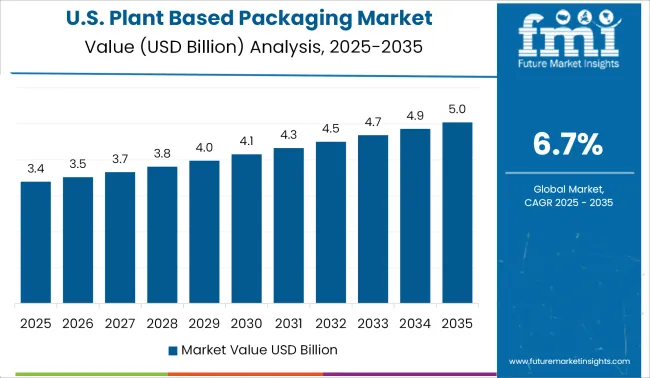

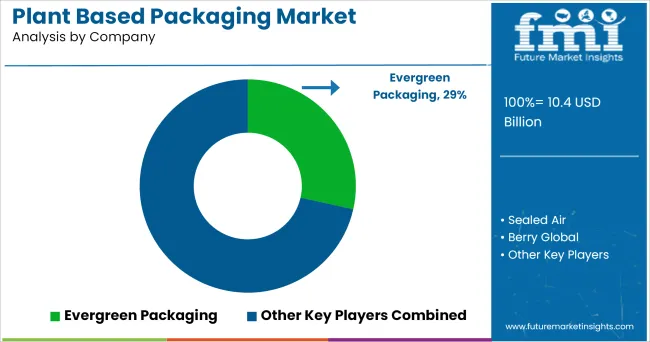

The Plant Based Packaging Market is estimated to be valued at USD 10.4 billion in 2025 and is projected to reach USD 19.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The plant-based packaging market is witnessing strong momentum as global industries shift toward low-impact, bio-derived alternatives to conventional plastics. Rising environmental awareness, supported by regulatory mandates and corporate sustainability pledges, is encouraging the adoption of renewable, biodegradable, and compostable packaging solutions.

Innovations in bio-polymers, fiber blends, and cellulose-based laminates are offering functional performance comparable to petrochemical plastics, making them suitable for mainstream applications. Additionally, increasing consumer demand for toxin-free and responsibly sourced packaging-particularly in food, personal care, and retail sectors-is shaping market trends. Manufacturing advancements and increased material availability have reduced cost disparities, enhancing the scalability of plant-based formats.

Looking ahead, the market is expected to benefit from both technological integration and government support, particularly as global brands prioritize circular economy strategies and green supply chain practices. As brands seek to improve ESG metrics and meet plastic reduction targets, plant-based packaging stands poised for continued expansion and sectoral diversification.

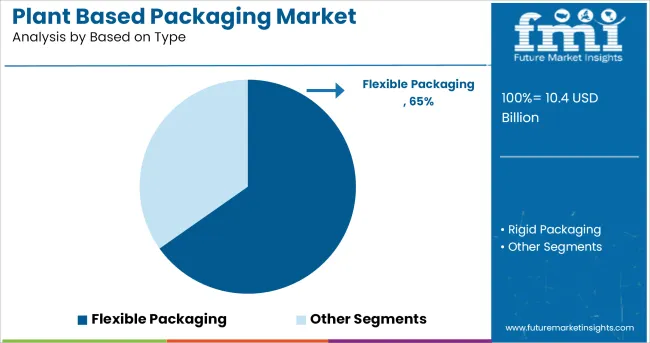

Flexible packaging accounts for 65.20% of total market revenue within the plant-based packaging industry, making it the most dominant type. Its widespread adoption is driven by its adaptability across various product categories and compatibility with bio-based films and compostable materials.

It has been favored for its light weight, reduced material usage, and ability to conform to different product shapes, minimizing waste during production and transport. Manufacturers have utilized its design flexibility to incorporate resealable closures and barrier properties using plant-based polymers.

Furthermore, flexible formats align with e-commerce packaging requirements and are well-suited for single-serve or portion-controlled items. The segment’s growth has been reinforced by its cost-effectiveness, consumer convenience, and alignment with minimalistic, sustainable branding trends, contributing to its continued leadership in the plant-based packaging market.

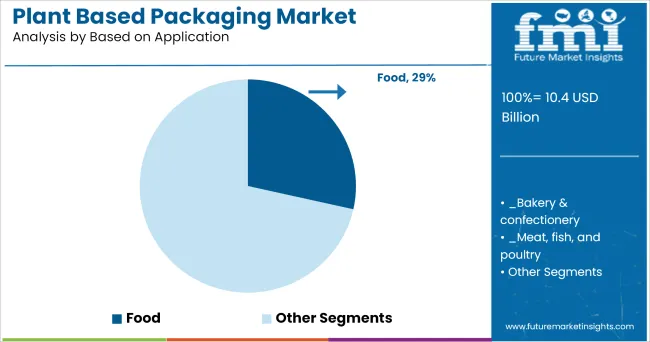

The food segment constitutes 28.50% of market revenue under the application category, establishing it as the most significant use case for plant-based packaging. Its dominance is attributed to growing consumer demand for sustainable and non-toxic packaging in everyday consumables.

Bio-based materials have been recognized for their ability to maintain product freshness, provide odor barriers, and meet food safety compliance standards. This is especially relevant for perishable items, organic foods, and clean-label products where packaging integrity and eco-profile are essential to brand perception. Regulatory pressure around single-use plastics in food service and retail sectors has further propelled adoption.

Additionally, the rise of ethical consumerism and increased visibility of sustainability labels on food packaging have reinforced the segment’s growth. Food brands have prioritized this shift not only to meet consumer expectations but also to gain competitive differentiation through visible environmental responsibility.

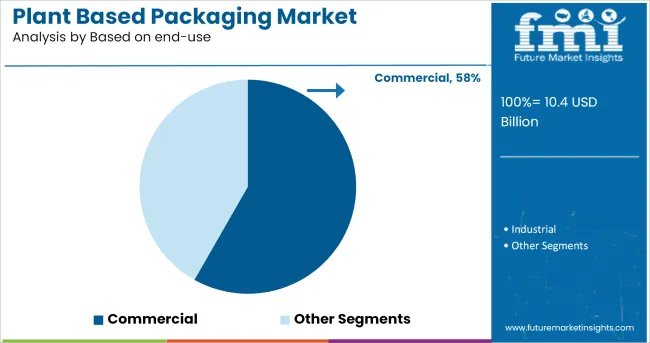

It is observed that the commercial sector holds 58.20% of market revenue in the plant-based packaging space, marking it as the leading end-use category. This leadership stems from widespread implementation across food services, hospitality, institutional catering, and organized retail.

Businesses in these sectors have been under increasing pressure to align with sustainability frameworks and reduce landfill contributions through compostable and biodegradable packaging. Plant-based solutions have enabled commercial entities to transition from polystyrene and PVC to alternatives that enhance their environmental footprint and consumer appeal.

The scalability of commercial procurement and the ability to integrate circular material recovery systems have further supported adoption. Additionally, ESG reporting requirements and green procurement policies in public and private sectors have made plant-based formats an operational and reputational imperative.

This has positioned the commercial end-use segment at the forefront of market expansion, reinforced by policy incentives and shifting stakeholder expectations.

Variety in packaging materials, types, and technologies helps the packaging industry provide innovative, safe, and sustainable packaging solutions for different products. Apart from sustainability, recyclability remains a key trend in the global packaging industry. The influence of environmental safety agencies on all sorts of packaging businesses continues to remain evident.

Plant based packaging is expected to grow in popularity as a result of its improved and unique preservation qualities. This might be owing to the use of bioplastics with value-added oxygen barriers. With the use of sophisticated technologies such as nanoparticle components and biopolymers, a new form of green plastic is expected to emerge on the market.

In terms of sales, the North American market is anticipated to take the lead in the global plant based packaging market. Leading companies in the USA plant-based packaging market are expected to provide new products that will increase the shelf life of goods while also protecting the components from the harmful impacts of their surroundings. Hence, propelling the demand for plant based packaging market in the USA and Canadian market.

The European plant based packaging market is estimated to grow at a moderate pace. Food packaging is necessary for product containment, preservation, and protection, as well as to prevent food spoilage, eliminate the possibility of adulteration, and show food in a hygienic and attractive way.

The plant based packaging market in Europe is expected to develop rapidly in the coming years, owing to a growing customer base that values the plant based packaging of consumer products, meals, and drinks.

Some key manufacturers operating the business in the plant based packaging market globally include

The key companies involved in the effort to adopt smart plant-based packaging

Coca-Cola employs sugarcane from Brazil but it's also exploring at using other plant-based resources.

In February 2024, Mondi Group increased its portfolio with the introduction of new and sustainable paper-based EverLiner products, i.e., EverLiner M R and EverLiner Labelite, made from recycled and lightweight materials. They provide greater long-term solutions in a variety of applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global plant based packaging market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the plant based packaging market is projected to reach USD 19.9 billion by 2035.

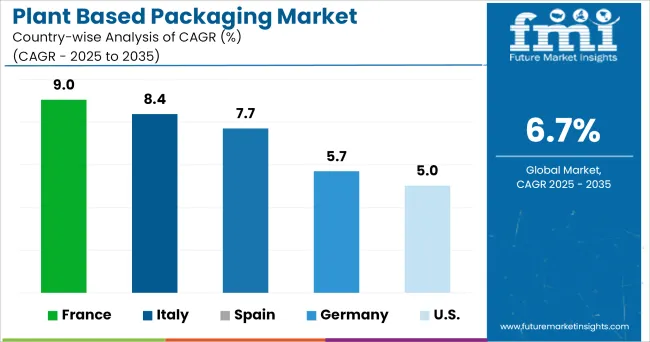

The plant based packaging market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in plant based packaging market are flexible packaging and rigid packaging.

In terms of based on application, food segment to command 28.5% share in the plant based packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Plant-Based Packaging Providers

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Food Packaging Market Trends & Industry Growth Forecast 2024-2034

Plant-Based Bioplastic Shrink Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Plant Based Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Care Services Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA