The plant sterol esters market demonstrates continuous growth projections between 2025 and 2035 because of rising health conscious customer requirements along with increasing cholesterol risk management knowledge as well as functional food sector expansion.

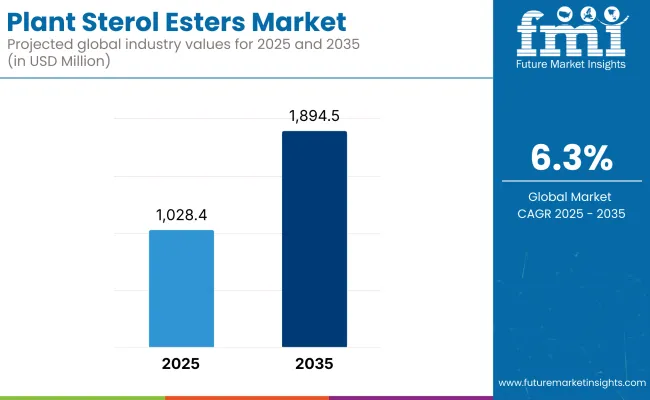

Plant sterol esters maintain clinical effectiveness as LDL cholesterol blockers and therefore they are included in fortified margarine and dairy and bakery products. The health conscious diet trends coupled with increasing regulatory functional claim approval worldwide will drive this market towards a USD 1,894.5 million value by 2035 with an expected 6.3% annual growth rate throughout the forecast period starting from 2025.

Product demand for natural plant-derived components enables manufacturing entities to develop new food and nutraceutical applications. Technical advances in microencapsulation and emulsification technologies help overcome sensory quality and shelf stability problems during product development.

The key producers direct their efforts toward cleaning labels of their products while developing new yogurt and spread lines and supplement solutions. Plant sterol esters will become more essential for preventive nutrition strategies which target lifestyle-related diseases within global health markets.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,028.4 million |

| Industry Value (2035F) | USD 1,894.5 million |

| CAGR (2025 to 2035) | 6.3% |

Source segments together with application segments determine functional properties as well as product value and product formation requirements for plant sterol esters. Each of the available plant sterol esters originates from soybean, vegetable oils and pine-derived sterols which delivers unique profiles regarding purity and stability properties.

Plant sterol esters function in functional foods with beverages and dietary supplements because of their ability to lower cholesterol and their status as heart health claim-compatible ingredients. The market segments show a developing trend between consumer health interests and product development for fortified nutrition and wellness-oriented products.

Demand is driven by functional food innovation and clinical awareness in North America. In America, this features more fortified produce launches and expansive cholesterol health campaigns.

Strong support from regulators and public health and fitness regulators have led Europe by far in adoption. Countries such as Finland and the UK encourage foods made with plant sterols to support cardiovascular wellness.

Asia-Pacific is gaining traction as middle class health awareness increases. Species of plant sterol esters are incorporated into dairy, beverages, and nutrition supplements for preventive care in China and Japan.

Regulatory Constraints and Limited Consumer Awareness

Due to varying global regulations along with consumer unfamiliarity about their cholesterol-reducing qualities the plant sterol esters market experiences specific obstacles. Certain regional health claim regulations control the marketing approach of manufacturers for sterol-enriched products while reducing their availability in functional foods and supplements.

Health-conscious consumers understand plant sterols today yet these products have less awareness among wider populations worldwide especially in developing regions. The process of adding sterol esters to food systems faces barriers regarding maintenance of product authenticity and preservation stability.

The mass-market food categories experience slowed penetration from plant sterols due to their high costs although scientific proof demonstrates their cardiovascular health benefits.

Functional Foods Growth and Heart Health Focus

Even with regulatory barriers, ingredients with cholesterol-lowering and heart-healthy benefits are in demand, especially among aging populations and health-conscious consumers. Their ability to reduce LDL cholesterol has led to the increasing incorporation of plant sterol esters into margarine, dairy products, spreads, and dietary supplements.

As functional foods become the new norm, however, companies are looking to emulsification and microencapsulation technologies to increase bioavailability and blend product ingredients. Further interest in natural, non-pharmaceutical solutions is also being driven by the clean-label trend and habits of preventive healthcare. As the rates of cardiovascular morbidity and mortality increase worldwide, plant sterol esters appears to be ideally placed as key components in active dietary health strategies.

During the 2020 to 2024 the plant sterol esters market maintained consistent growth by expanding in functional spreads, fortified dairy products and dietary supplements throughout North America and Europe. The demand for natural healthcare alternatives in cholesterol reduction drove investments to develop sterol-enriched products for consumers. The process of obtaining health claims and complex labelling standards acted as significant obstacles for the company's international growth plans.

The adoption of plant sterol esters in beverages alongside bakery and nutraceuticals will expand in the coming period from 2025 through 2035 because of improved formulation advances and updated clinical data findings. The rising demand for personalized nutrition together with cardio protective diets will drive markets toward multipurpose food products while also promoting localized food regulations.

Market Shifts: Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Factor | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Health claims approved in limited regions under strict guidelines. |

| Technological Advancements | Emulsification used to blend sterol esters into select food matrices. |

| Sustainability Trends | Sourcing focused on soy and vegetable oil derivatives. |

| Market Competition | Led by major ingredient suppliers and specialty nutraceutical firms. |

| Industry Adoption | Common in margarine, dairy, and capsules. |

| Consumer Preferences | Driven by cardiovascular health awareness and natural positioning. |

| Market Growth Drivers | Preventive health focus and functional food expansion. |

| Market Factor | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion of global health claim acceptance and standardized labelling policies. |

| Technological Advancements | Growth of microencapsulation, water-dispersible forms, and shelf-stable formulations. |

| Sustainability Trends | Shift toward palm-free, non-GMO, and sustainable sterol sources. |

| Market Competition | Entry of functional food manufacturers and DTC supplement innovators. |

| Industry Adoption | Expands to beverages, protein powders, functional snacks, and senior nutrition. |

| Consumer Preferences | Shift toward multi-benefit, plant-based, and personalized heart health products. |

| Market Growth Drivers | Accelerated by aging demographics, wellness trends, and integrated nutrition plans. |

The USA market for plant sterol esters is growing steadily, largely in response to increasing demand for heart-focused functional foods. However, the health benefits related to hypercholesterolemia and a potent supplement-focused diet are supporting the high acceptance of plant sterol esters in fortified food products including margarine, yogurt and milk.

To help consumers meet this preference for clean-label or non-GMO product lines, USA food manufacturers are introducing plant sterol esters. In addition, FDA health claims affirming cholesterol reduction benefits have increased the visibility and confidence in plant sterol-containing formulations.

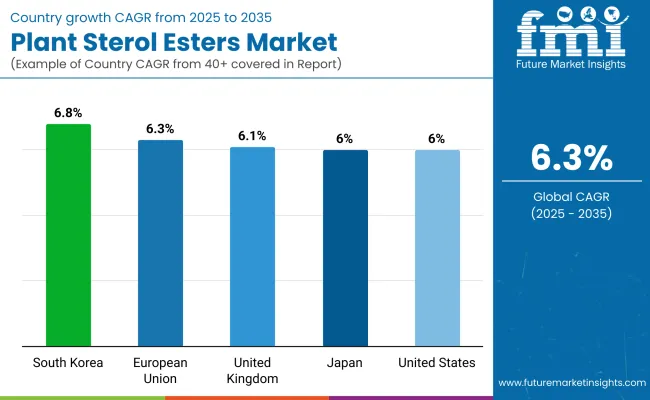

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

With informed consumer campaigns on heart health and dietary management following the literature, there is now increasing interest in the United Kingdom in plant sterol esters among consumers. The product is poised to thrive in both retail functional foods and pharmacy-based cholesterol control supplements.

Plant sterol-fortified spreads, juices and cereals are being launched by British food brands to appeal to aging populations and health-conscious shoppers. Guidelines on sterols (content and labelling) remain aligned with EU regulations to engender responsible marketing and product innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

The EU continues to be a leading and established market for plant sterol esters supported by an established culture for functional foods and backing by the EFSA regulatory body. In Europe, Germany, Finland and the Netherlands are at the forefront of product development and retail availability of sterol-enriched spreads and dairy alternatives.

Regulated food offerings enable EU health-conscious consumers to incorporate plant sterol esters into their diets on a daily basis. Local manufacturers also look into sterol ester formulations with plant basis that meet vegan and clean-labels requests.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan is also seeing steady growth in the plant sterol esters market, with the country having advantages stemming from its advanced functional food sector as well as its aging population. Plant sterols have been established in beverages, dairy products, and nutrition bars as “Foods for Specified Health Uses” (FOSHU).

Local Japanese manufacturers promote taste-neutral, super-stable sterol esters suited for the traditional and modern dietary formats. The demand in preventive health, as well as clinical nutrition space, continues to be fueled by science-driven awareness around cholesterol-lowering mechanisms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

In South Korea, the market is growing strongly with increasingly popular applications such as fortified dairy, soy milk, and ready-to-drink functional beverages. The boost in adoption of sterols-enriched products is driven by a rising consumer focus on lifestyle-led wellness and cardiovascular health.

There are domestic food and supplement companies where new delivery formats are being developed, and sterol esters are combined with complementary nutrients (omega-3s and vitamins). The scale of South Korea’s modern retail and e-commerce infrastructure is also accelerating market penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

As heart health, functional nutrition, and cholesterol management take center stage for both consumers and manufacturers, the plant sterol esters market remains on the rise. Plant sterol esters are produced from the esterification of plant sterols with fatty acids and decrease the bioavailability of LDL cholesterol in the human body, making them highly sought for nutraceuticals and health-forward food products.

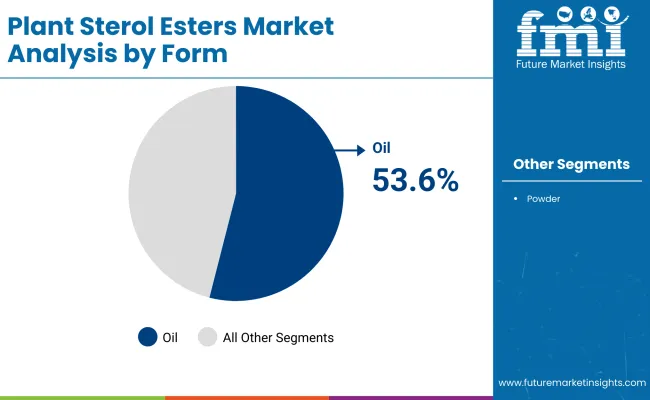

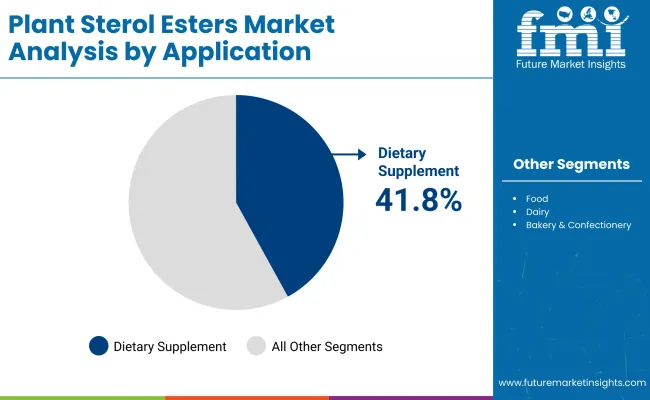

In terms of form categories, the largest segment, during the forecast period, is oil-based plant sterol esters, owing to their solubility in lipid matrices and wide application in cooking oils and fat-rich formulations. By application, demand is skewed towards dietary supplements as consumers use capsules and softgels to manage cardiovascular risk factors and support preventive wellness.

These segments combine for an overview of a burgeoning, proactive, ingredient-based health approach that depends on various bioactive plant compounds.

As regulatory authorities validate health claims associated with plant sterol ester consumption and functional food segments further infringe on pharmaceutical territory, the need for formats and applications that deliver convenience and efficacy intensifies. Such demand is met through oil-soluble formats and dietary supplements, which ensures continued growth across both personal wellness and food-as-medicine trends.

| Form Type | Market Share (2025) |

|---|---|

| Oil | 53.6% |

Oil-based plant sterol esters hold the highest share in the form segment, as they provide better solubility in fat-based systems and high bioavailability in cholesterol-lowering applications. Manufacturers deploy this form mainly in vegetable oils, margarine and spreads, where it mixes in easily without changing flavor or texture.

These oil-soluble esters exhibit excellent miscibility with a variety of edible oils and cooking oils commonly used by consumers, thus forming a consistent delivery platform for cardiovascular support. Lipid nature of the formulation supports sterol absorption and increases its therapeutic functionality.

Producers prefer oil because it provides greater flexibility for formulation, which is especially true in relation to functional food and personal care applications. In cosmetics, there are oil and sterol esters with their emollient features, granting skin with more hydration and skin barrier protection.

As consumers become more health-conscious and move toward food products with clinical efficacy, oil-based formulations enable precise dosing, improved functional performance. These are only a few of the examples that prove oil-soluble plant sterol esters will remain the global leader in this category thanks to their compatibility with both dietary and pharmaceutical product lines.

| Application Type | Market Share (2025) |

|---|---|

| Dietary Supplement | 41.8% |

The use of plant sterol esters is also high in dietary supplements, leading to the plant sterol esters market, as benefits of dietary supplements to manage cholesterol and support cardiovascular health remain non-prescription methods. These supplements come in the form of softgel capsules, chewables or functional powders, enabling users to incorporate plant sterol esters into their routines without requiring dietary changes.

The ease of adding them to the diet when needed, along with increasing clinical evidence confirming the efficacy of plant sterols, has made them a staple of cholesterol-savvy wellness regimes.

Due to their disease-specific approved health claims, and their synergistic compatibility with other heart-health products like omega-3s and CoQ10, pharmaceutical and nutraceutical companies increasingly formulate dietary supplements with plant sterol esters. Moreover, blood plasma derivatives have benefited from the backing of regulators such as the FDA and EFSA, leading in turn to an increase in consumer trust and product innovation in this area.

Dietary supplements become preventive and supportive tools with aging populations and increased hypercholesterolemia rates. This application will continue to be a leading category in the plant sterol esters market as they can easily be incorporated into health regimens and consumers trust them.

The plant sterol esters market is a niche within the larger landscape of functional foods and dietary supplements, and is primarily, however, the demand for cholesterol-reducing ingredients like plant sterol esters is aided by increasing awareness regarding managing cholesterol levels for heart health on a global scale. Plant sterol esters are derived from natural phytosterols and have been well studied for their ability to reduce LDL cholesterol absorption when added to food products such as spreads, dairy products, and dietary supplements.

Demand has been further stimulated by regulatory support in the form of approved health claims across Europe, North America and Asia. As the demand for natural, non-synthetic bioactive rises among consumers, so do manufacturers’ innovations around formulation stability, fat compatibility and delivery efficacy.

Like this, the competitive environment includes ingredient specialists, plant extraction companies and food-grade ester manufacturers fighting in this space on purity, bioavailability and alignment with global regulators.

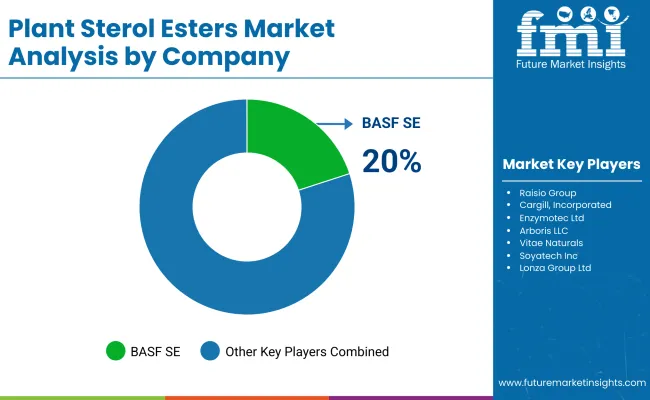

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 20-24% |

| ADM (Archer Daniels Midland) | 15-19% |

| Raisio Group | 12-16% |

| Cargill, Incorporated | 9-13% |

| Enzymotec Ltd. (part of Frutarom ) | 7-11% |

| Arboris LLC | 6-10% |

| Other Companies (combined) | 18-26% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Expanded high-purity plant sterol ester production for functional margarine and dairy in 2025. |

| ADM | Launched non-GMO plant sterol esters for clean-label cholesterol-lowering products in 2024. |

| Raisio Group | Rebranded Benecol ingredients for global B2B use in beverages and yogurts in 2025. |

| Cargill, Incorporated | Developed fat-soluble plant sterol esters suitable for bakery and nutraceuticals in 2024. |

| Enzymotec Ltd. | Rolled out lipid-based plant sterol ester blends tailored for clinical nutrition in 2025. |

| Arboris LLC | Introduced phytosterol -rich esters extracted from pine wood for dietary supplements in 2024. |

Key Company Insights

BASF SE

BASF leads the global market by supplying high-quality plant sterol esters tailored for large-scale food fortification. Its production capabilities and technical expertise make it a preferred supplier to multinationals in the dairy, spread, and supplement industries.

ADM (Archer Daniels Midland)

ADM offers non-GMO and kosher-certified sterol esters compatible with diverse fat matrices. Its vertically integrated supply chain allows consistent raw material sourcing and strong B2B positioning in heart health-oriented formulations.

Raisio Group

Raisio is renowned for its proprietary Benecol brand, offering clinically backed sterol ester ingredients. With expanded licensing and ingredient partnerships, it supports food manufacturers globally in developing cholesterol-lowering products.

Cargill, Incorporated

Cargill provides sterol esters that retain bioactivity and blend well into baked goods, powdered beverages, and capsules. Its R&D efforts support formulation flexibility and address evolving clean-label consumer preferences.

Enzymotec Ltd. (Frutarom)

Enzymotec focuses on advanced lipid-based delivery systems, offering sterol esters that enhance absorption and stability. The company is strong in clinical nutrition and dietary supplement channels, particularly in Europe and Asia.

Arboris LLC

Arboris specializes in sustainable phytosterol ester extraction from pine tree byproducts. Its focus on eco-friendly sourcing and unique sterol profiles caters to manufacturers seeking plant-based differentiation in supplements and functional foods.

Other Key Players (18-26% Combined)

Numerous regional and emerging players are actively contributing to the plant sterol esters market through specialized extraction, custom formulation, and niche dietary applications:

The overall market size for the plant sterol esters market was USD 1,028.4 million in 2025.

The plant sterol esters market is expected to reach USD 1,894.5 million in 2035.

The increasing focus on heart health, rising use of cholesterol-lowering food additives, and growing incorporation of oil-based formulations in dietary supplements fuel the plant sterol esters market during the forecast period.

The top 5 countries driving the development of the plant sterol esters market are the USA, UK, European Union, Japan, and South Korea.

Oil-based formulations and dietary supplements lead market growth to command a significant share over the assessment period.

Table 01: Global Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Form, 2012 – 2027

Table 02: Global Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 03: Global Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Food Application, 2012 – 2027

Table 04: Global Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Region, 2012 – 2027

Table 05: North America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 06: North America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Form, 2012 – 2027

Table 07: North America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 08: North America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Food Application, 2012 – 2027

Table 09: APEJ Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Country, 2012 – 2027

Table 10: APEJ Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Form, 2012 – 2027

Table 11: APEJ Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast by Application, 2012 – 2027

Table 12: APEJ Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Food Application, 2012 – 2027

Table 13: Japan Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Form, 2012 – 2027

Table 14: Japan Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 15: Japan Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Food Application, 2012 – 2027

Table 16: Western Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Country, 2012 – 2027

Table 17: Western Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Form, 2012 – 2027

Table 18: Western Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 19: Western Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Food Application, 2012 – 2027

Table 20: Eastern Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Country, 2012 – 2027

Table 21: Eastern Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Form, 2012 – 2027

Table 22: Eastern Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 23: Eastern Europe Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Food Application, 2012 – 2027

Table 24: Latin America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Country, 2012 – 2027

Table 25: Latin America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Form, 2012 – 2027

Table 26: Latin America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 27: Latin America Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Food Application, 2012 – 2027

Table 28: MEA Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Country, 2012 – 2027

Table 29: MEA Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Form, 2012 – 2027

Table 30: MEA Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Application, 2012 – 2027

Table 31: MEA Plant Sterol Esters Market Size (US$ MN) and Volume (Tons) Forecast By Food Application, 2012 – 2027

​Figure 01: Global Plant Sterol Esters Market Historical Volume (Tons), 2012 – 2021

Figure 02: Global Plant Sterol Esters Market Volume (Tons) Forecast, 2022 – 2027

Figure 03: Global Plant Sterol Esters Market Historical Value (US$ MN), 2012 – 2021

Figure 04: Global Plant Sterol Esters Market Value (US$ MN) Forecast, 2022 – 2027

Figure 05: Global Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 06: Global Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 07: Global Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 08: Plant Sterol Esters Market Absolute $ Opportunity, by Oil Form 2022 – 2027

Figure 09: Plant Sterol Esters Market Absolute $ Opportunity, by Powder Form 2022 – 2027

Figure 10: Global Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 11: Global Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 12: Global Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 13: Plant Sterol Esters Market Absolute $ Opportunity, by Food segment 2022 – 2027

Figure 14: Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027, by Beverage Segment

Figure 15: Plant Sterol Esters Market Absolute $ Opportunity, by Pharmaceutical segment 2022 – 2027

Figure 16: Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027, by Dietary Supplement Segment

Figure 17: Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027, by Cosmetics Segment

Figure 18: Global Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 19: Global Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 20: Plant Sterol Esters Market Absolute $ Opportunity, by Dairy segment 2022 – 2027

Figure 21: Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027, by Bakery& Confectionary Segment

Figure 22: Plant Sterol Esters Market Absolute $ Opportunity, by Spreads & Dressings segment 2022 – 2027

Figure 23: Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027, by Cereals & Snacks Segment

Figure 24: Plant Sterol Esters Market Absolute $ Opportunity, by Vegetable Oil segment 2022 – 2027

Figure 25: Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027, by Other Segment

Figure 26: Global Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 27: Global Plant Sterol Esters Market Share and BPS Analysis by Region – 2012, 2022 & 2027

Figure 28: Global Plant Sterol Esters Market Y-o-Y Growth Projections by Region, 2022 – 2027

Figure 29: APEJ Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 30: Japan Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 31: North America Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 32: Western Europe Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 33: Eastern Europe Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 34: Latin America Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 35: MEA Plant Sterol Esters Market Absolute $ Opportunity, 2022 – 2027

Figure 36: Global Plant Sterol Esters Market Attractiveness Index by Region, 2022 – 2027

Figure 37: North America Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 38: North America Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 39: North America Plant Sterol Esters Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 40: North America Plant Sterol Esters Market Y-o-Y Growth Projections by Country, 2022 – 2027

Figure 41: U.S. Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 42: Canada Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 43: North America Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 44: North America Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 45: North America Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 46: North America Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 47: North America Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 48: North America Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 49: North America Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 50: North America Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 51: North America Plant Sterol Esters Market Attractiveness Index by Country, 2022 – 2027

Figure 52: APEJ Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 53: APEJ Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 54: APEJ Plant Sterol Esters Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 55: APEJ Plant Sterol Esters Market Y-o-Y Growth Projections by Country, 2022 – 2027

Figure 56: U.S. Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 57: Canada Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 58: U.S. Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 59: Canada Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 60: U.S. Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 61: APEJ Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 62: APEJ Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 63: APEJ Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 64: APEJ Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 65: APEJ Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 66: APEJ Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 67: APEJ Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 68: APEJ Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 69: APEJ Plant Sterol Esters Market Attractiveness Index by Country, 2022 – 2027

Figure 70: Japan Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 71: Japan Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 72: Japan Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 73: Japan Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 74: Japan Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 75: Japan Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 76: Japan Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 77: Japan Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 77: Japan Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 78: Japan Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 79: Western Europe Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 80: Western Europe Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 81: Western Europe Plant Sterol Esters Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 82: Western Europe Plant Sterol Esters Market Y-o-Y Growth Projections by Country, 2022 – 2027

Figure 83: Germany Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 84: Italy Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 85: France Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 86: U.K. Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 87: Spain Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 88: BENELUX Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 89: Nordic Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 90: Rest of Western Europe Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 91: Western Europe Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 92: Western Europe Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 93: Western Europe Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 94: Western Europe Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 95: Western Europe Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 96: Western Europe Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 97: Western Europe Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 98: Western Europe Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 99: Western Europe Plant Sterol Esters Market Attractiveness Index by Country, 2022 – 2027

Figure 100: Eastern Europe Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 101: Eastern Europe Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 102: Eastern Europe Plant Sterol Esters Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 103: Eastern Europe Plant Sterol Esters Market Y-o-Y Growth Projections by Country, 2022 – 2027

Figure 104: Russia Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 105: Poland Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 106: Rest of Eastern Europe Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 107: Eastern Europe Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 108: Eastern Europe Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 109: Eastern Europe Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 110: Eastern Europe Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 111: Eastern Europe Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 112: Eastern Europe Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 113: Eastern Europe Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 114: Eastern Europe Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 115: Eastern Europe Plant Sterol Esters Market Attractiveness Index by Country, 2022 – 2027

Figure 116: Latin America Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 117: Latin America Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 118: Latin America Plant Sterol Esters Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 119: Latin America Plant Sterol Esters Market Y-o-Y Growth Projections by Country, 2022 – 2027

Figure 120: Brazil Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 121: Mexico Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 122: Rest of Latin America Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 123: Latin America Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 124: Latin America Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 125: Latin America Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 126: Latin America Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 127: Latin America Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 128: Latin America Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 129: Latin America Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 130: Latin America Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 131: Latin America Plant Sterol Esters Market Attractiveness Index by Country, 2022 – 2027

Figure 132: MEA Historical Plant Sterol Esters Market Size and Volume Analysis, 2012 – 2021

Figure 133: MEA Current and Future Plant Sterol Esters Market Size and Volume Analysis, 2022 – 2027

Figure 134: MEA Plant Sterol Esters Market Share and BPS Analysis by Country – 2012, 2022 & 2027

Figure 135: MEA Plant Sterol Esters Market Y-o-Y Growth Projections by Country, 2022 – 2027

Figure 136: GCC Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 137: South Africa Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 138: Turkey Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 139: Israel Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 140: Rest of MEA Plant Sterol Esters Market Absolute $ Opportunity 2012 to 2021 and 2027

Figure 141: MEA Plant Sterol Esters Market Share and BPS Analysis by Form – 2012, 2022 & 2027

Figure 142: MEA Plant Sterol Esters Market Y-o-Y Growth Projections by Form, 2022 – 2027

Figure 143: MEA Plant Sterol Esters Market Share and BPS Analysis by Application – 2012, 2022 & 2027

Figure 144: MEA Plant Sterol Esters Market Y-o-Y Growth Projections by Application, 2022 – 2027

Figure 145: MEA Plant Sterol Esters Market Share and BPS Analysis by Food Application – 2012, 2022 & 2027

Figure 146: MEA Plant Sterol Esters Market Attractiveness Index by Form, 2022 – 2027

Figure 147: MEA Plant Sterol Esters Market Attractiveness Index by Application, 2022 – 2027

Figure 148: MEA Plant Sterol Esters Market Attractiveness Index by Food Application, 2022 – 2027

Figure 149: MEA Plant Sterol Esters Market Attractiveness Index by Country, 2022 – 2027

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA