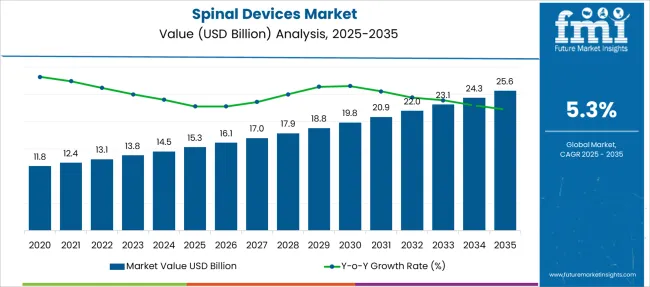

The Spinal Devices Market is estimated to be valued at USD 15.3 billion in 2025 and is projected to reach USD 25.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Spinal Devices Market Estimated Value in (2025 E) | USD 15.3 billion |

| Spinal Devices Market Forecast Value in (2035 F) | USD 25.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The spinal devices market is experiencing robust growth owing to the increasing prevalence of spinal disorders, aging population, and advancements in minimally invasive surgical techniques. Rising incidences of degenerative disc disease, trauma-related injuries, and spinal deformities have elevated the demand for both implantable devices and biologics that support spinal fusion and stability.

Technological innovations in spinal implants, improved biomaterials, and real-time surgical navigation systems are enhancing procedural outcomes and recovery rates. The market is further supported by expanded insurance coverage, growing access to specialized spine care, and strategic investments by healthcare providers in advanced surgical infrastructure.

As demand intensifies for cost-effective and clinically efficient spinal interventions, the outlook remains strong for devices that offer long-term biomechanical support and improved patient mobility.

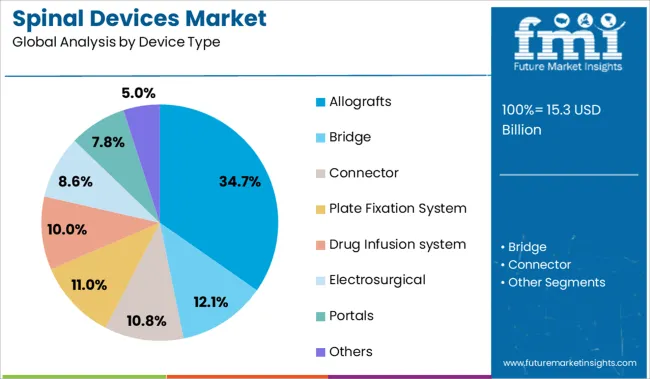

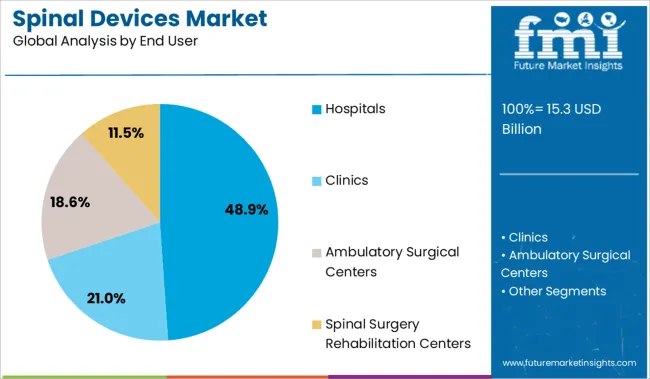

The market is segmented by Device Type and End User and region. By Device Type, the market is divided into Allografts, Bridge, Connector, Plate Fixation System, Drug Infusion system, Electrosurgical, Portals, and Others. In terms of End User, the market is classified into Hospitals, Clinics, Ambulatory Surgical Centers, and Spinal Surgery Rehabilitation Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The allografts segment is projected to account for 34.70% of total market revenue by 2025 within the device type category, making it the leading segment. This dominance is supported by increasing adoption of biological grafts that enhance spinal fusion without the need for harvesting patient tissue.

Allografts offer advantages such as reduced surgical time, lower donor site morbidity, and improved structural support for bone healing. Their compatibility with minimally invasive procedures and widespread acceptance in cervical and lumbar spine surgeries have further driven their utilization.

As spine specialists and hospitals seek biologically active solutions that optimize graft incorporation and fusion rates, the demand for allografts continues to grow steadily, securing their position as the preferred choice in spinal repair and reconstruction.

The hospitals segment is anticipated to hold 48.90% of overall revenue by 2025 under the end user category, positioning it as the dominant channel for spinal device utilization. This trend is driven by the availability of advanced surgical equipment, skilled orthopedic surgeons, and comprehensive post-operative care within hospital settings.

Higher patient inflow for complex spine surgeries and the integration of robotics and navigation-assisted systems have made hospitals the central hub for spinal procedures. Moreover, hospital-based procurement benefits from structured reimbursement pathways and bulk purchasing agreements, which further incentivize the use of cutting-edge spinal technologies.

With a consistent focus on clinical excellence and patient safety, hospitals remain the primary destination for spinal interventions, reinforcing their leadership in this market.

Currently, North America is the largest market for spinal devices. The availability of several market players, coupled with a surging geriatric population in the region, is expected to surge the market share. Apart from that, the availability of the latest technology in the healthcare sector in the region is expected to boost market growth further.

Asia Pacific is expected to be the fastest-growing market during the forecast period. The government's increasing investment in developing state-of-the-art healthcare infrastructure drives the market growth. Apart from that, an increase in disposable income, which has led to making this product affordable, is expected to surge the market growth further.

Based on the end-use, the hospital segment is expected to hold the highest market share during the forecast period. The ability to purchase these devices in bulk, coupled with the availability of supportive infrastructure makes the hospital segment the largest segment.

The global market for spinal device is expected to be driven by the advancement in technology and increase in number of spinal surgery, aging among population, etc. According to the National Spinal Cord Injury Association Resource Center, around 250,000 - 400,000 individuals were living with Spinal Cord Injury or Spinal Dysfunction, out of which 82% were males and remaining 18% were females.

The causes of spinal cord injury were motor vehicle accidents (44%), act of violence (24%), sudden falls (22%), sports (8%) and others (2%). Moreover, increased use of spinal devices in elderly patients and arthritis patients are some factors anticipated to fuel growth of the global spinal device market within the forecast period of 2020 to 2029.

However, therapeutics and ongoing drug researches to overcome the pain of surgery could pose a threat for the growth of the global spinal device market during the forecast period.

Increase in the production number of spinal implants, spinal surgery and ongoing researches on improving quality of care for continence is expected to create an attractive growth opportunity for the global spinal device market through 2029.

According to the National Spinal Cord Injury Association Resource Center, 32 spinal injuries per Million population or 7800 injuries occur in the USA each year. The hospitals end user segment is expected to hold the highest market share in global market for spinal devices during 2020 to 2029.

Region wise, the global spinal device market is classified into regions namely, North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan, Japan, Middle East & Africa. North America dominated the global market for spinal devices due to the availability of reimbursement policies as well as healthcare infrastructure.

Increasing number of spinal injury incidences through accidents, ageing and improved lifestyle among population are few trends which are expected to fuel the growth of the spinal device market in APEJ region through 2029.

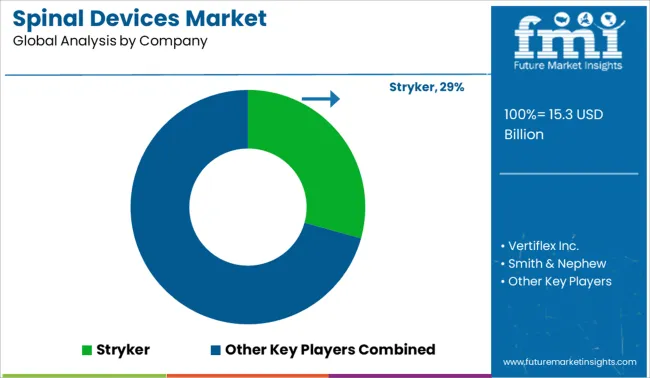

Some of the key players in the global spinal device market include Stryker, Vertiflex Inc., Smith & Nephew, Siemens Healthcare GmbH, RTI Surgical, Orthofix Holdings, Inc., Medtronic, Zimmer Inc., CONMED, Aspen Medical Products and others.

Most of the providers of spinal devices are adopting the strategy of providing these products through e-commerce and hospital pharmacies so that buyers can browse the products according to their needs. In October 2020, Stryker announced the launch of hand-held LITe BIO Delivery System to deliver bone graft material to spinal surgery sites. The system can be used for any type of spine fusion surgery.

The global spinal devices market is estimated to be valued at USD 15.3 billion in 2025.

The market size for the spinal devices market is projected to reach USD 25.6 billion by 2035.

The spinal devices market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in spinal devices market are allografts, bridge, connector, plate fixation system, drug infusion system, electrosurgical, portals and others.

In terms of end user, hospitals segment to command 48.9% share in the spinal devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spinal Implants and Devices Market Size and Share Forecast Outlook 2025 to 2035

Spinal Motion-Preservation Devices Market

Non-Fusion Spinal Devices Market Growth - Trends & Forecast 2025 to 2035

Spinal Access Systems Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Injectable Market Size and Share Forecast Outlook 2025 to 2035

Spinal Cord Stimulators Market Growth - Trends & Forecast 2025 to 2035

Spinal Osteosynthesis Units Market Trends – Industry Forecast 2025 to 2035

Spinal Stenosis Market – Growth & Demand 2025 to 2035

The Spinal Fusion Market is segmented by Product, Procedure and End User from 2025 to 2035

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Spinal Thoracolumbar Implants Market

China Spinal Fusion Market Analysis - Trends, Demand & Forecast 2025 to 2035

Dynamic Spinal Tethering Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Spinal Surgery Market

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA