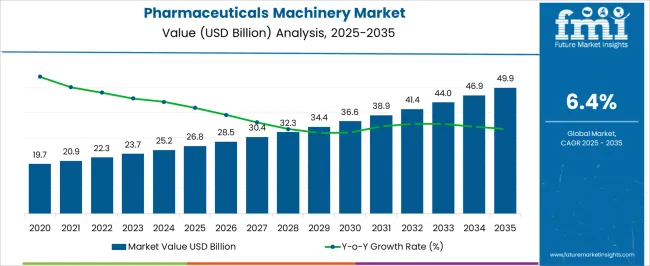

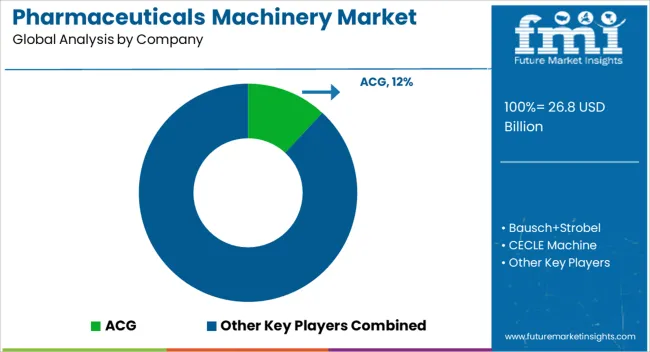

The pharmaceuticals machinery market is estimated to be valued at USD 26.8 billion in 2025 and is projected to reach USD 49.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The year-on-year (YoY) growth analysis of the pharmaceuticals machinery market shows consistent and significant expansion, with values projected to increase from USD 26.8 billion in 2025 to USD 49.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.4%. Over the first few years, steady growth is expected, with the market value rising from USD 26.8 billion in 2025 to USD 28.5 billion in 2026 and reaching USD 30.4 billion by 2027. This upward trend highlights a growing demand for advanced machinery in the pharmaceutical sector, as global drug production volumes rise and the need for efficient, high-quality manufacturing equipment continues to increase.

The continued growth in this market is likely to be driven by rising healthcare needs, increasing investments in pharmaceutical production, and the ongoing shift toward more complex drug formulations. By 2035, the pharmaceuticals machinery market is expected to reach USD 49.9 billion, with increasing demand from emerging economies. As the market matures, the adoption of automated, precise machinery is expected to dominate, further accelerating growth. This steady YoY increase indicates the continued importance of pharmaceuticals machinery in enabling higher production capacities, precision manufacturing, and meeting the rising demand for pharmaceuticals globally.

Production operations encounter equipment integration challenges as pharmaceutical machinery requires coordination between upstream processing equipment, downstream packaging systems, and quality control testing while managing batch tracking, environmental monitoring, and contamination prevention procedures. Manufacturing supervisors work with validation engineers to establish equipment performance parameters while coordinating with quality assurance departments about in-process testing and release criteria that ensure both product quality and regulatory compliance across different dosage forms and therapeutic applications.

Biopharmaceutical manufacturing operations experience specialized equipment considerations as biologics production requires coordination between sterile processing systems, cell culture technology, and purification equipment while maintaining aseptic conditions and process monitoring throughout manufacturing sequences. Technical operations teams coordinate with microbiological specialists to establish environmental monitoring procedures while working with process development groups about scale-up validation and technology transfer across different facility locations and production scales.

Packaging operations encounter automation complexity as pharmaceutical packaging machinery requires coordination between serialization systems, tamper-evident features, and regulatory labeling requirements while managing product traceability and anti-counterfeiting compliance. Packaging engineers coordinate with information technology teams to establish track-and-trace capabilities while working with regulatory compliance departments about labeling accuracy and audit trail documentation that supports both supply chain security and patient safety requirements.

| Metric | Value |

|---|---|

| Pharmaceuticals Machinery Market Estimated Value in (2025 E) | USD 26.8 billion |

| Pharmaceuticals Machinery Market Forecast Value in (2035 F) | USD 49.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The pharmaceuticals machinery market is experiencing sustained growth, supported by the rising demand for advanced manufacturing solutions that ensure efficiency, compliance, and scalability in drug production. Expanding global pharmaceutical output, driven by growing populations, increasing prevalence of chronic diseases, and rising healthcare expenditure, is fueling investments in modern machinery. Stricter regulatory requirements across major markets are encouraging manufacturers to adopt equipment capable of meeting precise quality control standards and improving operational consistency.

The integration of automation, robotics, and digital monitoring systems is enhancing productivity while reducing production errors and downtime. Growing demand for complex drug formulations, biologics, and personalized medicines is influencing machinery design, with a focus on flexibility and precision.

The market is also benefiting from expansions in generics manufacturing, as cost pressures prompt adoption of high-efficiency production systems As pharmaceutical companies continue to optimize manufacturing lines to meet diverse therapeutic demands and reduce time-to-market, the role of advanced machinery is expected to remain central, ensuring long-term growth potential across both developed and emerging markets.

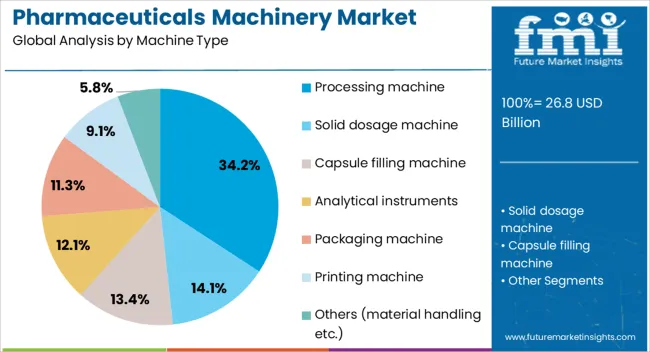

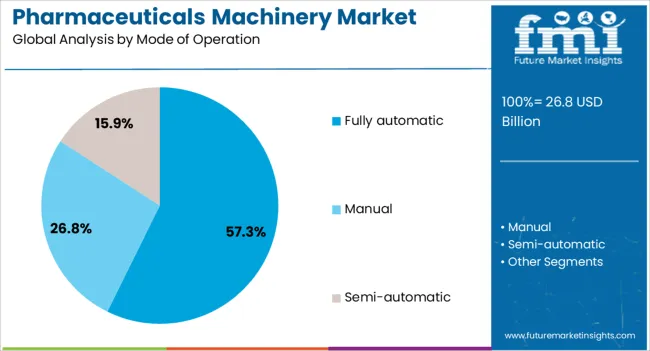

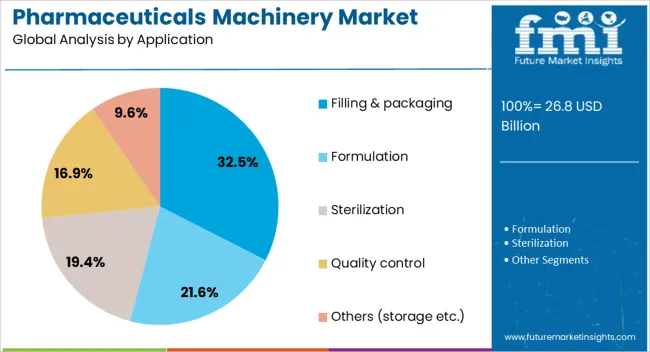

The pharmaceuticals machinery market is segmented by machine type, mode of operation, application, distribution channel, and geographic regions. By machine type, pharmaceuticals machinery market is divided into Processing machine, Solid dosage machine, Capsule filling machine, Analytical instruments, Packaging machine, Printing machine, and Others (material handling etc.). In terms of mode of operation, pharmaceuticals machinery market is classified into Fully automatic, Manual, and Semi-automatic. Based on application, pharmaceuticals machinery market is segmented into Filling & packaging, Formulation, Sterilization, Quality control, and Others (storage etc.).

By distribution channel, pharmaceuticals machinery market is segmented into Direct sales and Indirect sales. Regionally, the pharmaceuticals machinery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The processing machine segment is projected to hold 34.2% of the pharmaceuticals machinery market revenue share in 2025, positioning it as the leading machine type. Its dominance is being driven by the critical role it plays in key production stages, including blending, granulation, drying, and tablet compression. The ability of processing machines to handle high volumes with consistent output quality is supporting their adoption in large-scale pharmaceutical manufacturing facilities.

Technological advancements in design, including enhanced control systems and automation features, are improving process accuracy, reducing waste, and ensuring compliance with stringent regulatory standards. The growing complexity of drug formulations, such as sustained-release and high-potency products, is further reinforcing the need for precise and adaptable processing machinery.

Demand is also being supported by ongoing facility upgrades and expansions, as pharmaceutical manufacturers invest in equipment capable of meeting both current and future production requirements The segment’s capacity to ensure operational efficiency, product uniformity, and scalability makes it a core component of modern pharmaceutical production lines.

The fully automatic mode of operation segment is expected to account for 57.3% of the pharmaceuticals machinery market revenue share in 2025, making it the dominant operational category. Its leadership is being supported by the growing emphasis on minimizing human intervention in manufacturing processes to enhance consistency, precision, and compliance. Fully automatic systems enable continuous, high-speed production while reducing the risk of contamination, a critical factor in pharmaceutical environments.

Integration of advanced control systems, robotics, and real-time monitoring ensures that every production stage adheres to strict regulatory and quality requirements. The segment is also benefiting from the increasing need for efficiency in large-scale production, where high output rates and minimal downtime directly impact profitability.

Pharmaceutical manufacturers are adopting fully automated solutions to address labor shortages, reduce operational costs, and improve safety standards As the industry moves toward Industry 4.0 practices, the use of fully automatic machinery is expected to expand further, reinforcing its role as the preferred operational mode in global pharmaceutical production facilities.

The filling and packaging application segment is anticipated to hold 32.5% of the pharmaceuticals machinery market revenue share in 2025, establishing itself as the leading application area. This dominance is being driven by the critical importance of accurate dosing, secure packaging, and product integrity in the pharmaceutical supply chain. Filling and packaging machinery ensures compliance with regulatory standards while maintaining high throughput rates and reducing material waste.

The growing demand for diverse dosage forms, including injectables, capsules, and liquid formulations, is increasing the need for adaptable and precision-based equipment. Advancements in automation, vision inspection systems, and tamper-evident packaging technologies are enhancing efficiency and quality assurance in this segment.

Pharmaceutical companies are investing in these systems to extend shelf life, improve patient safety, and meet the rising demand for global distribution The segment’s ability to combine efficiency with strict quality control makes it indispensable in modern pharmaceutical production, ensuring its continued leadership in the market.

The pharmaceuticals machinery market is witnessing robust growth, driven by the increasing demand for advanced manufacturing technologies and the push for higher production efficiency. Opportunities exist in automation and smart machinery, with increasing investments in IoT and AI integration. Trends toward compact, modular solutions are shaping production strategies, while challenges related to regulatory compliance and high operational costs remain prevalent. Despite these hurdles, the market outlook remains positive, with continued technological advancements expected to support long-term growth.

The pharmaceuticals machinery market is experiencing significant growth driven by the increasing demand for advanced pharmaceutical production technologies. As the global healthcare sector expands, there is a growing need for efficient, high-quality manufacturing processes that ensure the precision and safety of pharmaceutical products. Technologies such as tablet presses, filling machines, and packaging equipment are in high demand. With rising investments in R&D and pharmaceutical infrastructure, manufacturers are focusing on upgrading their machinery to enhance production capacity and reduce costs, supporting the market's continued growth.

The market presents abundant opportunities in the automation and integration of smart technologies. Pharmaceutical manufacturers are increasingly adopting automated machinery to streamline production, reduce labor costs, and increase throughput. The integration of IoT, AI, and machine learning into pharmaceutical machinery is enhancing operational efficiency and product quality. Additionally, automated systems provide real-time data analytics for monitoring production, improving quality control, and ensuring compliance with stringent regulatory standards. As manufacturers look to stay competitive, the demand for smart machinery is expected to rise.

A noticeable trend in the pharmaceuticals machinery market is the growing preference for compact and modular equipment. As pharmaceutical companies aim to optimize production space and reduce operational costs, there is a rising demand for machinery that can fit into smaller, more flexible production environments. Modular systems allow for greater scalability and customization, enabling manufacturers to adjust production lines according to changing demands. These adaptable solutions are particularly beneficial in smaller facilities, where space optimization is critical, contributing to their increasing adoption in the market.

A significant challenge in the pharmaceuticals machinery market is maintaining compliance with strict regulatory standards. Manufacturers must ensure that their machinery meets local and international regulations, which can vary and change frequently. This requires continuous investment in technology upgrades and adherence to stringent safety and quality protocols. Additionally, the high cost of advanced pharmaceutical machinery, coupled with the need for skilled operators and regular maintenance, places financial pressure on manufacturers, especially smaller firms. These factors are slowing down the adoption of newer technologies in some regions.

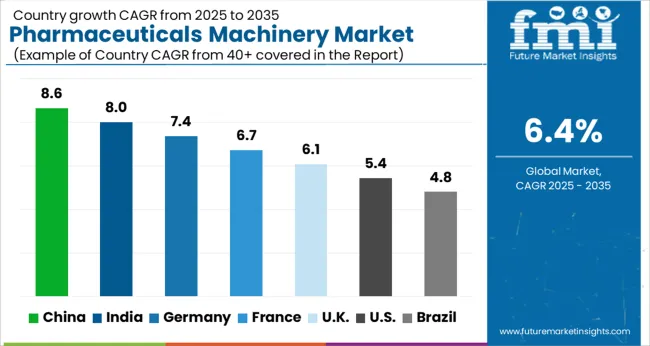

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The global pharmaceuticals machinery market is projected to grow at a 6.4% CAGR from 2025 to 2035. China leads with a growth rate of 8.6%, followed by India at 8% and Germany at 7.4%. The United Kingdom records a growth rate of 6.1%, while the United States shows the slowest growth at 5.4%. The varying growth rates reflect the unique needs and developments within each market. Emerging economies like China and India are seeing higher growth due to increasing pharmaceutical production capacities, modernization efforts, and government support for domestic manufacturing. In developed markets such as the USA and the UK, steady growth is driven by regulatory requirements, advancements in automation, and the continued focus on improving efficiency and product quality. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pharmaceuticals machinery market in China is projected to grow at a CAGR of 8.6%. As China continues to be one of the largest pharmaceutical manufacturing hubs globally, the demand for machinery that supports pharmaceutical production is rising significantly. The Chinese government’s focus on improving healthcare infrastructure and increasing the domestic production of pharmaceutical products is accelerating the demand for pharmaceutical machinery. Moreover, the growing need for high-quality, efficient, and automated machinery to meet the increasing demand for vaccines, generics, and over-the-counter drugs is further contributing to the market’s expansion. Additionally, China’s strong investments in research and development (R&D) in the biopharma sector are expected to boost the demand for advanced machinery in pharmaceutical manufacturing.

The pharmaceuticals machinery market in India is projected to grow at a CAGR of 8%. India’s strong presence in the global pharmaceutical manufacturing industry, particularly in generic drugs production, is fueling the demand for pharmaceutical machinery. The country’s focus on increasing self-sufficiency in drug production and exports is a significant factor driving market growth. As India modernizes its manufacturing facilities and embraces more automated and efficient production processes, the demand for advanced machinery is on the rise. Additionally, government initiatives such as "Make in India" are expected to further stimulate the adoption of advanced pharmaceutical machinery for both domestic and international markets.

The pharmaceuticals machinery market in Germany is projected to grow at a CAGR of 7.4%. As one of the largest pharmaceutical markets in Europe, Germany continues to see strong demand for pharmaceutical machinery, particularly in drug production, packaging, and filling operations. The market is driven by the increasing demand for high-quality manufacturing standards and the need for automated systems to meet the regulatory requirements. Germany’s focus on advancing medical research, manufacturing efficiency, and precision production is pushing the adoption of advanced pharmaceutical machinery. Additionally, the country’s strong pharmaceutical export industry is further boosting the demand for specialized machinery.

The pharmaceuticals machinery market in the United Kingdom is projected to grow at a CAGR of 6.1%. The UK’s strong pharmaceutical sector, which includes both large multinational companies and specialized biotech firms, is driving steady demand for pharmaceutical machinery. The need for high-efficiency machinery to support drug production, packaging, and quality control is rising as the UK continues to modernize its pharmaceutical manufacturing capabilities. The country’s focus on improving healthcare access and enhancing R&D activities in biopharma continues to support the demand for advanced pharmaceutical machinery. Additionally, post-Brexit regulatory adjustments are expected to further shape the demand for specialized equipment to meet evolving standards.

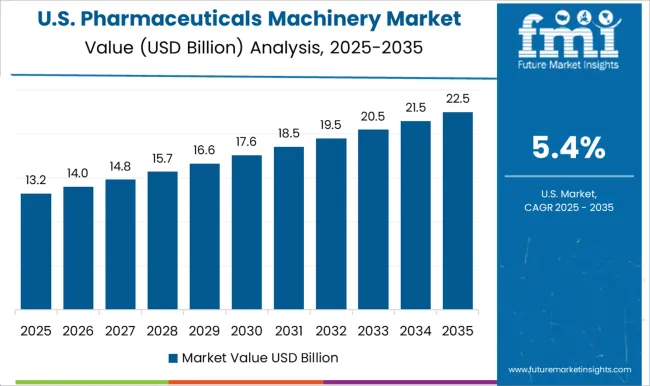

The pharmaceuticals machinery market in the United States is projected to grow at a CAGR of 5.4%. The USA remains the largest pharmaceuticals market globally, with a strong demand for machinery used in drug manufacturing, packaging, and labelling. The shift towards more automated production systems, along with increased regulatory scrutiny, is pushing the adoption of advanced machinery solutions. Moreover, the USA government’s support for healthcare, biotechnology, and pharmaceuticals, combined with a growing focus on personalized medicine, continues to spur demand for specialized pharmaceutical machinery. Although the growth rate in the USA is slower compared to emerging markets, its well-established pharmaceutical manufacturing infrastructure ensures steady market expansion.

The pharmaceutical machinery market is moderately concentrated. Leading suppliers provide advanced equipment to improve efficiency and ensure high-quality production in pharmaceuticals. ACG, Bausch+Strobel, and Fette Compacting lead with multi-functional production lines, enabling streamlined tablet, capsule, and packaging operations.

GEA, Glatt, and Syntegon Technology focus on granulation, coating, and packaging solutions, addressing diverse pharmaceutical manufacturing needs. Korsch, IMA, and Romaco specialize in high-efficiency tablet and capsule press systems, enhancing production speed and product consistency.

Regional players such as Sartorius, Paul Müller, and SED Pharma provide specialized machinery for biopharmaceuticals, sterile products, and niche applications, supporting localized manufacturing requirements. RIVA contributes with customized solutions for small- and medium-scale pharmaceutical production.

Market growth depends on automation, integration of multi-functional systems, and compliance with stringent quality standards. Leading suppliers maintain advantage through continuous innovation, reliable after-sales support, and adaptability to evolving pharmaceutical manufacturing trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.8 Billion |

| Machine Type | Processing machine, Solid dosage machine, Capsule filling machine, Analytical instruments, Packaging machine, Printing machine, and Others (material handling etc.) |

| Mode of Operation | Fully automatic, Manual, and Semi-automatic |

| Application | Filling & packaging, Formulation, Sterilization, Quality control, and Others (storage etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

ACG, GEA, IMA, Syntegon, Romaco, Fette Compacting, Sartorius, Paul Müller, RIVA, SED Pharma |

| Additional Attributes | Dollar sales by machine type (tableting, filling, packaging, labeling) and application (solid, liquid, semi-solid) are key metrics. Trends include rising demand for automated and high-efficiency machinery, along with increasing focus on regulatory compliance and product quality. Regional adoption, technological innovations, and advancements in machinery customization are shaping market growth. |

The global pharmaceuticals machinery market is estimated to be valued at USD 26.8 billion in 2025.

The market size for the pharmaceuticals machinery market is projected to reach USD 49.9 billion by 2035.

The pharmaceuticals machinery market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in pharmaceuticals machinery market are processing machine, solid dosage machine, capsule filling machine, analytical instruments, packaging machine, printing machine and others (material handling etc.).

In terms of mode of operation, fully automatic segment to command 57.3% share in the pharmaceuticals machinery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

Turbomachinery Control System Market Size and Share Forecast Outlook 2025 to 2035

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Oxytocic Pharmaceuticals Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Collating Machinery Market

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Separation Machinery Market Size and Share Forecast Outlook 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Tamper Evidence Machinery Market Size and Share Forecast Outlook 2025 to 2035

Poultry Keeping Machinery Market Growth - Trends & Forecast 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA