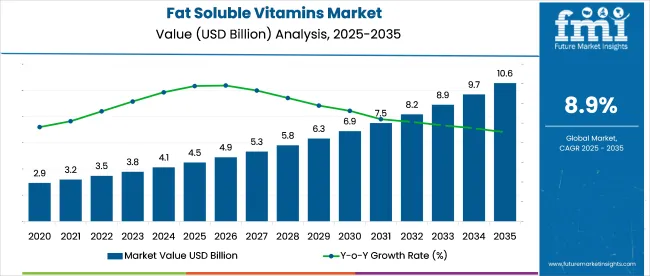

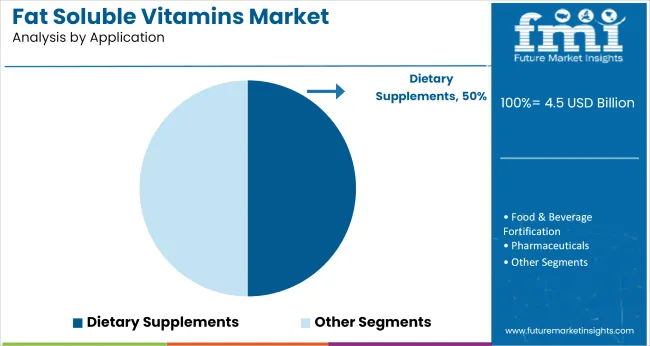

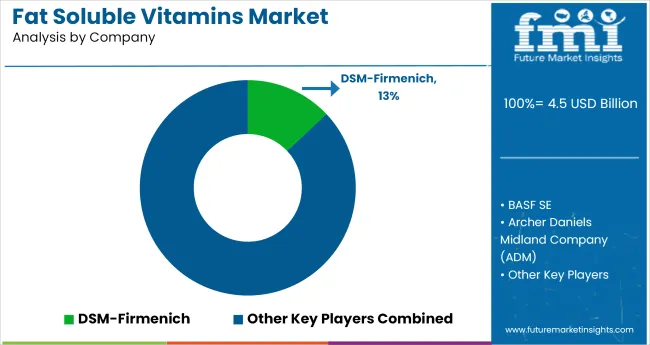

Fat soluble vitamins market revenue is forecast to expand from USD 4.5 billion in 2025 to USD 10.5 billion by 2035, showing a CAGR of 8.9% over the assessment period.

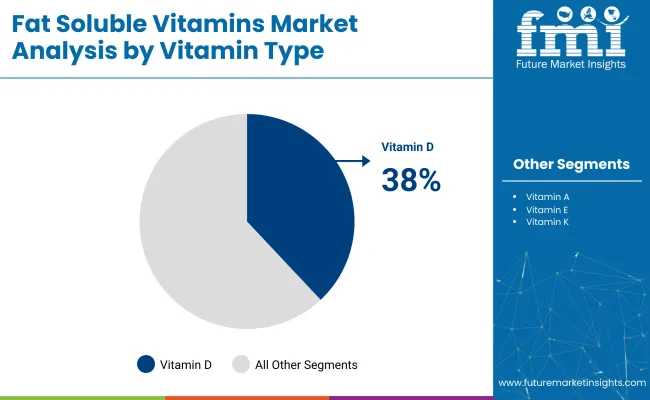

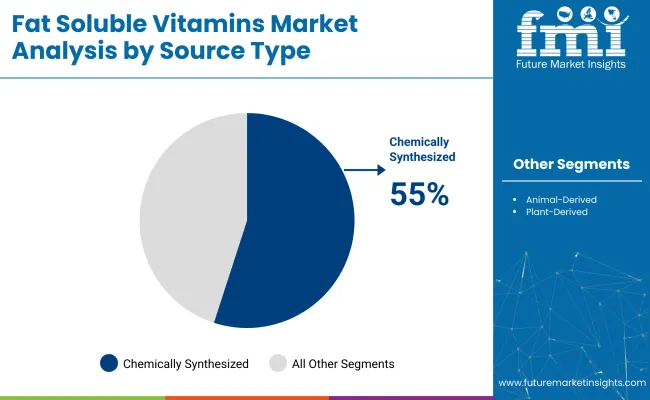

India’s growth rate of 9.6% has been shaped by wider supplement penetration across urban and rural retail networks and expanding domestic manufacturing capacity. Vitamin D is projected to lead by type, with a 38% industry share in 2035, supported by its widespread role in immune function and bone health. Chemically synthesized sources, expected to hold 55% share, continue to dominate due to cost efficiency, scalability, and consistent compound purity.

Geraldine Matchett, Co-CEO of Royal DSM (now part of DSM-Firmenich), stated, “Vitamins remain a cornerstone of our nutritional solutions portfolio. We see sustained demand driven by increasing consumer awareness of immune health, healthy aging, and the need for fortification, particularly in essential micronutrients like Vitamin D.” This highlights the growing focus on vitamins as key components of health, particularly with rising demand for immune support and micronutrient fortification in consumer products.

The industry holds specific shares within its parent markets. In the dietary supplements market, it accounts for around 10-12%, as these vitamins are crucial in supplement formulations. Within the vitamin ingredients market, the share is approximately 20-25%, due to the demand for fat soluble vitamins like A, D, E, and K in various products.

The functional foods market contributes about 5-7%, driven by the inclusion of these vitamins in food products designed to support health. In the animal feed additives market, the share is 3-5%. The cosmetics and personal care market holds about 2-3%, as vitamin E and other fat soluble vitamins are commonly used in skincare products.

The industry is expected to see significant growth through 2035, driven by vitamin D fortification, chemically synthesized feedstocks, and dietary supplements. Vitamin D will capture 38% of the industry share, with chemically synthesized inputs holding 55%, and dietary supplements accounting for 50%.

Vitamin D is expected to capture 38% of the industry share in 2035, driven by its application in food fortification policies and its ability to maintain stability under oil-phase conditions. This enables widespread usage in dairy, bakery, and beverage premixes. In particular, its bioavailability in calcifediol formats enhances dosage efficiency, allowing for better product labeling and consumer understanding.

National fortification schedules require specific amounts like 400 IU per liter for fluid milk, with a focus on raising supplement uptake among high-risk populations, such as the elderly and dark-skinned individuals. Research is also increasingly supporting its link to immune health, driving consumer demand.

Chemically synthesized vitamin production is expected to account for 55% of the industry share in 2035. This method relies on petrochemical precursors and catalytic processes, offering consistent purity, predictable yields, and lower production costs compared to extraction methods. Innovations in photochemical synthesis allow for the creation of high-assay crystalline vitamin D₃, achieving ≥98.5% purity.

The use of continuous-flow reactors significantly reduces solvent usage by 22%, streamlining production and improving compliance with Good Manufacturing Practices (GMP). Hydrogenation catalysts are now being regenerated on-site, reducing the need for rare-metal procurement and improving production efficiency.

Dietary supplements are projected to capture 50% of the industry share in 2035, thanks to convenient formats like capsules, gummies, and sprays. These formats allow for personalized dosing, quick industry rotations, and high merchandising flexibility. Soft-gel encapsulation, for instance, significantly enhances nutrient absorption compared to tablets.

Sugar-reduced gummies are particularly attractive to health-conscious consumers and retailers enforcing strict guidelines on child-friendly products. Metered oral sprays cater to seniors with difficulty swallowing pills, making them a popular option in healthcare settings. E-commerce strategies, such as QR-coded packs, are improving consumer traceability and enhancing trust.

Rising Health Consciousness Drives Fat Soluble Vitamin Adoption

The growth of the industry is driven by increasing consumer awareness of nutrition, rising prevalence of vitamin deficiencies, and expanding applications of these vitamins in various sectors like food fortification and supplements. The growing focus on health and wellness, combined with advancements in vitamin extraction and synthesis, is contributing to the industry's rapid expansion. As more consumers seek preventive healthcare solutions, fat soluble vitamins like Vitamin D and K are seeing heightened demand for supplementation and fortified food products.

Regulatory Compliance and Toxicity Concerns Impede Fat Soluble Vitamin Market Growth

The industry faces significant challenges, including stringent regulatory requirements and concerns over toxicity. Regulatory bodies in regions like the EU and the USA have established tolerable upper intake levels (ULs) for vitamins A and D due to documented toxicity risks. These regulations can limit product formulations and industry access. The risk of hypervitaminosis, particularly from excessive supplementation, poses health concerns and can deter consumer confidence

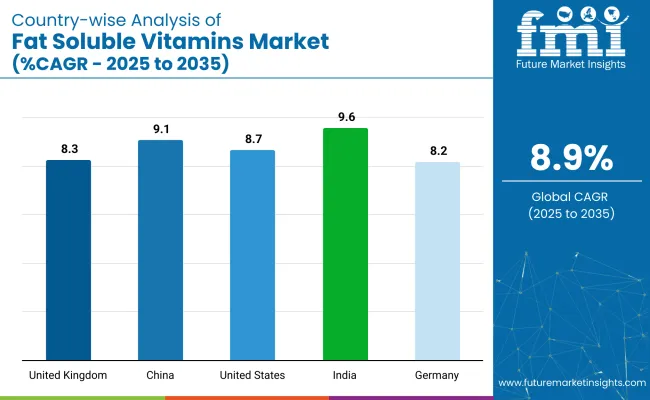

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 9.6% |

| China | 9.1% |

| United States | 8.7% |

| United Kingdom | 8.3% |

| Germany | 8.2% |

The industry demand is projected to rise at an 8.9% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 9.6%, followed by China at 9.1%, and the United States at 8.7%, while the United Kingdom posts 8.3% and Germany records 8.2%.

These rates translate to a growth premium of +8% for India, +2% for China, and -2% for the United Kingdom versus the baseline, while the United States and Germany show steady growth. Divergence reflects local catalysts: increased consumer awareness of the health benefits of fat soluble vitamins in India and China, while more stable demand in the United States, Germany, and the United Kingdom is attributed to mature industries with established consumption patterns in dietary supplements and fortified foods.

The industry in India is set to record a CAGR of 9.6% from 2025 to 2035. Expansion is being powered by mandatory vitamin-fortified edible oils, public procurement of vitamin-A milk for school meals, and export-oriented vitamin D₃ fermentation hubs granted Production-Linked Incentive subsidies. Domestic nutraceutical firms have shifted toward lipid-soluble blends positioned for immunity and eye health, while collaborations between dairy cooperatives and biotech institutes improve encapsulation and bioavailability.

Demand for fat soluble vitamins in China is estimated to grow at a CAGR of 9.1% through 2035. Premium infant-formula fortification, sports-nutrition expansion, and soybean-derived tocopherol production underpin steady volume growth. Child-nutrition directives mandate higher vitamin-A densities in formula powders, while e-commerce soft-gel sales reach lower-tier cities without margin erosion. Feed-grade vitamin orders stabilize as biosecurity reforms reshape the pig sector.

The industry in the United States is projected to post a CAGR of 8.7% from 2025 to 2035. Functional beverages, GRAS-cleared vitamin K₂ formulations, and retail private-label expansion drive demand. Federal research funding heightens vitamin-D deficiency awareness, while contract manufacturers lock in fermentation-derived actives to mitigate price swings.

Sales of fat soluble vitamins in the United Kingdom are projected to grow at a CAGR of 8.3% through 2035. Public-health guidance on daily vitamin D use, flexitarian demand for plant-derived forms, and venture funding for fermented vitamin K₂ boost category momentum. Subscription e-commerce services deliver personalized packs that sustain reorder cycles, while NHS precision-nutrition pilots integrate vitamin-A fortified meal replacements.

The industry in Germany is expected to expand at a CAGR of 8.2% between 2025 and 2035. Fermentation clusters in North Rhine-Westphalia specialize in menaquinone and cholecalciferol under generous R&D tax incentives, while functional dairy fortified with vitamins A and D benefits from robust cold-chain logistics. Nutricosmetic demand for tocopherol-rich serums is endorsed by the German Allergy and Asthma Association, and stringent shelf-life validation promotes microencapsulation across bakery and beverage formats.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as DSM-Firmenich, BASF SE, and Archer Daniels Midland Company (ADM) lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across food, beverage, and pharmaceutical sectors.

Key players including Lonza Group AG, Pfizer Inc., and Roche Vitamins offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Eastman Chemical Company, Chr. Hansen Holding A/S, and Zhejiang Medicine Co., Ltd., focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Industry Size (2025) | USD 4.5 billion |

| Projected Industry Value (2035) | USD 10.5 billion |

| CAGR (2025 to 2035) | 8.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Vitamin Type | Vitamin A, Vitamin D, Vitamin E, Vitamin K |

| Source Type | Animal-derived, Plant-derived, Chemically synthesized |

| Application | Dietary supplements, Food & Beverage fortification, Pharmaceuticals, Cosmetics |

| Region | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | DSM-Firmenich, BASF SE, Archer Daniels Midland Company (ADM), Lonza Group AG, Pfizer Inc., Roche Vitamins, Eastman Chemical Company, Chr. Hansen Holding A/S, Bayer AG, Zhejiang Medicine Co., Ltd. |

| Additional Attributes | Dollar sales, CAGR trends, product type distribution, size preferences, price range segmentation, competitor dollar sales & industry share, regional growth patterns |

By vitamin type, the industry includes vitamin A, vitamin D, vitamin E, and vitamin K.

By source type, the industry is segmented into animal-derived, plant-derived, and chemically synthesized.

By application, the industry comprises dietary supplements, food & beverage fortification, pharmaceuticals, and cosmetics.

By region, the industry analyzed across North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry value is projected to be USD 4.5 billion in 2025.

The forecasted industry value for 2035 is USD 10.5 billion.

The CAGR is 8.9% from 2025 to 2035.

Vitamin D is expected to lead with a 38% industry share in 2035.

India is the leading country with a 9.6% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fat-Replacing Starch Market

Fat Free Salad Dressings Market

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

No-Fat Cake Market Trends - Innovations & Consumer Demand 2025 to 2035

No-Fat Peanut Butter Market Trends - Consumer Demand & Growth 2025 to 2035

NMR Fat Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Non-fat Dry Milk Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA