The Fat Replacers, Salt Reducers and Replacers Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Fat Replacers, Salt Reducers and Replacers Market Estimated Value in (2025 E) | USD 2.5 billion |

| Fat Replacers, Salt Reducers and Replacers Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The fat replacers, salt reducers and replacers market is witnessing significant expansion, supported by rising consumer demand for healthier food options that align with dietary guidelines and wellness trends. Growing awareness about lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions is encouraging food and beverage manufacturers to integrate fat and salt reduction strategies into product development.

Regulatory bodies across various regions are implementing stringent labeling requirements and nutritional standards, which is prompting the food industry to adopt alternative ingredients that maintain product taste and texture while meeting health standards. Continuous innovations in food technology, including plant-based formulations and natural ingredient development, are improving the functionality of these replacers in diverse applications.

Investments in research are enhancing the sensory and nutritional performance of substitutes, making them more acceptable to consumers With rising emphasis on preventive healthcare, clean label products, and functional nutrition, the market is positioned for consistent growth, driven by strong demand across processed foods, dairy, bakery, snacks, and ready-to-eat meals.

The fat replacers, salt reducers and replacers market is segmented by product type, material, and geographic regions. By product type, fat replacers, salt reducers and replacers market is divided into Fat Reducer and Others. In terms of material, fat replacers, salt reducers and replacers market is classified into Optical Prism, Piezoelectric (PMUT), Pyroelectric, and Adhesive. Regionally, the fat replacers, salt reducers and replacers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fat reducer segment is projected to account for 51.2% of the fat replacers, salt reducers and replacers market revenue share in 2025, making it the leading product type. This dominance is being driven by rising consumer preference for low-fat foods that support weight management and reduce the risk of chronic diseases. The segment is benefiting from the introduction of innovative fat reduction technologies that maintain product palatability while significantly lowering calorie content.

Growing adoption of fat reduction strategies by manufacturers of bakery, dairy, confectionery, and snack products is reinforcing demand. Regulatory guidelines emphasizing reduced fat content in processed foods are also influencing large-scale industry adoption.

Technological advancements in carbohydrate- and protein-based fat mimetics are allowing manufacturers to replicate the creamy texture and mouthfeel associated with traditional fats, improving consumer acceptance As health-conscious consumers increasingly prioritize calorie control and nutritional balance, fat reducers are expected to maintain their leadership in the market, supported by continuous innovation and strong penetration across multiple food categories.

The optical prism segment is anticipated to capture 40.2% of the fat replacers, salt reducers and replacers market revenue share in 2025, positioning it as the leading material segment. Its dominance is attributed to its functional role in enhancing food processing precision and quality by supporting advanced analytical methods in ingredient formulation.

Optical prism technologies are widely utilized in quality assessment and testing processes that ensure accurate measurement of fat and salt replacement efficiency in food products. The segment’s growth is being reinforced by the rising demand for high-precision analytical tools within the food and beverage industry, where consistency, safety, and compliance with nutritional standards are critical.

The adoption of optical prism-based systems in research laboratories and production facilities is improving the effectiveness of product development cycles, accelerating time to market for healthier food alternatives With increasing emphasis on food safety regulations, product traceability, and functional ingredient development, optical prisms are expected to remain integral to the material segment, driving continued growth and application expansion across the industry.

The Fat Replacers, Salt Reducers, and Replacers market is valued at USD 2.1 Bn in 2025 and is projected to grow at a CAGR of 6.4% during the forecast period, to reach a value of USD 3.0 Bn by 2035. Newly released data from Future Market Insights market analysis shows that global Fat Replacers, Salt Reducers, and Replacers demand is projected to grow year-on-year (Y-o-Y) growth of 4.2% in 2025.

| Attributes | Details |

|---|---|

| Market Size Value in 2025 | USD 2.1 Billion |

| Market Forecast Value in 2035 | USD 3.0 Billion |

| Global Growth Rate (2025 to 2035) | 6.4% CAGR |

| Forecast Period | 2025 to 2035 |

| Collective Value Share: Top 3 Countries (2025A) | 41.4% |

The term "fat replacer" refers to substances that are utilized in food as a fat alternative. mostly used to maintain the same taste and texture of the meal while reducing the number of calories in it. There are many different kinds of fat substitutes, including those based on protein, fat, and carbohydrates. Applications for fat substitutes can be found in the food and beverage industries.

For the following five years, a high growth rate is anticipated in the global market for salt and fat substitutes. The market for fat substitutes is most developed in North America. The demand for food ingredients with improved texture and flavors, as well as growing worries about improving general health, are the main reasons propelling the market's expansion.

Due to their position as GRAS chemicals, which the US FDA has acknowledged, carbohydrate-based fat substitutes are the market leader in this category. Due to consumer demand for low-calorie, low-fat foods, the dairy and meat industries receive the majority of fat substitutes.

To avoid the negative effects that salt has on health, the food industry is constantly attempting to limit the amount of salt consumed in food. The food industry's main goal is to reduce the amount of salt while maintaining its brand equity. Because of the government's and the food industry's joint efforts, the market offers tremendous prospects. Salt replacers, salt reducers, and physical ingredient modification are different types of salt reducers.

Fat Replacers, Salt Reducers, and Replacers demand grew at 4.3% CAGR between 2025 and 2025. One of the main drivers of the worldwide fat replacers and salt replacers market is the rising consumer awareness of the importance of good eating habits and the global rise in health concerns.

In the upcoming years, the global market for salt and fat substitutes is anticipated to expand significantly at a rapid rate. The overall market is being driven by the rising demand for food ingredients with improved flavors and textures. Additionally, consumers are requesting goods that will aid them in maintaining their health as they become more aware of the advantages of living a healthy lifestyle.

Customers are looking for low-fat or fat-free goods and beverages as obesity rates increase globally. As a result, producers of food and beverages use lipid-, protein-, and carbohydrate-based fat substitutes.

Food product makers are also offering a combination of reduced fat goods and fat replacers because fat replacers alone cannot provide the required qualities. The majority of fat substitutes on the market are reformulated versions of substances that were once utilized in foods.

A new variety of fat replacement ingredients are also being developed by producers in the food replacement sector employing cutting-edge technologies. Additionally, the creation of cookies, salad dressings, frozen desserts, low-fat cheese, chips, and ice cream is finding extensive use of fat replacers.

These items, which are likely to combine fat and oil, are often used in things like chips, baked goods, and snack meals. Furthermore, the Food and Drug Administration has not yet approved the majority of new low-fat goods created with fat substitutes.

The US now holds the largest revenue share in the fat replacers, salt reducers, and replacers market, and it is expected to continue to rule during the forecast period. The market in the region is expected to increase as a result of the rising demand for food ingredients with superior flavors and textures.

High personal disposable income, changing lifestyles, and growing health consciousness is expected to accelerate the growth of the fat substitutes and salt substitute markets in the US.

The performance of the Indian Fat Replacers, Salt Reducers, and Replacers market can be attributed to the growing health consciousness among consumers and the increasing awareness of the benefits of fat replacers, salt reducers, and replacers.

The Carbohydrate Based Fat Replacers Segment accounted for a sizeable revenue market share in the Fat Replacers Product Type in 2025 as a result of its GRAS classification from the US FDA. Furthermore, some of the fat in dairy products, frozen desserts, salad dressings, and other products may be replaced by cellulose.

Cellulose microparticles that have been finely ground create a non-caloric network that has the fluidity and smoothness of fat. They contribute to the food's thickening or gelling and give it a creamy mouthfeel.

With the growing consumer knowledge of the various consumers ingesting beneficial fats, foods accounted for the greatest revenue market share by application in 2025. Protein-based components are expected to be advantageous in snacking, dairy, and frozen desserts, as well as bakery and confectionery products.

By 2035, Southeast Asia's consumption of milk and milk products is expected to increase by 125%, according to the UN Food and Agriculture Organization (FAO). This business is predicted to advance due to the increased demand for dairy products and healthy eating practices.

The industry for fat substitutes and salt reducers is being driven by the broad acceptance of these cost-effective fat substitutes in developing nations, which are utilized in a variety of dairy products like cheese, butter, and whipped cream.

P&G Food Ingredients, RS Flavor Ingredients, CP Kelco, Ashland Aqualon Functional Ingredients, Symrise, Nestle Inc., and Danisco are some of the well-known companies competing in the global market for salt and fat replacers. By offering improved formulas in the upcoming years, these firms hope to establish their position in the worldwide market and obtain a competitive advantage.

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 2.5 billion |

| Market Forecast Value in 2035 | USD 4.7 billion |

| Global Growth Rate | 6.4% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2025 to 2025 |

| Market Analysis | MT for Volume and USD Billion for Value |

| Key Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Chile, Peru, Germany, France, Italy, Spain, UK, Netherlands, Belgium, Nordic, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Central Africa, North Africa, and others |

| Key Market Segments Covered | Product Type, Application |

| Key Companies Profiled |

|

| Pricing | Available upon Request |

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

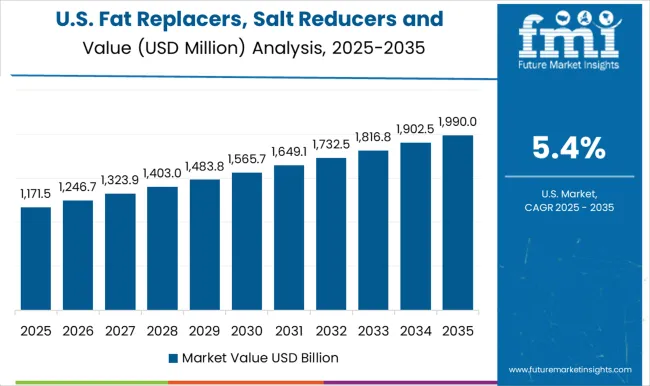

| Brazil | 4.8% |

The Fat Replacers, Salt Reducers and Replacers Market is expected to register a CAGR of 6.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.6%, followed by India at 8.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.8%, yet still underscores a broadly positive trajectory for the global Fat Replacers, Salt Reducers and Replacers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.4%. The USA Fat Replacers, Salt Reducers and Replacers Market is estimated to be valued at USD 892.7 million in 2025 and is anticipated to reach a valuation of USD 1.5 billion by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 121.9 million and USD 73.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Product Type | Fat Reducer and Others |

| Material | Optical Prism, Piezoelectric (PMUT), Pyroelectric, and Adhesive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Inc., P&G Food Ingredients, RS Flavor Ingredients, CP Kelco, Kerry Group Plc., Nestle Inc., Ashland Aqualon Functional Ingredients, Tate & Lyle Plc., Ingredion Incorporated, Royal DSM N.V, Ashland Global Holdings Inc., Archer Daniels Midland Company, FMC Corporation, Corbion N.V, and Associated British Foods Plc. |

| Additional Attributes |

The global fat replacers, salt reducers and replacers market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the fat replacers, salt reducers and replacers market is projected to reach USD 4.7 billion by 2035.

The fat replacers, salt reducers and replacers market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in fat replacers, salt reducers and replacers market are fat reducer, _fat-based fat replacer, _carbohydrate-based fat replacer, _protein-based fat replacer, others, _salt reducer, _salt replacer and _others.

In terms of material, optical prism segment to command 40.2% share in the fat replacers, salt reducers and replacers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fat-Replacing Starch Market

Fat Free Salad Dressings Market

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

No-Fat Cake Market Trends - Innovations & Consumer Demand 2025 to 2035

No-Fat Peanut Butter Market Trends - Consumer Demand & Growth 2025 to 2035

NMR Fat Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Non-fat Dry Milk Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA