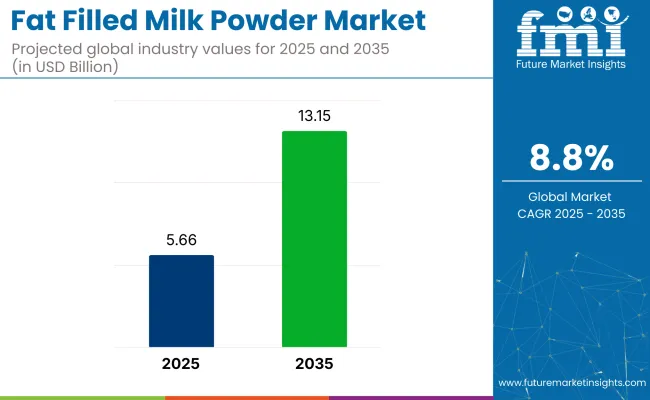

The fat filled milk powder market is projected to expand from USD 5.66 billion in 2025 to USD 13.15 billion by 2035, registering a CAGR of 8.8% throughout the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.66 billion |

| Industry Value (2035F) | USD 13.15 billion |

| CAGR (2025 to 2035) | 8.8% |

The market is seeing rising demand, especially in price-sensitive countries. In 2023, EU dairy exports to West Africa exceeded 400,000 metric tons, with FFMP making up a growing share due to its affordability. Poland, Belgium, and Ireland are among the top EU exporters of FFMP, leveraging lower production costs and palm oil import access.

Algeria alone imported over 150,000 tons of FFMP, sourced mainly through EU trade routes. According to UN Comtrade, Vietnam’s imports of FFMP rose by 18% in 2022, reflecting increased use in processed foods and beverages.

New Zealand and Malaysia are expanding their blending facilities, targeting Southeast Asia’s urbanizing markets. In Bangladesh, FFMP now accounts for over 35% of total dairy imports, supported by government subsidies on dairy-based infant and adult nutrition products. These shifts reflect how FFMP has become a strategic substitute in food processing, driven by both price volatility and changing dietary habits.

The fat-filled milk powder (FFMP) market holds specific shares within its parent markets. In the dairy ingredients market, it accounts for around 6-8%, as FFMP is a key product within the broader dairy sector. Within the food and beverage market, the share is approximately 3-5%, driven by its use in cost-effective dairy applications like confectionery and beverages.

In the infant nutrition market, FFMP holds about 4-6%, mainly used in infant formula as an affordable alternative to whole milk powder. The animal feed market contributes around 2-3%, with FFMP serving as a nutritional supplement. The retail market holds a share of 4-6%, driven by consumer demand for affordable dairy-based products.

The fat filled milk powder market in 2025 operates across region-specific formats and application channels. In Saudi Arabia and Nigeria, bulk product formats are utilized in bakery preparation, vending whitener operations, and confectionery base lines within non-refrigerated foodservice segments.

In the Netherlands and Belgium, fat filled milk powders are integrated into condensed and chocolate manufacturing systems designated for export processing. In North America, the product remains centered in institutional-scale food manufacturing with low exposure in consumer retail platforms.

Logistics networks in Southeast Asia manage product movement through standardized ambient transportation and handling structures. Packaging formats are designed for commissary repacking, retail presentation, and bulk storage rotations.

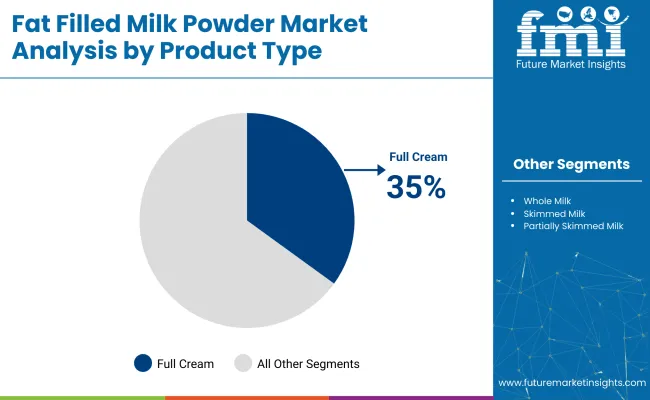

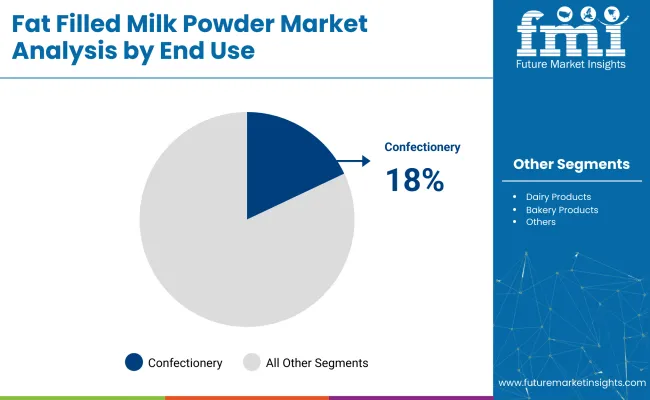

Fat filled milk powder with 28% protein content is projected to secure a 28% share by 2025. Full cream variants will dominate the product type segment with 35% share. Among distribution channels, supermarkets and hypermarkets will account for 40% share, while confectionaries are expected to lead the end-use segment at 18%.

Fat filled milk powder with 28% protein content is expected to contribute 28% to global sales by 2025, driven by demand from low-cost dairy alternatives in food processing. Producers favor this content level for meeting nutritional labeling standards while keeping manufacturing costs competitive.

Full cream fat filled milk powder is projected to account for 35% of the market share by 2025, supported by rising demand in bakery and dairy-based product applications.Its creamy consistency and high fat content make it ideal for confectionery fillings and milk-based beverages.

Supermarkets and hypermarkets are expected to secure 40% market share by 2025, reflecting growing consumer preference for convenient access to household dairy ingredients.Expanded cold chain infrastructure and wider retail footprints are improving product visibility and shelf stability.

Confectionaries are anticipated to hold 18% market share by 2025, supported by strong integration of fat filled milk powder in creams, fillings, and chocolate-based products.The ingredient provides a cost-effective substitute for whole milk without sacrificing richness or taste.

The market is expanding steadily as price-sensitive regions substitute whole milk powder with affordable dairy-fat alternatives. In 2024, global FFMP consumption surpassed 2.4 million metric tons, with high uptake in West Africa, the Middle East, and Southeast Asia.

High Adoption in Dairy Reconstitution, Bakery, and Beverage Segments

FFMP is widely used to manufacture reconstituted milk, sweetened beverages, and ice creams in markets with limited access to fresh dairy. In Nigeria, over 85% of milk powder imports fall under the fat filled category. Cost savings of up to 30% compared to whole milk powder are prompting large-scale bakeries in Asia to switch formulas.

Price Volatility in Dairy Fat Driving Market Substitution

Fluctuations in butterfat prices have made FFMP a stable-cost alternative. In 2023, global dairy fat prices rose 19.6%, leading many processors to reformulate with palm-based fat blends. EU-origin FFMP is increasingly exported to price-sensitive destinations through government-backed trade incentives and bilateral dairy agreements.

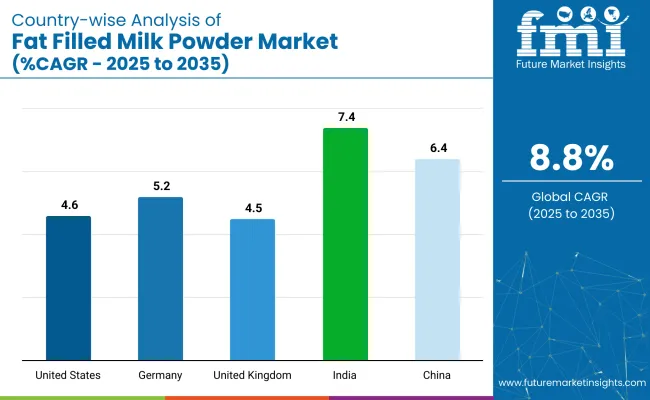

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.4% |

| China | 6.4% |

| Germany | 5.2% |

| United States | 4.6% |

| United Kingdom | 4.5% |

The market is set to grow at 8.8% CAGR from 2025 to 2035, with growth across key regions. In the United States market is projected to expand at 4.6% CAGR, driven by FDA regulations promoting reduced-fat dairy use and tariff reductions under USMCA. Federal support for price stability and FFMP integration into long-term contracts also bolsters the market.

Germany follows with a 5.2% CAGR, benefiting from the National Reformulation Strategy and EU regulations phasing out industrial trans fats. KfW loans support investment in modern equipment, accelerating FFMP adoption.

In the BRICS group, India is growing at 7.4% CAGR, with FSSAI regulations boosting transparency on vegetable-fat content and export incentives under the TMA scheme. China, expanding at 6.4% CAGR, benefits from zero tariffs on FFMP imports under updated FTAs and government subsidies for FFMP use in milk beverages.

The United Kingdom, part of the OECD, is expected to see a 4.5% CAGR. Growth is being driven by tariff-free dairy imports from New Zealand. FFMP processing is being improved with help from UK government grants. Reconstitution methods are being upgraded to support local manufacturers. Across OECD regions, adoption is being influenced by new trade policies and financial support for exports.

India is expected to expand at a CAGR of 7.4% through 2035, fueled by rising demand from institutional buyers in the bakery, confectionery, and tea-processing sectors. Imports are declining as Indian manufacturers such as Amul and Schreiber Dynamix scale domestic production using vegetable fat blends.

Affordable price points have made fat filled powder more attractive than SMP (skimmed milk powder) in southern and eastern states. Government support for value-added dairy exports has opened new sales channels in Africa and Southeast Asia.

China’s market is projected to grow at a CAGR of 6.4% through 2035, supported by increasing use in reconstituted dairy drinks and milk-based desserts. Urban demand is being driven by bakery chains, cafés, and school nutrition programs.

Domestic producers in Hebei and Heilongjiang are expanding their use of palm fat and local milk solids. The ongoing crackdown on adulterated dairy imports has elevated trust in locally produced fat filled products. Growth is being further aided by cold chain development in inland provinces.

Germany’s fat filled milk powder market is projected to grow at a CAGR of 5.2% through 2035, driven by increased demand in nutritionally balanced, long-life food products. German dairy cooperatives are offering low-cholesterol variants suited for infant cereals, soups, and sports drinks.

Producers are investing in EU-certified, palm-free formulations in response to clean-label trends. Exports to North Africa and the Middle East are expanding as buyers favor fortified and functional dairy alternatives. Government support for sustainable dairy practices is reinforcing consumer trust.

The USA market is forecast to grow at a CAGR of 4.6% through 2035. Demand is rising among private-label brands and contract foodservice operators seeking cost-effective alternatives to whole milk powder.

Midwest processors are blending dairy solids with coconut or palm-based fat for use in powdered creamer, ice cream mixes, and nutritional supplements. Domestic consumption is concentrated in value-added and industrial applications, while export growth is modest. Regulatory clarity on vegetable fat usage is helping improve product labeling and acceptance.

The UK is projected to grow at a CAGR of 4.5% through 2035. Fat filled milk powder is increasingly used in private-label hot drink mixes, affordable dairy spreads, and bakery fillings. Manufacturers are reducing import reliance by blending Irish milk solids with vegetable fat alternatives in local plants.

Cost pressures from inflation have made fat filled variants more attractive than traditional dairy bases. Retailers are promoting fortified formulations to meet low-income household nutrition targets. Growth is led by demand for stable, versatile dairy components in affordable food lines.

The market is led by players like Nestlé S.A., Danone S.A., Fonterra Co-operative Group, and Fries land Campina, who dominate through broad product portfolios and extensive global reach. These companies focus on developing a variety of fat-filled milk powders for different segments, including baby food, dairy products, and bakery applications.

Lactalis Group, Arla Foods, and Dairy Farmers of America invest in product innovation and expanding their market presence through strategic acquisitions and partnerships. Smaller players like Agropur Cooperative and Olam International are carving out niches by targeting emerging markets and offering specialized products. The market is fragmented, with competition driven by both large multinational firms and regional players pushing for innovation and local market penetration.

Recent Fat Filled Milk Powder Industry News

In January 2025, Fries land Campina announced a planned merger with Belgian dairy cooperative Milcobel, aiming to finalize integration by mid-year. The deal, still subject to regulatory and shareholder approvals, is set to create a €14 billion dairy giant with operations across 30 countries. The combined entity will be supported by over 11,000 dairy farms, strengthening its global supply network and product reach.

In June 2025, Lactalis Ingredients received regulatory clearance from the USA Department of Justice to complete its USD 2.1 billion acquisition of General Mills’ USA yogurt business. This acquisition marks a significant expansion of Lactalis’ presence in North America and enhances its branded dairy portfolio.

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 5.66 billion |

| Projected Market Value (2035) | USD 13.15 billion |

| CAGR (2025 to 2035) | 8.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Protein Content | 24% protein content and 28% protein content. |

| Product Type | Full cream milk powder, whole milk powder, skimmed milk powder, partially skimmed milk powder. |

| Distribution Channel | Supermarkets & hypermarkets, Convenience stores, Department stores, Specialty stores, Online |

| End Use | Dairy products, Bakery products, Confectionaries, Ice cream, Others |

| Region | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Nestlé S.A., Danone S.A., Fonterra Co-operative Group Limited, Fries land Campina, Lactalis Group, Arla Foods, Dairy Farmers of America, Inc., Saputo Inc., Glanbia plc, Kraft Heinz Company, Murray Goulburn Co-operative Co. Limited, Agropur Cooperative, Olam International, China Mengniu Dairy Company Limited, Yili Industrial Group Company Limited |

| Additional Attributes | Dollar sales growth, CAGR trends, product type distribution, consumer preferences, size segmentation, price range segmentation, competitor dollar sales & market share, regional growth patterns |

The segmentation is into 24% protein content and 28% protein content.

The segmentation is into full cream milk powder, whole milk powder, skimmed milk powder, partially skimmed milk powder.

The segmentation is into supermarkets and hypermarkets, convenience stores, department stores, specialty stores, and online.

The segmentation is into dairy products, bakery products, confectionaries, ice cream, and others.

The segmentation is into North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The market is valued at USD 5.66 billion in 2025.

The market is forecast to reach USD 13.15 billion by 2035.

The market is projected to grow at a CAGR of 8.8% from 2025 to 2035.

Instant fat filled milk powder leads with a 57.3% share in 2025.

India is projected to grow the fastest with a CAGR of 10.2% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Demand for Fat Filled Milk Powder in EU Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Fat Filled Milk Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Fat Filled Milk Powder in Korea Size and Share Forecast Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fat-Replacing Starch Market

Fat Free Salad Dressings Market

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

No-Fat Cake Market Trends - Innovations & Consumer Demand 2025 to 2035

No-Fat Peanut Butter Market Trends - Consumer Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA