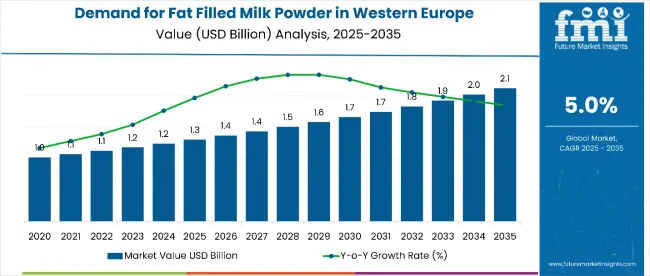

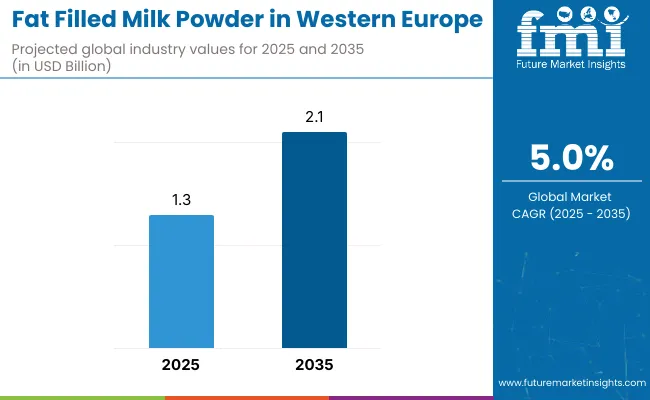

Sales of fat filled milk powder in Western Europe are estimated at USD 1.3 billion in 2025, and are projected to reach USD 2.1 billion by 2035, reflecting a CAGR of approximately 5.0% over the forecast period. This growth reflects expanding convenience food adoption and increased per capita consumption across major urban centers throughout the region. The rise in demand is linked to shifting lifestyle patterns, growing preference for shelf-stable dairy alternatives, and evolving food processing trends.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 1.3 Billion |

| Market Size (2035) | USD 2.1 Billion |

| CAGR (2025 to 2035) | 5.0% |

By 2025, per capita consumption in leading Western European countries such as Netherlands, Germany, and France averages between 2.1 to 2.8 kilograms, with projections reaching 3.4 to 4.5 kilograms by 2035. Netherlands leads among individual countries, expected to generate USD 467 million in fat filled milk powder sales by 2035, followed by Germany (USD 421 million), France (USD 378 million), Italy (USD 329 million), and United Kingdom (USD 287 million).

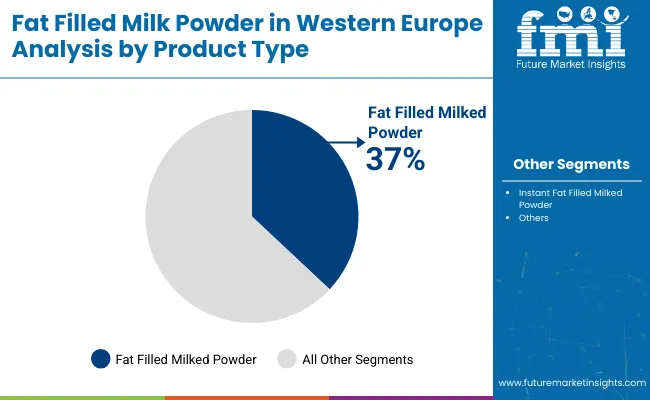

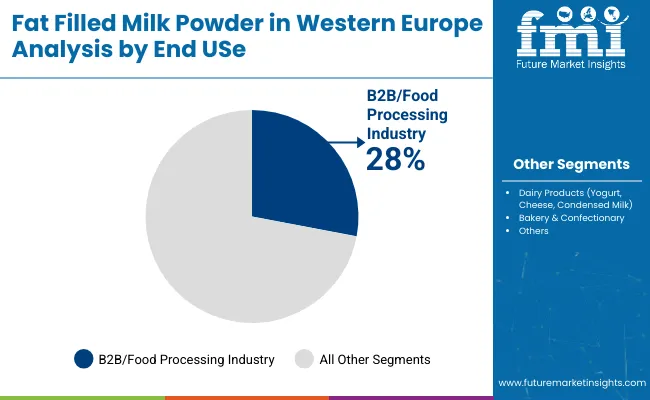

The largest contribution to demand continues to come from 28% fat content products, which are expected to account for 37% of total sales in 2025, owing to optimal nutritional composition, cost-effectiveness compared to whole milk powder, and consumer preference for moderate-fat dairy alternatives. By end use classification, dairy products represent the dominant application, responsible for 28.4% of all sales, while food processing and retail channels are expanding rapidly.

Consumer adoption is particularly concentrated among convenience-oriented households and cost-conscious families, with urbanization levels and disposable income emerging as significant drivers of demand. While pricing remains competitive, the average cost advantage over whole milk powder has stabilized around 20-25% in 2025.

Continued improvements in processing efficiency and supply chain optimization are expected to accelerate affordability and access across diverse income segments. Regional disparities persist, but per capita demand in Southern European countries is narrowing the gap with traditionally strong Northern European consumption patterns.

The fat filled milk powder segment in Western Europe is classified across several categories. By product type, the key segments include 26% fat content, instant 26%, 28% fat content, and instant 28% variants. By end use, the segment spans B2B food processing applications including ice cream, bakery and confectionery, chocolate, beverages, soups, sauces, coffee and tea, and dairy products, as well as B2C retail channels including supermarkets, convenience stores, department stores, specialty stores, and online retail. By country, coverage includes United Kingdom, Germany, France, Italy, Spain, Netherlands, and rest of Western Europe territories.

28% fat content variants are projected to dominate sales in 2025, supported by optimal nutritional balance, cost advantages over whole milk powder, and widespread adoption in both retail and food processing applications. Other variants such as 26% and instant formulations are growing steadily, each serving distinct consumption and processing needs.

In 2025, the B2B food processing industry is projected to account for 28% of total fat filled milk powder sales in Western Europe, cementing its position as the leading end-use segment. Its dominance stems from the ingredient’s adaptability across diverse product categories, cost competitiveness against whole milk powder, and ability to deliver consistent quality in large-scale production.

The sector benefits from strong demand in dairy manufacturing, bakery, confectionery, and beverage industries, all of which integrate fat filled milk powder for texture, taste, and nutritional enhancements. Western Europe’s advanced food processing infrastructure and established export further strengthen the segment’s growth prospects over the next decade.

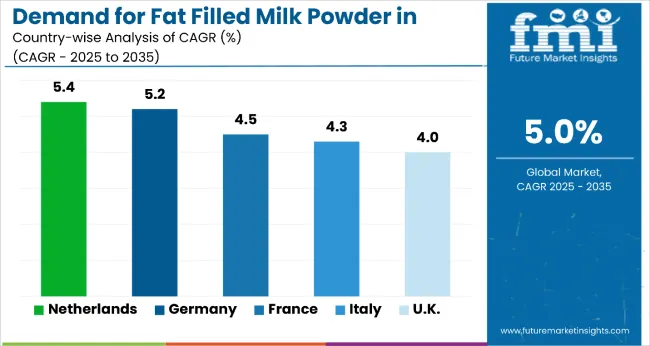

| Country | CAGR (2025 to 2035) |

|---|---|

| Netherlands | 5.4% |

| Germany | 5.2% |

| France | 4.5% |

| Italy | 4.3% |

| UK | 4.0% |

The Netherlands leads with the highest projected CAGR of 5.4% from 2025 to 2035, supported by advanced production capacity and a strong export orientation. Germany follows closely at 5.2%, driven by its vast industrial processing infrastructure and competitive pricing strategies.

France, with a CAGR of 4.5%, benefits from premium positioning and strong culinary integration, appealing to both domestic and export. Italy is projected to grow at 4.3%, where modernization in processing and expanding exports to Mediterranean are key growth levers. The United Kingdom, at 4.0%, is leveraging retail network expansion and e-commerce adoption to sustain demand.

Fat filled milk powder sales will not grow uniformly across every Western European country. Rising dairy processing capabilities and faster adoption of cost-effective dairy alternatives in traditionally strong dairy regions give Netherlands and Italy a measurable edge, while mature consumer countries such as Germany and France expand more steadily from higher baseline consumption. The table below shows the compound annual growth rate (CAGR) each of the five key countries is expected to record between 2025 and 2035.

Fat filled milk powder in Netherlands lead the highest CAGR of 5.4%, driven by strong production infrastructure and efficient export channels. The country’s well-established dairy processing plants ensure consistent supply to both domestic and international. Its strategic port locations, including Rotterdam, allow easy access to EU and global destinations. Advanced automation in production boosts both volume and quality output.

The Netherlands also leads in R&D investment for product innovation, especially in nutritional fortification and tailored blends. Per capita consumption of dairy products here is among the highest in the region, supporting steady internal demand. Major brands, especially FrieslandCampina, dominate share with integrated farmer-to-market models. The country’s focus on sustainability and green energy adoption in dairy processing enhances its competitive edge globally.

Sales of fat-filled milk powder in Germany is expected to grow at a CAGR of 5.2%, due to its vast food processing capabilities and large consumer base. High-quality production standards, combined with a diverse range of applications in bakery, confectionery, and beverages, drive consistent demand. Germany benefits from a well-connected logistics network, ensuring efficient supply to both domestic retailers and export destinations.

Retail penetration is exceptionally high, with fat filled milk powder available across supermarkets, hypermarkets, and discount chains. Increasing interest in cost-effective dairy alternatives further boosts the product’s competitiveness. Industrial buyers value the ingredient’s long shelf life and functionality in multiple recipes. Investments in automation and energy-efficient production methods are enhancing Germany’s output capacity. The country is also strengthening its export profile to neighboring EU states, ensuring growth beyond local consumption.

Revenue of fat-filled milk powder in France is projected to expand at a CAGR of 4.5%, driven by rich culinary traditions and demand for high-quality dairy products. The country integrates the ingredient into both artisanal and industrial production, ensuring broad coverage. Fat filled milk powder is increasingly used in bakery, confectionery, and dessert manufacturing, appealing to both premium and mass-market segments.

France’s export capacity is strong, particularly to French-speaking in Africa and the Middle East. Food service adoption is high, with chefs valuing its stability, taste, and cost benefits. Domestic demand is underpinned by a culture of high dairy consumption and innovation in product formats. Companies in France often focus on premium quality and EU certification compliance, enhancing consumer trust. Ongoing investment in processing technology is also improving efficiency and output consistency.

Sales of fat-filled milk powder in Italy is projected to grow at a CAGR of 4.3%, due to modernization in processing facilities, enabling higher efficiency and output quality. The ingredient is increasingly incorporated into traditional Mediterranean recipes, as well as modern convenience foods. Italian manufacturers are adapting their formulations to suit both domestic tastes and export requirements.

Export potential to Mediterranean and Middle Eastern is rising, supported by competitive pricing. Urbanization and busier lifestyles are driving higher retail adoption of shelf-stable dairy alternatives. Ice cream, coffee, and bakery sectors are among the biggest consumers of fat filled milk powder in Italy. Product innovation, including flavor-enhanced variants, is boosting appeal. Government incentives for sustainable manufacturing are further encouraging upgrades in dairy production facilities.

Sales of fat-filled milk powder in the United Kingdom is expected to grow at a CAGR of 4.0%, due to its strong retail distribution networks and growing online sales channels. Consumers increasingly value the product’s long shelf life, affordability, and versatility in food preparation. The food service sector is a significant consumer, integrating fat filled milk powder into beverages, desserts, and bakery products.

Competitive pricing compared to whole milk powder is encouraging adoption among both households and industrial users. Online grocery platforms have emerged as a strong growth driver, especially post-pandemic. Retail diversity, from supermarkets to specialty stores, ensures broad accessibility across the UK. Product innovation is also helping brands differentiate in a price-sensitive space. Sustainability initiatives in packaging and sourcing are increasingly influencing purchasing decisions.

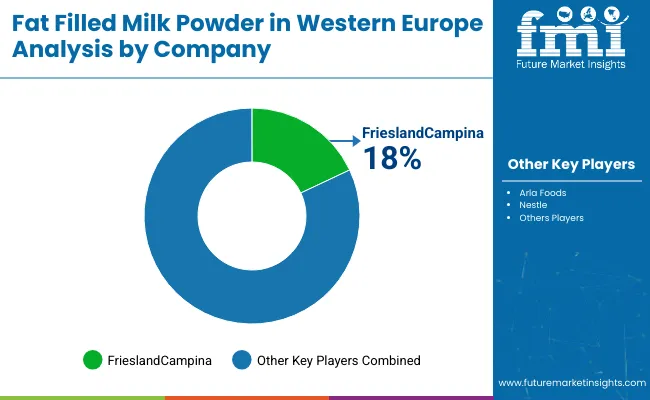

The competitive environment is characterized by a mix of established dairy cooperatives and multinational food ingredient suppliers. Processing scale rather than pure product diversity remains the decisive success factor: the five largest suppliers collectively serve more than 25,000 food manufacturers and retailers across the region and account for a majority of both B2B and retail distribution in the category.

FrieslandCampina is the most established cooperative participant. As a leading European dairy cooperative, the company offers comprehensive fat filled milk powder solutions, all meeting strict European quality standards. Its core range of dairy ingredients and nutritional products gives it deep penetration in food processing channels while maintaining full regional coverage through major retailers and food service distributors.

Arla Foods, with strong Northern European heritage, leverages cooperative scale and sustainability positioning to place premium fat filled milk powder in quality-focused applications and health-conscious consumer segments. Recent investments in sustainable packaging and organic certifications have allowed Arla to introduce premium variants positioned for environmentally aware consumers, reinforcing its role as a responsibility-focused supplier.

The next tier comprises specialized processors and regional dairy companies. Danone focuses on premium applications for health-focused food manufacturing, recent innovation initiatives showed growth in functional ingredient applications, signaling established positioning in value-added segments. Fonterra, expanding through international positioning, adds high-specification fat filled powders to growing export-oriented supply chains and is expected to benefit from increasing demand for reliable global ingredient sourcing.

Private-label programs at major European retailers including Carrefour, Tesco, and REWE are widening consumer access at price points 10-18% below branded equivalents, putting margin pressure on smaller suppliers while supporting household adoption. Consolidation is therefore likely to continue as processing scale and distribution coverage become critical for maintaining retail partnerships and quality consistency in this expanding category.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1.3 Billion |

| By Product Type | 26% Fat Content, Instant 26% Fat Content, 28% Fat Content, and Instant 28% Fat Content |

| By End-Use Application | B2B/Food Processing Industry (Ice Cream, Bakery & Confectionery, Chocolate, Fruits & Flavored Beverages, Soups, Sauces, Coffee & Tea, and Dairy Products such as Yogurt, Cheese, Condensed Milk, and B2C/Retail (Supermarkets & Hypermarkets, Convenience Stores, Department Stores, Specialty Stores, and Online Retail) |

| Regions Covered | Western Europe |

| Country Covered | Netherlands, Germany, France, Italy, and United Kingdom |

| Top Companies Profiled | Arla Foods, Alpen Food Group, Dana Dairy, Vreugdenhil, Armor Proteines, BONILAIT PROTEINES, Polindus, Hoogwegt International, Belgomilk, Dale Farm Ltd, Lakeland Diaries, Holland Dairy Foods, and Revala Ltd. |

| Additional Attributes | Cost-effective alternative to whole milk powder, rising adoption in bakery, confectionery, and beverage manufacturing, strong export demand from Western Europe, advancements in dairy processing technology, increasing focus on sustainable and energy-efficient production |

The global demand and trends analysis of fat filled milk powder in Western Europe is estimated to be valued at USD 1.3 billion in 2025.

The market size for the demand and trends analysis of fat filled milk powder in Western Europe is projected to reach USD 2.1 billion by 2035.

The demand and trends analysis of fat filled milk powder in Western Europe is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in demand and trends analysis of fat filled milk powder in Western Europe are fat filled milk powder 26%, instant fat filled milk powder 26%, fat filled milk powder 28% and instant fat filled milk powder 28%.

In terms of end use, b2b / food processing industry segment to command 35.5% share in the demand and trends analysis of fat filled milk powder in Western Europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand and Trends Analysis of Fat Filled Milk Powder in Korea Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand for Fat Filled Milk Powder in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Powdered Cellulose Market Analysis by Source, End-use, Functionality, and Country Through 2035

Western Europe Baby Powder Market Analysis – Size, Share & Trends 2025 to 2035

Demand and Trend Analysis of Yogurt Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Western Europe Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Fat Fractions Market

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA