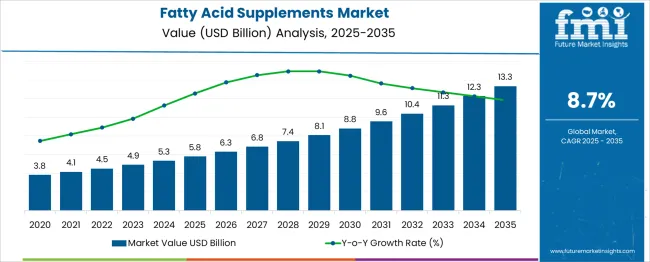

The Fatty Acid Supplements Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. The steady increase in market value reflects a robust growth trajectory with an 8.7% CAGR, indicating strong and expanding demand for fatty acid supplements in various applications. Between 2025 and 2030, the market value rises from USD 5.8 billion to USD 8.8 billion, adding USD 3.0 billion.

This period accounts for 40% of the total decade’s opportunity, characterized by annual increments growing from USD 0.5 billion in the early years to approximately USD 0.7 billion by 2030. Growth during this phase is driven by increasing consumer awareness of health benefits, wider adoption in dietary supplements, and expanded distribution channels. From 2030 to 2035, the market further advances by USD 4.5 billion, contributing 60% of the absolute opportunity.

Annual additions accelerate, reaching USD 1.0 billion in the final forecast year. This surge is supported by rising demand from aging populations, sports nutrition, and clinical applications, alongside ongoing product innovation and regulatory support. The data demonstrates a significant absolute dollar opportunity that increases in magnitude over time, with the latter half of the decade showing faster growth. The expanding market size presents ample potential for new entrants and established players focusing on innovation and market penetration.

| Metric | Value |

|---|---|

| Fatty Acid Supplements Market Estimated Value in (2025 E) | USD 5.8 billion |

| Fatty Acid Supplements Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The fatty acid supplements market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.3% of the global dietary supplements market, driven by growing awareness of health benefits related to omega fatty acids. Within the nutraceuticals and functional foods sector, a share of approximately 3.5% is assessed based on demand for supplements supporting cardiovascular and cognitive health.

In the animal nutrition industry, around 2.7% is observed reflecting use of fatty acid additives to improve livestock growth and immunity. Within the pharmaceutical ingredients market, about 2.1% is evaluated due to incorporation of fatty acids in therapeutic formulations. In the sports nutrition segment, a contribution of roughly 1.9% is calculated given interest in fatty acid supplements for inflammation reduction and recovery support.

Market growth has been influenced by rising consumer interest in preventive healthcare and natural ingredient supplements. Innovations have focused on extraction and purification techniques for high potency omega 3 and omega 6 fatty acids, as well as formulation of vegetarian and sustainable sources like algae. Interest has increased in encapsulation technologies that improve bioavailability and reduce fishy aftertaste.

The North America region has been observed to lead demand, while Asia Pacific is showing rapid growth driven by expanding health awareness. Strategic initiatives have included partnerships between ingredient suppliers and supplement manufacturers to develop clinically supported products, improve formulation stability, and enhance targeted delivery mechanisms.

The fatty acid supplements market is witnessing sustained expansion driven by evolving consumer health preferences, heightened awareness of chronic disease prevention, and growing penetration of nutritional education across global populations. Regulatory backing from health authorities for the preventive role of fatty acids in cardiovascular and cognitive health has supported increased adoption through over-the-counter channels.

The rapid rise of clean-label nutraceuticals and rising geriatric demographics are fueling consistent demand, while innovation in microencapsulation and softgel delivery formats is enhancing shelf stability and bioavailability. Strategic partnerships between pharmaceutical and nutraceutical companies, along with expanding e-commerce access, are expected to accelerate market penetration further. Personalized nutrition trends and clinical validation of novel fatty acid formulations will likely underpin future growth.

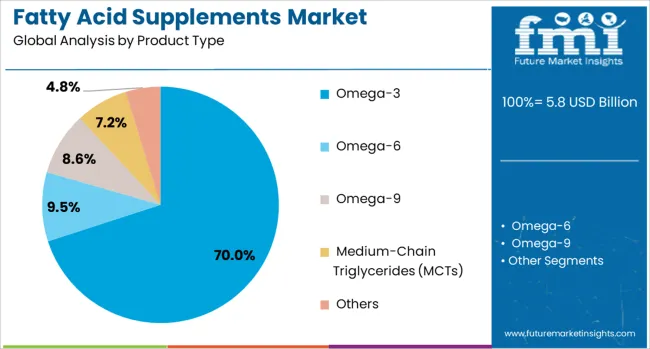

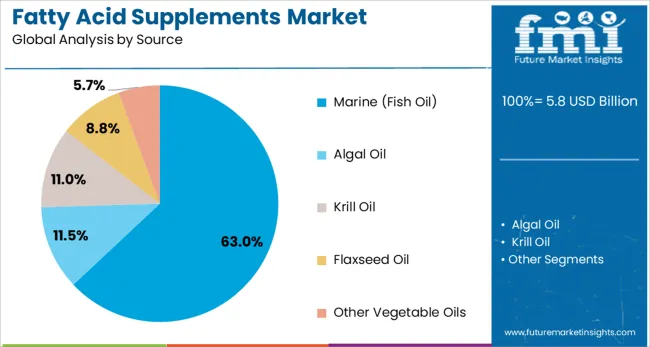

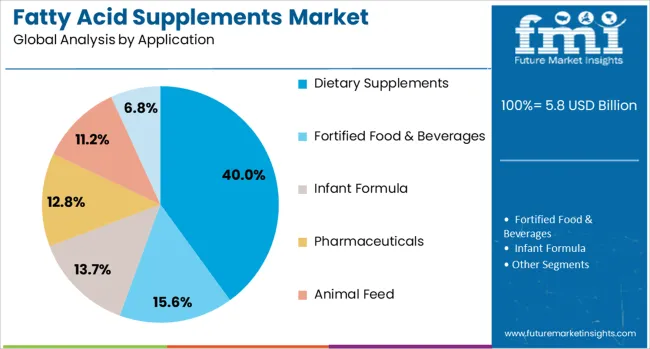

The fatty acid supplements market is segmented by product type, source, application, and geographic regions. The fatty acid supplements market is divided by product type into Omega‑3, Omega‑6, Omega‑9, Medium‑Chain Triglycerides (MCTs), and Others. In terms of the source of the fatty acid supplements, the market is classified into Marine (Fish Oil), Algal Oil, Krill Oil, Flaxseed Oil, and Other Vegetable Oils.

The fatty acid supplements market is segmented into Dietary Supplements, Fortified Food & Beverages, Infant Formula, Pharmaceuticals, Animal Feed, and Cosmetics (in the broader essential fatty acid segment). Regionally, the fatty acid supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Omega‑3 supplements are projected to hold 70.0% of the fatty acid supplements market revenue in 2025, positioning them as the leading product type. This dominance is being driven by extensive clinical evidence supporting their cardiovascular, cognitive, and anti-inflammatory benefits.

Rising consumer inclination toward proactive health maintenance and prevention of lifestyle diseases has strengthened demand across all age groups. Formulation improvements that reduce fishy aftertaste, enhance absorption, and improve palatability have contributed to wider acceptance.

Health organizations’ endorsements and inclusion of omega‑3 in dietary recommendations have further reinforced its credibility and demand longevity.

Marine-based sources, particularly fish oil, are expected to account for 63.0% of the market in 2025, making it the most preferred raw material for fatty acid supplements. This is attributed to its high concentration of bioactive EPA and DHA, which have strong evidence-backed efficacy across multiple health indications.

Technological advancements in purification and deodorization have improved quality, taste, and sustainability perception of fish oil products. Additionally, consumer trust in marine-derived sources, coupled with robust global fisheries infrastructure, has ensured consistent supply and competitive pricing advantages.

Continued clinical research around marine-derived omega‑3 benefits is likely to support its future leadership.

Dietary supplements are projected to lead with a 40.0% market share in 2025, driven by growing integration of fatty acids into daily nutrition regimens. This segment’s strength is rooted in the increasing trend of self-directed wellness management and preventive supplementation.

Consumer demand for functional, easily consumable formats such as capsules, gummies, and powders is encouraging aggressive portfolio expansion by brands. Retail expansion across pharmacy chains, wellness stores, and digital platforms is broadening accessibility.

The positioning of fatty acid supplements as everyday essentials for heart, joint, and brain health has cemented their relevance within the global dietary supplements category.

The fatty acid supplements market is being driven by increased consumer interest in health maintenance and nutritional balance. Essential fatty acids such as omega-3, omega-6, and omega-9 are recognized for their roles in supporting cardiovascular function, brain health, and inflammation management. Growth has been stimulated by rising demand for natural and effective dietary supplements. Product availability in various forms, including capsules, soft gels, and liquids, has expanded accessibility. Advancements in extraction and purification methods have improved product quality, while plant-based alternatives are being embraced to meet diverse dietary preferences.

The demand for fatty acid supplements has been significantly influenced by rising awareness about chronic health issues and the need for nutritional support. Cardiovascular diseases and cognitive disorders have been addressed through the regular intake of these supplements. Preventive health strategies have led to increased adoption across various age groups and populations seeking to maintain overall wellness. Healthcare professionals frequently recommend dietary supplements containing essential fatty acids as adjuncts to balanced diets. The demand has also been supported by public health campaigns promoting nutritional supplementation to improve quality of life. The broad acceptance of fatty acid supplements has been facilitated by their perceived benefits in metabolic regulation and immune support.

Continuous innovation in product formulation and ingredient sourcing has been observed in the fatty acid supplements market. Advanced extraction technologies such as cold pressing and molecular distillation have been employed to enhance the purity and bioavailability of active components. Alternative sources, including algal oils and seed-based extracts, have been adopted to address environmental and dietary considerations. Encapsulation technologies have been optimized to mask odors and improve shelf stability, increasing consumer acceptance. Diverse delivery formats, including gummies, powders, and fortified functional foods, have been introduced to cater to varying consumer preferences. These innovations have facilitated market penetration and supported expansion into new consumer segments seeking convenient and effective nutritional products.

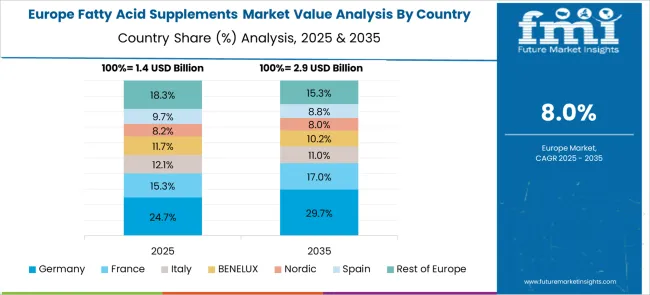

Market expansion has been observed across multiple regions with varying growth trajectories. Mature markets in North America and Europe have shown consistent demand due to established consumer knowledge and well-developed retail infrastructures. Emerging markets in the Asia-Pacific have exhibited rapid growth fueled by an increase in the urban population and rising disposable income levels. Regional manufacturers have tailored formulations and product offerings to meet local preferences and regulatory requirements. Expansion into Latin America and the Middle East has been supported by growing healthcare awareness and improving supply chain logistics. Collaborative efforts between manufacturers and distributors have facilitated enhanced market accessibility, contributing to steady adoption rates across diverse demographics.

Challenges related to regulatory compliance and quality assurance have been encountered in the fatty acid supplements market. Varied regulatory frameworks across countries have required manufacturers to adapt product labeling, safety testing, and health claims accordingly. Quality control issues, including potential contamination, oxidation, and adulteration, have necessitated stringent production and storage protocols. Cost factors associated with premium-grade raw materials and advanced processing methods have affected market pricing structures. Consumer confidence has been influenced by transparency in ingredient sourcing and third-party certifications. Educational initiatives aimed at clarifying product efficacy and safety have been instrumental in overcoming market hesitancy and ensuring sustained growth within competitive landscapes.

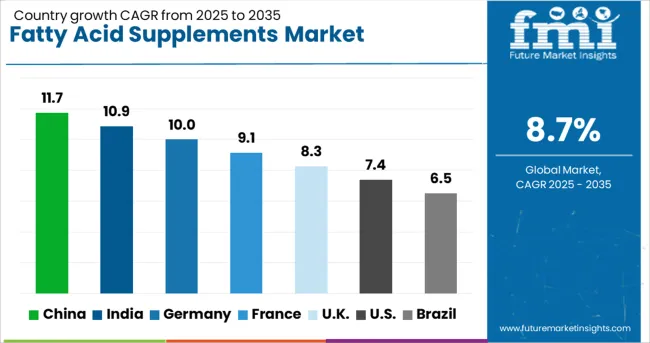

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

| USA | 7.4% |

| Brazil | 6.5% |

The fatty acid supplements market is expected to grow at a global CAGR of 8.7% between 2025 and 2035, driven by increasing awareness of health benefits, rising demand in dietary supplements, and expansion in functional foods. China leads with an 11.7% CAGR, supported by growing nutraceutical manufacturing and rising health-conscious consumers. India follows at 10.9%, fueled by expanding wellness trends and supplement adoption. Germany, at 10.0%, benefits from strong pharmaceutical and dietary supplement industries. The UK, projected at 8.3%, sees growth from increasing consumer focus on preventive health. The USA, at 7.4%, reflects steady demand from dietary supplement and health food markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 11.7% from 2025 to 2035 in the fatty acid supplements segment, driven by increasing awareness of health and wellness and a growing aging population seeking nutritional support. Domestic companies such as BY-HEALTH and Amway China are introducing omega-3 and other essential fatty acid products targeting cardiovascular and cognitive health. Partnerships with international suppliers have enhanced product quality and ingredient sourcing. Retail expansion through e-commerce platforms has broadened consumer reach in both urban and rural areas. Rising research investments in nutraceutical efficacy have further strengthened market confidence.

India is expected to grow at a CAGR of 10.9% from 2025 to 2035, with rising consumer interest in preventive healthcare driving demand. Companies including Himalaya Wellness and Cipla are developing affordable fatty acid supplements aimed at heart health and maternal nutrition. Increasing penetration of wellness retail outlets and online pharmacies has facilitated wider distribution. Government initiatives promoting dietary supplementation and awareness campaigns have contributed to steady market growth. Traditional Ayurvedic formulations incorporating essential fatty acids are also gaining acceptance among health-conscious consumers.

Germany is forecasted to achieve a CAGR of 10.0% from 2025 to 2035, supported by a mature nutraceutical industry and strong regulatory frameworks ensuring product quality. Major players such as BASF and Queisser Pharma have focused on high-purity omega-3 formulations with scientifically validated health claims. Consumer preference for natural and plant-based fatty acid supplements has increased. Distribution through pharmacies and health stores remains a key channel, supported by professional recommendations. Research investments continue to emphasize cardiovascular and inflammatory health benefits.

The United Kingdom is projected to expand at a CAGR of 8.3% from 2025 to 2035, driven by rising interest in preventive nutrition and aging population needs. Companies like Vitabiotics and Holland & Barrett are leading the market with omega-3 and multinutrient supplements targeting cognitive and heart health. The rise of direct-to-consumer online sales platforms has improved accessibility. Health professionals are increasingly recommending fatty acid supplements as part of wellness regimens. Government health guidelines encouraging dietary supplementation also support market growth.

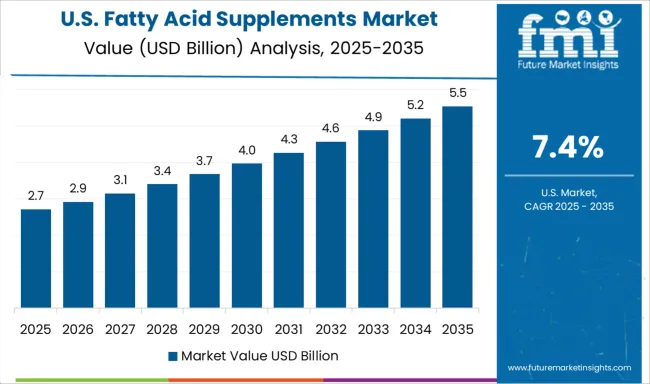

The United States is forecasted to grow at a CAGR of 7.4% from 2025 to 2035, driven by high consumer awareness and a strong dietary supplement culture. Leading firms such as Nature Made and Nordic Naturals focus on premium omega-3 and other fatty acid products with stringent quality certifications. Retail channels including supermarkets, pharmacies, and online platforms provide broad accessibility. The aging demographic seeking heart and brain health support is a significant growth segment. Regulatory scrutiny ensures product safety and transparency, enhancing consumer confidence.

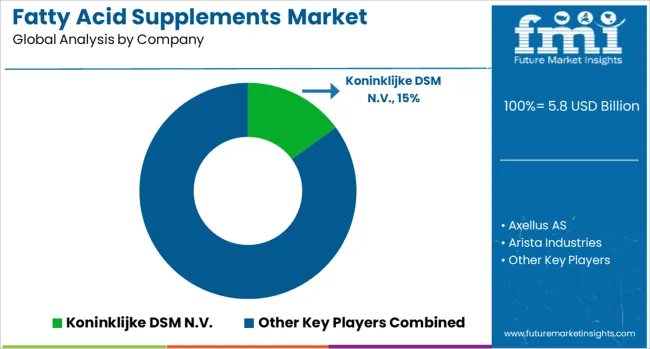

The fatty acid supplements market is led by global nutraceutical and specialty ingredient companies supplying omega-3, omega-6, and other essential fatty acids for dietary supplements, functional foods, and pharmaceuticals. Koninklijke DSM N.V. is a major player with a broad portfolio of purified and concentrated omega-3 oils, focusing on sustainable sourcing and clinical efficacy.

Croda Health Care offers customized fatty acid formulations for both human and animal nutrition markets, supported by strong R&D capabilities. GlaxoSmithKline plc integrates fatty acid supplements into its consumer health division, emphasizing evidence-based product development and global distribution. Arista Industries and Copeinca AS supply high-quality fish oils and marine-derived fatty acids, targeting pharmaceutical-grade and dietary applications.

Epax AS specializes in highly concentrated omega-3 oils, providing purity and stability certifications to meet stringent regulatory standards. Axellus AS focuses on clinical nutrition and specialty supplements, while EFG Elbe Fetthandel GmbH acts as a regional distributor and processor of fatty acid raw materials across Europe.

DMS offers integrated supply chain solutions from raw material sourcing to finished supplement formulations. Key strategies include investment in refining technologies to improve bioavailability and shelf life, partnerships with clinical research organizations for product validation, and expanding global distribution networks. Entry into this market is limited by strict regulatory requirements, the need for traceable raw material sourcing, and established relationships with pharmaceutical and nutraceutical manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.8 Billion |

| Product Type | Omega‑3, Omega‑6, Omega‑9, Medium‑Chain Triglycerides (MCTs), and Others |

| Source | Marine (Fish Oil), Algal Oil, Krill Oil, Flaxseed Oil, and Other Vegetable Oils |

| Application | Dietary Supplements, Fortified Food & Beverages, Infant Formula, Pharmaceuticals, Animal Feed, and Cosmetics (in broader essential fatty acid segment) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Koninklijke DSM N.V., Axellus AS, Arista Industries, Croda Health Care, Copeinca AS, Glaxo Smith Kline plc, EFG Elbe Fetthandel GmbH, Epax AS, and DMS |

| Additional Attributes | Dollar sales by fatty acid type and application, demand dynamics across omega-3, omega-6, and omega-9 fatty acids in cardiovascular health, cognitive function, and inflammation management, regional trends in marine-sourced vs plant-based supplements across North America, Europe, and Asia-Pacific, innovation in delivery formats (soft gels, gummies, liquids, powders), sustainability in sourcing (algal vs fish oil), and emerging use cases in personalized nutrition, pediatric supplementation, and geriatric wellness. |

The global fatty acid supplements market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the fatty acid supplements market is projected to reach USD 13.3 billion by 2035.

The fatty acid supplements market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in fatty acid supplements market are omega‑3 , omega‑6, omega‑9, medium‑chain triglycerides (mcts) and others.

In terms of source, marine (fish oil) segment to command 63.0% share in the fatty acid supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Essential Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Rice Bran Fatty Alcohols in UK Size and Share Forecast Outlook 2025 to 2035

Polyglycerol Esters Of Fatty Acids Market

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA