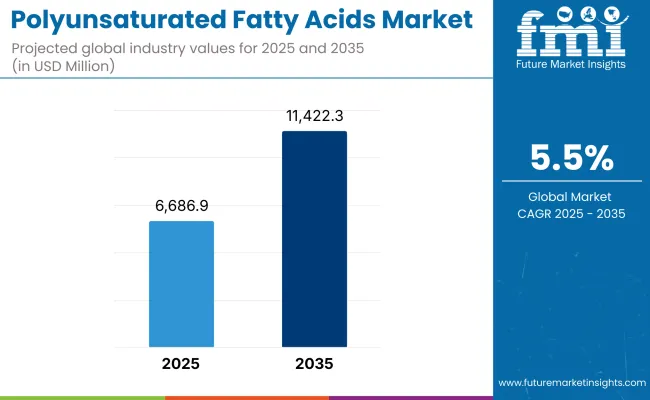

The polyunsaturated fatty acids market is projected to grow from USD 6,686.9 million in 2025 to USD 11,422.3 million by 2035, expanding at a CAGR of 5.5% over the forecast period.

With a worldwide focus on cardiovascular health, cognitive development, and immune support, consumption of PUFA is increasing rapidly across the diets, pharmaceuticals, and functional foods sectors. Increasing prevalence of omega-3 and omega-6 fatty acids, and growing use of marine and plant-based omega-3 fatty acids further expected to drive the growth of omega-3 and omega-6 fatty acids market.

Polyunsaturated fatty acids (PUFAs), particularly omega-3 and omega-6 fatty acids (eicosapentaenoic, docosahexaenoic, linoleic and arachidonic acids), are essential for cellular membrane liquid crystalline organization, neuronal development, cardiovascular health, and regulation of inflammatory response.

They come from marine sources fish oil, krill oil, algae and from plant (flaxseed, chia seed, sunflower, safflower), and then are processed into oils, syrups, soft gels and capsules to better fit into foods, supplements and drugs.

PUFAs play natural roles in human nutrition and are widely used in infant formulas, dietary supplements, pharma-grade interventions, and fortified functional foods, as well as in animal feed to enhance growth rate and reproductive performance and immunity.

Plant-based and algae-derived omega fatty acids are gaining the market preference, as a result of vegan nutrition trends and sustainability concerns related to over-fishing. Furthermore, growing demand for high-purity PUFAs from pharmaceutical break throughs against lifestyle diseases and developmental health and wellness are likely to further drive market growth.

The regulatory guidelines create a favorable environment to DHA/EPA fortification in infant nutrition, and this high-growth segment also drives the growth of the market. On the consumer side, food manufacturers add PUFA-based enriched SKUs across dairy, beverages, baked goods and nutritional bars, bolstering mainstream adoption.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6,686.9 million |

| Industry Value (2035F) | USD 11,422.3 million |

| CAGR (2025 to 2035) | 5.5% |

PUFAs is being driven by high protein supplement penetration, functional food adoption and increasing clinical application, North America continues to represent a major market. The soft gel omega-3 segment is robust in the USA, with increasing need for plant-derived DHA and ALA among vegetarian and flexitarian consumers. Demand was further augmented in 2023 when FDA qualified several EPA/DHA cardio vascular health claims.

Omega-3 enriched baby formula and prenatal supplements are also on the rise as consumers pay attention to developmental nutrition. IRISH PUFAs FORLIVE STOCK: Another big opportunity for IGF type products exists in the animal feed industry, where PUFAs are increasingly used to promote animal health and produce omega-3 enriched eggs, contributing to the regional volume growth.

In Europe, PUFA´sconsumption is sustained by a strong nutraceutical development landscape, clean-label trends, and positive EU / EFSA regulations. The biggest users of pharmaceutical-grade omega-3s (used to treat hypertriglyceridemia and inflammation-related conditions) in these countries are Germany, the UK, and the Netherlands.

Marine-based DHA and EPA are used widely, but sources such as flaxseed and chia oil are becoming more popular in the vegan and allergen-free product lines. Growing demand for functional dairy and beverages containing PUFA, and EU infant nutrition regulations, ensure a healthy market for DHA/EPA-fortified goods. Eco-friendly sourcing and traceability of marine oils remain a top consumer concern.

Asia-Pacific is the fastest-growing PUFA market, driven by increasing health awareness and middle-class nutrition, along with demand from infant formula in China, India, Japan, and Southeast Asia. China accounts for the largest regional market for omega-3-based infant formulas and supplements, while Japan represents the leading market for prescription omega-3 pharmaceuticals and for elderly wellness applications.

Plant-based PUFAs and functional food formulations drive India's growth, especially among urban segments. The religious and vegetarian-friendly reasons are making algae-sourced omega-3 oils more visible. Demand for omega-3 across aquaculture and poultry sectors is also accelerating as it enhances growth rates and feed efficiency.

PUFAs have promising opportunities in both human and animal nutrition in Latin America, Middle East and Africa. Brazil and Mexico lag behind but opportunities given rising middle class consumers for dietary supplements, and omega-3 enriched foods in premium retail and maternal health departments.

In the Middle East, both lifestyle-related diseases have high incidence rates there and the parallel uptake of PUFA-based pharmaceuticals and supplements. Slow market development for PUFA is exhibited in African markets but increasing interest in PUFA-fortified baby food and livestock feed are evident, particularly in urbanized regions.

Increased access is also being brought about by regional supply chain partnerships and local encapsulation units, which boost affordability.

Marine Source Dependency and Sustainability Risks

Marine-based sources, notably for the long-chain polyunsaturated fatty acids (PUFAs) EPA and DHA, continue to dominate the industry. This dependence exposes them to supply volatility fromover fishing, environmental destruction and climate-induced variability in fish stocks.

In 2023, the global availability of fish oil narrowed, as El Niño driven declines in Peruvian anchovy harvests drove up raw material prices and caused glitches in the omega-3 supply chain. Furthermore, fears surrounding mercury and dioxin pollution across marine sources undermines confidence. The switch to sustainable marine harvesting and scaling up algae-based production will be essential to ensure long-term supply and limit ecological risk.

Oxidation Sensitivity and Formulation Complexity

PUFAs are chemically unstable and susceptible to oxidation, which results in rancid products, depletion of nutrients, and undesirable odor or taste, especially in food and beverage products. Innovative encapsulation, antioxidative systems, and cold-chain supply logistics are needed to maintain shelf life and sensory quality, resulting in a high cost and technical barriers to the formulation.

Industry reports show over 20% of worldwide softgel supplement recalls in 2023 tied to oxidation-based quality issues. Formulation still poses a challenge for the stable integration of PUFAs into heat-treated products such as bakery products or dairy. This breakthrough barrier also requires innovations in lipid encapsulation, microemulsion and nano-dispersion systems to ensure the expansion of functional food.

Algae-Based Omega-3 Gaining Momentum in Vegan and Prenatal Nutrition

Growing plant-based lifestyles and awareness about prenatal nutrition continues to spur demand around algae-sourced omega-3s, especially DHA. Algae oil is a sustainable, mercury-free ingredient with super high purity and environmental safety, meeting both vegan labeling and infant health requirements.

New softgels, infant drops, and functional beverages led double-digit growth for algae-derived DHA in the North American and European prenatal markets in 2023. As the cultivation of microalgae becomes more cost-competitive, producers with sustainability certifications, organic claims, and traceable sourcing will be rewarded with premium positioning and brand loyalty across wellness-minded demographics.

PUFA-Fortified Functional Foods Targeting Cardiovascular and Cognitive Health

The trend towards consumers seeking functional foods rather than pills has opened numerous opportunities for PUFA en- forcement in ready-to-drink beverages, snacks, dairy products, and breakfast foods. In 2023, more than 300 new SKUs debuted around the globe with omega-3 fortification, especially in yogurts, protein bars and heart-health-promoting spreads.

As the world increasingly worries about heart disease, attention deficit/hyperactivity disorder (ADHD) and age-related cognitive decline, food manufacturers are using PUFAs as a clean-label functional ingredient. Health claims backed by clinical data, alongside flavor stability and shelf-life retention will drive demand for value-added products that facilitate nutrition with convenience consumption formats.

Expanding Applications in Animal Nutrition and Aquaculture

PUFAs are gaining acceptance in the animal feed business for enhancing reproductive efficiency, immunity and growth performance in domestic animals and aquaculture species. Functional meat and eggs from omega-3 enriched feed can satisfy the increasing consumer demand for nutritionally enhanced products from animals. PUFA-enriched diets are utilized in aquaculture for improving the fish quality, enhanced survivability, and resistance against diseases.

In 2023 top feed makers in Asia and Europe began ramping up the proportion of plant-derived and algal PUFAs(polyunsaturated fatty acids) in poultry and shrimp feed formulations. Companies that are able to grow accessible, affordable PUFA formulations tailored to specific species tailored to large-scale agricultural farming operations will have their share of a fast growing, value-added niche in international animal nutrition.

Between 2020 and 2024, the market for polyunsaturated fatty acids (PUFAs) should witness sustained growth, driven primarily by the growing consumer interest in cardiovascular health, immune support and cognitive function. Marine source omega-3 fatty acids led the market share, followed by plant source omega-3, whereas, global omega-3market segment is driven by omega-3 application two segments mainly dietary supplements and infant formula.

An increase in vegan and vegetarian lifestyles has popularized plant-based sources such as flaxseed and chia seed oils. PUFAs were then incorporated in functional products by the food and beverage sector as well as pharmaceutical formulations, and the delivery system became standard in soft gels and oil based formats.

Looking forward, the PUFA market is projected to grow from USD 6,686.9 million in 2025 to USD 11,422.3 million by 2035, at a CAGR of 5.5%. Cosmetic microencapsulation technology, enhanced bioavailability and personalized nutrition are anticipated to drive market growth and diversification.

It is likely thatomega-6 fatty acids will come back into play as the diversity of formulations broadens. Demand for plant based sources will rapidly grow with sustainability concerns and algal technology developing. Pediatric and aging populations will be served by new formats for products like syrups, chewable, and advanced softgels. Application of PUFAs in the nutrition of animals and clinical nutrition will maximize market diversification.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Screening infant formula and dietary supplements for purity and source validation. |

| Technological Advancements | The marine oil processing was occurred by conventional extraction and purification methods. |

| Industry-Specific Demand | Robust demand in dietary supplements, infant formula and heart health formulations. |

| Sustainability & Circular Economy | Focus on sustainable marine sourcing and reduced fishery dependence. |

| Production & Supply Chain | Reliance on marine oil supplier sand inconsistent raw material pricing. |

| Market Growth Drivers | Rising health awareness, demand for functional nutrition, and omega-3 adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global agreement on omega-3 PUFA industry standards for factors such as concentration, traceability, and plant-based claim limits. |

| Technological Advancements | Increased adoption of technologies for enzymatic extraction, algal fermentation and nanoemulsions for improved absorption . |

| Industry-Specific Demand | G rowing demand in functional food, animal feed, personalized wellness and therapeutic application. |

| Sustainability & Circular Economy | Complete incorporation of algae and plant sourced omega oils with eco certifications and traceable sourcing. |

| Production & Supply Chain | Diversified sourcing from chia, flaxseed and algae; vertically integrated supply chains and clean-label manufacturing. |

| Market Growth Drivers | Sustainable sourcing, personalized nutrition trends, new delivery formats, expanded therapeutic use. |

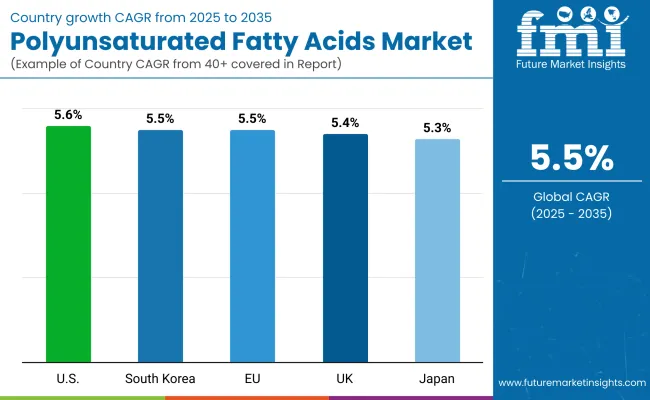

The USA Polyunsaturated Fatty Acids (PUFAs) has a steady growth with health awareness and nutritional supplements driving the market. Fish oil-derived Omega-3 fatty acids lead the market owing to their cardiac and cognitive health benefits. The dietary supplement and pharmaceutical segments account for the largest soft gels and capsules delivery formats.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The market is driving steady growth in the UK polyunsaturated fatty acids market, integrating growing demand for clean-label and plant-based nutrition. Both food & beverage products and functional supplements currently include omega-3 & omega-6 PUFAs. Flaxseed and chia oils are emerging as alternative sources.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

The European Union PUFAs market is growing rapidly, driven by a strong regulatory environment that facilitates health claims, and expanding application in dietary and pharmaceutical formulations. Both marine and plant oils are commonly utilized, with increased activity in animal feeding and food-grade syrups.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The polyunsaturated fatty acids market in Japan is mature and innovative with a very high awareness of health benefits associated with Omega-3 consumption. Marine sources continue to prevail, especially for DHA and EPA-rich oils, which are widely utilized in dietary supplements and food applications. Demand for high-purity syrups and pharma-grade PUFA concentrates is also seen in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The South Korean polyunsaturated fatty acids market is expanding with rising health and wellness trends, particularly among younger consumers and fitness-focused individuals. Pioneering growth in animal oil categories are being outperformed by plant-based alternatives, while marine oils remain the driving force in segments such as pharmaceuticals and infant nutrition.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Omega-3 fatty acids account for the largest share of the PUFA market,owing to their established benefits on cardiovascular, cognitive, and anti-inflammatory outcomes, and are commonly used in dietary supplements, infant formulas, and to a lesser extent pharmaceutical formulations. Clinically supported key compounds include EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid) to help reduce cholesterol, improve brain health and lower blood pressure.

As populations age and awareness of good preventive health care has increased, consumer demand for omega-3 has expanded worldwide, but especially in North America,Europe and Japan. Worldwide omega-3 ingredients appeared in more than 60% of dietary supplement launches in2023.

Regulatory support, for example, GRAS status within the USA and positive EFSA opinions in Europe, continues to support market acceptance. Novel approaches like plant-based omega-3s (derived from algae)are also broadening consumer reach, particularly among vegans and flexitarians.

The metabolic importance of omega-6 fatty acids is a new area, particularly in terms of their roles in skin health, immune modulation and metabolismvia linoleic and arachidonic acid. Omega-6 PUFAs ,which are commonly used in functional foods, cosmetics, and nutritional therapy, are primarily derived from plant oils, including sunflower, soybean, and evening primrose oil.

Though omega-6 intake is high in many diets, specialized formulations are aiming at specific ratios (omega-6 to omega-3) for use in inflammation, joint health and women’swellness products. Demand in nutraceuticals and fortified food is increasing, particularly inAsia-Pacific and Latin America, where plant-based oils form part of traditional diets. The segment also les from growing inclusion of omega-6 in infant nutrition, clinical nutrition products that enhance cellular development and immune function.

Polyunsaturated fatty acids' single largest application is dietary supplements, which is being fueled by the global trend toward self-care, preventive health and lifestyle disease management. Omega-3 and omega-6 supplements are commonly available, in their natural softgel, oil, and capsule forms, and cover a wide range of health needs, including heart, joint, eye, brain, and prenatal health.

As chronic conditions such as hypertension and obesity become more prevalent daily PUFA supplementation is coming into the consumer focus with special emphasis on adults above 40 years, fitness enthusiasts and pregnant women.

North America is the largest market and China, India and Southeast Asia are also experience double-digit CAGRs as a result of urbanization and higher disposable incomes. Reaching even more consumers are e-commerce and personalized nutrition platforms that sell custom PUFA blends or high-potency, targeted omega-3 formulations.

DHA and ARA are polyunsaturated fatty acids that are critical for brain and retinal development in infants and are included as a standard component of many premium infant formula products around the world. Regulatory agencies like EFSA(Europe) and FDA (USA) require minimum levels of DHA in infant formula, creating a sustainable demand for high-purity, microencapsulated sources of PUFA.

Marine DHA still dominates, but algae and plant-based sources are emerging to fill vegetarian products and hypoallergenic requirements. In China andSoutheast Asia, a high-growth sector for infant nutrition demand for omega-3-fortified formulas is being fueled by increasing birth rates and premiumization trends.

Companies specializing in infant nutrition are additionally working on methods to source sustainably, as well as technologies to improve bioavailability, enhancing absorption and shelf stability.

Polyunsaturated fatty acids (PUFAs) market, which is growing steadily, backed up by rising consumer awareness about the nutritional health, cardiovascular health, cognitive development, and immune support. Omega-3 and Omega-6 fatty acids: The trend of Omega-3 and Omega-6 fatty acids are expected to proliferate in dietary supplements, infant nutrition, and also pharmaceuticals and functional foods.

Trends such as increased demand for plant-based sources, developments in microencapsulation, and incorporation of innovative vegan and personalized nutrition products are likely to influence the market dynamics across the globe.

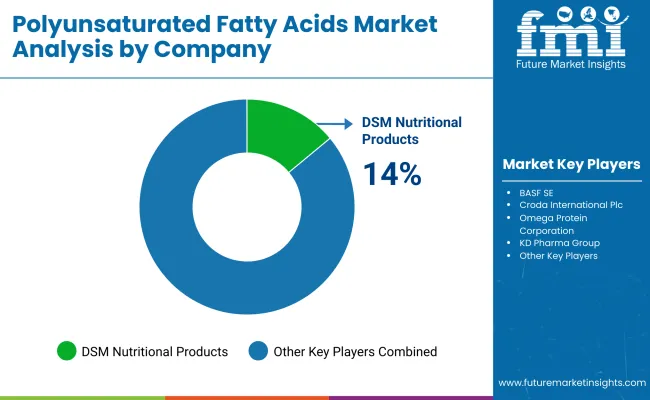

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DSM Nutritional Products | 14-18% |

| BASF SE | 11-14% |

| Croda International Plc | 9-12% |

| Omega Protein Corporation | 6-9% |

| KD Pharma Group | 4-7% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| DSM Nutritional Products | Provides omega-3 and omega-6 oils for supplements and infant formula. Robust for marine as well as algal sourcing and encapsulation technologies . |

| BASF SE | Provides high-dose PUFAs for use in pharmaceuticals and clinical nutrition. Famed for clinical validation, and sustainable sourcing. |

| Croda International Plc | A plant-based omega oil company for food, cosmetics and nutraceuticals; Specializes in plant-based and functional ingredient development. |

| Omega Protein Corporation | Provide smarine-based PUFAs, giving the majority to animal nutrition and supplements. Robust in initiatives in fisheries |

| KD Pharma Group | Manufacturing high purityomega-3 APIs and softgel formulations. Best known for:Customizable concentrations; pharma-grade solutions. |

Key Company Insights

DSM Nutritional Products

DSM Nutritional Products is a global leader with a wide range of marine- and algal-sourced omega-3 and omega-6 fatty acids. Its target industries are dietary supplements, infant formula, pharmaceuticals and clinical nutrition. DSI is strong on R&D and specializes in microencapsulation technologies with improved stability, bioavailability and taste masking capabilities.

Its focus is on sustainable sourcing and its eye is increasingly on algae-based, plant-friendly alternatives to fish oil. As a trusted supplier to health-conscious consumers and brand owners seeking science-backed, high-purity PUFA ingredients with stringent quality control and global regulatory compliance, DSM produces a range of PUFA-derived products for specific applications.

BASF SE

BASF SE is a major producer of high purity polyunsaturated fatty acids (PUFAs), especially omega-3 products, for pharmaceutical and clinical nutrition applications. Its advanced purification and concentration technologies allow for minimal oxidation and high stability, with strict international pharmacopeia quality standards. BASF enables opening and end-to-end traceability & provides formulation know-how to soft gels, emulsions, and other delivery formats.

Provides third party verified quality assurance and scientific validation, environmentally friendly marine oil sourcing. As a supplier of choice for companies focused on cardiovascular, inflammatory and cognitive health through clinically validated PUFA-based formulations, BASF is the only supplier with a global manufacturing and distribution footprint.

Croda International Plc

Croda InternationalPlc's range of plant-based and vegan approved polyunsaturated fatty acids (PUFAs) is perfect for brands riding the wave of clean-label and eco-friendly demand. The company supplies omega-3 and omega-6 oils from algae and other sustainable botanical sources to markets including functional foods, cosmetics and nutraceuticals.

Sensory attributes, including taste and smell,and bioavailability, are very important to Croda. It also uses its formulation expertise to assist clients in incorporating PUFAs into beverages, gummies and skin care products.

Omega Protein Corporation

Omega Protein Corporation has been producing marine-based PUFA for decades, and is known for its omega-3 based oils that use the menhaden fish. The company serves important markets such as dietary supplements, animal feed,aquaculture and functional food industries. With vertically integrated operations from sustainable fishing to processing and refining, Omega Protein is committed to delivering quality, traceability, and environmental compliance.

The firm specializes inomega-3 fatty acids EPA and DHA with stringent controls to reduce the risk of oxidation and contamination. Known for having a long history of consistency and marine stewardship at its heart, Omega Protein is a trusted supplier to companies looking for responsibly sourced marine oils for human and animal nutrition.

KD Pharma Group

KD Pharma Group is a worldwide expert in omega-3 with specialization in highly concentrated omega-3APIs, as well as finished dosage forms, e.g. capsules, liquids and emulsions. The company utilizes advanced purification technologies to produce pharmaceutical-grade EPA and DHA with high bioavailability such as supercritical CO₂ extraction.

KD Pharma serves regulated pharma and nutraceuticals with a heavy focus on cardiovascular, prenatal, and inflammatory health. It provides customized omega-3 solutions, co-designing formulations with partners world wide, from North America and Europe to Asia. Their technical competence, regulatory certifications, and clinical studies have earned KD Pharma the reputation of being a reliable provider of premium PUFA products.

Omega-3 Fatty Acids, Omega-6 Fatty Acids

Marine, Plant, Chia Seed Oil, Flax Seed Oil, Other

Dietary Supplement, Infant Formula, Pharmaceuticals, Food and Beverages, Animal Food and Feed

North America,Latin America,Western Europe,South Asia,East Asia,Eastern Europe,Middle East & Africa

The overall market size for the Polyunsaturated Fatty Acids Market was USD 6,686.9 Million in 2025.

The Polyunsaturated Fatty Acids Market is expected to reach USD 11,422.3 Million in 2035.

Increased demand for heart and brain health supplements, growth in infant nutrition, and shift toward plant-based and sustainable sources will drive demand.

The top 5 countries driving the development of the Polyunsaturated Fatty Acids Market are the USA, China, Germany, Japan, and South Korea.

Omega-3 Fatty Acids are expected to lead due to their broad applications in cardiovascular health, cognitive development, and clinical nutrition.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Source, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Form, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Source, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Form, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Essential Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyglycerol Esters Of Fatty Acids Market

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA