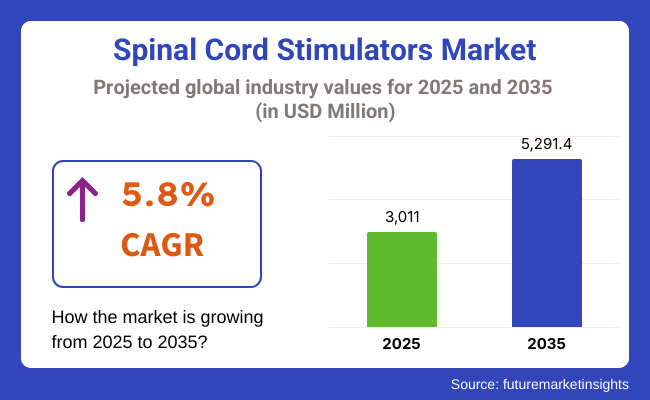

The global Spinal Cord Stimulator Market is estimated to be valued at USD 3,011.0 million in 2025 and is projected to reach USD 5,291.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. The growth of the market is driven by the increasing prevalence of chronic neuropathic pain and failed back surgery syndrome (FBSS).

Healthcare providers are increasingly favoring SCS over long-term opioid therapy, due to its minimally invasive nature and durable analgesic effect. Technological advancement such as rechargeable battery systems and segmented leads enabling precise paresthesia targeting and enhancing therapy customization and patient compliance.

Furthermore, reimbursement coverage for SCS procedures has been expanded in key markets, facilitating wider clinical adoption. Hospital and Ambulatory surgical centers are investments in neuromodulation infrastructure are also contributing to market momentum. As clinical data supporting long‑term efficacy and cost-effectiveness continue to accumulate, SCS is poised to become a mainstream option for complex chronic pain management.

Major manufacturers steering the spinal cord stimulator market include Abbott (St. Jude), Boston Scientific, Medtronic, and Nevro. These firms are actively advancing neuromodulation platforms, optimizing battery longevity, and enhancing patient-centric designs. In 2024, Medtronic plc. Received FDA approval for the Inceptiv™ closed-loop rechargeable spinal cord stimulator (SCS) for the treatment of chronic pain.

This device offer a closed-loop feature that senses biological signals along the spinal cord and automatically adjusts stimulation in real time. "A new era for spinal cord stimulation technology is beginning, and with Inceptiv SCS, Medtronic is at the forefront," said David Carr, Vice President and General Manager, Pain Interventions, Medtronic.

On the other hand, Boston Scientific Corporation also announced the USA FDA approval of WaveWriter™ SCS Systems with an expanded indication for the treatment of chronic low back and leg pain in people without prior back surgery. “Early and effective intervention with SCS therapy is associated with long-term success and improved outcomes for people living with chronic back pain,″ said Jim Cassidy, President, Neuromodulation, Boston Scientific Corporation. Manufacturers are also forming strategic partnerships with pain management centers to train clinicians and secure procedural volume. These initiatives, combined with reimbursement support and expanding indications, are reinforcing the market’s growth trajectory.

North America is leading the SCS market in 2025, supported by a mature neuromodulation infrastructure and high procedural volumes. Leading institutions have standardized SCS as primary treatment for FBSS and complex regional pain syndrome. The USA Centers for Medicare & Medicaid Services has expanded reimbursement for novel SCS indications, facilitating broader access.

Additionally, SCS utilization in outpatient ambulatory surgery centers (ASCs) is increasing, leveraging value-based care models. Competitive differentiation via device longevity and ecosystem services is sustaining growth in the region. Europe continues to demonstrate steady SCS market expansion, facilitated by early adoption in Germany, the UK., and France. National guidelines now recommend neuromodulation ahead of opioid escalation, driving procedure referrals. Public-private partnerships are enabling registry-led post-market evidence collection, reinforcing therapy confidence among payers.

Rechargeable devices are expected to hold a dominant 69.4% share in the spinal cord stimulator market in 2025, underscoring a clear preference for long-term cost-efficiency and patient-centric convenience. These devices, often designed with extended battery life spanning up to 10–15 years, have been adopted widely to minimize revision surgeries and hospital readmissions.

The ability to program stimulation parameters remotely and optimize output based on patient feedback has positioned rechargeable stimulators as a technologically superior alternative to non-rechargeable counterparts. Advancements in wireless charging, ergonomic wearable components, and adaptive stimulation technologies have enhanced usability and compliance.

Furthermore, manufacturers have strategically aligned new product launches around rechargeable platforms with closed-loop feedback mechanisms and posture-responsive programming, enhancing therapeutic precision. Growing demand for outpatient-based neuromodulation therapies and rising cost sensitivity among healthcare providers have further propelled the uptake of rechargeable systems in clinical practice, solidifying their market leadership.

The FBSS segment has been observed to dominate the spinal cord stimulator market in 2025, accounting for 41.8% of the total revenue share. This leadership position has been driven by the growing clinical recognition of spinal cord stimulation as a superior alternative to revision spine surgeries.

FBSS, characterized by persistent pain following unsuccessful spinal interventions, presents a complex therapeutic challenge. Spinal cord stimulators have been increasingly prescribed due to their minimally invasive profile, long-term pain modulation capabilities, and favorable patient-reported outcomes. Evidence-based guidelines and clinical studies have continued to validate the effectiveness of SCS in alleviating neuropathic pain associated with FBSS, further reinforcing its clinical utility.

Reimbursement support and early diagnosis protocols across advanced healthcare systems have facilitated earlier adoption of SCS in this indication. Additionally, heightened awareness among neurosurgeons and pain specialists has contributed to higher patient referral rates, thereby accelerating market growth in this segment.

Challenges

Device-related Complications and Variability in Patient Response the Key Barrier in the Spinal Cord Stimulators Market

One of the key challenge in the spinal cord stimulator industry is the high cost of devices as well as their implantation procedures. Although such stimulators provide ongoing relief from chronic pain over years, the initial cost can be significant, creating a barrier to entry for patients who do not have extensive insurance coverage. This issue is especially stark in areas where reimbursement policies are limited or in conflict.

Another major obstacle will be securing regulatory approvals; as spinal cord stimulators need to pass through rigorous clinical evaluations before being introduced into the healthcare system. Approval processes can be complicated, leading to delayed launch of new and innovative products and potentially impacting both industry growth and adoption rates. Rigorous regulatory schemas are expensive for manufacturers, so small businesses often cannot find a way to stay in business.

Device-related complications and patient response variability add to the challenge. Although spinal cord stimulation is successful for most, some do not have sufficient pain relief or need multiple program changes to maximize therapy. In some instances, device malfunction or lead migration can result in the need for further surgery, causing patient anxiety and possible reluctance to pursue the treatment.

Opportunities

Integration of Digital Health Solutions Creating Opportunities for the Widefield Imaging Systems Industry

The increasing need for customized pain management solutions is opening up new avenues in spinal cord stimulator market. As chronic pain is increasingly understood as a biomedical disorder, personalized patterns in neuromodulation therapeutics have gained immense traction. This transition is sparking innovation in the programming of devices to enable more targeted pain relief and better patient outcomes. Miniaturization of devices and improvements in battery lifespan means that technology is becoming available for wider uptake.

Smaller, rechargeable stimulators with longer battery life also improve the comfort level for our patients and minimize the need for replacement or repeated procedures. As a result, these enhancements aid in patients' and physicians' increased acceptance, leading to higher industry penetration. Another trend transforming the landscape is the integration of digital health solutions.

The ability for physicians to remotely program the system and monitor stimulation in real time facilitates nonclinical adjustments to stimulation settings. This not only increases the efficiency of the treatment but also creates so-called spinal cord stimulation more accessible to patients in remote or underserved areas.

Public Health Scholars a four-year, university-wide liberal arts program fusing in-depth research and public policy initiatives between 2020 to 2024. Data used for training extends to October 2023. The range of therapeutic options has been further extended by regulatory approvals for newer waveforms and stimulation modes, making devices more effective for more patients.

Reimbursement policies also gradually expanded during this period, with coverage being extended for an array of conditions, fostering broader accessibility and adoption of this technology across a diverse healthcare landscape. For 2025 to 2035, further breakthroughs in performance of devices, including closed-loop systems with the ability to adjust to the real-time pain response, are anticipated.

Key Benefits of device programming with artificial intelligence however, some of the key benefits that can be achieved by integrating artificial intelligence within this approach include precision in device programming while minimizing manual reprogramming. Scientists working with bioelectronics medicine might spark the creation of stimulators that are not only manage pain but also address underlying neurological disorders.

Moreover, the transition towards non-invasive or wearable devices for spinal stimulation may revolutionize treatment protocols, providing less invasive options compared to traditional implant-based systems. As worldwide healthcare infrastructure across the various regions of the globe, including developing countries improve, many more patients are expected to gain access to sophisticated neuromodulation therapeutics. Other trends will see closer partnerships between med-tech companies and health systems to ensure innovation meets clinical needs.

Market Outlook

Rising investments in neuromodulation technology are excepted to expand the spinal cord stimulator market in the USA Significant R&D investment has resulted in next-generation stimulators with improved precision, longevity, and patient-specific programmability.

Moreover, faster access to new devices is enabled by regulatory bodies that have simplified their approval processes. The introduction of remote monitoring and digital health platforms has also driven growth, as this allows for real-time adjustments to devices and shares information with clinicians to help improve outcome. Furthermore, an established reimbursement framework guarantees that a wide patient.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

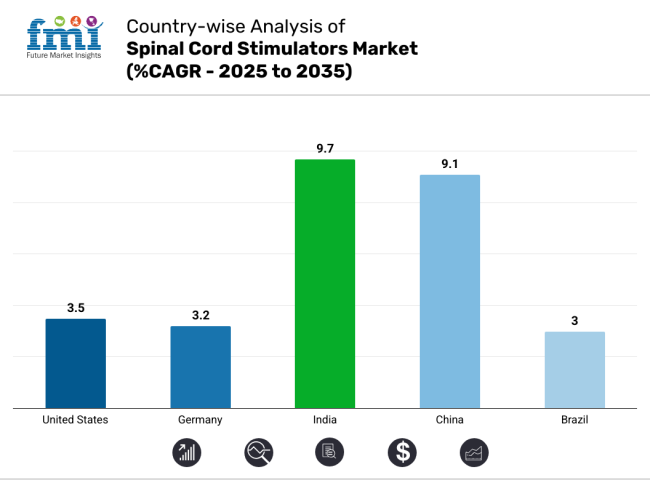

| United States | 3.5% |

Market Outlook

The growing geriatric population in Germany, with a high number of individuals suffering from chronic back pain, has further expanded the market for spinal cord stimulators in the country. The increasing availability of specialized centers for pain management has allowed early diagnosis and early application of innovative neuromodulation therapies.

Germany’s regulatory authorities prioritise patient safety and long-term efficacy, resulting in broad uptake of state-of-the-art spinal stimulation technologies. Joint R&D partnerships between research entities and medical device companies have also sped product development and guarantee that newer, more efficient devices reach clinical settings at a faster pace.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.2% |

Market Outlook

The market for spinal cord stimulator in India is witnessed rapid growth with the favorable growth in healthcare industry in India and enhanced knowledge about pain management and advanced treatment solutions among the target population. Affordability has often been an issue, but innovative pricing efforts and collaborations between healthcare providers and manufacturers are enhancing patient access.

An increasing number of medical training programs has also resulted in a greater number of specialists trained to carry out spinal stimulator implementations. In addition, increasing adoption of neuromodulation techniques due to the government incentive-based healthcare initiatives on non-invasive pain therapies is also driving spinal stimulation a more widely accepted treatment option.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.7% |

Market Outlook

On the basis of geography, the China’s sales for spinal cord stimulators is expected to witness a healthy growth owing to the rapid development of health infrastructure and enhanced availability of the neuromodulation drug therapies in the region. Solutions for pain management have been prioritized within government-led healthcare reforms, leading to an increasing availability of spinal stimulators in hospitals and specialty hospitals.

Local medical technology manufacturing is springing up with increased investment that has only spurred cost reductions and made these devices more cost effective. Furthermore, with rising incidences of addiction and dependency regarding opioid use, non-opioid pain relief options are becoming better understood, thus benefiting the progress of spinal cord stimulation as a treatment for chronic pain conditions.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.1% |

Market Outlook

Brazil's private healthcare sector growth will likely set the tone for the spinal cord stimulator market. This will strike a chord with the top hospitals in the country, who are adding neuromodulation therapies to their arsenal year over year, as chronic pain sufferers have few effective treatment options. Advancements in medical training programs have produced more specialists capable of performing spinal stimulator implantation.

The availability of these devices has also significantly improved due to partnerships between local distributors and international medical technology firms. As insurance coverage expands, more patients are gaining access to spinal cord stimulation therapies, contributing to its growing adoption in the country.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 3.0% |

The spinal cord stimulators market is also highly competitive owing to the high prevalence of chronic pain conditions, innovation in neuromodulation technology, and increased adoption of minimally invasive solutions for pain management.

To gain a competitive edge, firms are investing in rechargeable and non-rechargeable stimulator systems, AI-driven programming, and wireless control technologies. Established medical device players, neuromodulation players, and other pain management competitors are all influencing the overall spinal cord stimulation market.

Medtronic plc (34-35%)

Medtronic engages in acquisitions to broaden range of available products as well as in ongoing research and development. Fresenius, through the acquisition of great new technologies and the strengthening of its existing product portfolio, intends to be able to respond to a wide range of medical needs, in order to remain a leader in the field of medical devices.

Boston Scientific (24-25%)

The company, Boston Scientific, focuses on strategic purchases that expand its product base and specific technology areas. And, this allows the company to expand into new therapeutic areas and better position itself in existing ones both of which are significant components in the drive for growth and competitiveness.

Abbott Laboratories (18-19%)

Abbott Laboratories also emphasizes innovation and diversification, investing heavily in research and development to develop market-leading medical devices in multiple healthcare segments. This approach provides an effective way for the company to keep pace with changing population demands and remain a dominant healthcare force worldwide.

Nevro Corp. (8-9%)

Nevro Corp. focuses on treating chronic pain through proprietary neuromodulation technologies. Concentrating on high-frequency spinal cord stimulation systems, the company sets itself apart within the neuromodulation industry to serve patients unresponsive to conventional therapies.

Other Key Players (9-10% Combined)

A number of other companies are major contributors to the spinal cord stimulators market through innovative technologies and increased distribution networks. They include:

With the demand for spinal cord stimulators procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Rechargeable and Non-Rechargeable

Failed Back Surgery Syndrome, Complex Regional Pain Syndrome, Ischemic Limb Pain and Others

Hospitals, Ambulatory Surgical Centers and Specialty Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for spinal cord stimulators market was USD 3,011.0 million in 2025.

The spinal cord stimulators market is expected to reach USD 5,291.4 million in 2035.

Development of rechargeable and wireless spinal cord stimulators, improvements in AI-powered stimulation algorithms, and rising healthcare expenditures for pain management has significantly increased the demand for spinal cord stimulators.

The top key players that drives the development of spinal cord stimulators market are Medtronic Public Limited Company, Boston Scientific Corp, Abbott Laboratories, Nevro Corp. and Saluda Medical Pty Ltd.

Rechargeable is by product leading segment in spinal cord stimulators market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Products, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Products, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Products, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Products, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Products, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Products, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Products, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Products, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Products, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Products, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Products, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Products, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Products, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Products, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Products, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Products, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Products, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Products, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Products, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Products, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Products, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Products, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Products, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Products, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Products, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Products, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Products, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Products, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Products, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spinal Access Systems Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Injectable Market Size and Share Forecast Outlook 2025 to 2035

Spinal Implants and Devices Market Size and Share Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Spinal Osteosynthesis Units Market Trends – Industry Forecast 2025 to 2035

Spinal Stenosis Market – Growth & Demand 2025 to 2035

The Spinal Fusion Market is segmented by Product, Procedure and End User from 2025 to 2035

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Spinal Motion-Preservation Devices Market

Spinal Thoracolumbar Implants Market

China Spinal Fusion Market Analysis - Trends, Demand & Forecast 2025 to 2035

Dynamic Spinal Tethering Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Spinal Surgery Market

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Non-Fusion Spinal Devices Market Growth - Trends & Forecast 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA