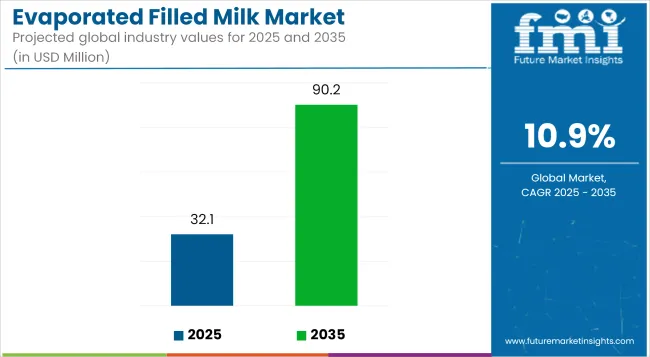

Surging demand is expected to elevate the global evaporated filled milk market from USD 32.05 million in 2025 to approximately USD 90.19 million by 2035, translating to a CAGR of 10.9% over the decade. Consumer interest in dairy alternatives that offer similar taste and texture but at a lower cost has significantly strengthened the market dynamics for evaporated filled milk.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 32.05 Million |

| Projected Market Size in 2035 | USD 90.19 Million |

| CAGR (2025 to 2035) | 10.9% |

Cost-sensitive regions with limited access to fresh milk and cold chain infrastructure are increasingly adopting this product as a stable, accessible dairy alternative. Additionally, the rise in processed food consumption and shelf-stable formulations has favored its uptake in commercial kitchens and large-scale food manufacturing operations.

A noticeable expansion in demand has been observed from both the retail and B2B sectors, particularly within bakery, dessert, and ready-to-eat product lines. Market growth is supported by a dual trend of affordability and functionality. However, the absence of strong consumer branding, limited awareness in developed countries, and regulatory concerns around milk fat alternatives may restrict its widespread adoption.

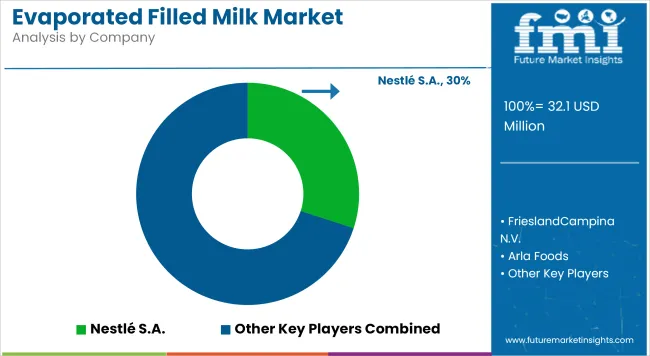

Market participants are actively working to improve nutritional fortification and enhance labeling to align with clean-label trends. The surge in private label offerings and regional brand diversification is also altering the competitive environment.

Between 2025 and 2035, the market is anticipated to transition from niche adoption to wider B2B integration, especially in economies across Asia-Pacific and the Middle East. By 2025, canned variants are expected to dominate the market, given their distribution convenience and longer shelf life.

By 2035, innovation around functional ingredient integration and fortified formats is expected to unlock new application territories. The market’s expansion is likely to remain anchored in its ability to deliver cost-effective dairy-like performance across foodservice and industrial food applications.

Private label brands are projected to account for approximately 18.4% of the evaporated filled milk market by 2025. This segment has emerged as a strategic lever for value-conscious consumers and mass-market retailers, especially in Latin America and Southeast Asia. The cost advantages of private labels, combined with regionally tailored taste profiles and packaging formats, have intensified their appeal in low- and middle-income consumer segments.

Supermarket chains in the Philippines, Egypt, and Nigeria have expanded their house-brand evaporated filled milk lines, often sourcing from regional co-packers or contract manufacturers. Unlike multinationals, private label products have more flexibility to adapt to shifting fat blend regulations or consumer labeling preferences, particularly around palm oil disclosure.

However, regulatory frameworks such as the Codex Alimentarius Standard for Filled Milks (CODEX STAN 253-2006) can influence product formulation and market entry dynamics. In response, private label players are increasingly focused on complying with labeling accuracy and clean-label demand by reducing additives and incorporating vitamin fortification.

Regional co-packers such as Pinoy Dairies and Middle East-based Gulf & Safa Dairies have benefited from this shift. As consumer trust in supermarket brands increases, private label growth is expected to outpace branded counterparts in high-volume, cost-sensitive B2C categories.

Powdered evaporated filled milk is anticipated to hold a 15.7% market share by 2025 and is projected to witness rapid adoption, particularly in foodservice and institutional sectors. This segment offers advantages in transportation, warehousing, and ambient storage-benefits that resonate in countries with underdeveloped cold chain infrastructure. Southeast Asian countries such as Vietnam and Cambodia have reported steady imports of powdered filled milk for use in beverages and dessert mixes.

Multinational companies including NZMP (Fonterra), FrieslandCampina Kievit, and Hoang Anh Dairy have capitalized on this demand through fat-modified milk powder blends optimized for tropical climate reconstitution. Additionally, powdered variants align well with military rations, emergency food supply programs, and government procurement in Africa and South Asia. Powdered formats also support consistent fat levels and customized ingredient profiles for diverse culinary needs.

Despite these advantages, challenges such as lower perceived freshness and longer hydration times may limit household adoption. Nonetheless, institutional buyers prioritizing volume, price stability, and shelf life continue to drive segment expansion. Regulatory considerations around milk powder reconstitution ratios and labeling requirements are monitored by regional agencies such as the ASEAN Food Safety Network.

Regulatory Compliance and Product Standardization

The Evaporated filled milk market is adversely affected by food safety regulations, which require product standardization imposed by food safety organizations such as the FDA, EFSA and Codex Alimentarius. Labeling requirements, ingredient limitations, and nutritional composition restrictions add layers of complexity for manufacturers.

Moreover, discrepancies in regional standards present obstacles for global trade and product formulation. To comply with the flexibility that is present in the global environment, companies have to drill down on regulatory need technical experts, ensuring standardized production processes, and a higher level of transparency in product labels.

Consumer Perception and Competition from Dairy Alternatives

There is a rising demand for nutritious alternatives and the growing popularity of plant-based dairy substitutes as well as premium dairy offerings can give a tough competition to the evaporated filled milk market. Lactose-free, organic, and fortified plant-based options have become popular among health-conscious consumers.

There are also consumer trust issues regarding vegetable oil usage in filled milk products. These being said, players need to educate consumers about the nutritional benefits of evaporated filled milk, develop variants fortified with additional nutrients, and adopt sustainable sourcing practices.

Growing Demand in Emerging Markets and Foodservice Industry

The increasing need for economical dairy substitutes in developing markets is fueling the growth of evaporated filled milk. In pastes where access to fresh milk is limited, filled milk (including evaporated and/or condensed milk) is a cost-effective solution for households and foodservice, thanks to its permanence.

Furthermore, the growing bakery, confectionery & food service sectors serve as an excellent complement for evaporated filled milk as key components in recipes. Increasing demand in these sectors will be rewarding for companies investing in localized production, strategic distribution partnerships, and out-of-the-box packaging solutions.

Innovations in Formulation and Sustainable Packaging

The development of new, product formulations like low fat, fortified and lactose free evaporated filled milk, is creating new market opportunities. This trend is driving manufacturers to fortify with vitamins, minerals and functional ingredients to target health-conscious consumers.

But sustainable packaging alternatives like recyclable canisters, biodegradable boxes and lightweight materials meet rising environmental awareness. Brands focusing on clean-label formulations, sustainable packaging, and creative dairy blends will be well-positioned in this changing landscape.

The Evaporated filled milk market created steady growth with driving factors, including growing affordability concerns, the thriving demand in developing regions, and extended shelf life.

However, challenges like variations in raw material pricing, competition from plant-based alternatives, and compliance with regulations were also present in the market. “Filling” spirits (like brandy) and “denatured” alcohols, used in cleaning products, were particularly targeted, yet “companies responded by extending the product lines, sourcing improvements, and marketing the low-cost, versatile options that filled milk provides,” the authors write.

Trends to follow from 2025 to 2035 include sustainable dairy production, artificial intelligence-based supply chain optimization, and functional ingredient advancements. Growth of fortified filled milk (with proteins, probiotics, and omega-3 fatty acids) to meet the increasing demand for nutrition-oriented dairy-based products.

This will be complemented by the continued implementation of technologies such as blockchain for product traceability, digital marketing for consumer engagement, and eco-friendly packaging initiatives, which will all play an integral role in market evolution. The next phase of Evaporated filled milk market will be characterized by companies focusing on innovation, sustainability, and strategic global expansion.

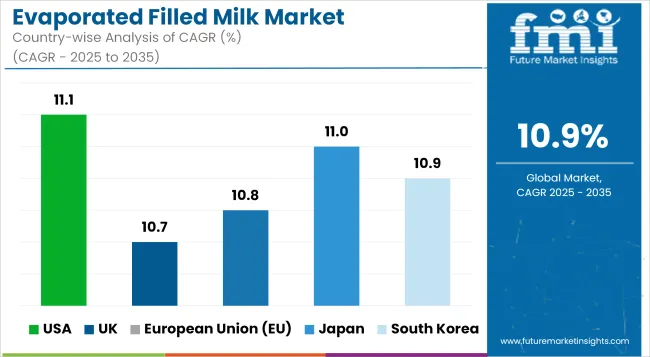

The United States leads the evaporated filled milk market owing to the increasing demand for shelf-stable dairy alternatives along with rising consumer preference for affordable milk substitutes and presence of major dairy product manufacturers. One of the prime factors responsible for market growth is increasing usage of evaporated filled milk for bakery, confectionery and processed food applications.

The increasing investments in product development, such as fortified and lactose-free, are also expected to boost the market growth. Moreover, inclusion of plant based and functional ingredients in the evaporated filled milk formulations are enhancing facilitators of product attractiveness.

Driven by changing consumer trends, companies focus on building sustainable packaging and extended shelf-life products. Demand in the USA market is driven further by the growing trend of using evaporated filled milk in food service, ready-to-eat meals, and coffee creamer applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.1% |

The United Kingdom is a key market for evaporated filled milk, owing to the growing demand for low-cost substitutes for dairy, increasing applications in bakery and confectionery, and growing awareness of long-lasting replacements for dairy. A projection on the reduction in food waste and increasing shelf-life products are further driving the market growth.

Market expansion is enhanced through favorable government regulations promoting dairy alternatives, alongside the introduction of low-fat and enriched evaporated milk variations. And through innovation in plant-based filled milk formulations, organic ingredient sourcing, and sustainable packaging are trending.

Health-conscious consumers are also supporting lactose-free, vitamin fortified and sugar-reduced evaporated milk, companies are investing in it as well. Additionally, market adoption in the UK is driven by the rising consumer demand for convenient and nutritionally enhanced dairy substitutes in retail, cafés, and food service industries. The rising trend of plant-based diets also increasing the rate of non-dairy filled milk products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.7% |

The European evaporated filled milk market is dominated by Germany, France, And Italy Due To Strong Dairy Industry Infrastructure, Rising Demand For Long-Lasting Milk Substitutes, and Increasing Investments in Fortified Dairy Alternatives.

This drives market due to the European Union focusing on sustainable dairy production, as well as investing in high protein and nutrient-enriched evaporated milk formulations. Moreover, the use of sustainable, BPA-free packaging, shelf-life enhancement technologies, and hybrid dairy-plant blends helps contribute to the diversity of products available.

Moreover, the growing need for convenient, non-refrigerated dairy products in convenience stores, hotels, and the catering sector is anticipated to propel market growth. The broader adoption across the EU is also supported by the expansion of regulatory frameworks ensuring safe and quality of dairy, and innovations in low-sugar and cholesterol-reducing milk alternatives.

In addition, the increasing trend of fortifying dairy products with probiotics and omega-3s is driving innovation in the evaporated filled milk market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

The filled milk sector in Japan is growing due to the country’s obsession with high-end dairy substitutes, soaring demand for high-nutrition milk products and a rising appetite for shelf-stable dairy substitutes. Increasing demand for extended shelf-life dairy for convenience and ready-to-eat meals is fuelling market growth.

Innovation is being driven by the country's focus on advanced food processing technologies combined with the inclusion of milk that is enriched with calcium and low-lactose filled. In addition, stringent government regulations regarding food safety, coupled with rising investments towards sustainable dairy production, are driving companies to develop high-quality, shelf-stable milk alternatives.

Furthermore, the growing use of evaporated filled milk in premium confections, match-based drinks, and classic desserts is propelling market growth, in Japan’s food industry. Moreover, the rising investment by Japan towards the integration of AI technology in the dairy sector has played a pivotal role in revolutionizing the processing and smart packaging of evaporated milk products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.0% |

The market for evaporated filled milk in South Korea is expected to grow, with strong government initiatives towards sustainable dairy production, increasing demand for convenient and affordable dairy alternatives, and rising uptake of fortified milk products.

Market expansion is also driven by strict food safety regulations and growing investments in low-fat, high-protein, and vitamin-enriched milk alternatives. Furthermore, the country is seeking to become more competitive in dairy processing with artificial intelligence based quality control, aseptic packaging, and probiotic-enhanced formulations.

Market adoption of filled milk is also fueled by its growing demand in café chains, dessert manufacturing, and home cooking applications. Health-conscious consumers are now demanding omega-rich, lactose-free, and organic varieties of evaporated milk, and companies are catering to these demands with their investments.

In South Korea, a surge in demand for new millennial plant-based applications, as well as dairy-free and hybrid plant-dairy milk combinations is further driving demand for innovative evaporated filled milk solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.9% |

Market Drivers the evaporated filled milk market are expanding owing to high demand for cost-effective dairy alternatives, increasing application in bakery and confectionery products and increasing consumption in developing countries.

With the evolution of consumer preferences, companies are working to enhance product shelf life, fortification with vital nutrients, and sustainable packaging solutions. Highlights include lactose-free products, organic evaporated filled milk, and new products of plant-based filled milk alternatives.

The overall market size for evaporated filled milk market was USD 32.05 million in 2025.

The evaporated filled milk market expected to reach USD 90.19 million in 2035.

The demand for the evaporated filled milk market will be driven by increasing consumption in the food and beverage industry, rising demand for cost-effective dairy alternatives, expanding bakery and confectionery applications, growing popularity in emerging markets, and extended shelf life benefits for convenient storage and transportation.

The top 5 countries which drives the development of evaporated filled milk market are USA, UK, Europe Union, Japan and South Korea.

Goat milk and regular milk drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Global Prefilled Formalin Vials Market Trends – Size, Share & Growth 2025 to 2035

Prefilled Syringe Drug Molecule Market Analysis - Size, Share, and Forecast 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Pre-Filled Hemostasis Agents Market - Trends & Forecast 2025 to 2035

Oil Filled Transformer Market Growth – Trends & Forecast 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Transformer Market Growth – Trends & Forecast 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand for Fat Filled Milk Powder in EU Size and Share Forecast Outlook 2025 to 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Polymer-based Prefilled Syringe Market Growth & Healthcare Trends 2024-2034

Demand and Trends Analysis of Fat Filled Milk Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Fat Filled Milk Powder in Korea Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA