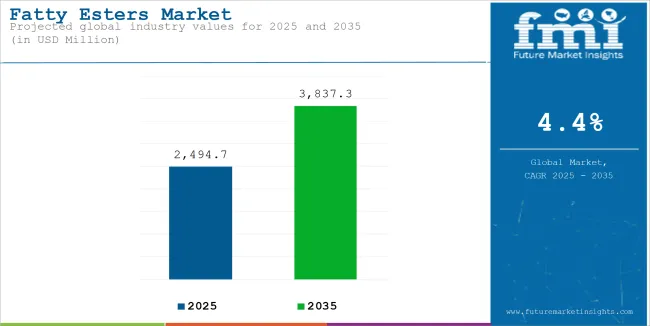

The global fatty esters market reached USD 2,011.5 million in 2020. Worldwide demand for fatty esters saw a 4.8% year-on-year growth in 2025, suggesting an expansion of the market to USD 2,494.7 million in 2025. Projections for the period between 2025 and 2035 indicate a 4.4% compound annual growth rate (CAGR) for global fatty esters sales, resulting in a market size of USD 3,837.3 million by the end of 2035.

Fatty Acid Methyl Esters (FAME) are most widely used due to their properties like high oxidation stability and eco-friendly and biodegradable nature. The fatty esters market is growing rapidly due to increased demand for a green environment and low carbon impact.

FAME is widely used in applications such as biofuels for vehicles, machinery (including construction, mining, and farming), stationary power generators, cosmetics, lubricants, industrial solvents, pharmaceuticals, and fuel additives.

The eco-friendly nature of fatty esters makes them especially popular in the food and agriculture sectors, where they serve as carriers for fertilizers and pesticides. Increasing awareness of environmental concerns, the demand for fame is expected to continue expanding, driven by its sustainability benefits and adaptability in diverse industrial applications.

Methyl Esters is a clear, viscous fluid used as a surfactant, cutting fluid additive, lubricant, and plasticizer. It is a plasticizer for cellulosic resins, polyvinyl acetate, and polystyrene. Methyl esters are added to castor oil to produce heptaldehyde and methyl undecenoate for flavors and perfumes in the cosmetics and pharmaceutical industries.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 2494.7 million |

| Projected Size (2035) | USD 3837.3 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

The growth trajectory of Glycol esters is anticipated to grow at the fastest CAGR in the forecast period and is expected to account for a CAGR of 4.4% from 2025 to 2035.

Glycerol esters drive significant demand in the fatty esters market due to their versatile applications and eco-friendly properties. Fatty esters are mainly used as antioxidants and softening agents, which play a crucial role in enhancing the taste and texture of chewing gum, including SBR and polyvinyl acetate-based varieties.

Additionally, glycerol esters are effective emulsification stabilizers in soft drinks, ensuring product consistency and quality. In the cosmetic and depilatory industries, they are utilized as tackifiers, improving product performance and stability. Glycerol esters are also used in agricultural industries for tobacco cultivation, promoting better distribution of nutrients.

As demand for sustainable, biodegradable, and multifunctional ingredients continues to grow, glycerol esters demand goes on increasing in industrial applications. It is expected to drive further growth in the esters market.

The annual growth rates of the fatty esters market from 2025 to 2035 are illustrated in the table below. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e., January through June (H1) to the second half consisting of July through December (H2).

This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the sector's growth for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 4.4% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.4% (2024 to 2034) |

| H2 2024 | 4.5% (2024 to 2034) |

| H1 2025 | 4.6% (2025 to 2035) |

| H2 2025 | 4.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 4.6% in the first half and grow to 4.7% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 10 BPS each.

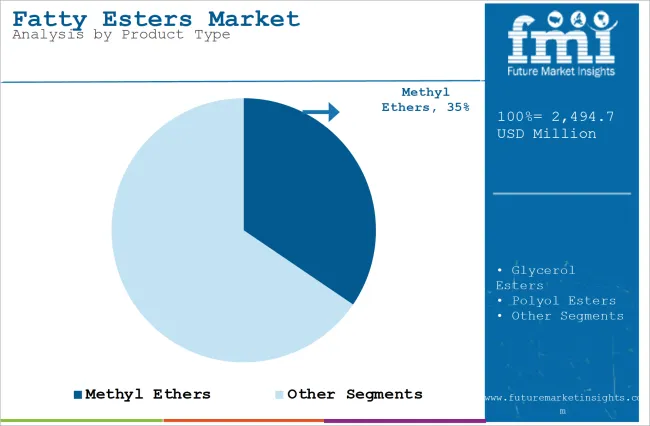

The section explains the market share analysis of the leading segments in the industry. In terms of product type, the Methyl Esters type will likely dominate and generate a share of around 34.5% in 2025.

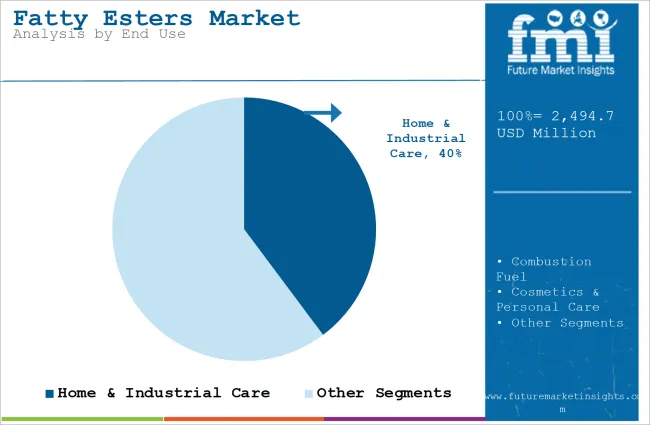

Based on the end use, the Cosmetics and Personal care segment is projected to hold a major share of 39.8% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Methyl Ethers (Product Type) |

|---|---|

| Value Share (2025) | 34.5% |

Biodiesel is made through a chemical process called transesterification, where fats or oils (like palm oil or other natural triglycerides) react with methanol or ethanol to produce fatty acid methyl esters (FAME) and glycerin.

In this process, the glycerin in fats is replaced with methyl alcohol to create biodiesel. Methanol is most widely used because it achieves better conversion rates, while ethanol is often used for its lower cost.

From these results, biodiesel is prepared using a mix of fatty acid esters, which can be produced using vegetable or animal fats. Biodiesel is considered a clean, renewable alternative fuel that helps reduce greenhouse gas emissions.

| Segment | Residential (End Use) |

|---|---|

| Value Share (2025) | 39.8% |

High-purity fatty acid esters are specially designed for personal and hair care, and they are extensively used in products like hair treatment creams, body lotions, and ointments.

Fatty acid esters have functional characteristics like emollients, emulsifiers or co-emulsifiers, plasticizers, and solubilizers for flavors and fragrances, which are used for the texture and performance of cosmetics. These have ability to deliver superior moisturizing effects and provide smooth, non-greasy finishes which makes the products high quality standard in personal care products.

In the pharmaceutical industry, fatty ester products are used as cosmetics products, which should be skin-friendly. As consumer preference shifts towards high-quality and sustainable products, the demand for fatty esters in these industries continues to increase, and this will be reflected in increasing market growth.

Between 2020 and 2024, the target market registered a growth rate of 4.4% by reaching a value of USD 2389.6 million in 2024 from USD 2011.5 million in 2020. This growth was driven by natural and plant-based ingredients in the personal care market.

The fatty esters market gradually increases demand for personal care and cosmetics, which has been a driving factor. Fatty esters act as emulsifiers in skin care products, helping to blend oil and water-based ingredients in lotions, creams, and sunscreens.

Additionally, fatty esters are also used as function as emollients, providing hydration and help in softening the skin. In haircare, fatty acid esters act as conditioners, improving hair texture and adding shine.

As the demand for innovative, natural products grows, particularly in markets like South Korea, which is known for its unique beauty products and focus on natural ingredients, the share of fatty acid esters in the market has seen significant growth from 2020 to 2024.

Looking ahead for fatty esters, demand grows due to methyl esters, which help make biodiesel fuels and gradually grow market share from 2025 to 2035.

As global demand focusing on renewable and sustainable energy sources intensifies, biodiesel made from FAME is becoming an increasingly popular alternative to fossil fuels due to its environmental benefits, such as reducing carbon dioxide, HC, and PM emissions, even leading to an increase in other emissions.

Governments are likely to expand mandates for renewable energy, promoting biodiesel’s use in transportation and industry. Increasing adoption of biofuels, particularly in regions like Europe and North America, as part of climate change mitigation strategies will continue to increase the demand for biodiesel fuels made from fatty acid esters. Rising use of bio-based fuels in industries seeking to reduce their carbon footprint and follow emissions regulations.

Growing Demand for Fatty Esters in Food and Beverages Industries

Growing demand for fatty acid esters in the food and beverage industry is driven by their versatile functional properties, such as emulsifiers, stabilizers. Fatty acid methyl esters and fatty acid ethyl esters which helps in increasing the consistency, shelf life, and overall quality of a wide range of food products.

Fatty esters are commonly used in food and beverages industry for making daily use product like bakery goods, dairy products, margarine, sauces, and beverages to prevent separation and smooth mixing of oil and water-based ingredients.

Nowadays, as consumer preferences shift toward hygiene, more natural ingredients are made from fatty acid esters, which is derived from renewable sources are gaining popularity due to their sustainability and non-toxic nature. Furthermore, with increasing demand for convenience foods, additives made from fatty esters have improved product stability and shelf life also rises.

Polyglycol ethers is widely used as emulsifier is in the making of baked products. Polyglycol is used for the softness of bakery products like breads, the flakiness of pastries, and the texture of various baked delicious products.

Emulsifiers also helps in the even distribution of fat throughout the dough, maintaining the uniform structure and extended freshness. Due to these above properties of PEG it is mostly used in food and beverages industry which helps in increasing the demand for Fatty acid esters market.

Increasing demand for Cosmetics and Skincare Boost Fatty Esters Market

Increasing the demand for cosmetics and skincare products is gradually boosting the growth of the fatty acid esters market. Fatty acid esters, having functional properties like emulsifying, stabilizing, and thickeners are key ingredients in personal and skin care formulations.

Fatty esters help in stabilizing oil and water mixtures in creams, lotions, and sunscreens, providing a smooth and consistent texture. Additionally, they act as moisturizers and emollients, keeping the skin hydrated and soft.

APL offers a wide range of Personal Care Products & Cosmetic Ingredients for various applications:

Glycol esters - These are fatty acid esters made up of ethylene glycol and propylene glycol, which are used as a pacifying agents in low-viscosity shampoos, baby toiletries, liquid soaps, and bath gels. They have applications with other surface active agents as stabilizing, dispersing, wetting, foaming, and suspending agents.

Fatty acid/alcohol esters - Fatty acid/alcohol esters are widely used in personal care products as thickeners & dispersants. Additionally, it is also widely used as a skin conditioning agent, emollient, emulsifier in cosmetics, and anti-septic creams. Tridecyl esters have been recommended for use in all products that are used throughout the day, such as moisturizers, lotions, make-up, face creams, and day creams.

As consumers become more aware of the benefits of natural and non-toxic ingredients, consumers are shifting toward products containing bio-based ingredients like fatty acid esters.

These esters are biodegradable and safe for skin use, making them highly favored in beauty care. Moreover, the increasing trend of "green" and sustainable beauty products is driving brands to adopt fatty acid esters as a key component to meet consumer demand for eco-friendly, effective skincare solutions, contributing to the market's growth.

Rising Demand for Fatty Acid Esters in the Textile Industry

Fatty acid esters are increasing in demand in the textile industry due to their sustainable properties and eco-friendly nature. Fatty acid esters are primarily used as softeners, lubricants, and finishing agents in fabric production.

These fatty acids are widely used for the finishing of products which includes texture, smoothness, and overall feel of textiles, which helps manufacturers to produce high-quality fabrics. Fatty acid esters also play a role in enhancing the durability and strength of textiles, improving their resistance to wear and tear.

One of the growing focuses is on sustainability in the textile industry, which has further lifted the demand for biodegradable and non-toxic alternatives like fatty acid esters, which align with the industry's shift towards eco-friendly practices.

Nowadays, consumers prefer to change towards sustainable products, due to which demand also increases towards products, so companies face stricter environmental regulations. Due to these factors, manufacturers are shifting towards efficient and sustainable ingredients in textile manufacturing, and the market of fatty esters is expected to rise, promoting further market growth.

Dynamic Prices of Raw Materials May Impede Market Growth

Fatty Ethers prices of raw materials are restricting the growth in the market. Fatty acid ethers are made from many raw materials such as palm oil, coconut oil, and soybean oil, which prices vary widely due to factors such as weather conditions affecting crop yields, geopolitical tensions impacting trade, and changes in agricultural policies or subsidies. These economic fluctuations directly influence production costs for manufacturers.

When raw material prices rise sharply, manufacturers may face higher production expenses, which leads to decreased profit margins, and due to high demand, the supply gets shortage, so due to these manufacturers increased costs for the consumers, which results in gaining the profit margin.

Sharp fluctuations in the prices of raw materials may lead to price uncertainty for both consumers and suppliers, potentially hampering the fatty acid market growth.

Tier 1 companies comprise players with a revenue of over USD 500 million, capturing a significant 25-30% share in the global market. These players are characterized by high production capacity and a broad product portfolio.

These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple fatty ester applications and a broad geographical reach underpinned by a robust consumer base. Prominent companies within Tier 1 include Arkema, BASF SE, Cargill Incorporated, Cayman Chemical, and other players.

Tier 2 companies include mid-size players with revenue of below USD 800 million, having a presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge.

These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Krishi Oils Limited, Larodan AB (ABITEC), Merck KGaA, TCI Chemicals (India) Pvt. Ltd, Wilmar International Ltd, and another player.

The section below covers the industry analysis for the demand for fatty esters in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa, is provided.

The USA will hold 35.5% of North American market share due to its strong demand in industries like personal care, pharmaceuticals, and biofuels, which focus on eco-friendly, sustainable ingredients. Germany will lead Western Europe with 22.7% due to its robust industrial base and focus on innovation in producing fatty acid esters.

China is also contributing to East Asia, which holds a share of 17.6% due to the expansion of the chemical industry and significant investments in bio-based alternatives, especially in industrial applications.

These companies play a significant role in driving market growth by introducing new, environmentally friendly, and more efficient fatty acid esters.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

| Japan | 5.6% |

| India | 5.0% |

| Germany | 4.8% |

| China | 5.3% |

The United States drives market growth through innovations and sustainability in fatty acid esters for personal care, pharmaceuticals, and biofuels, catering to the increasing demand for eco-friendly, biodegradable products. USA is focusing on R&D investments, which helps in the significant growth of green chemistry to expand the market.

Germany contributes about 22.7% to the fatty acid esters market through its strong chemical manufacturing base, which leads in producing high-quality and sustainable products. Commitment towards green chemistry and advanced production techniques supports the growing demand for biodegradable esters across industries, including automotive, cosmetics, and biofuels.

China boosts the fatty acid esters market with its large-scale production capacity and significant investments in bio-based alternatives. China’s rapid industrialization and adoption of eco-friendly products are driving demand for fatty acid esters, particularly in industrial applications, agriculture, and personal care.

Key companies producing fatty esters are slightly consolidate the market with about 25-30% share that are prioritizing technological advancements, integrating sustainable practices, and expanding their footprints in the region. Customer satisfaction remains paramount, with a keen focus on producing fatty esters to meet diverse applications.

These industry leaders actively foster collaborations to stay at the forefront of innovation, ensuring their fatty esters align with the evolving demands and maintain the highest standards of quality and adaptability.

Recent Industry Developments

The Product Type segment is further categorized into Methyl Ethers, Glycerol Ethers, Polyol Esters, Sorbitan Esters, Medium-Chain Triglycerides (MCTs), Isopropyl Esters and Ethyl Esters.

The End Use segment is classified into Combustion fuel, Home & Industrial Care, Cosmetics & Personal Care, Pharmaceuticals & Nutraceuticals, Agrochemicals, Others (Rubber, Plastic, Textile, etc.).

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The global fatty esters market for residential end use was valued at USD 2,494.7 million in 2025.

The demand for fatty esters industry is set to reach USD 3,837.3 million in 2035.

Fatty acid methyl esters (FAME) are key components of biodiesel, a renewable alternative to fossil fuels. Government initiatives promoting renewable energy and reduced carbon emissions will support market growth.

The fatty esters demand is projected to reach USD 2,494.7 million by 2035 growing at CAGR of 4.4% in the forecast period.

Cosmetics & Personal Care use is expected to lead during the forecast period.

Table 1: Global Market Value (US$ Million), By Type, 2015 to 2021

Table 2: Global Market Value (US$ Million), By Type, 2022 to 2032

Table 3: Global Market Value (US$ Million), By Application, 2015 to 2021

Table 4: Global Market Value (US$ Million), By Application, 2022 to 2032

Table 5: Global Market, By Region, 2015 to 2021

Table 6: Global Market, By Region, 2022 to 2032

Table 7: North America Market Value (US$ Million), By Type, 2015 to 2021

Table 8: North America Market Value (US$ Million), By Type, 2022 to 2032

Table 9: North America Market Value (US$ Million), By Application, 2015 to 2021

Table 10: North America Market Value (US$ Million), By Application, 2022 to 2032

Table 11: North America Market, By Country, 2015 to 2021

Table 12: North America Market, By Country, 2022 to 2032

Table 13: Latin America Market Value (US$ Million), By Type, 2015 to 2021

Table 14: Latin America Market Value (US$ Million), By Type, 2022 to 2032

Table 15: Latin America Market Value (US$ Million), By Application, 2015 to 2021

Table 16: Latin America Market Value (US$ Million), By Application, 2022 to 2032

Table 17: Latin America Market, By Country, 2015 to 2021

Table 18: Latin America Market, By Country, 2022 to 2032

Table 19: Europe Market Value (US$ Million), By Type, 2015 to 2021

Table 20: Europe Market Value (US$ Million), By Type, 2022 to 2032

Table 21: Europe Market Value (US$ Million), By Application, 2015 to 2021

Table 22: Europe Market Value (US$ Million), By Application, 2022 to 2032

Table 23: Europe Market, By Country, 2015 to 2021

Table 24: Europe Market, By Country, 2022 to 2032

Table 25: Asia Pacific Market Value (US$ Million), By Type, 2015 to 2021

Table 26: Asia Pacific Market Value (US$ Million), By Type, 2022 to 2032

Table 27: Asia Pacific Market Value (US$ Million), By Application, 2015 to 2021

Table 28: Asia Pacific Market Value (US$ Million), By Application, 2022 to 2032

Table 29: Asia Pacific Market, By Country, 2015 to 2021

Table 30: Asia Pacific Market, By Country, 2022 to 2032

Table 31: MEA Market Value (US$ Million), By Type, 2015 to 2021

Table 32: MEA Market Value (US$ Million), By Type, 2022 to 2032

Table 33: MEA Market Value (US$ Million), By Application, 2015 to 2021

Table 34: MEA Market Value (US$ Million), By Application, 2022 to 2032

Table 35: MEA Market, By Country, 2015 to 2021

Table 36: MEA Market, By Country, 2022 to 2032

Table 37: Global Market Incremental $ Opportunity, By Type, 2015 to 2021

Table 38: Global Market Incremental $ Opportunity, By Application, 2022 to 2032

Table 39: Global Market Incremental $ Opportunity, By Region, 2022 to 2032

Table 40: North America Market Incremental $ Opportunity, By Type, 2015 to 2021

Table 41: North America Market Incremental $ Opportunity, By Application, 2022 to 2032

Table 42: North America Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 43: Latin America Market Incremental $ Opportunity, By Type, 2015 to 2021

Table 44: Latin America Market Incremental $ Opportunity, By Application, 2022 to 2032

Table 45: Latin America Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 46: Europe Market Incremental $ Opportunity, By Type, 2015 to 2021

Table 47: Europe Market Incremental $ Opportunity, By Application, 2022 to 2032

Table 48: Europe Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 49: Asia Pacific Market Incremental $ Opportunity, By Type, 2015 to 2021

Table 50: Asia Pacific Market Incremental $ Opportunity, By Application, 2022 to 2032

Table 51: Asia Pacific Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 52: MEA Market Incremental $ Opportunity, By Type, 2015 to 2021

Table 53: MEA Market Incremental $ Opportunity, By Application, 2022 to 2032

Table 54: MEA Market Incremental $ Opportunity, By Country, 2022 to 2032

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2015 to 2032

Figure 2: Global Market Absolute $ Historical Gain (2015 to 2021) and Opportunity (2022 to 2032), US$ Million

Figure 3: Global Market Share, By Type, 2022 & 2032

Figure 4: Global Market Y-o-Y Growth Projections, By Type - 2022 to 2032

Figure 5: Global Market Attractiveness Index, By Type - 2022 to 2032

Figure 6: Global Market Share, By Application, 2022 & 2032

Figure 7: Global Market Y-o-Y Growth Projections, By Application - 2022 to 2032

Figure 8: Global Market Attractiveness Index, By Application - 2022 to 2032

Figure 9: Global Market Share, By Region, 2022 & 2032

Figure 10: Global Market Y-o-Y Growth Projections, By Region - 2022 to 2032

Figure 11: Global Market Attractiveness Index, By Region - 2022 to 2032

Figure 12: North America Market Value (US$ Million) and Year-on-Year Growth, 2015 to 2032

Figure 13: North America Market Absolute $ Opportunity Historical (2015 to 2021) and Forecast Period (2022 to 2032), US$ Million

Figure 14: North America Market Share, By Type, 2022 & 2032

Figure 15: North America Market Y-o-Y Growth Projections, By Type - 2022 to 2032

Figure 16: North America Market Attractiveness Index, By Type - 2022 to 2032

Figure 17: North America Market Share, By Application, 2022 & 2032

Figure 18: North America Market Y-o-Y Growth Projections, By Application - 2022 to 2032

Figure 19: North America Market Attractiveness Index, By Application - 2022 to 2032

Figure 20: North America Market Share, By Country, 2022 & 2032

Figure 21: North America Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 22: North America Market Attractiveness Index, By Country - 2022 to 2032

Figure 23: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2015 to 2032

Figure 24: Latin America Market Absolute $ Opportunity Historical (2015 to 2021) and Forecast Period (2022 to 2032), US$ Million

Figure 25: Latin America Market Share, By Type, 2022 & 2032

Figure 26: Latin America Market Y-o-Y Growth Projections, By Type - 2022 to 2032

Figure 27: Latin America Market Attractiveness Index, By Type - 2022 to 2032

Figure 28: Latin America Market Share, By Application, 2022 & 2032

Figure 29: Latin America Market Y-o-Y Growth Projections, By Application - 2022 to 2032

Figure 30: Latin America Market Attractiveness Index, By Application - 2022 to 2032

Figure 31: Latin America Market Share, By Country, 2022 & 2032

Figure 32: Latin America Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 33: Latin America Market Attractiveness Index, By Country - 2022 to 2032

Figure 34: Europe Market Value (US$ Million) and Year-on-Year Growth, 2015 to 2032

Figure 35: Europe Market Absolute $ Opportunity Historical (2015 to 2021) and Forecast Period (2022 to 2032), US$ Million

Figure 36: Europe Market Share, By Type, 2022 & 2032

Figure 37: Europe Market Y-o-Y Growth Projections, By Type - 2022 to 2032

Figure 38: Europe Market Attractiveness Index, By Type - 2022 to 2032

Figure 39: Europe Market Share, By Application, 2022 & 2032

Figure 40: Europe Market Y-o-Y Growth Projections, By Application - 2022 to 2032

Figure 41: Europe Market Attractiveness Index, By Application - 2022 to 2032

Figure 42: Europe Market Share, By Country, 2022 & 2032

Figure 43: Europe Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 44: Europe Market Attractiveness Index, By Country - 2022 to 2032

Figure 45: MEA Market Value (US$ Million) and Year-on-Year Growth, 2015 to 2032

Figure 46: MEA Market Absolute $ Opportunity Historical (2015 to 2021) and Forecast Period (2022 to 2032), US$ Million

Figure 47: MEA Market Share, By Type, 2022 & 2032

Figure 48: MEA Market Y-o-Y Growth Projections, By Type - 2022 to 2032

Figure 49: MEA Market Attractiveness Index, By Type - 2022 to 2032

Figure 50: MEA Market Share, By Application, 2022 & 2032

Figure 51: MEA Market Y-o-Y Growth Projections, By Application - 2022 to 2032

Figure 52: MEA Market Attractiveness Index, By Application - 2022 to 2032

Figure 53: MEA Market Share, By Country, 2022 & 2032

Figure 54: MEA Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 55: MEA Market Attractiveness Index, By Country - 2022 to 2032

Figure 56: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2015 to 2032

Figure 57: Asia Pacific Market Absolute $ Opportunity Historical (2015 to 2021) and Forecast Period (2022 to 2032), US$ Million

Figure 58: Asia Pacific Market Share, By Type, 2022 & 2032

Figure 59: Asia Pacific Market Y-o-Y Growth Projections, By Type - 2022 to 2032

Figure 60: Asia Pacific Market Attractiveness Index, By Type - 2022 to 2032

Figure 61: Asia Pacific Market Share, By Application, 2022 & 2032

Figure 62: Asia Pacific Market Y-o-Y Growth Projections, By Application - 2022 to 2032

Figure 63: Asia Pacific Market Attractiveness Index, By Application - 2022 to 2032

Figure 64: Asia Pacific Market Share, By Country, 2022 & 2032

Figure 65: Asia Pacific Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 66: Asia Pacific Market Attractiveness Index, By Country - 2022 to 2032

Figure 67: US Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 68: US Market Share, By Type, 2021

Figure 69: US Market Share, By Application, 2021

Figure 70: Canada Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 71: Canada Market Share, By Type, 2021

Figure 72: Canada Market Share, By Application, 2021

Figure 73: Brazil Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 74: Brazil Market Share, By Type, 2021

Figure 75: Brazil Market Share, By Application, 2021

Figure 76: Mexico Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 77: Mexico Market Share, By Type, 2021

Figure 78: Mexico Market Share, By Application, 2021

Figure 79: Germany Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 80: Germany Market Share, By Type, 2021

Figure 81: Germany Market Share, By Application, 2021

Figure 82: UK Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 83: UK Market Share, By Type, 2021

Figure 84: UK Market Share, By Application, 2021

Figure 85: France Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 86: France Market Share, By Type, 2021

Figure 87: France Market Share, By Application, 2021

Figure 88: Italy Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 89: Italy Market Share, By Type, 2021

Figure 90: Italy Market Share, By Application, 2021

Figure 91: BENELUX Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 92: BENELUX Market Share, By Type, 2021

Figure 93: BENELUX Market Share, By Application, 2021

Figure 94: Nordic Countries Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 95: Nordic Countries Market Share, By Type, 2021

Figure 96: Nordic Countries Market Share, By Application, 2021

Figure 97: China Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 98: China Market Share, By Type, 2021

Figure 99: China Market Share, By Application, 2021

Figure 100: Japan Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 101: Japan Market Share, By Type, 2021

Figure 102: Japan Market Share, By Application, 2021

Figure 103: South Korea Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 104: South Korea Market Share, By Type, 2021

Figure 105: South Korea Market Share, By Application, 2021

Figure 106: GCC Countries Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 107: GCC Countries Market Share, By Type, 2021

Figure 108: GCC Countries Market Share, By Application, 2021

Figure 109: South Africa Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 110: South Africa Market Share, By Type, 2021

Figure 111: South Africa Market Share, By Application, 2021

Figure 112: Turkey Market Value (US$ Million) and Forecast, 2022 to 2032

Figure 113: Turkey Market Share, By Type, 2021

Figure 114: Turkey Market Share, By Application, 2021

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyglycerol Esters Of Fatty Acids Market

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Essential Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Esters Market Trends & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA