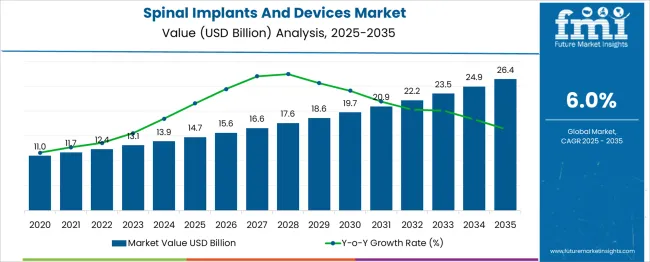

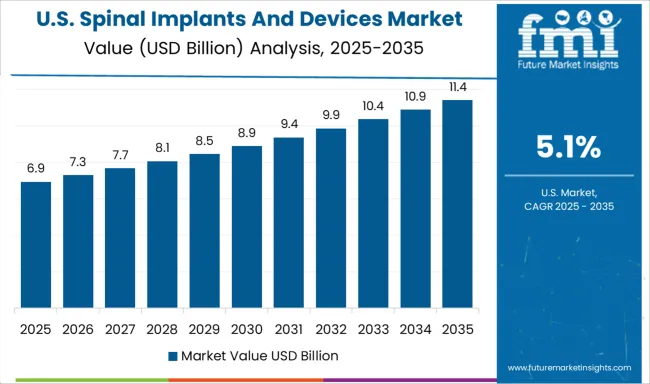

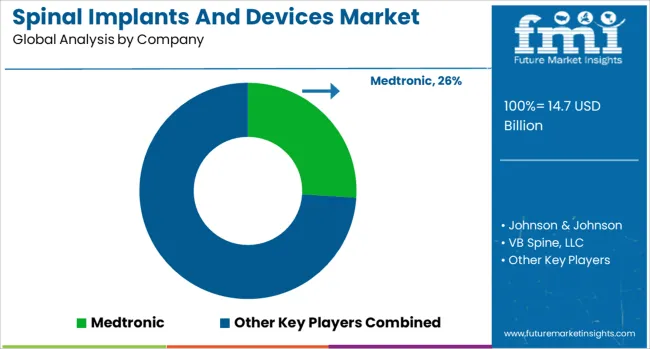

The global spinal implants and devices market is anticipated to grow from USD 14.7 billion in 2025 to approximately USD 26.4 billion by 2035, recording an absolute increase of USD 11.7 billion over the forecast period. This translates into a total growth of 79.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.79X during the same period, supported by increasing prevalence of spinal disorders, aging population demographics, technological advancements in minimally invasive procedures, and growing adoption of motion preservation technologies.

Between 2025 and 2030, the spinal implants and devices market is projected to expand from USD 14.7 billion to USD 20.9 billion, resulting in a value increase of USD 6.2 billion, which represents 53.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for minimally invasive surgical procedures, increasing adoption of robotic-assisted spine surgeries, and growing prevalence of degenerative spinal conditions. Medical device manufacturers are expanding their product portfolios to address the growing demand for advanced spinal solutions that offer better patient outcomes and reduced recovery times.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 14.7 billion |

| Forecast Value in (2035F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

From 2030 to 2035, the market is forecast to grow from USD 20.9 billion to USD 26.4 billion, adding another USD 5.5 billion, which constitutes 47.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of outpatient surgical centers, integration of artificial intelligence in surgical planning, and development of personalized spinal implant solutions. The growing adoption of biologics and bone growth stimulators will drive demand for advanced spinal fusion technologies with enhanced healing capabilities and improved patient outcomes.

Between 2020 and 2025, the spinal implants and devices market experienced steady expansion, driven by increasing awareness of spinal health and growing demand for surgical interventions to address chronic back pain. The market developed as healthcare providers recognized the need for advanced spinal solutions to combat the rising incidence of spinal disorders caused by sedentary lifestyles, aging populations, and occupational hazards. Technological innovations and surgeon training programs began focusing on the importance of precision-based spinal procedures for optimal patient recovery.

Market expansion is being supported by the increasing prevalence of spinal disorders and degenerative conditions affecting millions of patients worldwide. Modern healthcare systems are increasingly focused on surgical interventions that can provide long-term relief from chronic spinal conditions, restore mobility, and improve quality of life. The proven efficacy of spinal fusion devices, motion preservation technologies, and biologics in treating complex spinal pathologies makes them preferred solutions in orthopedic and neurosurgical procedures.

The growing focuses on minimally invasive surgical techniques is driving demand for advanced spinal devices that enable smaller incisions, reduced tissue damage, and faster recovery times. Healthcare provider preference for multifunctional devices that combine structural support with biological enhancement is creating opportunities for innovative product development. The rising influence of evidence-based medicine and clinical outcome studies is also contributing to increased adoption of proven spinal technologies across different surgical specialties and patient demographics.

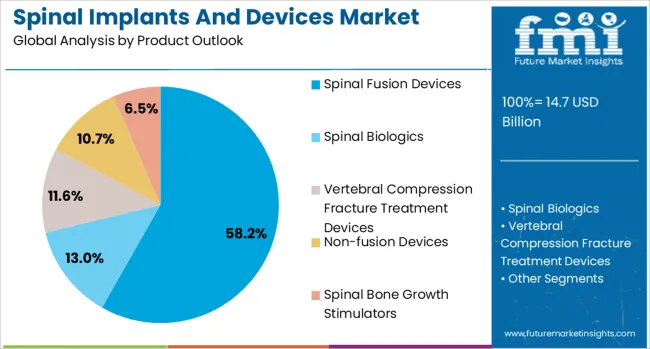

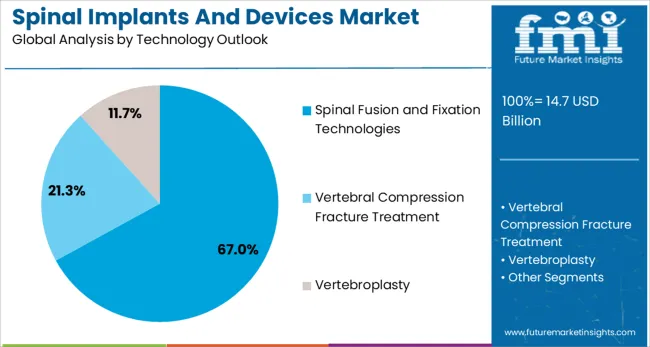

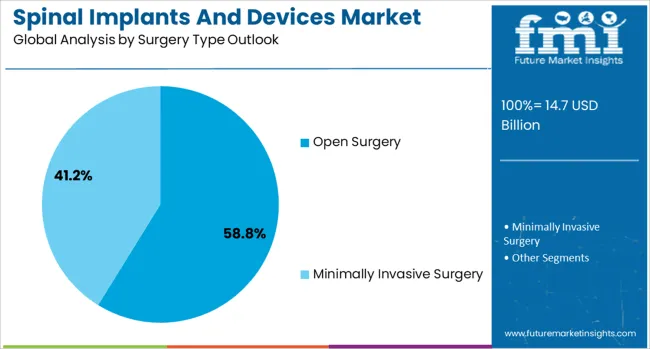

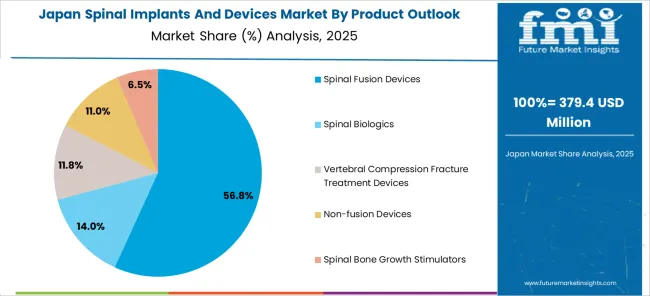

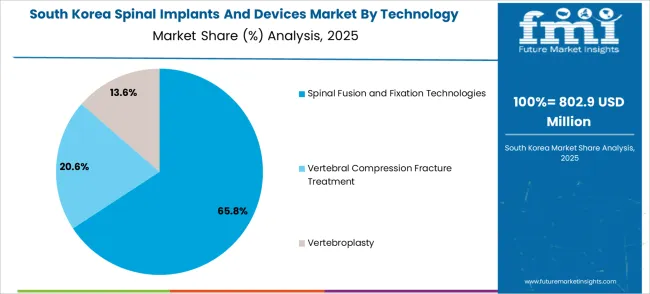

The market is segmented by product, technology, surgery type, procedure type, and region. By product, the market is divided into spinal fusion devices, spinal biologics, vertebral compression fracture treatment devices, non-fusion devices, and spinal bone growth stimulators. Based on technology, the market is categorized into spinal fusion and fixation technologies, vertebral compression fracture treatment, vertebroplasty, kyphoplasty/vertebral augmentation, and motion preservation technologies. In terms of surgery type, the market is segmented into open surgery and minimally invasive surgery. By procedure type, the market is classified into laminotomy, discectomy, foraminotomy, corpectomy, and facetectomy. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The spinal fusion devices segment is projected to account for 58.2% of the spinal implants and devices market in 2025, reaffirming its position as the category's dominant product type. Surgeons increasingly rely on fusion technologies to address complex spinal pathologies, including degenerative disc disease, spinal instability, and traumatic injuries. Spinal fusion devices provide structural support while facilitating bone growth and permanent stabilization of affected vertebral segments.

This segment forms the foundation of most spinal surgical procedures, as it represents the most established and clinically validated approach to treating severe spinal conditions. Orthopedic and neurosurgeon preferences continue to strengthen demand for fusion solutions with proven long-term outcomes. With patient populations experiencing higher rates of spinal degeneration due to aging and lifestyle factors, spinal fusion devices align with both corrective and preventative treatment goals. Their broad clinical applications across multiple spinal regions ensure market dominance, making them the central growth driver of spinal device demand.

Spinal fusion and fixation technologies are projected to represent 67% of spinal implants and devices demand in 2025, underscoring their role as the preferred technological approach for comprehensive spinal stabilization. Surgeons gravitate toward these technologies for their ability to provide immediate mechanical stability while promoting long-term biological fusion. Positioned as the gold standard for treating spinal instability, these technologies offer both corrective benefits, such as deformity correction, and preventative benefits, including adjacent segment protection.

The segment is supported by the continuous advancement of fixation hardware, including pedicle screw systems, interbody cages, and rod constructs that offer improved biomechanical properties. The manufacturers are increasingly combining traditional fixation with biological enhancement products like bone morphogenetic proteins and synthetic grafts, enhancing fusion rates and justifying premium pricing. As spine surgeons prioritize long-term stability and fusion success, spinal fusion and fixation technologies will continue to dominate market demand, reinforcing their essential role within the spinal surgery ecosystem.

The open surgery approach is forecasted to contribute 58.8% of the spinal implants and devices market in 2025, reflecting the continued preference for traditional surgical access in complex spinal procedures. Surgeons rely on open approaches for comprehensive visualization, precise device placement, and management of challenging anatomical variations. This methodology aligns with established surgical training protocols and provides the tactile feedback necessary for optimal implant positioning and biological preparation.

Open surgery techniques provide superior access for multi-level procedures and complex deformity corrections that require extensive bone work and soft tissue management. The segment also benefits from surgeon familiarity and institutional protocols that prioritize proven approaches with established safety profiles. With many spinal conditions requiring extensive surgical intervention and reconstruction, open surgery serves as the primary access method, making it a critical driver of device utilization and procedural success in the spinal surgery market.

The spinal implants and devices market is advancing rapidly due to increasing prevalence of spinal disorders and growing demand for surgical solutions to chronic back pain conditions. The market faces challenges including high device costs, reimbursement limitations, and potential complications associated with spinal procedures. Innovation in minimally invasive technologies and biological enhancement products continue to influence product development and market expansion patterns.

The growing adoption of minimally invasive approaches is enabling surgeons to achieve comparable outcomes while reducing patient morbidity and healthcare costs. These techniques offer reduced blood loss, shorter hospital stays, and faster recovery times that improve patient satisfaction. Advanced imaging technologies and navigation systems are driving procedural accuracy and expanding the range of conditions treatable through minimally invasive methods.

Modern spinal surgery is incorporating robotic assistance and computer-guided navigation to enhance surgical precision and improve implant placement accuracy. These technologies improve surgical outcomes while reducing radiation exposure and operative time. Advanced planning software and real-time guidance systems also enable personalized surgical approaches that optimize device selection and positioning for individual patient anatomy.

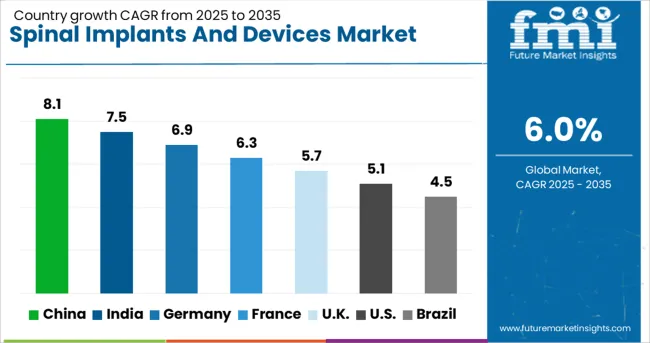

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The spinal implants and devices market is experiencing robust growth globally, with China leading at 8.1% CAGR through 2035, driven by rapid healthcare modernization, aging population demographics, and increasing adoption of advanced spinal surgical technologies. India follows closely at 7.5%, supported by expanding medical infrastructure, growing medical tourism sector, and rising awareness of spinal treatment options. Germany shows steady growth at 6.9%, focusing on precision engineering and clinical research validation. France records 6.3%, focusing on advanced surgical techniques and comprehensive healthcare coverage. The UK demonstrates 5.7% growth, prioritizing cost-effective treatment protocols and evidence-based device selection. The USA shows 5.1% growth, maintaining market leadership through innovation and premium device adoption. Brazil exhibits 4.5% growth, supported by expanding healthcare access and increasing procedural volumes. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from spinal implants and devices in China is projected to exhibit strong growth with a CAGR of 8.1% through 2035, driven by rapid healthcare infrastructure development and increasing demand for advanced spinal surgical solutions among the aging population. The country's expanding middle class and growing healthcare expenditure are creating significant demand for premium spinal devices and minimally invasive surgical technologies. Major international and domestic medical device manufacturers are establishing comprehensive distribution networks to serve the growing population of patients requiring spinal interventions across tier-1 and tier-2 cities.

Revenue from spinal implants and devices in India is expanding at a CAGR of 7.5%, supported by increasing healthcare investment, growing medical tourism sector, and rising awareness of advanced spinal treatment options. The country's large patient population and emerging healthcare infrastructure are driving demand for cost-effective spinal solutions that deliver clinical efficacy. International medical device companies and domestic manufacturers are establishing strategic partnerships to serve the significant unmet medical need for spinal interventions.

Revenue from spinal implants and devices in Germany is projected to grow at a CAGR of 6.9% through 2035, supported by the country's advanced healthcare system, strong medical device manufacturing capabilities, and focuses on clinical evidence generation. German healthcare providers prioritize precision-engineered spinal solutions with proven long-term outcomes and comprehensive clinical validation. The market benefits from extensive research collaborations between medical device manufacturers and leading orthopedic centers.

Revenue from spinal implants and devices in France is projected to grow at a CAGR of 6.3% through 2035, driven by the country's comprehensive healthcare coverage, advanced surgical training programs, and strong focuses on patient outcome optimization. French healthcare providers consistently demand high-quality spinal devices that deliver superior clinical results while maintaining cost-effectiveness within the national healthcare system.

Revenue from spinal implants and devices in the UK is projected to grow at a CAGR of 5.7% through 2035, supported by the National Health Service framework and strong focuses on cost-effective treatment protocols. British healthcare providers value clinical evidence, proven outcomes, and economic efficiency, positioning advanced spinal devices as essential components of comprehensive spine care programs.

Revenue from spinal implants and devices in the USA is projected to grow at a CAGR of 5.1%, supported by advanced healthcare infrastructure, extensive clinical research capabilities, and strong reimbursement coverage for medically necessary spinal procedures. American healthcare providers prioritize innovative technologies, premium device features, and evidence-based surgical approaches that deliver optimal patient outcomes and long-term satisfaction.

Revenue from spinal implants and devices in Brazil is projected to grow at a CAGR of 4.5% through 2035, supported by expanding healthcare infrastructure, increasing medical device availability, and growing awareness of advanced spinal treatment options. Brazilian healthcare providers are increasingly adopting international surgical standards and advanced device technologies to address the significant burden of spinal disorders within the population.

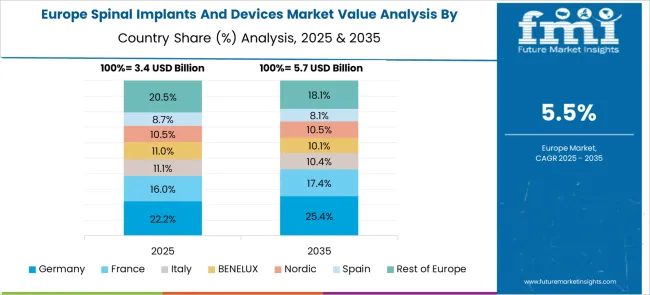

The European spinal implants and devices market demonstrates sophisticated development across major economies with Germany leading through its precision medical device engineering excellence and advanced clinical research capabilities, supported by companies focusing on high-quality spinal fusion systems, comprehensive surgical solutions, and evidence-based treatment protocols while maintaining strict regulatory standards and clinical validation requirements. The UK shows strength in evidence-based healthcare approaches and cost-effective treatment protocols, with organizations specializing in innovative spinal technologies and minimally invasive surgical systems that meet rigorous clinical standards.

France contributes through its advanced surgical innovation and comprehensive healthcare coverage programs, delivering sophisticated spinal implant solutions that combine traditional orthopedic expertise with modern surgical techniques for enhanced patient outcomes. Sweden and Nordic countries focuses on patient-centered healthcare approaches and innovative medical technologies. Italy and Spain demonstrate growth in specialized spine surgery applications and healthcare infrastructure modernization. The market benefits from stringent EU medical device regulations, established clinical research infrastructure, and growing demand for advanced spinal solutions that provide superior patient outcomes and long-term clinical success.

The Japanese spinal implants and devices market demonstrates steady growth driven by precision manufacturing focus, advanced medical technology development, and healthcare system preference for high-quality surgical solutions that ensure superior reliability and clinical efficacy throughout spine surgery applications. Japanese organizations prioritize sophisticated implant design and comprehensive quality assurance systems, creating demand for spinal devices featuring advanced biomaterials, precision manufacturing, and integrated surgical instrumentation that align with Japanese medical device excellence standards.

The market focuses on technological innovation in implant design, surgical precision, and patient outcome optimization that reflects Japanese attention to detail in medical device development and surgical care delivery. Growing investment in aging population healthcare solutions and surgical innovation supports adoption of next-generation spinal implants with enhanced fusion capabilities, minimally invasive approaches, and comprehensive patient monitoring for optimal surgical outcomes. Japanese healthcare providers focus on device reliability, consistent clinical performance, and long-term patient benefit through advanced spinal technology implementation.

The South Korean spinal implants and devices market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of advanced surgical technologies, and growing demand for sophisticated spine surgery solutions requiring comprehensive clinical efficacy and patient outcome optimization capabilities. The market benefits from South Korea's technological leadership in medical device manufacturing and increasing focus on healthcare modernization that drives investment in advanced spinal implant platforms meeting international clinical standards.

Korean healthcare organizations increasingly adopt advanced spinal fusion devices, minimally invasive surgical systems, and integrated navigation technologies to improve surgical outcomes and patient recovery while ensuring cost-effectiveness requirements. Growing influence of Korean medical technology companies and orthopedic innovation initiatives supports demand for sophisticated spinal implant solutions that ensure comprehensive functionality while maintaining clinical accessibility. The integration of robotic-assisted surgery and AI-powered surgical planning creates opportunities for next-generation spine surgery systems with enhanced precision and personalized treatment capabilities.

The spinal implants and devices market is characterized by intense competition among established medical device manufacturers, specialized spine companies, and emerging technology developers. Companies are investing in advanced product development, clinical research programs, surgeon education initiatives, and strategic acquisitions to deliver innovative, effective, and commercially viable spinal solutions. Product differentiation, clinical evidence generation, and market access strategies are central to strengthening competitive positions and market share growth.

Medtronic, USA-based, leads the market with 26.0% global value share, offering comprehensive spinal device portfolios with focus on fusion technologies, biologics, and minimally invasive solutions. Johnson & Johnson provides established product lines across multiple spinal segments with focuses on clinical evidence and surgeon education. NuVasive specializes in minimally invasive technologies and lateral access procedures with innovative surgical approaches.

Zimmer Biomet delivers comprehensive spine solutions with focus on motion preservation and fusion technologies across global markets. Globus Medical provides innovative spinal implants with focuses on expandable technologies and robotic-assisted surgery platforms. VB Spine LLC focuses on specialized fusion devices with unique design features for enhanced surgical outcomes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 14.7 billion |

| Product | Spinal fusion devices, Spinal biologics, Vertebral compression fracture treatment devices, Non-fusion devices, Spinal bone growth stimulators |

| Technology | Spinal fusion and fixation technologies, Vertebral compression fracture treatment, Vertebroplasty, Kyphoplasty/vertebral augmentation, Motion preservation technologies |

| Surgery Type | Open surgery, Minimally invasive surgery |

| Procedure Type | Laminotomy, Discectomy, Foraminotomy, Corpectomy, Facetectomy |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Medtronic, Johnson & Johnson, VB Spine LLC, NuVasive, Zimmer Biomet, Globus Medical, Alphatec Spine, Orthofix Holdings, RTI Surgical Holdings, Ulrich GmbH |

| Additional Attributes | Dollar sales by device type and surgical approach, regional demand trends, competitive landscape, surgeon preferences for fusion versus motion preservation technologies, integration with robotics and navigation systems, innovations in biologics and bone growth enhancement |

The global spinal implants and devices market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the spinal implants and devices market is projected to reach USD 26.4 billion by 2035.

The spinal implants and devices market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in spinal implants and devices market are spinal fusion devices, thoracic & lumbar fusion devices, cervical fusion devices, spinal biologics, allografts, xenografts, dbm, bmp, synthetic bone grafts, vertebral compression fracture treatment devices, non-fusion devices and spinal bone growth stimulators.

In terms of technology outlook, spinal fusion and fixation technologies segment to command 67.0% share in the spinal implants and devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spinal Access Systems Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Injectable Market Size and Share Forecast Outlook 2025 to 2035

Spinal Cord Stimulators Market Growth - Trends & Forecast 2025 to 2035

Spinal Osteosynthesis Units Market Trends – Industry Forecast 2025 to 2035

Spinal Stenosis Market – Growth & Demand 2025 to 2035

The Spinal Fusion Market is segmented by Product, Procedure and End User from 2025 to 2035

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Spinal Motion-Preservation Devices Market

Spinal Thoracolumbar Implants Market

China Spinal Fusion Market Analysis - Trends, Demand & Forecast 2025 to 2035

Dynamic Spinal Tethering Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Spinal Surgery Market

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Non-Fusion Spinal Devices Market Growth - Trends & Forecast 2025 to 2035

Bio-Implants Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Smart Implants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA