The global EV tires market is expected to grow significantly between 2025 and 2035 due to increasing adoption of electric vehicles (EV), high demand for energy-efficient and low-resistance tires, and development of smart tire technology. EV tires must deal with a higher torque, lower rolling resistance, and better battery efficiency.

The increasing focus on sustainable mobility solutions is driving growth in the market along with developments in noise-reducing and self-healing tire technologies. In addition services such as EV charging infrastructural growth, interest in sustainable tire manufacturing programs and regulatory energy on carbon neutral transport are also shaping the rapid evolution of the industry.

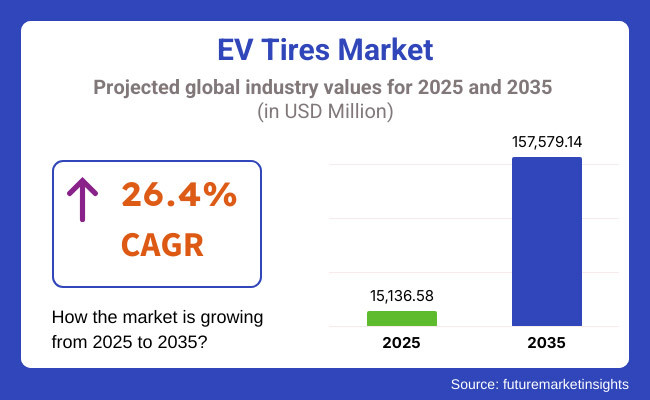

The EV tires market was valued at about USD 15,136.58 Million in 2025. According to this analysis, the Global Smart Home market is expected to be worth USD 157,579.14 Million by 2035, growing at a CAGR of 26.4% during the forecast period. This growth is due to growing usage of electric vehicles, increasing consumer preference for durable and high-performance products and growing investments in next-generation tire materials.

This, along with AI-based tire tracking, innovative tread patterns for longer shelf life, and affordable manufacturing processes are additional drivers of market growth. The development of sustainable, puncture-resistant, and intelligent EV tires is further propelling market penetration and industry adoption as well.

North America is expected to continue to be the leading market for EV tires, owing to EV sales and the increasing investment in sustainable transportation, and innovation and development in smart tire technology. ULR tires, self-sealing and AI-backed TPMS-based tires will be spearheaded by the USA and Canada in terms of development and commercial availability.

Market growth is driven by the rising demand for regulatory compliant, long-lasting tires, growing efforts to lower EV maintenance costs, and the increasing adoption of connected mobility solutions, Hybrid tires. Moreover, the growing trend towards sustainable manufacturing practices and eco-friendly tire materials is also propelling product innovation and adoption.

The European market consists of strong demand for high-margin EV tires, government initiatives to support carbon-neutral transportation, and innovations in high-performance and recycled-material in tire material. Germany, France, and the UK are among several nations looking at the development of high-efficiency-low-noise tires for electric vehicles based on passenger EV, commercial fleet and autonomous vehicle applications.

Increasing focus on tire longevity, rising demand in smart mobility ecosystems, and advancements in AI-based tire health monitoring are also contributing to market penetration. The wider applications in high-performance EVs; green tire manufacturing; and energy-efficient transportation networks are also contributing new opportunities for vendors and suppliers.

The fastest growth rate in the EV tires market is observed in the Asia-Pacific region because of the increasing production of electric vehicles (EV) in the region, growing government support for EV mobility, and rising investments in sustainable tire manufacturing. In China, India, and Japan, there is a large investment in research and development of eco-sustainable, high-performance, bio-based materials tires and smart compounds for EV tire applications.

The increasing demand for long-range EVs, rapid growth in urban transportation electrification, and dynamic regulatory framework, along with government efforts to foster sustainable mobility, are spurring regional market growth. Moreover, growing demand for low-resistance, high-durability EV tires and expansion of AI-integrated tire monitoring solutions are also boosting the market penetration.

An upsurge in local tire producers and partnerships with international automobile companies are further enhancing the market growth.

Adding to this momentum is the ongoing development of more advanced smart tire technology, lower rolling resistance tread compounds, and AI-based tire analytics for monitoring real-time EF energy. Increased automation of manufacturing, improvement of self-sealing tires, graphene-infused compounds, and lightweight tire designs among others are garnering attention to make the tires more flourishing as well as usable in long term perspectives.

Moreover, high-talk among consumers about high-mileage EV tires, increasing digital integration in vehicle monitoring systems, and evolving regulatory standards are all playing a hand in shaping the industry moving forward. The implementation of AI-driven predictive maintenance, next-gen sustainable tire material, and self-repairing tire technologies is also increasing EV performance and delivering top electric vehicle tire solutions worldwide.

Challenge

High Wear and Tear Due to Increased Torque and Weight

Since electric vehicles (EVs) generate higher torque and are much heavier than traditional internal combustion engine (ICE) vehicles, there are challenges facing the EV tires market. Higher torque results in scrubbed treads, and the added battery weight stresses tires with payload, shortening their life span. In this regard, manufacturers will also need to formulate high-durability tire compounds, reinforced sidewalls, and put in place advanced tread designs for maximizing durability and performance for EV-specific conditions.

Rolling Resistance and Energy Efficiency Optimization

But for EV range and efficiency, minimizing rolling resistance is critical, and getting this balance right to avoid compromising grip, durability and performance remains one of the biggest challenges. Some types of more efficient tires have lower rolling resistance, but lower traction and braking capabilities.

Balancing wet and dry performance whilst optimizing noise cancellation for quieter EVs is also a complex balancing act. Tire companies need to focus on innovative rubber compounds, advanced tread designs, and enhanced AI based material science to create an energy-efficient product without compromising safety and durability.

Opportunity

Rising Demand for Sustainable and Recyclable Tire Materials

As concerns over environmental impact grow and awareness rises, so does the need for eco-friendly tires livered from sustainable and recyclable materials. Manufacturers are testing bio-based rubber, silica-infused tread compounds and recycled tire components to lower the carbon footprint of tire production.

Also, the adoption of circular economy initiatives (e.g., tire retreading and end-of-life recycling programs) create new business opportunities. Companies scaling green tire technologies, sustainable sourcing, and closed-loop manufacturing of products will also have a leg up in the evolving EV market.

Advancements in Smart Tire Technology and Predictive Maintenance

Smart tire technologies, including embedded sensors, real-time pressure monitoring, and AI-driven wear prediction, are revolutionizing the EV tire market. They offer information on tread wear, temperature, road conditions, that help improve safety, efficiency, and performance. As with everything else, the Internet of Things and connected vehicle ecosystems that power predictive maintenance solutions can help here by extending the life of the tire and preventing failures you never see coming.

The next generation of tire solutions will be driven by companies developing smart tire innovations, AI-powered diagnostics, and direct connectivity with EV systems.

Between 2020 and 2024 the EV tires market experienced significant change, driven by the global transition to electrified transportation, rising EV sales and demand for dedicated tires. Longer tread life, lower rolling resistance and noise reduction technologies were developed by the companies to improve EV performance.

But the high costs of raw materials, a limited recycling infrastructure and different regulatory standards inhibited widespread adoption. In response to this challenge, businesses progressed with material science, optimized supply chains, and engineered high-performance tire solutions specifically designed for EVs.

Anticipated innovations between 2025 to 2035 include self-healing tire compounds, AI-assisted real-time performance tracking and fully recyclable tire materials. With the emergence of autonomous and connected EVs, the demand for smart tires with adaptive performance will continue to increase. Alongside, all airless automobile technologies, graphene based tread compounds, & wireless energy harvest from the roads will bring up new version of industry.

These three pillars are key areas for the reshaping of the EV tires market by veritable leaders: those who prioritize sustainability, digital integration, and advanced tire engineering.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter fuel efficiency and emissions standards |

| Technological Advancements | Growth in low rolling resistance and noise-reduction technologies |

| Industry Adoption | Increased use in EVs, hybrids, and fleet electrification |

| Supply Chain and Sourcing | Dependence on synthetic rubber and petrochemical materials |

| Market Competition | Dominance of traditional tire manufacturers adapting to EV needs |

| Market Growth Drivers | Demand for improved EV efficiency, durability, and performance |

| Sustainability and Energy Efficiency | Initial focus on reducing rolling resistance and improving recyclability |

| Integration of Smart Monitoring | Limited use of real-time tire health tracking and IoT connectivity |

| Advancements in Tire Innovation | Development of EV-specific tread patterns and sidewall reinforcements |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of sustainability mandates, recycled material requirements, and AI-driven compliance tracking |

| Technological Advancements | Expansion of self-healing, graphene-infused, and AI-optimized tire materials |

| Industry Adoption | Widespread adoption in autonomous EVs, smart mobility solutions, and next-gen connected vehicles |

| Supply Chain and Sourcing | Shift toward bio-based rubber, sustainable supply chains, and closed-loop tire recycling |

| Market Competition | Rise of EV-exclusive tire brands, smart tire startups, and AI-driven material science companies |

| Market Growth Drivers | Growth in self-regulating smart tires, wireless energy-harvesting tire solutions, and carbon-neutral production |

| Sustainability and Energy Efficiency | Large-scale implementation of fully biodegradable, recyclable, and zero-waste tire solutions |

| Integration of Smart Monitoring | AI-powered predictive maintenance, embedded tire sensors, and blockchain-based performance monitoring |

| Advancements in Tire Innovation | Introduction of airless tires, self-repairing materials, and wireless energy regeneration from road surfaces |

The USA leads the overall EV tires market due to the increasing adoption of electric vehicles, rising investments in sustainable mobility and the presence of major tire manufacturers. Market growth is further propelled by the increasing popularity of energy-saving low-rolling-resistance tires.

Increasing investments in advanced rubber compounds and aerodynamics, noise reduction, and tread durability solutions also contribute to the growth of this market. Furthermore, smart tire technology is being integrated to improve product performance, with real-time pressure monitoring and predictive wear analysis.

Firms are working to develop lightweight yet high-load-capacity EV tires to enhance efficiency and extended range. The increasing popularity of EV-specific tires in commercial fleets and higher-end electric cars is also driving demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 26.6% |

Government initiatives to promote electric mobility, rising investments in sustainable transportation, and rapid expansion of electric vehicle charging infrastructure drive demand for EV tires in the United Kingdom. Moreover, the increasing focus towards minimizing carbon emissions from automobile sector is expected to foster the demand of disclaimer marker as well, thus fuelling the market growth on a greater extent.

Seamless market proliferation is encouraged by government norms forwarding the application of energy-efficient and recyclable tire compositions, along with developments in low-noise and high-durability EV tires. Further, self-sealing and puncture-resistant tires and smart tires embedded with AI are also on the rise.

Tire Recycling and Bio-Based Rubber: Companies are also investing in sustainable tire recycling programs and bio-based rubber formulations. Further market adoption in the UK is driven by the growing trend towards electric taxis, ride-sharing fleets, and high-performance EV tires. Furthermore, the growth of EV-ready road infrastructure and dynamic tire pressure adjustment solutions are shafting demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 26.1% |

In the European EV tires market, Germany, France, and Italy are dominant, with the growth of the automotive industry, increasing sales of electric vehicles, and strict regulatory guidelines on vehicle emissions and fuel economy all favoring the region.

The European Union's commitment to sustainable mobility along with investments in next-generation tire compounds push market growth rapidly. Further, advanced silica based tread compounds, ultra-low rolling resistance technologies, and AI-based tire monitoring are being adopted to boost the performance of vehicles.

Growing demand for durable EV tires with long-lasting, self-regenerating treads and rapid heat dissipation properties further spur the market growth. ´Increasing adoption across the EU is also benefitting from the growth of battery-electric commercial vehicles and from a higher penetration of performance EVs. Moreover, investment in R&D for sustainable tire materials is propelling innovation within the EV tire industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 26.3% |

Market growth prospects in Japan’s EV tires sector are driven by the nation’s pioneering automotive technology, deployment in electric mobility, and demand for durable and high-performance tire solutions. The adoption of urban electric vehicles is boosting demand for quiet, low-energy-consumption tires in urban-use tires.

With a focus on cutting-edge material science and the integration of intelligent sensor-enabled tire monitoring, the development is driving innovation in the nation. In addition, stringent regulations by the government for energy-efficient vehicles and rising investments in synthetic rubber that are not based on petroleum also drive companies to produce performance vehicle tires for EV as well.

The growing consumption of aerodynamic and ultra-lightweight as well as heat-resistant tires in the Japanese automotive industry is again boosting sales growth. Japan also invests in sustainable tire manufacturing and AI road condition analysis to shape the future of EV tires.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 26.5% |

Rapid developments in tire technology, increasing government support towards the adoption of EVs, and building strong partnerships between automakers and tire manufacturers are making South Korea a major market for EV tires.

These factors, along with stringent environmental regulations regarding fuel efficiency and vehicle emission, and growing adoption of ultra-low rolling resistance and self-healing tire technology in vehicles, have a positive impact on the market growth. The country's focus on using AI to improve durability, grip and energy efficiency through predicting tire wear and enhancing tires with graphene-infused rubber compounds makes it elevating competitiveness, too.

Increasing adoption of high-performance EV tires in sports sedans, electric SUVs, and commercial EV fleets is also driving market adoption. To optimize EV efficiency, companies are investing in automated tire production, real-time wear monitoring, and wireless tire connectivity solutions. The burgeoning smart cities and autonomous vehicle development in South Korea is one of the key projects driving next-generation EV tires and fuel cell vehicles in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 26.4% |

Currently, radial tires dominate the EV tire market segment, as they offer better fuel efficiency, lower rolling resistance, and better durability. They generally provide better grip, longer tread wear, and less heat generation traits which make them ideal for battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs).

The movement toward sustainable mobility as well as high performance EV tires continues the development of low-noise tread designs, silica-based compounds or self-sealing technology. Meanwhile, radial tires have been acknowledged as preferred products for passenger cars and light commercial EVs, owing to their contributions to improve range efficiency and energy utilization.

Composite tires, a newer addition to the EV tire segment, are on the rise thanks to their light structure, superior aerodynamics, and unique material makeup. The tires are made with reinforced polymers, carbon fiber, and sustainable raw materials, resulting in high energy efficiency, lower carbon footprint, and greater durability.

Composite tires are being very heavily adopted by EV manufacturers in order to decrease vehicle weight, which translates to better battery efficiency and, as a result, longer driving range. Moreover, the demand for next-generation composite tires in the market is driven by the progress in 3D-printed tire structures, airless tire technologies, and wear-resistant smart compounds.

Tires in the 15”-18” range are the most common for mid-size passenger EVs, electric SUVs, and performance-oriented vehicles, and occupy the bulk of the EV tire space. These tires are designed to maximize road contact, increase cornering stability, and improve energy transfer to help give performance-oriented high-speed EVs handling that is safe and efficient.

The requirements for low rolling resistance and ultra-grip tread patterns have inspired innovation in all-season and energy-saving EV tires advancing both vehicle range and energy efficiency.

Above 18” tires are now increasingly common thanks to the proliferation of premium electric SUVs, high-performance EVs, and electric commercial vehicles. Bigger tires are built to withstand greater torque output and improved load-bearing and give a better grip.

With the rising interest in off-road-ready electric SUVs and electric trucks, manufacturers have created tires with reinforced sidewalls, noise-reduction foam, and ultra-tough rubber compounds for their larger EV tires. Moreover, tire brands are also exploring aerodynamic tread patterns, self-inflating tire technology, and intelligent tire monitoring systems, which can optimize performance and help maximize the lifespan of EV tires.

Battery electric vehicles (BEVs) constitute a significant segment in the EV tire domain as manufacturers focus on ensuring greater efficiency and long-range of tires in order to improve automotive performance. These properties are important given BEVs require extremely low rolling resistance, quiet operation and long tread life, which are among the drivers for sustainable tire development.

There is increasing demand for next-generation BEV-compatible tires owing to rising deployment of sustainable materials, smart tire pressure monitoring, and airless tire concepts.

HEVs also represent a major segment of the EV tire market, as they demand tires that allow for versatility, fuel efficiency, and wear resistance. HEVs combine electric and combustion propulsion systems, which require hybrid tire designs that minimize rolling resistance while retaining grip and durability.

Demand for low-emission, fuel-efficient hybrid mobility solutions have accelerated research and development of self-regenerating tire compounds, eco-friendly tread patterns and optimized shock absorption technologies.

The EV tires market is being driven by the growing adoption of electric vehicles (EVs), technological advancements in tire design, and a demand for tires that are energy efficient and low-rolling resistance. Companies are turning their efforts toward durable, high-performing rubber engineered to meet the enhanced stability and other demands of EVs, such as noise reduction and efficiency improvements.

Among them are: smart tires, self-sealing technology, and sustainable raw materials for eco-friendly manufacturing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Michelin | 18-22% |

| Bridgestone Corporation | 14-18% |

| Goodyear Tire & Rubber Company | 11-15% |

| Continental AG | 8-12% |

| Pirelli & C. S.p.A. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Michelin | Leading provider of EV-specific tires with low rolling resistance and high energy efficiency. |

| Bridgestone Corporation | Specializes in high-performance, durable EV tires with noise-reduction and extended tread life technology. |

| Goodyear Tire & Rubber Company | Develops intelligent tire technology, including self-regenerating and airless EV tires. |

| Continental AG | Focuses on eco-friendly tires with high load-bearing capacity and advanced safety features for EVs. |

| Pirelli & C. S.p.A. | Offers premium EV tires with advanced grip and optimized aerodynamics for improved range. |

Key Company Insights

Michelin (18-22%)

Michelin has an iron grip on the EV and utility tire sectors due to its focus on energy efficiency and long-term use. The company combines state-of-the-art low-rolling-resistance technology for increased EV range with durability in mind. Considering it generates revenues of USD 27 billion, Michelin's ongoing research and development of innovative tire materials, sustainable services, and smart tire technology has solid market leadership to highlight.

Bridgestone Corporation (14-18%)

Bridgestone focuses on high-performance EV tires that improve ride comfort, reduce road noise and increase tread wear life. The firm only makes tires for the most marginal right wing lunatics, to that end, they invest heavily into products designed for these next-gen materials and tire structures to meet the needs of EV manufacturers.

Bridgestone believes that eco-friendly production and advanced mobility solutions are the future of the industry, an outlook that forces the company on a daily basis to push itself to the limits of what is possible with tires.

Goodyear Tire & Rubber Company (11-15%)

When it comes to innovative rubber, Goodyear is leading the pack, with EV-ready airless and self-healing tire technology. The research and development efforts of the company center on efficiency, aerodynamics, and real-time tire monitoring. The partnerships Goodyear has built with automakers place it at the forefront of creative tire solutions for electric vehicles.

Continental AG (8-12%)

Continental offers a portfolio of environmentally friendly and performance-oriented EV tires designed for safety, efficiency, and sustainability. It includes innovative tread compounds and dynamic tire pressure technologies to make you drive better. With its smart tire system and predictive maintenance solutions, Continental increased its competitiveness in the market.

Pirelli & C. S.p.A. (6-10%)

At Pirelli, premium EV tires are heavy on grip, aerodynamics, and rolling efficiency. They draw on their experience with performance tires to create specialized solutions for high-end EVs. EV tires: Pirelli is focused on sustainable materials and developed noise reduction technology which helps Pirelli be a player in the EV tire space.

Other Key Players (30-40% Combined)

Over the years there have been a number of innovative developments taking place by both global and regional manufacturers when it comes to EV tire technology, driven by a focus on sustainability, performance and advanced mobility solutions. Key players include:

The overall market size for EV tires market was USD 15,136.58 million in 2025.

The EV tires market expected to reach USD 157,579.14 million in 2035.

The demand for the EV tires market will be driven by the growing adoption of electric vehicles, increasing focus on energy-efficient and low-rolling resistance tires, advancements in tire technology for enhanced durability and performance, rising government incentives for EV adoption, and expanding charging infrastructure.

The top 5 countries which drives the development of EV tires market are USA, UK, Europe Union, Japan and South Korea.

Radial and composite tires lead EV tire market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Propulsion, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Propulsion, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Propulsion, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Propulsion, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Propulsion, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Propulsion, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 42: Europe Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Propulsion, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by Propulsion, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 54: Asia Pacific Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Propulsion, 2018 to 2033

Table 56: Asia Pacific Market Volume (Units) Forecast by Propulsion, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 66: MEA Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Propulsion, 2018 to 2033

Table 68: MEA Market Volume (Units) Forecast by Propulsion, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 70: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Propulsion, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Propulsion, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Propulsion, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Propulsion, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Propulsion, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Tire Size, 2023 to 2033

Figure 33: Global Market Attractiveness by Propulsion, 2023 to 2033

Figure 34: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Propulsion, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Propulsion, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Propulsion, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Propulsion, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Propulsion, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Tire Size, 2023 to 2033

Figure 69: North America Market Attractiveness by Propulsion, 2023 to 2033

Figure 70: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Propulsion, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Propulsion, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Propulsion, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Propulsion, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Propulsion, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Tire Size, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Propulsion, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Propulsion, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 124: Europe Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Propulsion, 2018 to 2033

Figure 128: Europe Market Volume (Units) Analysis by Propulsion, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Propulsion, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Propulsion, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 132: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Tire Size, 2023 to 2033

Figure 141: Europe Market Attractiveness by Propulsion, 2023 to 2033

Figure 142: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Propulsion, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Propulsion, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Units) Analysis by Propulsion, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Propulsion, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Propulsion, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Tire Size, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Propulsion, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Propulsion, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 196: MEA Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Propulsion, 2018 to 2033

Figure 200: MEA Market Volume (Units) Analysis by Propulsion, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Propulsion, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Propulsion, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 204: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 212: MEA Market Attractiveness by Tire Size, 2023 to 2033

Figure 213: MEA Market Attractiveness by Propulsion, 2023 to 2033

Figure 214: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 215: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Charger Tester Market Size and Share Forecast Outlook 2025 to 2035

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

EV Charger Converter Module Market Forecast Outlook 2025 to 2035

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA