging-integrated devices. The government supports research with funding programs and tax incentives. Moreover, the adherence of Germany to strict regulatory standards and quality assurance processes increases the credibility and reliability of its healthcare solutions, thus attracting patients both domestically and from abroad.

The United States ablation devices market is mainly driven by its advanced healthcare system, high prevalence of chronic diseases, and significant investment in medical technology innovation.

The strongest driver behind the USA market involves the major efforts toward R&D. The USA hosts major ablation medical equipment manufacturers and significant research centers for the constant generation of novel products in ablation technology. Included among the improved ablation solutions are robotic assistance, AI-derived imaging guidance and personalized treatments designed to make both the procedures easier and outcomes from them much improved. In addition, the streamlined regulatory framework and expedited approval processes in the country, including those by the FDA, ensure that innovative devices are brought to the market at a fast pace.

The ablation devices market in India is growing rapidly due to the growth in its healthcare infrastructure, lifestyle-related diseases, and awareness regarding minimally invasive treatments. There is a considerable burden of non-communicable diseases, which includes cancer and cardiovascular conditions. This has fueled the demand for effective treatment options such as ablation technologies. The growing middle class, with higher disposable incomes and access to private healthcare, is also driven, as more patients now seek advanced treatments that improve the quality of life.

Healthcare infrastructure investment by the government has become one of the significant drivers in the Indian market. Such schemes like Ayushman Bharat, reducing costs for millions of patients, have advanced the reach of high-end medical technologies, including ablation devices, to more people. Private healthcare providers are also expanding their networks across the country, preparing well-equipped facilities with high-end ablation technologies to cater to the growth.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Geographical expansion into the emerging markets, particularly United States and Asia Pacific countries, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Ablation Devices Industry Outlook

In terms of product type, the industry is divided into advanced ablation catheters, MRI guided neurosurgical ablation, standard ablation catheters, bipolar energy ablation devices, cryotherapy ablation devices, hydrothermal ablation (HTA) devices, microwave endometrial ablation devices, thermal balloon ablation devices

In terms of technology, the industry is segregated into Radiofrequency (RF) Ablation, Microwave Ablation, Laser Ablation, Ultrasound Ablation, Cryoablation Devices, Hydrothermal/Hydromechanical Ablators, Accessories among others.

In terms of application, the industry is segregated into Cardiovascular Disease Treatment, Cancer Treatment, Ophthalmological Treatment, Pain Management, Urological Treatment, Orthopedic Treatment, Cosmetic/ Aesthetic Surgery, Gynecological Treatment and Others Applications.

In terms of functional, the industry is segregated into robotic and conventional.

In terms of end user, the industry is divided into hospitals, ambulatory surgical centres and clinics.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global ablation devices industry is projected to witness CAGR of 7.8% between 2025 and 2035.

The global ablation devices industry stood at USD 6,424.7million in 2020.

The global ablation devices industry is anticipated to reach USD 18,742.8 million by 2035 end.

China is expected to show a CAGR of 13.2% in the assessment period.

The key players operating in the global ablation devices industry are Medtronic plc, Abbott Laboratories, Johnson and Johnson, Boston Scientific Corporation, AngioDynamics Inc., Biotronik SE & Co. KG., Japan Lifeline Co., CathRx Ltd., AtriCure, Inc., Hologic, Inc. among Others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 6: Global Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 12: North America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 34: South Asia Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 36: South Asia Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2017 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Functional, 2017 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Functional, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Technology, 2023 to 2033

Figure 27: Global Market Attractiveness by Application , 2023 to 2033

Figure 28: Global Market Attractiveness by Functional, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Functional, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 55: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Technology, 2023 to 2033

Figure 57: North America Market Attractiveness by Application , 2023 to 2033

Figure 58: North America Market Attractiveness by Functional, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Functional, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Functional, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Functional, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 115: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 116: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 117: Europe Market Attractiveness by Application , 2023 to 2033

Figure 118: Europe Market Attractiveness by Functional, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Functional, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: East Asia Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 134: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 135: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 136: East Asia Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 137: East Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 138: East Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 139: East Asia Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 143: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 144: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 145: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Application , 2023 to 2033

Figure 148: East Asia Market Attractiveness by Functional, 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Functional, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 162: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 163: South Asia Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 164: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 165: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 166: South Asia Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 167: South Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 168: South Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 169: South Asia Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 173: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 174: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 175: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Application , 2023 to 2033

Figure 178: South Asia Market Attractiveness by Functional, 2023 to 2033

Figure 179: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Application , 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Functional, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Application , 2023 to 2033

Figure 208: Oceania Market Attractiveness by Functional, 2023 to 2033

Figure 209: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application , 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Functional, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2017 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Functional, 2017 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Functional, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Functional, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application , 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Functional, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tumour Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Thyroid Ablation Devices Manufacturers

Microwave Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Ablation Technology Market Size, Share, and Forecast Outlook 2025 to 2035

FBAR Devices Market

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Magnetic Ablation Catheter Market Outlook – Share, Growth & Forecast 2025-2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA