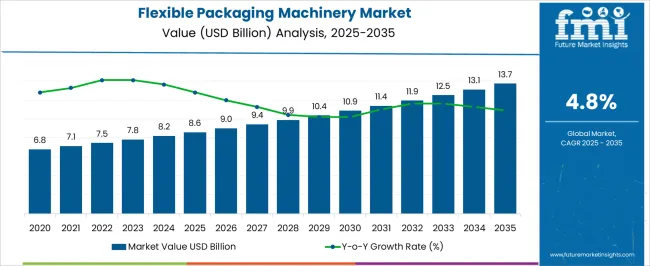

The flexible packaging machinery market is projected to grow from USD 8.6 billion in 2025 to USD 13.7 billion by 2035, with a CAGR of 4.8%. The market shows steady growth, beginning at USD 6.8 billion in 2021 and reaching USD 8.6 billion by 2025. This initial phase of growth reflects the increasing demand for efficient and versatile packaging solutions across various sectors, including food and beverages, pharmaceuticals, and consumer goods. From 2025 to 2030, the market gains momentum, growing from USD 8.6 billion to USD 10.9 billion. This phase is driven by heightened demand for automated and energy-efficient packaging machinery, alongside innovations in eco-friendly and customizable packaging options.

The market's momentum accelerates as manufacturers adapt to shifting consumer preferences for more sustainable and cost-effective packaging technologies. By 2030, the market will continue to expand at a steady pace, reaching USD 10.4 billion, with increasing adoption of intelligent packaging solutions, such as those incorporating IoT and AI for real-time monitoring and quality control. The next five years see the market grow from USD 10.9 billion to USD 13.7 billion by 2035. The adoption of new materials, technological advancements, and the ongoing shift toward flexible and lightweight packaging options supports this growth momentum.

| Metric | Value |

|---|---|

| Flexible Packaging Machinery Market Estimated Value in (2025 E) | USD 8.6 billion |

| Flexible Packaging Machinery Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The flexible packaging machinery market is influenced by several parent markets that contribute significantly to its growth and demand across various sectors. The packaging machinery market plays a crucial role, accounting for around 20-25% of the market share. As consumer demand grows for lightweight, versatile, and cost-effective packaging solutions, flexible packaging machinery provides efficient solutions for various industries such as food and beverages, pharmaceuticals, and consumer goods. The food and beverage packaging market contributes approximately 18-22% to the flexible packaging machinery market. The increasing demand for convenience foods, snacks, and ready-to-eat meals drives the need for flexible packaging solutions that offer better product preservation and longer shelf life. In the pharmaceutical packaging market, flexible packaging machinery represents about 10-12% of the market share. With the rising demand for medicines, particularly in smaller quantities, flexible packaging solutions become critical in providing cost-effective, tamper-proof, and lightweight packaging for pharmaceutical products. The consumer goods packaging market contributes around 8-10% to the flexible packaging machinery market. Flexible packaging solutions are increasingly being adopted for personal care, household products, and other consumer goods, owing to their ability to be customized for various shapes and sizes, providing both convenience and sustainability. The e-commerce and retail packaging market accounts for approximately 6-8% of the market share, driven by the rapid growth of online shopping. Flexible packaging machinery ensures safe, durable, and cost-effective packaging for products that are shipped directly to consumers.

The Flexible Packaging Machinery market is experiencing strong growth, supported by the increasing demand for efficient, versatile, and sustainable packaging solutions. The shift toward lightweight and adaptable packaging formats has driven the adoption of advanced machinery capable of handling diverse materials and designs. Growing consumer preference for packaged goods with extended shelf life, combined with the rising influence of e-commerce and on-the-go consumption patterns, has intensified the need for high-performance packaging equipment.

Investments in automation, digital controls, and quick-changeover capabilities are enabling manufacturers to improve productivity while reducing downtime. Sustainability trends and regulatory requirements for recyclable and biodegradable materials are further shaping equipment innovations.

The market is also benefiting from the rapid expansion of the food and beverages sector, pharmaceuticals, and personal care industries As manufacturers aim to balance cost efficiency, environmental compliance, and product differentiation, the adoption of flexible packaging machinery with software-driven and modular features is expected to continue rising, ensuring long-term market expansion.

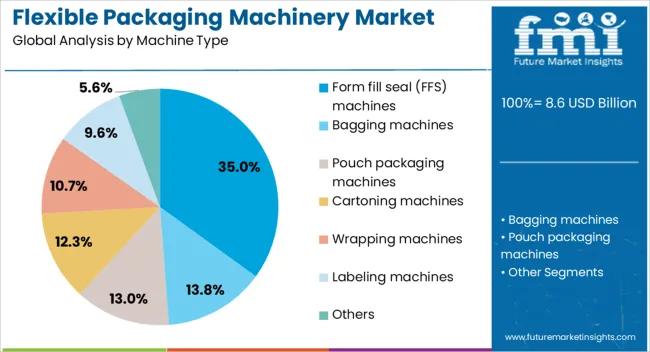

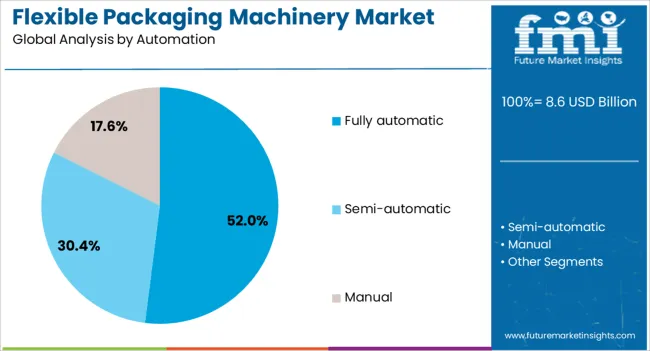

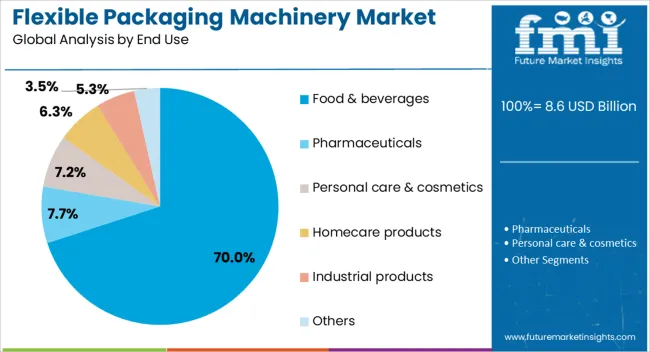

The flexible packaging machinery market is segmented by machine type, automation, end use, distribution channel, and geographic regions. By machine type, flexible packaging machinery market is divided into Form fill seal (FFS) machines, Bagging machines, Pouch packaging machines, Cartoning machines, Wrapping machines, Labeling machines, and Others. In terms of automation, flexible packaging machinery market is classified into Fully automatic, Semi-automatic, and Manual. Based on end use, flexible packaging machinery market is segmented into Food & beverages, Pharmaceuticals, Personal care & cosmetics, Homecare products, Industrial products, and Others. By distribution channel, flexible packaging machinery market is segmented into Indirect and Direct. Regionally, the flexible packaging machinery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The form fill seal machines segment is projected to hold 35% of the Flexible Packaging Machinery market revenue share in 2025, making it the leading machine type. The growth of this segment has been driven by its ability to integrate multiple packaging steps, including forming, filling, and sealing, into a single streamlined process. This design has been preferred for its efficiency in high-volume production environments where speed, consistency, and minimal labor intervention are critical.

The adaptability of form fill seal machines to handle a wide range of packaging materials, sizes, and formats has expanded their application across industries. Their compatibility with advanced control systems and the capability to incorporate sustainable packaging materials have further increased their appeal.

Manufacturers have been investing in these machines to meet stringent hygiene and safety standards while optimizing throughput The segment’s dominance is further reinforced by its cost-effectiveness in long-term operations, making it an attractive option for both large-scale producers and small to mid-size enterprises.

The fully automatic segment is expected to account for 52% of the Flexible Packaging Machinery market revenue share in 2025, establishing itself as the leading automation category. Growth in this segment has been driven by the need to achieve high operational efficiency, precision, and consistency in packaging processes. Fully automatic systems reduce reliance on manual labor, minimizing the risk of errors while increasing production speed.

The integration of advanced control software, sensors, and real-time monitoring has enhanced the capability of these machines to operate continuously with minimal downtime. Demand has been further supported by the rising cost of labor and the need for compliance with quality and safety regulations.

Industries with high output requirements, such as food and beverages, pharmaceuticals, and personal care, have increasingly favored fully automatic solutions due to their scalability and adaptability The ability to integrate with other production line equipment and deliver significant long-term cost savings has ensured the continued dominance of this segment.

The food and beverages segment is projected to hold 70% of the Flexible Packaging Machinery market revenue share in 2025, making it the largest end-use industry. The segment’s growth has been fueled by the rising consumption of packaged food and drinks driven by urbanization, busy lifestyles, and increasing demand for convenience products. Flexible packaging offers advantages such as extended shelf life, product safety, and reduced material usage, all of which align with industry priorities.

Food and beverage manufacturers have been investing heavily in machinery that supports rapid changeovers, high-speed output, and the use of eco-friendly materials to meet evolving consumer and regulatory demands. The growth of e-commerce grocery delivery and ready-to-eat meals has also expanded the need for efficient, high-volume packaging solutions.

Additionally, branding opportunities offered by advanced printing and customization capabilities on flexible packaging have made it a preferred choice As product variety increases, the sector’s reliance on flexible packaging machinery is expected to remain strong, supporting its leading market position.

The flexible packaging machinery market is experiencing steady growth, driven by the increasing demand for convenient, lightweight, and cost-effective packaging solutions across various industries. These solutions are particularly crucial in sectors such as food and beverages, pharmaceuticals, and personal care, where packaging plays a significant role in product preservation, convenience, and brand differentiation. The rise of e-commerce has further boosted the demand for packaging machinery, as efficient and adaptable systems are needed to meet growing online retail requirements. Technological advancements in automation, robotics, and smart manufacturing are enhancing production speed and precision, supporting the adoption of more sustainable packaging materials

The flexible packaging machinery market faces several challenges despite its growth potential. One of the primary concerns is the fluctuation in raw material costs, which affects production expenses. Additionally, the competitive nature of the market, with numerous suppliers offering similar technologies, creates pricing pressures. The integration of advanced machinery with existing production systems, especially in older facilities, can be complex and costly. Companies also face the challenge of keeping up with rapid technological advancements, requiring continuous investment in R&D. Stringent regulatory standards around food safety, sustainability, and material usage are also putting pressure on manufacturers to innovate without compromising on quality. These challenges necessitate ongoing investments in technology, compliance, and strategic partnerships to remain competitive.

The flexible packaging machinery market is primarily driven by the increasing demand for efficient and adaptable packaging solutions. The growth of the food and beverage industry, particularly for ready-to-eat and convenience foods, has propelled the need for packaging systems that provide both efficiency and safety. Moreover, advancements in automation and robotics are improving manufacturing processes, reducing labor costs, and enhancing precision in production. The rise of e-commerce and online shopping has also played a significant role in the demand for packaging solutions that are both functional and visually appealing. As consumers demand more eco-friendly and sustainable packaging options, manufacturers are developing solutions that align with these preferences, further fueling market growth. The rise in personalized and customized packaging is increasing demand for flexible packaging machinery.

The flexible packaging machinery market offers numerous opportunities for growth, particularly as the demand for sustainable packaging increases. Manufacturers can explore innovations in machinery that process biodegradable and recyclable materials, catering to the growing consumer preference for eco-friendly solutions. The rise in personalized packaging and digital printing technology also opens up new opportunities for product differentiation and customization. Additionally, the growing trend in e-commerce requires packaging solutions that ensure product protection during transit, creating demand for new types of packaging machinery. Emerging markets, especially in Asia-Pacific and Latin America, offer significant growth potential due to their expanding industrial sectors and urbanization. By capitalizing on these trends, manufacturers can explore new markets and diversify their product offerings, strengthening their position in the industry.

The integration of smart technologies, such as IoT and AI, is transforming the industry by enabling real-time data analytics, predictive maintenance, and automated operations, resulting in improved efficiency and reduced downtime. The demand for eco-friendly packaging solutions is driving manufacturers to innovate and develop machinery that can process eco-friendly materials, such as biodegradable films and recyclable substrates. The rise in consumer preference for personalized packaging is also shaping the market, leading to advancements in digital printing technology. The growing emphasis on reducing material waste and increasing energy efficiency in production processes is encouraging the adoption of more sustainable and cost-effective machinery solutions. These trends are paving the way for a more intelligent, efficient, and sustainable future for the packaging machinery market.

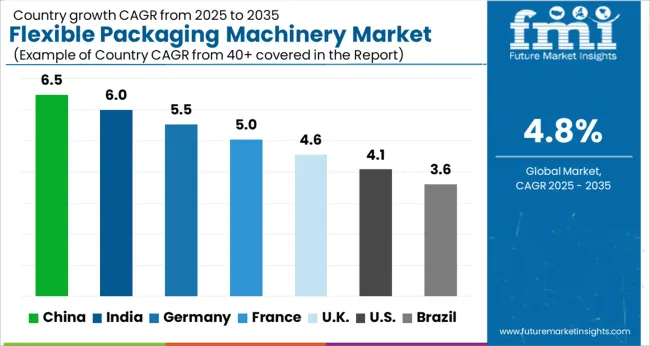

| Countries | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global flexible packaging machinery market is projected to grow at a CAGR of 4.8% from 2025 to 2035. China leads with a growth rate of 6.5%, followed by India at 6.0%, and Germany at 5.5%. The United Kingdom and the United States show more moderate growth rates of 4.6% and 4.1%, respectively. The market is driven by the increasing demand for efficient, cost-effective packaging solutions in the food, beverage, healthcare, and consumer goods sectors. Technological advancements in packaging automation, coupled with e-commerce growth, are significant factors driving the demand for flexible packaging machinery across these regions. The analysis spans over 40+ countries, with the leading markets shown below.

China is set to lead the flexible packaging machinery market with a projected CAGR of 6.5% from 2025 to 2035. As one of the largest manufacturing hubs globally, China’s demand for flexible packaging machinery is fueled by the rapid growth in consumer goods, food and beverage, and pharmaceuticals sectors. The expansion of e-commerce and the need for cost-effective packaging solutions are significant drivers for market growth. The increasing demand for high-quality, efficient, and durable packaging solutions in various industries continues to fuel the market, with a particular emphasis on innovations in automation and speed. The growing shift towards online retail and rapid consumer demand across the country is expected to keep market growth strong.

The flexible packaging machinery market in India is projected to expand at a CAGR of 6.0% from 2025 to 2035. The rapid growth of India’s food processing, healthcare, and consumer goods industries is driving the demand for packaging machinery solutions. As the packaging industry continues to modernize, there is an increasing focus on improving packaging quality, reducing material waste, and enhancing production efficiency.The market is also supported by the rise of small and medium enterprises (SMEs) that are increasingly adopting cost-effective packaging solutions to improve product presentation and extend shelf life. The increasing penetration of online retail and logistics networks further strengthens the market outlook.

Germany’s flexible packaging machinery market is expected to grow at a CAGR of 5.5% from 2025 to 2035. The market growth is supported by the country’s strong manufacturing base, particularly in the automotive, food, and pharmaceutical industries, where packaging machinery plays a critical role in production processes. The growing demand for innovative packaging solutions, particularly in the food sector, and advancements in machinery technology that emphasize speed, automation, and reduced waste are expected to drive the market. Germany’s commitment to improving packaging technologies and maintaining high industry standards ensures continued market growth, with a focus on developing smarter and more efficient machinery.

The flexible packaging machinery market in the United Kingdom is projected to grow at a CAGR of 4.6% from 2025 to 2035. The market expansion is driven by the growing demand for efficient and cost-effective packaging solutions in the food and beverage, pharmaceutical, and consumer goods sectors. The UK’s strong retail sector and focus on product innovation continue to fuel demand for flexible packaging machinery. As consumer preferences shift towards convenience, and e-commerce continues to grow, packaging machinery that meets evolving packaging needs becomes increasingly important.

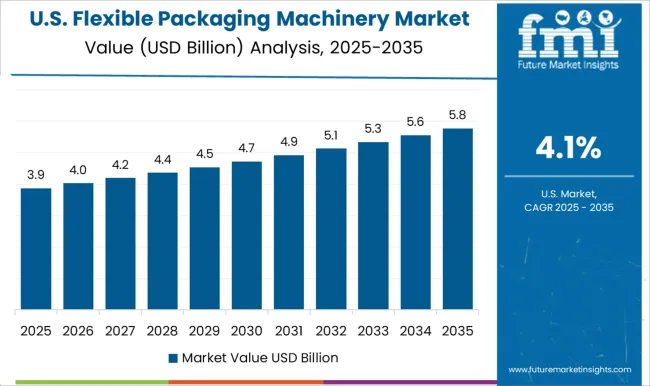

The USA flexible packaging machinery market is projected to expand at a CAGR of 4.1% from 2025 to 2035. As a leader in the global packaging industry, the USA continues to see rising demand for flexible packaging machinery driven by the food and beverage, healthcare, and consumer products sectors. The market benefits from the ongoing shift towards more efficient, and automated packaging solutions in these sectors. Demand for machinery that offers flexibility, cost-effectiveness, and superior performance is growing, particularly in e-commerce packaging solutions. The increasing focus on innovation in packaging technologies and machinery to reduce material waste and enhance productivity is expected to drive the market.

In the flexible packaging machinery market, competition is led by companies offering innovative, high-performance equipment tailored to industries such as food, pharmaceuticals, and consumer goods. Syntegon, Coesia, and Krones are dominant players, providing automated solutions that emphasize precision, efficiency, and flexibility. Syntegon focuses on the food and pharmaceutical sectors, delivering flexible packaging systems designed to meet hygiene standards and improve production efficiency.

Coesia offers a broad range of high-speed packaging machines, integrating advanced automation technologies that enhance productivity and product quality across various sectors. Krones excels in the beverage industry, specializing in filling, packaging, and labeling systems, with a focus on optimization and digitalization of production lines. Key strategies in the market involve expanding product portfolios and technological innovation. Tetra Pak positions itself with high-quality packaging solutions designed for the food and beverage industries. Its systems are designed to improve production speed while maintaining product integrity. IMA Group competes by offering versatile packaging machinery, particularly for food and pharmaceuticals, focusing on customization and meeting specific customer needs.

ProMach provides a comprehensive selection of packaging systems, offering increased efficiency across multiple sectors. Marchesini stands out in the pharmaceutical industry, providing packaging solutions that meet regulatory standards while offering high-speed performance. Multivac specializes in vacuum packaging systems, offering solutions designed to enhance food product preservation and extend shelf life.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.6 Billion |

| Machine Type | Form fill seal (FFS) machines, Bagging machines, Pouch packaging machines, Cartoning machines, Wrapping machines, Labeling machines, and Others |

| Automation | Fully automatic, Semi-automatic, and Manual |

| End Use | Food & beverages, Pharmaceuticals, Personal care & cosmetics, Homecare products, Industrial products, and Others |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Syntegon, Coesia, Krones, Tetra Pak, IMA Group, ProMach, Marchesini, and Multivac |

| Additional Attributes | Dollar sales by machinery type (form-fill-seal, pouch packaging, horizontal/vertical), application (food, pharmaceuticals, consumer goods, others), and automation level (manual, semi-automated, fully automated). Demand dynamics are driven by the growing trend towards sustainability, demand for high-speed packaging solutions, and increasing adoption of flexible packaging in industries like food and beverages. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing investments in packaging automation and environmentally conscious packaging solutions. |

The global flexible packaging machinery market is estimated to be valued at USD 8.6 billion in 2025.

The market size for the flexible packaging machinery market is projected to reach USD 13.7 billion by 2035.

The flexible packaging machinery market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in flexible packaging machinery market are form fill seal (ffs) machines, bagging machines, pouch packaging machines, cartoning machines, wrapping machines, labeling machines and others.

In terms of automation, fully automatic segment to command 52.0% share in the flexible packaging machinery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Flexible Colored PU Foams Market Growth - Trends & Forecast 2025 to 2035

Flexible Endoscopes Market Growth - Trends & Forecast 2025 to 2035

Flexible Pipes Market Analysis by Application, Material, and Region: Forecast for 2025 to 2035

Flexible Thin Film Market Trends - Growth & Forecast 2025 to 2035

Flexible Glass for Flexible Electronics Market Analysis by Application, End User, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA