The global flexible colored polyurethane (PU) foams market is estimated at USD 6.06 billion in 2025 and is forecast to expand to USD 10.06 billion by 2035, advancing at a CAGR of 5.2%. Growth is driven by increasing demand for custom-coloured cushioning materials in upholstery, automotive interiors, packaging, and construction. Manufacturers are introducing pigmentation technologies that ensure consistent color durability under UV exposure and mechanical stress.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 6.06 billion |

| Market Value (2035) | USD 10.06 billion |

| CAGR (2025 to 2035) | 5.2% |

Flexible colored PU foams have been utilized across a wide range of industries, including ergonomic furniture, vehicle interiors, and protective packaging, where color consistency plays a role in both functional design and brand identity. Product customization related to color, density, and flexibility has matched evolving user expectations, while increasing regulatory and consumer focus on emissions has encouraged a shift toward environmentally responsible manufacturing.

Procurement strategies have increasingly prioritized bio-based polyols and low-VOC alternatives. Companies such as BASF SE introduced foam grades incorporating renewable raw materials to support internal decarbonization initiatives. At the same time, Dow Inc. and Huntsman Corporation developed flame-retardant and water-based systems aimed at meeting compliance benchmarks under REACH and USA EPA standards. These efforts have supported the dual requirement for enhanced product safety and reduced environmental impact in applications like packaging, insulation, and consumer goods.

Upholstery remains the leading application area for colored PU foams. Rising activity in home and office furnishing markets has contributed to higher demand from both residential and commercial segments. Manufacturers have increasingly sought foam solutions that offer visual appeal while also meeting expectations for recyclability or renewable content, particularly in regions with evolving waste and sustainability regulations.

The Asia-Pacific region continues to represent a significant portion of global output and usage. Nations including China, India, and South Korea have reported elevated demand across end-user industries such as packaging, electronics, and interior furnishings.

Local production capabilities, combined with policy-driven support for clean manufacturing technologies, are shaping the development of foam materials in these countries. In Japan, the growing use of compact, protective foam in electronics packaging and household products has supported demand for materials with high dimensional stability and long-lasting color retention.

The flexible cell-structure segment is projected to account for approximately 62% of the global market in 2025 and is expected to grow at a CAGR of 5.3% through 2035. These foams are widely used due to their softness, elasticity, and ability to be dyed in various colors without compromising performance. Applications span across bedding, furniture, automotive interiors, and packaging.

In automotive manufacturing, color-matched inserts reduce post-production processes like fabric wrapping or painting, especially in Japan and Germany. Innovations in cell size control and pigment dispersion are improving aesthetic and functional outcomes. Manufacturers are focusing on uniformity in foam expansion and durability, even under repetitive stress, to meet consumer expectations in comfort-related segments.

Sustainable formulations with reduced VOC content are gaining traction, especially in the EU, due to environmental regulations, further solidifying the position of flexible cell-structured PU foams as the market’s leading segment over the forecast period.

Upholstery furniture is estimated to remain the dominant application segment, representing around 48% of total market demand in 2025, growing at a CAGR of 5.1% through 2035. Demand is driven by the increasing popularity of customized and modular furniture solutions for both residential and commercial spaces. Colored PU foams are favored in sofa cushions, armchairs, and mattress overlays where both aesthetics and ergonomic support are important.

In North America and Europe, commercial furniture designers increasingly request on-demand foam colors for hotels, cafes, and offices to match branded interiors. Strict fire-safety and indoor air-quality regulations in Europe are accelerating the use of certified low-emission foams.

Manufacturers are offering foams with integrated antimicrobial and anti-sagging properties to meet evolving consumer and commercial requirements. Color consistency, durability, and long-term shape retention remain critical, making this segment highly lucrative for foam producers investing in innovation and customization over the next decade.

Environmental Concerns and Regulatory Compliance

One of the major hindrances for the flexible colored PU foams market is environmental sustainability; nevertheless, manufacturers are coming up with bio-based polyurethane materials produced from renewable resources, minimizing the environmental impact. Manufacturers must respond to changing regulations that require reduced carbon emissions and increased sustainability. Complying with such regulations may require investment, research and development, which might influence profit margins.

Advancements in Sustainable Foam Technologies

Witah growing attention towards sustainability, copier manufacturers may consider investing in the development of colored PU foams that are biogradable and recyclable. Advances in bio-based polyols and water-blown foaming techniques also make it possible to create products that meet environmental needs and do so without sacrificing performance.

Industries that adapt sustainable initiatives within their manufacturing pipeline reap the fruits of a competitive advantage while catering to an increasing portion of the population that makes up environmentally aware consumers.

The flexible colored PU foams marketin the USA is expanding. More people want furniture, car seats, and bed stuff made of it. They like colors that last and are light. This boosts sales.

Rules exist for safety and chemicals. The EPA and CPSC set these rules. New colored foams and those that don’t catch fire easily are in demand. Less VOC is also preferred. Business furniture needs more foam. People want foam that can be changed and used again.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

In the UK, demand from home design, cars, and beds helps the flexible colored PU foams market. The move to green and good-looking materials in homes and businesses fuels growth. The HSE and BSI guide the rules.

Key trends includes use of green and plant-based PU foams, more bright and light-colored foams in home style, and growing favor for modular work furniture.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

The flexible colored PU foams marketin the European Union is growing due to high demand in car seats, medical cushions, and high-end furniture areas. EU laws pushing for green manufacturing and cutting down harmful chemicals help the market grow. Rules are watched over by the European Chemicals Agency (ECHA) and REACH.

Germany, France, and Italy are main markets due to strong furniture and car-making industries. Big trends include the use of bright foams in car roofs and safe furniture for kids. There is also a rise in use of water-based color methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

The flexible colored PU foams marketin Japan is growing fast. People want these foams for small furniture, car interiors, and electronic packages. The look and use of these foams are key in Japanese homes. The Ministry of Economy, Trade, and Industry (METI) and the Japan Urethane Industry Association manage this market.

Big trends include new foam textures for comfy use, more need for smart furniture, and tiny cushions for gadgets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The market for flexible colored PU foams in South Korea is growing. This is mainly because of high need in electronics packaging, stylish furniture for young people, and car interiors. The government pushes for green materials and new lightweight foams, helping this growth. Laws are set by KEITI and KATS. Key trends include new color-tech, focus on soft and long-lasting gaming furniture, and using foams in electric cars.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

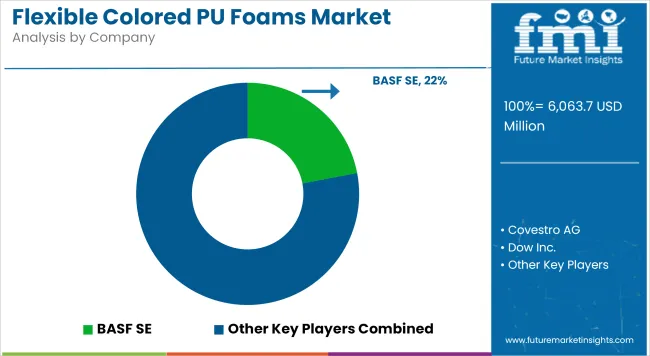

The market features global firms such as BASF, Huntsman, Dow, Covestro, Wanhua, Saint-Gobain Performance Plastics, Carpenter Company, Recticel, Armacell, and Rogers Corporation. These companies are diversifying their offerings by launching color-fast pigment systems, flame-retardant grades, and low-VOC formulations. BASF introduced colored PU foams with enhanced fire resistance for public seating, enhancing compliance with safety codes.

Huntsman expanded production capacity in China to meet APAC demand in automotive and furniture sectors. Firms are collaborating with downstream manufacturers to develop foam grades aligned with product aesthetics, sustainability requirements, and regulatory frameworks. Competitive advantage hinges on pigment quality, color consistency, formulation versatility, and technical support for custom applications through 2035.

The market size was approximately USD 6.06 billion in 2025.

The market is projected to reach approximately USD 10.06 billion by 2035.

Key drivers include increasing consumer preference for customized and visually appealing products, growing applications in the automotive and furniture industries, and advancements in polyurethane foam technologies enhancing product performance.

China, the United States, Germany, Japan, and India are key contributors to the market.

The furniture and interiors segment is expected to lead due to the widespread use of flexible colored PU foams in sofas, chairs, mattresses, and carpets, driven by consumer demand for comfort and aesthetic appeal.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA