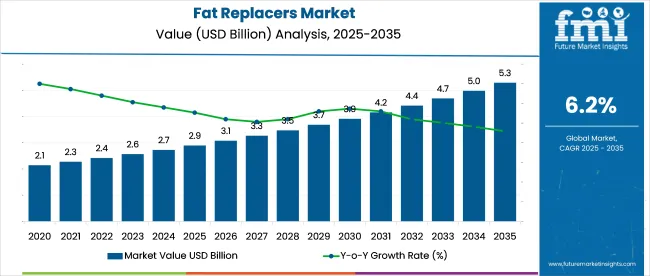

The fat replacers market is forecast to expand from USD 2.9 billion in 2025 to USD 5.3 billion by 2035 at a 6.2% CAGR over the assessment period.

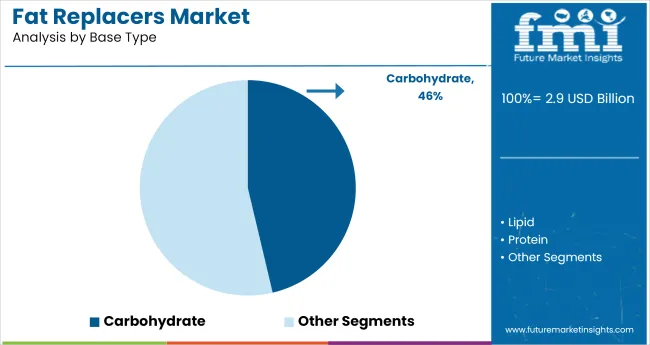

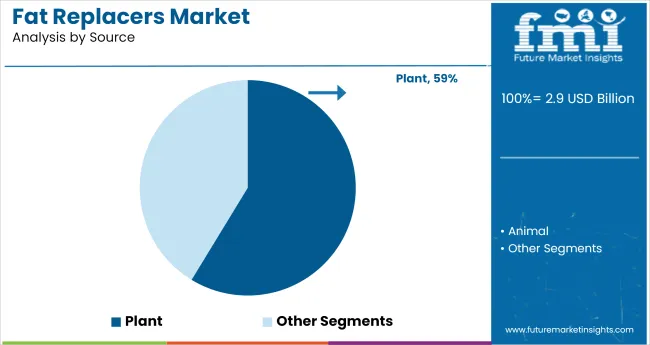

Increased application of carbohydrate-based substitutes-projected to account for 46.3% of the industry share-has been influenced by their compatibility with water activity levels and pH conditions in high-moisture food systems. Plant-based sources, expected to hold 58.7% of demand, have been selected for their yield efficiency and performance consistency in emulsion stabilisation and bulk delivery.

In October 2023, Dennis Woodside, President of Impossible Foods, stated, “We've cracked the code on replicating the juicy, fatty texture of ground beef using plants... Our coconut oil-based system melts and sizzles just like animal fat, delivering that craveable experience without the cholesterol.” This quote highlights the company’s success in creating plant-based fat replacers that replicate the texture and functionality of animal fat, a key advancement in the plant-based meat sector.

The industry holds a specific share within its parent markets. In the food additives market, it holds around 4-6%, as fat replacers as a specialized category within food ingredients. Within the food and beverage market, the share is approximately 2-3%, driven by the growing demand for reduced-fat products. In the functional foods market, fat replacers account for about 5-7%, with a focus on creating healthier, functional products.

The health and wellness market contributes around 3-4%, as consumers increasingly seek low-fat alternatives in their diet. The nutraceutical market holds a smaller share of about 2-3%, as fat replacers are used in supplements aimed at weight management and health.

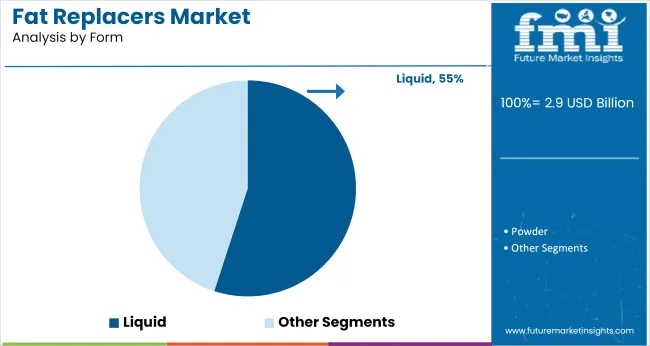

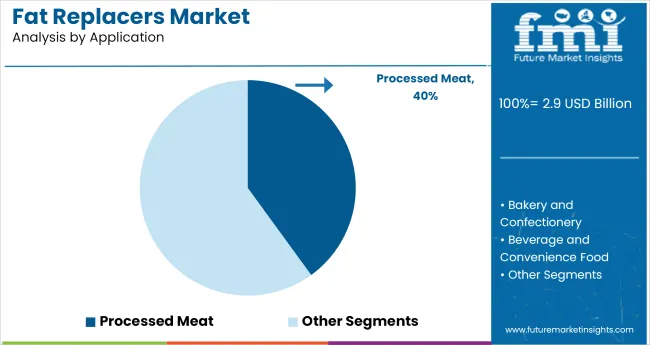

The industry is set for growth, with carbohydrate-based replacers capturing 46.3% industry share in 2025. Plant-based inputs are projected to hold 58.7%, liquid fat replacers will dominate with 55%, and processed meat formulations will account for 40% share.

Carbohydrate-based replacers are expected to account for 46.3% of the industry share in 2025. These replacers offer low caloric density, stability under thermal stress, and compatibility with various processing methods. Their gelling and bulking properties allow for the replication of fat mouthfeel without altering key formulation parameters.

Amylopectin and dextrose polymers, for example, form elastic gels that mimic fat-phase lubrication during mastication. High-molecular-weight dextrins support moisture retention in baked snacks, while modified food starch ensures heat tolerance in high-temperature applications like flash frying. Polydextrose reduces calorie load without impacting flavor, making it an ideal choice for bakery lines and frozen meals.

Plant-based replacers are projected to hold 58.7% of the industry share in 2025, driven by the increasing demand for animal-free ingredients, label clarity, and dietary compliance. These plant-based inputs are widely used for textural emulation and emulsification without triggering common allergens like dairy, soy, or gluten.

Pea and chickpea protein isolates are commonly used in emulsions to replace cream-based fats, while oat-derived β-glucans form pseudo-fat structures that support heart-health claims. Soy fiber-cellulose blends mimic meat textures, and sunflower lecithin enhances spreadability and prevents lipid phase separation in cold spreads. The demand for vegan, halal, and kosher labeling also drives this segment’s growth.

Liquid forms are expected to dominate with 55% of the industry share in 2025. Their high metering precision, enhanced stability, and compatibility with continuous inline processing are key drivers. Liquid-phase systems ensure homogeneous dispersion in products such as dressings, soups, and emulsions for processed meats.

These systems also optimize viscosity for continuous feeding through closed-loop systems, with emulsifier-stabilized blends that eliminate the need for rehydration or pre-mixing. Glycerol and propylene glycol carriers extend shelf life and prevent microbial degradation. Liquid formats also reduce cleanup time in clean-in-place (CIP) systems, improving operational uptime and minimizing labor inputs.

Processed meat applications are projected to capture 40% of the industry in 2025, driven by regulatory pressures to reduce fat, saturated fat, and calories per serving. These replacers help manufacturers meet label claims without compromising product structure or sensory qualities. Konjac-based hydrogel systems simulate animal fat mouthfeel, improving cooking yields in ground meat products.

Micro-emulsified oils allow sausages to withstand smokehouse treatments while maintaining thermal performance. Sodium alginate-fiber blends preserve cohesion in low-fat cold cuts and deli meats, and collagen-mimicking plant fibers offer comparable bite resistance to animal fat inclusions. These replacers also ensure texture retention during freezing and reheating.

The industry is driven by rising demand for low-fat claims and precise ingredient integration, particularly in sauces, spreads, and snacks. However, challenges such as aeration collapse and heat stability issues in high-heat applications like baking and frying limit broader adoption, particularly in commercial bakery and QSR sectors.

Low-Fat Claims Fuel Precision Ingredient Integration

The industry is growing as stricter labeling regulations in regions like the EU and Canada push brands to meet low-fat and reduced-fat criteria without compromising texture. Ingredients like modified starches, whey protein concentrates, and micro-particulated egg whites are being integrated into products like sauces, spreads, and snack fillings.

Companies like Tate & Lyle and Ingredion are increasing production of enzyme-treated starch blends that are optimized for cold-fill and bake-stable products. Retailers now require sensory parity with full-fat versions, with documentation of fat reduction percentages and mouthfeel equivalence becoming crucial for product acceptance.

Functional Gaps in Aeration and Heat Stability Limiting Use

Despite advancements, fat replacers still face limitations in bakery and frying systems where aeration and heat tolerance are critical. Carbohydrate- and protein-based substitutes fail to deliver the same mouthfeel and texture when exposed to high heat, such as in laminated doughs or frying applications. These replacers often collapse under high temperatures, resulting in poor volume, soggy textures, or compromised crispiness. Due to these functional gaps, quick-service restaurants (QSR) and commercial bakeries are restricting the use of these replacers to cold-processed applications or fillings.

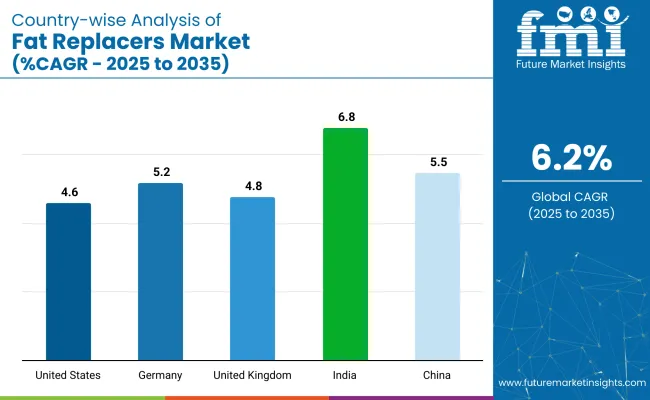

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| Germany | 5.2% |

| United Kingdom | 4.8% |

| China | 5.5% |

| India | 6.8% |

Analysis shows that the fat replacer demand to climb 6.2% annually from 2025 to 2035. India leads at 6.8%, a +26% premium driven by trans-fat bans and starch mimetics in snacks across its BRICS corridor. China’s 5.5% (+2%) is buoyed by weight-management drinks and low-oil condiments endorsed in diet guidelines.

Germany’s 5.2% sits 4% below baseline as OECD dairy-analog plants adopt microparticulated whey amid debate on saturated-fat levies. The United Kingdom posts 4.8% (-11%), where HFSS rules spur fibre bulking agents but cost pressure tempers bakery reformulation. The United States lags at 4.6% (-15%) as clean-label emulsifiers outshine carbohydrate replacers. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The United States industry is projected to expand at a CAGR of 4.6% through 2035. Growth is being reinforced by national dietary guidelines that prioritize calorie reduction and by reformulation programs pursued across packaged snacks, dairy analogues, and quick-service offerings. Brands have embraced carbohydrate-based fat mimetics and structured lipids to replicate mouthfeel while meeting clean-label criteria demanded by health-conscious shoppers.

Regulatory clarity from the FDA regarding permissible ingredient labeling has lowered reformulation risk, and venture funding has been directed toward novel lipid-protein complexes that improve organoleptic performance in baked goods and frozen desserts-ensuring consistent adoption downstream in food-service procurement.

The sales of industry in Germany are forecast to register a CAGR of 5.2% between 2025 and 2035. Progress has been driven by stringent nutritional profiling rules under the Nutri-Score system, which pressures processors to curb lipid content in ready meals and bakery staples.

Investment by ingredient suppliers has targeted oat-derived β-glucan matrices and micro-encapsulated sunflower oleogels that withstand high-temperature baking while preserving crumb softness. Retailers have prioritized reformulated SKUs carrying “light” front-of-pack cues, and scientific consortia funded by the Federal Ministry of Food and Agriculture have validated satiety benefits of fiber-fat hybrids-bolstering consumer confidence and ensuring repeat purchases across discounter chains.

The United Kingdom industry is anticipated to witness a CAGR of 4.8% during 2025 to 2035. Reformulation pledges under the UK Food Industry Responsibility Deal have incentivized caloric trimming in convenience foods, with fat-replacement technologies leveraged to maintain indulgent texture.

Retailers have emphasized front-of-pack traffic-light labeling, prompting widespread uptake of tapioca-based fat mimetics and pea-protein emulsions that stabilize reduced-fat spreads. Import duties on specialty oils have encouraged domestic R&D into rapeseed-derived structured lipids, while the Food Standards Agency’s salt-and-fat reduction campaigns have heightened consumer scrutiny-accelerating the shift toward lower-fat ready meals and impulse snacks across supermarket chains.

The industry in China is set to advance at a CAGR of 5.5% over the forecast period. Dietary Guidelines for Chinese Residents have encouraged lower-fat cooking practices, boosting demand for lipid-alternative ingredients in instant noodles, bakery, and dairy drinks. Domestic fermentation firms have developed konjac-glucomannan gels and rice-based dextrins that align with local palate preferences.

The Healthy China 2030 initiative has prompted public canteens to overhaul menus using calorie-reduced sauces, and e-commerce platforms have highlighted “light” product tags-accelerating diffusion of fat-substitution technologies throughout Tier-1 and Tier-2 cities.

Sales in India are forecast to increase at a CAGR of 6.8% till 2035. Demand is being catalyzed by heightened incidence of lifestyle-related ailments, pushing packaged-food players to reformulate traditional snacks and dairy sweets. Indigenous research institutions have optimized guar-gum and chickpea-protein complexes that deliver creamy texture at reduced lipid content, while price volatility in edible oils has encouraged processors to hedge with carbohydrate-based bulking agents.

The Food Safety and Standards Authority of India’s push for trans-fat elimination has further accelerated substitution in bakery shortening and street-food frying mediums, channeling investment toward scalable fat-mimetic production capacity.

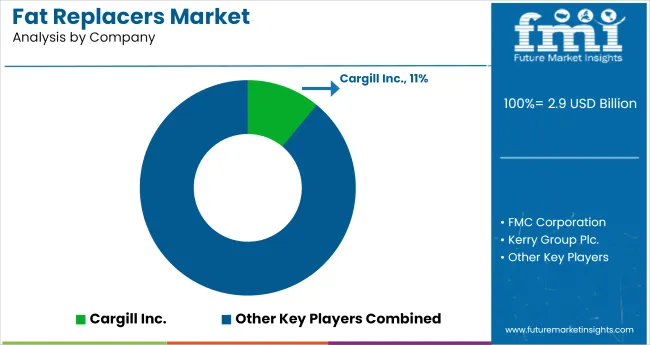

The industry is dominated by companies like Cargill Inc., FMC Corporation, and Kerry Group Plc., which lead through innovation and extensive product offerings. Cargill and Ingredion focus on developing these replacers for a number of applications, including low-fat and reduced-calorie products, while FMC and Ashland Global Holdings invest in technologies to create plant-based fat alternatives.

Tate & Lyle and Royal DSM use functional ingredients that enhance the texture and mouthfeel of reduced-fat foods. The industry is moderately fragmented, with large firms competing on scale, R&D, and distribution, while smaller players continue to innovate in niche areas.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Industry Value (2025) | USD 2.9 billion |

| Projected Industry Value (2035) | USD 5.3 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion, million units for volume |

| Base Type | Carbohydrate, Lipid, Protein, Others |

| Source | Plant, Animal |

| Form | Liquid, Powder |

| Application | Processed Meat, Bakery and Confectionery, Beverage and Convenience Food |

| Region | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Cargill Inc., FMC Corporation, Kerry Group Plc., Tate & Lyle Plc., Royal DSM N.V, Ashland Global Holdings Inc., Archer Daniels Midland Company, Ingredion Incorporated, Corbion N.V, Associated British Foods Plc. |

| Additional Attributes | Dollar sales, CAGR trends, product type segmentation, regional growth patterns, competitor dollar sales & industry share, price range segmentation, application-specific demand, distribution channel analysis |

By base type, the industry is segmented into carbohydrate, lipid, protein, and others.

By source, the industry includes plant and animal.

By form, the industry is bifurcated into liquid and powder.

By application, the industry is segmented into processed meat, bakery and confectionery, beverage, and convenience food.

By region, the region is analyzed by North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania.

The projected valuation of the industry in 2025 is USD 2.9 billion.

The forecast valuation of the industry by 2035 is USD 5.3 billion.

The expected CAGR for the industry from 2025 to 2035 is 6.2%.

The carbohydrate base type segment will lead the industry in 2035, with a 46.3% industry share.

India is expected to experience the highest growth in the industry with a 6.8% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fat-Replacing Starch Market

Fat Free Salad Dressings Market

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

No-Fat Cake Market Trends - Innovations & Consumer Demand 2025 to 2035

No-Fat Peanut Butter Market Trends - Consumer Demand & Growth 2025 to 2035

NMR Fat Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Non-fat Dry Milk Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA