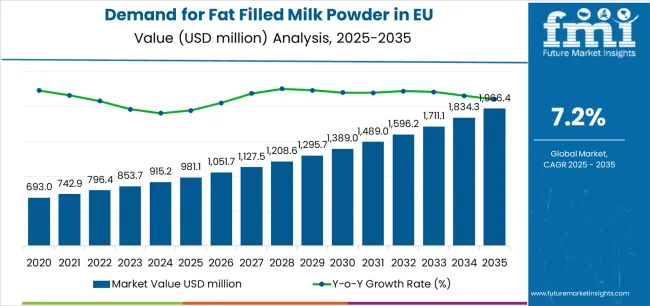

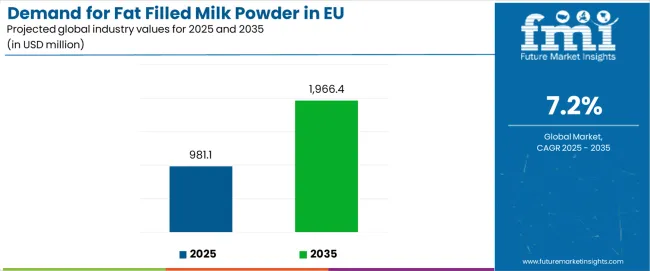

European Union fat filled milk powder sales are projected to grow from USD 981.1 million in 2025 to approximately USD 1,966.4 million by 2035, recording an absolute increase of USD 981.1 million over the forecast period. This translates into total growth of 100%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.2% between 2025 and 2035. The overall industry size is expected to grow by exactly 2.0X during the same period, supported by the increasing demand for cost-effective dairy ingredients, growing applications across confectionery and bakery manufacturing, and expanding usage in recombined dairy products throughout European food processing and consumer retail channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 981.1 million |

| Market Forecast Value (2035) | USD 1,966.4 million |

| Forecast CAGR (2025-2035) | 7.2% |

Future Market Insights, globally acknowledged for evidence-based foresight in nutrition and ingredient innovation, states that between 2025 and 2030, EU fat filled milk powder demand is projected to expand from USD 981.1 million to USD 1,396.5 million, resulting in a value increase of USD 415.4 million, which represents 42.3% of the total forecast growth for the decade. This phase of development will be shaped by rising food manufacturer adoption of cost-effective dairy alternatives, increasing usage in recombined milk products across developing markets, and growing recognition of fat filled milk powder as functional ingredient enabling price-competitive formulations. Manufacturers are expanding their product portfolios to address the evolving preferences for consistent quality, customized fat blends, and functionally optimized compositions meeting European food manufacturing standards.

From 2030 to 2035, sales are forecast to grow from USD 1,396.5 million to USD 1,966.4 million, adding another USD 565.7 million, which constitutes 57.7% of the overall ten-year expansion. This period is expected to be characterized by further expansion of palm-free varieties, integration into premium confectionery formulations for enhanced mouthfeel, and development of specialized blends targeting specific application requirements. The growing emphasis on sustainable sourcing and increasing manufacturer willingness to adopt certified palm-free alternatives will drive demand for high-quality fat filled milk powder products that deliver authentic dairy functionality with cost optimization.

Between 2020 and 2025, EU fat filled milk powder sales experienced solid expansion at a CAGR of 6%, growing from USD 733.1 million to USD 981.1 million. This period was driven by increasing cost pressures in dairy ingredient procurement, rising awareness of fat filled milk powder's functional versatility, and growing recognition of formulation flexibility across diverse food applications. The industry developed as major food processors and specialized dairy companies recognized the commercial potential of cost-effective dairy ingredient alternatives. Product innovations, improved fat blend technologies, and quality consistency enhancements began establishing manufacturer confidence and mainstream acceptance of fat filled milk powder in industrial food production.

Industry expansion is being supported by the rapid increase in processed food manufacturing across European countries and the corresponding demand for cost-effective, functionally reliable, and consistent dairy ingredients with proven performance in applications requiring milk solids and fat content. Modern food manufacturers rely on fat filled milk powder as strategic ingredient substitutes in chocolate products, dairy recombination, bakery fillings, and ice cream formulations, driving demand for products that deliver authentic dairy taste, appropriate fat profiles, and reliable functionality at competitive pricing. Even minor cost considerations, such as whole milk powder price volatility, supply chain disruptions, or margin pressure requirements, can drive comprehensive adoption of fat filled milk powder to maintain optimal product quality while supporting cost-effective manufacturing.

The growing awareness of ingredient economics and increasing recognition of fat filled milk powder's functional equivalence are driving demand for dairy ingredient alternatives from certified suppliers with appropriate food safety credentials and quality consistency. Regulatory authorities are increasingly establishing clear guidelines for dairy ingredient labeling, composition standards, and quality requirements to maintain consumer safety and ensure product transparency. Scientific research studies and sensory analyses are providing evidence supporting fat filled milk powder's functional performance and taste equivalence, requiring specialized blending technologies and standardized production protocols for optimal fat integration, appropriate particle characteristics, and consistent rehydration performance across diverse processing applications.

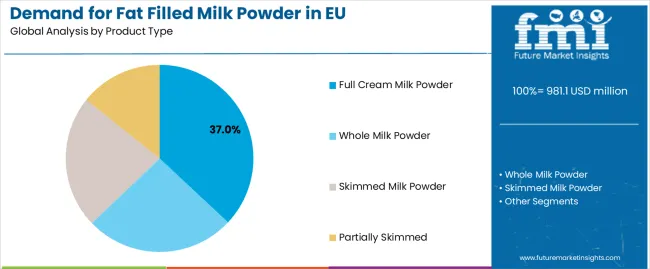

Sales are segmented by product type, application (end use), distribution channel, nature, and country. By product type, demand is divided into full cream milk powder, whole milk powder, skimmed milk powder, and partially skimmed formats. Based on application, sales are categorized into dairy products, bakery products, confectionaries, ice cream, and others. In terms of distribution channel, demand is segmented into supermarkets & hypermarkets, specialty stores, department stores, online, and convenience stores. By nature, sales are classified into organic/palm-free and conventional. Regionally, demand is focused on Germany, the Netherlands, France, Italy, Spain, and the Rest of Europe.

The full cream milk powder segment is projected to account for 37% of EU fat filled milk powder sales in 2025, declining slightly to 36% by 2035, establishing itself as the preferred format across European manufacturers. This commanding position is fundamentally supported by full cream milk powder's superior taste profile, excellent creaminess characteristics, and optimal fat content enabling authentic dairy flavor delivery. The full cream format delivers exceptional manufacturing value, providing food processors with an ingredient solution that replicates whole milk powder functionality while offering cost advantages essential for margin-sensitive applications.

This segment benefits from mature formulation expertise, well-established supplier relationships, and extensive application knowledge from multiple food manufacturers who maintain rigorous quality specifications and continuous process optimization. Additionally, full cream fat filled milk powder offers versatility across various applications, including chocolate confectionery, bakery creams, dairy beverages, and ice cream bases, supported by proven blending technologies that address traditional challenges in fat distribution uniformity and storage stability.

The segment is expected to maintain its dominant position through 2035 at 36%, demonstrating stable positioning as alternative formats complement rather than displace full cream's established preference throughout the forecast period.

Key advantages:

.webp)

Dairy products applications are positioned to represent 33% of total fat filled milk powder demand across European operations in 2025, declining slightly to 32% by 2035, reflecting the segment's maturity as the primary application within the overall category. This substantial share directly demonstrates that dairy recombination and dairy-based products represent the core usage, with manufacturers utilizing fat filled milk powder for recombined milk production, yogurt formulations, cheese analogs, and dairy beverage applications requiring cost-effective milk solid solutions.

Modern dairy processors increasingly view fat filled milk powder as essential cost management tools, driving demand for products optimized for specific protein-to-fat ratios with appropriate emulsification properties, controlled dissolution characteristics, and stability profiles supporting extended shelf life requirements. The segment benefits from continuous innovation focused on improved functionality, enhanced nutritional profiling, and application-specific customization enabling diverse dairy product manufacturing.

The segment's declining share reflects faster expansion in bakery and confectionery applications, with dairy products maintaining solid absolute growth while representing a smaller percentage as alternative applications expand throughout the forecast period.

Key drivers:

Supermarkets and hypermarkets are strategically estimated to control 45% of total European fat filled milk powder sales in 2025, declining to 42% by 2035, reflecting the critical importance of modern retail channels for ensuring consumer accessibility and mainstream availability. European retail operators consistently demonstrate growing shelf space allocation for affordable dairy products manufactured using fat filled milk powder ingredients that deliver value pricing, consistent quality, and familiar taste profiles across everyday dairy categories.

The segment provides essential consumer touchpoints through widespread distribution, competitive pricing strategies, and promotional activities supporting category awareness and trial purchase. Major European retailers, including Carrefour, Tesco, Rewe, Aldi, and Lidl, systematically feature dairy products, confectioneries, and bakery goods incorporating fat filled milk powder, often through private-label offerings and value-oriented brands that normalize cost-effective dairy ingredient usage and drive household consumption.

The segment's declining share through 2035 reflects growing online channel adoption, which expands from 12% to 18%, as digital-savvy consumers increasingly leverage e-commerce convenience while maintaining supermarket preference for routine grocery shopping throughout the forecast period.

Success factors:

Conventional fat filled milk powder products are strategically positioned to contribute 94% of total European sales in 2025, declining to approximately 90% by 2035, representing products manufactured through standard fat blending processes typically utilizing palm oil or palm kernel oil without organic or palm-free certifications. These conventional products successfully deliver cost-effective functionality and consistent quality while ensuring broad commercial availability across all food manufacturing sectors that prioritize ingredient economics and processing efficiency.

Conventional production serves cost-conscious manufacturers, value-oriented food applications, and mass market processors that require reliable dairy ingredients at competitive price points without sustainability certification premiums. The segment derives significant competitive advantages from established palm oil supply chains, economies of scale in processing, and the ability to meet substantial volume requirements from major food manufacturers without sourcing constraints limiting raw material flexibility.

The segment's declining share through 2035 reflects the category's evolution toward premium organic/palm-free products, which grow from 6% in 2025 to 10% in 2035, as sustainability-focused food brands and premium product developers increasingly prioritize certified sustainable sourcing and palm-free positioning responding to consumer environmental concerns.

Competitive advantages:

EU fat filled milk powder sales are advancing robustly due to increasing whole milk powder price volatility, growing food manufacturer margin pressure, and rising demand for cost-effective dairy ingredients. However, the industry faces challenges, including palm oil sustainability concerns affecting consumer perception, regulatory scrutiny regarding ingredient transparency, and quality perception gaps compared to whole milk powder in premium applications. Continued innovation in fat blend technologies and sustainable sourcing remains central to industry development.

The rapidly accelerating development of palm-free fat filled milk powder formulations is fundamentally transforming the category from commodity ingredients facing sustainability criticism to premium alternatives, enabling clean-label positioning and environmental responsibility claims previously unattainable through conventional palm-based production. Advanced fat blending platforms featuring sunflower oil, coconut oil, and butterfat combinations allow manufacturers to create fat filled milk powder with palm-free credentials, transparent sourcing documentation, and functional performance comparable to palm-based alternatives. These sustainability innovations prove particularly transformative for premium food brands, environmentally conscious processors, and export-oriented manufacturers, where palm-free certification proves essential for market access and brand positioning.

Major fat filled milk powder suppliers invest heavily in alternative fat sourcing partnerships, sustainability certification programs, and traceability system development, recognizing that palm-free varieties represent high-value growth opportunities for differentiated product portfolios. Manufacturers collaborate with sustainable agriculture organizations, certification bodies, and environmental consultants to develop scalable supply chains that ensure sustainability integrity while maintaining cost competitiveness supporting mainstream adoption.

Modern fat filled milk powder producers systematically incorporate advanced homogenization systems, including high-pressure processing, ultrasonic emulsification, and optimized spray drying technologies that deliver superior fat distribution, enhanced reconstitution properties, and improved stability characteristics compared to conventional processing methods. Strategic integration of technological improvements enables manufacturers to position fat filled milk powder as premium functional ingredients where consistent particle size directly determines food manufacturer purchasing decisions. These technical improvements prove essential for demanding applications, as quality-focused processors require specifications validation, batch consistency testing, and scientific documentation supporting functional equivalence to whole milk powder.

Companies implement extensive process control programs, equipment technology upgrades, and quality assurance testing targeting performance excellence, including fat oxidation prevention, moisture content optimization, and particle morphology consistency throughout production. Manufacturers leverage technology positioning in marketing communications, emphasizing quality superiority and technical capabilities, positioning premium fat filled milk powder as reliable ingredients delivering authentic dairy functionality.

European food manufacturers increasingly prioritize customized fat filled milk powder specifications featuring specific fatty acid compositions, melting point ranges, and functional characteristics that optimize performance in targeted applications from chocolate tempering to bakery cream stability. This customization trend enables suppliers to drive premium pricing through specialized solutions, strengthen customer relationships through technical collaboration, and create differentiated offerings resonating with food processors seeking competitive advantages. Customization proves particularly important for confectionery manufacturers where fat crystallization behavior directly impacts product quality and manufacturing efficiency.

The development of sophisticated formulation capabilities, including fat fraction analysis, thermal behavior profiling, and application testing facilities, expands suppliers' abilities to create tailored solutions meeting exact customer specifications without compromising consistency. Suppliers collaborate with food technologists, product developers, and quality managers to develop customized products balancing functional performance with cost efficiency, supporting premium positioning and customer loyalty while maintaining production scalability across specialized manufacturing requirements.

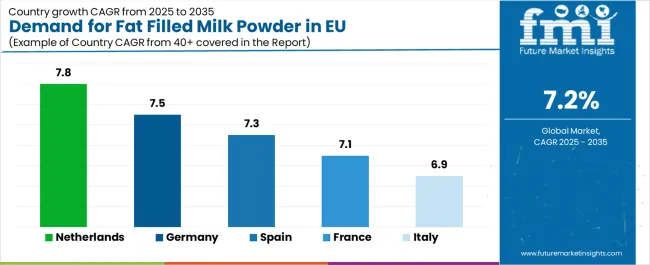

| Country | CAGR % (2025 to 2035) |

|---|---|

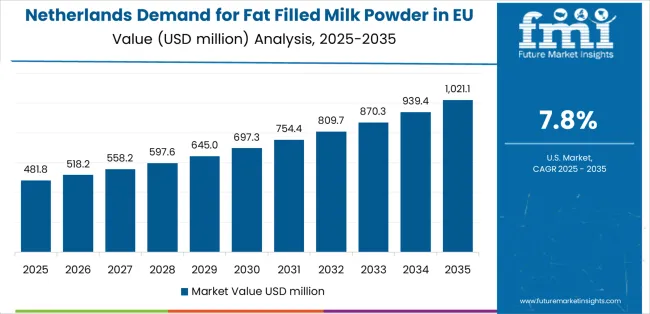

| Netherlands | 7.8% |

| Germany | 7.5% |

| Spain | 7.3% |

| France | 7.1% |

| Italy | 6.9% |

EU fat filled milk powder sales demonstrate solid growth across major European economies, with Netherlands leading expansion at 7.8% CAGR through 2035, driven by dairy processing innovation and export capacity. Germany shows robust growth at 7.5% CAGR through extensive manufacturing infrastructure. Spain maintains 7.3% CAGR, benefiting from developing food processing sector. France records 7.1% CAGR reflecting mature market dynamics. Rest of Europe shows 7% CAGR across diverse smaller markets. Italy demonstrates 6.9% CAGR with steady industrial adoption. Overall, sales show differentiated regional development reflecting varying food manufacturing maturity and ingredient adoption rates across European markets.

Revenue from fat filled milk powder in Germany is projected to exhibit robust growth with a CAGR of 7.5% through 2035, driven by exceptionally well-developed food manufacturing sector, comprehensive confectionery production capacity, and strong processed food exports throughout the country. Germany's sophisticated chocolate manufacturing industry and internationally recognized leadership in food quality standards are creating substantial demand for reliable fat filled milk powder supplies across all manufacturing segments.

Major food manufacturers, including numerous confectionery companies, bakery producers, and dairy processors, systematically incorporate fat filled milk powder in formulations, often requiring specialized specifications meeting exact functional requirements and rigorous safety standards. German demand benefits from strong export orientation supporting ingredient volume requirements, substantial domestic consumption across chocolate and bakery categories, and technical expertise that naturally supports fat filled milk powder adoption across diverse food manufacturing applications.

Growth drivers:

Revenue from fat filled milk powder in the Netherlands is expanding at a leading CAGR of 7.8% through 2035, supported by strong dairy processing innovation, export-oriented ingredient manufacturing, and strategic position as European dairy ingredient hub. Netherlands' sophisticated dairy industry and established ingredient trading networks create ideal conditions for fat filled milk powder production and distribution across European markets.

Major dairy companies and ingredient processors systematically invest in fat filled milk powder production capacity and quality enhancement, creating comprehensive supply capabilities serving both domestic and export markets. Netherlands sales particularly benefit from well-developed logistics infrastructure, technical dairy processing expertise, and comprehensive quality systems supporting European food manufacturing requirements.

Success factors:

Revenue from fat filled milk powder in France is growing at a CAGR of 7.1% through 2035, fundamentally driven by diverse food manufacturing base spanning confectionery, bakery, and dairy sectors, along with established ingredient processing capabilities. France's strong food processing tradition and quality focus create natural demand for reliable fat filled milk powder supplies across multiple manufacturing categories.

Major food companies strategically incorporate fat filled milk powder in cost-sensitive applications while maintaining quality standards, creating opportunities for suppliers offering consistent quality and competitive pricing. French sales particularly benefit from well-developed confectionery manufacturing tradition, creating natural demand for dairy ingredients supporting authentic taste profiles and premium texture delivery.

Development factors:

Revenue from fat filled milk powder in Italy is growing at a CAGR of 6.9% through 2035, substantially supported by developing food processing sector, growing confectionery production, and increasing adoption of cost-effective ingredients. Italian food industry modernization and expanding processed food manufacturing create opportunities for fat filled milk powder adoption across traditional and contemporary applications.

Major food manufacturers strategically invest in ingredient optimization and cost management initiatives, creating demand for fat filled milk powder suppliers offering quality consistency and application support. Italian sales particularly benefit from growing confectionery sector and expanding bakery manufacturing, creating natural adoption drivers across dairy ingredient applications.

Growth enablers:

Demand for fat filled milk powder in Spain is projected to grow at a CAGR of 7.2%, supported by expanding food processing sector, growing bakery production, and increasing confectionery manufacturing. Spanish food industry development and evolving ingredient procurement practices position fat filled milk powder as aligned with manufacturing cost optimization.

Major food companies systematically explore cost-effective ingredient alternatives, with fat filled milk powder supporting competitive pricing strategies and margin improvement initiatives. Spain's developing position as Mediterranean food production base supports ingredient demand through volume growth and application diversification across food manufacturing categories.

Growth factors:

Demand for fat filled milk powder in Rest of Europe is expanding at a CAGR of 7.2%, representing collective strength across diverse smaller EU markets including Poland, Belgium, Czech Republic, Austria, and other European countries. These varied markets demonstrate unified growth driven by regional food manufacturing development and consistent ingredient adoption patterns.

Rest of Europe sales benefit from developing processed food sectors, increasing modern retail penetration introducing affordable food products, and growing food manufacturing operations requiring cost-effective dairy ingredients. These markets represent significant collective opportunity as food manufacturing modernization accelerates and ingredient optimization practices expand across diverse European operations.

Development drivers:

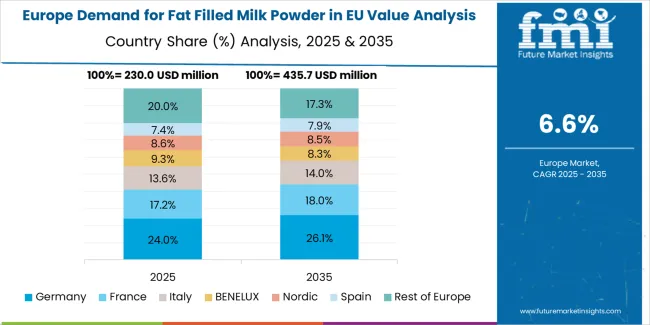

EU fat filled milk powder sales are projected to grow from USD 981.1 million in 2025 to USD 1,966.4 million by 2035, registering a CAGR of 7.2% uniformly across all major markets over the forecast period. All countries demonstrate identical growth trajectories reflecting consistent category development, with market share positions determined by established production capacity, food manufacturing infrastructure, and historical dairy industry presence rather than differential growth rates.

Germany maintains the largest share at 30.6% in 2025, driven by extensive food manufacturing infrastructure and strong confectionery production, while growing at 7.2% CAGR. The Netherlands holds the second position at 21.1% share, leveraging dairy processing expertise and export orientation. France accounts for 16.8% share, while Rest of Europe collectively represents 19%. Italy and Spain hold 7.5% and 5% shares respectively, reflecting smaller but developing markets.

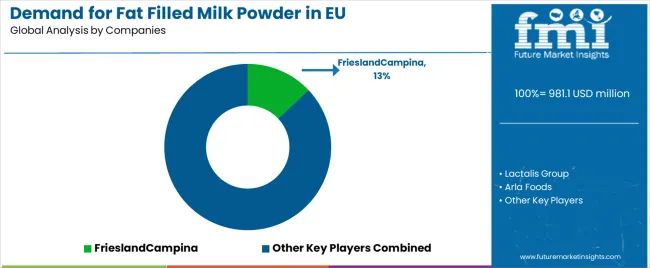

EU fat filled milk powder sales are defined by competition among multinational dairy companies, regional ingredient processors, and specialized milk powder manufacturers. Companies are investing in sustainable sourcing, fat blend innovation, quality consistency systems, and technical service capabilities to deliver high-quality, functionally optimized, and competitively priced fat filled milk powder solutions. Strategic partnerships with food manufacturers, confectionery companies, and ingredient distributors, along with sustainability certifications and application development expertise, are central to strengthening competitive position.

Major participants include Friesl and Campina with an estimated 13% share, leveraging its Netherlands production base, extensive European distribution network, and comprehensive dairy ingredient expertise. Friesl and Campina benefits from vertically integrated supply chains, technical application knowledge, and ability to supply multiple food industry segments from confectionery to dairy processing, supporting broad market penetration and customer loyalty.

Lactalis Group holds approximately 11% share, emphasizing European manufacturing scale, private label supply capabilities, and diversified food ingredient portfolio. The company's success in developing cost-competitive dairy ingredients with consistent quality creates strong positioning across food manufacturing applications, supported by extensive production infrastructure and customer relationship strength.

Arla Foods accounts for roughly 9% share through its position as Nordic-European dairy cooperative with sustainability credentials, providing reliable fat filled milk powder through farmer-owned production system and environmental commitment. The company benefits from cooperative structure ensuring stable milk supply, sustainability positioning resonating with premium brands, and comprehensive European presence enabling responsive service.

Fonterra represents approximately 6% share in EU sales, supporting growth through global dairy expertise, technical formulation capabilities, and strong ingredients business serving European food manufacturers. Fonterra leverages dairy science leadership, application development support, and international scale enabling competitive pricing and quality consistency.

Other companies collectively hold 61% share, reflecting competitive dynamics within European fat filled milk powder sales, where numerous regional processors, specialized blending companies, private label suppliers, and emerging sustainability-focused producers serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through specialized fat blends, palm-free certification, customized specifications, and technical service excellence resonating with food manufacturers seeking reliable ingredient partners.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,966.4 million |

| Product Type | Full Cream Milk Powder, Whole Milk Powder, Skimmed Milk Powder, Partially Skimmed |

| Application (End Use) | Dairy Products, Bakery Products, Confectionaries, Ice Cream, Others |

| Distribution Channel | Supermarkets & Hypermarkets, Specialty Stores, Department Stores, Online, Convenience Stores |

| Nature | Organic/Palm-free, Conventional |

| Countries Covered | Germany, the Netherlands, France, Italy, Spain, and the Rest of Europe |

| Key Companies Profiled | FrieslandCampina, Lactalis Group, Arla Foods, Fonterra, Nestlé Ingredients |

| Additional Attributes | Dollar sales by product type, application category, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with dairy cooperatives and ingredient processors; customer preferences for various fat blend compositions and functional characteristics; integration with food processing technologies and confectionery manufacturing systems; innovations in sustainable sourcing and palm-free formulations; adoption across food manufacturing, confectionery production, and bakery applications; regulatory framework analysis for dairy ingredient labeling and composition standards; supply chain strategies; and penetration analysis for cost-conscious food manufacturers across European markets. |

The global demand for fat filled milk powder in EU is estimated to be valued at USD 981.1 million in 2025.

The market size for the demand for fat filled milk powder in EU is projected to reach USD 1,966.4 million by 2035.

The demand for fat filled milk powder in EU is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in demand for fat filled milk powder in EU are full cream milk powder, whole milk powder, skimmed milk powder and partially skimmed.

In terms of application (end use), dairy products segment to command 33.0% share in the demand for fat filled milk powder in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand and Trends Analysis of Fat Filled Milk Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand and Trends Analysis of Fat Filled Milk Powder in Korea Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Market Analysis by Type, Distribution Channel, Region and Other Applications Through 2035

Milk Fat Fractions Market

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Europe Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Europe Human Milk Oligosaccharides Market Growth – Trends, Demand & Innovations 2025-2035

Skim Milk Powder Market Outlook – Growth, Demand & Forecast 2025 to 2035

Non-fat Dry Milk Market Size and Share Forecast Outlook 2025 to 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Europe Superfood Powder Market Analysis – Size, Share & Forecast 2025-2035

Competitive Breakdown of Buttermilk Powder Providers

Whole Milk Powder Market

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA