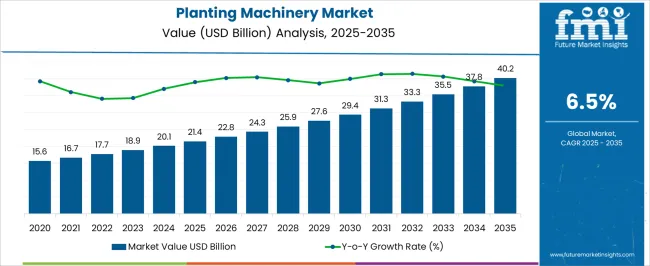

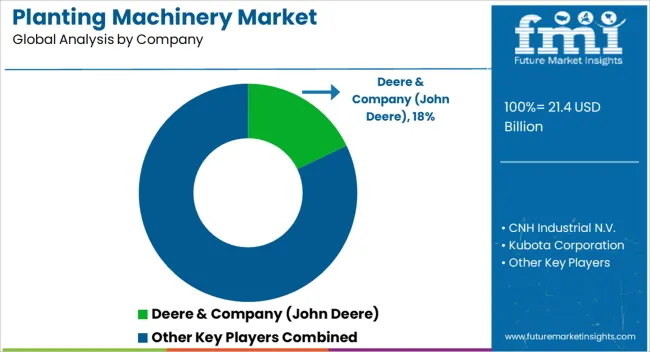

The planting machinery market is estimated to be valued at USD 21.4 billion in 2025 and is projected to reach USD 40.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

This expansion is being driven by the increasing adoption of mechanized farming solutions, rising efficiency demands in large-scale agriculture, and the integration of precision farming practices. The market is projected to be influenced by investments in high-capacity planting equipment, evolving crop patterns, and the need to optimize yield outputs. Over the forecast period, incremental revenue opportunities are anticipated as manufacturers focus on enhancing machinery durability, operational efficiency, and adaptability to diverse agricultural environments. During 2025–2035, the planting machinery market is expected to experience steady value accumulation, fueled by rising demand for advanced planting systems and evolving farm mechanization strategies.

Regional adoption rates are projected to vary, reflecting local crop cycles, soil conditions, and farm size distributions. Manufacturers are likely to strengthen their market presence through product diversification, equipment customization, and strategic partnerships with distributors. Overall, the market trajectory indicates sustained growth, with an emphasis on improving operational productivity, reducing labor dependency, and supporting high-yield agriculture shaping competitive dynamics and long-term value creation.

| Metric | Value |

|---|---|

| Planting Machinery Market Estimated Value in (2025 E) | USD 21.4 billion |

| Planting Machinery Market Forecast Value in (2035 F) | USD 40.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The planting machinery market is estimated to hold a notable proportion within its parent markets, representing approximately 10-12% of the agricultural machinery market, around 8-9% of the farm equipment market, close to 15-17% of the precision agriculture market, about 5-6% of the tractor attachments market, and roughly 7-8% of the crop production equipment market. Collectively, the cumulative share across these parent segments is observed in the range of 45-52%, highlighting the strategic importance of planting machinery in modern agricultural operations. The market has been driven by the increasing demand for efficient, high-capacity planting solutions that can optimize crop yields while reducing labor requirements.

Adoption is influenced by factors such as crop type, farm size, and the need for improved operational efficiency. Market participants have focused on developing planting machinery that offers precise seed placement, uniform distribution, and compatibility with existing farm equipment, thereby improving productivity and reducing operational costs. As a result, the planting machinery market has not only captured a significant share within agricultural machinery and precision agriculture markets but has also influenced farm equipment, tractor attachments, and crop production equipment sectors, underlining its key role in enhancing agricultural productivity, supporting mechanized farming practices, and streamlining planting operations.

The planting machinery market is experiencing steady growth, supported by increasing global demand for agricultural mechanization and efficiency improvements in crop production. Rising adoption of modern machinery is being driven by the need to enhance productivity, optimize resource utilization, and reduce labor dependency in both large-scale and smallholder farming operations. Technological advancements in precision planting, sensor-based automation, and integrated monitoring systems are enabling improved sowing accuracy, uniform seed distribution, and reduced input wastage.

Governments and agricultural organizations are increasingly promoting mechanization through subsidies and financial incentives, which are expanding access to modern planting equipment. Growing demand for cereals and other staple crops is also influencing machinery selection and deployment.

The market is further being shaped by rising focus on sustainable agriculture practices, including efficient use of seeds and fertilizers As farming operations evolve to meet the challenges of climate variability, labor shortages, and increasing production targets, the planting machinery market is positioned for sustained growth, with manufacturers prioritizing innovation, automation, and adaptability to diverse crop types.

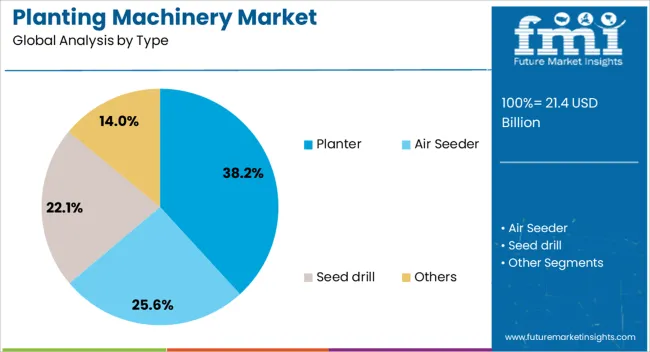

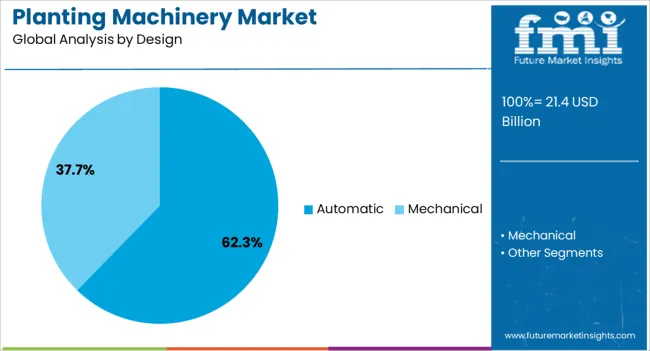

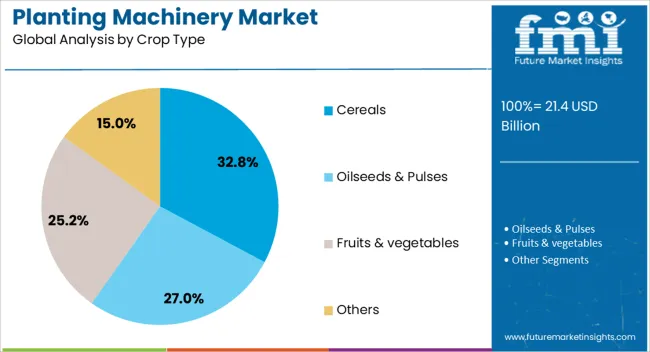

The planting machinery market is segmented by type, design, crop type, and geographic regions. By type, planting machinery market is divided into planter, air seeder, seed drill, and others. In terms of design, planting machinery market is classified into automatic and mechanical. Based on crop type, planting machinery market is segmented into cereals, oilseeds & pulses, fruits & vegetables, and others. Regionally, the planting machinery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The planter segment is projected to hold 38.2% of the planting machinery market revenue share in 2025, making it the leading machinery type. Its adoption is being driven by its ability to provide uniform seed placement, reduce seed wastage, and enhance crop yields, particularly in large-scale cereal cultivation. Planters are compatible with multiple row configurations and can be adapted to diverse soil types, improving operational flexibility and field efficiency.

Integration with precision farming technologies allows for optimized planting depth and spacing, which contributes to higher productivity and better germination rates. The segment is further supported by increasing farmer preference for mechanized sowing solutions that reduce labor dependency and ensure timely planting.

Continuous improvements in machine design, including enhanced durability, reliability, and ease of maintenance, are also reinforcing adoption The ability of planters to support modern agriculture practices while minimizing input costs is ensuring their leadership in the market.

The automatic design segment is expected to account for 62.3% of the planting machinery market revenue share in 2025, establishing it as the leading design type. Its prominence is being driven by advancements in automation technology, enabling self-regulated seed metering, row control, and monitoring systems. Automatic machinery reduces human error and ensures consistent performance, which is critical for maximizing yield in precision agriculture.

Adoption is being fueled by increasing labor shortages, rising wage costs, and the growing need for timely planting across multiple crop cycles. Farmers and agribusinesses are prioritizing automated solutions to achieve uniformity, efficiency, and scalability in operations. Technological innovations, including integrated sensors and software-driven controls, are enhancing operational efficiency and machine versatility.

The ability of automatic machinery to adapt to different field conditions and crop requirements without manual intervention further strengthens its market position As efficiency and productivity pressures increase in agriculture, automatic planting machinery is expected to maintain its dominance in market share.

The cereals crop type segment is projected to hold 32.8% of the planting machinery market revenue share in 2025, making it the leading crop-specific application. This leadership is being driven by the global emphasis on cereal production to meet rising population and food security demands. Planting machinery designed for cereals enables precise seed placement and optimal spacing, which are critical for achieving high yields and uniform crop growth.

The segment is further supported by widespread adoption in major cereal-producing regions, where efficiency and mechanization are prioritized to reduce labor dependency and improve operational scalability. Continuous innovations in machinery, including adjustable seed drills and adaptable row configurations, are enhancing compatibility with different cereal varieties.

Government policies, subsidies, and programs encouraging modern agricultural practices are also contributing to segment growth As the demand for cereals continues to expand globally, the adoption of specialized planting machinery for this crop type is expected to remain a key driver of market revenue.

The planting machinery market is experiencing robust growth driven by increasing mechanization, precision planting demands, and adoption of smart farming techniques. Opportunities are being expanded through customizable equipment and advanced seed placement technologies, while trends favor digital integration and operational efficiency. Challenges stemming from high equipment costs and maintenance requirements are being mitigated through support services and financing solutions. Overall, the market is being positioned for sustained expansion as commercial and large-scale farmers increasingly rely on planting machinery to enhance productivity, efficiency, and competitive agricultural practices globally.

The planting machinery market is being significantly influenced by the rising adoption of mechanized solutions in agriculture to enhance efficiency, productivity, and crop yield. Farmers and commercial agricultural enterprises are increasingly investing in seed drills, planters, and transplanters that enable precise seed placement, uniform spacing, and optimal depth control. The growing focus on labor reduction and the need to manage large-scale farmlands efficiently is further fueling demand. Machinery equipped with automated controls and GPS-based systems is being favored to reduce operational errors, minimize seed wastage, and enhance overall farm output. Demand is particularly strong in regions with large arable lands and mechanized farming practices, where the integration of advanced machinery is being recognized as a critical factor for competitive agricultural operations. The need for durable, high-performance equipment that can adapt to diverse soil types and climatic conditions is amplifying market growth consistently.

Opportunities in the planting machinery market are being expanded through the development of advanced seed placement technologies and customizable machinery features. Precision planters, variable-rate seeders, and multi-crop compatible machines are being increasingly adopted to optimize resource utilization and enhance crop performance. Collaborations between equipment manufacturers and agricultural service providers are enabling the introduction of tailored solutions that cater to specific crop requirements and field conditions. Additionally, opportunities are being observed in integrating machinery with farm management software for data-driven planting strategies, which can improve overall productivity and operational efficiency. The focus on durability, low maintenance, and energy-efficient machinery designs is creating significant market prospects, particularly for large-scale commercial farms seeking high-performance planting solutions that balance efficiency with cost-effectiveness.

Planting machinery trends are being shaped by the increasing integration of digital technologies and smart planting techniques that enhance operational control and decision-making. Machinery equipped with GPS navigation, IoT sensors, and automated guidance systems is being widely adopted to improve planting accuracy, monitor soil conditions, and reduce seed wastage. The trend toward modular and adaptable equipment is allowing farmers to adjust machinery configurations based on crop type and field requirements. Additionally, data-driven analytics is being employed to optimize planting schedules, monitor performance, and plan resource allocation efficiently. These trends are reinforcing market expansion as digital integration and smart systems become essential for modern agricultural practices, providing enhanced precision, reduced labor dependence, and improved crop outcomes across diverse geographies.

The planting machinery market is facing challenges due to high initial capital investment, maintenance requirements, and operational complexity. Advanced seeders and planters often require significant expenditure, making adoption difficult for smallholder farmers or low-margin agricultural enterprises. Maintenance and spare part availability remain critical factors, as improper servicing can lead to reduced equipment lifespan and operational inefficiencies. Additionally, machinery performance can be affected by variable soil conditions, climatic fluctuations, and improper usage, which may require training and specialized handling. These factors, combined with occasional supply chain disruptions, create barriers to widespread adoption and require manufacturers to provide after-sales support, flexible financing options, and durable designs to mitigate risks and ensure consistent market growth.

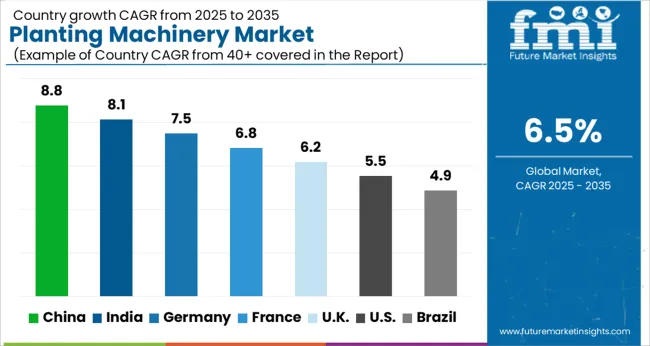

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global planting machinery market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads with a growth rate of 8.8%, followed by India at 8.1%, and Germany at 7.5%. The United Kingdom records a growth rate of 6.2%, while the United States shows a comparatively slower growth of 5.5%. Growth is driven by the mechanization of agriculture, rising demand for efficient crop production, and government incentives promoting modern farming techniques. Emerging economies such as China and India benefit from increasing arable land utilization and adoption of advanced machinery, while developed economies like Germany, UK, and USA focus on precision agriculture, automation, and sustainability initiatives. This report includes insights on 40+ countries; the top markets are shown here for reference.

The planting machinery market in China is expanding at a CAGR of 8.8%, fueled by rapid agricultural modernization and government support for mechanized farming. Farmers are increasingly adopting advanced seeders, planters, and transplanters to enhance productivity and reduce labor costs. China’s focus on increasing crop yields for staple grains such as rice, wheat, and corn is driving the demand for high-capacity planting equipment. Domestic manufacturers are investing in technologically advanced machinery with GPS-guided and precision planting capabilities. Additionally, training programs and agricultural extension services are helping farmers efficiently integrate modern machinery into their operations. Rising mechanization in smaller farms and large-scale commercial farms alike is sustaining market growth.

The planting machinery market in India is growing at a CAGR of 8.1%, supported by government schemes like PM-KISAN and initiatives promoting mechanization in agriculture. Farmers are increasingly shifting from manual sowing to machine-driven seeders and transplanters, especially in rice and wheat cultivation regions. Indian manufacturers are producing cost-effective, durable, and fuel-efficient planting machinery to meet the needs of small and medium-scale farms. The emphasis on improving crop yields and reducing labor dependency is boosting market adoption. Export opportunities for domestically manufactured machinery and increased awareness about precision planting technologies further contribute to market growth.

The planting machinery market in Germany is growing at a CAGR of 7.5%, driven by advanced agricultural technology adoption and high labor costs. Farmers are investing in precision seeders, GPS-guided planters, and automated machinery to optimize crop yields and resource efficiency. German manufacturers emphasize innovation, automation, and compliance with environmental regulations to deliver high-performance machinery. The growing interest in sustainable and precision farming practices is boosting demand for machinery that minimizes waste and energy use. Large-scale commercial farms and agricultural cooperatives are key adopters of technologically advanced equipment, ensuring consistent market expansion in Germany.

The planting machinery market in the United Kingdom is expanding at a CAGR of 6.2%, supported by mechanization trends and increased efficiency requirements. UK farmers are adopting modern planters and seeders to reduce manual labor, enhance productivity, and improve precision in sowing operations. Manufacturers are supplying machinery with GPS capabilities, automated functions, and high reliability. Government agricultural support schemes, research initiatives, and farm modernization programs further encourage the integration of advanced planting machinery. The demand is also influenced by large-scale commercial farms and agribusiness operators seeking cost-effective solutions with improved yield performance.

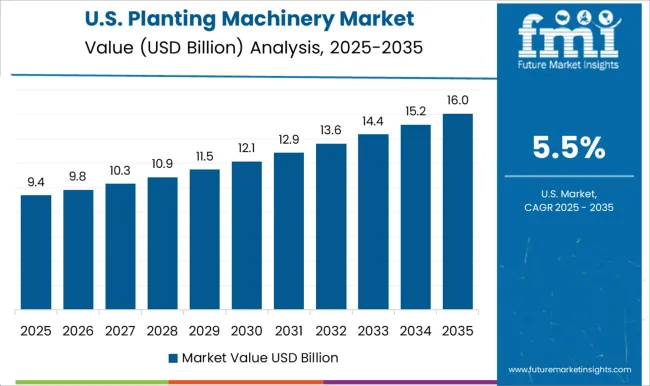

The planting machinery market in the United States is growing at a CAGR of 5.5%, fueled by precision agriculture, automation, and high-efficiency farm equipment adoption. USA farmers are increasingly using advanced seeders, planters, and transplanters to optimize yields, conserve resources, and reduce operational costs. Manufacturers focus on innovative machinery designs, automation, and integration with farm management software to enhance performance. Government incentives for mechanization and crop productivity improvement further support market expansion. Large-scale commercial farms, agribusiness companies, and contract farming operations are key consumers, creating a steady demand for high-capacity and technologically advanced planting machinery in the USA

The planting machinery market is witnessing significant growth as agricultural operations increasingly focus on improving efficiency, crop yield, and precision farming practices. Key players such as Deere & Company (John Deere), CNH Industrial N.V., and Kubota Corporation are leading the market by offering advanced planting machinery that integrates precision technology, automated controls, and durable construction to meet diverse farming needs. These companies are investing in research and development to design equipment that enhances planting accuracy, reduces seed wastage, and optimizes field operations. AGCO Corporation, Mahindra & Mahindra Ltd., and CLAAS KGaA mbH are also contributing by providing versatile solutions tailored for various crops, soil types, and farm sizes, supporting farmers in achieving higher productivity.

Increasing global demand for food, combined with the need for mechanization in emerging economies, is driving the adoption of modern planting machinery, reinforcing the market’s growth trajectory. The market is further influenced by innovations in smart agriculture, including GPS-guided planters, variable rate seeding technology, and IoT-enabled monitoring systems that provide real-time data for precision planting. Manufacturers such as Kuhn Group, Bucher Industries AG, and Great Plains Manufacturing, Inc. are developing equipment that balances efficiency with sustainability, enabling farmers to optimize input usage while minimizing environmental impact.

Collaborative initiatives between machinery manufacturers and agricultural research organizations are accelerating the introduction of advanced machinery capable of supporting large-scale farming operations and diverse climatic conditions. With rising mechanization in both developed and developing regions, and the increasing focus on reducing labor dependency while improving operational efficiency, the planting machinery market is poised for continued expansion. The strategic investments by key industry players, coupled with technological advancements and rising global food demand, are expected to shape the competitive landscape and drive long-term growth in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.4 billion |

| Type | Planter, Air Seeder, Seed drill, and Others |

| Design | Automatic and Mechanical |

| Crop Type | Cereals, Oilseeds & Pulses, Fruits & vegetables, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Deere & Company (John Deere), CNH Industrial N.V., Kubota Corporation, AGCO Corporation, Mahindra & Mahindra Ltd., CLAAS KGaA mbH, Kuhn Group, Bucher Industries AG, and Great Plains Manufacturing, Inc. |

| Additional Attributes | Dollar sales by machinery type (seed drills, planters, transplanters) and application (row crops, horticulture, precision farming) are key metrics. Trends include rising demand for mechanized and precision planting solutions, growth in large-scale agriculture, and increasing adoption of automation and GPS-guided systems. Regional adoption, technological advancements, and farm efficiency goals are driving market growth. |

The global planting machinery market is estimated to be valued at USD 21.4 billion in 2025.

The market size for the planting machinery market is projected to reach USD 40.2 billion by 2035.

The planting machinery market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in planting machinery market are planter, air seeder, seed drill and others.

In terms of design, automatic segment to command 62.3% share in the planting machinery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Turbomachinery Control System Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Collating Machinery Market

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Separation Machinery Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Machinery Market Size and Share Forecast Outlook 2025 to 2035

Tamper Evidence Machinery Market Size and Share Forecast Outlook 2025 to 2035

Poultry Keeping Machinery Market Growth - Trends & Forecast 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plastic Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Product Dispensing Machinery Market

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Recycling Equipment And Machinery Market Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Biofuel Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA