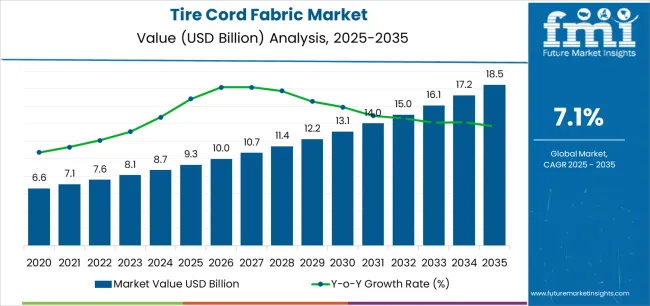

The global tire cord fabric market is valued at USD 9.3 billion in 2025. It is slated to reach USD 18.5 billion by 2035, recording an absolute increase of USD 9.1 billion over the forecast period. FMI’s verified research on advanced composites and performance materials indicates that this translates into a total growth of 97.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.98X during the same period, supported by increasing demand for radial tire production, growing adoption of electric vehicle tire platforms requiring low rolling resistance cords, and rising emphasis on sustainable tire reinforcement solutions across diverse passenger car, commercial vehicle, and specialty tire manufacturing applications.

Between 2020 and 2025, the tire cord fabric market experienced steady growth, driven by increasing tire production infrastructure development and growing recognition of advanced cord fabrics as essential reinforcement materials for reliable tire performance and durability in diverse automotive applications. The market developed as tire engineers and manufacturers recognized the potential for high-tenacity synthetic cords to enhance tire structural integrity while supporting weight reduction and fuel efficiency requirements. Technological advancement in cord dipping processes and adhesion systems began emphasizing the critical importance of maintaining bonding performance and operational efficiency in radial tire production applications.

Between 2025 and 2030, the tire cord fabric market is projected to expand from USD 9.3 billion to USD 13.1 billion, resulting in a value increase of USD 3.8 billion, which represents 41.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing radialization of commercial vehicle tires, rising adoption of electric vehicle tire platforms requiring specialized low rolling resistance cord fabrics, and growing demand for high-tenacity polyester and nylon cords that ensure structural integrity and performance optimization. Tire manufacturers and cord fabric producers are expanding their production capabilities to address the growing demand for efficient tire reinforcement materials and advanced adhesion systems.

From 2030 to 2035, the market is forecast to grow from USD 13.1 billion to USD 18.5 billion, adding another USD 5.3 billion, which constitutes 58.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of sustainable cord production technologies and recyclable fabric architectures, the development of advanced dipping systems and resorcinol-free adhesion technologies for improved environmental compliance, and the growth of specialized applications for electric vehicle tires, motorsport tires, and aviation tire platforms requiring superior strength-to-weight ratios. The growing adoption of circular economy principles and bio-based cord materials will drive demand for tire cord fabrics with enhanced sustainability profiles and environmental performance features.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 9.3 billion |

| Forecast Value in (2035F) | USD 18.4 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

From 2030 to 2035, the market is forecast to grow from USD 13.1 billion to USD 18.4 billion, adding another USD 5.3 billion, which constitutes 58.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of electric vehicle tire production requiring specialized low rolling resistance cord architectures, the development of sustainable dipping systems eliminating resorcinol compounds for enhanced environmental and occupational health compliance, and the growth of specialized applications for high-performance passenger car tires, heavy-duty commercial vehicle tires, and specialty applications in aviation and motorsport segments. The growing adoption of circular economy integration and chemical recycling pathways for post-consumer tire materials will drive demand for tire cord fabrics with enhanced recyclability and compatibility with emerging depolymerization technologies.

Between 2020 and 2025, the tire cord fabric market experienced consistent growth, driven by increasing radialization penetration in commercial vehicle segments across emerging markets and growing recognition of advanced synthetic cords as essential materials for meeting stringent tire performance standards including rolling resistance, load capacity, and durability in diverse operating conditions. The market developed as tire manufacturers and automotive OEMs recognized the potential for high-tenacity polyester and nylon cords to enhance tire performance while supporting vehicle fuel efficiency, safety requirements, and total cost of ownership optimization. Technological advancement in cord treatment processes, adhesion chemistry, and manufacturing automation began emphasizing the critical importance of maintaining consistent quality and production efficiency in high-volume tire manufacturing applications.

Market expansion is being supported by the increasing global demand for radial tire production infrastructure and the corresponding need for high-performance reinforcement materials that can ensure structural integrity, maintain dimensional stability, and support operational durability across various passenger car, commercial vehicle, and specialty tire applications. Modern tire manufacturers are increasingly focused on implementing cord fabrics that can deliver superior strength-to-weight ratios, ensure consistent adhesion to rubber compounds, and provide versatile performance in demanding operating conditions including high speeds, heavy loads, and extreme temperatures.

The growing emphasis on electric vehicle tire development and low rolling resistance requirements is driving demand for tire cord fabrics that can support effective structural reinforcement, enable weight optimization, and ensure comprehensive performance characteristics that extend EV driving range. Tire engineers' preference for reinforcement materials that combine high tensile strength with dimensional stability and manufacturing efficiency is creating opportunities for innovative tire cord fabric implementations featuring advanced polyester and hybrid cord architectures. The rising influence of sustainability requirements and circular economy principles is also contributing to increased adoption of recyclable cord fabrics and bio-based materials that can provide reliable performance without compromising environmental objectives or end-of-life tire recyclability.

The ongoing shift from bias tire construction to radial tire technology in commercial vehicle and off-road segments across emerging markets is generating substantial incremental demand for high-quality tire cord fabrics. Radialization delivers superior tire durability, reduced fuel consumption, and improved vehicle handling characteristics, making it the preferred construction method for fleet operators and logistics companies seeking to optimize total cost of ownership. This structural transition in tire technology is particularly pronounced in India, China, and Brazil, where commercial vehicle fleets are modernizing rapidly and regulatory frameworks are increasingly mandating radial tire adoption for safety and environmental reasons.

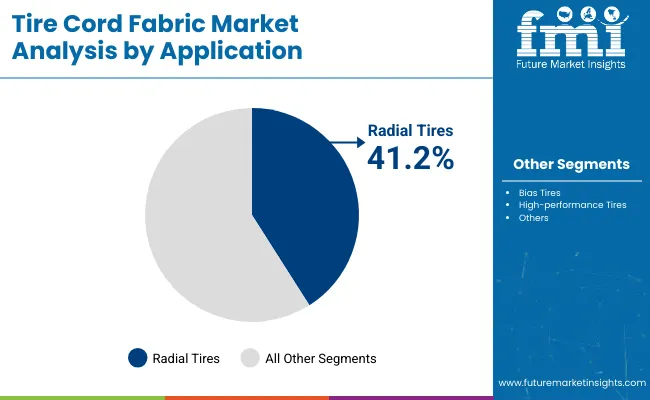

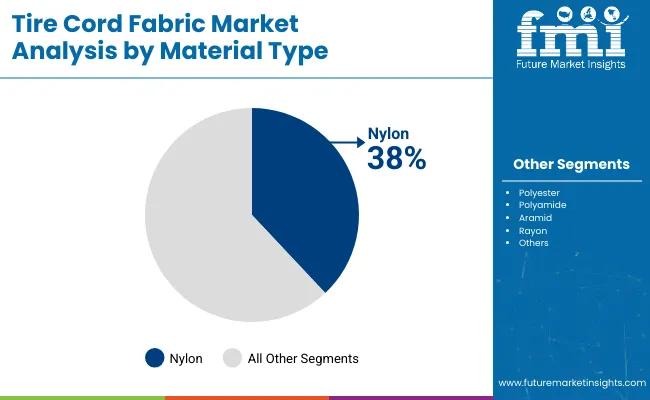

The market is segmented by application, material type, vehicle type, and region. By application, the market is divided into radial tires, bias tires, and high-performance/specialty tires. Based on material type, the market is categorized into nylon, polyester, rayon, aramid, and others. By vehicle type, the market includes passenger cars, SUVs/MUVs, light commercial vehicles, heavy commercial vehicles, motorbikes, agricultural/off-road, and aircraft & others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

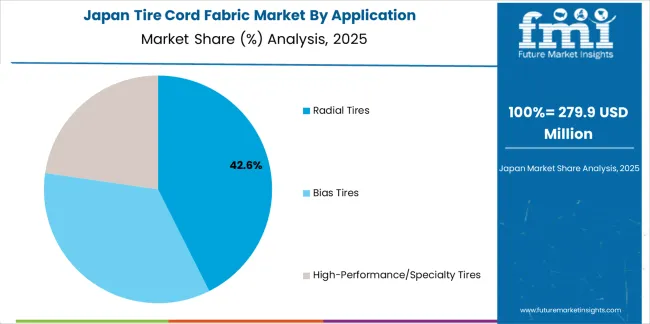

The radial tires segment is projected to maintain its leading position in the tire cord fabric market in 2025 with 41.2% market share, reaffirming its role as the preferred application category for passenger car, commercial vehicle, and specialty tire manufacturing. Tire manufacturers increasingly utilize cord fabrics for radial construction due to their superior load distribution characteristics, enhanced durability performance, and ability to support modern tire design requirements including low rolling resistance, high-speed capability, and consistent handling performance. Within the radial segment, passenger-car radial applications dominate with 58.0% share, followed by commercial-vehicle radial at 31.0%, reflecting the broad adoption of radial technology across diverse vehicle categories.

This application segment forms the foundation of modern tire manufacturing infrastructure, as it represents the construction method with the greatest performance advantages and established market penetration across multiple vehicle segments and geographic regions. Tire manufacturer investments in radial production capacity continue to strengthen adoption among automotive OEMs and replacement tire distributors seeking superior tire performance and customer satisfaction. With vehicle applications requiring enhanced fuel efficiency and safety performance, radial tire construction aligns with both regulatory requirements and consumer expectations, making it the central component of comprehensive tire development and manufacturing strategies.

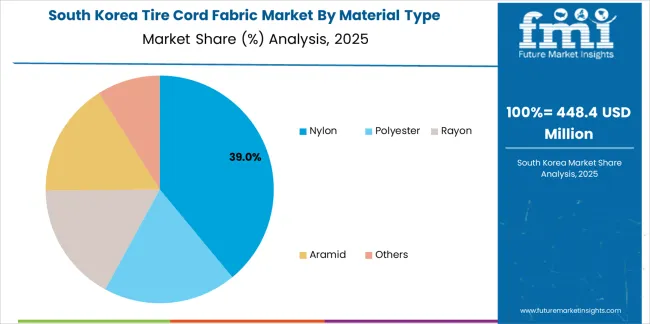

The nylon material segment is projected to represent the largest share of tire cord fabric demand in 2025 with 38.0% market share, underscoring its critical role as the primary reinforcement material for commercial vehicle tires, motorcycle tires, and specialty tire applications requiring superior strength and impact resistance. Tire manufacturers prefer nylon cord fabrics due to their excellent tensile strength characteristics, superior adhesion to rubber compounds, and ability to withstand manufacturing processes while ensuring tire durability and performance specifications. Within the nylon category, Nylon 6 dominates with 62.0% share of nylon consumption, while Nylon 66 accounts for 38.0%, reflecting different performance and cost optimization strategies across tire applications.

The segment is supported by continuous innovation in nylon polymer technologies and the growing availability of specialized dipping systems that enable effective rubber-to-cord bonding with enhanced adhesion strength and fatigue resistance. Additionally, nylon cord manufacturers are investing in comprehensive sustainability programs to support renewable feedstock integration and reduced environmental impact across the nylon production value chain. As commercial vehicle tire production expands and electric vehicle platforms demand specialized cord solutions, the nylon material segment will continue to maintain strong market position while supporting advanced tire performance utilization and manufacturing optimization strategies.

The tire cord fabric market is advancing steadily due to increasing demand for radial tire production infrastructure and growing adoption of specialized reinforcement materials that provide enhanced structural integrity and performance optimization across diverse passenger car, commercial vehicle, and specialty tire applications. However, the market faces challenges, including raw material price volatility affecting nylon and polyester polymer costs, intense competition from alternative tire construction technologies and reinforcement materials, and stringent environmental regulations regarding dipping chemistry and manufacturing emissions. Innovation in sustainable cord production technologies and recyclable fabric architectures continues to influence product development and market expansion patterns.

The growing adoption of electric vehicle platforms is enabling tire manufacturers to achieve enhanced energy efficiency performance, extended driving range capabilities, and comprehensive weight optimization through specialized cord fabrics engineered for low rolling resistance tire constructions. Advanced high-tenacity polyester and hybrid cord architectures provide improved strength-to-weight ratios while allowing more effective structural reinforcement and consistent performance characteristics across various EV tire specifications and load requirements. Manufacturers are increasingly recognizing the competitive advantages of EV-optimized cord solutions for product differentiation and OEM partnership development. Major tire producers are establishing dedicated EV tire development programs and securing strategic cord fabric supply agreements to support next-generation electric vehicle tire production capabilities.

The ongoing transition from bias to radial tire construction in commercial vehicle segments across India, China, Brazil, and other emerging markets is generating substantial incremental demand for tire cord fabrics. Radialization delivers superior tire durability, reduced fuel consumption through lower rolling resistance, and improved vehicle handling characteristics that optimize total cost of ownership for fleet operators and logistics companies. Government initiatives promoting commercial vehicle safety standards and environmental compliance are accelerating radial tire adoption across truck and bus segments in major emerging economies. Tire manufacturers are expanding radial production capacity in regional markets while establishing local cord fabric supply chains to serve growing commercial vehicle tire demand.

Modern tire cord fabric manufacturers are incorporating next-generation dipping systems featuring resorcinol-free adhesion chemistry to enhance environmental compliance, improve occupational health and safety performance, and support comprehensive sustainability objectives while maintaining superior rubber-to-cord bonding strength. These advanced adhesion technologies improve manufacturing process safety while enabling new applications including recyclable tire constructions and bio-based rubber compound compatibility. Advanced dipping system integration also allows facilities to support stringent OEM qualification requirements and manufacturing efficiency beyond traditional cord treatment approaches. Investment in closed-loop dipping systems and energy-efficient curing technologies continues to drive manufacturing excellence and competitive positioning in the global tire cord fabric market.

The tire cord fabric industry is experiencing growing emphasis on sustainable material development including bio-based nylon polymers, recycled polyester content integration, and recyclable cord architectures compatible with emerging tire pyrolysis and depolymerization technologies. Leading cord fabric producers are establishing strategic partnerships with chemical recyclers and bio-polymer developers to advance sustainable feedstock utilization while maintaining performance specifications required for demanding tire applications. This sustainability transition is being driven by tire manufacturer commitments to circular economy principles, automotive OEM supplier requirements for reduced environmental impact, and regulatory frameworks promoting sustainable tire production across major markets. Innovation in sustainable cord production is creating new competitive dynamics and market opportunities for manufacturers that successfully balance environmental performance with technical specifications and cost competitiveness.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7.9% |

| United States | 6.4% |

| Germany | 6.1% |

| Japan | 5.9% |

| South Korea | 6.5% |

| Brazil | 6.8% |

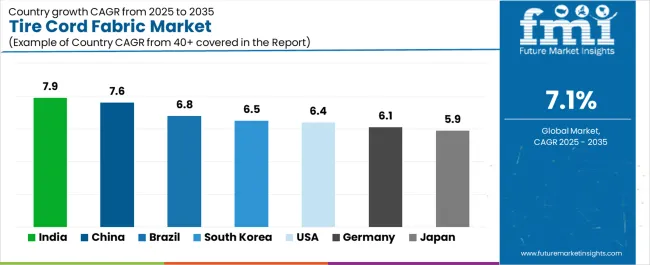

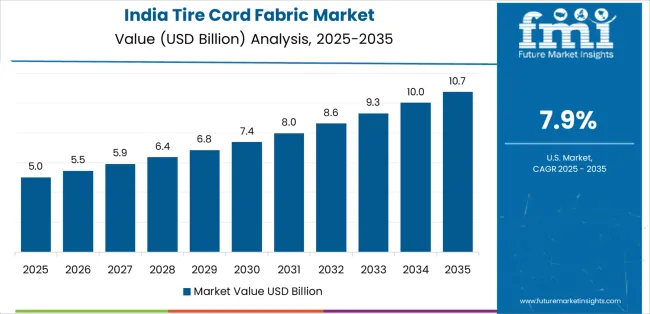

The tire cord fabric market is experiencing robust growth globally, with India leading at a 7.9% CAGR through 2035, driven by rapid OE and aftermarket expansion, accelerating shift from bias to radial construction in commercial vehicle segments, and significant investment in new domestic cord fabric production capacity. China follows closely at 7.6%, supported by expanding radialization in commercial vehicle tires, localization of polyester and nylon intermediate production, and substantial investment in EV tire platforms driving low rolling resistance cord demand.

Brazil shows strong growth at 6.8%, emphasizing commercial vehicle parc renewal and agriculture/off-road tire capacity additions. South Korea records 6.5%, focusing on tire export hub positioning and EV-optimized tire platforms requiring high-tenacity polyester cords. The United States demonstrates 6.4% growth, supported by demand for EV and high-performance tires, retread growth in commercial fleets, and premium aramid/rayon adoption. Germany exhibits 6.1% growth, supported by premium OEM tire mix and light-weighting targets driving hybrid cord development. Japan shows 5.9% growth, emphasizing export of premium tires with advanced dipping systems and smart tire programs.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from tire cord fabric in India is projected to exhibit exceptional growth with a CAGR of 7.9% through 2035, driven by rapid original equipment and aftermarket tire demand expansion and accelerating shift from bias to radial tire construction in truck and bus segments supported by government vehicle safety initiatives and logistics sector modernization programs. The country's expanding automotive production base and increasing commercial vehicle fleet growth are creating substantial demand for high-quality tire cord fabrics. Major international cord fabric suppliers and domestic manufacturers are establishing comprehensive production capabilities to serve both local tire markets and emerging export opportunities to neighboring regions.

Revenue from tire cord fabric in China is expanding at a CAGR of 7.6%, supported by the country's ongoing expansion of radialization in commercial vehicle tire segments, successful localization of polyester and nylon intermediate chemical production, and substantial investment in electric vehicle tire platforms requiring specialized low rolling resistance cord architectures. The country's massive tire production infrastructure and increasing emphasis on performance tire development are driving demand for advanced reinforcement materials. Leading international and domestic cord fabric manufacturers are establishing extensive production and innovation capabilities to address the evolving requirements of China's sophisticated tire industry.

Revenue from tire cord fabric in Brazil is expanding at a CAGR of 6.8%, supported by the country's ongoing commercial vehicle parc renewal following economic recovery, government localization incentives promoting domestic tire and component production, and expanding agriculture/off-road tire capacity additions serving the country's substantial agricultural sector. The nation's growing logistics infrastructure and agricultural mechanization trends are driving sophisticated tire cord requirements throughout the industrial sector. International suppliers and regional manufacturers are establishing comprehensive distribution and technical support capabilities to serve the expanding Brazilian market.

Revenue from tire cord fabric in South Korea is growing at a CAGR of 6.5%, driven by the country's strategic position as a global tire export hub, accelerating development of EV-optimized tire platforms by major tire manufacturers, and substantial investments in high-tenacity polyester cord production capabilities. The country's advanced tire manufacturing infrastructure and strong emphasis on research and development are supporting demand for premium reinforcement materials across major production facilities. Leading cord fabric producers are establishing specialized capabilities to serve both domestic tire export production and emerging electric vehicle tire requirements.

Revenue from tire cord fabric in the United States is expanding at a CAGR of 6.4%, supported by the country's growing demand for electric vehicle and high-performance tire applications, expanding retread tire industry serving commercial fleet operators, and increasing adoption of premium aramid and rayon cord materials for specialized tire constructions. The nation's comprehensive tire manufacturing infrastructure and advanced automotive market are maintaining consistent demand for high-quality reinforcement materials. Tire manufacturers are investing in production technology modernization and specialty cord applications to serve both emerging EV tire requirements and established commercial tire segments.

Revenue from tire cord fabric in Germany is growing at a CAGR of 6.1%, driven by the country's emphasis on premium OEM tire fitments requiring advanced cord specifications, aggressive vehicle light-weighting targets supporting fuel efficiency improvements, and strong focus on research and development for hybrid cord architectures combining polyester and aramid materials. Germany's established tire manufacturing infrastructure and focus on high-performance applications are supporting steady demand for specialty cord fabrics throughout major production regions. Industry leaders are establishing specialized research and production capabilities to serve both automotive OEM requirements and export tire markets.

Revenue from tire cord fabric in Japan is expanding at a CAGR of 5.9%, supported by the country's focus on premium tire exports to global markets, advanced dipping and adhesion system technologies providing superior rubber-to-cord bonding performance, and comprehensive smart tire and low-noise tire development programs requiring specialized cord specifications. Japan's sophisticated tire technology infrastructure and precision manufacturing expertise are driving demand for high-quality reinforcement materials and advanced production systems. Leading tire and cord fabric companies are investing in specialized capabilities to serve advanced tire applications across automotive, motorcycle, and specialty vehicle segments.

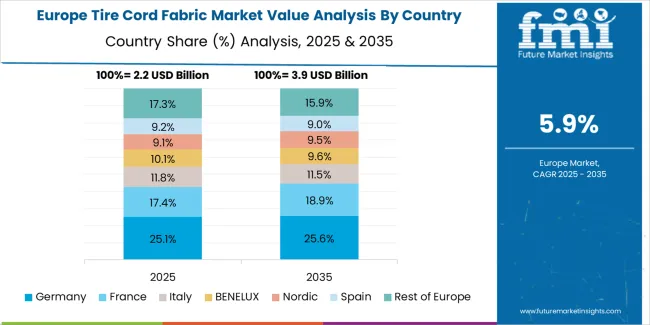

The tire cord fabric market in Europe is projected to grow steadily over the forecast period, with Western Europe accounting for the largest regional cord fabric demand. Germany leads European consumption with approximately 22% market share, driven by premium passenger car tire production for domestic OEMs and high-performance tire exports serving global markets. The country's advanced tire manufacturing infrastructure and emphasis on light-weighting and fuel efficiency support consistent demand for high-tenacity polyester and hybrid cord fabrics across diverse tire applications.

Italy follows with about 16% of European consumption, benefiting from established tire manufacturing presence and growing focus on specialty tire production for motorcycle, agricultural, and industrial applications. France reflects steady demand at approximately 14% market share, supported by commercial vehicle tire production and increasing emphasis on sustainable cord materials compatible with circular economy initiatives. Spain accounts for about 11% of European cord fabric consumption, balancing passenger car tire manufacturing and commercial vehicle tire production across its diversified industrial base.

The United Kingdom represents approximately 12% of European demand, growing with replacement tire market activity and specialty tire applications serving industrial and off-road vehicle segments. Central and Eastern Europe accounts for about 18% of European consumption, concentrated in Poland, Czech Republic, Hungary, and Romania, where expanding tire production capacity serves both regional markets and pan-European OEM supply chains.

The Nordic region and Benelux countries combined maintain approximately 7% market share, supported by premium tire applications and specialty vehicle tire production including winter tires, forestry equipment tires, and sustainable tire development programs. Premium OEM fitments, fast-growing EV platforms, and stringent rolling-resistance limits favor polyester and hybrid (polyester/aramid) cord architectures throughout Western Europe, while CEE hosts rising cord fabric conversion capacity supplying EU tire manufacturers with cost-competitive reinforcement materials. Western Europe leads in R&D focused on advanced adhesion systems and recyclable cord architectures compatible with emerging tire recycling and circular economy initiatives.

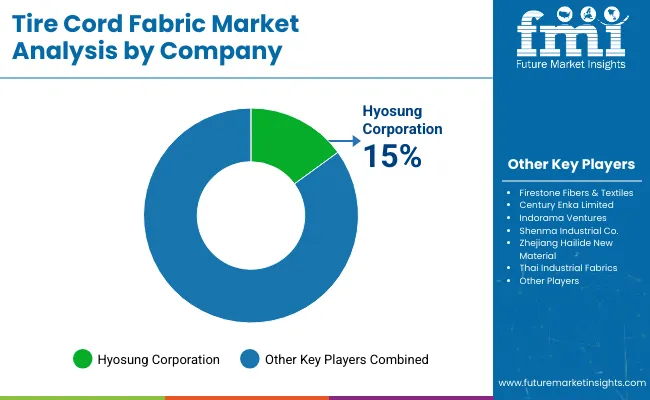

The tire cord fabric market is characterized by competition among established synthetic fiber manufacturers, integrated tire cord producers, and specialty reinforcement material suppliers. Hyosung Corporation leads the market with a 16.0% share, offering comprehensive tire cord solutions including high-tenacity nylon and polyester fabrics with a focus on manufacturing excellence and global supply chain capabilities. Companies are investing in advanced production technology research, dipping system innovation, sustainability initiatives, and comprehensive product portfolios to deliver reliable, efficient, and high-performance tire cord fabric solutions. Innovation in sustainable manufacturing processes, resorcinol-free adhesion systems, and recyclable cord architectures is central to strengthening market position and competitive advantage.

Kordsa provides integrated tire reinforcement solutions with emphasis on advanced adhesion technologies and sustainability-focused product development for low rolling resistance passenger and EV tires. Kolon Industries delivers specialized cord fabric production with focus on high-tenacity polyester and nylon materials serving Asian tire manufacturing markets. SRF Limited offers comprehensive nylon tire cord capabilities with recent capacity expansions and process upgrades to improve energy efficiency and adhesion performance for radial tire applications. Teijin Limited focuses on premium aramid and hybrid cord solutions for high-performance and specialty tire applications. Indorama Ventures provides integrated polyester value chain capabilities spanning PET resin to tire cord fabric production. Shenma Industrial, Zhejiang Hailide New Material, Toray Industries, and Century Enka offer specialized production capabilities, regional supply chain advantages, and technology innovation in nylon and polyester cord fabrics.

Tire cord fabric represents specialized high-strength synthetic fiber materials within tire reinforcement applications, projected to grow from USD 9.3 billion in 2025 to USD 18.4 billion by 2035 at a 7.1% CAGR. These critical tire reinforcement materials---primarily supplied as nylon, polyester, rayon, and aramid cord fabrics treated with specialized dipping chemistry for rubber adhesion---serve as essential structural components for radial tires, bias tires, and high-performance tire constructions across passenger car, commercial vehicle, motorcycle, and specialty tire manufacturing applications. Market expansion is driven by increasing radialization of commercial vehicle tires in emerging markets, growing demand for electric vehicle tire platforms requiring low rolling resistance cord solutions, expanding tire production capacity globally, and rising emphasis on sustainable cord materials and recyclable tire architectures in diverse automotive and specialty vehicle applications.

How Tire Industry Regulators Could Strengthen Safety Standards and Environmental Compliance?

How Tire Industry Associations Could Advance Quality Standards and Technical Excellence?

How Cord Fabric Manufacturers Could Drive Innovation and Market Leadership?

How Tire Manufacturers Could Optimize Production Efficiency and Product Performance?

How Investors and Financial Enablers Could Support Market Growth and Technology Development?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 9.3 billion |

| Application | Radial Tires, Bias Tires, High-Performance/Specialty Tires |

| Material Type | Nylon, Polyester, Rayon, Aramid, Others |

| Vehicle Type | Passenger Cars, SUVs/MUVs, Light Commercial Vehicles, Heavy Commercial Vehicles, Motorbikes, Agricultural/Off-Road, Aircraft & Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, United States, Germany, Japan, South Korea, Brazil, and 40+ countries |

| Key Companies Profiled | Hyosung Corporation, Kordsa, Kolon Industries, SRF Limited, Teijin Limited, and Indorama Ventures |

| Additional Attributes | Dollar sales by application, material type, and vehicle type category, regional demand trends, competitive landscape, technological advancements in dipping systems, resorcinol-free adhesion development, sustainable cord material innovation, and EV tire platform optimization |

Asia Pacific

North America

Europe

Latin America

Middle East & Africa

The global tire cord fabric market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the tire cord fabric market is projected to reach USD 18.5 billion by 2035.

The tire cord fabric market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in tire cord fabric market are radial tires, bias tires and high-performance/specialty tires.

In terms of material type, nylon segment to command 38.0% share in the tire cord fabric market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Market

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA